Lotas Capital 2025 Review: Everything You Need to Know

Executive Summary

Lotas Capital is an offshore forex broker established in 2017. It offers multi-asset trading services with questionable regulatory oversight. This lotas capital review reveals a broker that caters primarily to beginners and small-scale investors with its low entry barriers, including a minimum deposit requirement of just 100 USD and leverage up to 1:500.

The broker operates under STP (Straight Through Processing) and ECN (Electronic Communication Network) business models. It provides access to forex, commodities, indices, stocks, and cryptocurrencies. However, Lotas Capital's offshore regulatory status under the Mwali International Services Authority (MISA) raises concerns about trader protection and fund security.

According to available user feedback, Lotas Capital receives a modest rating of 2.9 out of 5 based on 15 reviews. Only 47% of reviewers recommend the broker. This lukewarm reception reflects mixed experiences among traders, particularly regarding customer service quality and overall trading experience. While the broker's low minimum deposit and high leverage ratios may appeal to novice traders, the limited regulatory oversight and below-average user satisfaction scores warrant careful consideration.

Important Notice

Regional Entity Differences: Lotas Capital operates as an unregulated offshore broker under the jurisdiction of the Mwali International Services Authority (MISA). Traders should be aware that offshore regulatory frameworks may offer limited protection compared to major financial regulatory bodies. The regulatory differences between jurisdictions can significantly impact dispute resolution, fund protection, and legal recourse options.

Review Methodology: This comprehensive evaluation is based on publicly available data, user feedback from multiple review platforms, and regulatory information. Our analysis incorporates direct user experiences and verifiable company information to provide an objective assessment of Lotas Capital's services and reliability.

Rating Overview

Broker Overview

Lotas Capital was established in 2017. It is headquartered in Mwali, Comoros, positioning itself as an offshore forex broker specializing in multi-asset trading. The company operates under both STP (Straight Through Processing) and ECN (Electronic Communication Network) business models, which theoretically should provide traders with direct market access and competitive pricing. However, the broker's offshore location and regulatory framework raise questions about operational transparency and trader protection standards.

The broker targets retail traders seeking access to global financial markets with relatively low capital requirements. Lotas Capital's business approach focuses on providing high leverage ratios and low minimum deposits to attract novice traders and those with limited initial capital. According to available information, the company maintains offices in Fomboni and Sofia, suggesting a multi-jurisdictional operational structure typical of offshore brokers.

This lotas capital review indicates that while the broker offers access to multiple asset classes including forex pairs, CFDs, stocks, and cryptocurrencies, the limited regulatory oversight from MISA (Mwali International Services Authority) may not provide the same level of protection as brokers regulated by established financial authorities such as the FCA, CySEC, or ASIC.

Regulatory Framework: Lotas Capital operates under the authorization of the Mwali International Services Authority (MISA) with license number T2023347. The company is registered as Lotas Trading LTD, an International Business Company (IBC) with registration number HY00823423. However, MISA is considered an offshore regulatory body with limited international recognition.

Minimum Deposit Requirements: The broker maintains an accessible entry point with a minimum deposit requirement of 100 USD. This makes it suitable for traders with limited initial capital and those testing the platform before committing larger amounts.

Available Trading Assets: Lotas Capital provides access to multiple asset classes including major and minor currency pairs, commodities such as gold and oil, global stock indices, individual stocks, and various cryptocurrencies. This offers traders diversification opportunities across different markets.

Leverage Specifications: The broker offers leverage ratios up to 1:500, which significantly amplifies both potential profits and losses. This high leverage ratio appeals to traders seeking maximum capital efficiency but requires careful risk management due to increased exposure.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs was not detailed in available sources. This represents a transparency concern for potential clients seeking comprehensive cost analysis.

Trading Platform Options: The available materials do not specify which trading platforms Lotas Capital supports. This leaves questions about MetaTrader availability, proprietary platform features, and mobile trading capabilities unanswered.

This lotas capital review highlights significant information gaps that potential clients should address through direct communication with the broker before opening accounts.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Lotas Capital's account conditions present a mixed picture for potential traders. The broker's primary strength lies in its accessibility, with a minimum deposit requirement of just 100 USD, significantly lower than many established brokers who typically require 250-500 USD minimum deposits. This low entry barrier makes the platform particularly attractive to novice traders and those with limited initial capital.

The leverage offering of up to 1:500 represents another appealing feature for traders seeking maximum capital efficiency. However, such high leverage ratios require sophisticated risk management skills and can lead to substantial losses for inexperienced traders. While this leverage ratio is competitive within the offshore broker segment, it exceeds the regulatory limits imposed by major financial authorities like ESMA.

Unfortunately, specific information about account types, their respective features, and the account opening process remains unclear in available sources. The absence of detailed information about Islamic accounts, professional trader accounts, or VIP account tiers suggests either limited account variety or poor information transparency. User feedback indicates a rating of 2.9 out of 5, with some criticism directed at account-related policies and procedures.

Compared to regulated brokers, Lotas Capital's account conditions appear basic, lacking the comprehensive account structures and detailed fee schedules typically expected from established market participants. This lotas capital review suggests that while the low minimum deposit is advantageous, the overall account offering lacks depth and transparency.

The evaluation of Lotas Capital's tools and resources reveals significant deficiencies in this critical area. Available information does not specify the trading platforms supported by the broker, leaving questions about whether clients have access to industry-standard platforms like MetaTrader 4 or MetaTrader 5, or if the broker relies on proprietary solutions.

Market analysis and research support appear to be notably absent from the broker's offering. Professional traders typically expect comprehensive market commentary, technical analysis, economic calendars, and trading signals as standard features. The lack of information about these resources suggests that Lotas Capital may not provide the analytical support necessary for informed trading decisions.

Educational resources, which are particularly important for the broker's target demographic of novice traders, are not mentioned in available materials. Quality brokers typically offer webinars, trading tutorials, e-books, and comprehensive learning centers to help clients develop their trading skills. The absence of such resources represents a significant gap in the broker's value proposition.

Automated trading support, including Expert Advisors (EAs) and algorithmic trading capabilities, remains unspecified. This lack of information about advanced trading features may deter experienced traders who rely on automated strategies. User feedback regarding tools and resources has been generally negative, contributing to the low overall satisfaction rating.

Customer Service and Support Analysis (Score: 5/10)

Customer service represents a crucial aspect of any brokerage operation. Yet Lotas Capital's support infrastructure remains largely undefined in available sources. The lack of specific information about customer service channels, response times, and service quality raises concerns about the broker's commitment to client support.

Available contact information suggests the broker maintains customer support lines. However, details about availability hours, supported languages, and communication methods are not specified. For an international broker serving diverse markets, comprehensive multilingual support is typically essential for effective client service.

Response time benchmarks and service quality metrics are absent from available information. This makes it difficult to assess the efficiency of the broker's support operations. Professional brokers typically provide 24/5 support during market hours with guaranteed response times for different inquiry types.

User feedback indicates mixed experiences with customer service, contributing to the overall rating of 2.9 out of 5. Some reviewers have expressed frustration with support quality, though specific details about common issues or resolution effectiveness are not provided in available sources. The 47% recommendation rate suggests that customer service issues may be a contributing factor to overall client dissatisfaction.

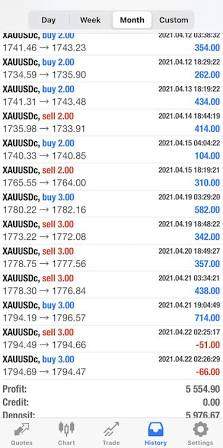

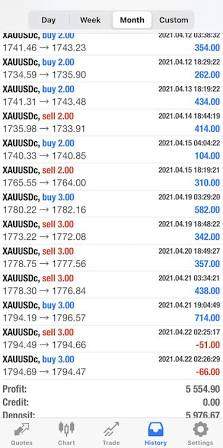

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation for Lotas Capital is hampered by insufficient information about platform stability, execution quality, and overall trading environment. Without specific details about the trading platforms offered, it becomes challenging to assess the user interface quality, charting capabilities, and order management features that directly impact daily trading activities.

Order execution quality, including information about slippage rates, requote frequency, and execution speeds, is not documented in available sources. These factors are crucial for traders, particularly those employing scalping strategies or trading during high-volatility periods. The absence of such performance metrics raises questions about execution transparency.

Platform stability and uptime statistics are not provided. This leaves uncertainty about the reliability of the trading infrastructure during critical market periods. Professional traders require consistent platform availability and robust technical infrastructure to execute their strategies effectively.

Mobile trading capabilities and cross-device synchronization features remain unspecified. This is concerning given the increasing importance of mobile trading in today's market environment. The lack of information about trading environment factors such as spread stability and liquidity provision further complicates the assessment of overall trading experience quality.

This lotas capital review indicates that the limited available information about trading experience represents a significant transparency issue that potential clients should address before committing to the platform.

Trust and Safety Analysis (Score: 3/10)

Trust and safety represent the most concerning aspects of Lotas Capital's offering. The broker's regulatory status under the Mwali International Services Authority (MISA) provides minimal oversight compared to established financial regulatory bodies. MISA, while legitimate, lacks the international recognition and stringent requirements associated with major regulators like the FCA, ASIC, or CySEC.

Fund safety measures, including segregated account policies, deposit insurance, and client money protection schemes, are not detailed in available sources. Established brokers typically provide comprehensive information about how client funds are protected and segregated from company operational funds. The absence of such information raises significant concerns about fund security.

Company transparency regarding financial reporting, management structure, and operational procedures appears limited. Professional brokers typically publish annual reports, maintain clear corporate governance structures, and provide detailed information about their operational framework. The lack of such transparency contributes to trust concerns.

The broker's offshore operational structure, while legal, inherently provides fewer protections for traders compared to brokers operating under major regulatory frameworks. Dispute resolution mechanisms and legal recourse options may be limited in offshore jurisdictions. User feedback reflects these trust concerns, with the low recommendation rate of 47% suggesting that safety and reliability issues impact client confidence.

User Experience Analysis (Score: 4/10)

User experience analysis reveals significant challenges for Lotas Capital. This is evidenced by the 2.9 out of 5 rating from 15 reviews and the low 47% recommendation rate. These metrics indicate that less than half of the broker's clients would recommend the service to others, suggesting fundamental issues with the overall client experience.

The user satisfaction data suggests problems across multiple service areas. However, specific details about the most common complaints are not provided in available sources. Typically, low user ratings reflect issues with platform reliability, customer service quality, withdrawal processes, or trading conditions that don't meet client expectations.

Interface design and platform usability information is not available. This makes it difficult to assess whether the trading environment is intuitive and user-friendly. For a broker targeting novice traders, platform ease-of-use becomes particularly important for client retention and satisfaction.

The registration and account verification process details are not specified. However, streamlined onboarding procedures are essential for positive initial user experiences. Fund operation experiences, including deposit and withdrawal convenience and processing times, remain undocumented but likely contribute to the overall user satisfaction ratings.

The user demographic appears to consist primarily of small-scale investors and beginners seeking high leverage and low minimum deposits. However, the poor user experience ratings suggest that the broker may not be adequately serving even this target market's needs and expectations.

Conclusion

This comprehensive lotas capital review reveals a broker with significant limitations that potential traders should carefully consider. While Lotas Capital offers attractive entry-level conditions including a low 100 USD minimum deposit and high leverage up to 1:500, these benefits are overshadowed by substantial concerns regarding regulatory oversight, transparency, and user satisfaction.

The broker appears most suitable for novice traders and small-scale investors who prioritize accessibility over regulatory protection. However, even this target demographic should exercise caution given the poor user ratings and limited information about essential trading conditions, platform features, and client protection measures.

The primary advantages include low capital requirements and high leverage ratios. The significant disadvantages encompass inadequate regulatory oversight, poor user satisfaction scores, and insufficient transparency about trading conditions and client protections. Traders seeking reliable, well-regulated brokerage services may find better alternatives among established brokers with stronger regulatory credentials and proven track records of client satisfaction.