LEOM MARKET 2025 Review: Everything You Need to Know

Executive Summary

LEOM MARKET is an unreliable forex broker that poses major scam risks to traders. Multiple industry sources report that this broker operates without proper regulatory oversight, which represents a major red flag for potential clients. The platform claims to offer forex and CFD trading services. However, its unregulated status severely undermines its credibility in the competitive brokerage landscape.

User experiences with LEOM MARKET have been consistently negative. Traders report various issues related to transparency and reliability. The broker's website lacks essential regulatory information and firm addresses. These are standard features among legitimate brokers. This leom market review reveals that the platform targets investors seeking forex and CFD trading opportunities. But the overwhelming evidence suggests that traders should exercise extreme caution when considering this broker.

The absence of regulatory compliance from recognized financial authorities makes LEOM MARKET a high-risk proposition for traders. Industry experts consistently advise against using unregulated brokers, particularly those that have been flagged by multiple sources as potentially fraudulent operations.

Important Disclaimers

Regional Entity Differences: LEOM MARKET is registered in China and does not hold regulatory authorization from other major financial jurisdictions. Traders should be aware that the lack of international regulatory oversight significantly impacts the safety and security of funds deposited with this broker.

Review Methodology: This comprehensive evaluation is based on available user feedback, industry reports, and publicly accessible information. The assessment has not involved direct testing of the platform's services. All conclusions are drawn from third-party sources and user testimonials found in the available research materials.

Rating Framework

Broker Overview

LEOM MARKET was established in 2021 as a forex and CFD trading broker. The company positioned itself in the competitive online trading market. The company operates from China but lacks the regulatory credentials that characterize reputable brokerage firms. According to broker analysis reports, LEOM MARKET's business model centers around providing access to foreign exchange markets and contracts for difference. However, specific operational details remain unclear due to limited transparency.

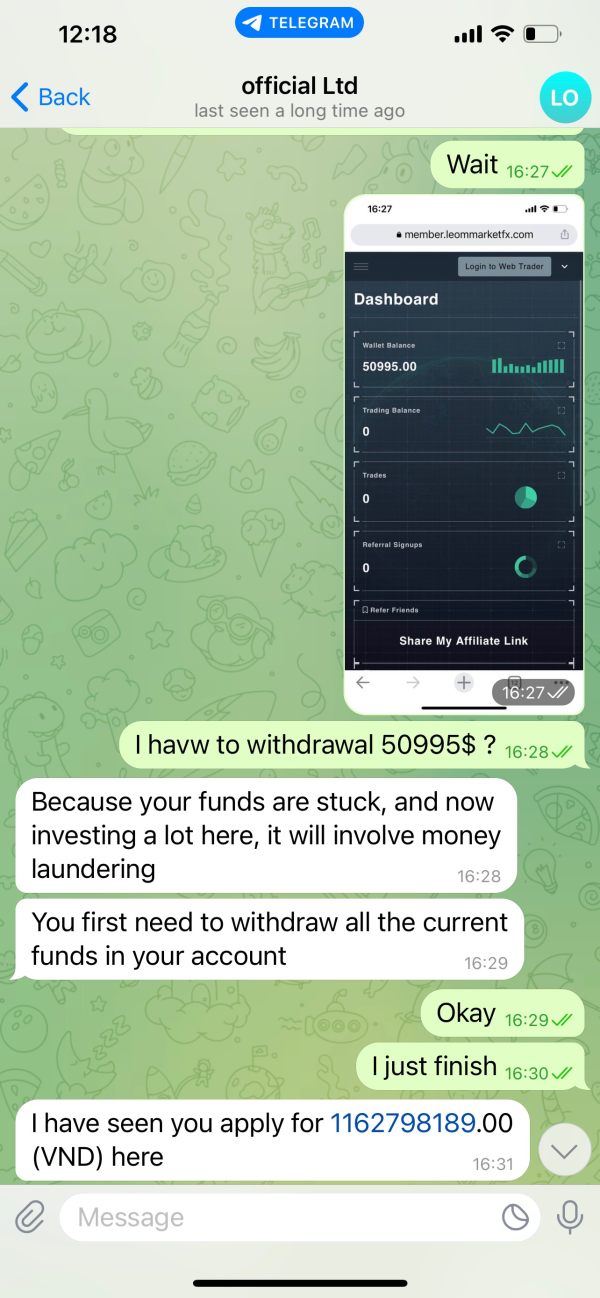

The broker's website presents trading opportunities that "look good to be true," according to industry watchdogs. This apparent attractiveness is overshadowed by significant credibility concerns. The absence of prominent regulatory credentials and licensing information on their platform distinguishes LEOM MARKET negatively from legitimate brokers. Legitimate brokers typically display such information prominently for trader verification.

The company's operational approach appears to target retail traders interested in forex and CFD markets. However, the lack of proper regulatory oversight raises serious questions about fund safety and operational legitimacy. This leom market review indicates that while the broker may offer access to popular trading markets, the associated risks far outweigh any potential benefits for serious traders.

Regulatory Status: LEOM MARKET operates without authorization from recognized financial regulatory bodies. Registration is limited to China without international regulatory compliance.

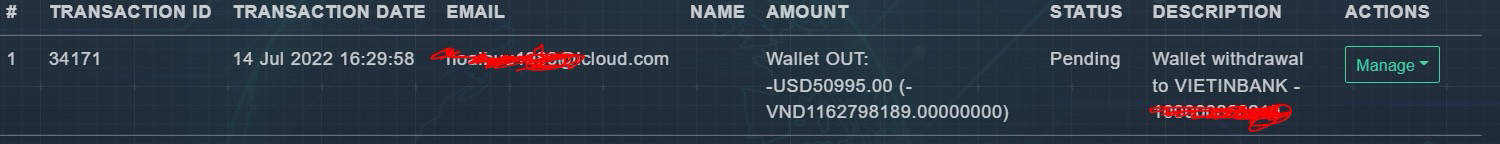

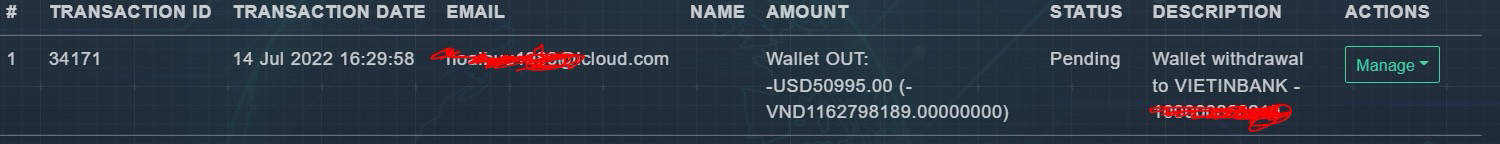

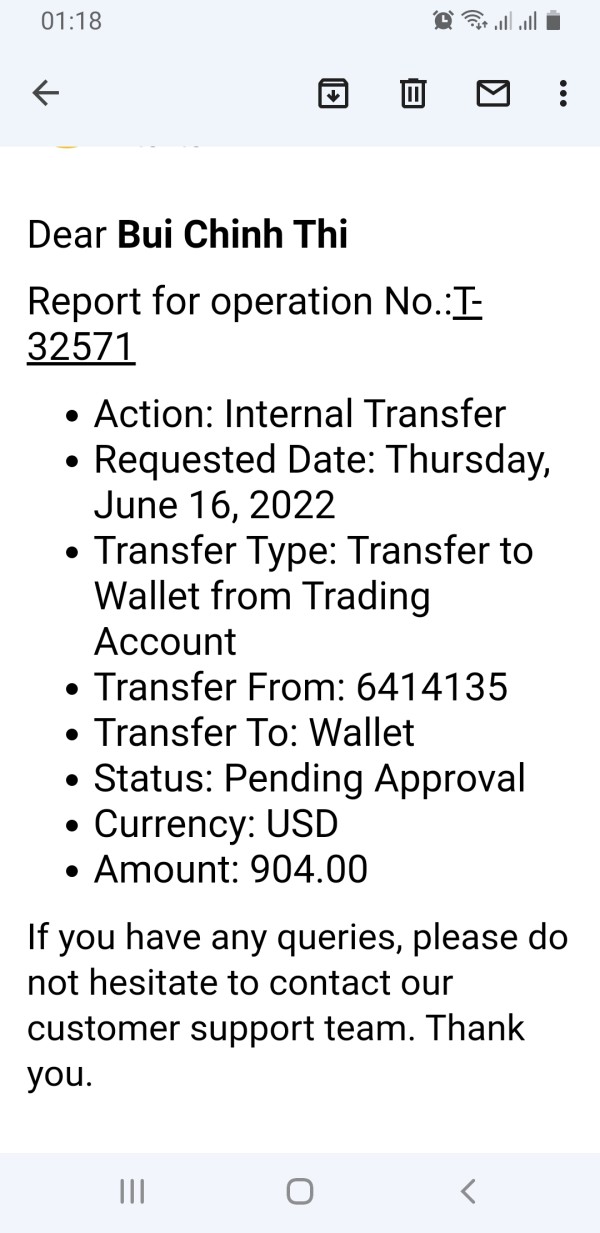

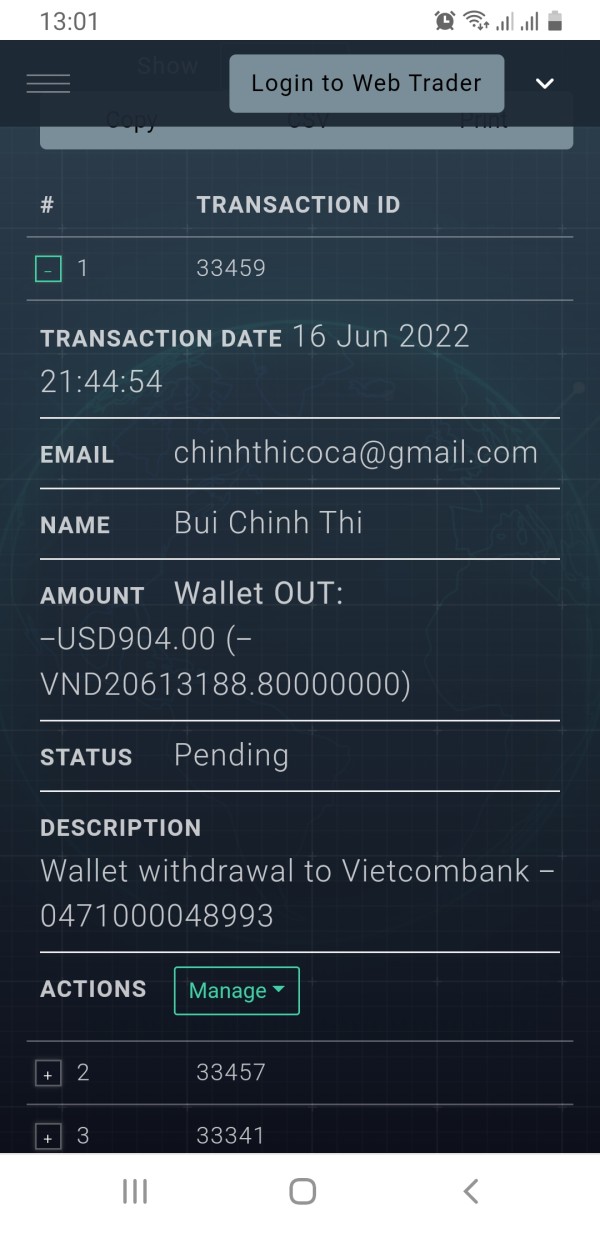

Deposit and Withdrawal Methods: Specific information regarding payment methods and processing procedures is not detailed in available materials. This raises transparency concerns.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts. This is unusual for legitimate trading platforms.

Promotional Offers: Available research does not reveal specific bonus or promotional structures offered by the platform.

Tradeable Assets: The broker focuses primarily on forex currency pairs and contracts for difference. However, the exact range of available instruments remains unclear.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available. This hampers traders' ability to assess the platform's competitiveness.

Leverage Ratios: Specific leverage offerings have not been disclosed in available materials.

Platform Options: The trading platform types and technological infrastructure details are not specified in accessible documentation.

Geographic Restrictions: Information about regional trading limitations is not provided in available sources.

Customer Support Languages: Available support languages and communication options are not clearly specified.

This leom market review reveals significant information gaps that legitimate brokers typically address transparently.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of LEOM MARKET's account conditions reveals concerning gaps in transparency and information disclosure. Unlike reputable brokers who clearly outline their account types, minimum deposit requirements, and specific features, LEOM MARKET provides insufficient details about their account structures. Available research materials do not contain comprehensive information about different account tiers or their respective benefits.

The account opening process lacks the clarity that traders expect from professional brokerage services. Industry standards dictate that legitimate brokers should provide detailed information about account features, trading conditions, and associated costs. However, LEOM MARKET's approach to account information disclosure falls significantly short of these expectations.

User feedback suggests that the platform's account conditions are not clearly communicated. This leads to confusion and dissatisfaction among traders. The absence of transparent account information makes it difficult for potential clients to make informed decisions about their trading setup. This leom market review emphasizes that the lack of clear account condition disclosure represents a significant weakness in the broker's service offering.

The assessment of LEOM MARKET's trading tools and resources reveals substantial deficiencies compared to industry standards. Established brokers typically offer comprehensive suites of analytical tools, research resources, and educational materials to support trader success. However, available information about LEOM MARKET's tool offerings is extremely limited.

Professional trading platforms usually provide access to advanced charting software, market analysis tools, economic calendars, and automated trading capabilities. The research materials do not indicate that LEOM MARKET offers these essential trading resources. This puts potential clients at a significant disadvantage compared to traders using properly equipped platforms.

Educational resources are particularly important for developing traders. Reputable brokers invest heavily in providing webinars, tutorials, and market insights. The absence of detailed information about LEOM MARKET's educational offerings suggests that the broker may not prioritize trader development and success.

The lack of comprehensive tool information makes it difficult for traders to assess whether the platform can meet their analytical and strategic trading requirements.

Customer Service and Support Analysis

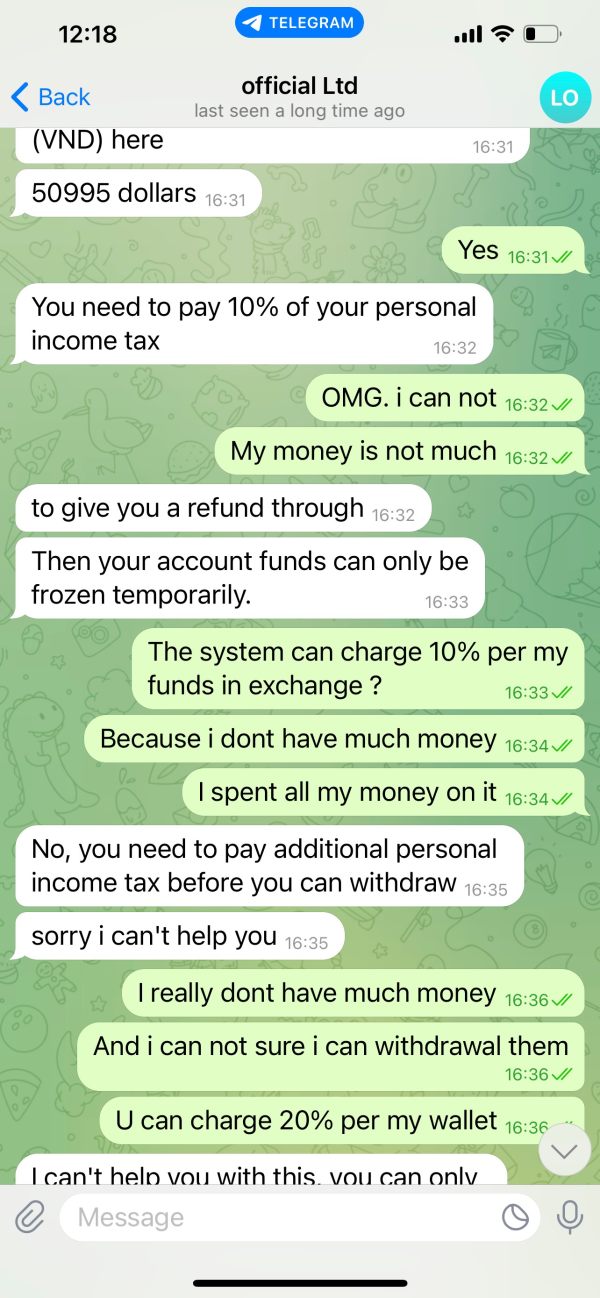

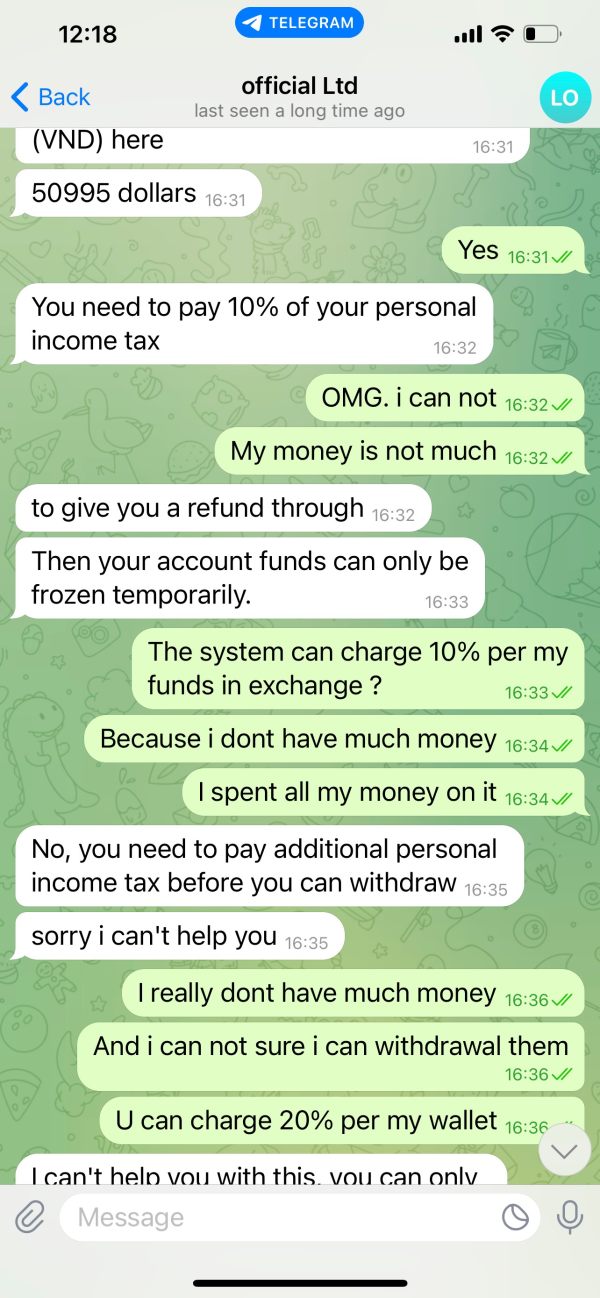

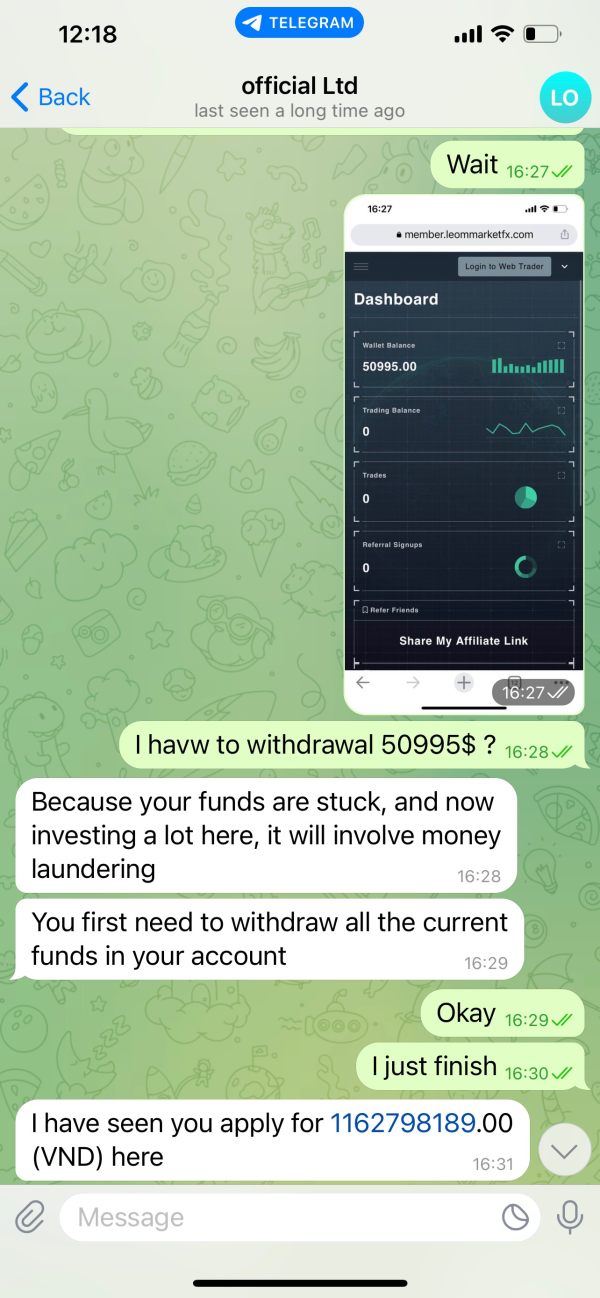

Customer service quality represents a critical factor in broker evaluation. LEOM MARKET's performance in this area raises significant concerns. User feedback consistently indicates that the broker's support services are unreliable and insufficient for addressing trader needs effectively. Professional brokers typically offer multiple communication channels, extended support hours, and multilingual assistance.

The available research suggests that LEOM MARKET's customer service infrastructure does not meet industry standards for responsiveness and problem resolution. Traders report difficulties in obtaining adequate support when facing platform-related issues or account concerns. This pattern of poor customer service significantly impacts the overall trading experience and undermines confidence in the broker's commitment to client satisfaction.

Reliable customer support is essential for addressing technical issues, account inquiries, and trading-related problems promptly. The negative feedback regarding LEOM MARKET's support services indicates that traders may face significant challenges when requiring assistance. This could result in financial losses or trading disruptions.

The absence of detailed information about support channels, response times, and service quality standards further reinforces concerns about the broker's commitment to professional customer service delivery.

Trading Experience Analysis

The trading experience evaluation reveals substantial concerns about LEOM MARKET's platform performance and execution quality. User feedback consistently indicates poor trading experiences, with traders expressing dissatisfaction about various aspects of platform functionality. Professional trading platforms should provide stable execution, competitive pricing, and reliable order processing to ensure optimal trading conditions.

Platform stability and execution speed are crucial factors that directly impact trading profitability and user satisfaction. The negative user experiences reported suggest that LEOM MARKET may not provide the technical infrastructure necessary for professional trading activities. Traders require platforms that can handle market volatility and execute orders efficiently during various market conditions.

Mobile trading capabilities have become essential in modern forex trading. These allow traders to manage positions and monitor markets from anywhere. The lack of detailed information about LEOM MARKET's mobile trading solutions raises questions about the broker's commitment to providing comprehensive trading access across different devices and platforms.

This leom market review indicates that the overall trading environment provided by the broker does not meet the standards expected by serious traders who require reliable and professional trading conditions.

Trust Factor Analysis

Trust represents the foundation of any successful broker-client relationship. LEOM MARKET's trust profile reveals serious deficiencies that should concern potential traders. The broker's unregulated status represents the most significant trust issue, as regulatory oversight provides essential protections for trader funds and ensures operational standards compliance.

Multiple industry sources have flagged LEOM MARKET as a potentially fraudulent operation. This represents a severe trust warning for prospective clients. Legitimate brokers typically hold licenses from recognized regulatory authorities such as the FCA, CySEC, or ASIC. These provide investor protection schemes and operational oversight.

The absence of transparent company information, including proper business addresses and regulatory credentials, further undermines trust in the broker's legitimacy. Professional brokers maintain transparency about their corporate structure, regulatory status, and operational procedures to build client confidence.

Fund safety measures, such as segregated client accounts and investor compensation schemes, are standard features among reputable brokers. The lack of clear information about such protections with LEOM MARKET raises serious concerns about the safety of deposited funds and the broker's commitment to client protection.

User Experience Analysis

User experience analysis reveals widespread dissatisfaction among traders who have interacted with LEOM MARKET's services. The overall user satisfaction levels appear to be consistently low, with traders expressing frustration about various aspects of the platform's functionality and service delivery. Professional brokers typically prioritize user experience design to ensure intuitive navigation and efficient trading workflows.

Interface design and platform usability significantly impact trader productivity and satisfaction. The negative user feedback suggests that LEOM MARKET's platform design may not provide the intuitive and efficient trading environment that modern traders expect. User-friendly interfaces should facilitate quick order placement, easy account management, and comprehensive market analysis capabilities.

The registration and account verification processes should be streamlined and transparent to provide a positive initial experience for new traders. User complaints about various platform aspects indicate that LEOM MARKET may not have invested adequately in user experience optimization and platform development.

Common user complaints center around reliability issues, lack of transparency, and poor service quality. These collectively create a negative trading environment that undermines trader confidence and success potential.

Conclusion

This comprehensive leom market review reveals that LEOM MARKET represents a high-risk brokerage option that traders should avoid. The broker's unregulated status, combined with widespread negative user feedback and industry scam warnings, creates an unacceptable risk profile for serious traders. The significant gaps in transparency, inadequate customer service, and poor user experiences collectively demonstrate that LEOM MARKET does not meet the standards expected from professional forex brokers.

Based on the available evidence, this broker is not recommended for any type of trader, whether beginner or experienced. The absence of regulatory protection, combined with the numerous red flags identified in this analysis, suggests that traders should seek alternative brokers with proper regulatory credentials and positive industry reputations for their trading activities.