Is LEOM MARKET safe?

Business

License

Is Leom Market Safe or Scam?

Introduction

Leom Market positions itself as a player in the forex trading arena, offering a variety of financial instruments, including forex, commodities, and cryptocurrencies. However, the rise of online trading has also led to an increase in the number of unregulated brokers, making it essential for traders to exercise caution when selecting a broker. The potential for scams and fraudulent practices necessitates a thorough evaluation of any trading platform before committing funds. This article aims to provide a comprehensive assessment of Leom Market, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. Our findings are based on extensive research, including reviews from financial authorities, trader feedback, and industry analysis.

Regulation and Legitimacy

The regulatory environment surrounding a broker is a critical factor in determining its safety and reliability. Regulatory bodies enforce standards that protect traders, ensuring fair practices and safeguarding client funds. Unfortunately, Leom Market is not regulated by any reputable authority, which raises significant concerns regarding its legitimacy. Below is a summary of the regulatory information available for Leom Market:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that Leom Market operates without the accountability that comes with being licensed. This lack of regulation is compounded by various warnings issued by financial authorities, including the UK's Financial Conduct Authority (FCA), which has flagged Leom Market for targeting UK investors without authorization. Such warnings are significant red flags, indicating that traders should exercise extreme caution when considering whether Leom Market is safe to trade with.

Company Background Investigation

Leom Market lacks transparency regarding its ownership and management structure. Established in 2022, the broker has not provided verifiable information about its corporate history, making it difficult to assess its credibility. The absence of a physical address and corporate registration details raises serious questions about the company's legitimacy. Furthermore, the management team behind Leom Market is largely unknown, with no publicly available professional backgrounds or qualifications. This opacity is concerning, as reputable brokers typically provide detailed information about their leadership and operational practices.

The overall lack of transparency in Leom Markets operations contributes to the perception that it is not a trustworthy broker. Without adequate information about who runs the company, traders are left vulnerable to potential scams. The combination of a short operational history and a lack of regulatory oversight suggests that Leom Market may not have the experience or accountability necessary to instill confidence among traders looking to invest their capital.

Trading Conditions Analysis

When evaluating whether Leom Market is safe, it is essential to consider its trading conditions, including fees, spreads, and commissions. While the broker claims to offer competitive trading conditions, the lack of transparency regarding its fee structure raises concerns. Traders often report hidden fees and unclear commission policies, which can significantly affect overall trading costs. Below is a comparison of Leom Market's trading costs against industry averages:

| Fee Type | Leom Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (0 - 10 USD per lot) |

| Overnight Interest Range | N/A | Varies (0.5% - 2%) |

The lack of specific data regarding spreads and commissions makes it difficult for traders to gauge the overall cost of trading with Leom Market. Moreover, the absence of a clear fee structure can lead to unexpected costs, making it challenging for traders to manage their budgets effectively. This opacity in trading conditions is yet another reason to question whether Leom Market is a safe trading option.

Customer Fund Security

The security of customer funds is paramount when assessing any broker's reliability. Leom Market has not provided adequate information regarding its fund protection measures. Reputable brokers typically segregate client funds from their operational funds and participate in investor compensation schemes. However, Leom Market does not appear to have any such safeguards in place.

The lack of fund segregation means that in the event of financial difficulties or insolvency, traders may lose their investments without recourse. Furthermore, there is no indication that Leom Market offers negative balance protection, which could expose traders to unlimited losses. The absence of these critical safety measures raises serious concerns about the security of funds deposited with Leom Market, leading many to question whether Leom Market is a safe broker.

Customer Experience and Complaints

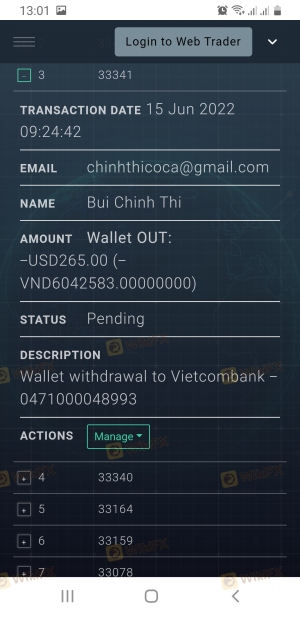

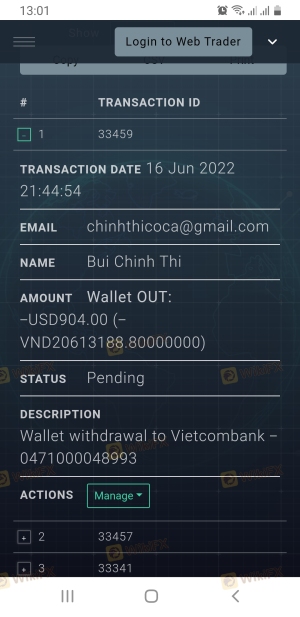

Customer feedback is an invaluable resource for evaluating the reliability of a broker. Unfortunately, reviews of Leom Market indicate a pattern of negative experiences among traders. Common complaints include difficulties in withdrawing funds, poor customer service, and aggressive marketing tactics. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Delayed Responses |

| Misleading Marketing Tactics | High | No Clarification |

One notable case involved a trader who reported being unable to withdraw their funds after initially experiencing successful transactions. The trader claimed that after depositing a significant amount, withdrawal requests were ignored, leading to frustration and financial loss. Such experiences highlight the potential risks associated with trading through Leom Market, raising further doubts about whether Leom Market is safe for traders.

Platform and Trade Execution

The trading platform offered by Leom Market is another critical aspect to consider. Traders have reported mixed experiences regarding the platform's performance, including issues with stability and execution quality. Concerns about slippage and order rejections have been raised, indicating that the platform may not be as reliable as it claims.

Moreover, there are allegations of potential manipulation within the trading environment, which could further undermine trader confidence. A trading platform that exhibits signs of manipulation is a significant red flag, suggesting that traders may not have a fair chance to execute their strategies effectively. Given these concerns, it is essential to question whether Leom Market is a safe trading platform.

Risk Assessment

Engaging with Leom Market comes with a range of inherent risks. The lack of regulation, transparency, and customer fund protection creates a high-risk environment for traders. Below is a summary of the key risk areas associated with Leom Market:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight, significant warnings issued. |

| Fund Security | High | No fund segregation or investor protection measures. |

| Customer Service | Medium | Poor responsiveness to complaints and withdrawal requests. |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider using regulated brokers with established reputations. Additionally, traders should only invest amounts they can afford to lose and always remain vigilant about the potential for scams.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Leom Market is not a safe trading option. The lack of regulation, transparency, and customer fund protection raises significant concerns about its legitimacy. Traders should be wary of engaging with Leom Market, as the risks associated with this broker far outweigh any potential benefits.

For those looking for reliable alternatives, it is recommended to consider well-regulated brokers with a proven track record of positive customer experiences. Brokers such as IC Markets, OANDA, and FXCM are examples of reputable options that provide the necessary protections and transparency that traders deserve. As the trading landscape continues to evolve, prioritizing safety and reliability is paramount for anyone looking to invest in the forex market.

Is LEOM MARKET a scam, or is it legit?

The latest exposure and evaluation content of LEOM MARKET brokers.

LEOM MARKET Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LEOM MARKET latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.