KUT Review 1

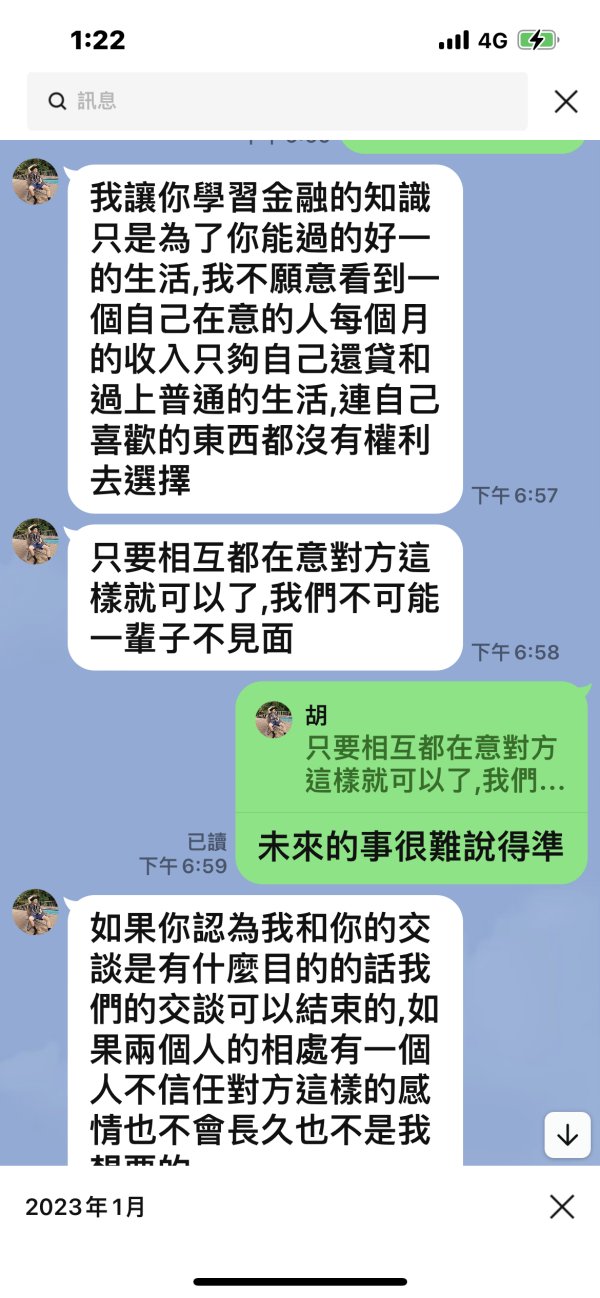

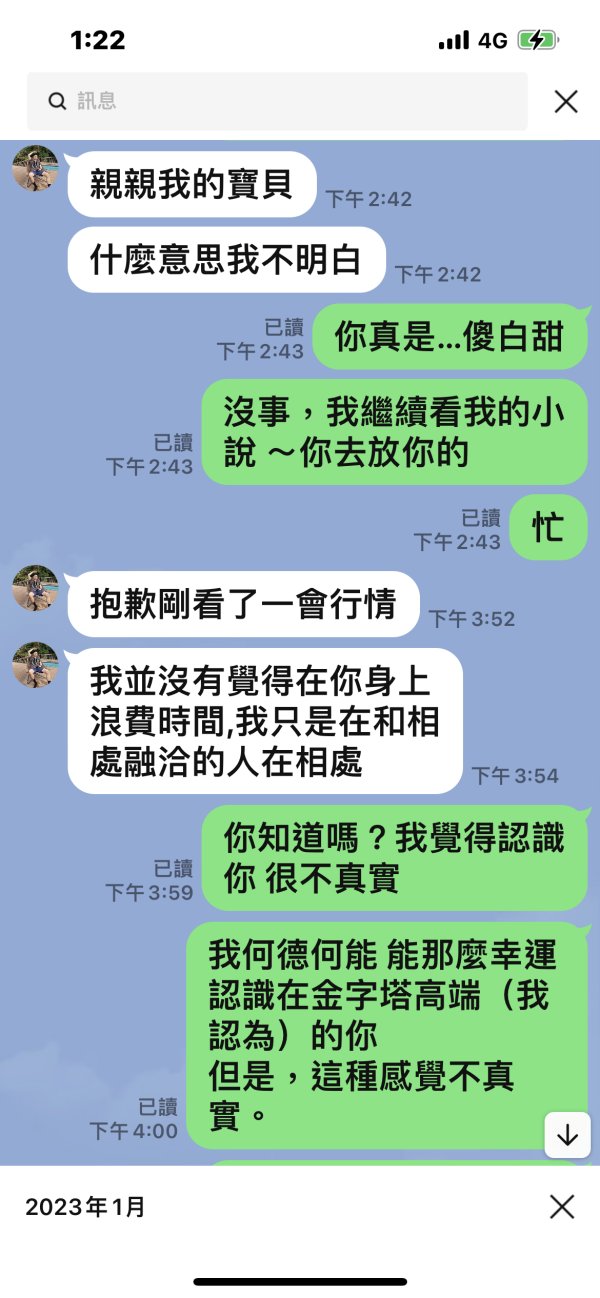

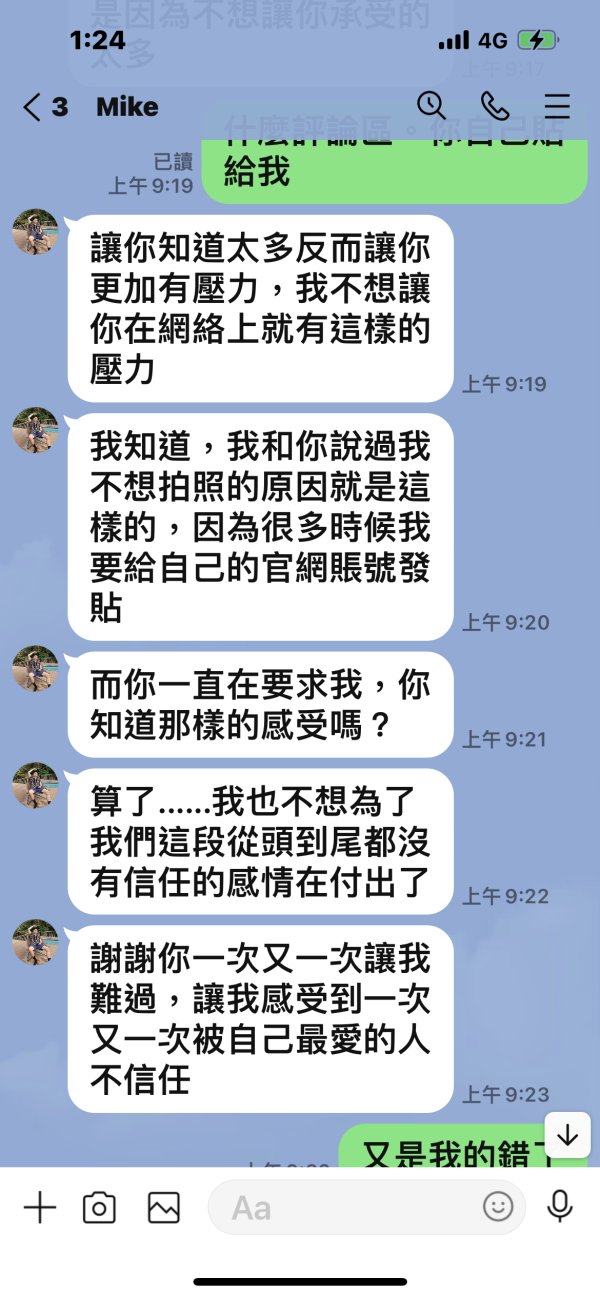

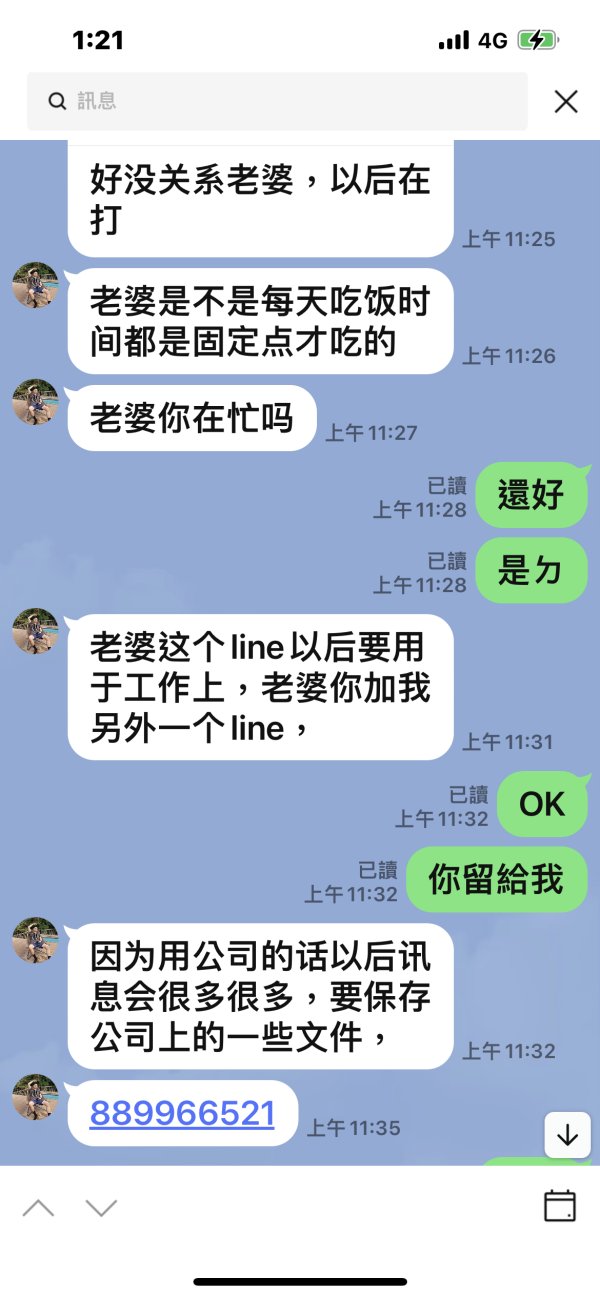

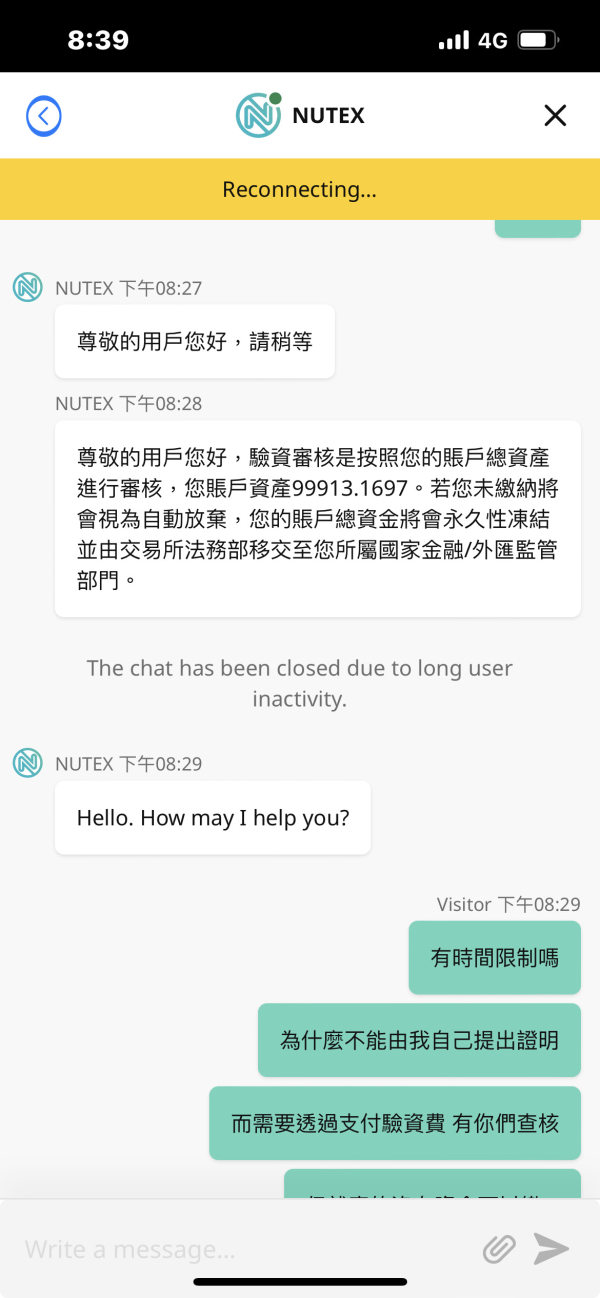

ID: qibi236 When you don’t invest money, they start to swear. If you want you to invest in virtual currency and trade with you, there will be profits.

KUT Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

ID: qibi236 When you don’t invest money, they start to swear. If you want you to invest in virtual currency and trade with you, there will be profits.

This kut review examines a forex broker that operates from Hong Kong. The broker presents significant concerns for potential traders who want to invest their money safely. KUT positions itself as a forex trading service provider, claiming to offer zero spreads to attract cost-conscious traders who want to save money on trading costs. However, our analysis reveals substantial gaps in transparency and regulatory oversight that raise serious red flags for anyone considering this broker.

The broker's most notable claim is providing forex trading services with zero spreads. This appears attractive to traders seeking low-cost trading environments where they can maximize their profits. KUT targets forex traders, particularly those prioritizing minimal trading costs over regulatory protection and comprehensive service offerings that provide better safety and support. However, the absence of clear regulatory information and lack of detailed trading conditions significantly undermines the broker's credibility in the competitive forex market.

Our investigation indicates that KUT lacks proper regulatory oversight. No mention of authorization from recognized financial authorities appears in their materials, which creates serious concerns about trader protection. This absence of regulatory backing, combined with limited transparency regarding trading conditions, platform specifications, and company operations, positions this broker as a high-risk option for serious traders who value safety and reliability. The lack of comprehensive information about essential trading elements such as leverage, deposit requirements, and customer support structures further compounds these concerns for potential clients.

Traders should exercise extreme caution when considering KUT. The broker shows significant regulatory gaps and limited transparency that create serious risks for investors. The absence of clear regulatory authorization means users lack standard protections typically provided by established financial authorities that oversee broker operations. Different regional entities may operate under varying standards, and potential clients should thoroughly investigate local regulatory compliance before engaging with any services from this broker.

This review is based on publicly available information and user feedback where accessible. We conducted this analysis without direct testing of the platform's services, which limits our ability to provide firsthand experience insights. Given the limited information available, traders are strongly advised to conduct additional due diligence and consider regulated alternatives that provide comprehensive transparency and client protection measures for safer trading experiences.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 3/10 | Poor |

| Customer Service and Support | 4/10 | Below Average |

| Trading Experience | 3/10 | Poor |

| Trust and Regulation | 2/10 | Very Poor |

| User Experience | 3/10 | Poor |

| Overall Rating | 3.2/10 | Poor |

KUT operates as a forex broker claiming headquarters in Hong Kong. However, comprehensive company background information remains notably sparse, which creates transparency concerns for potential clients. The broker positions itself within the competitive forex trading market, attempting to attract traders through promises of zero-spread trading conditions that could save money on trading costs. However, the lack of detailed company history, founding year, and operational track record creates significant transparency concerns for potential clients who need reliable information to make informed decisions.

The company's business model appears focused primarily on forex trading services. Specific details about their operational structure, technology infrastructure, and service delivery mechanisms are not readily available to potential clients. This lack of transparency extends to fundamental business information that traders typically require when evaluating potential brokers, including company registration details, operational history, and management structure that demonstrate credibility and reliability. Without this essential information, traders cannot properly assess the broker's legitimacy and operational capabilities.

Regarding regulatory oversight, KUT presents a concerning picture with no mention of authorization from recognized financial authorities. Unlike established brokers that proudly display their regulatory credentials on their websites and marketing materials, KUT's materials lack reference to oversight from major regulatory bodies such as the FCA, ASIC, CySEC, or other respected financial authorities. This regulatory gap represents a significant risk factor that potential traders must carefully consider when evaluating this kut review and comparing it to properly regulated alternatives that offer better protection.

Regulatory Status: Available information indicates no clear regulatory authorization from established financial authorities. This represents a major concern for trader protection and fund security that cannot be overlooked.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available materials. This creates uncertainty about fund management procedures that traders need to understand before opening accounts.

Minimum Deposit Requirements: The broker has not clearly specified minimum deposit amounts for different account types. This makes it difficult for potential traders to understand entry requirements and plan their initial investments accordingly.

Bonuses and Promotions: No information is available regarding promotional offers, welcome bonuses, or ongoing trading incentives. These details might be available to new or existing clients but are not clearly communicated in public materials.

Tradeable Assets: The primary focus appears to be forex trading with limited information about other options. The specific range of currency pairs, exotic options, and other potential instruments remains unspecified in available documentation that potential clients can review.

Cost Structure: While the broker claims zero spreads, critical information about commission structures, overnight fees, deposit/withdrawal charges, and other potential costs is notably absent. This lack of transparency about the complete cost structure makes it impossible for traders to accurately calculate their total trading expenses.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available materials. This leaves traders uncertain about available trading power and associated risk exposure that could significantly impact their trading strategies.

Platform Options: Details about trading platforms, whether proprietary or third-party solutions like MetaTrader, are not clearly outlined. This information gap makes it difficult for traders to assess whether the platform meets their technical requirements and trading preferences.

Geographic Restrictions: Information about service availability in different jurisdictions and any regulatory restrictions is not comprehensively addressed. Potential clients need this information to determine whether they can legally access the broker's services in their location.

Customer Service Languages: Supported languages for customer service interactions and regional support availability remain unspecified. This creates uncertainty about communication capabilities for international traders who may need support in their native languages.

This kut review highlights significant information gaps that potential traders should carefully consider. These missing details make it extremely difficult to properly evaluate KUT against other broker options in the competitive forex market.

The account conditions offered by KUT present a mixed picture with concerning transparency gaps. While the broker promotes zero spreads as a primary attraction for cost-conscious traders, the absence of comprehensive account structure information raises significant questions about the complete trading environment. Most established brokers provide detailed breakdowns of different account tiers, each with specific features, minimum deposits, and trading conditions that help traders choose the most suitable option for their needs.

The lack of information about account types severely limits traders' ability to assess whether KUT's offerings align with their trading strategies. Professional traders typically require detailed specifications about account features, including available leverage, minimum trade sizes, maximum position limits, and any restrictions on trading strategies such as scalping or hedging. Furthermore, the account opening process remains unclear, with no detailed information about required documentation, verification procedures, or approval timeframes that could affect when traders can start trading.

Established brokers typically provide transparent onboarding processes, including Know Your Customer requirements and anti-money laundering compliance procedures. The absence of such information suggests either inadequate regulatory compliance or poor communication of essential procedural requirements that traders need to understand. Special account features, such as Islamic accounts for Sharia-compliant trading, VIP services for high-volume traders, or demo accounts for strategy testing, are not mentioned in available materials.

This lack of specialized options may limit the broker's appeal to diverse trading communities. It suggests a potentially limited service structure compared to comprehensive broker offerings that cater to different trader types and preferences. The evaluation of account conditions in this kut review reveals significant information deficits that potential traders should carefully consider when comparing KUT to more transparent alternatives in the competitive forex broker landscape.

KUT's trading tools and resources present significant concerns due to the complete absence of detailed information. The broker provides no indication of analytical capabilities, research offerings, and educational materials that modern traders require for success. Modern forex trading requires sophisticated tools for technical analysis, fundamental research, and market insights, yet available information provides no indication of what analytical resources KUT offers its clients who need these essential trading components.

Professional traders typically expect comprehensive charting packages, technical indicators, automated trading capabilities, and real-time market data feeds. The lack of information about these essential trading tools raises questions about whether KUT provides the technological infrastructure necessary for serious forex trading activities that require advanced analytical capabilities. Without proper analytical tools, traders may find themselves at a significant disadvantage in the competitive forex markets where information and analysis capabilities can determine trading success.

Educational resources represent another critical gap in KUT's apparent offerings to potential clients. Successful brokers typically provide extensive educational materials including webinars, trading guides, market analysis, and strategy development resources that help traders improve their skills and knowledge. The absence of any mention of educational support suggests either non-existent educational programs or poor communication of available learning resources that could benefit traders at all experience levels.

Research capabilities, including economic calendars, market commentary, and expert analysis, are fundamental components of professional trading environments. Established brokers often provide daily market insights, technical analysis reports, and economic event previews to help traders make informed decisions about their trading strategies and market positions. The lack of information about such research support indicates potential deficiencies in the comprehensive trading environment that serious traders require for consistent success.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, remains completely unaddressed in available materials. This absence of information about automation options may significantly limit the broker's appeal to sophisticated traders who rely on automated strategies for consistent market participation and risk management.

Customer service quality represents a critical factor in broker evaluation. KUT provides remarkably little information about their support infrastructure and service delivery capabilities that traders depend on for assistance. Professional brokers typically offer multiple communication channels including live chat, phone support, email assistance, and comprehensive FAQ sections to address client needs efficiently and promptly.

The absence of detailed customer service information raises significant concerns about response times, service quality, and problem resolution capabilities. Traders require reliable support for technical issues, account management questions, and urgent trading concerns that may arise during active market hours when quick responses can be crucial. Without clear service level commitments, potential clients cannot assess whether KUT provides adequate support for their trading activities and account management needs.

Multilingual support capabilities remain completely unspecified, which may limit the broker's accessibility to international traders. Global forex brokers typically provide support in multiple languages with native speakers who understand both linguistic nuances and cultural trading preferences that can affect client satisfaction. Operating hours for customer support services are not clearly defined, creating uncertainty about availability during different market sessions when traders may need immediate assistance.

Forex markets operate 24 hours during weekdays, and traders often require support during extended hours. They need to address urgent issues that may affect their trading positions and account management needs without delay. The absence of information about specialized support services, such as dedicated account managers for high-volume traders or technical support for platform issues, suggests potential limitations in service differentiation and personalized client care that many traders expect from their chosen brokers.

The trading experience evaluation for KUT reveals substantial concerns due to the complete absence of platform specifications. Available information provides no insights into execution quality data, and user experience feedback that traders need to make informed decisions. Modern forex trading relies heavily on platform stability, execution speed, and comprehensive functionality, yet available information provides no insights into these critical performance factors that can significantly impact trading success.

Platform stability and reliability represent fundamental requirements for successful forex trading. This becomes particularly important during high-volatility market conditions when rapid execution becomes crucial for protecting profits and limiting losses. The lack of information about system uptime, server locations, and infrastructure capabilities raises questions about KUT's ability to provide consistent trading environments during critical market moments when traders need reliable platform performance.

Order execution quality, including fill rates, slippage statistics, and rejection rates, remains completely unaddressed. These factors are essential elements in trading performance evaluation that professional traders use to assess broker quality. Professional traders require transparent execution statistics to assess whether a broker's execution capabilities align with their trading strategies and performance expectations for consistent profitability.

Mobile trading capabilities have become increasingly important as traders require access to markets and account management functions. Modern traders need these capabilities while away from desktop environments for flexibility and convenience. The absence of information about mobile applications, responsive web platforms, or mobile-optimized interfaces suggests potential limitations in trading accessibility and convenience that could restrict trading opportunities.

Advanced trading features such as one-click trading, advanced order types, risk management tools, and customizable interfaces are not mentioned. These features significantly impact trading efficiency and risk management capabilities, making their absence a notable concern for serious traders who depend on advanced functionality. This kut review emphasizes that the lack of comprehensive trading experience information represents a significant limitation for traders seeking detailed platform evaluation before committing to a new broker relationship.

Trust and regulatory compliance represent the most critical concerns in this KUT evaluation. The broker fails to demonstrate adequate oversight from recognized financial authorities that protect trader interests and ensure fair business practices. Regulatory authorization serves as the foundation of trader protection, ensuring brokers operate under established guidelines that protect client funds and maintain operational standards that benefit all traders.

The absence of regulatory credentials from major authorities represents a fundamental risk factor. Major authorities such as the Financial Conduct Authority, Australian Securities and Investments Commission, Cyprus Securities and Exchange Commission, or other respected regulatory bodies provide essential oversight that protects traders. Regulated brokers must comply with strict capital requirements, client fund segregation rules, and operational transparency standards that protect trader interests and provide recourse in case of disputes.

Client fund protection mechanisms, including segregated accounts, investor compensation schemes, and independent auditing requirements, are not addressed. Available information provides no details about these essential safety measures that regulated brokers typically implement. Regulated brokers typically maintain client funds in separate accounts at tier-one banks, providing protection against broker insolvency and operational risks that unregulated entities may not offer to their clients.

Company transparency, including detailed corporate information, management backgrounds, and operational history, remains notably absent from KUT's available materials. Established brokers typically provide comprehensive corporate information, demonstrating transparency and accountability to their client base and regulatory authorities who oversee their operations. The lack of third-party auditing, independent reviews from respected industry sources, and recognition from professional trading organizations further compounds trust concerns for potential clients.

Reputable brokers often showcase independent evaluations and industry recognition that validate their operational quality. They demonstrate service standards that meet industry benchmarks and regulatory requirements for client protection.

User experience evaluation for KUT proves challenging due to the absence of comprehensive user feedback. Available information lacks interface demonstrations, and detailed service descriptions that potential clients need to assess overall service quality. Modern broker evaluation relies heavily on user testimonials, independent reviews, and detailed user journey analysis to assess overall service quality and client satisfaction levels that indicate broker performance.

The lack of available user reviews and testimonials suggests either limited client base activity or insufficient online presence. This absence makes it difficult to generate meaningful user feedback that potential clients can use for evaluation. Established brokers typically accumulate substantial user reviews across multiple platforms, providing potential clients with insights into real-world trading experiences and service quality assessments from actual users.

Interface design and usability information remains completely unavailable for potential client review. This makes it impossible to assess whether KUT provides intuitive navigation, efficient account management tools, and user-friendly trading environments that facilitate successful trading activities. Modern traders expect sophisticated yet accessible interfaces that facilitate efficient trading activities and comprehensive account oversight without unnecessary complexity or technical barriers.

Registration and verification processes are not detailed in available materials for potential client review. This creates uncertainty about onboarding efficiency and documentation requirements that could affect account opening timelines. Streamlined account opening procedures with clear verification steps represent important factors in overall user experience evaluation, particularly for traders seeking rapid market access to capitalize on trading opportunities.

Common user complaints and resolution procedures are not addressed in available information. This suggests either absence of established complaint handling processes or inadequate transparency regarding client issue management that could affect trader satisfaction. Professional brokers typically maintain transparent complaint procedures and demonstrate commitment to client satisfaction through responsive problem resolution that builds trust and loyalty.

The absence of user experience data in this evaluation highlights the significant information gaps. Potential traders must consider these limitations when evaluating KUT against more transparent broker alternatives that provide comprehensive user experience documentation and feedback from real clients.

This comprehensive kut review reveals significant concerns that substantially outweigh any potential benefits the broker might offer. While KUT's claim of zero spreads may initially appear attractive to cost-conscious traders seeking to minimize trading costs, the fundamental lack of regulatory oversight and transparency creates unacceptable risks for serious forex trading activities. The absence of proper regulatory authorization represents the most critical concern, as it leaves traders without essential protections typically provided by established financial authorities who oversee broker operations.

Combined with limited transparency regarding trading conditions, platform specifications, and operational procedures, KUT presents a high-risk proposition. Experienced traders should approach this broker with extreme caution due to these significant deficiencies in transparency and regulatory compliance. KUT is not recommended for traders seeking reliable, regulated forex trading environments with comprehensive service offerings and transparent operational standards that protect client interests.

The significant information gaps and regulatory concerns make this broker unsuitable for serious trading activities. This is particularly true for traders prioritizing fund security and professional service standards over potentially attractive cost structures that may not provide adequate value when considering overall risk factors.

FX Broker Capital Trading Markets Review