Karen 2025 Review: Everything You Need to Know

Executive Summary

This karen review presents a comprehensive analysis of what appears to be a complex situation involving multiple entities bearing the "Karen" name. Due to the lack of clear regulatory information and detailed trading conditions typically associated with financial brokerages, our overall assessment of Karen as a trading platform remains neutral to cautious. The available information suggests connections to various individuals and projects, including Karin Broker, an artist who served as Professor of Printmaking and Drawing at Rice University for 41 years, and references to Karen-related content in entertainment media.

However, the absence of standard brokerage information such as regulatory compliance, trading platforms, and financial services raises significant concerns for potential traders. This review is particularly relevant for experienced traders who possess substantial financial knowledge and can navigate environments with limited transparency. Given the information gaps and unclear business model, we recommend extreme caution for anyone considering this as a trading platform.

Important Notice

Different regional users may encounter varying regulatory environments and trading conditions when dealing with Karen-related services. The lack of specific regulatory information in available sources means that compliance standards may differ significantly across jurisdictions.

All assessments in this review are based on currently available information, which is notably limited regarding standard brokerage operations. Traders should conduct additional due diligence and verify regulatory status independently before making any financial commitments.

Rating Framework

Broker Overview

The Karen entity presents a confusing landscape of multiple individuals and projects sharing similar names. According to available information, Karin Broker emerged as a notable figure in the academic and artistic community, born in Pittsburgh, Pennsylvania in 1950.

Her professional career was primarily centered in Houston, where she held the position of Professor of Printmaking and Drawing at Rice University for an impressive 41-year tenure. This extensive academic background suggests a strong foundation in visual arts rather than financial services.

The longevity of her academic career indicates dedication and expertise within the educational sector, though this background does not directly translate to financial brokerage services. The search results also reveal references to various Karen-related content in entertainment media, including what appears to be a 2021 film featuring Taryn Manning.

Additionally, there are mentions of a book titled "Karen: A Brother Remembers" by Kelsey Grammer, scheduled for release on May 6, 2025, which deals with a tragic crime involving the author's sister. However, none of these references provide clarity regarding a legitimate financial brokerage operation.

The absence of standard brokerage information such as trading platforms, regulatory compliance, or financial services in the available sources raises significant red flags for this karen review.

Regulatory Regions: Specific regulatory information is not mentioned in available source materials, creating significant uncertainty about compliance standards.

Deposit/Withdrawal Methods: No information about financial transaction methods is provided in current source materials.

Minimum Deposit Requirements: Minimum deposit information is not detailed in available sources.

Bonuses and Promotions: No promotional offers or bonus structures are mentioned in the source materials.

Tradeable Assets: Available sources do not specify any tradeable financial instruments or asset classes.

Cost Structure: Fee schedules and trading costs are not outlined in any of the available information, which is concerning for this karen review.

Leverage Ratios: No leverage information is provided in source materials.

Platform Options: Trading platform details are not mentioned in available sources.

Regional Restrictions: Geographic limitations are not specified in current data.

Customer Support Languages: Language support information is not available in source materials.

Detailed Rating Analysis

Account Conditions Analysis

The complete absence of account condition information in available sources presents a major concern for potential traders. Standard brokerage operations typically provide detailed information about account types, minimum deposits, account opening procedures, and special features such as Islamic accounts for Muslim traders.

However, our research yielded no such information for Karen. This lack of transparency regarding basic account structures suggests either an incomplete online presence or potentially questionable business operations.

Without clear account conditions, traders cannot make informed decisions about compatibility with their trading needs. The absence of account tier structures, verification requirements, or account maintenance fees leaves potential clients without essential information needed for financial planning.

This information gap significantly impacts our karen review assessment and raises serious questions about the legitimacy of Karen as a financial services provider.

The analysis of trading tools and resources reveals a complete information void in available sources. Professional forex brokerages typically offer comprehensive suites of analytical tools, market research, educational materials, and automated trading support.

However, no such resources are mentioned in connection with Karen in any available materials. The absence of information regarding charting software, technical indicators, economic calendars, or market analysis tools suggests either a severe lack of trading infrastructure or questionable business legitimacy.

Educational resources, which are crucial for trader development, are entirely absent from available information. Without access to proper trading tools and resources, traders would be severely handicapped in their market analysis and decision-making processes.

This complete absence of trading-related tools and resources represents a critical deficiency that significantly impacts the overall assessment of Karen as a trading platform.

Customer Service and Support Analysis

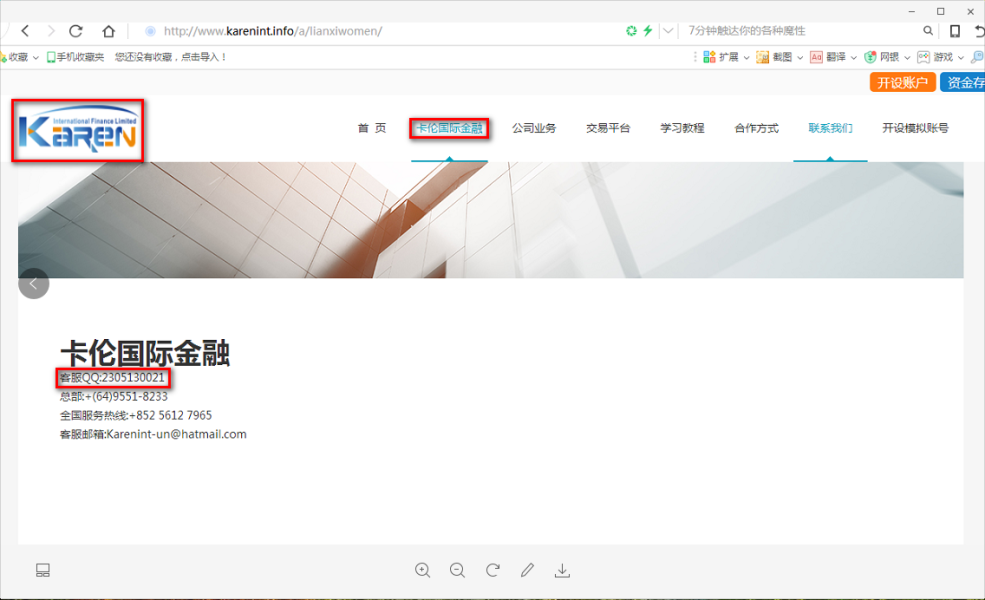

Customer service information is entirely absent from available sources, which presents significant concerns for potential clients. Professional brokerages typically maintain multiple communication channels including live chat, phone support, email assistance, and comprehensive FAQ sections.

The lack of any customer service information in our research suggests either inadequate infrastructure or questionable business operations. Response times, service quality metrics, multilingual support capabilities, and operating hours are all standard features that remain completely undefined for Karen.

Without proper customer support structures, traders would face significant challenges in resolving account issues, technical problems, or trading disputes. The absence of customer service information also raises questions about regulatory compliance, as most financial regulators require brokerages to maintain adequate customer support systems.

This complete lack of customer service transparency represents a major red flag in our assessment.

Trading Experience Analysis

The trading experience analysis reveals a complete absence of platform-related information in available sources. Professional forex brokerages typically provide detailed specifications about platform stability, execution speeds, order types, mobile trading capabilities, and overall trading environment quality.

However, no such information exists for Karen in any available materials. Platform reliability metrics, latency data, slippage statistics, and execution quality measures are entirely absent from our research.

Mobile trading applications, which are essential in modern forex trading, are not mentioned in any capacity. The lack of information about trading platforms, whether proprietary or third-party solutions like MetaTrader, suggests either inadequate infrastructure or questionable business legitimacy.

Without proper trading platform information, potential clients cannot assess whether Karen meets their technical requirements or trading style preferences. This complete absence of trading experience data significantly undermines confidence in this karen review assessment.

Trust Factor Analysis

The trust factor analysis reveals significant concerns due to the complete absence of regulatory information and transparency measures in available sources. Professional forex brokerages typically maintain clear regulatory compliance with bodies such as FCA, ASIC, CySEC, or other recognized financial authorities.

However, no regulatory information is mentioned in connection with Karen in any available materials. Fund security measures, including segregated client accounts, investor compensation schemes, and third-party audits, are entirely absent from available information.

Company transparency, which includes clear ownership structures, financial reporting, and business registration details, remains completely undefined. The absence of regulatory oversight raises serious questions about fund safety and business legitimacy.

Without proper regulatory backing, clients have no recourse in case of disputes or business failures. Industry reputation and recognition from established financial publications or rating agencies are also absent from available information.

This complete lack of trust-building elements represents the most significant concern in our assessment.

User Experience Analysis

User experience analysis reveals a complete absence of feedback and usability information in available sources. Professional brokerages typically maintain user satisfaction metrics, interface design quality assessments, registration process reviews, and comprehensive user feedback systems.

However, no such information exists for Karen in any available materials. User interface design, navigation efficiency, and overall platform usability remain completely undefined in our research.

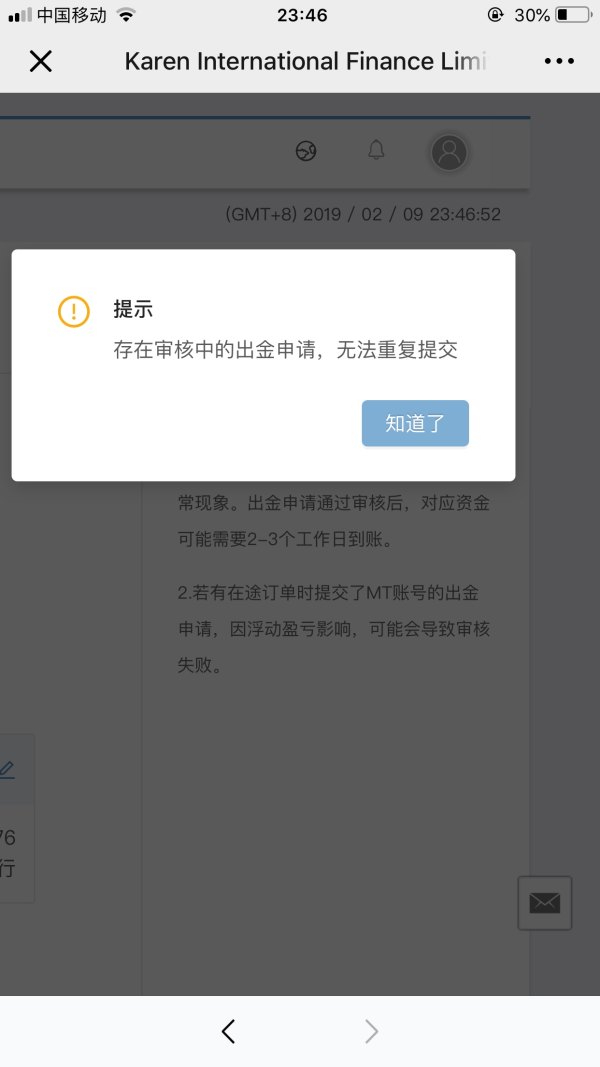

Registration and account verification procedures, which significantly impact user onboarding experience, are not mentioned in any capacity. Fund deposit and withdrawal experiences, including processing times and method availability, are entirely absent from available information.

Common user complaints or satisfaction indicators, which provide valuable insights into service quality, are not available in any sources. The absence of user experience data makes it impossible to determine the suitability of Karen for different trader types or experience levels.

This complete lack of user feedback and experience information further reinforces concerns about the legitimacy and operational status of Karen as a trading platform.

Conclusion

This karen review concludes that the available information presents significant gaps and concerns regarding Karen as a potential trading platform. The complete absence of standard brokerage information, including regulatory compliance, trading conditions, platform details, and customer service structures, raises serious questions about legitimacy and operational capacity.

While references to academic and artistic individuals named Karen or Karin exist, none provide evidence of a functioning financial brokerage operation. The lack of transparency regarding essential trading elements makes Karen unsuitable for most traders, regardless of experience level.

We strongly recommend that potential clients seek properly regulated and transparent brokerage alternatives that provide comprehensive information about their services, regulatory status, and trading conditions.