KAIHER 2025 Review: Everything You Need to Know

Executive Summary

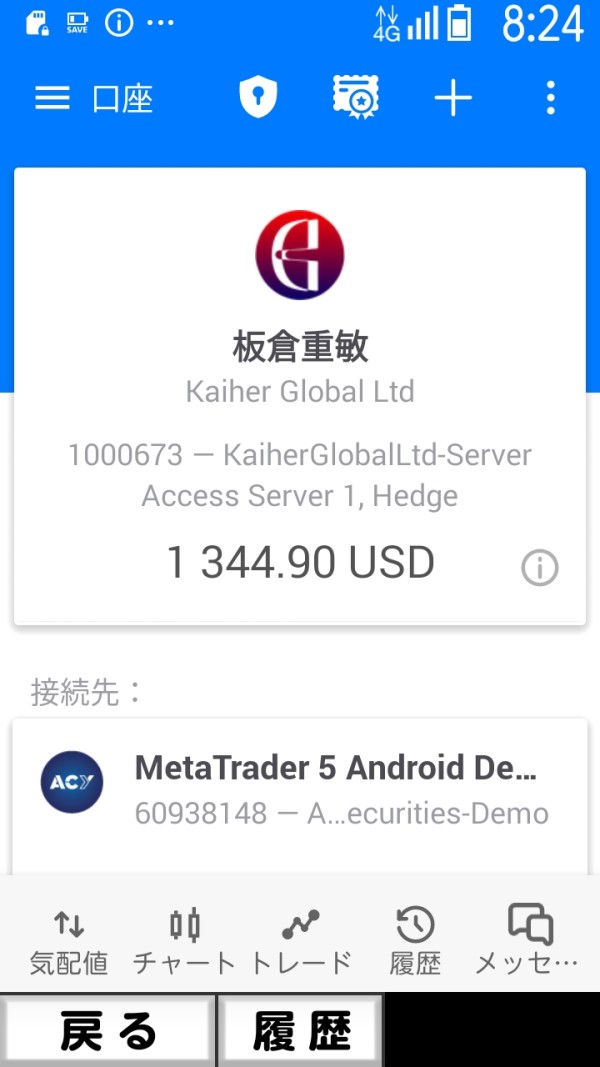

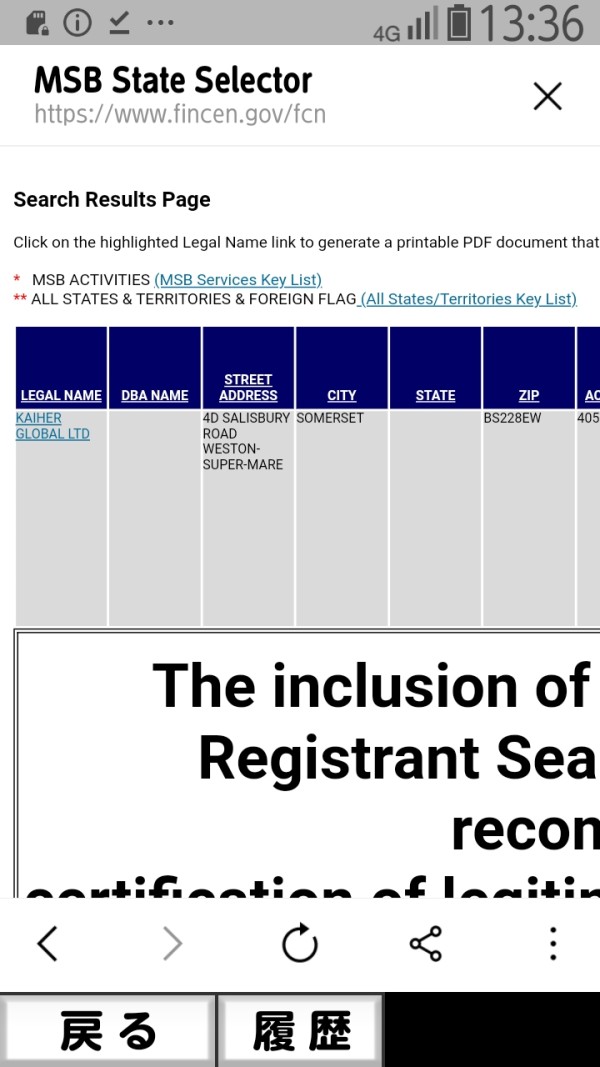

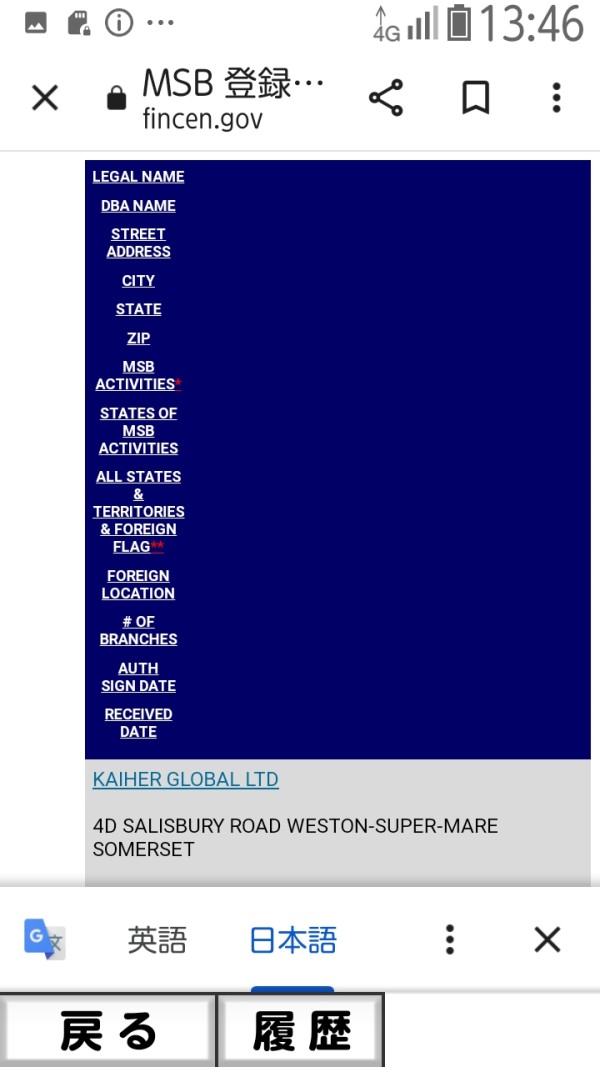

KAIHER is a foreign exchange broker that claims to have multiple regulatory licenses. Its legitimacy remains highly questionable, though the company presents itself as a major player in the trading industry. The broker was founded in 2024 and claims to be based in Melbourne, Australia, while KAIHER Markets Limited operates from the Bahamas. This setup presents significant red flags that potential investors should carefully consider before using their services.

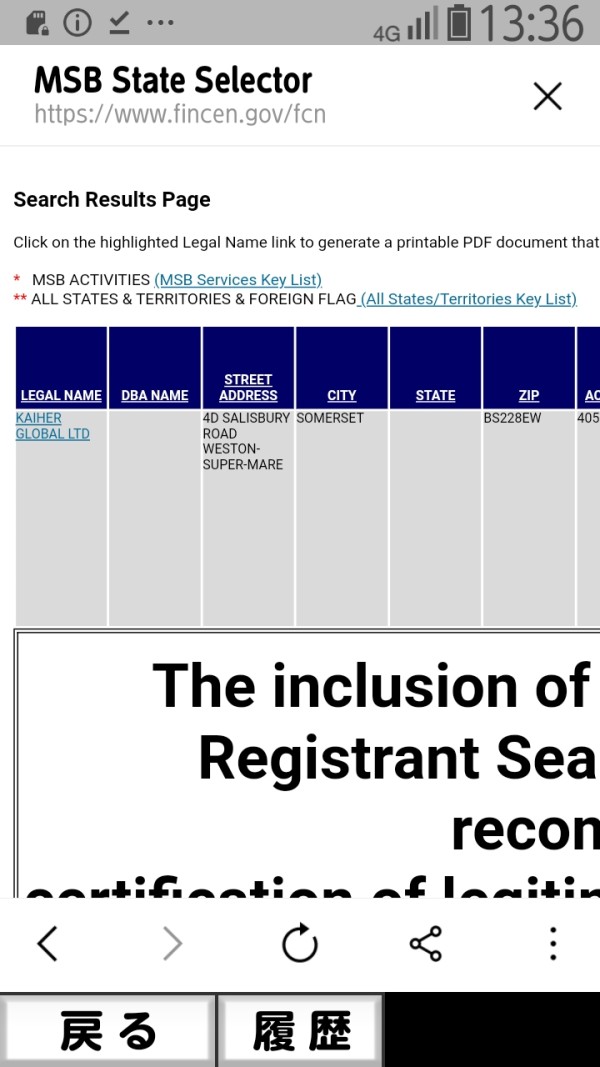

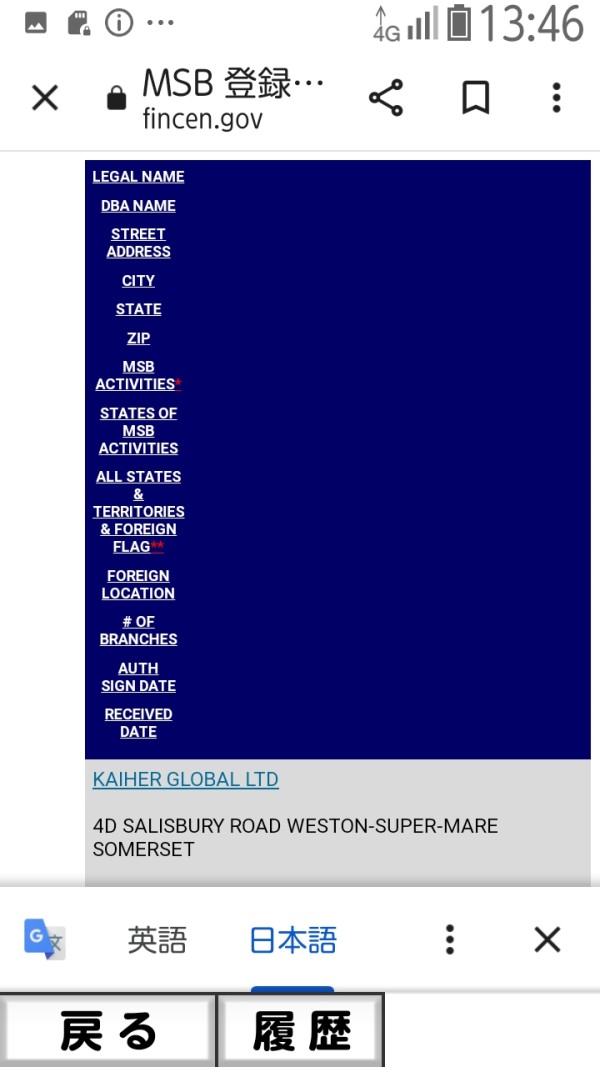

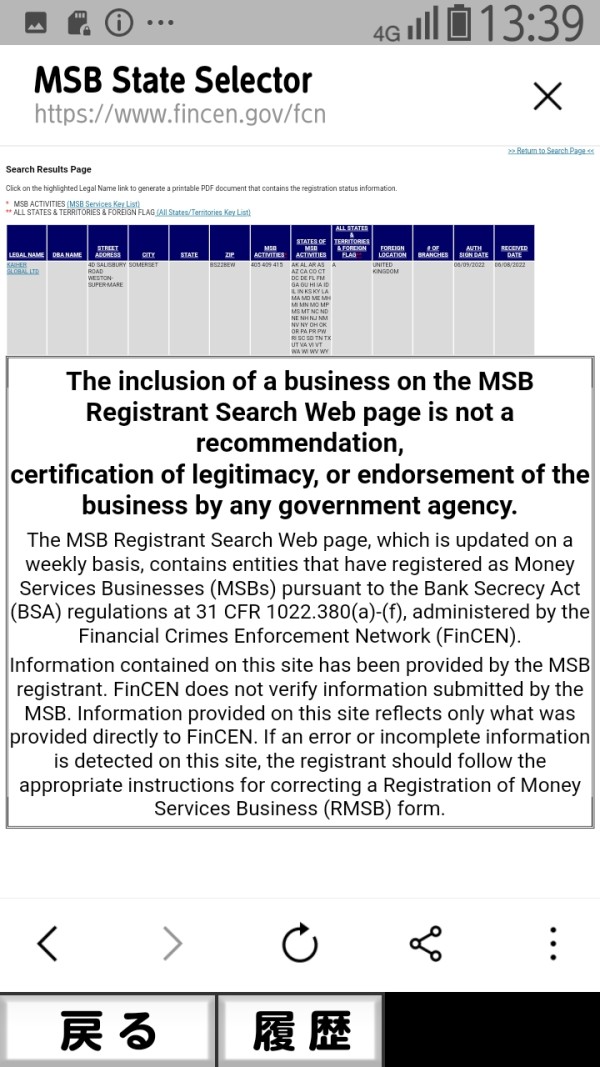

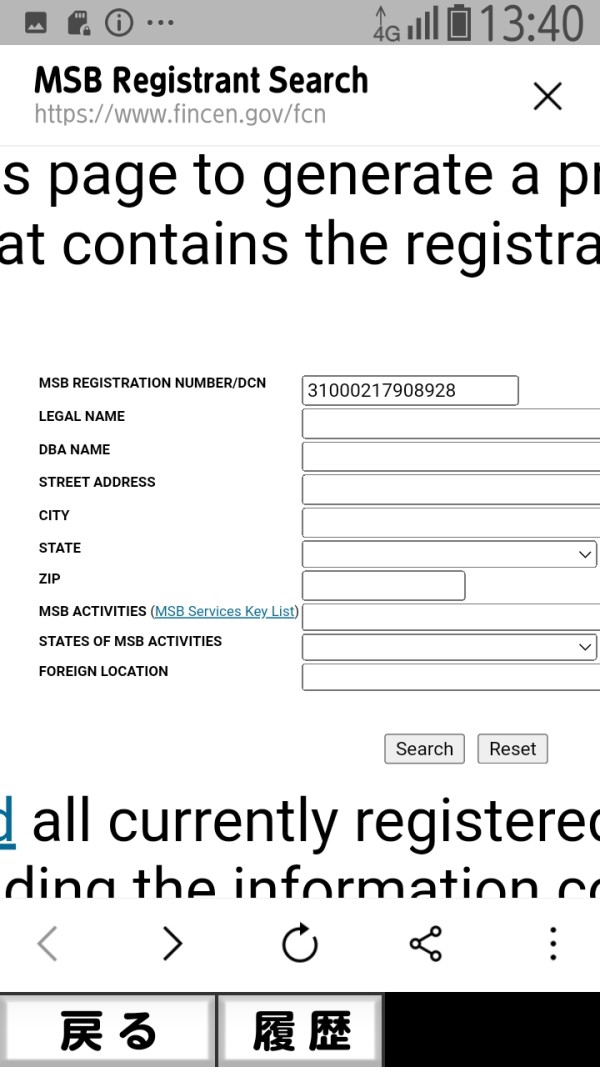

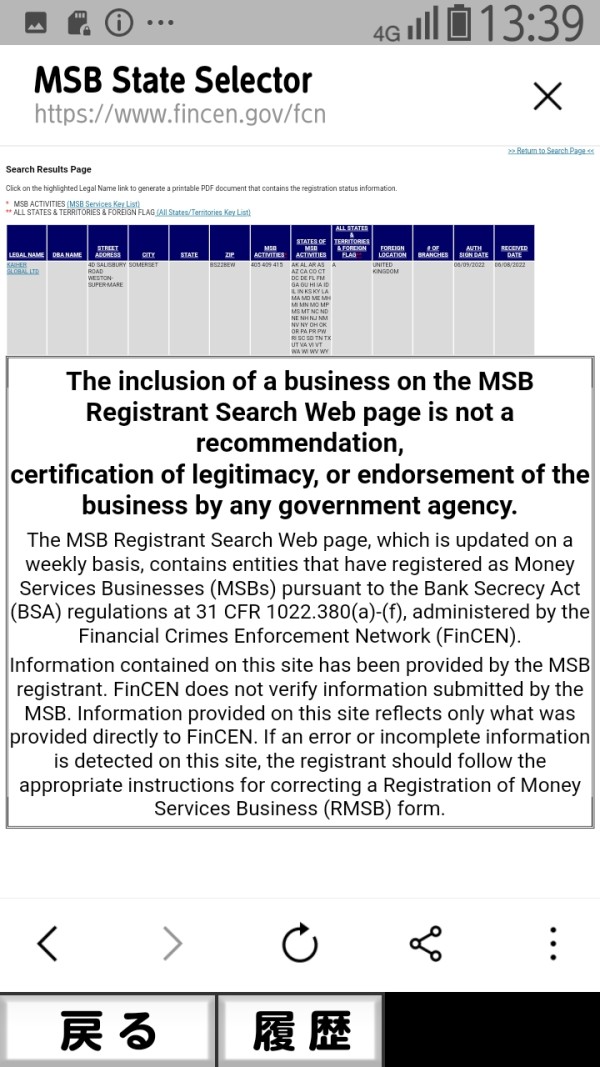

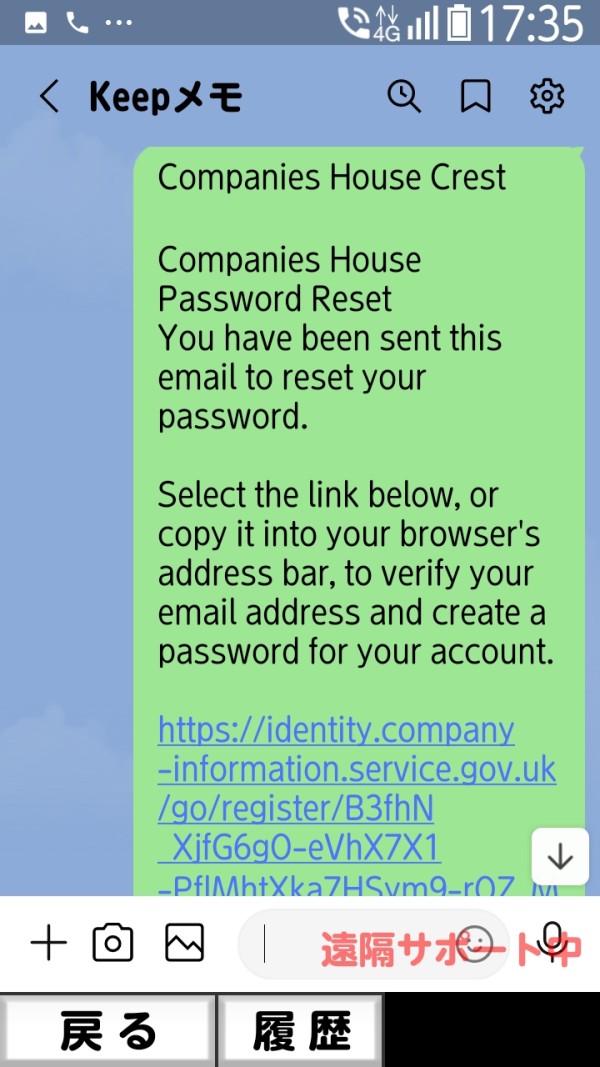

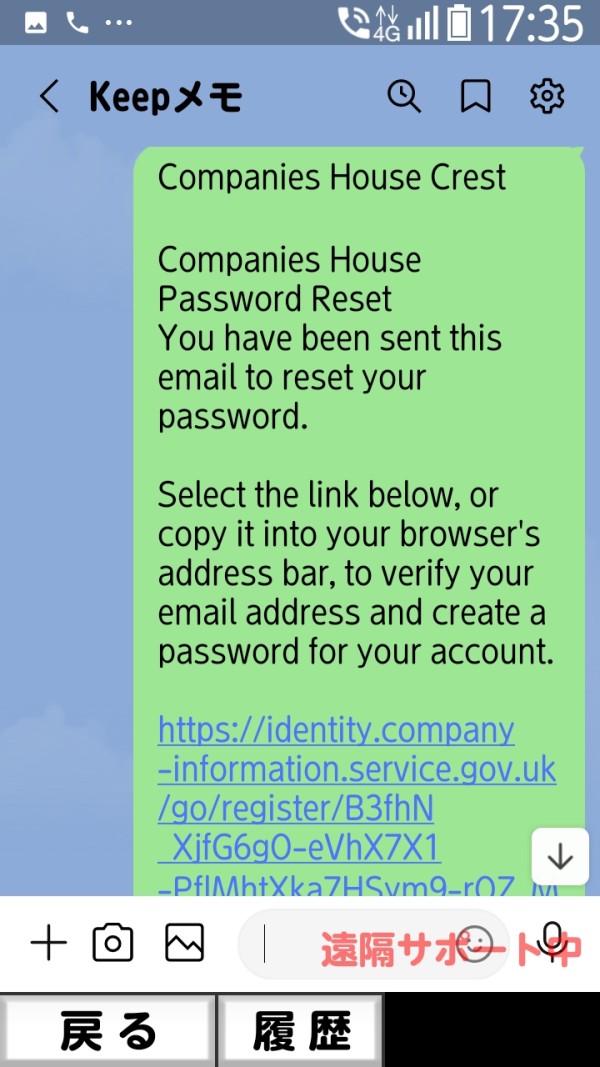

The company claims to be licensed by several major financial authorities. These include the Australian Securities and Investment Commission, the Securities Commission of The Bahamas, the Cyprus Securities and Exchange Commission, the United Kingdom Financial Conduct Authority, the Federal Financial Supervisory Authority, and the Dubai Financial Services Authority. However, regulatory warnings have been issued against the company, with the Securities Commission of The Bahamas specifically warning against KAIHER MARKETS LIMITED on July 19, 2024.

KAIHER offers many financial services including Forex, Index CFDs, Commodities, ETF CFDs, Stock CFDs, and Cryptocurrency trading. Despite this diverse product offering, user trust remains very low, with multiple reports of fraudulent activities and concerns about the broker's legitimacy. This comprehensive kaiher review reveals significant concerns that potential traders should know about before considering this platform for their investment activities.

Important Notice

This review is based on publicly available information and user feedback collected as of 2024. KAIHER's regulatory status varies significantly across different jurisdictions, and potential users must thoroughly verify the broker's legitimacy in their specific region before using their services. The regulatory claims made by KAIHER have been disputed by official warnings from regulatory bodies, particularly the Securities Commission of The Bahamas. Readers should exercise extreme caution and conduct independent verification of all claims made by this broker.

Rating Overview

Broker Overview

KAIHER Markets Limited was established in 2024. This makes it one of the newest companies in the competitive forex brokerage space. The company claims to operate from Melbourne, Australia, while being registered in the Bahamas, creating an immediate concern about its operational transparency. The broker positions itself as a comprehensive financial services provider, offering access to multiple asset classes through online trading platforms.

The company's business model centers around providing retail and institutional clients with access to global financial markets through CFD trading. KAIHER claims to serve a diverse clientele seeking exposure to various financial instruments, from traditional forex pairs to modern cryptocurrency assets. However, the broker's short operational history and questionable regulatory claims raise significant concerns about its stability and legitimacy.

KAIHER offers trading across multiple asset categories including foreign exchange pairs, stock indices through CFDs, commodities trading, ETF CFDs, individual stock CFDs, and cryptocurrency instruments. The broker claims to provide competitive trading conditions, though specific details about spreads, commissions, and execution quality remain largely undisclosed. The platform allegedly supports various trading strategies and caters to both novice and experienced traders, though user feedback suggests significant gaps between promises and actual service delivery. This kaiher review indicates that potential clients should approach with extreme caution given the numerous regulatory warnings and user complaints.

Regulatory Status: KAIHER claims authorization from multiple prestigious regulatory bodies including ASIC, SCB, CySEC, FCA, BaFin, and DFSA. However, the Securities Commission of The Bahamas issued a specific warning against KAIHER MARKETS LIMITED, contradicting the broker's regulatory claims and raising serious questions about its legitimacy.

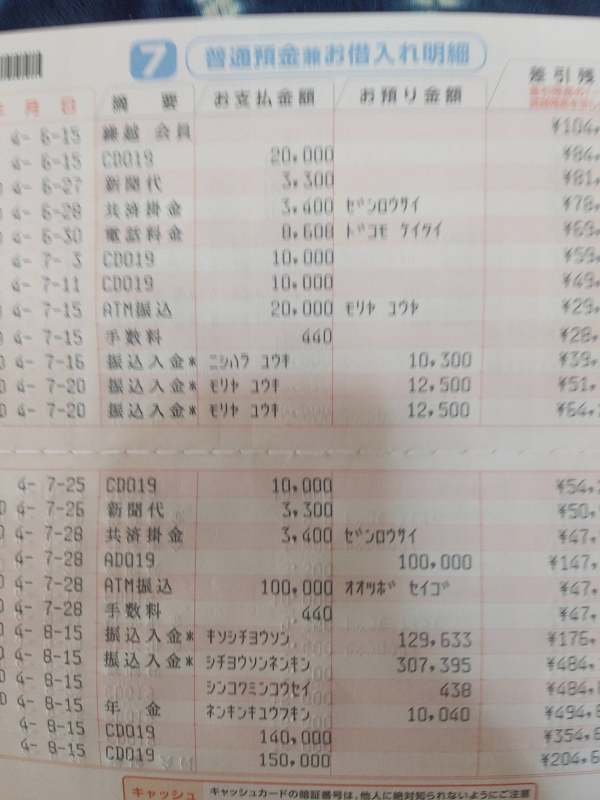

Deposit and Withdrawal Methods: Specific information about available payment methods is not detailed in available sources. This represents a significant transparency gap that potential clients should investigate thoroughly before committing funds.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts in available documentation. This makes it difficult for potential traders to assess accessibility and account tier structures.

Bonus and Promotions: Information regarding promotional offers, welcome bonuses, or trading incentives is not available in current sources. This suggests limited marketing transparency or absence of such programs.

Available Trading Assets: KAIHER provides access to a comprehensive range of financial instruments including major and minor forex pairs, global stock indices through CFDs, precious metals and energy commodities, ETF contracts for difference, individual stock CFDs from major exchanges, and various cryptocurrency pairs for digital asset exposure.

Cost Structure: The broker has not provided transparent information about spreads, commissions, overnight fees, or other trading costs. User reports suggest concerns about hidden fees and non-transparent pricing structures, which significantly impacts the overall value proposition for traders.

Leverage Ratios: Specific leverage information is not available in current sources. This prevents potential traders from understanding risk exposure and margin requirements for different asset classes.

Trading Platforms: Available documentation does not specify which trading platforms are offered. This represents a critical information gap for traders evaluating execution capabilities and analytical tools.

Geographic Restrictions: Information about restricted jurisdictions or regional limitations is not detailed in available sources. However, the regulatory warnings suggest potential restrictions in certain regions.

Customer Support Languages: Specific information about supported languages for customer service is not available in current documentation. This kaiher review highlights the need for better transparency in service offerings.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

KAIHER's account conditions represent one of the most concerning aspects of this broker's offering. The complete lack of transparency regarding account types, minimum deposit requirements, and specific trading conditions creates an environment where potential traders cannot make informed decisions about their investment choices. Unlike established brokers who provide detailed account specifications, KAIHER fails to disclose fundamental information that traders require.

The absence of clear information about account tiers, whether demo accounts are available, or what specific benefits each account level provides demonstrates a significant lack of professional standards. Users have expressed frustration about the difficulty in obtaining basic account information, with many reporting that even after initial contact, specific terms and conditions remain unclear.

The broker's failure to provide transparent information about account opening procedures, verification requirements, or account maintenance fees further compounds concerns about their operational legitimacy. When compared to industry standards where reputable brokers provide comprehensive account documentation, KAIHER's approach appears deliberately opaque.

The lack of information about specialized account types, such as Islamic accounts for Muslim traders or professional accounts for qualified investors, suggests either a limited service offering or poor communication of available options. This kaiher review emphasizes that potential traders should demand complete transparency before proceeding with account opening procedures.

KAIHER claims to offer comprehensive financial services across multiple asset classes. This suggests some level of trading tool availability, though the specific details about analytical tools, charting capabilities, technical indicators, and market research resources remain largely undisclosed. This creates uncertainty about the actual quality and depth of tools available to traders.

The broker's website mentions access to various financial instruments but fails to specify whether advanced trading tools such as algorithmic trading support, expert advisors, or automated trading systems are available. For modern traders who rely heavily on sophisticated analytical tools, this information gap represents a significant concern about the platform's capabilities.

Educational resources, which are crucial for trader development, appear to be either limited or poorly communicated. Reputable brokers typically provide extensive educational materials including webinars, tutorials, market analysis, and trading guides. The absence of clear information about such resources suggests KAIHER may not prioritize trader education and development.

Users have expressed doubts about the effectiveness and reliability of available trading tools. Some question whether the platform provides adequate functionality for serious trading activities. The lack of specific information about mobile trading capabilities, API access for institutional clients, or integration with third-party analytical tools further limits the platform's appeal to professional traders.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents a critical weakness in KAIHER's operational framework. User feedback consistently highlights poor support quality and responsiveness, creating significant concerns about the broker's commitment to client satisfaction. The available information does not specify customer service channels, operating hours, or response time commitments, creating uncertainty about support availability when traders encounter issues.

User reports indicate prolonged response times to inquiries. Many express frustration about the difficulty in reaching knowledgeable support representatives. The quality of assistance provided appears inconsistent, with users reporting that customer service representatives often lack adequate knowledge to resolve technical or account-related issues effectively.

The absence of clear information about multilingual support capabilities raises concerns for international traders who may require assistance in their native languages. Professional brokers typically provide comprehensive language support to serve diverse global clienteles, and KAIHER's unclear communication about this service aspect suggests potential limitations.

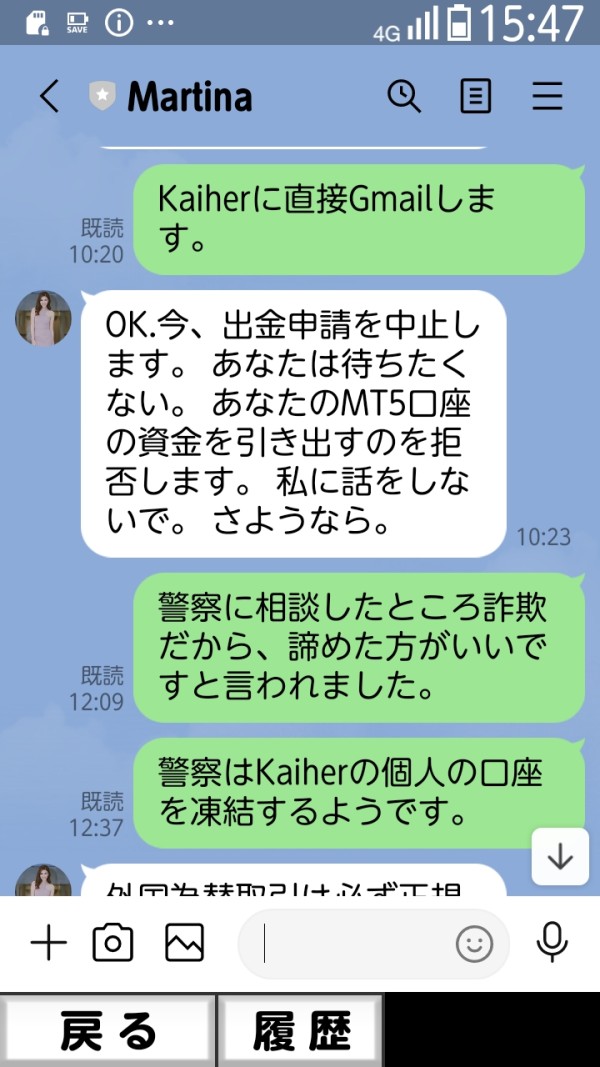

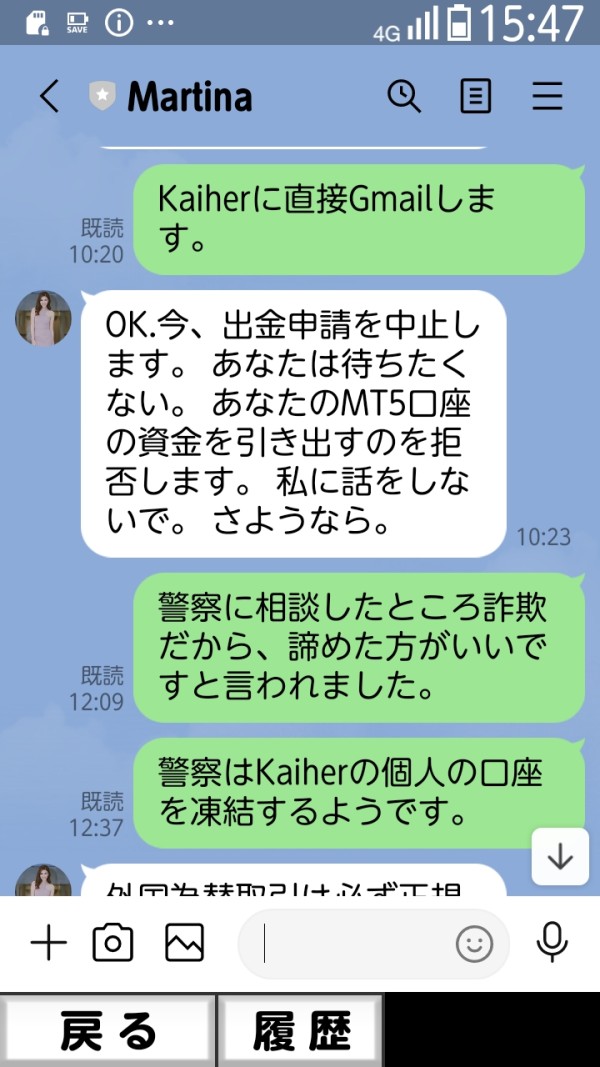

Problem resolution capabilities appear particularly weak. Several users report that their concerns were either inadequately addressed or remained unresolved for extended periods. The lack of escalation procedures or senior support options compounds these issues, leaving traders with limited recourse when standard support channels fail to provide satisfactory assistance.

Trading Experience Analysis (Score: 4/10)

The trading experience with KAIHER presents numerous concerns based on available user feedback and platform analysis. Users have reported issues with platform stability, suggesting that the trading infrastructure may not meet professional standards required for consistent market access and order execution.

Slippage and requoting issues have been specifically mentioned by users. This indicates potential problems with order execution quality that can significantly impact trading profitability, particularly for strategies that depend on precise entry and exit points. The lack of transparent information about execution policies and order handling procedures compounds these concerns.

Platform functionality appears limited based on user reports. Traders express dissatisfaction about the available features and analytical capabilities, suggesting that the platform may not provide the tools necessary for effective trading. The absence of detailed information about platform specifications, supported order types, or advanced trading features suggests potential limitations that could affect trading effectiveness.

Mobile trading experience, which is crucial for modern traders who need market access while away from desktop computers, remains unclear due to insufficient information about mobile platform capabilities. The lack of specific details about mobile app features, compatibility, or performance represents a significant information gap. This kaiher review indicates that traders should thoroughly test platform capabilities before committing significant funds.

Trust and Reliability Analysis (Score: 2/10)

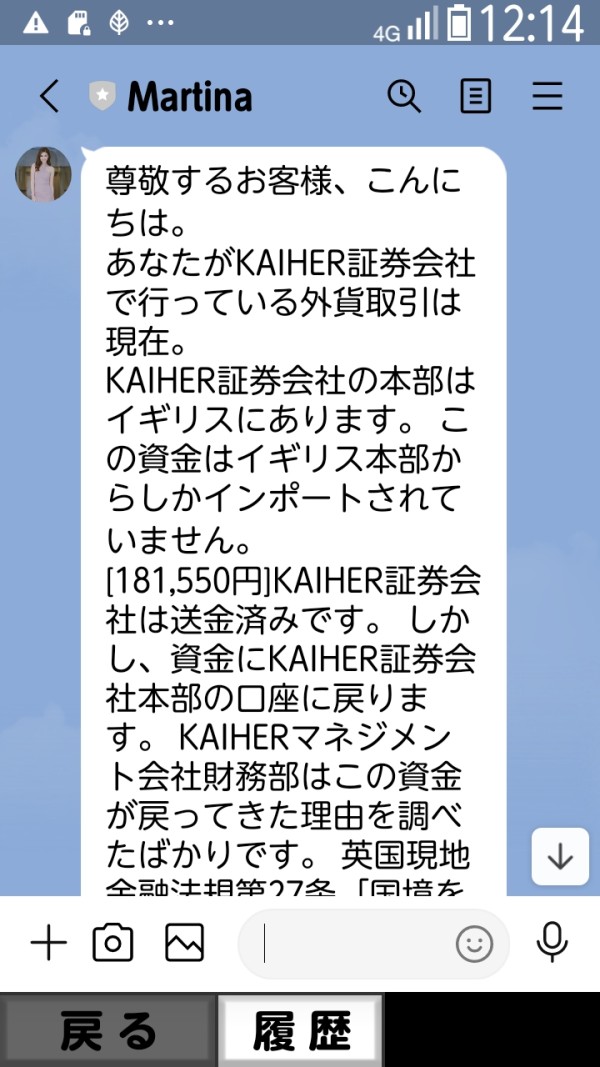

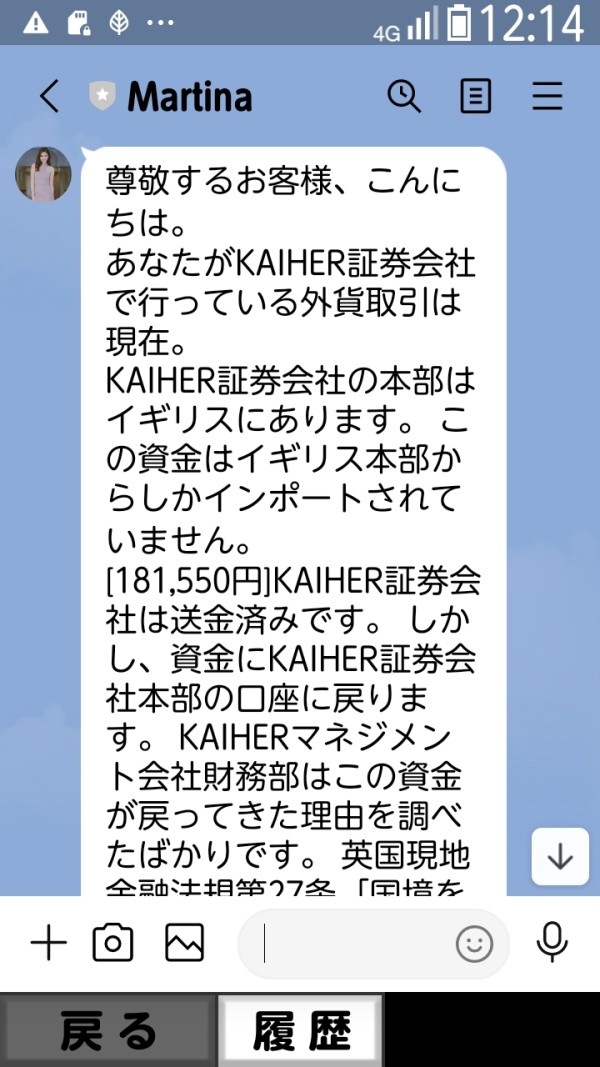

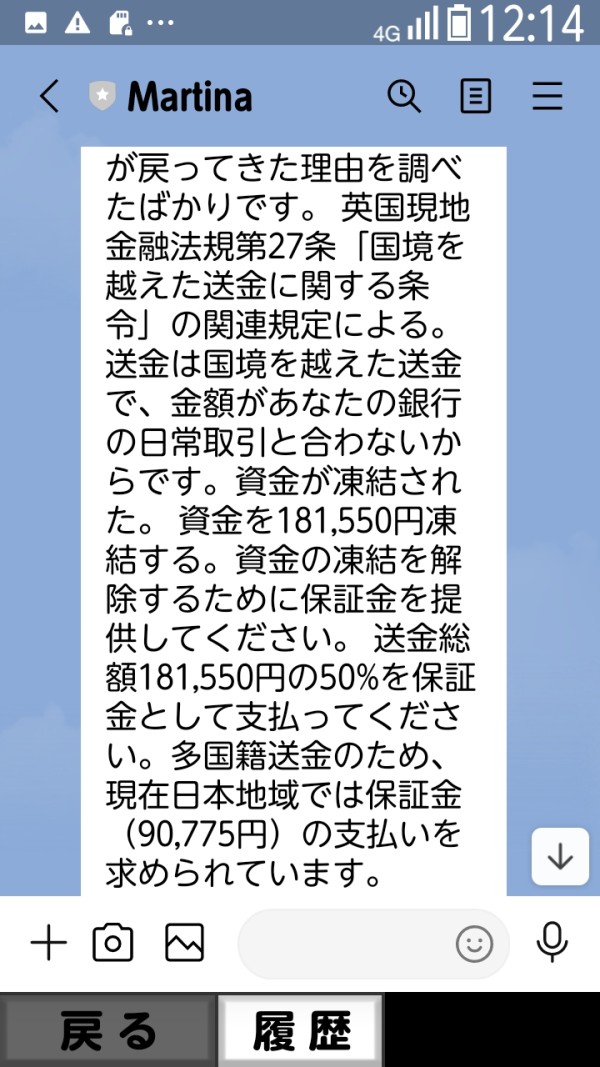

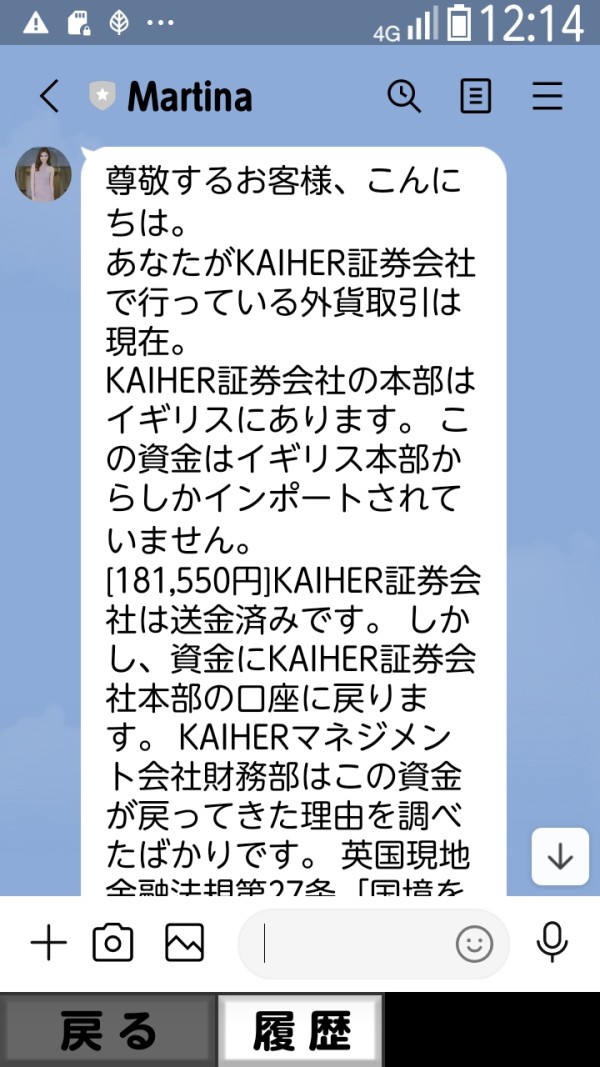

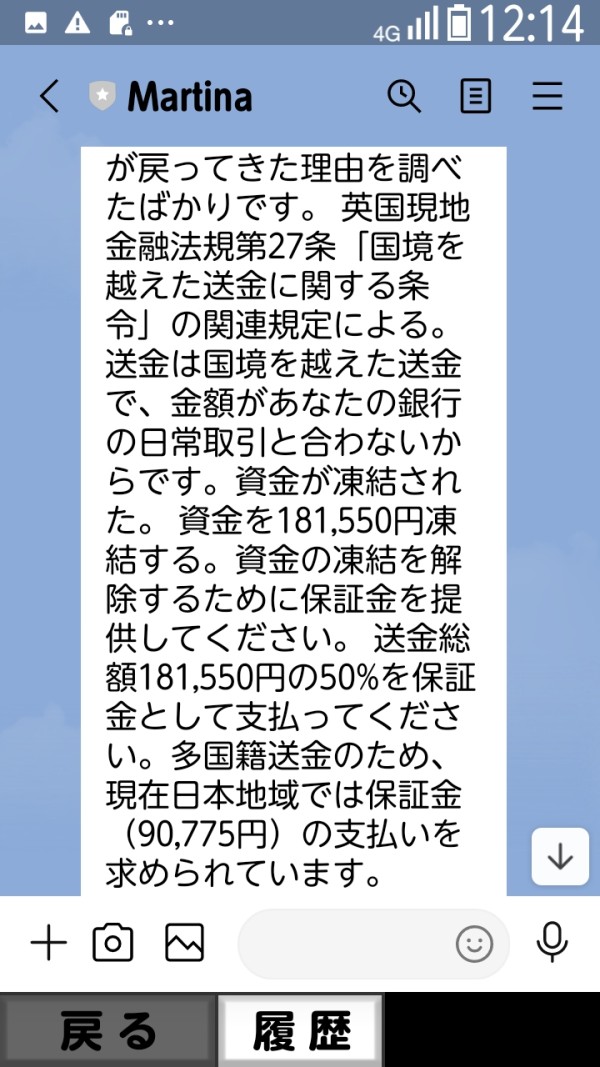

KAIHER's trust and reliability score represents the most serious concern for potential traders. The regulatory warnings issued against the company, particularly from the Securities Commission of The Bahamas, directly contradict the broker's claims about regulatory compliance and authorization.

This fundamental discrepancy raises severe questions about the company's honesty and operational legitimacy. The broker's claims of authorization from multiple prestigious regulatory bodies including ASIC, FCA, and CySEC appear to be unsubstantiated based on official warnings from regulatory authorities. Such false regulatory claims represent serious red flags that suggest potential fraudulent operations designed to mislead potential clients about the broker's legitimacy.

WikiFX's classification of KAIHER as a potential scam platform further undermines confidence in the broker's reliability. Independent rating agencies play crucial roles in identifying problematic brokers, and such warnings should be taken seriously by potential investors considering the platform.

The lack of transparency about fund security measures, segregated account policies, or investor protection schemes compounds trust concerns. Reputable brokers typically provide detailed information about client fund protection and regulatory compliance measures, while KAIHER's opacity in these areas suggests potential risks to client assets.

Third-party evaluations consistently highlight concerns about KAIHER's operations. Multiple sources question the broker's legitimacy and warn potential traders about associated risks. The convergence of regulatory warnings, independent assessments, and user complaints creates a compelling case for extreme caution when considering this broker.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with KAIHER appears significantly below industry standards. Consistent reports of disappointment and concern come from traders who have interacted with the platform, creating a pattern of negative feedback that potential users should consider carefully. The lack of positive user testimonials and the prevalence of negative feedback suggest systematic issues with service delivery and client satisfaction.

Interface design and usability information remains largely unavailable. This prevents potential users from assessing whether the platform provides intuitive navigation and efficient trading workflows. Modern traders expect sophisticated yet user-friendly interfaces, and the absence of detailed platform information suggests potential limitations in user experience design.

Registration and account verification processes appear problematic based on user feedback. Reports of complications and delays in account setup procedures indicate that even basic interactions with the broker may be frustrating. Efficient onboarding processes are essential for positive initial user experiences, and difficulties in these areas often indicate broader operational issues.

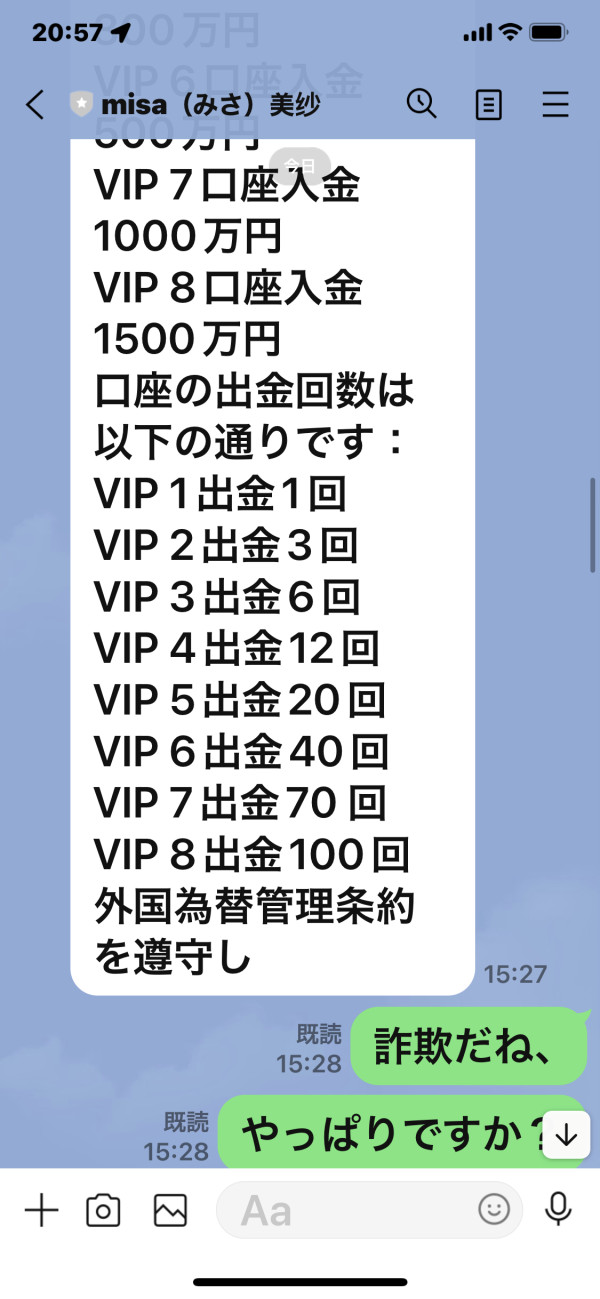

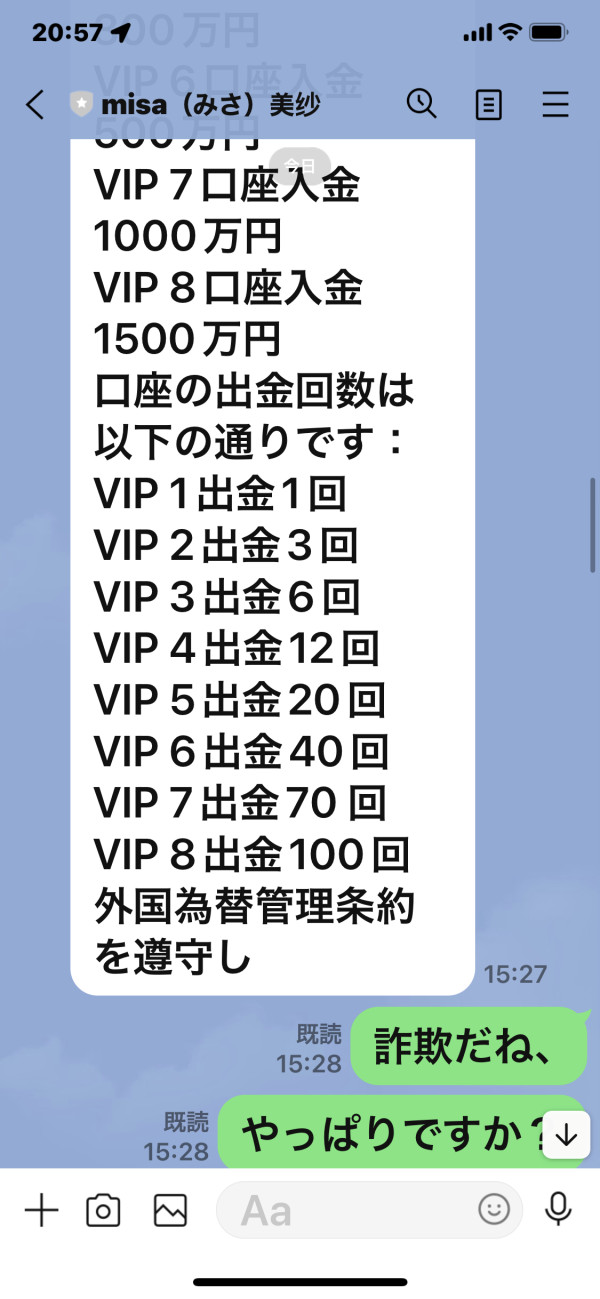

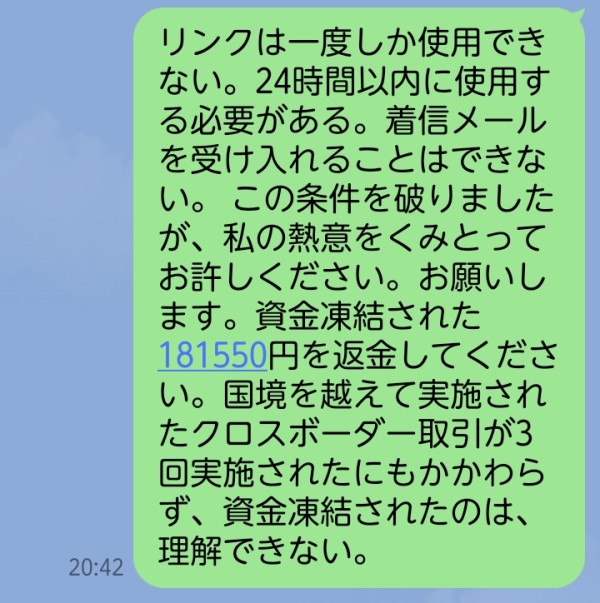

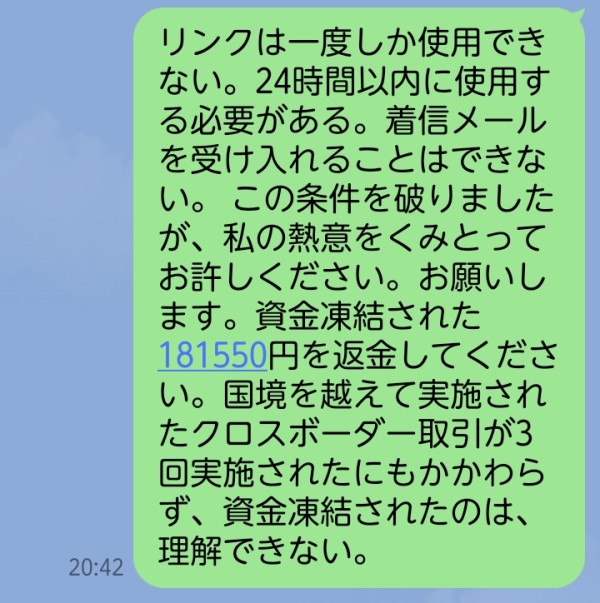

Fund management experiences, including deposit and withdrawal processes, have received negative feedback from users who report difficulties in accessing their funds or completing financial transactions. Such issues represent serious concerns about the broker's operational reliability and client service standards.

The user demographic appears to include traders seeking diverse product offerings. However, the high risk associated with the platform makes it unsuitable for most investor profiles. The imbalance between negative and positive user feedback demonstrates widespread dissatisfaction with KAIHER's services and operational practices.

Conclusion

This comprehensive kaiher review reveals significant concerns about KAIHER's legitimacy, operational transparency, and service quality that make it unsuitable for most traders and investors. The regulatory warnings, particularly from the Securities Commission of The Bahamas, combined with consistently negative user feedback, create a compelling case against engaging with this broker.

The broker's failure to provide transparent information about fundamental trading conditions, combined with reports of poor customer service and questionable business practices, suggests that potential traders should seek alternative, properly regulated brokers for their trading activities. Risk-averse investors should definitely avoid KAIHER due to the numerous red flags and regulatory concerns.

While the broker claims to offer product diversity across multiple asset classes, the significant drawbacks including low trustworthiness, regulatory warnings, lack of transparency, and poor user satisfaction far outweigh any potential benefits. Traders seeking reliable forex and CFD services should prioritize properly regulated brokers with established track records and positive regulatory standing.