Is kaiher safe?

Business

License

Is Kaiher Safe or Scam?

Introduction

Kaiher is a forex brokerage firm that claims to operate from the United Kingdom, primarily focusing on forex trading. With a relatively short operational history of 1-2 years, the broker has attracted attention in the forex market for its offerings, including the popular MetaTrader 5 (MT5) trading platform. However, as with any financial services provider, it is crucial for traders to conduct thorough due diligence before engaging with Kaiher. The forex market is rife with scams and unregulated entities, making it essential for traders to assess the credibility and safety of brokers carefully. This article investigates whether Kaiher is a safe trading platform or a potential scam, utilizing a combination of regulatory information, company background, trading conditions, and customer feedback to inform our analysis.

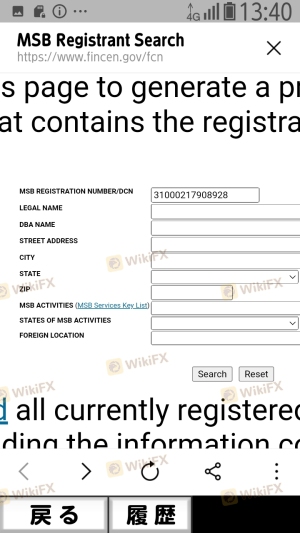

Regulation and Legitimacy

The regulatory status of a brokerage is a fundamental aspect that determines its legitimacy and the protection it offers to traders. In the case of Kaiher, it currently operates without any valid regulatory oversight. This lack of regulation raises significant concerns about the safety of traders' funds and the broker's overall credibility. Below is a summary of the regulatory information available for Kaiher:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | United Kingdom | Unauthorized |

The absence of a regulatory license means that Kaiher is not subject to the stringent oversight that regulated brokers must adhere to. This lack of oversight can expose traders to a higher risk of fraud and financial mismanagement. Furthermore, there have been multiple complaints lodged against Kaiher, indicating potential issues with fund withdrawals and overall trustworthiness. The regulatory quality and compliance history are critical factors for traders to consider, and the absence of a regulatory framework for Kaiher suggests that it may not be a safe option for trading.

Company Background Investigation

Kaiher is registered as Kaiher Global Ltd, with its operations purportedly based in the United Kingdom. However, detailed information regarding its ownership structure and management team remains sparse. The firm's age, coupled with a lack of transparency, raises questions about its operational integrity.

The management team's background is crucial in assessing the broker's reliability. Unfortunately, there is limited publicly available information about the qualifications and professional experience of Kaiher's management. This lack of information can lead to concerns about the company's transparency and the potential for mismanagement. A broker's credibility often hinges on its leadership's experience and track record, and the obscurity surrounding Kaiher's management may be a red flag for potential traders.

Trading Conditions Analysis

An examination of trading conditions is essential for evaluating a broker's competitiveness and fairness. Kaiher claims to offer competitive trading conditions, including the use of the MT5 platform. However, the specifics regarding spreads, commissions, and other trading costs are not readily available, which complicates the assessment of its overall fee structure. Below is a comparison of Kaiher's trading costs against industry averages:

| Cost Type | Kaiher | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Available | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Available | 0.5%-2% |

The lack of transparency in Kaiher's fee structure is concerning. Traders typically look for brokers that offer clear and competitive pricing, and the absence of detailed information may indicate potential hidden fees or unfavorable trading conditions. It is essential for traders to be wary of brokers that do not provide sufficient information about their costs, as this could lead to unexpected expenses and a negative trading experience.

Client Fund Security

The safety of client funds is a paramount concern for any trader. In the case of Kaiher, the broker's policies regarding fund security, such as fund segregation and investor protection measures, are unclear. Without proper regulatory oversight, there is no guarantee that clients' funds are held securely in separate accounts, which is a standard practice among regulated brokers.

Furthermore, the absence of negative balance protection policies could expose traders to significant risks, especially in volatile market conditions. Historical issues related to fund safety and disputes have also been reported by users, which further exacerbates concerns about the overall security of funds held with Kaiher. Traders must prioritize brokers that demonstrate a commitment to safeguarding client assets and providing clear information on their security practices.

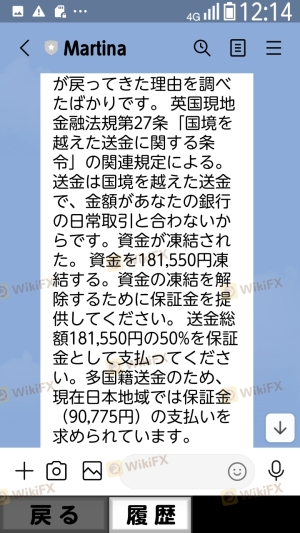

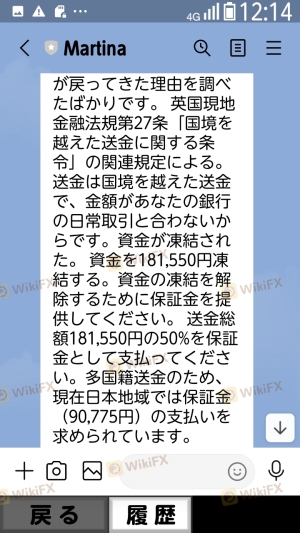

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews and testimonials about Kaiher reveal a concerning pattern of complaints, particularly regarding withdrawal issues and customer support responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Inconsistent |

| Account Management | High | Poor |

Many users have reported difficulties in withdrawing funds, suggesting that the broker may engage in practices that hinder access to clients' money. Additionally, the quality of customer support has been criticized, with users noting slow response times and inadequate assistance. These complaints highlight significant red flags regarding the broker's operational integrity and commitment to customer service.

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. Kaiher offers the MT5 platform, which is known for its stability and range of features. However, user experiences regarding execution quality, slippage, and order rejection rates are mixed. Traders have reported instances of slippage during high volatility, which can adversely affect trading outcomes.

Moreover, any signs of platform manipulation or discrepancies between quoted prices and actual execution can lead to distrust among traders. It is essential for traders to choose brokers that provide reliable execution and transparency in their trading operations to ensure a fair trading environment.

Risk Assessment

Engaging with an unregulated broker like Kaiher poses several risks. The absence of regulatory oversight, combined with reported withdrawal issues and customer complaints, suggests a high-risk trading environment. Below is a summary of the key risk areas associated with trading through Kaiher:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety Risk | High | Unclear fund security measures |

| Customer Support Risk | Medium | Poor response and support quality |

To mitigate these risks, traders should consider conducting thorough research, reading user reviews, and exploring alternative brokers with established regulatory frameworks. It is advisable to prioritize brokers that provide transparency, regulatory protection, and a solid reputation in the market.

Conclusion and Recommendations

In conclusion, the investigation into Kaiher raises significant concerns regarding its safety and reliability as a forex broker. The absence of regulatory oversight, coupled with numerous complaints about withdrawal issues and poor customer support, suggests that traders should approach this broker with caution. While the MT5 platform offers certain advantages, the overall risk profile associated with Kaiher indicates it may not be a safe choice for trading.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities, offer transparent trading conditions, and demonstrate a commitment to client fund security. By prioritizing safety and regulatory compliance, traders can better protect their investments and enhance their trading experience.

Is kaiher a scam, or is it legit?

The latest exposure and evaluation content of kaiher brokers.

kaiher Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

kaiher latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.