Jiaxing 2025 Review: Everything You Need to Know

Executive Summary

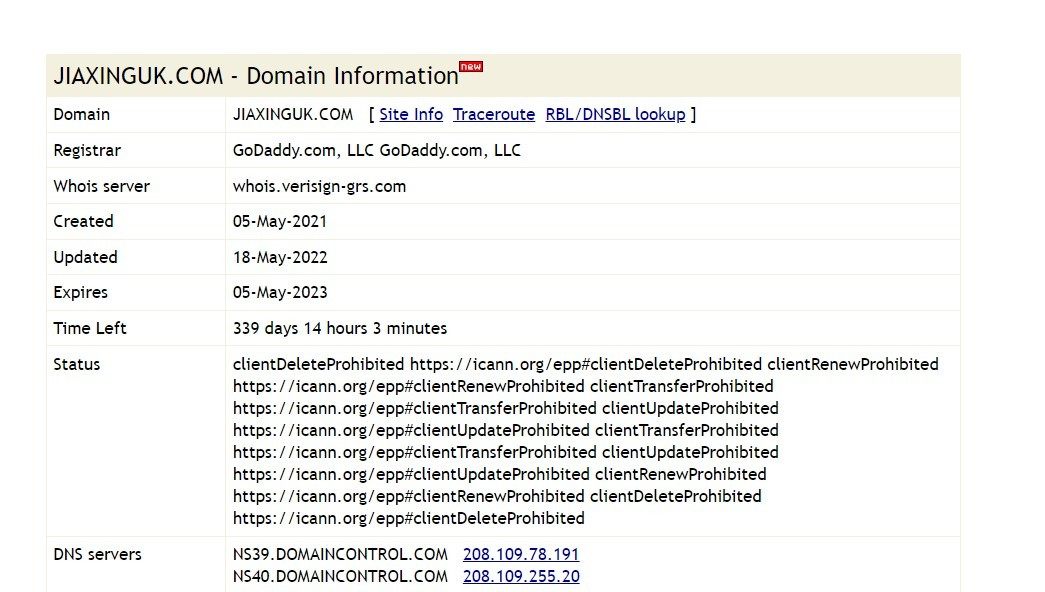

This Jiaxing review presents a complete analysis of a brokerage entity operating under FINRA regulation. Jiaxing appears to be connected with real estate and financial services based on available information. Jiaxing Ren works as a broker at J.P. Morgan Securities LLC under FINRA oversight with CRD#: 7337511. FINRA regulation offers a basic level of trust and compliance assurance for potential clients.

The brokerage shows key characteristics including regulatory compliance under established financial authorities. It also has professional connections with major financial institutions. However, detailed trading conditions, user feedback, and complete service offerings remain limited in available documentation. The primary user group appears to be investors seeking regulated financial services with institutional backing. Specific trading features and account conditions require further clarification.

FINRA regulation provides credibility, but the absence of detailed user reviews creates challenges. The lack of complete trading information results in a neutral overall assessment. Investors should conduct additional research to understand specific service offerings and trading conditions before engagement.

Important Notice

Regional Entity Differences: Jiaxing-related financial services may operate under different regulatory requirements across various jurisdictions. The FINRA regulation mentioned applies specifically to U.S. operations. Investors should verify applicable regulatory frameworks in their respective regions. Different geographical locations may have varying service offerings, compliance requirements, and operational standards.

Review Methodology: This assessment is based on available regulatory information and industry standards. However, complete user feedback and detailed trading experience data remain limited. This may impact the completeness of conclusions. Potential clients should seek additional information directly from service providers to make informed decisions.

Rating Framework

Broker Overview

Jiaxing's financial services presence is anchored by regulatory compliance through FINRA. The identified personnel includes Jiaxing Ren operating as a broker at J.P. Morgan Securities LLC. The regulatory identification CRD#: 7337511 provides a verifiable compliance trail within the U.S. financial system. The connection with established financial institutions suggests operational integration within mainstream financial services infrastructure.

The geographical connection to Jiaxing, Zhejiang, China, indicates potential cross-border financial services capabilities. Specific operational details remain limited in available documentation. The presence of real estate agents and brokers companies in the Jiaxing region suggests a broader financial services ecosystem. This may include various investment and brokerage activities as documented by Dun & Bradstreet.

Trading Platform and Assets: Specific information regarding trading platforms, available asset classes, and investment instruments is not detailed in current documentation. The regulatory framework suggests professional-grade services. Complete trading specifications require additional verification. This Jiaxing review acknowledges the limitation in available trading platform details.

Regulatory Jurisdiction: The brokerage operates under FINRA regulation within the United States financial system. This provides standardized compliance and oversight. FINRA's regulatory framework ensures adherence to industry standards for broker-dealer operations and client protection protocols.

Deposit and Withdrawal Methods: Specific information regarding funding methods, processing times, and available payment systems is not detailed in available resources. Potential clients should inquire directly about supported payment methods and transaction procedures.

Minimum Deposit Requirements: Current documentation does not specify minimum deposit thresholds or account opening requirements. This information gap requires direct verification with service providers.

Promotional Offerings: Details regarding welcome bonuses, promotional campaigns, or special offers are not mentioned in available materials. Prospective clients should confirm current promotional availability directly.

Available Assets: Specific information about tradeable instruments, market access, and investment options is not detailed in current documentation. The regulatory framework suggests professional investment services availability.

Cost Structure: Commission rates, spread information, and fee schedules are not specified in available resources. This Jiaxing review notes the importance of obtaining detailed cost breakdowns before account opening.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in current documentation. FINRA-regulated entities typically operate under established leverage limitations.

Platform Options: Information regarding trading platform availability, mobile applications, and technical features is not specified in available materials.

Geographic Restrictions: Service availability across different jurisdictions and any geographic limitations are not detailed in current documentation.

Customer Support Languages: Available support languages and communication channels are not specified in accessible information.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The evaluation of account conditions faces significant limitations due to insufficient publicly available information. FINRA regulation suggests professional-standard account structures. Specific details regarding account types, minimum balance requirements, and account features remain undocumented in accessible resources. The regulatory framework implies institutional-quality account management.

Without detailed specifications, potential clients cannot adequately assess suitability. Account opening procedures, verification requirements, and documentation needs are not specified in available materials. The absence of clear account tier structures or special account types limits evaluation. This Jiaxing review emphasizes the need for direct inquiry to understand account conditions fully.

The lack of transparent account condition information contrasts with industry standards. Detailed account specifications are typically publicly available in the industry. Potential clients should request complete account documentation before proceeding with any account opening procedures.

Available information provides limited insight into trading tools, analytical resources, and educational materials offered by the brokerage. The regulatory framework suggests professional-grade infrastructure. Specific details regarding research capabilities, market analysis tools, and trading software remain unspecified in accessible documentation.

Educational resources, webinars, market commentary, and training materials are not detailed in current information sources. The absence of tool specifications makes it difficult to assess the brokerage's competitive position. Professional traders cannot evaluate trader support and market analysis capabilities.

Automated trading support, API access, and advanced trading features are not mentioned in available resources. Professional traders seeking sophisticated trading tools would need to verify capabilities directly with service providers.

Customer Service and Support Analysis (4/10)

Customer service evaluation is significantly limited by the absence of user feedback and service quality indicators in available documentation. FINRA regulation implies professional service standards. Specific details regarding support channels, response times, and service quality remain unverified through user testimonials or independent reviews.

Support availability, including business hours, emergency contact procedures, and multilingual capabilities, is not specified in accessible information. The lack of documented customer service experiences prevents assessment of problem resolution effectiveness. Overall client satisfaction levels cannot be determined.

Professional service standards implied by regulatory compliance suggest adequate support infrastructure. Without user feedback or service level documentation, evaluation remains incomplete. Potential clients should test customer service responsiveness before committing to significant account funding.

Trading Experience Analysis (4/10)

Trading experience assessment faces substantial limitations due to insufficient information regarding platform performance, execution quality, and user interface design. The regulatory framework suggests professional trading infrastructure. Specific details about platform stability, order execution speed, and trading environment quality remain undocumented.

Mobile trading capabilities, platform compatibility, and technical performance metrics are not specified in available resources. The absence of user testimonials regarding trading experience prevents evaluation of real-world platform performance. Reliability assessment remains incomplete.

Order execution quality, slippage rates, and platform downtime statistics are not available in accessible documentation. This Jiaxing review notes that trading experience evaluation requires direct platform testing. User feedback verification is also necessary.

Trust and Security Analysis (7/10)

Trust evaluation benefits significantly from verified FINRA regulation, which provides established compliance and oversight frameworks. The regulatory identification CRD#: 7337511 offers verifiable credentials within the U.S. financial system. This supports credibility assessment. FINRA's regulatory requirements include client protection measures and operational standards that enhance trustworthiness.

The association with J.P. Morgan Securities LLC provides additional institutional credibility. This suggests integration within established financial services infrastructure. However, specific security measures, fund protection protocols, and company transparency initiatives are not detailed in available documentation.

Regulatory compliance provides foundational trust elements, but assessment requires additional information. Fund segregation, insurance coverage, and cybersecurity measures need verification. The regulatory framework offers significant trust advantages compared to unregulated alternatives.

User Experience Analysis (4/10)

User experience evaluation is severely limited by the absence of client testimonials, satisfaction surveys, and usage feedback in available documentation. The regulatory framework suggests professional service delivery. Specific user interface design, registration processes, and overall client satisfaction levels remain unverified.

Platform usability, navigation efficiency, and user-friendly features are not documented in accessible resources. The lack of user experience feedback prevents assessment of common client concerns. Satisfaction levels and service improvement areas cannot be evaluated.

Registration procedures, account verification processes, and onboarding experiences are not detailed in available information. Potential clients should seek user feedback through alternative channels. They should also request demonstration access to evaluate user experience quality.

Conclusion

This Jiaxing review reveals a brokerage entity with solid regulatory foundations through FINRA compliance. However, significant information gaps exist regarding service offerings and user experiences. The regulatory framework provides trustworthiness advantages, particularly the verified credentials under CRD#: 7337511. Association with established financial institutions also adds credibility.

The brokerage appears suitable for investors prioritizing regulatory compliance and institutional backing. Detailed trading conditions and service specifications require direct verification. The absence of user feedback and detailed trading information results in a neutral overall assessment. This occurs despite regulatory advantages.

Primary strengths include FINRA regulatory compliance and institutional associations. Weaknesses center on limited publicly available information regarding trading conditions, user experiences, and service offerings. Prospective clients should conduct thorough research and direct inquiry before account opening.