Is JIAXING safe?

Pros

Cons

Is Jiaxing Safe or a Scam?

Introduction

Jiaxing International Ltd., often referred to simply as Jiaxing, positions itself as a forex broker catering to traders interested in currency pairs, commodities, and cryptocurrencies. With the allure of trading opportunities in a volatile market, it has attracted attention from both novice and experienced traders. However, the necessity for cautious evaluation of forex brokers cannot be overstated; the financial landscape is fraught with potential risks, including scams and unregulated entities that can jeopardize traders' investments. In this article, we will explore the legitimacy of Jiaxing by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on the analysis of multiple online sources, reviews, and regulatory databases, providing a comprehensive assessment of whether Jiaxing is safe or if it poses significant risks to its clients.

Regulation and Legitimacy

When assessing the credibility of any forex broker, regulatory oversight is a critical factor. Regulation ensures that brokers adhere to specific standards, providing a layer of protection for traders. In the case of Jiaxing, the broker claims to operate out of the United Kingdom; however, it is important to note that it lacks legitimate regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

As depicted in the table above, Jiaxing does not hold any licenses from recognized financial authorities, such as the UK's Financial Conduct Authority (FCA) or Hong Kong's Securities and Futures Commission (SFC). This lack of regulation is a significant red flag. Furthermore, reports indicate that the SFC has issued warnings against Jiaxing, advising potential investors to exercise caution. The absence of regulatory oversight raises serious concerns about the broker's legitimacy and the safety of funds deposited with them. Without such oversight, traders are left vulnerable to potential fraud and malpractice, making the question of Is Jiaxing Safe even more pertinent.

Company Background Investigation

Understanding the company‘s history and ownership structure is essential in evaluating its legitimacy. Jiaxing International Ltd. claims to have been established in 2016, but discrepancies in its online presence suggest otherwise. The company’s website was registered in 2021, raising questions about its operational history and credibility. Furthermore, there is a lack of transparency regarding the ownership and management team, with no verifiable information available about the individuals behind the broker. This opacity is concerning, as reputable brokers typically disclose their management teams qualifications and experience.

Moreover, the broker's website has been reported as inaccessible or down, which further complicates the ability to gather reliable information. This lack of transparency and the inability to verify the companys claims contribute to doubts about its safety and reliability. Given these factors, the question of Is Jiaxing Safe remains unresolved, as potential clients are left in the dark regarding the broker's true nature and operational integrity.

Trading Conditions Analysis

Another critical aspect of assessing a broker's legitimacy is its trading conditions. Jiaxing claims to offer various financial instruments, including forex currency pairs, commodities, and cryptocurrencies. However, the overall fee structure and trading conditions appear to be ambiguous and potentially unfavorable for traders.

| Fee Type | Jiaxing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (typically 1-2 pips) |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific information regarding spreads, commissions, and overnight interest rates is troubling. Traders often rely on transparent fee structures to make informed decisions, and the lack of clarity here could indicate hidden fees or unfavorable trading conditions. Furthermore, the absence of a demo account prevents potential users from testing the platform and understanding its cost structure before committing funds. This lack of transparency in trading conditions raises further questions about Is Jiaxing Safe, as traders could face unexpected costs that diminish their potential profits.

Client Funds Security

The safety of client funds is paramount when considering a forex broker. Jiaxing's website does not provide clear information regarding its fund security measures. There is no mention of segregated accounts, which are essential for protecting client funds from being misused by the broker. Additionally, there is no indication of investor protection schemes, which are common in regulated environments and provide a safety net for traders.

The absence of these crucial security measures poses a significant risk to clients, as they may find it difficult to recover their funds in the event of bankruptcy or fraudulent activities. Historical complaints and warnings from regulatory bodies further exacerbate concerns regarding the safety of funds held with Jiaxing. Given these factors, the question of Is Jiaxing Safe is met with a cautious response, as potential investors must weigh the risks of entrusting their capital to an unregulated entity without robust security protocols.

Customer Experience and Complaints

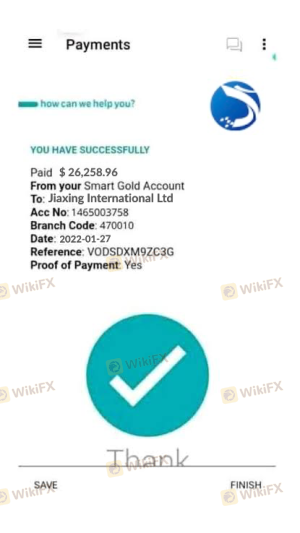

Evaluating customer feedback is vital in determining a broker's reliability. Reviews and testimonials about Jiaxing reveal a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with trade execution.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Trade Execution | High | Poor |

Many users have reported that after depositing funds, they faced significant challenges in accessing their money. Additionally, the quality of customer support has been criticized, with clients often receiving delayed or inadequate responses to their inquiries. Such complaints indicate a lack of accountability and responsiveness, which are essential traits for any reputable broker. The severity of these complaints raises further doubts about Is Jiaxing Safe, as traders may find themselves trapped in a situation where their investments are inaccessible and support is unhelpful.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial factors for any forex trader. Jiaxing claims to offer the MetaTrader 5 (MT5) platform, which is widely regarded as a robust trading tool. However, user experiences suggest that the platform may not perform as expected. Reports of slippage, order rejections, and execution delays have surfaced, leading to frustration among traders.

Moreover, the absence of a demo account limits potential users' ability to evaluate the platform's performance before committing real funds. The lack of transparency regarding platform reliability and execution quality raises concerns about potential manipulation or technical issues that could negatively impact trading outcomes. Given these factors, the question of Is Jiaxing Safe remains pertinent, as traders must consider the risks associated with a potentially unreliable trading platform.

Risk Assessment

In conclusion, the overall risk profile of Jiaxing is concerning. The absence of regulatory oversight, lack of transparency regarding company operations, ambiguous trading conditions, and negative customer experiences all contribute to a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | Medium | Possible platform issues |

| Customer Service Risk | High | Poor support and responsiveness |

To mitigate these risks, potential traders should exercise extreme caution and consider alternatives. Engaging with regulated brokers that offer transparent fee structures, robust customer support, and secure fund management should be a priority for anyone entering the forex market.

Conclusion and Recommendations

After examining the available evidence, it is clear that Jiaxing poses significant risks to potential investors. The lack of regulatory oversight, transparency issues, and negative customer feedback suggest that the broker may not be a safe option for trading. Therefore, it is advisable for traders to seek out regulated and reputable alternatives that can provide a safer trading environment.

For those considering forex trading, we recommend exploring brokers with established regulatory frameworks, transparent trading conditions, and positive user experiences. Some reputable alternatives include brokers regulated by the FCA, ASIC, or CySEC, which are known for their stringent oversight and commitment to client protection. Ultimately, the question of Is Jiaxing Safe leads to a definitive caution against engaging with this broker, as the risks far outweigh the potential benefits.

Is JIAXING a scam, or is it legit?

The latest exposure and evaluation content of JIAXING brokers.

JIAXING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JIAXING latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.