JC 2025 Review: Everything You Need to Know

Executive Summary

JC forex broker works as a middleman between consumers and product providers. The company offers trading services in the forex and CFD markets with simple, direct access. According to available information, the broker follows NFA rules and gives traders access to the MetaTrader 5 platform for smooth execution and safe fund management. This jc review shows that the broker targets intermediate to advanced traders who want exposure to foreign exchange and contract for difference trading opportunities.

The broker's key highlights include zero spread costs and an impressive average trading speed of 0ms. These features show highly efficient order execution capabilities that benefit active traders. JC forex broker uses the industry-standard MetaTrader 5 platform, which supports various trading strategies and automated trading systems. The combination of NFA oversight and advanced trading infrastructure makes this broker particularly suitable for traders who prioritize execution speed and cost-effective trading conditions.

The primary target audience for JC forex broker consists of intermediate to advanced traders who have experience in forex and CFD markets. These traders seek a reliable platform with competitive trading costs and fast execution speeds. The broker's focus on providing zero spread costs and lightning-fast execution speeds appeals to active traders and those implementing scalping or high-frequency trading strategies.

Important Notice

Traders should know that JC forex broker's regulatory framework may vary across different jurisdictions. The specific services offered might differ depending on the trader's location, which can affect available protections and features. While the broker reports NFA regulation, potential clients should verify the regulatory status in their specific region before opening an account. Cross-border regulatory differences can significantly impact the level of protection and services available to traders.

This evaluation is based on publicly available information and user feedback accessible at the time of writing. Market conditions, regulatory requirements, and broker policies may change, potentially affecting the accuracy of certain details presented in this review. Prospective traders are encouraged to conduct their own research and verify current information directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

JC forex broker works as a financial middleman that helps retail consumers trade with liquidity providers in the foreign exchange and CFD markets. The broker's business model centers on providing access to global financial markets through advanced trading technology while maintaining regulatory compliance under NFA supervision. While specific founding details are not extensively documented in available sources, the broker has established itself as a service provider focusing on execution efficiency and cost-effective trading solutions.

The company's operational framework emphasizes technological advancement and regulatory adherence. This approach positions the broker to serve traders who demand high-performance trading environments with reliable execution and competitive costs. JC forex broker's approach to market access combines traditional brokerage services with modern execution technology, creating a trading ecosystem designed for both manual and automated trading strategies.

This jc review indicates that JC forex broker operates primarily through the MetaTrader 5 platform. The platform offers traders access to forex and CFD instruments with fast execution and competitive pricing. The broker's regulatory standing under NFA oversight provides a foundation of legitimacy, while the focus on zero spread costs and rapid execution speeds suggests a commitment to competitive trading conditions. The broker's asset coverage includes foreign exchange pairs and contracts for difference, catering to traders seeking diversified market exposure through a single platform.

Regulatory Jurisdiction: JC forex broker operates under NFA regulation, providing traders with regulatory protection and oversight. This regulatory framework ensures compliance with industry standards for client fund protection and operational transparency.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in the available documentation. Prospective clients should contact the broker directly for comprehensive information about funding options and processing procedures.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with JC forex broker is not specified in the current information sources. This detail would need to be confirmed directly with the broker's account opening team.

Bonus and Promotional Offers: Available documentation does not include specific details about bonus programs or promotional offers. Traders interested in incentive programs should inquire directly with the broker about current promotional activities.

Tradeable Assets: JC forex broker provides access to foreign exchange currency pairs and contracts for difference. This asset selection allows traders to participate in forex markets and gain exposure to various underlying instruments through CFD trading.

Cost Structure: The broker offers zero spread costs according to available information, which represents a competitive advantage for active traders. However, detailed information about commission structures and other potential fees is not comprehensively documented in current sources.

Leverage Ratios: Specific leverage ratios offered by JC forex broker are not detailed in the available information. Leverage policies typically vary based on account type and regulatory requirements.

This jc review highlights that while some key operational details are available, comprehensive information about account specifications requires direct communication with the broker for complete clarity.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of JC forex broker's account conditions reveals limited publicly available information regarding specific account types and their corresponding features. This information gap makes it challenging to provide a comprehensive assessment of the broker's account offerings and their suitability for different trader profiles. The absence of detailed account specifications, including minimum deposit requirements, account tier structures, and special account features, contributes to the moderate rating in this category.

Without specific information about account types, potential clients cannot adequately evaluate whether the broker offers accounts suitable for their trading volume, experience level, or strategic requirements. The lack of transparency regarding account opening procedures and documentation requirements further complicates the assessment process. Additionally, information about special account features such as Islamic accounts for Muslim traders or professional account categories for qualified investors is not readily available.

The account conditions assessment is further limited by the absence of information about account maintenance fees, inactivity charges, or other account-related costs that could impact the overall trading experience. This jc review emphasizes that prospective traders would need to contact the broker directly to obtain comprehensive account condition details before making informed decisions about account opening.

JC forex broker's tools and resources offering centers around the MetaTrader 5 platform. This represents a significant strength in this evaluation category because MetaTrader 5 is widely recognized as an industry-leading trading platform. The platform provides comprehensive charting capabilities, technical analysis tools, and support for automated trading strategies through Expert Advisors. The platform's robust functionality makes it suitable for various trading approaches, from manual analysis to algorithmic trading systems.

The MetaTrader 5 platform offers advanced charting features with multiple timeframes, extensive technical indicator libraries, and customizable interface options that cater to different trader preferences. The platform's support for multiple order types and advanced risk management tools enhances the trading experience for both novice and experienced traders. Additionally, the platform's mobile compatibility ensures traders can monitor and manage their positions from anywhere.

However, the assessment of additional tools and resources beyond the trading platform is limited due to insufficient information about research services, educational materials, or market analysis offerings. The absence of details about economic calendars, market news feeds, or proprietary research tools prevents a more comprehensive evaluation of the broker's resource portfolio. While the MetaTrader 5 platform provides a solid foundation for trading activities, the overall tools and resources offering would benefit from more comprehensive supplementary services.

Customer Service and Support Analysis

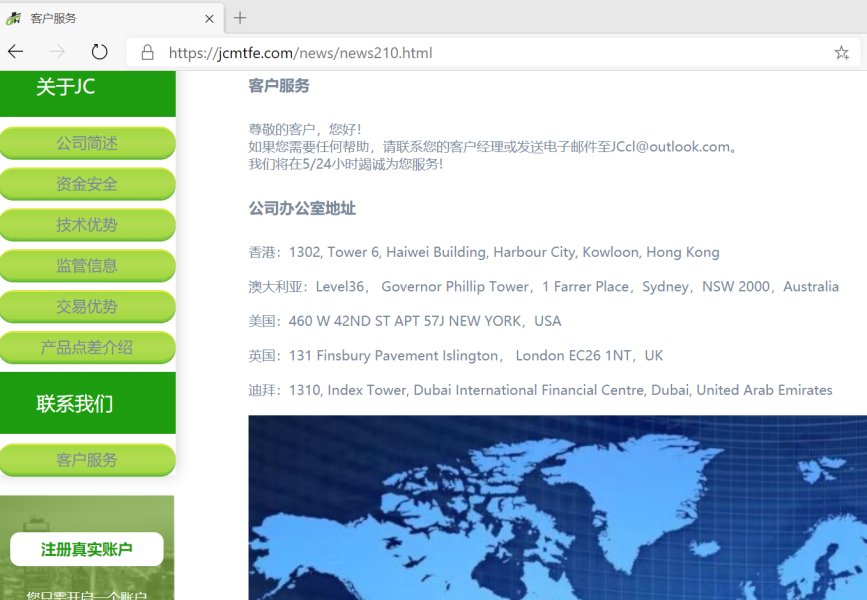

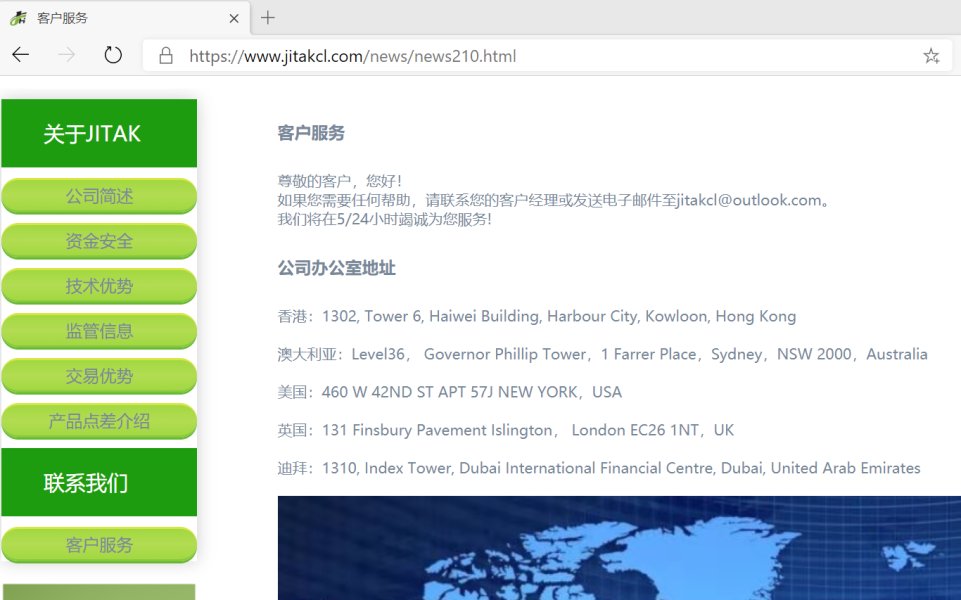

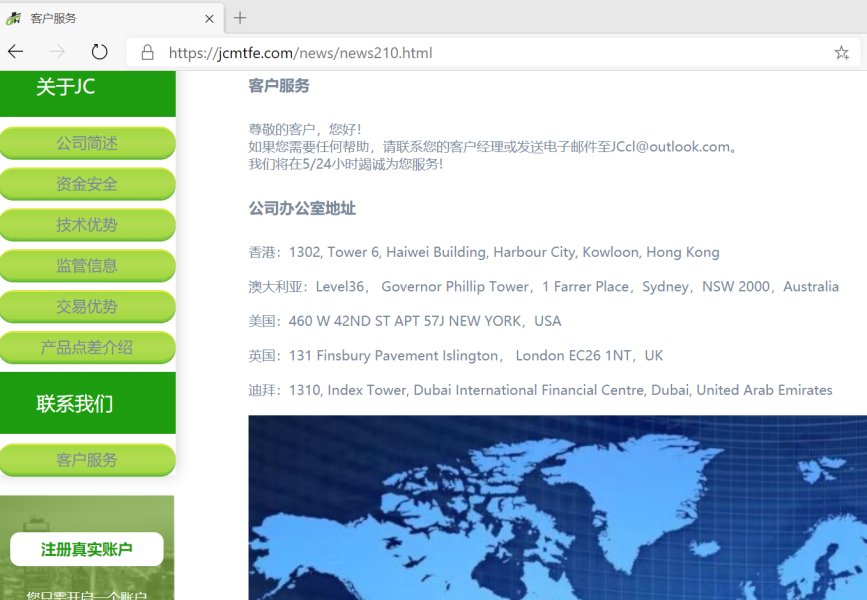

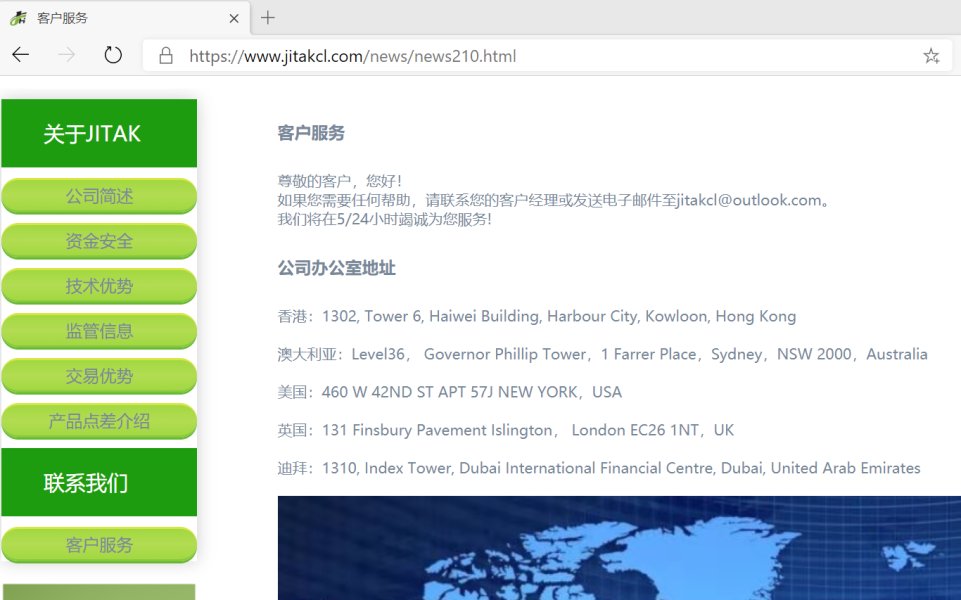

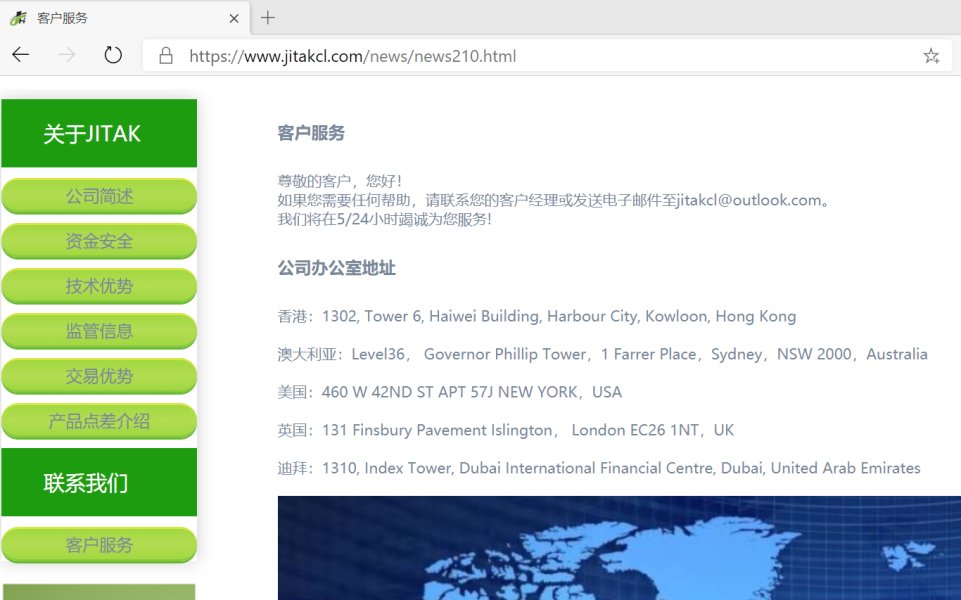

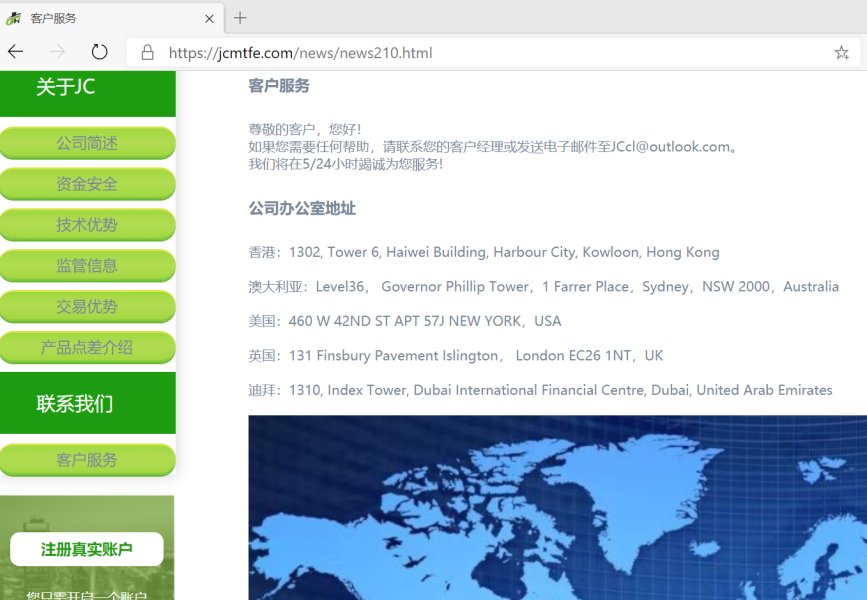

The evaluation of JC forex broker's customer service and support capabilities is significantly hindered by the limited availability of specific information. Details regarding support channels, operating hours, and service quality metrics are not readily available in current documentation. Without detailed information about available communication methods such as live chat, telephone support, or email assistance, it becomes difficult to assess the broker's commitment to client service excellence.

Response time metrics, which are crucial indicators of customer service quality, are not documented in the available information sources. The absence of data regarding average response times for different communication channels prevents traders from setting appropriate expectations for support interactions. Additionally, information about multilingual support capabilities is not available, which could be important for international traders requiring assistance in their native languages.

The lack of documented customer service hours and global support coverage creates uncertainty about the availability of assistance during different trading sessions. Given the 24-hour nature of forex markets, comprehensive customer support coverage is essential for addressing urgent trading-related issues. Without specific information about escalation procedures or specialized support teams for different account types, the overall customer service assessment remains limited and requires direct verification with the broker.

Trading Experience Analysis

The trading experience evaluation reveals several positive indicators, particularly regarding execution performance and cost structure. JC forex broker reports an average trading speed of 0ms, which represents exceptional execution efficiency that can significantly benefit active traders and those implementing time-sensitive trading strategies. This execution speed suggests robust technological infrastructure and efficient order routing systems.

The broker's zero spread cost structure represents another significant advantage for the trading experience. This eliminates one of the primary trading costs that can impact profitability, especially for high-frequency traders or scalping strategies. This cost advantage can be particularly beneficial for traders who execute multiple positions throughout the trading day and need to minimize transaction costs to maintain profitability.

However, the trading experience assessment is limited by the absence of information regarding slippage rates, requote frequency, and overall platform stability during high-volatility market conditions. Additionally, details about available order types, partial fill policies, and execution methods are not comprehensively documented. The lack of information about mobile trading capabilities and platform customization options further limits the complete assessment of the trading experience. This jc review indicates that while execution speed and cost metrics are impressive, a more comprehensive evaluation would require additional performance data.

Trust and Regulation Analysis

The trust and regulation assessment for JC forex broker is anchored by its regulatory status under the National Futures Association. NFA regulation provides a foundation of regulatory oversight and client protection that ensures compliance with industry standards. This regulatory framework offers traders some level of protection and recourse in case of disputes or operational issues.

However, the overall trust assessment is limited by the absence of additional trust indicators such as detailed company ownership information, operational history, or third-party security certifications. Information about client fund protection measures, including segregated account policies and investor compensation schemes, is not comprehensively documented in available sources. The lack of transparency regarding the broker's financial stability, audit reports, or credit ratings prevents a more thorough trust evaluation.

The assessment is further constrained by limited information about the broker's track record, industry reputation, or handling of past regulatory issues. Without access to comprehensive compliance history or disciplinary actions, traders cannot fully evaluate the broker's regulatory standing. Additionally, information about data security measures, cybersecurity protocols, and privacy protection policies is not readily available, which represents important trust factors in today's digital trading environment.

User Experience Analysis

The user experience evaluation for JC forex broker is significantly limited by the scarcity of documented user feedback and comprehensive interface assessments. Without substantial user reviews or testimonials, it becomes challenging to gauge actual trader satisfaction levels or identify common user experience strengths and weaknesses. The absence of user-generated content about platform usability, customer service experiences, or overall satisfaction prevents a thorough user experience analysis.

Information about the registration and account verification process is not detailed in available sources. This makes it difficult to assess the ease of onboarding new clients and the overall user journey from initial interest to active trading. The user experience encompasses various touchpoints including account opening, platform navigation, fund management, and ongoing support interactions, but comprehensive information about these processes is limited. Additionally, details about user interface design, platform customization options, and mobile application functionality are not extensively documented.

The target user profile appears to be intermediate to advanced traders seeking forex and CFD trading opportunities. However, specific user experience optimizations for this demographic are not clearly articulated in available documentation. Without information about user feedback mechanisms, complaint resolution procedures, or continuous improvement initiatives, the assessment of user experience commitment remains incomplete. The evaluation would benefit significantly from access to actual user testimonials and detailed interface reviews.

Conclusion

This comprehensive jc review reveals a forex broker with several notable strengths, particularly in execution performance and cost structure. The evaluation also highlights areas where additional information transparency would benefit potential clients seeking to make informed trading decisions. JC forex broker's NFA regulation provides regulatory legitimacy, and the combination of zero spread costs with 0ms average execution speed presents compelling advantages for active traders seeking efficient and cost-effective trading conditions.

The broker appears most suitable for intermediate to advanced traders who prioritize execution speed and cost efficiency in their trading strategies. This is particularly true for those engaged in scalping or high-frequency trading approaches that require fast execution and minimal costs. The MetaTrader 5 platform provides a solid technological foundation that supports various trading methodologies and automated trading systems.

However, the evaluation identifies significant information gaps regarding account conditions, customer service capabilities, and user experience metrics that prospective traders should address through direct broker communication. While the core trading infrastructure appears robust, the limited availability of comprehensive operational details suggests that potential clients should conduct thorough research before account opening to ensure the broker's offerings align with their specific trading requirements and expectations.