Inveslo 2025 Review: Everything You Need to Know

Summary

This inveslo review gives you a complete look at a forex broker that has gotten lots of bad attention from traders. Inveslo works as an online forex broker that offers ECN accounts with spreads starting from 0.1 pips, but traders have to pay a $3 commission for each lot they trade. The platform uses MetaTrader 4 (MT4), which many traders know well, and lets you trade currencies, cryptocurrencies, indices, precious metals, and energy products.

But our research shows some worrying things about what users say and how open the company is about its business. User ratings average just 1.3 stars on review websites, and people are making serious claims that Inveslo might not be a real business. The broker seems to want experienced traders who like low-spread trading, but potential clients should be very careful because of all the bad reviews and problems with how the platform works.

The company doesn't give clear information about regulations, and many users complain about bad customer service, problems getting their money out, and poor trading conditions.

Important Notice

Regional Entity Differences: We don't have information about regulatory oversight or different rules for different regions. Traders should check the regulatory status in their own country before using this broker.

Review Methodology: This review uses available user feedback, industry reports, and public information about Inveslo's services. Since there isn't much official documentation, traders should do more research before making any investment decisions.

Rating Framework

Broker Overview

Inveslo works as an online forex and CFD broker, but we don't know when it started or where its main office is located. The company says it provides electronic trading services and focuses mainly on forex markets while also offering other financial instruments. The broker uses an ECN (Electronic Communication Network) model, which should give better pricing and faster order execution for traders.

The platform's main offering uses MetaTrader 4 (MT4), one of the most popular trading platforms in the industry. Inveslo lets you trade major and minor currency pairs, cryptocurrency instruments, stock indices, precious metals like gold and silver, and energy commodities. But the broker doesn't share much information about how it operates, and we don't know much about its corporate structure, management team, or business history.

From what we can find, Inveslo's regulatory status isn't clear, which is a big concern for potential traders. The lack of clear regulatory oversight from recognized financial authorities makes us wonder about client fund protection and whether they follow industry standards. This inveslo review shows how important regulatory compliance is when choosing a broker, making this a critical thing for potential clients to think about.

Regulatory Jurisdictions: Available information doesn't show regulatory oversight from recognized financial authorities, which is a big compliance concern for potential traders.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures aren't detailed in available documentation, so you need to ask the broker directly.

Minimum Deposit Requirements: The minimum account opening deposit isn't specified in available sources, so you'll need to contact them directly for this information.

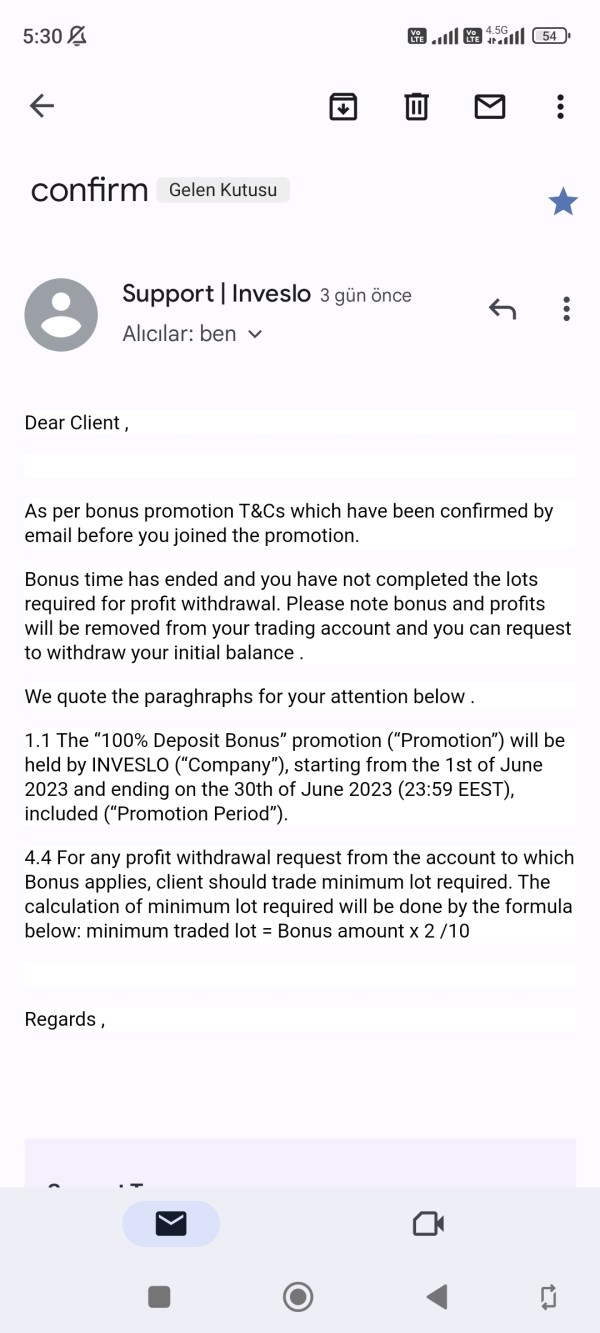

Bonus and Promotions: No promotional offers or bonus programs are mentioned in available documentation.

Tradeable Assets: The platform supports currencies, cryptocurrencies, indices, precious metals, and energy products, giving reasonable diversification opportunities for traders.

Cost Structure: ECN accounts have spreads starting from 0.1 pips with a commission charge of $3 per standard lot, which may become expensive for high-frequency traders.

Leverage Ratios: Specific leverage offerings aren't detailed in available sources.

Platform Options: Primary trading happens through MetaTrader 4 (MT4), with no mention of additional platform alternatives.

Geographic Restrictions: Specific country restrictions aren't outlined in available documentation.

Customer Support Languages: Available support languages aren't specified in current documentation.

This inveslo review shows big information gaps that potential traders should address by talking directly with the broker before opening an account.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Inveslo's account structure seems limited and focuses mainly on ECN account types with a commission-based pricing model. The broker advertises spreads starting from 0.1 pips, which could attract cost-conscious traders, but the $3 per lot commission significantly affects overall trading costs, especially for smaller position sizes or high-frequency trading strategies.

The lack of detailed information about minimum deposit requirements, account tiers, or special account features shows a big transparency problem. Most good brokers give clear account specifications, including Islamic accounts for Muslim traders, demo account options, and various account levels to fit different trader profiles and capital requirements.

User feedback shows dissatisfaction with account conditions, particularly about fee transparency and unexpected charges. The commission structure might be competitive for larger trades, but it may not be cost-effective for retail traders executing smaller positions. Also, the lack of information about account protection measures, such as negative balance protection or segregated client funds, raises concerns about trader safety.

The account opening process details aren't easily available, which makes it hard to evaluate how efficient the broker's onboarding is. This inveslo review emphasizes that transparent account conditions are fundamental to trustworthy broker operations, and the information gaps here are concerning.

Inveslo's trading infrastructure centers around MetaTrader 4 (MT4), a well-known platform that's reliable and has lots of features. MT4 provides essential trading functions including technical analysis tools, automated trading through Expert Advisors (EAs), and customizable charting options. But the broker's reliance only on MT4 without offering alternative platforms or proprietary tools limits options for traders who prefer different interfaces.

The lack of detailed information about additional trading tools, market research resources, or educational materials is a big limitation. Modern traders expect access to economic calendars, market analysis, trading signals, and educational content to support their decision-making processes. Successful brokers typically provide comprehensive research departments, daily market commentary, and technical analysis to add value beyond basic execution services.

User feedback shows limited satisfaction with the available tools and resources, suggesting that Inveslo may not provide the comprehensive trading environment expected in today's competitive marketplace. The lack of mobile trading app details or web-based platform alternatives further restricts trading flexibility for active traders who need multi-device access.

Advanced trading features such as copy trading, social trading integration, or sophisticated order management tools aren't mentioned in available documentation, showing a basic service offering that may not meet the needs of more sophisticated trading strategies.

Customer Service Analysis (Score: 3/10)

Customer service is one of Inveslo's biggest weaknesses based on available user feedback. Multiple sources show poor customer support experiences, with users reporting slow response times, unprofessional communication, and inadequate problem resolution capabilities. These issues are particularly concerning for forex traders who need reliable support for time-sensitive trading matters.

The specific customer service channels available through Inveslo aren't clearly documented, making it difficult for potential clients to understand how to access support when needed. Professional brokers typically offer multiple contact methods including live chat, telephone support, email communication, and comprehensive FAQ sections. The lack of clear support channel information suggests potential accessibility issues.

Response time seems to be a big concern based on user reports, with traders experiencing delays in getting assistance for account issues, technical problems, or withdrawal requests. In the fast-paced forex market, delayed customer service can result in missed trading opportunities or prolonged resolution of critical account issues.

The multilingual support capabilities aren't specified, which could present communication barriers for international traders. Professional customer service should include native language support for major markets and trading sessions to ensure effective communication and problem resolution.

Trading Experience Analysis (Score: 4/10)

The trading experience with Inveslo seems problematic based on user feedback and available information. While the MetaTrader 4 platform itself is reliable and has lots of features, users report issues with platform stability, execution quality, and overall trading environment. These concerns significantly impact the practical trading experience regardless of the underlying platform's capabilities.

Order execution quality is a critical concern, with reports of slippage and requoting issues affecting trade entries and exits. ECN execution should theoretically provide better pricing and faster execution, but user experiences suggest implementation problems that undermine these potential advantages. Slippage during volatile market conditions and requoting of orders can significantly impact trading profitability and strategy effectiveness.

Platform stability issues have been reported, which can be particularly problematic for active traders or those using automated trading strategies. Unexpected platform disconnections or technical glitches can result in missed opportunities or unmanaged risk exposure. The reliability of trading infrastructure is fundamental to successful forex trading operations.

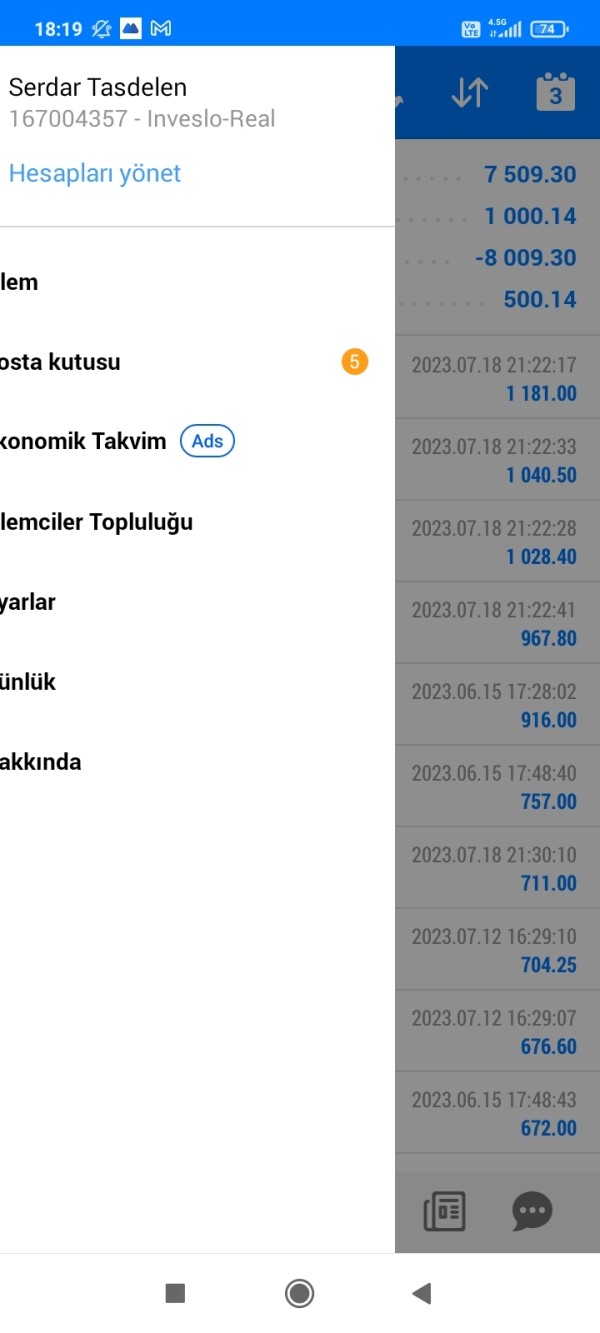

The trading environment's liquidity provision and spread consistency seem questionable based on user feedback. While advertised spreads start from 0.1 pips, the actual trading conditions may vary significantly from marketing claims. This inveslo review emphasizes that consistent, transparent pricing is essential for effective trading strategy implementation.

Trustworthiness Analysis (Score: 2/10)

Trustworthiness is Inveslo's biggest weakness, with multiple red flags raising serious concerns about the broker's legitimacy and operational integrity. The lack of clear regulatory oversight from recognized financial authorities is a fundamental trust issue, as regulatory compliance provides essential client protections and operational standards.

User ratings averaging 1.3 stars across review platforms show widespread dissatisfaction and potential operational problems. Such consistently low ratings typically suggest systemic issues rather than isolated incidents, indicating fundamental problems with the broker's business practices or service delivery. The prevalence of negative reviews and scam allegations requires serious consideration by potential clients.

Fund security measures aren't clearly documented, raising concerns about client money protection and segregation practices. Good brokers typically maintain segregated client accounts, provide clear information about fund protection measures, and operate under regulatory frameworks that mandate specific client protection standards.

The company's transparency about its corporate structure, management team, and business operations seems limited. Professional brokers typically provide detailed company information, regulatory documentation, and clear communication about their business practices. The information gaps surrounding Inveslo's operations contribute to trust concerns and make independent verification difficult.

Industry reputation seems significantly damaged based on available reviews and user experiences, with allegations of fraudulent practices and operational misconduct requiring careful consideration by potential traders.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Inveslo seems extremely low, with the 1.3-star average rating reflecting widespread dissatisfaction across multiple aspects of the broker's services. User feedback consistently highlights problems with customer service quality, trading conditions, and operational transparency, creating a pattern of negative experiences that potential clients should carefully consider.

The user interface and platform accessibility aren't extensively documented, but the reliance on MetaTrader 4 should provide a familiar experience for traders used to this platform. However, the lack of modern web-based alternatives or mobile app details may limit accessibility for traders who prefer contemporary trading interfaces.

Account registration and verification processes aren't clearly outlined, which can create uncertainty for potential clients about onboarding requirements and timelines. Efficient account opening procedures are essential for positive initial user experiences, and unclear processes can indicate broader operational inefficiencies.

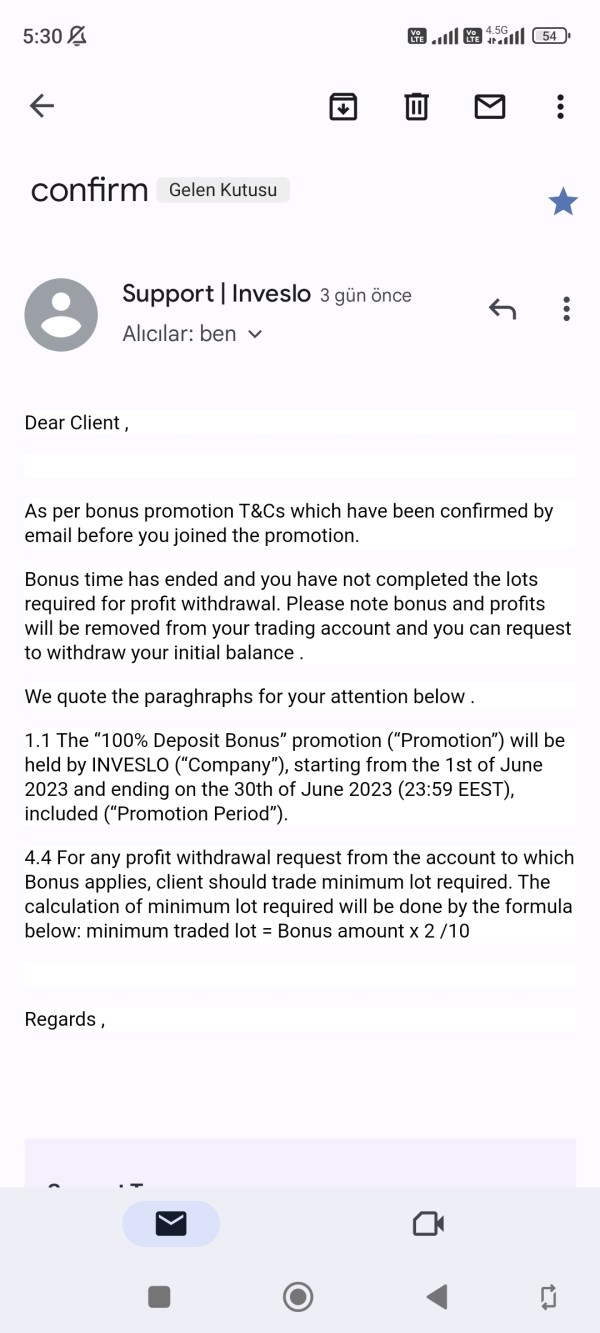

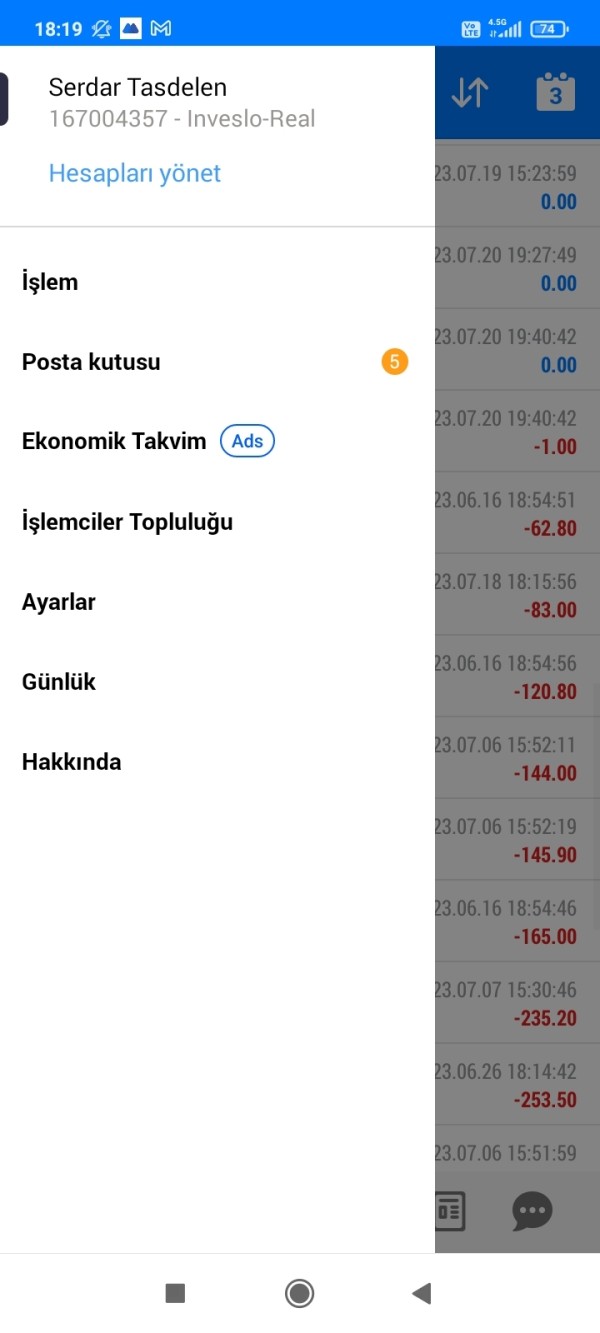

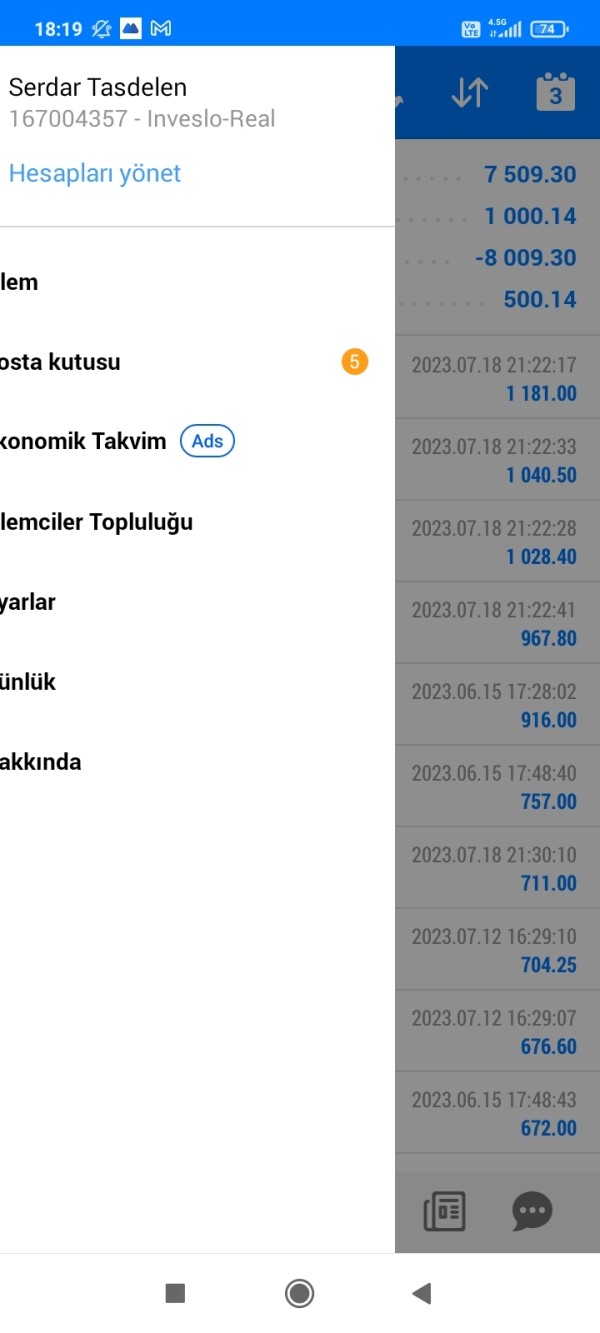

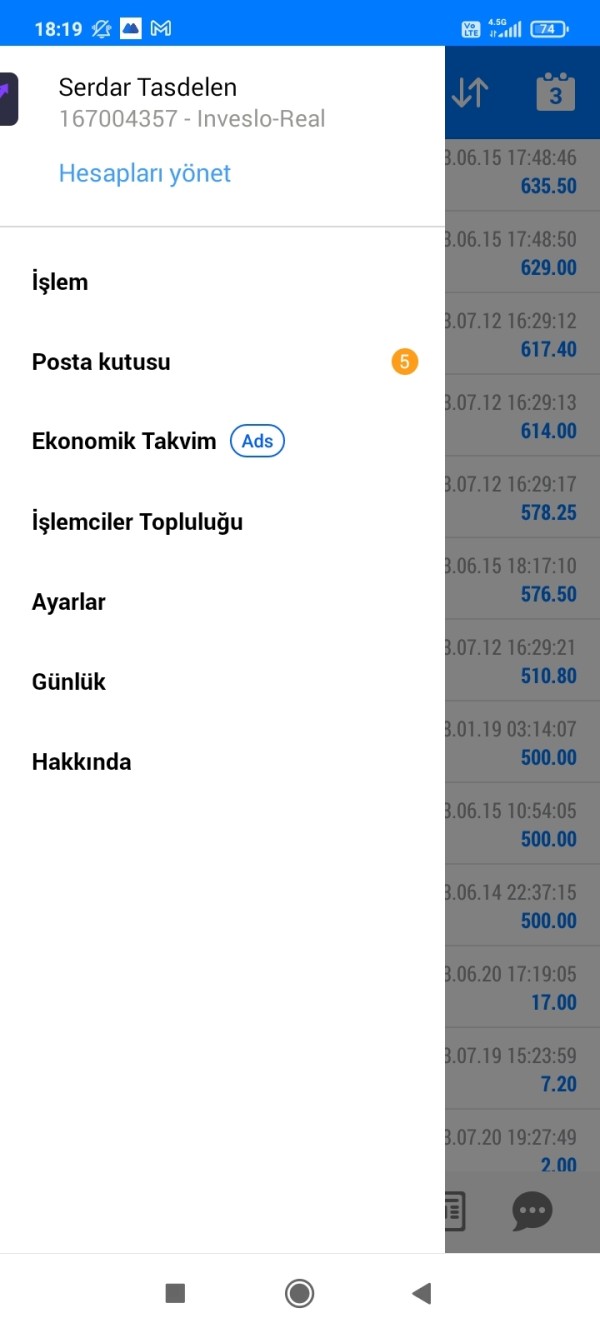

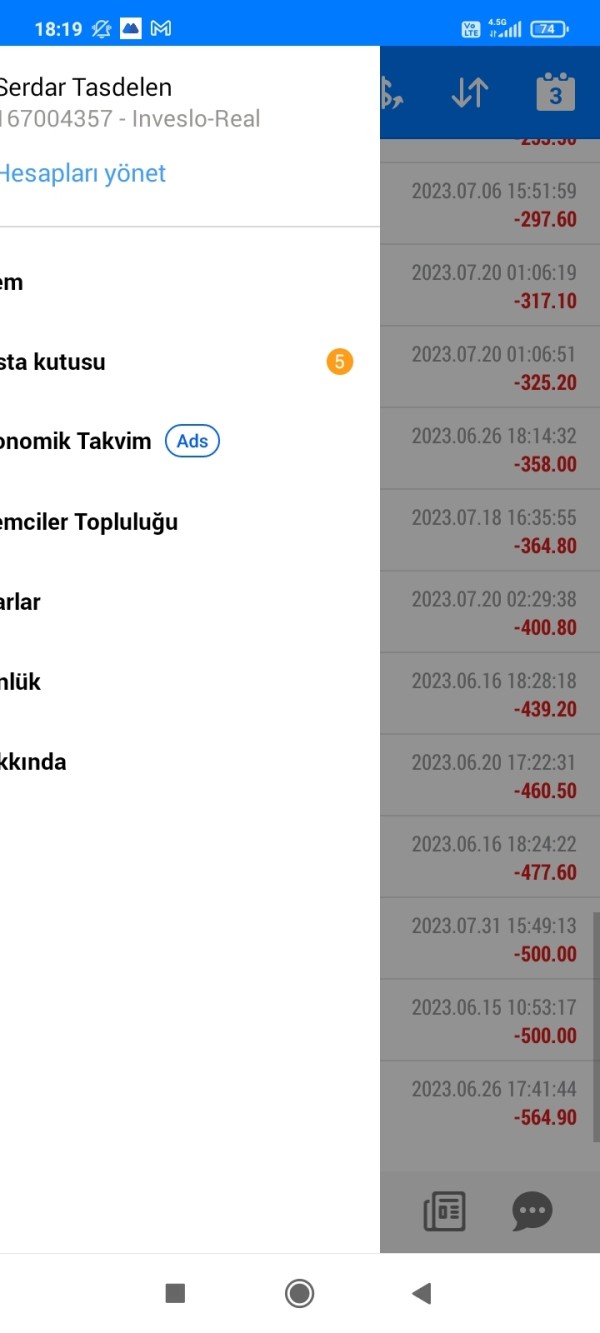

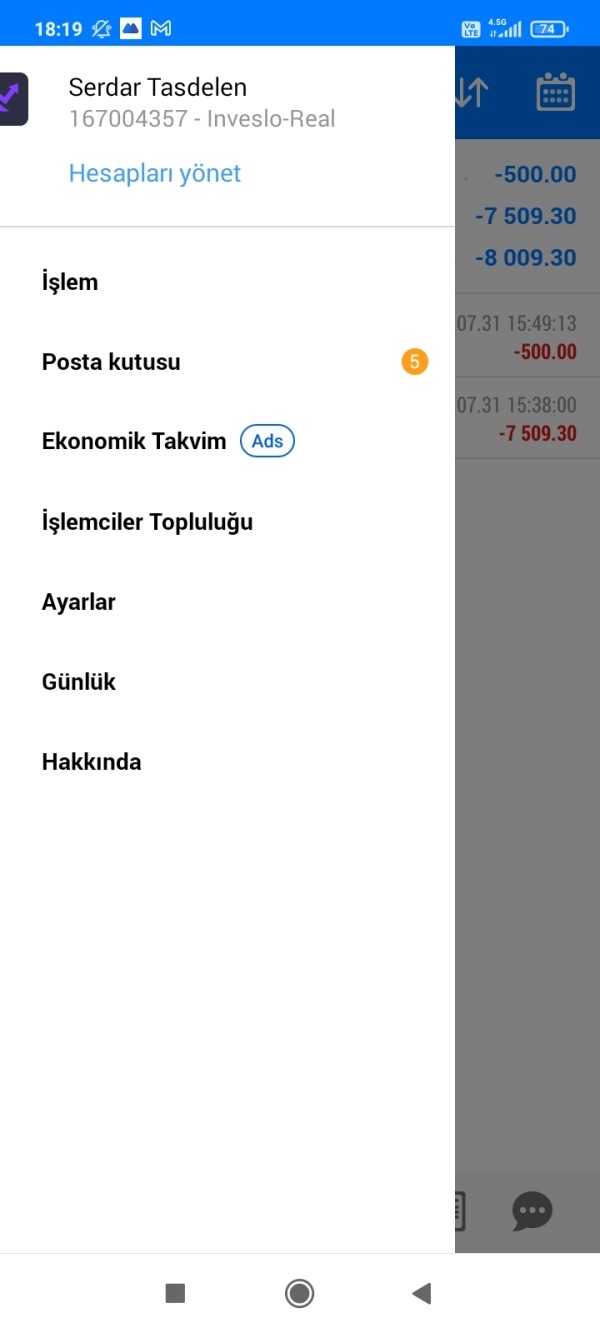

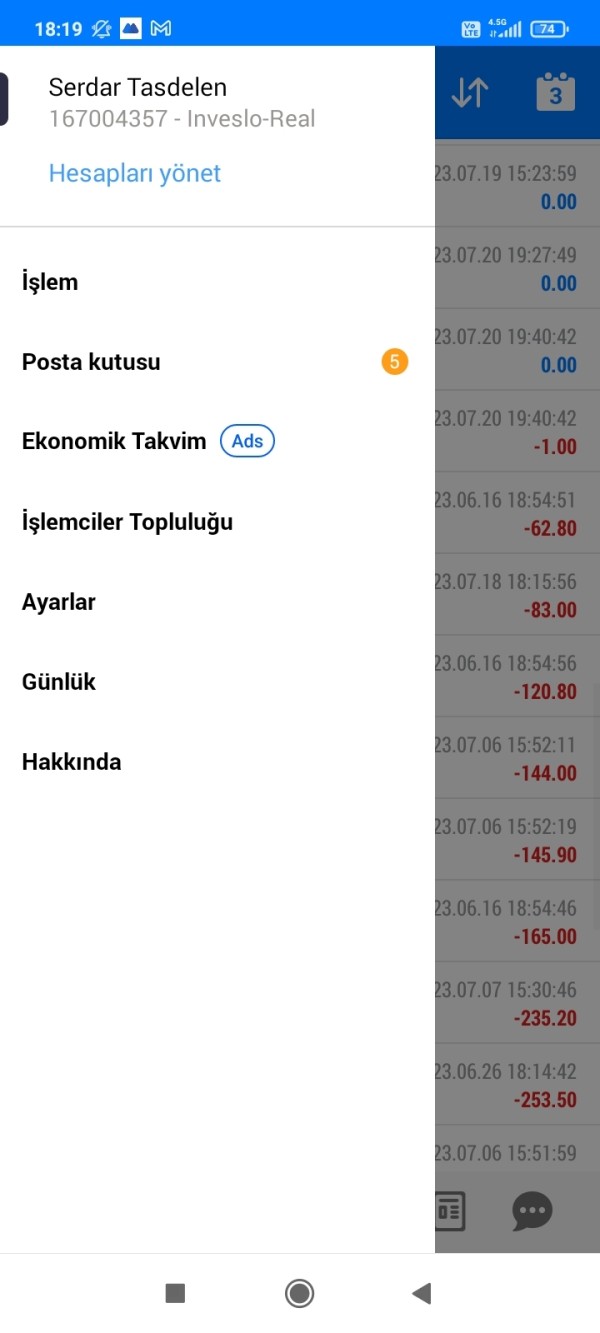

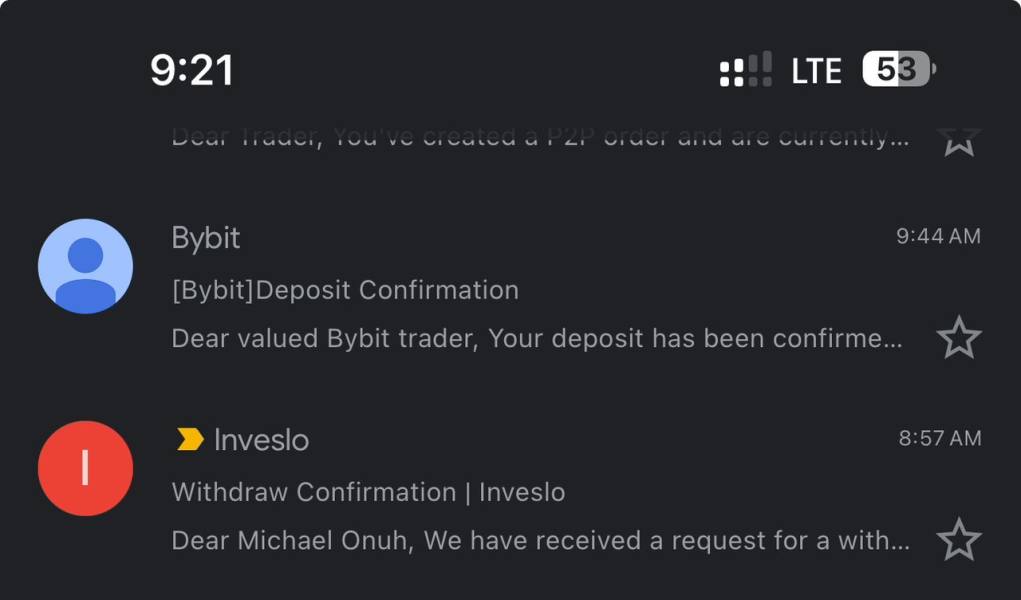

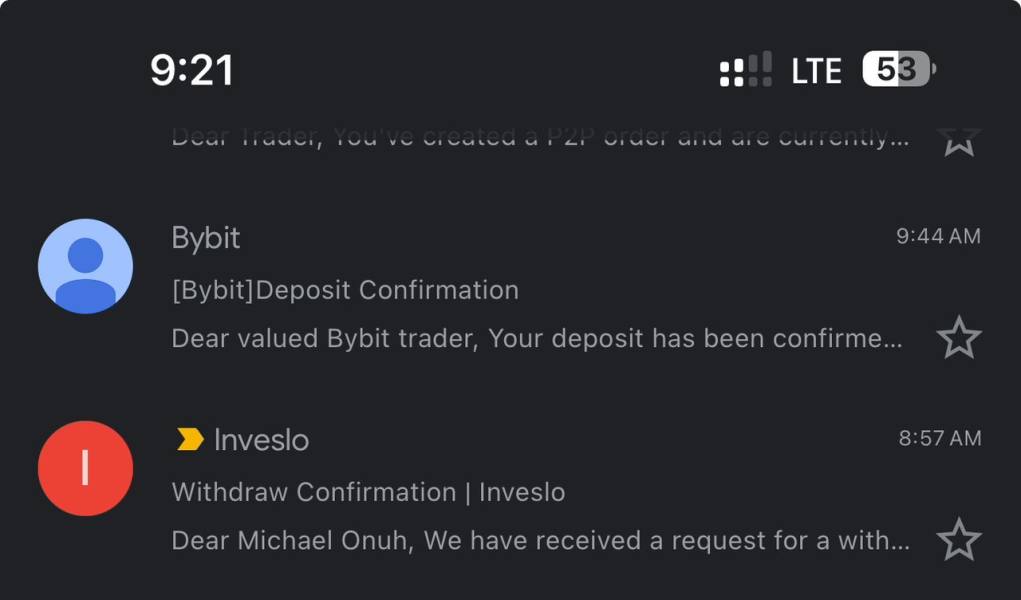

Funding and withdrawal experiences seem problematic based on user feedback, with reports of difficulties accessing funds and unclear withdrawal procedures. These issues represent serious concerns for traders who need reliable access to their capital and trading profits.

Common user complaints focus on customer service quality, trading condition discrepancies, and withdrawal difficulties. The concentration of negative feedback in these critical areas suggests systemic operational problems rather than isolated incidents, indicating fundamental issues with the broker's service delivery model.

Conclusion

This inveslo review reveals a broker with significant operational and trustworthiness concerns that potential traders should carefully consider. While Inveslo offers some potentially attractive features such as low spreads and ECN execution through the established MT4 platform, these advantages are overshadowed by substantial negative user feedback, unclear regulatory status, and transparency issues.

The broker may theoretically appeal to experienced traders seeking low-cost trading environments, but the risks associated with poor customer service, questionable trustworthiness, and operational concerns make it unsuitable for most trader profiles. The consistently low user ratings and widespread negative feedback indicate systemic problems that extend beyond typical service issues.

Primary advantages include competitive spread offerings and familiar MT4 platform access, while significant disadvantages encompass poor customer service, unclear regulatory oversight, limited transparency, and widespread user dissatisfaction. The risk-reward profile strongly favors avoiding this broker in favor of more established, properly regulated alternatives with better track records of client satisfaction and operational integrity.