OTC Global Holdings Review 1

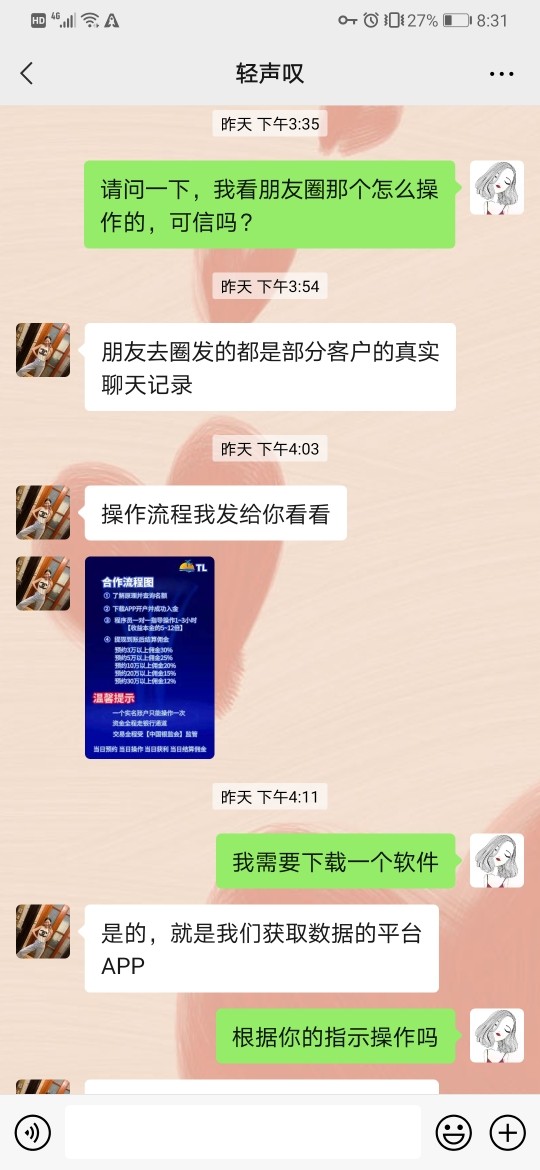

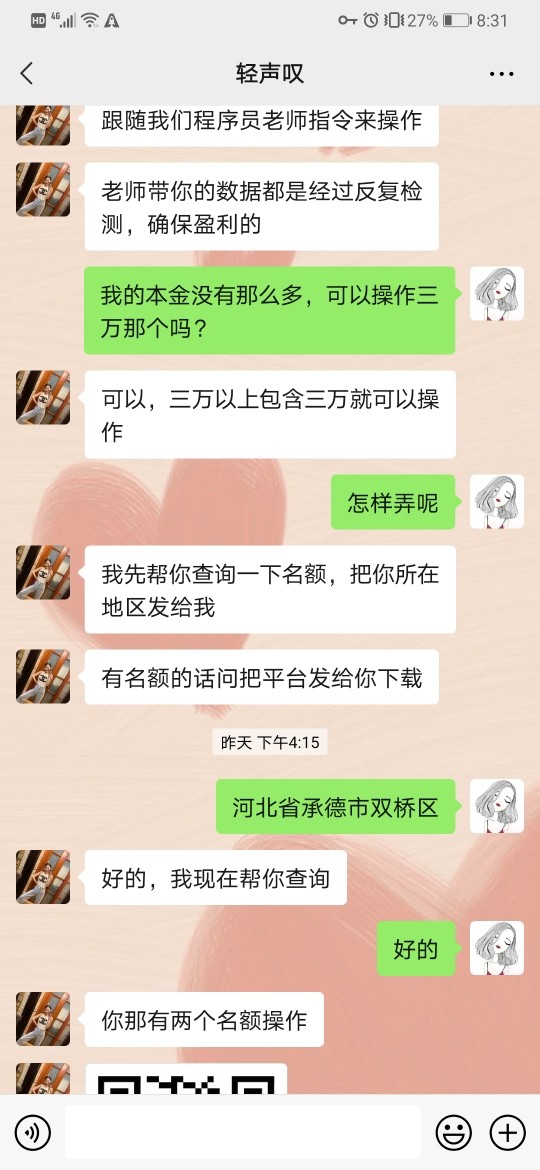

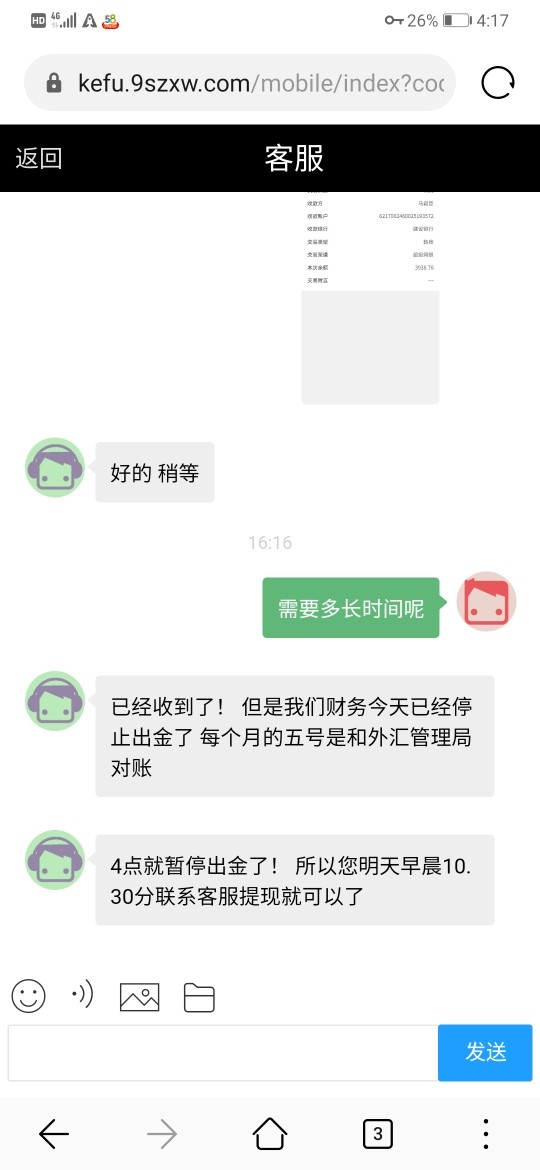

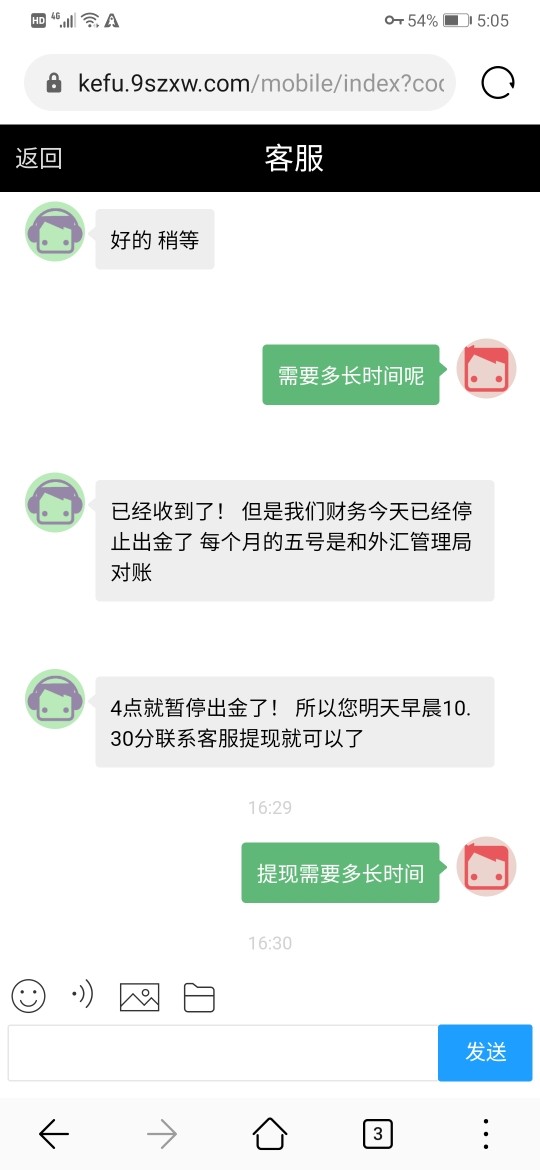

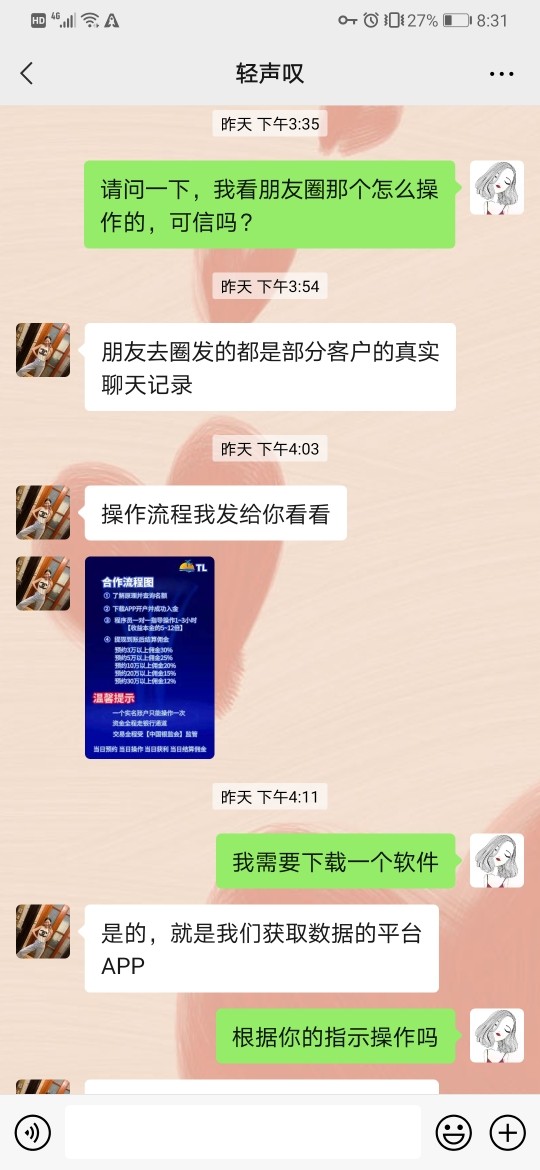

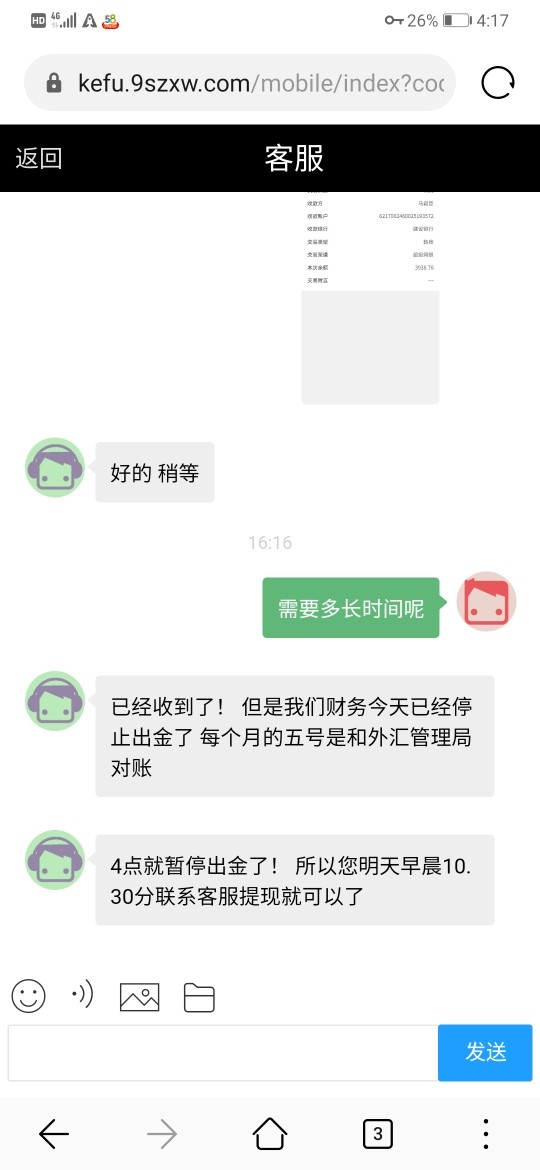

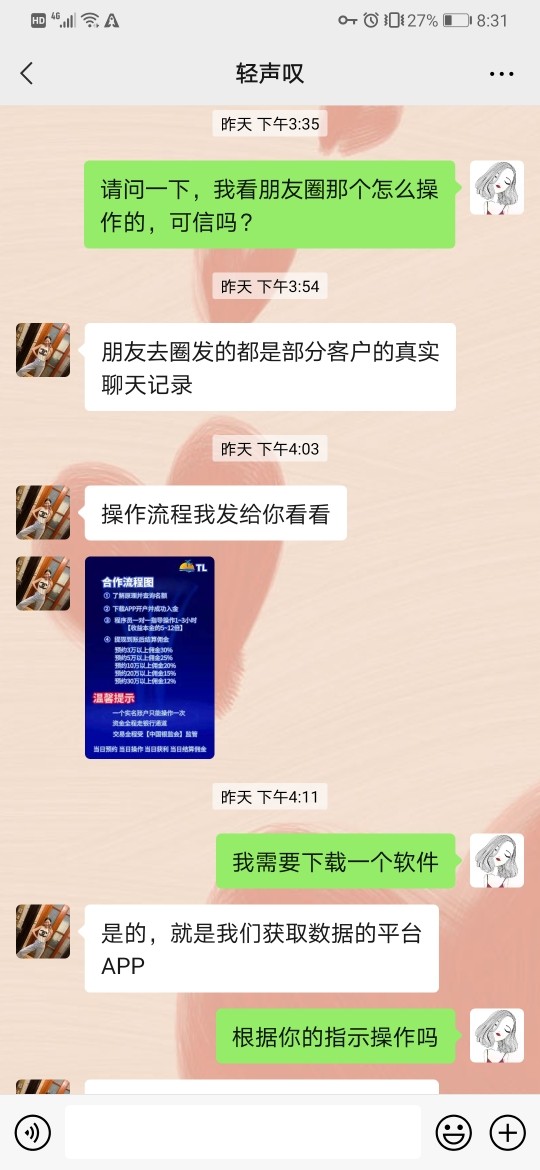

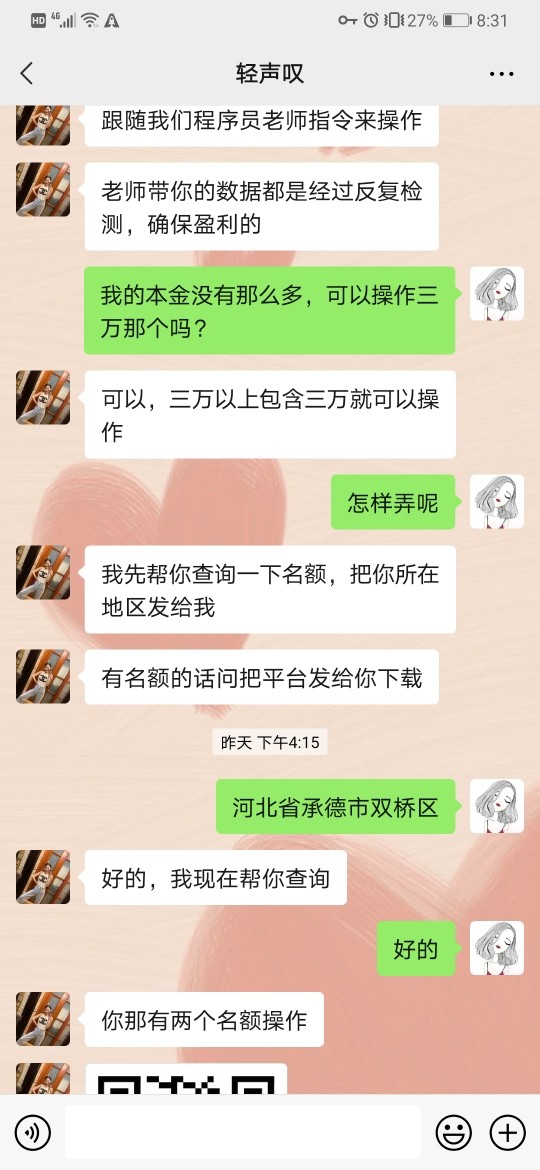

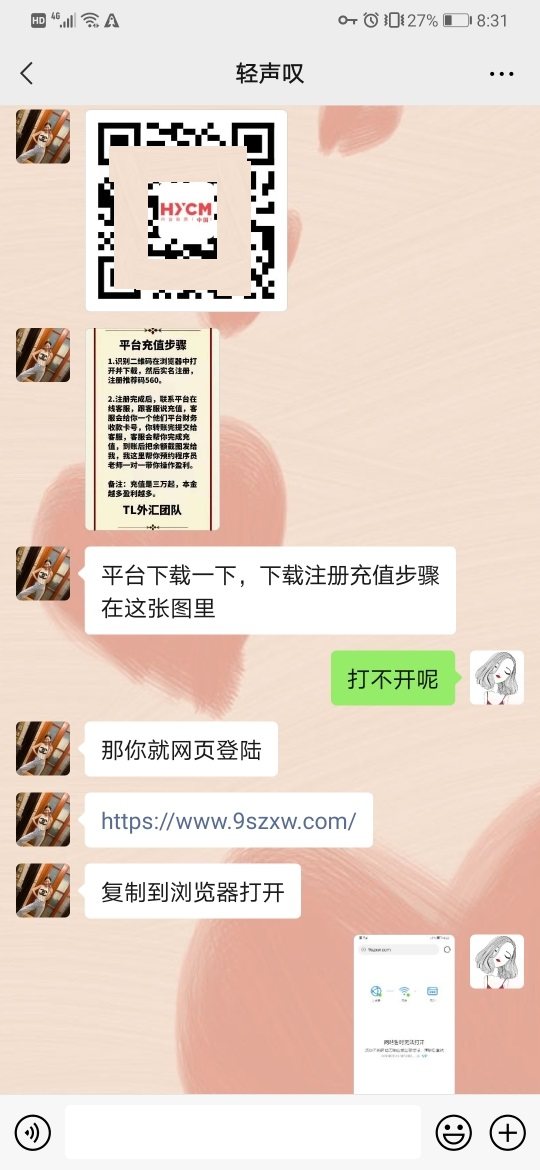

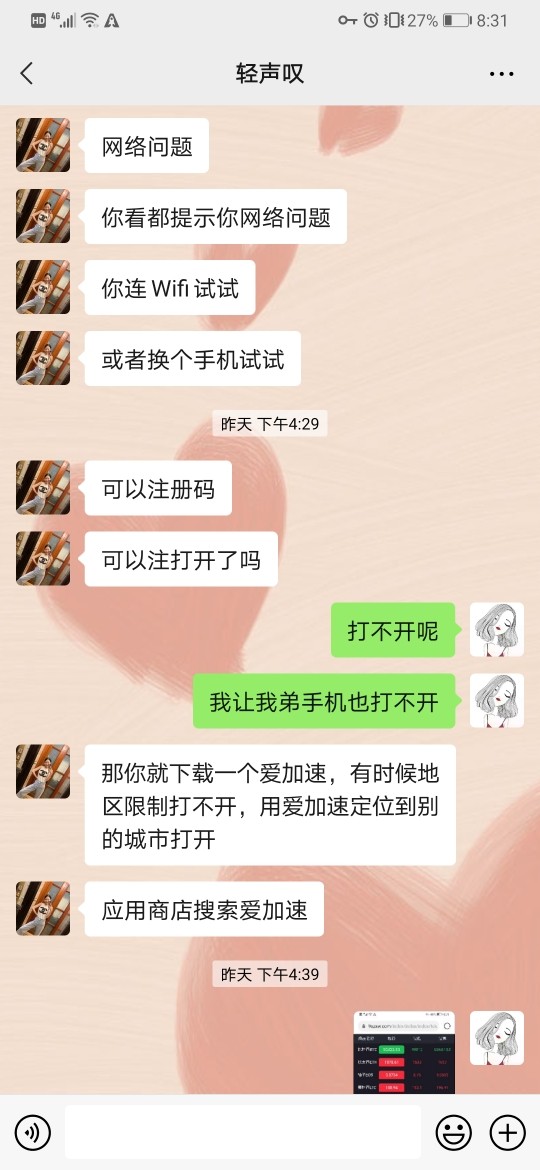

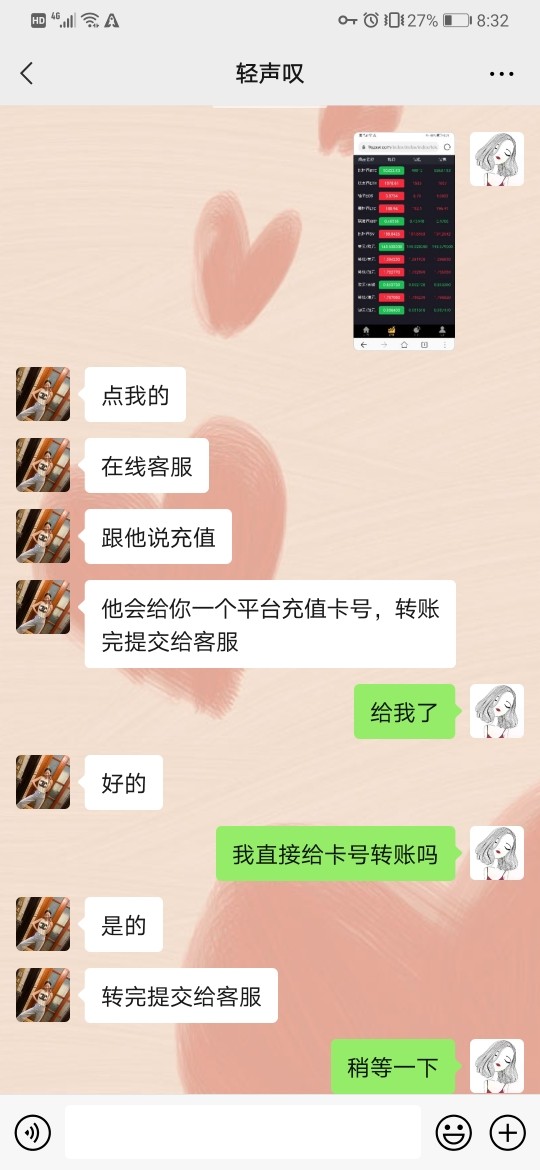

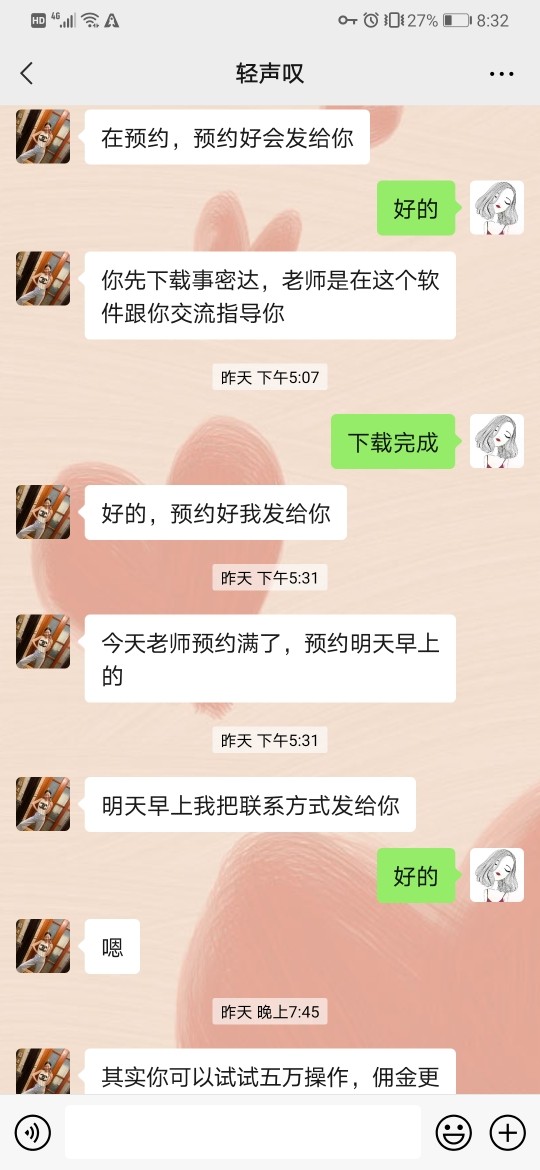

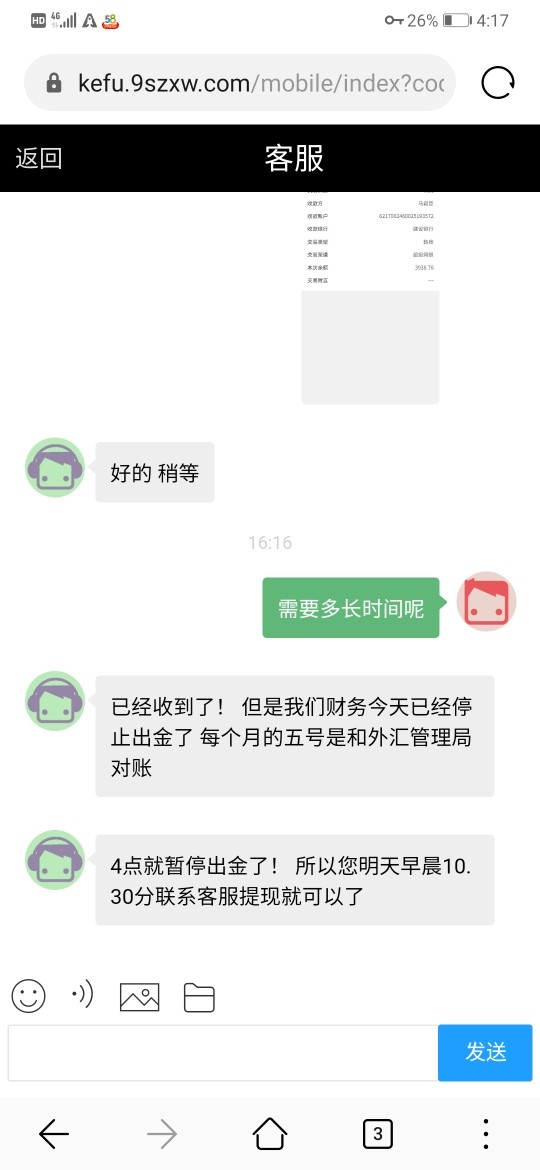

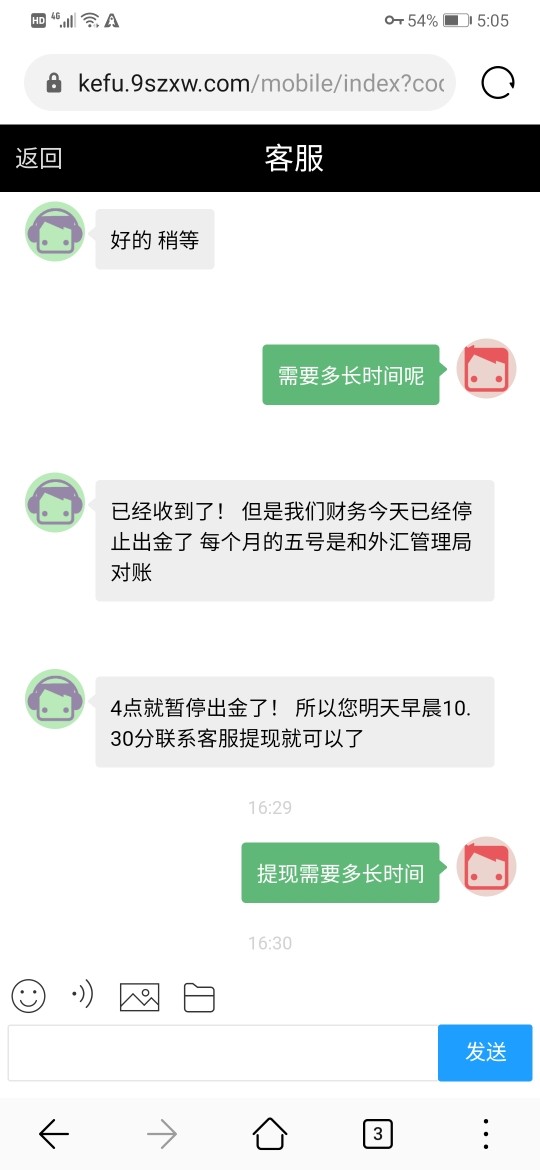

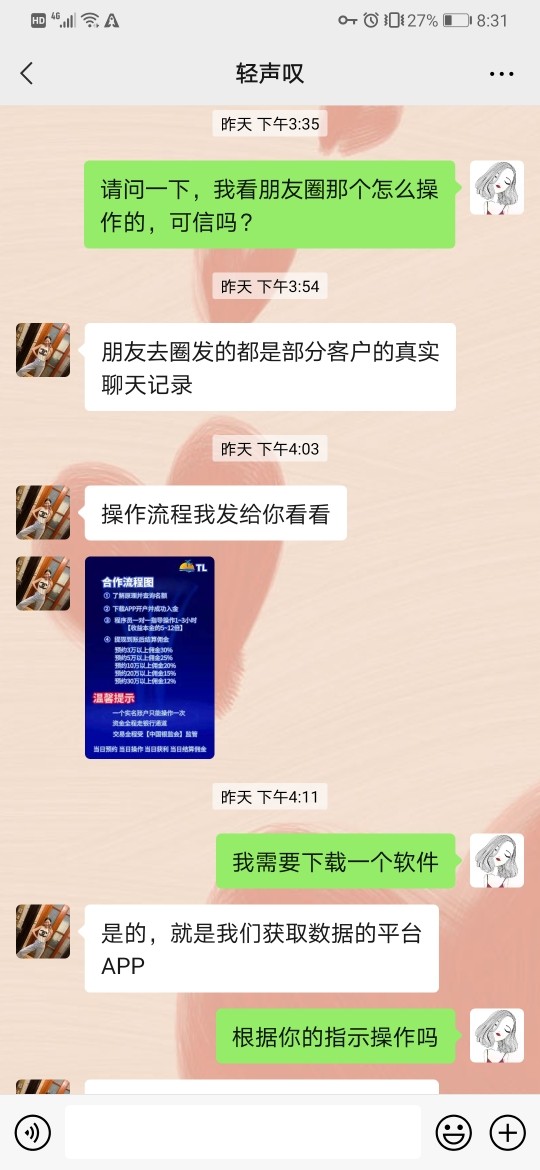

They induced me and said that the fprex arbitrage was profitable. But I need to pay various fees. Now I am still unable to withdraw funds.

OTC Global Holdings Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They induced me and said that the fprex arbitrage was profitable. But I need to pay various fees. Now I am still unable to withdraw funds.

This comprehensive Otc Global Holdings review examines one of the world's most prominent independent institutional commodity brokers. Founded in 2007 and headquartered in Houston, Texas, OTC Global Holdings has established itself as a formidable force in the commodities trading sector. The company specializes in both financial and physical instruments. OTC Global Holdings experienced remarkable growth in 2023, achieving a 47% annual growth rate, which culminated in its acquisition by BGC Group for $325 million in a predominantly cash transaction.

OTC Global Holdings distinguishes itself through its expertise in the physical oil market and comprehensive commodity brokerage services. The company operates from multiple strategic locations. These locations include Chicago, Des Moines, Geneva, Houston, London, Louisville, New Jersey, New York, and Singapore, positioning itself to serve institutional investors and professional traders across global markets. This acquisition by BGC Group has further strengthened the company's market position in the energy, commodities, and shipping sector. The acquisition establishes it as BGC's largest asset class.

The broker primarily targets institutional investors and professional traders who require sophisticated commodity trading solutions. They also need expertise in both financial derivatives and physical commodity markets.

OTC Global Holdings operates across multiple jurisdictions and regulatory environments. The company's services and operational procedures may vary significantly depending on regional regulations and local market conditions. Potential clients should be aware that different offices may operate under varying regulatory frameworks. They should also understand that compliance requirements differ by location.

This review is based on the most recent available information and market feedback. Given the dynamic nature of the commodities brokerage industry and recent corporate changes following the BGC Group acquisition, some operational details may be subject to ongoing modifications. Readers are advised to verify current terms and conditions directly with OTC Global Holdings before making any trading decisions.

| Dimension | Score | Rationale |

|---|---|---|

| Account Conditions | 6/10 | Limited publicly available information regarding specific account terms and conditions |

| Tools and Resources | 8/10 | Comprehensive commodity brokerage services covering financial and physical instruments |

| Customer Service and Support | 5/10 | Multiple global offices but specific service quality metrics not publicly detailed |

| Trading Experience | 7/10 | Strong expertise in physical oil markets and institutional-grade trading infrastructure |

| Trust and Reliability | 6/10 | BGC Group acquisition enhances credibility, though specific regulatory details are limited |

| User Experience | 5/10 | Institutional focus with limited public user feedback available |

OTC Global Holdings emerged in 2007 with a clear mission to become the premier independent institutional commodity broker globally. The company has successfully achieved this goal. It has established itself as the world's largest independent institutional broker of commodities. Based in Houston, Texas, the firm has built its reputation on providing comprehensive brokerage services covering both financial and physical commodity instruments.

The company's business model centers on facilitating high-volume institutional transactions across various commodity markets. According to MarketsWiki reports, OTC Global Holdings has demonstrated consistent growth and market expansion. This growth is evidenced by their record-breaking 2023 performance. The firm's expertise spans multiple commodity sectors, with particular strength in energy markets, especially physical oil trading where their knowledge and market connections provide significant value to clients.

OTC Global Holdings operates through a network of strategically located offices across major financial centers. The company's global presence includes operations in Chicago, Des Moines, Geneva, Houston, London, Louisville, New Jersey, New York, and Singapore. This international footprint enables the firm to provide round-the-clock service to institutional clients. It also helps maintain strong relationships across different commodity markets and time zones.

The recent acquisition by BGC Group represents a significant milestone in the company's evolution. This $325 million transaction has immediately strengthened BGC's position in the energy, commodities, and shipping sector. The transaction establishes it as the acquirer's largest asset class. The integration presents what industry analysts describe as a textbook case of complementary business combination.

Regulatory Framework: Specific regulatory information is not detailed in available public materials. The company operates across multiple jurisdictions including the United States, United Kingdom, and other international markets through its various office locations.

Deposit and Withdrawal Methods: Detailed information regarding specific deposit and withdrawal mechanisms is not publicly disclosed in available materials. This reflects the institutional nature of the business where such arrangements are typically customized for large clients.

Minimum Deposit Requirements: Specific minimum deposit requirements are not publicly detailed. This is consistent with institutional brokerage operations where account minimums are typically substantial and negotiated individually.

Promotions and Bonuses: Available materials do not indicate specific promotional offerings. This aligns with the institutional focus where competitive pricing and service quality typically take precedence over promotional incentives.

Tradeable Assets: The company provides comprehensive coverage of commodity markets through both financial and physical instruments. This includes energy products, agricultural commodities, metals, and other raw materials. The company has particular expertise in oil markets.

Cost Structure: Specific fee structures and commission details are not publicly disclosed in available materials. This reflects standard industry practice for institutional brokerage where pricing is typically customized and negotiated.

Leverage Options: Leverage specifications are not detailed in publicly available information. Institutional commodity trading typically involves sophisticated risk management approaches.

Platform Options: Specific trading platform details are not extensively covered in available materials. The company's institutional focus suggests sophisticated trading infrastructure.

Geographic Restrictions: The company operates globally through multiple offices. Specific jurisdictional limitations are not detailed in available public information.

Customer Service Languages: With offices spanning multiple countries, multilingual support capabilities are implied. Specific language offerings are not detailed in available materials.

This Otc Global Holdings review reveals a firm positioned primarily for institutional clients requiring sophisticated commodity trading solutions.

The evaluation of OTC Global Holdings' account conditions reflects the institutional nature of their business model. Unlike retail brokers who typically publish standardized account types and requirements, institutional commodity brokers often customize account structures based on client needs and trading volumes. Available public information does not provide specific details about account types, minimum deposit requirements, or standard account features.

The company's focus on institutional investors suggests that account opening procedures likely involve comprehensive due diligence processes. These include detailed financial background checks and regulatory compliance verification. This institutional approach typically results in more complex but more flexible account structures compared to retail offerings.

The lack of publicly available account condition details is not uncommon in the institutional brokerage space. Terms are often negotiated individually based on client size, trading frequency, and specific requirements. However, this opacity makes it challenging for potential clients to assess suitability without direct consultation.

The score of 6/10 reflects this information limitation while acknowledging that institutional-grade account services typically offer sophisticated features and personalized service levels that exceed retail standards. The Otc Global Holdings review indicates that prospective clients should expect to engage in detailed discussions with the firm to understand specific account terms and conditions.

OTC Global Holdings demonstrates strong capabilities in tools and resources, earning an 8/10 rating based on their comprehensive commodity brokerage services. According to MarketsWiki reports, the company covers both financial and physical instruments across commodity markets. This indicates sophisticated trading infrastructure and market access capabilities.

The firm's expertise in physical oil markets represents a significant resource advantage. It provides clients with insights and access that purely financial brokers cannot match. This combination of financial and physical market knowledge creates substantial value for institutional clients seeking comprehensive commodity exposure.

The company's global office network serves as an extended resource, providing local market knowledge and relationships across major commodity trading centers. Offices in Houston, London, Singapore, and other key locations offer clients access to regional expertise and market intelligence.

The recent BGC Group acquisition is likely to enhance the company's tools and resources significantly. BGC's technology infrastructure and broader market access capabilities should complement OTC Global Holdings' existing commodity expertise. This creates an enhanced service offering for clients.

However, specific details about proprietary research capabilities, analytical tools, or educational resources are not extensively documented in available materials. The institutional focus suggests that such resources exist but are likely provided through direct client relationships rather than public platforms.

Customer service evaluation for OTC Global Holdings receives a moderate 5/10 rating. This is primarily due to limited publicly available information about service quality and support mechanisms. The company's institutional focus means that customer service likely operates differently from retail brokers, with dedicated relationship managers and customized support structures.

The global office network suggests strong geographical coverage for client support. Locations span major time zones from Singapore to New York. This infrastructure implies 24-hour coverage capabilities, which is essential for commodity markets that trade around the clock.

However, specific information about response times, service quality metrics, or client satisfaction measures is not available in public materials. The institutional nature of the business means that service quality is typically assessed through direct client relationships rather than public reviews or ratings.

The company's rapid growth and successful acquisition by BGC Group suggests that client satisfaction levels are likely strong. Institutional clients typically have high service expectations and multiple alternatives. Poor service quality would likely impede the type of growth the company has demonstrated.

Without specific user feedback or documented service level agreements, the rating remains moderate despite the likely high quality of institutional-grade support services.

The trading experience evaluation awards OTC Global Holdings a solid 7/10 rating. This is based primarily on their demonstrated expertise in commodity markets and institutional-grade infrastructure. The company's specialization in both financial and physical commodity instruments suggests sophisticated execution capabilities and deep market access.

The firm's particular strength in physical oil markets provides clients with trading opportunities and execution quality that many competitors cannot match. This expertise likely translates to superior order execution and market timing capabilities in energy commodities.

The global office network enhances trading experience by providing local market access and relationships across major commodity trading centers. This geographical coverage enables efficient execution across different time zones and regional markets.

The recent integration with BGC Group should further enhance trading capabilities through access to broader technology infrastructure and expanded market access. BGC's established trading platforms and execution capabilities complement OTC Global Holdings' commodity expertise.

However, specific performance metrics such as execution speed, slippage statistics, or platform reliability data are not available in public materials. The institutional focus means that such performance data is typically shared directly with clients rather than published publicly.

The Otc Global Holdings review suggests that trading experience quality is likely high based on the company's market position and client base. Specific technical performance data remains undisclosed.

Trust and reliability assessment yields a 6/10 rating for OTC Global Holdings. This reflects both positive indicators and information limitations. The company's acquisition by BGC Group for $325 million represents a significant positive indicator, as this transaction required extensive due diligence and regulatory approvals.

The firm's establishment as the world's largest independent institutional commodity broker indicates strong market reputation and client trust. Achieving this market position requires consistent performance and reliability over the company's operational history since 2007.

However, specific regulatory information is not detailed in available public materials. While the company operates across multiple jurisdictions through its global office network, specific regulatory authorizations, compliance records, or regulatory standing details are not publicly documented.

The institutional client base provides some reliability indication. Institutional investors typically conduct thorough due diligence before establishing trading relationships. The company's continued growth and successful exit to BGC Group suggests strong operational and financial standing.

The lack of publicly available regulatory details and compliance information limits the ability to fully assess trust factors. Institutional brokers often maintain lower public profiles regarding regulatory matters, but this opacity affects comprehensive trust evaluation.

User experience evaluation receives a 5/10 rating. This primarily reflects the institutional nature of OTC Global Holdings' business and limited publicly available user feedback. The company's focus on institutional investors means that user experience differs significantly from retail brokerage standards and expectations.

Institutional user experience typically emphasizes relationship management, customized service delivery, and sophisticated trading capabilities rather than user-friendly interfaces or simplified onboarding processes. The company's global office network suggests strong relationship management capabilities and personalized service delivery.

However, specific information about user satisfaction, interface design, or operational efficiency is not available in public materials. The institutional client base means that user feedback is typically shared through direct relationships rather than public review platforms.

The company's rapid growth and successful acquisition suggest that user experience quality meets institutional standards. Sophisticated investors have high expectations and multiple alternatives. Poor user experience would likely impact client retention and growth.

Without specific user testimonials, satisfaction surveys, or documented user experience metrics, the evaluation remains moderate despite the likely high quality of institutional-grade service delivery.

This comprehensive Otc Global Holdings review reveals a specialized institutional commodity broker with significant market expertise and strong growth trajectory. The company's position as the world's largest independent institutional commodity broker, combined with its 47% growth in 2023 and successful acquisition by BGC Group, demonstrates substantial market credibility and operational strength.

OTC Global Holdings appears most suitable for institutional investors and professional traders requiring sophisticated commodity trading solutions. They also need expertise in both financial and physical markets. The company's particular strength in physical oil markets and global office network provide significant value for clients seeking comprehensive commodity exposure.

The main advantages include proven market expertise, strong growth performance, global operational presence, and enhanced capabilities through BGC Group integration. However, limitations include limited publicly available information about specific service terms, regulatory details, and user feedback. This reflects the institutional focus but may concern transparency-focused clients.

FX Broker Capital Trading Markets Review