Insta-Trading 2025 Review: Everything You Need to Know

Summary

This insta-trading review gives a neutral look at the broker. The main concern is that it operates without regulation, which creates fraud risks that traders need to think about carefully. Insta-Trading is run by Trasilion EOOD, a company registered in Bulgaria. It offers many trading options including forex, commodities, indices, and cryptocurrencies, plus advanced charting tools that help traders make smart decisions.

The platform targets small to medium-sized investors and people who want to trade cryptocurrency. It gives access to multiple types of assets through what looks like a complete trading setup. But the lack of regulatory oversight seriously hurts the overall safety of this broker.

Insta-Trading does offer various trading tools and real-time market data that can help traders who want to diversify their portfolios. However, the absence of proper financial regulation creates serious concerns about fund security and how transparent the company operates. According to available information, users have said that the platform provides helpful tools for trading decisions. Still, the unregulated nature of the broker presents big risks that potential clients must consider against any benefits they might see.

The broker focuses on cryptocurrency trading alongside traditional instruments, which may appeal to modern traders. But the regulatory concerns overshadow these potential advantages.

Important Notice

This evaluation covers Insta-Trading as operated by Trasilion EOOD, a company registered in Bulgaria. Traders should know that operating across different areas without proper regulatory oversight may expose them to varying legal and market risks. These could differ a lot from regulated alternatives.

The assessment in this review is based on available user feedback, market reports, and information from the platform itself. However, given the unregulated status of Insta-Trading, independent verification of claims and features may be limited. Potential users are strongly advised to do thorough research before engaging with this broker.

Rating Framework

Broker Overview

Insta-Trading operates under Trasilion EOOD, a company registered in Bulgaria. Specific founding details are not clearly documented in available sources. The broker positions itself as a multi-asset trading platform. It offers access to forex markets, commodities, stock indices, and cryptocurrency trading.

This business model appears designed to cater to traders seeking diversified exposure across traditional and digital asset classes. The company's operational structure centers around providing trading access to various financial instruments. It has particular emphasis on cryptocurrency trading capabilities that may appeal to modern retail traders.

However, the lack of specific historical information about the company's establishment and growth trajectory raises questions about operational transparency. The broker offers trading in foreign exchange pairs, commodities such as precious metals and energy products, major stock indices, and various cryptocurrencies. This insta-trading review notes that while the asset diversity is extensive, the absence of regulatory oversight from recognized financial authorities significantly impacts the platform's credibility.

The company operates without supervision from major regulatory bodies such as the FCA, CySEC, or ASIC. These typically provide investor protection and operational standards.

Regulatory Status: Insta-Trading operates without regulation from any recognized financial supervisory authority. This presents significant risks for trader fund security and dispute resolution.

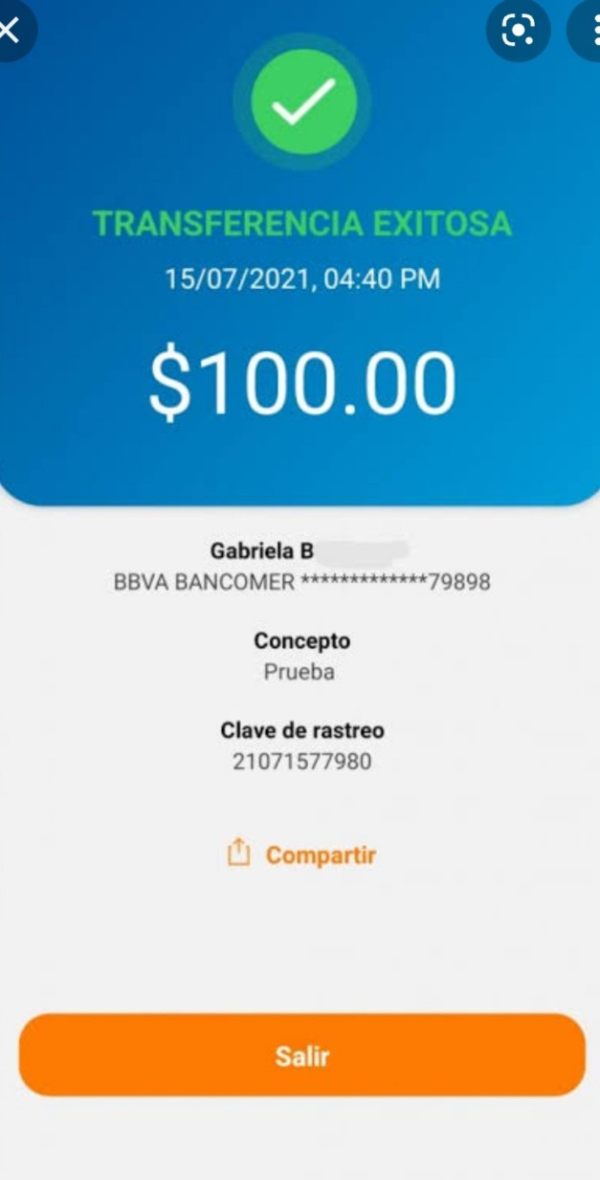

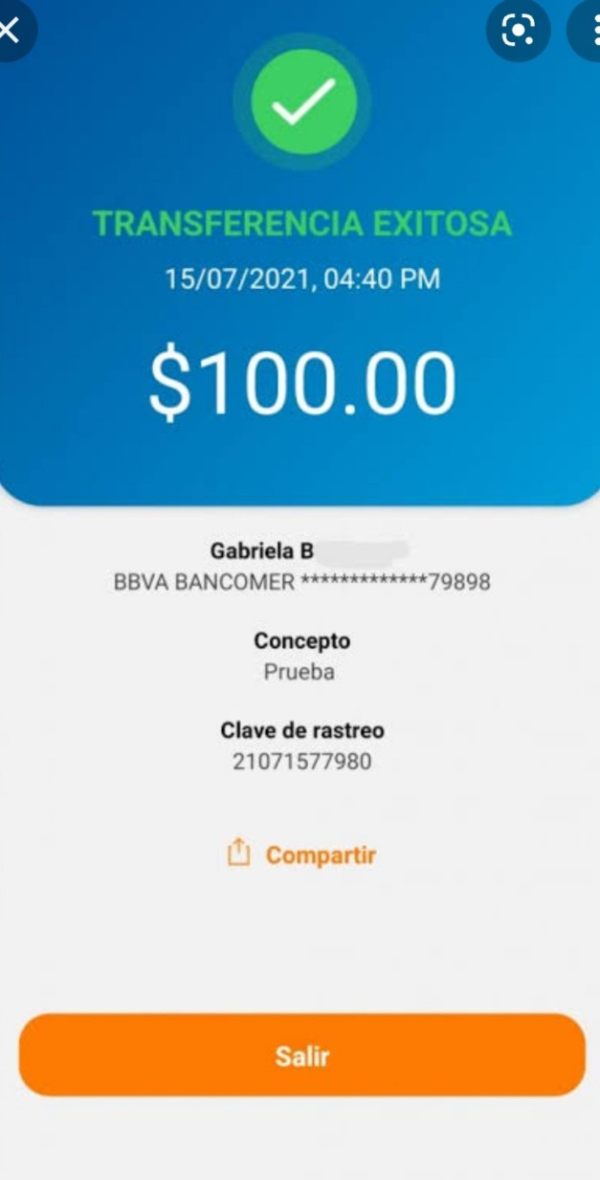

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in current available sources. Most brokers typically offer bank transfers and electronic payment methods.

Minimum Deposit Requirements: The specific minimum deposit amount required to open an account with Insta-Trading is not specified in available documentation.

Bonus and Promotions: Current promotional offers and bonus structures are not detailed in accessible information sources.

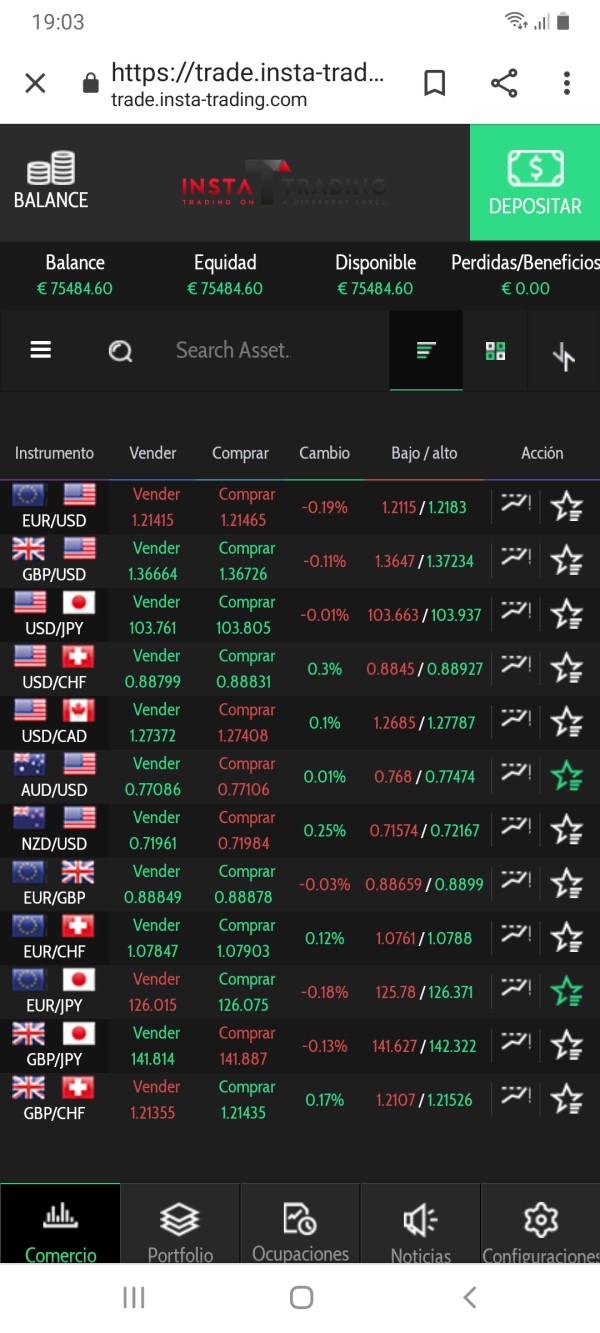

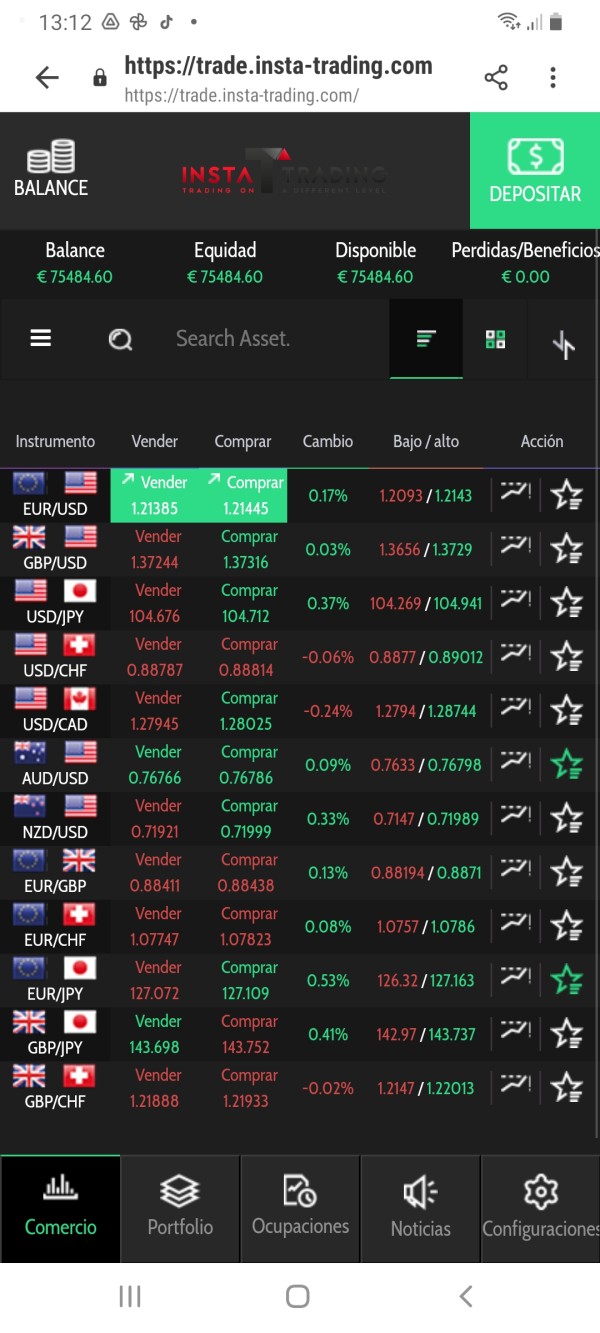

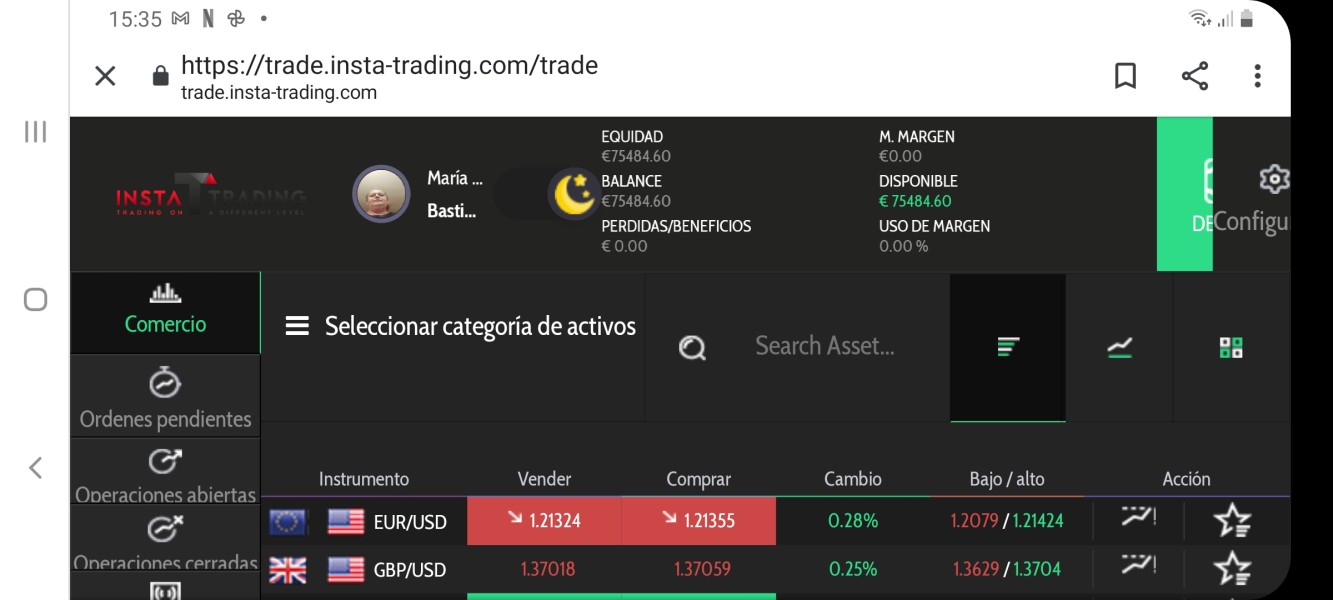

Tradeable Assets: The platform provides access to forex currency pairs, commodity markets, major stock indices, and cryptocurrency trading. It offers reasonable diversification for retail traders.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not detailed in current sources. This is concerning for transparency.

Leverage Options: Available leverage ratios are not specified in accessible documentation. This is typically a crucial factor for forex traders.

Platform Selection: The specific trading platforms offered are not clearly indicated in available sources. These might include MetaTrader 4/5 or proprietary solutions.

Geographic Restrictions: Information about regional trading restrictions is not specified in current documentation.

Customer Support Languages: Available customer service languages are not detailed in accessible sources.

This insta-trading review emphasizes that the lack of detailed operational information further compounds concerns about transparency and regulatory compliance.

Detailed Rating Analysis

Account Conditions Analysis

The specific account types and structures offered by Insta-Trading are not clearly documented in available sources. This makes it difficult to assess the variety and features of different account tiers. Without detailed information about minimum deposit requirements, account benefits, or special features, potential traders cannot make informed comparisons with other brokers in the market.

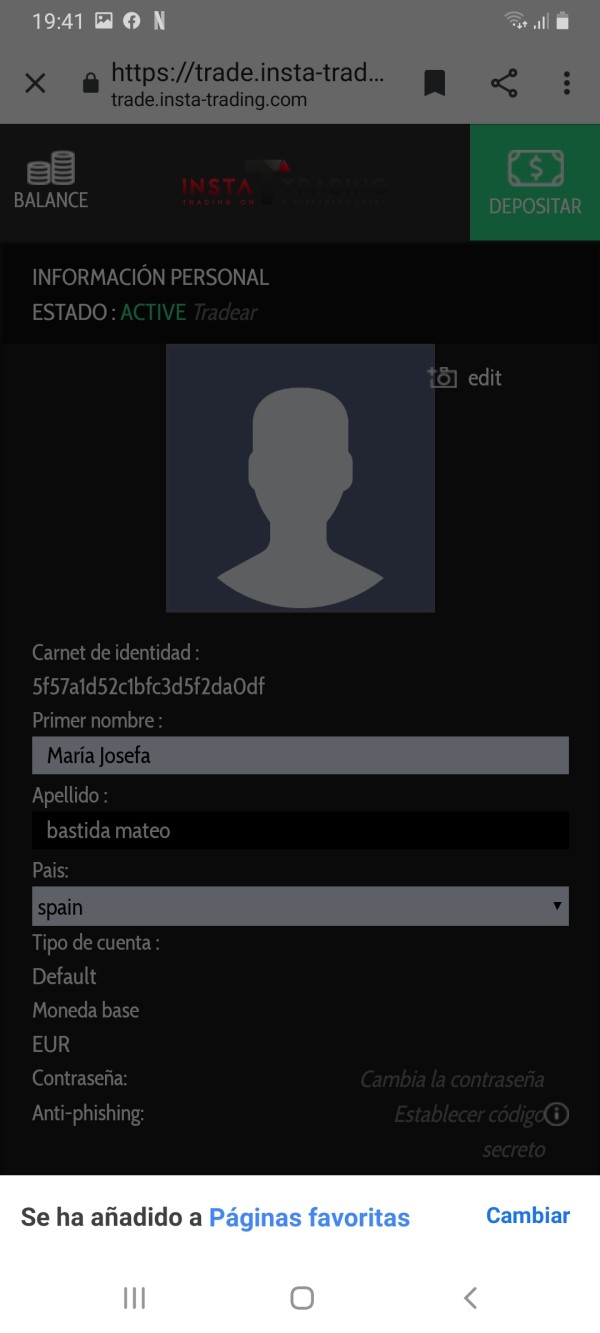

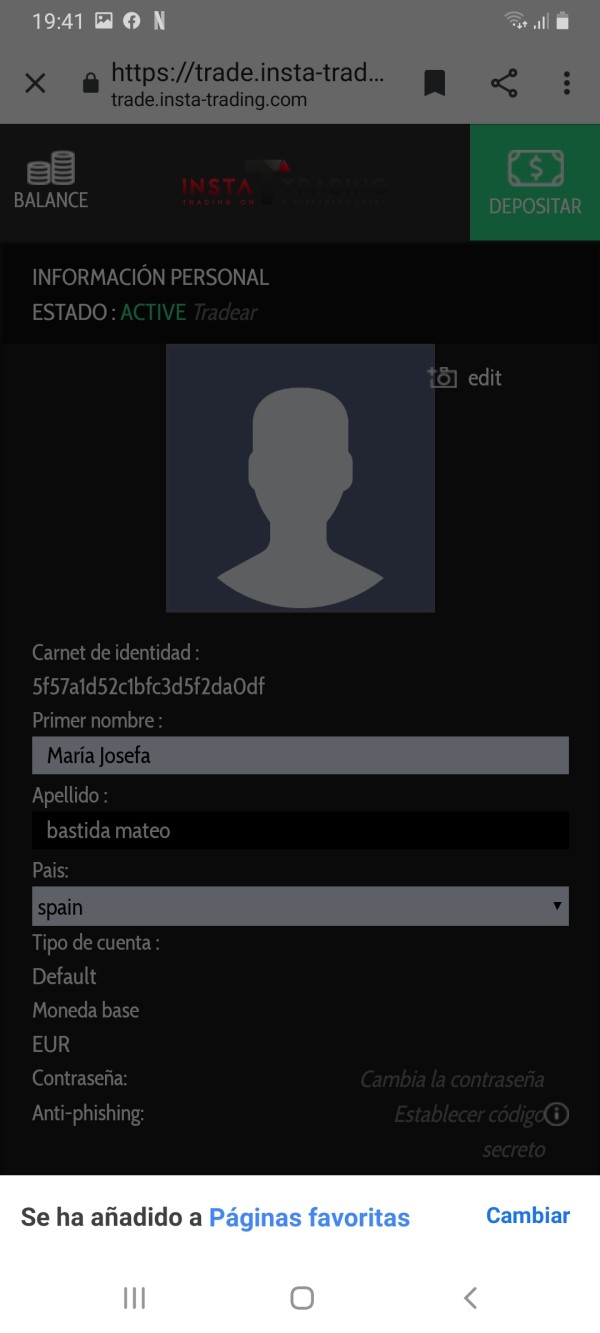

The account opening process details are not specified. This raises concerns about verification procedures and compliance with anti-money laundering standards. Most regulated brokers provide clear information about their account structures. These include demo accounts, standard accounts, and premium tiers with varying benefits and requirements.

Special account features such as Islamic accounts for Muslim traders, or professional account options for experienced traders, are not mentioned in available documentation. This lack of transparency regarding account conditions makes it challenging for traders to understand what they can expect when opening an account. The absence of clear account information in this insta-trading review reflects broader transparency concerns that potential users should consider carefully before proceeding with account registration.

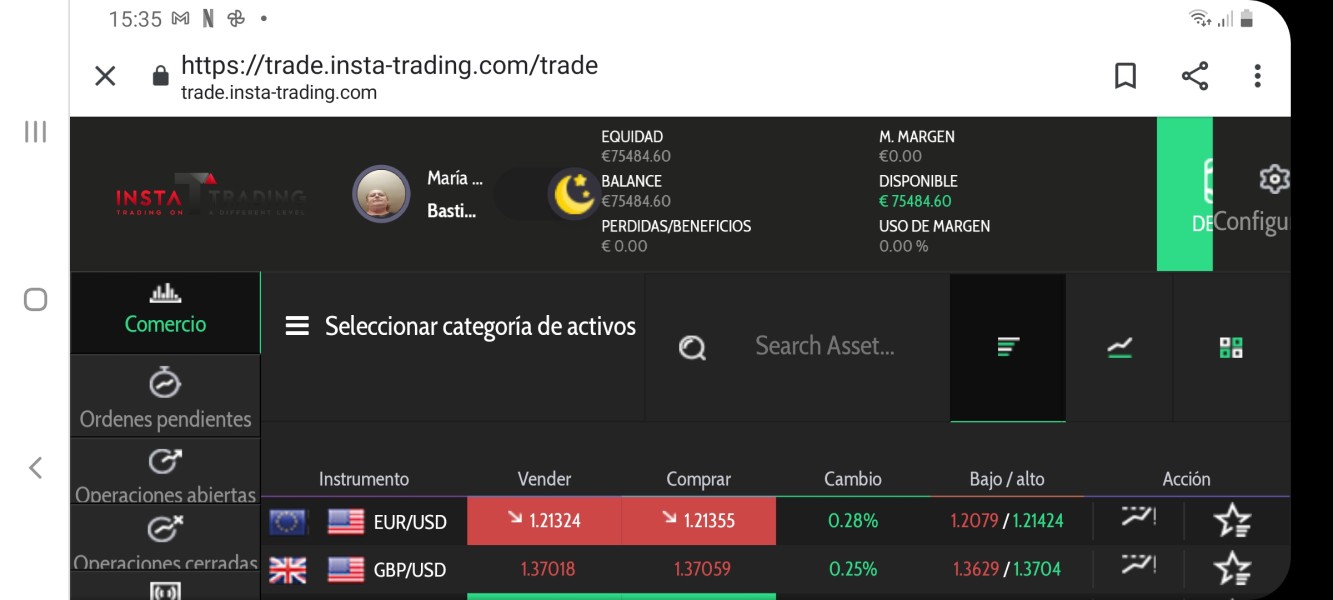

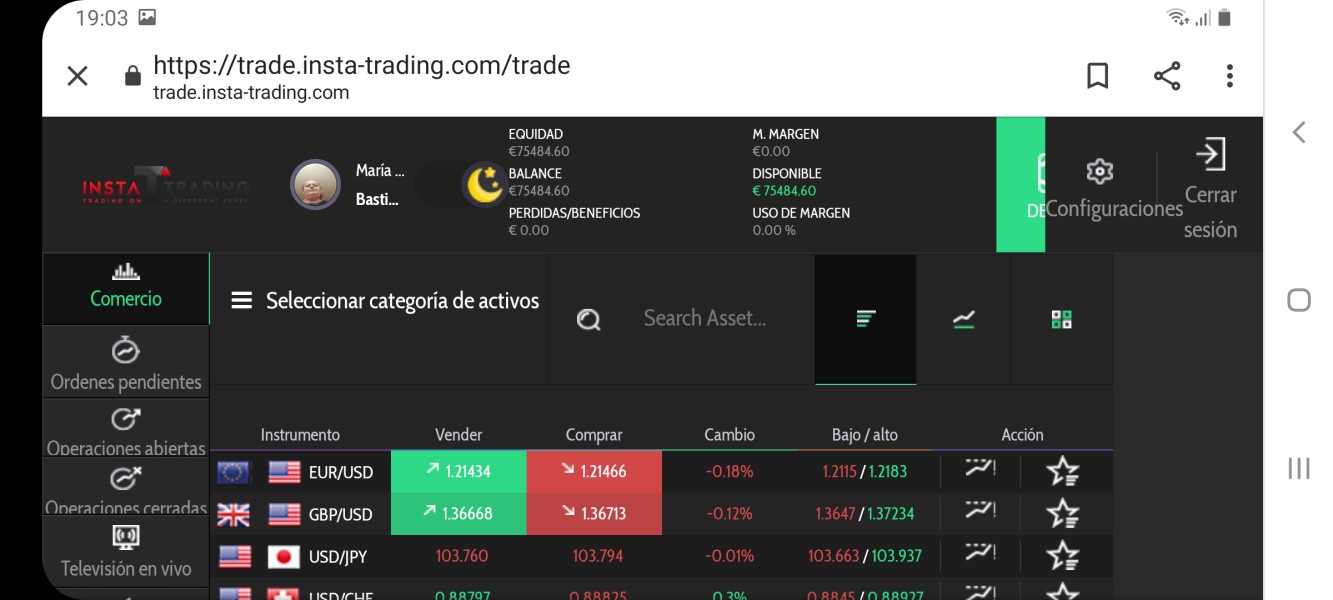

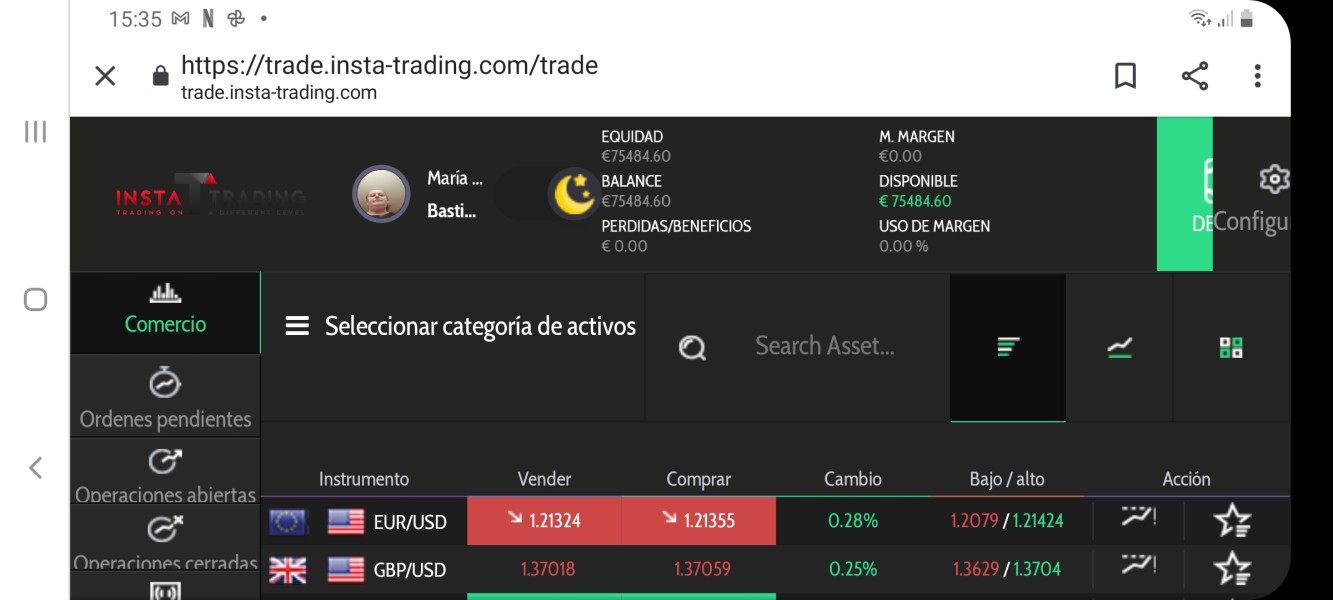

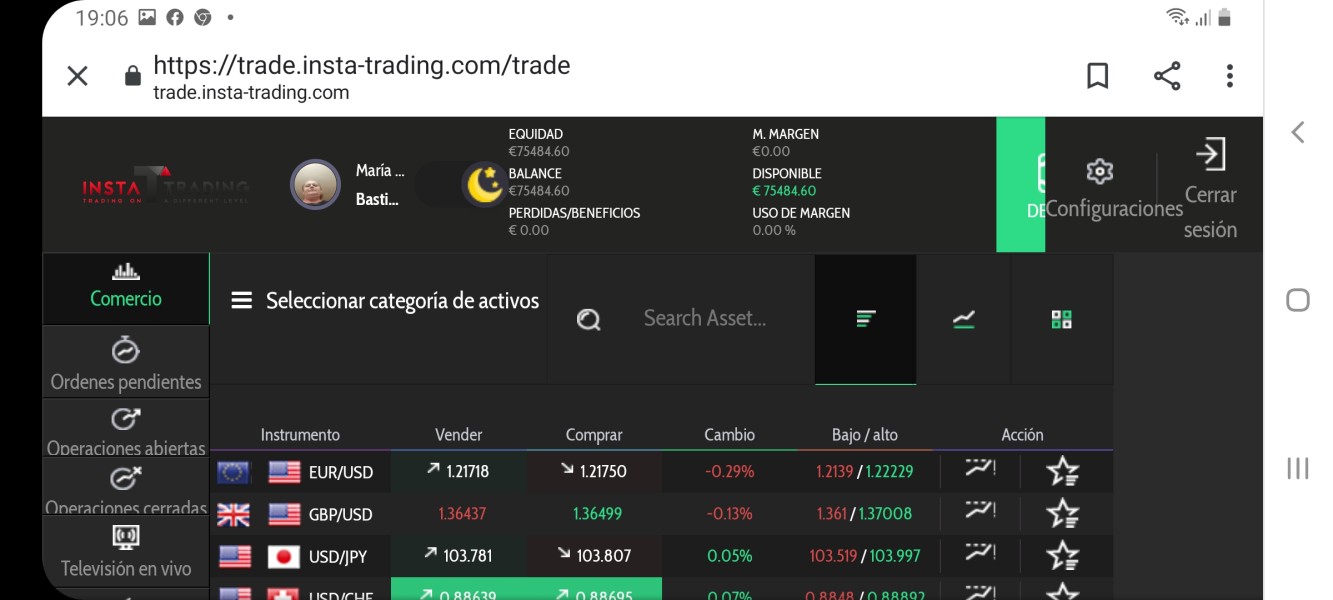

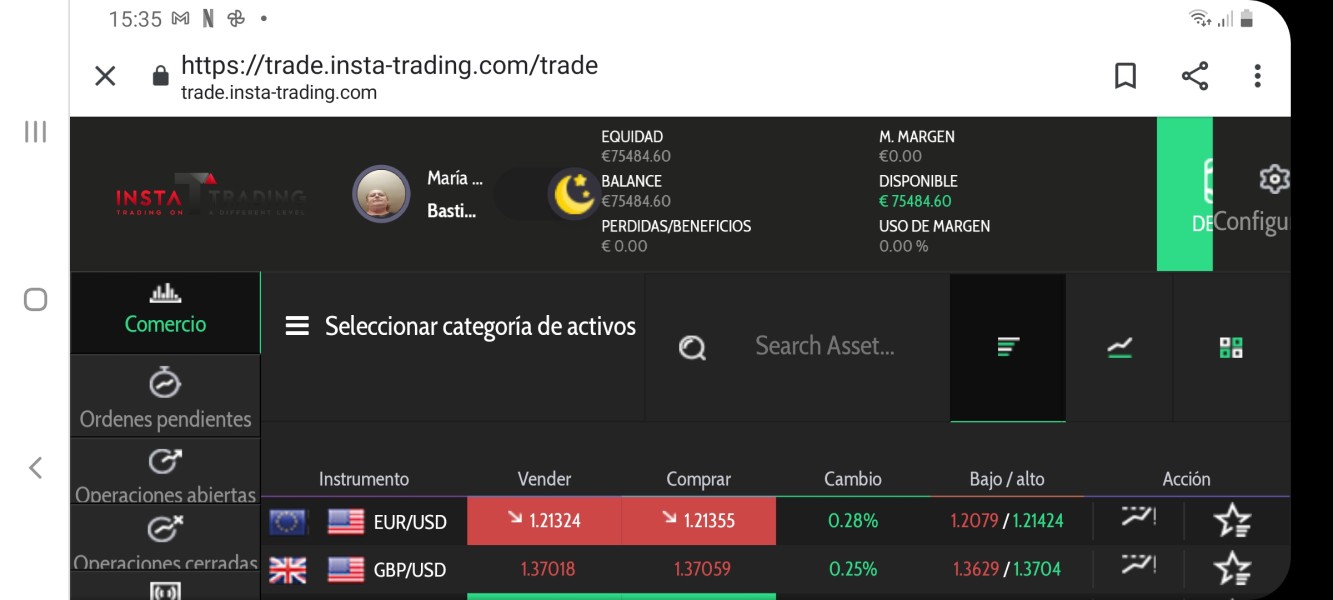

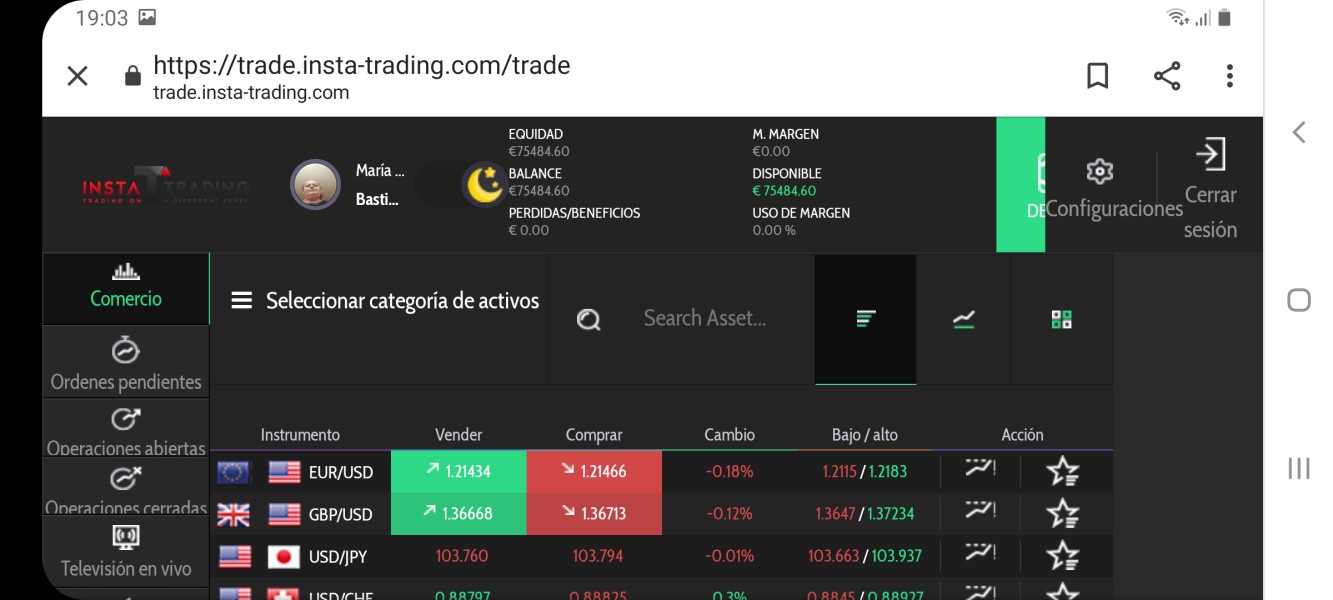

Insta-Trading offers multiple trading instruments across forex, commodities, indices, and cryptocurrency markets. This provides traders with diverse investment opportunities. The platform features advanced charting tools and real-time market data. According to user feedback, these can assist traders in making informed trading decisions.

The availability of comprehensive charting capabilities suggests that the platform invests in technical analysis tools that are essential for modern trading strategies. Real-time market data access is crucial for active traders who need up-to-date pricing information for effective decision-making. However, specific information about educational resources, market research, or fundamental analysis tools is not detailed in available sources.

Many competitive brokers provide extensive educational materials, webinars, and market analysis to support trader development. Such offerings are not clearly documented for Insta-Trading. Automated trading support, expert advisors, or algorithmic trading capabilities are not specifically mentioned. This may limit the platform's appeal to more sophisticated traders seeking advanced trading automation.

Customer Service and Support Analysis

Customer service channels and availability are not specifically detailed in accessible documentation. This presents a significant concern for traders who may need support during trading hours or for account-related issues. Effective customer support is crucial for resolving technical problems, account inquiries, and trading disputes.

Response times for customer inquiries are not documented. This makes it impossible to assess the efficiency of support services. Professional brokers typically provide clear information about expected response times across different communication channels.

Service quality metrics and customer satisfaction ratings are not available in current sources. User feedback suggests mixed experiences with the platform. The lack of detailed customer service information raises questions about the broker's commitment to client support.

Multilingual support availability is not specified. This could be problematic for international traders who prefer assistance in their native languages. Most global brokers provide support in multiple languages to serve diverse customer bases effectively.

Trading Experience Analysis

The platform stability and execution speed are not specifically documented in available sources. These factors are crucial for effective trading performance. User feedback indicates that the platform provides tools helpful for making trading decisions. This suggests some positive aspects of the trading environment.

Order execution quality details are not specified. This makes it difficult to assess whether the broker provides fair and efficient trade execution. Professional traders typically require information about execution speeds, slippage rates, and order fill quality.

The platform features advanced charting tools. These can enhance the trading experience for technical analysts and active traders. However, comprehensive information about platform functionality, customization options, and advanced features is limited in available sources.

Mobile trading experience details are not documented. Mobile access is increasingly important for modern traders who need to monitor and manage positions on the go. This insta-trading review notes that mobile platform quality can significantly impact overall user satisfaction.

Trust Score Analysis

Insta-Trading operates without regulation from recognized financial authorities. This represents the most significant trust concern for potential users. Regulatory oversight provides essential protections including segregated client funds, compensation schemes, and operational standards that protect trader interests.

Fund security measures are not detailed in available documentation. This raises serious concerns about client money protection. Regulated brokers typically provide clear information about fund segregation, insurance coverage, and banking arrangements that protect client deposits.

Company transparency regarding ownership, financial statements, and operational procedures is limited. This further impacts trust scores. Professional brokers usually provide comprehensive information about their corporate structure and financial stability.

The platform has been associated with potential fraud risks according to available information. This significantly impacts its trustworthiness. User feedback and market reports suggest caution when considering this broker for trading activities.

User Experience Analysis

Overall user satisfaction metrics are not comprehensively documented in available sources. This makes it difficult to assess general client contentment with the platform. Limited user feedback suggests that while some find the trading tools helpful, concerns about the unregulated status persist.

Interface design and usability details are not specifically documented. User-friendly design is crucial for effective trading performance. Modern traders expect intuitive interfaces that facilitate quick decision-making and efficient trade execution.

Registration and verification processes are not detailed in available sources. This raises questions about onboarding procedures and compliance standards. Professional brokers typically provide clear information about account opening requirements and verification timelines.

The main user complaints center around the unregulated status and associated fraud risks. This significantly impacts overall user confidence. Potential users should carefully consider these concerns when evaluating the platform for their trading needs.

Conclusion

This insta-trading review concludes that while the broker offers multiple trading instruments and advanced charting tools, the unregulated status and potential fraud risks require extreme caution from prospective users. The platform may suit small to medium-sized investors interested in cryptocurrency trading. But the lack of regulatory protection presents significant risks.

The main advantages include diverse trading instruments across forex, commodities, indices, and cryptocurrencies, plus advanced charting capabilities that can support trading decisions. However, the critical disadvantages include the absence of regulatory oversight, limited transparency regarding operational details, and documented fraud risk concerns that overshadow any potential benefits. Traders considering Insta-Trading should carefully weigh these risks against their trading needs and consider regulated alternatives that provide better investor protection and operational transparency.