iGlobal 2025 Review: Everything You Need to Know

Summary

This comprehensive iglobal review reveals concerning findings about the broker's reputation and reliability in 2025. According to Global Fraud Reviews, iGlobal Invest has been flagged as a potential scam operation. This raises serious red flags for prospective traders who want to invest their money safely. User ratings across different platforms show consistently low scores, with RVS iGlobal receiving 3.0/5 and iGLOBAL IMPACT ITES scoring 2.9/5. These low scores indicate widespread dissatisfaction among clients who have used the platform.

Despite these concerning allegations, iGlobal does offer some features that may appeal to novice traders. These features include demo accounts and swap-free options for Islamic trading, which can be helpful for beginners. The platform appears to target newcomers to the forex market, particularly those interested in technology-related trading opportunities, but this focus doesn't address the serious trust issues. However, the numerous fraud allegations and poor user feedback significantly undermine the broker's credibility in the trading community. The competitive spreads mentioned in available information cannot compensate for the fundamental trust issues that plague this platform and make traders worried about their money. Potential traders should exercise extreme caution when considering iGlobal as their trading partner.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. It's important to note that iGlobal may operate different entities across various jurisdictions, and regulatory status may vary by region depending on local laws. The specific information regarding regulatory compliance was not detailed in available materials, which itself raises concerns about transparency and whether the company follows proper rules.

Our evaluation methodology relies on user testimonials, industry reports, and available platform data to provide accurate information. Given the serious fraud allegations mentioned in this review, potential clients should conduct thorough due diligence before engaging with this broker to protect their investments.

Rating Framework

Broker Overview

iGlobal presents itself as a trading platform offering various financial services. However, detailed information about its founding year and corporate background remains limited in available documentation, which is concerning for potential clients. The lack of transparent corporate information is itself a concerning factor for potential clients seeking a reliable trading partner who will protect their investments.

The company appears to focus on attracting new traders through its account management portal and basic trading features. However, the absence of comprehensive business model information and unclear corporate structure raises questions about the platform's legitimacy and long-term viability for serious traders.

According to available information, iGlobal operates primarily through its account management portal. However, specific details about asset classes and trading instruments remain unclear, making it hard for traders to know what they can invest in. This iglobal review found no clear information regarding primary regulatory oversight, which represents a significant red flag for traders prioritizing safety and compliance with financial laws. The platform's main appeal seems to be its accessibility for beginners, but the lack of regulatory clarity severely undermines its credibility in the competitive forex market where trust is essential.

Regulatory Status: Specific regulatory information was not detailed in available materials. This raises immediate concerns about compliance and oversight from financial authorities.

Deposit and Withdrawal Methods: Available documentation does not specify the payment methods supported by the platform.

Minimum Deposit Requirements: No specific minimum deposit amounts were mentioned in the available information.

Bonuses and Promotions: Details about promotional offers and bonus structures were not provided in the source materials.

Tradeable Assets: The range of available trading instruments was not specified in the documentation reviewed.

Cost Structure: While the platform mentions competitive spreads, specific commission structures and fee details remain unclear. The lack of transparent pricing information makes it difficult for traders to assess the true cost of trading with iGlobal and plan their investment strategies.

Leverage Options: Maximum leverage ratios were not specified in the available information.

Platform Options: The primary trading interface appears to be the iGlobal account management portal. However, technical specifications and features remain undocumented, leaving traders unsure about what tools they will have access to.

Regional Restrictions: Information about geographical limitations was not provided in available materials.

Customer Support Languages: Available support languages were not specified in the documentation.

This iglobal review highlights the concerning lack of detailed information about basic trading conditions. Such information is essential for informed decision-making when choosing a broker to handle your money.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by iGlobal receive a below-average rating due to the significant lack of transparency regarding basic account features. Available information does not specify the types of accounts offered, minimum deposit requirements, or account opening procedures. This makes it impossible for potential traders to make informed decisions about whether the platform meets their needs.

The absence of clear information about account types and their respective features represents a major shortcoming. Most reputable brokers provide detailed specifications about their account offerings, including minimum deposits, maximum leverage, and special features that help traders succeed. The fact that such fundamental information is not readily available raises serious questions about the platform's professionalism and transparency with potential clients.

User feedback reflected in the low ratings suggests that clients have experienced difficulties with account-related services. The 3.0/5 rating for RVS iGlobal indicates that users are not satisfied with the overall account experience they received from the company. While the platform does mention Islamic account options through swap-free trading, the lack of comprehensive account information makes it difficult to recommend iGlobal for serious trading activities that require reliable service.

The competitive spreads mentioned in available materials cannot compensate for the fundamental lack of transparency in account conditions. This iglobal review emphasizes that traders need clear, detailed information about account features to make informed decisions, and iGlobal falls short in this critical area that affects every aspect of trading.

iGlobal receives an average rating for tools and resources, primarily based on its provision of demo accounts and swap-free options. These features demonstrate some consideration for different trader needs, particularly those of Islamic traders who require Sharia-compliant trading conditions that align with their religious beliefs.

The demo account feature is particularly valuable for novice traders, allowing them to practice trading strategies without risking real money. This educational approach aligns with the platform's apparent focus on attracting new traders to the forex market who want to learn before investing. The swap-free option also shows awareness of diverse religious and cultural trading requirements that some traders must follow.

However, the limited information about additional trading tools, research resources, and educational materials significantly impacts the overall score. Most established brokers offer comprehensive market analysis, economic calendars, technical indicators, and educational content to support trader development and help them make better decisions. The absence of detailed information about such resources suggests that iGlobal's offering may be quite basic compared to other platforms.

The lack of information about automated trading support, advanced charting tools, or third-party integrations further limits the platform's appeal to more experienced traders. While the basic tools mentioned may suffice for beginners, serious traders typically require more sophisticated analytical and trading tools to implement effective strategies that can generate consistent profits.

Customer Service and Support Analysis (5/10)

Customer service receives an average rating, though this assessment is hampered by the lack of specific information about support channels, response times, and service quality. The low user ratings and fraud allegations significantly impact confidence in the support system's effectiveness when traders need help with their accounts.

The absence of detailed information about customer service availability, including operating hours, supported languages, and communication channels, makes it difficult to assess the true quality of support offered. Most reputable brokers provide 24/5 or 24/7 support through multiple channels including live chat, email, and phone support to help traders whenever problems arise.

User feedback suggesting dissatisfaction, as reflected in the low overall ratings, indicates that clients may have experienced difficulties in getting adequate support when needed. The fraud allegations mentioned in Global Fraud Reviews particularly concern the platform's ability to resolve client issues satisfactorily and protect trader interests.

Without specific examples of problem resolution or positive customer service experiences, it's challenging to provide a more favorable assessment. The lack of transparency about support procedures and the negative user sentiment combine to create concerns about the reliability of customer service when traders encounter problems that need immediate attention.

Trading Experience Analysis (5/10)

The trading experience with iGlobal receives an average rating, primarily due to limited information about platform performance, execution quality, and user interface design. While competitive spreads are mentioned, the overall trading environment remains unclear from available documentation, making it hard to judge the actual experience.

Platform stability and execution speed are critical factors for successful trading, yet no specific performance data or user feedback about these aspects was available in the reviewed materials. The reliance on an account management portal suggests a potentially simplified trading interface, which might appeal to beginners but could frustrate more experienced traders seeking advanced functionality for complex strategies.

The competitive spreads mentioned represent a positive aspect of the trading environment, as tight spreads can significantly impact trading profitability. However, without information about execution quality, slippage rates, or requotes, it's difficult to assess the true quality of the trading experience that users actually receive.

Mobile trading capabilities and cross-platform compatibility were not detailed in available information, which is increasingly important as traders expect seamless access across devices. The lack of specific user testimonials about trading experience makes it challenging to verify the platform's performance claims and determine if they deliver what they promise.

This iglobal review emphasizes that while basic trading functionality may be available, the absence of detailed performance information and user feedback creates uncertainty about the actual trading experience quality. Traders need reliable performance to succeed in the competitive forex market.

Trust and Reliability Analysis (2/10)

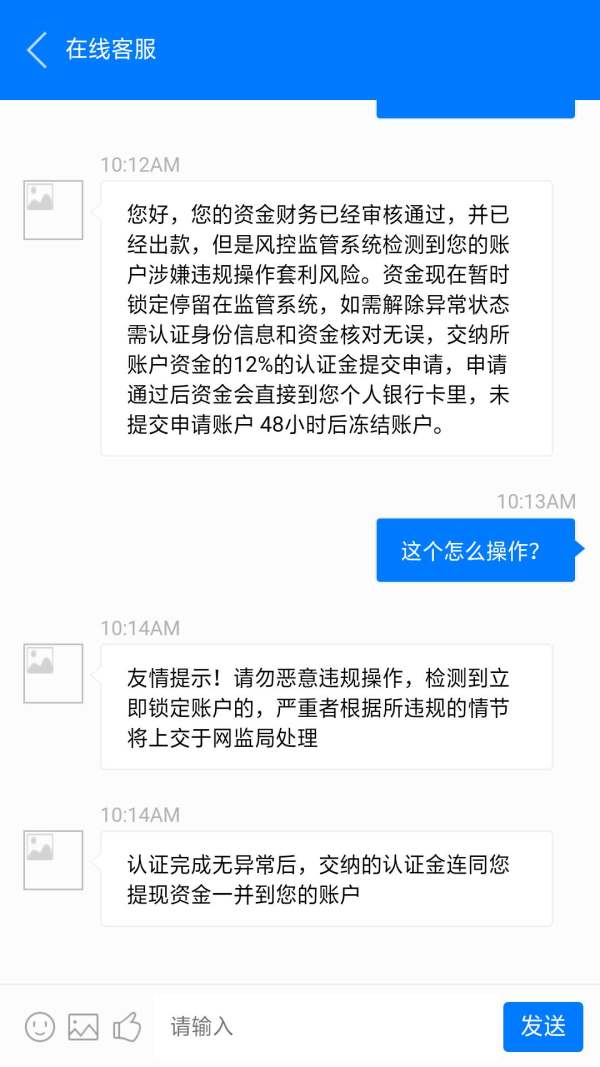

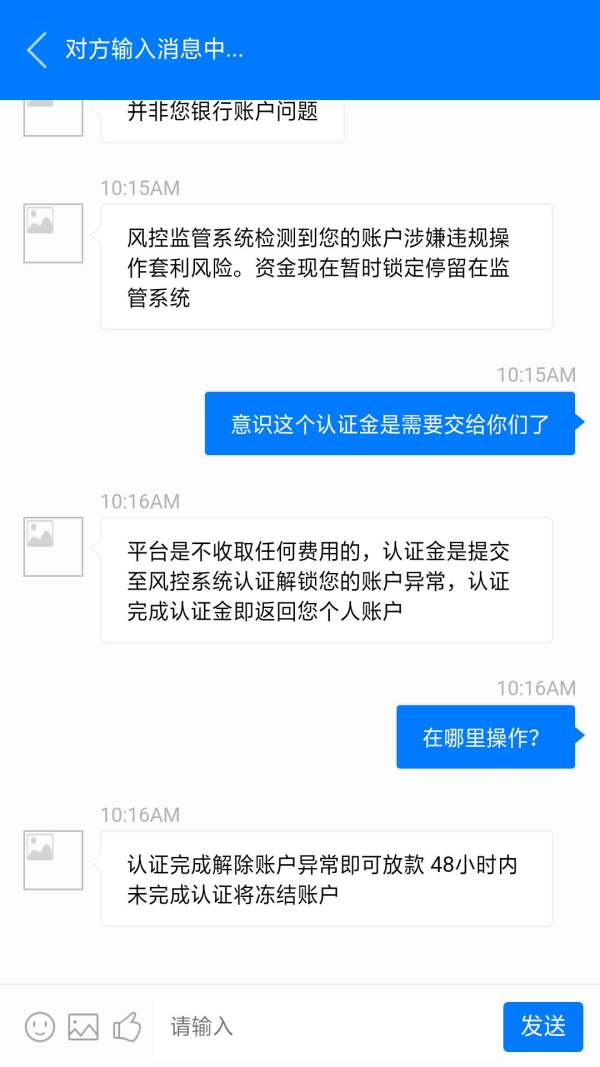

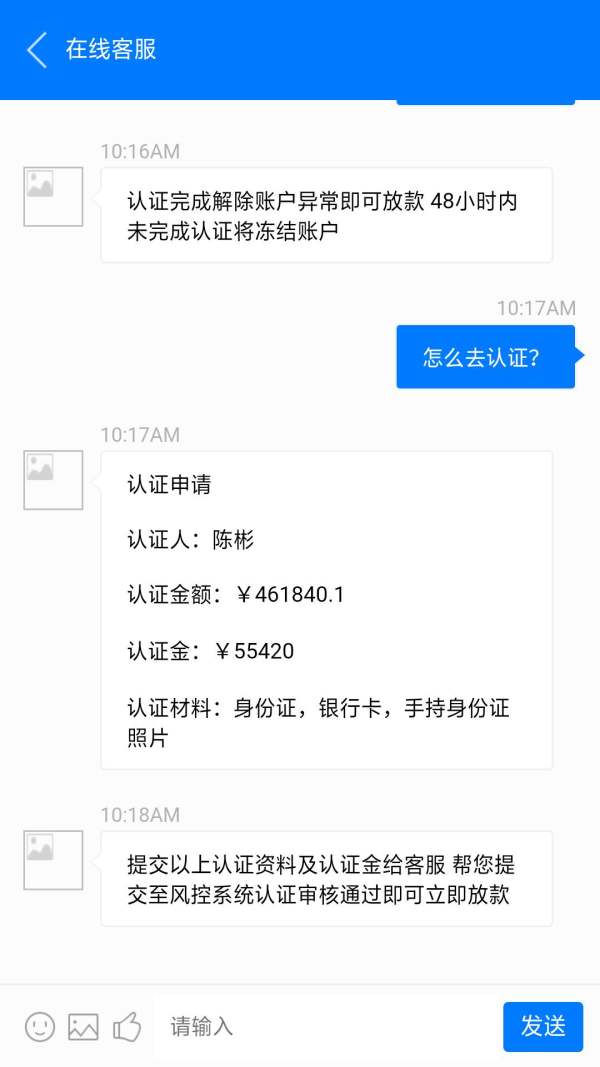

Trust and reliability receive the lowest rating in this evaluation due to serious fraud allegations and the absence of clear regulatory information. According to Global Fraud Reviews, iGlobal Invest has been flagged as a potential scam, which represents a fundamental threat to trader security and fund safety that cannot be ignored.

The lack of detailed regulatory information is particularly concerning in an industry where oversight and compliance are crucial for trader protection. Reputable brokers typically display their regulatory licenses prominently and provide clear information about client fund segregation and protection measures that keep trader money safe.

The fraud allegations specifically mentioned in the available information create serious doubts about the platform's legitimacy and operational integrity. Such allegations, when combined with low user ratings, suggest that multiple clients may have experienced problems with the broker that go beyond normal service issues and involve potential financial losses.

Without evidence of proper regulatory oversight, transparent business practices, or positive industry recognition, it becomes extremely difficult to recommend iGlobal as a trustworthy trading partner. The absence of information about fund protection measures, dispute resolution procedures, or regulatory compliance further undermines confidence in the platform's reliability and ability to protect trader investments.

User Experience Analysis (4/10)

User experience receives a below-average rating based on the consistently low user ratings and negative feedback reflected in available sources. The 3.0/5 rating for RVS iGlobal and 2.9/5 for iGLOBAL IMPACT ITES indicate widespread user dissatisfaction across different aspects of the service that affects how traders feel about the platform.

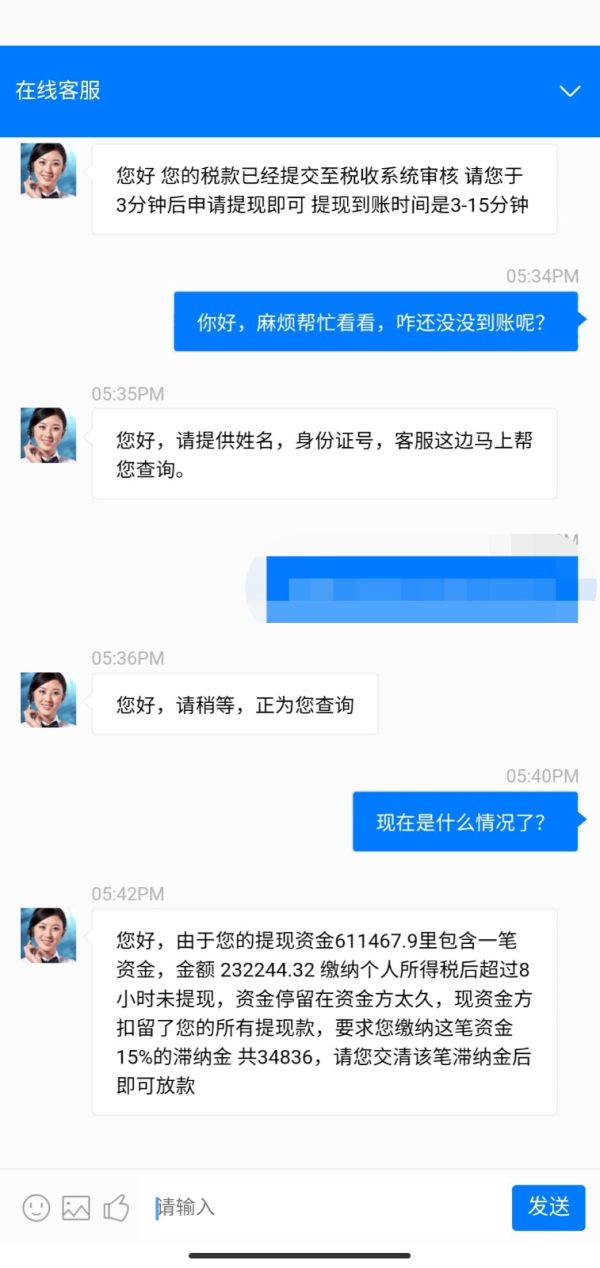

The fraud allegations mentioned in Global Fraud Reviews represent the most serious user experience concern, suggesting that some clients may have experienced significant problems with fund withdrawal or platform reliability. Such issues fundamentally undermine user confidence and satisfaction, making traders worry about their money and whether they can access it when needed.

While the platform appears designed for novice traders, the lack of detailed information about user interface design, registration processes, and account management procedures makes it difficult to assess the actual usability of the platform. The focus on beginners suggests an attempt to create a user-friendly environment, but user ratings indicate this goal may not be achieved effectively in practice.

The absence of positive user testimonials or case studies highlighting successful trader experiences further impacts the user experience assessment. Most reputable brokers can provide examples of satisfied clients and positive outcomes, which are notably missing from available iGlobal information and raise questions about whether such positive experiences exist.

Conclusion

This comprehensive iglobal review reveals significant concerns about the broker's reliability and trustworthiness in 2025. The fraud allegations from Global Fraud Reviews, combined with consistently low user ratings and lack of regulatory transparency, create substantial red flags for potential traders who want to protect their investments.

While iGlobal offers some basic features like demo accounts and swap-free options that may appeal to beginners, these cannot compensate for the fundamental trust and reliability issues. The platform may be suitable for novice traders seeking basic trading functionality, but extreme caution is advised given the serious allegations and negative user feedback from actual users.

The main advantages include accessibility for beginners and Islamic trading options, while significant disadvantages include poor trust ratings, fraud allegations, and lack of transparency about regulatory compliance and business operations. Potential traders should thoroughly investigate alternative brokers with stronger regulatory oversight and better user satisfaction records before considering iGlobal for their trading activities and financial investments.