Hirose Financial 2025 Review: Everything You Need to Know

Executive Summary

Hirose Financial stands out as a low-risk forex broker. This broker has earned positive reviews from users on many different platforms. This hirose financial review shows a well-regulated company with strong credentials, including oversight by two top-level regulatory authorities and an excellent trust score of 90/100. The broker sets itself apart by offering two different platforms: the LION Trader platform that they created themselves and the popular MetaTrader 4.

Hirose Financial is part of Hirose Tusyo, which is one of Japan's biggest forex providers. The broker has become a trusted choice for regular traders who want safety and security when they trade. The company focuses on forex trading solutions and credit services, which shows it has professional-grade systems while still being easy for individual traders to use. This positioning appeals most to traders who care more about following regulations and being transparent than getting flashy promotional deals.

Important Disclaimer

This review recognizes that Hirose Financial works in different countries. Rules and regulations may be different depending on where you live, which could affect what services you can get and how you're protected. The information here comes from public sources, user reviews from multiple platforms, and the broker's official statements. We've tried to make sure everything is accurate, but you should check current terms and conditions directly with the broker since financial rules and company policies can change.

Rating Framework

Broker Overview

Company Foundation and Background

Hirose Financial started in 2010. It works as a special part of Hirose Tusyo, using the parent company's long experience as one of Japan's top forex providers. The company has built its reputation by providing advanced forex trading and credit solutions, positioning itself between professional-grade systems and services that regular people can use. This careful approach has helped the company grow steadily while following strict rules across all the places where it operates.

The broker's business plan focuses on providing complete forex trading solutions. They don't try to grow aggressively through big promotional campaigns. This careful approach has helped them maintain a strong position with regulators and get positive feedback from users, making Hirose Financial a preferred choice among traders who value stability and rule-following over risky incentives.

Platform and Service Architecture

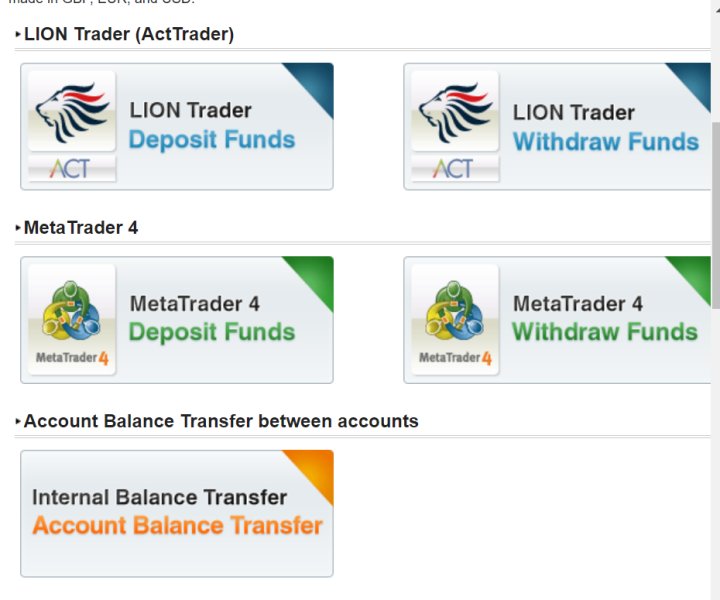

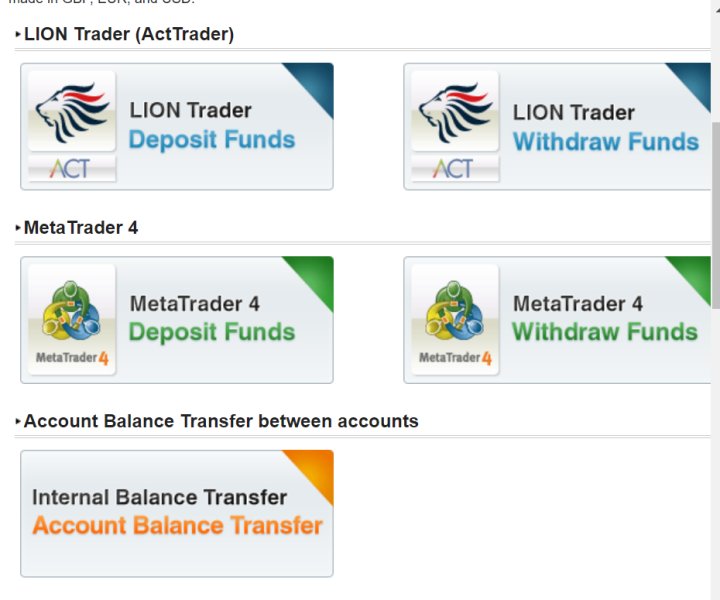

Hirose Financial's two-platform strategy shows they want to serve different trading preferences and skill levels. The LION Trader platform that they built shows off the company's technology skills, while MetaTrader 4 makes sure it works with widely-used trading tools and automated systems. This hirose financial review shows that forex is the main type of trading they offer, with the broker putting its resources into delivering excellent currency trading experiences rather than spreading across many different types of investments.

The rules that support Hirose Financial's operations include oversight by two top-level regulatory authorities. This gives clients strong protection and makes sure they follow international best practices in financial services. This regulatory foundation supports the broker's impressive trust score and helps a lot with its positive market reputation.

Regulatory Compliance and Licensing

Hirose Financial works under two top-level regulatory authorities. This ensures complete oversight and client protection that meets international standards for financial service providers.

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal options is not detailed in available documents. You need to contact the broker directly for current payment processing options.

Minimum Deposit Requirements

Available materials don't specify minimum deposit amounts. This suggests possible flexibility in account funding requirements that should be confirmed when opening an account.

Promotional Offers and Bonuses

Current documents don't mention specific bonus structures or promotional campaigns. This shows the broker focuses on service quality rather than using incentives to get new clients.

Tradeable Assets Portfolio

The broker mainly focuses on forex trading. They offer comprehensive currency pair coverage designed to meet different trading strategies and market exposure needs.

Cost Structure Analysis

Specific spread and commission information is not detailed in available materials. You need to ask directly for accurate cost assessments and fee structures.

Leverage Provisions

Available documents don't specify leverage ratios. You need to contact them directly to understand margin trading capabilities and risk management rules.

Platform Selection Options

Hirose Financial gives you access to both LION Trader and MetaTrader 4 platforms. This accommodates different trading styles and technical analysis preferences through this comprehensive hirose financial review.

Geographic Restrictions

Current materials don't specify regional limitations. However, regulatory compliance requirements may affect service availability in certain areas.

Customer Support Languages

Available documents don't detail specific language support options for customer service communications.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

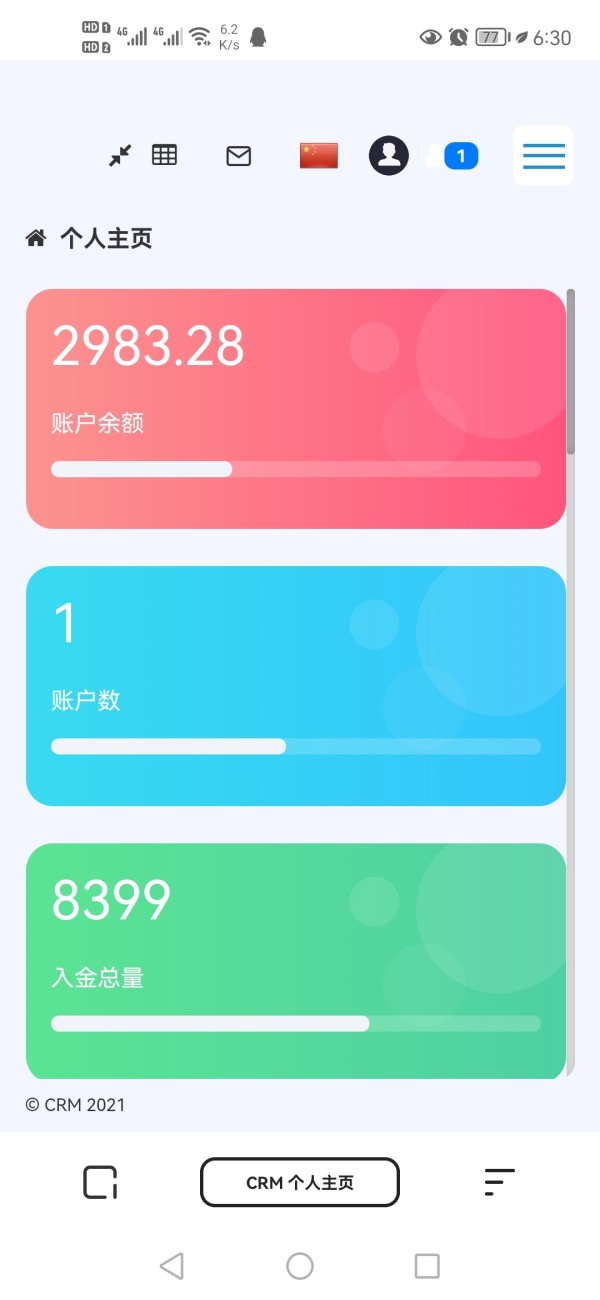

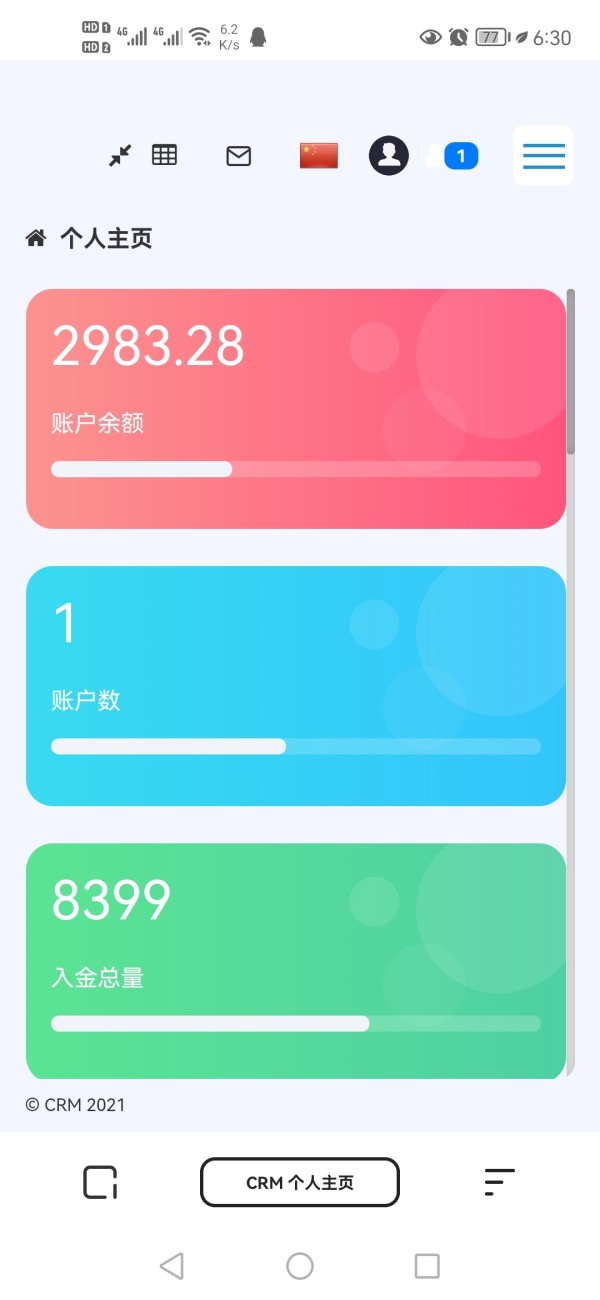

Hirose Financial's account structure shows careful thought about different trader preferences through its two-account approach. The LION Trader Account and MetaTrader 4 Account represent different ways for clients to access the broker's services, each matching specific trading platform preferences and functionality needs. This separation lets traders pick accounts that best match their technical analysis needs and how familiar they are with different platforms.

The lack of detailed minimum deposit information in available materials suggests possible flexibility in account funding requirements. However, this lack of transparency makes it hard to fully evaluate how accessible the broker is for smaller retail traders. Account opening procedures aren't well documented in current materials, which means you need to contact them directly to understand verification requirements and how long it takes.

User feedback consistently points out the flexibility of account conditions. Traders appreciate the straightforward approach to account management and the absence of complex tier structures that might make trading decisions harder. However, the limited availability of specific cost information in public materials represents a big gap in transparency that affects how we can evaluate account competitiveness.

The hirose financial review process shows that while the broker maintains good account condition standards, better transparency about fees, spreads, and specific account features would strengthen its market position and client confidence levels.

The broker's commitment to providing strong trading tools is clear through its two-platform strategy. This combines their own technology with industry-standard solutions. LION Trader represents Hirose Financial's technology capabilities, offering customized features designed specifically for forex trading, while MetaTrader 4 integration ensures it works with the extensive ecosystem of third-party tools and automated systems that many traders rely on.

Platform stability and functionality get consistent praise from users. They report reliable performance during various market conditions and trading sessions. The availability of comprehensive charting tools and technical indicators across both platforms supports different trading strategies, from basic technical analysis to sophisticated automated trading approaches.

While specific information about research and analysis resources isn't detailed in available materials, user feedback suggests adequate support for informed trading decisions. Educational resources and market analysis provisions aren't well documented, representing an area where better information availability would benefit potential clients seeking comprehensive trading support.

The broker's focus on forex trading solutions translates into practical benefits for traders. This includes consistent execution quality and access to competitive market conditions that support various trading styles and frequency requirements.

Customer Service and Support Analysis (Score: 7/10)

User evaluations consistently highlight professional and responsive customer service. Traders report satisfactory resolution of inquiries and technical issues. The quality of support interactions appears to meet industry standards, contributing to positive overall user experiences and client retention rates.

Response times get favorable mentions in user feedback. This suggests efficient handling of client communications and problem resolution. Service quality assessments indicate competent support staff capable of addressing both basic account inquiries and more complex trading-related questions effectively.

The absence of detailed information about specific communication channels, multilingual support capabilities, and service hours in available materials limits comprehensive evaluation of support accessibility. Operating hours and language support options require direct verification, which may affect international clients seeking specific communication preferences.

Professional service delivery appears consistent across user interactions. Traders express confidence in the support team's ability to handle various client needs. However, enhanced transparency regarding support capabilities and availability would strengthen the broker's appeal to international trading communities.

Trading Experience Analysis (Score: 8/10)

Platform stability emerges as a significant strength in user evaluations. Traders report consistent performance across different market conditions and trading sessions. The two-platform approach successfully accommodates various trading preferences, from those seeking advanced proprietary features to traders preferring the familiar MetaTrader 4 environment.

Execution quality receives positive user feedback. This suggests reliable order processing and competitive fill rates that support effective trading strategy implementation. The trading environment appears well-suited to various approaches, from scalping to longer-term position trading, based on user experience reports.

Platform functionality completeness is evident through the provision of essential charting tools and technical indicators across both trading platforms. While specific mobile trading experience details aren't extensively documented, the overall trading infrastructure appears robust and suitable for contemporary trading requirements.

This hirose financial review identifies the trading experience as a particular strength. Users express general satisfaction with platform performance and execution quality. The combination of proprietary technology and industry-standard platforms creates a comprehensive trading environment that meets diverse client needs effectively.

Trust and Safety Analysis (Score: 9/10)

Hirose Financial's exceptional trust score of 90/100 reflects its strong regulatory foundation and commitment to operational transparency. Supervision by two top-level regulatory authorities provides comprehensive oversight and ensures adherence to strict financial services standards that protect client interests and maintain market integrity.

The broker's regulatory compliance framework demonstrates institutional-grade risk management and client protection measures. This regulatory foundation underpins client confidence and contributes significantly to the broker's positive reputation within the forex trading community.

Industry recognition and awards mentioned in available materials support the broker's credibility and market standing. The company's association with Hirose Tusyo, a major Japanese forex provider, adds additional credibility through established market presence and operational experience.

User trust levels appear consistently high. Traders express confidence in the broker's reliability and operational integrity. The absence of significant negative incidents or regulatory issues in available materials supports the strong trust rating and reinforces the broker's position as a low-risk trading partner.

User Experience Analysis (Score: 7/10)

Overall user satisfaction levels reflect positively on Hirose Financial's service delivery. Traders express general contentment with their trading experiences. The broker's focus on stability and reliability appears to resonate well with its target demographic of security-conscious traders.

Platform interface design receives favorable user feedback. Both LION Trader and MetaTrader 4 options provide intuitive navigation and accessible functionality. The two-platform approach successfully accommodates different user preferences and technical skill levels.

Registration and verification processes aren't extensively detailed in available materials. However, user feedback suggests reasonable onboarding experiences without significant complications or delays. Account management functionality appears adequate for standard trading requirements.

The target user profile aligns well with traders seeking stable, regulated trading environments rather than aggressive promotional offers or speculative features. User feedback indicates satisfaction with this positioning, though some may prefer more comprehensive information availability regarding specific service features and capabilities.

Conclusion

This comprehensive hirose financial review reveals a well-regulated, low-risk forex broker that prioritizes stability and regulatory compliance over aggressive market positioning. The combination of top-level regulatory supervision, impressive trust scores, and positive user feedback establishes Hirose Financial as a suitable choice for traders who value security and operational reliability in their trading partnerships.

The broker's two-platform approach and focus on forex trading excellence make it particularly appropriate for retail traders seeking diversified service options within a regulated environment. While enhanced transparency regarding specific account conditions and cost structures would strengthen its market appeal, the overall service quality and regulatory foundation provide a solid foundation for confident trading relationships.

Primary advantages include strong regulatory oversight, positive user evaluations, and stable trading infrastructure. Areas for improvement center on information transparency and detailed service specification availability for prospective clients.