Mycapital 2025 Review: Everything You Need to Know

Executive Summary

MyCapital operates as an unregulated forex broker. It presents both opportunities and significant risks for traders who want diversified investment services. This Mycapital review reveals a platform that lacks the regulatory oversight typically expected from established financial service providers, which raises immediate concerns about trader protection and fund security. Despite these regulatory shortcomings, the broker attempts to differentiate itself through certain technological features and market access options.

The platform's most notable characteristic appears to be its focus on providing trading services without the backing of major financial regulators. This fundamentally impacts its credibility and trustworthiness in the competitive forex market. According to available information, MyCapital has been subject to various safety assessments, with multiple sources questioning whether it operates as a legitimate broker or potentially represents scam risks to unsuspecting traders.

The primary user base for MyCapital would theoretically consist of traders willing to accept higher regulatory risks in exchange for potentially more flexible trading conditions. However, the lack of comprehensive regulatory protection means that users must exercise extreme caution when considering this broker for their trading activities.

Important Disclaimer

This Mycapital review is based on publicly available information and third-party assessments of the broker's services and regulatory status. Readers should note that MyCapital's unregulated status presents inherent risks that could result in significant financial losses, particularly for international traders who may have limited legal recourse in case of disputes or fund recovery issues.

Our evaluation methodology relies on analysis of available online resources, regulatory databases, and user-generated content where accessible. This review has not involved direct testing of the platform's services or conducting primary research through user interviews. Given the broker's unregulated nature, potential clients should conduct additional due diligence and consider consulting with financial advisors before making any investment decisions.

Rating Framework

Broker Overview

MyCapital presents itself as a forex broker operating without regulatory oversight from major financial authorities. This immediately distinguishes it from mainstream brokers in the industry. Based on available information, the company's establishment date and specific corporate background remain unclear, contributing to the overall transparency concerns that characterize unregulated financial service providers.

The broker's business model appears to focus on providing forex trading access to retail clients. However, specific details about their operational structure, company ownership, and geographic presence are not readily available in public sources. This lack of transparency is typical among unregulated brokers and represents a significant red flag for potential clients seeking reliable trading partners.

According to various online assessments, MyCapital has been the subject of safety evaluations that question its legitimacy as a financial service provider. The absence of proper regulatory licensing means that clients would not benefit from investor protection schemes, deposit insurance, or regulatory oversight that typically safeguards traders' interests in the forex market.

The broker's target market appears to include traders who prioritize access over regulation. However, this approach carries substantial risks that far outweigh any potential benefits. Without regulatory backing, clients have limited recourse for dispute resolution or fund recovery in case of operational issues or broker insolvency.

Regulatory Status: MyCapital operates as an unregulated broker. This means it lacks oversight from established financial regulatory bodies such as the FCA, ASIC, CySEC, or other major authorities that typically govern forex brokers.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees are not detailed in available sources. This raises additional transparency concerns.

Minimum Deposit Requirements: The broker's minimum deposit thresholds are not specified in available documentation. This makes it difficult for potential clients to assess accessibility and account tier structures.

Promotional Offers: Details about bonus programs, promotional campaigns, or special offers are not mentioned in available sources. This suggests either absence of such programs or poor marketing transparency.

Tradeable Assets: While the broker is identified as a forex service provider, specific information about currency pairs, asset variety, and market access options remains undisclosed in available materials.

Cost Structure: Information regarding spreads, commission rates, overnight fees, and other trading costs is not available in public sources. This prevents accurate cost assessment for potential clients.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available documentation. This is concerning given the importance of these factors in forex trading.

Platform Options: Details about trading platform availability, whether proprietary or third-party solutions like MetaTrader, are not specified in accessible sources.

Geographic Restrictions: Information about restricted countries or regional limitations is not available in current documentation.

Customer Support Languages: Supported languages for customer service are not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by MyCapital remain largely opaque due to limited publicly available information about their service structure. This Mycapital review finds that the broker's failure to clearly communicate account types, minimum deposit requirements, and account features represents a significant transparency deficit that undermines client confidence.

Without detailed information about account tiers, clients cannot make informed decisions about which account type might suit their trading needs and financial capabilities. The absence of clear account opening procedures, verification requirements, and account management features suggests either poor communication practices or deliberately obscured terms that could disadvantage clients.

Industry-standard account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or VIP accounts for high-volume traders are not mentioned in available sources. This lack of specification makes it impossible to assess whether MyCapital accommodates diverse client needs or provides competitive account structures.

The broker's unregulated status further complicates account condition evaluation. Clients cannot rely on standardized regulatory requirements that typically ensure fair account terms and transparent fee structures. This regulatory absence means account holders would lack protection against arbitrary changes to account conditions or unfavorable terms modifications.

MyCapital's trading tools and educational resources appear to be either limited or poorly documented, based on available information sources. The broker's failure to prominently feature trading tools, market analysis resources, or educational materials suggests a significant gap in client support infrastructure compared to regulated competitors.

Professional trading tools such as advanced charting software, technical indicators, economic calendars, and market research are essential for informed trading decisions. The absence of detailed information about such tools raises questions about MyCapital's commitment to providing comprehensive trading support for its clients.

Educational resources including webinars, tutorials, market analysis, and trading guides are standard offerings among reputable brokers. The lack of visible educational content suggests that MyCapital may not prioritize client development and trading education, which could disadvantage inexperienced traders seeking to improve their skills.

Automated trading support, including Expert Advisors, algorithmic trading capabilities, and API access, are increasingly important in modern forex trading. Without clear information about such advanced features, clients cannot assess whether MyCapital supports sophisticated trading strategies and automated systems.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker selection, yet MyCapital's support infrastructure appears inadequately documented in available sources. The lack of clear information about support channels, response times, and service quality raises concerns about the broker's commitment to client assistance.

Standard support channels including live chat, telephone support, email assistance, and help desk tickets are expected features among professional forex brokers. Without detailed information about available support methods, potential clients cannot assess accessibility and convenience of customer assistance when needed.

Response times and service quality metrics are essential for evaluating customer support effectiveness. The absence of user testimonials, response time guarantees, or service level commitments suggests that MyCapital may not prioritize customer service excellence or may lack the infrastructure to provide professional support.

Multilingual support capabilities are particularly important for international brokers serving diverse client bases. The lack of information about supported languages and regional support teams indicates potential limitations in serving non-English speaking clients or those in different time zones.

Trading Experience Analysis

The trading experience offered by MyCapital cannot be adequately assessed due to insufficient information about platform performance, execution quality, and user interface design. This Mycapital review identifies significant gaps in available data about core trading functionality that directly impacts client satisfaction.

Platform stability and execution speed are fundamental requirements for successful forex trading, particularly during volatile market conditions. Without user feedback or performance metrics, potential clients cannot evaluate whether MyCapital provides reliable trading infrastructure capable of handling various market scenarios.

Order execution quality, including slippage rates, requote frequency, and price accuracy, directly affects trading profitability. The absence of detailed information about execution practices and performance statistics prevents accurate assessment of MyCapital's trading environment quality.

Mobile trading capabilities have become essential for modern forex traders who require market access across multiple devices. Without clear information about mobile app availability, functionality, and user experience, clients cannot determine whether MyCapital supports flexible trading approaches.

Trust and Regulation Analysis

Trust and regulatory compliance represent MyCapital's most significant weaknesses, with the broker operating without oversight from recognized financial regulators. This unregulated status fundamentally undermines client protection and creates substantial risks for anyone considering their services.

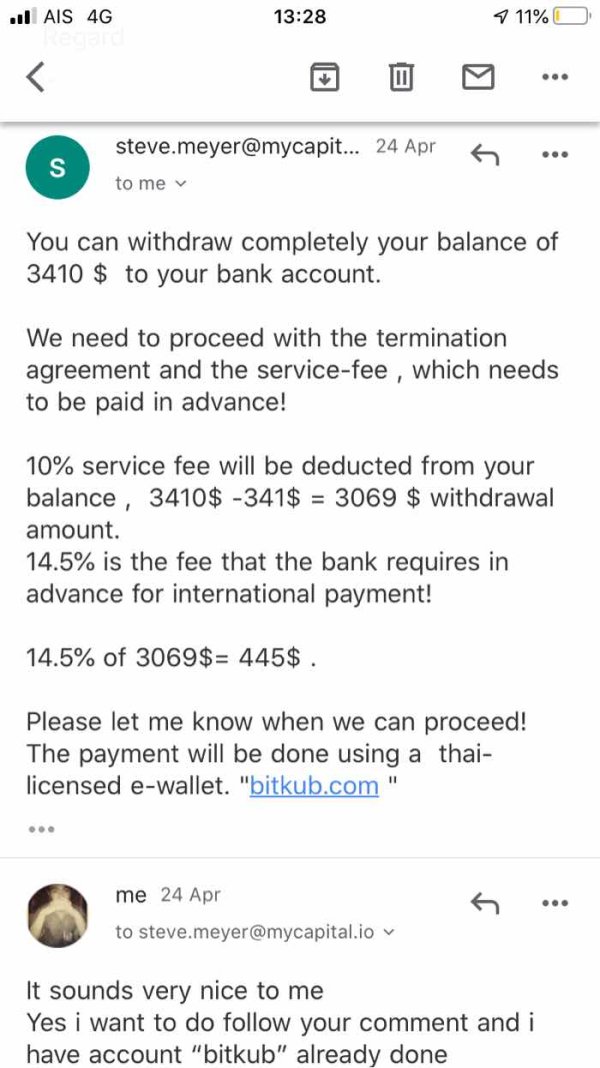

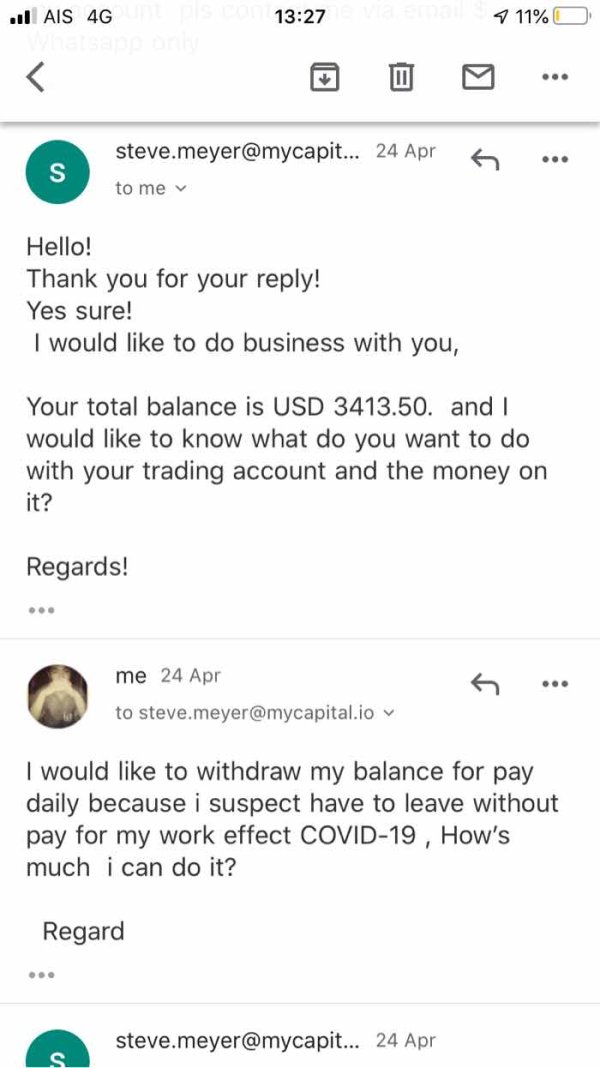

The absence of regulatory licensing means MyCapital is not subject to capital adequacy requirements, client fund segregation mandates, or operational transparency standards that protect traders in regulated jurisdictions. This regulatory gap exposes clients to risks including fund misappropriation, operational irregularities, and limited legal recourse.

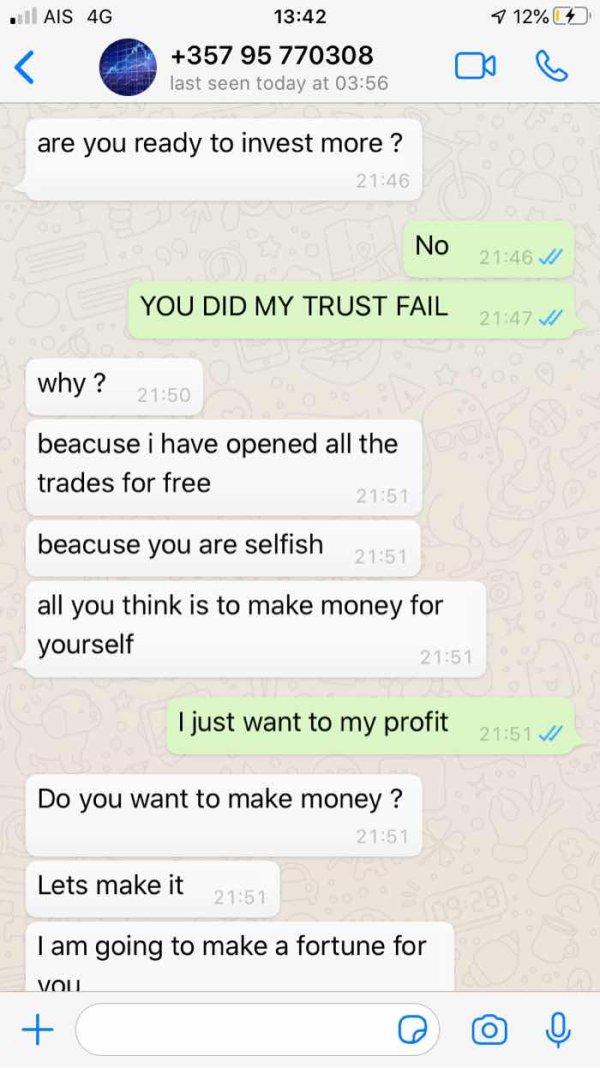

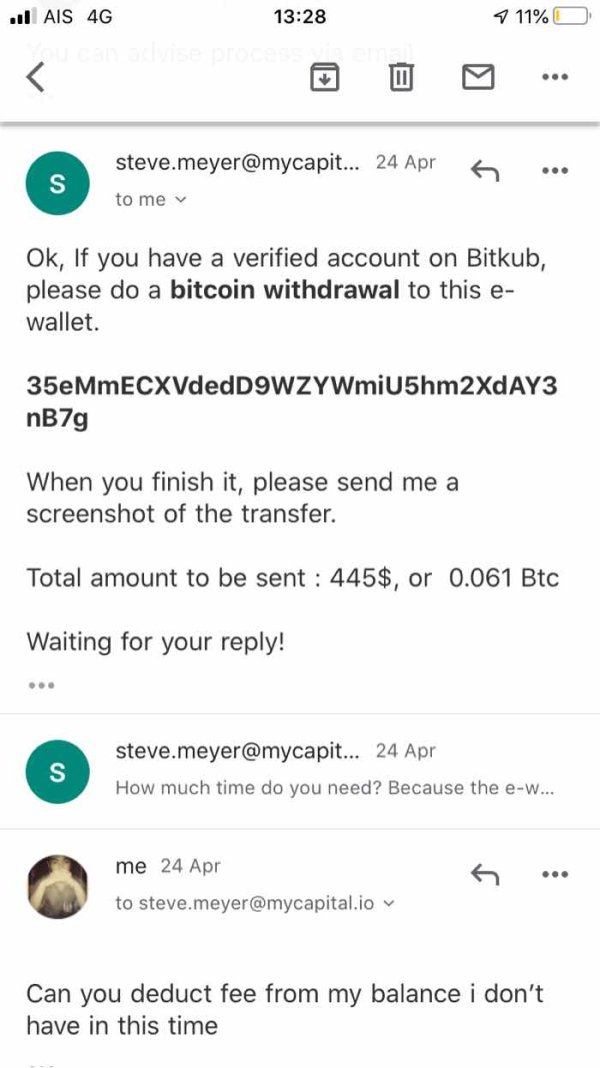

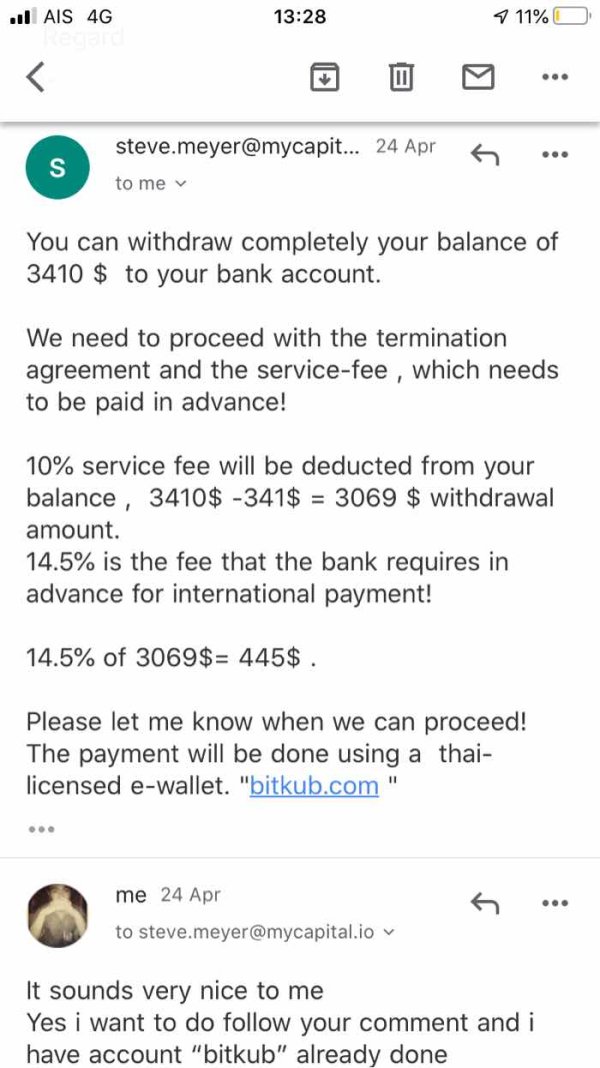

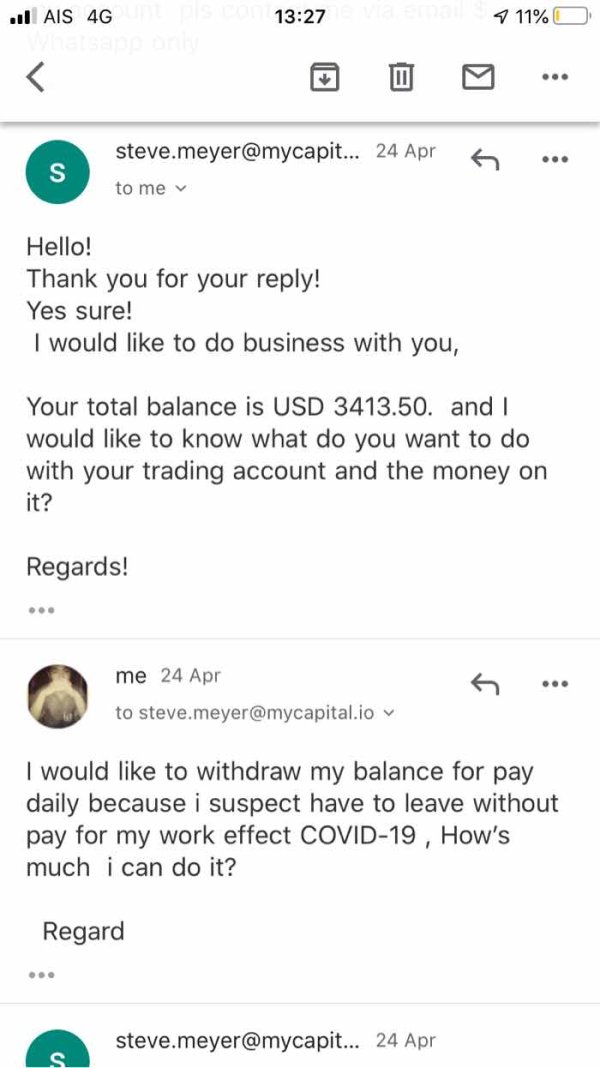

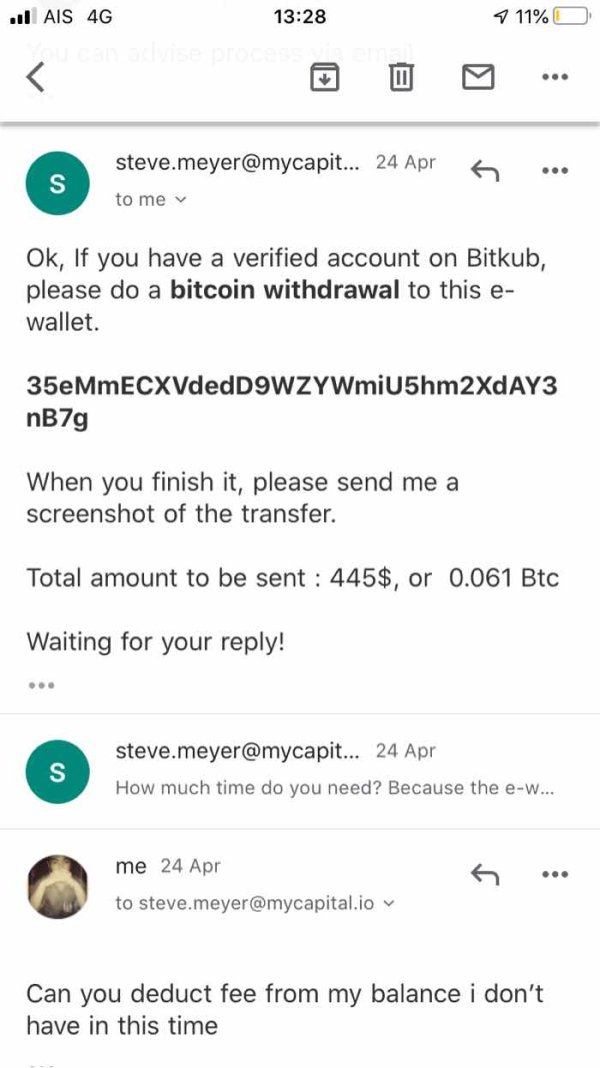

Industry reputation and third-party assessments appear to raise questions about MyCapital's legitimacy, with various sources examining whether the broker operates as a legitimate business or represents potential scam risks. Such scrutiny indicates significant trust deficits that should concern potential clients.

Fund security measures, including segregated client accounts, deposit protection schemes, and audit requirements, are typically mandated by financial regulators. MyCapital's unregulated status means clients cannot rely on such protections, creating substantial financial risks that outweigh any potential trading benefits.

User Experience Analysis

User experience evaluation for MyCapital is hindered by limited available feedback and the broker's poor transparency regarding platform features and client services. The overall user journey, from account opening through active trading, appears to lack the polish and reliability expected from professional forex brokers.

Website design and information accessibility reflect a broker's professionalism and commitment to client communication. MyCapital's limited online presence and poor information transparency suggest potential deficiencies in user interface design and client communication practices.

Account registration and verification processes are critical touchpoints that shape initial client impressions. Without clear information about onboarding procedures, document requirements, and verification timelines, potential clients cannot assess the convenience and efficiency of beginning their trading relationship with MyCapital.

Overall user satisfaction appears questionable given the broker's regulatory status and transparency issues. The combination of unregulated operations, limited available information, and safety concerns creates an environment where positive user experiences would be unlikely and sustainable client relationships difficult to maintain.

Conclusion

This Mycapital review reveals a broker that presents significant risks and limitations that far outweigh any potential benefits for forex traders. MyCapital's unregulated status, combined with poor transparency and limited available information about their services, creates an environment unsuitable for serious trading activities.

The broker's failure to provide clear information about account conditions, trading costs, platform features, and regulatory compliance indicates either poor business practices or deliberate obfuscation that should concern potential clients. The absence of regulatory oversight eliminates essential client protections and creates substantial financial risks.

While some traders might be attracted to potentially flexible conditions offered by unregulated brokers, the risks associated with MyCapital appear to significantly outweigh any possible advantages. Traders seeking reliable, secure, and transparent forex services would be better served by choosing regulated brokers that offer comprehensive client protections and clear operational transparency.