HF Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive hf markets review evaluates a forex broker that has built a strong presence in global trading since 2010. HF Markets (HFM) used to be called HotForex. The company presents itself as a regulated ECN broker offering diverse financial instruments. It provides competitive leverage options up to 1:2000.

Based on available data and user feedback, HF Markets receives a moderate rating of 3/5 stars from traders. The broker's key strengths include an extensive selection of over 1,000 CFD instruments across multiple asset classes. It also offers exceptionally high leverage ratios that appeal to experienced traders seeking amplified market exposure. The platform caters primarily to sophisticated investors and high-leverage trading enthusiasts. These traders value instrument diversity and flexible trading conditions.

However, user satisfaction remains mixed. Particular concerns have been raised about customer service responsiveness and fee transparency. The broker maintains regulatory compliance across multiple jurisdictions including CySEC, FCA, and DFSA. Potential clients should carefully evaluate their specific trading needs against the platform's offerings. The $0 minimum deposit requirement makes it accessible to newcomers. However, the overall user experience suggests it may be better suited for traders with prior market experience.

Important Notice

Regional Entity Variations: HF Markets operates through different legal entities across various jurisdictions. Each entity is subject to distinct regulatory frameworks and trading conditions. Users must verify which entity serves their region and understand the applicable regulatory protections. The broker's services in Cyprus are regulated by CySEC. UK operations fall under FCA oversight, and Dubai activities are supervised by DFSA.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, user feedback from multiple sources, and industry reports current as of 2025. The assessment aims to provide objective analysis. It acknowledges that individual trading experiences may vary based on account type, trading volume, and regional regulations.

Rating Framework

Broker Overview

Founded in 2010, HF Markets has evolved from its HotForex origins into a globally recognized trading platform. The company is headquartered in Mauritius. The broker operates under an ECN no-dealing-desk execution model. This positions it as an intermediary that connects traders directly to liquidity providers rather than taking the opposite side of trades. This approach theoretically reduces conflicts of interest and can provide more competitive pricing during active market periods.

According to industry reports, HF Markets has garnered over 60 industry awards. This suggests recognition within the financial services community. The company's business model centers on providing access to diverse financial markets through technology-driven solutions. It targets both retail and institutional clients across multiple continents. The broker's growth trajectory has been supported by strategic expansion into various regulatory jurisdictions. This enables service provision to a broader international client base.

The platform's infrastructure supports multiple trading environments through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary HFM mobile application. Asset coverage spans traditional forex pairs, precious metals including gold, individual stocks, government bonds, market indices, energy commodities, agricultural products, cryptocurrencies, and exchange-traded funds (ETFs). This comprehensive offering positions HF Markets as a one-stop solution for traders seeking portfolio diversification across asset classes. The broker operates under regulatory oversight from the Cyprus Securities and Exchange Commission (CySEC), the UK's Financial Conduct Authority (FCA), and the Dubai Financial Services Authority (DFSA). This provides multiple layers of compliance and client protection depending on the trading entity used.

Regulatory Jurisdictions: HF Markets maintains licenses across three primary regulatory zones. The Cyprus entity operates under CySEC authorization. This provides European Union passporting rights and investor compensation scheme coverage. UK clients are served through an FCA-regulated entity, offering Financial Services Compensation Scheme protection. The Dubai office holds DFSA authorization for Middle Eastern operations. This ensures compliance with regional financial regulations.

Deposit and Withdrawal Methods: Specific information regarding payment processing options was not detailed in available sources. It requires direct verification with the broker.

Minimum Deposit Requirements: The platform offers a $0 minimum deposit threshold. This eliminates financial barriers for new traders to open accounts and explore the trading environment without initial capital commitment.

Promotional Offerings: Current bonus and promotional campaign details were not specified in available documentation. They should be confirmed through official broker channels.

Available Trading Assets: The instrument universe encompasses approximately 1,000 tradeable products across ten asset categories. Forex coverage includes major, minor, and exotic currency pairs. Commodities span precious metals, energy products, and agricultural futures. Equity markets are accessible through individual stock CFDs and index products. Fixed-income exposure is available via government bond instruments, while cryptocurrency trading covers major digital assets.

Cost Structure: Spreads are characterized as moderate within industry standards. However, specific commission schedules and fee structures require clarification directly from the broker. The absence of detailed cost information in public materials represents a transparency concern for cost-conscious traders.

Leverage Ratios: Maximum leverage reaches 1:2000, among the highest levels available in the retail trading industry. This extreme leverage amplifies both profit potential and loss risk. It makes the platform particularly suitable for experienced traders with robust risk management strategies.

Platform Options: Traders can access markets through the industry-standard MT4 and MT5 platforms. Both offer comprehensive charting tools, technical indicators, and automated trading capabilities. The HFM mobile application provides on-the-go trading functionality for smartphone and tablet users.

Geographic Restrictions: Specific country exclusions and regional service limitations were not detailed in available sources.

Customer Support Languages: The range of supported languages for customer service was not specified in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

HF Markets demonstrates a client-friendly approach to account accessibility through its zero minimum deposit requirement. This effectively removes financial barriers that might prevent potential traders from exploring the platform. This policy particularly benefits newcomers to forex trading who wish to test strategies with minimal initial capital commitment. According to available information, the broker offers multiple account types designed to accommodate varying trading styles and experience levels. However, specific account tier details require direct verification.

User feedback indicates appreciation for the low entry threshold. Several traders note that the absence of minimum deposit requirements allowed them to begin trading without significant upfront investment. However, the same users express frustration regarding the lack of transparent commission information readily available during the account opening process. This opacity in fee structure creates uncertainty about true trading costs. It particularly affects high-frequency traders where commission charges can significantly impact profitability.

The account opening process appears streamlined according to user reports. However, specific verification timeframes and required documentation were not detailed in available sources. When compared to industry competitors, HF Markets' zero minimum deposit policy positions it favorably against brokers requiring substantial initial funding. This makes it accessible to a broader demographic of potential traders seeking market entry opportunities.

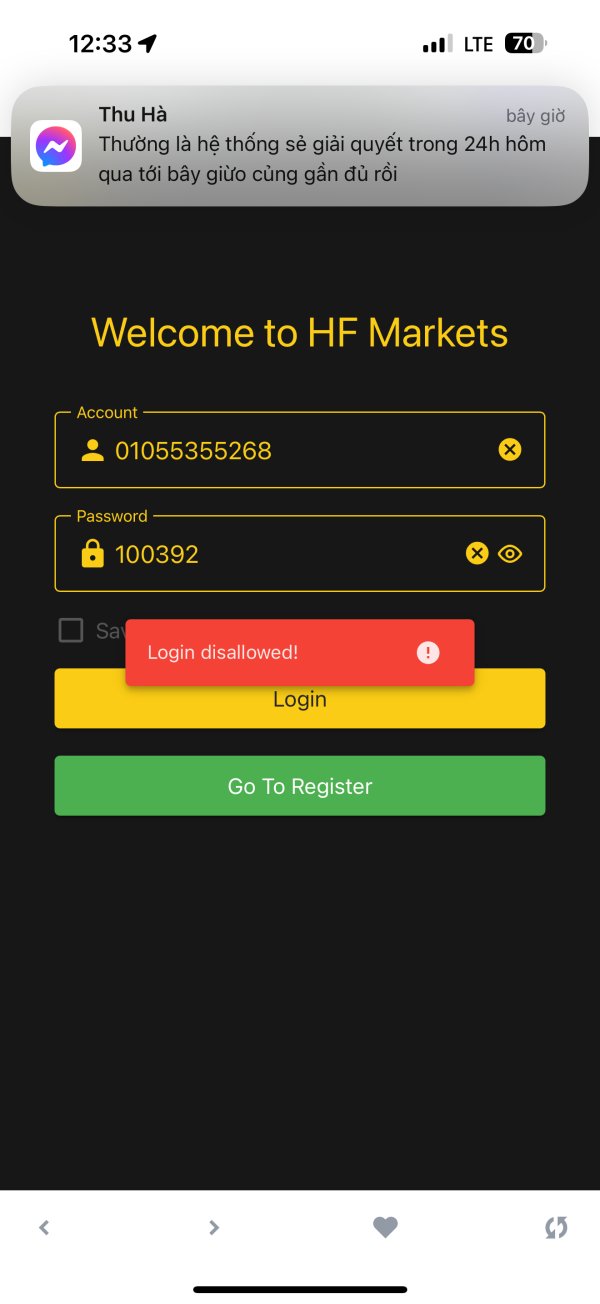

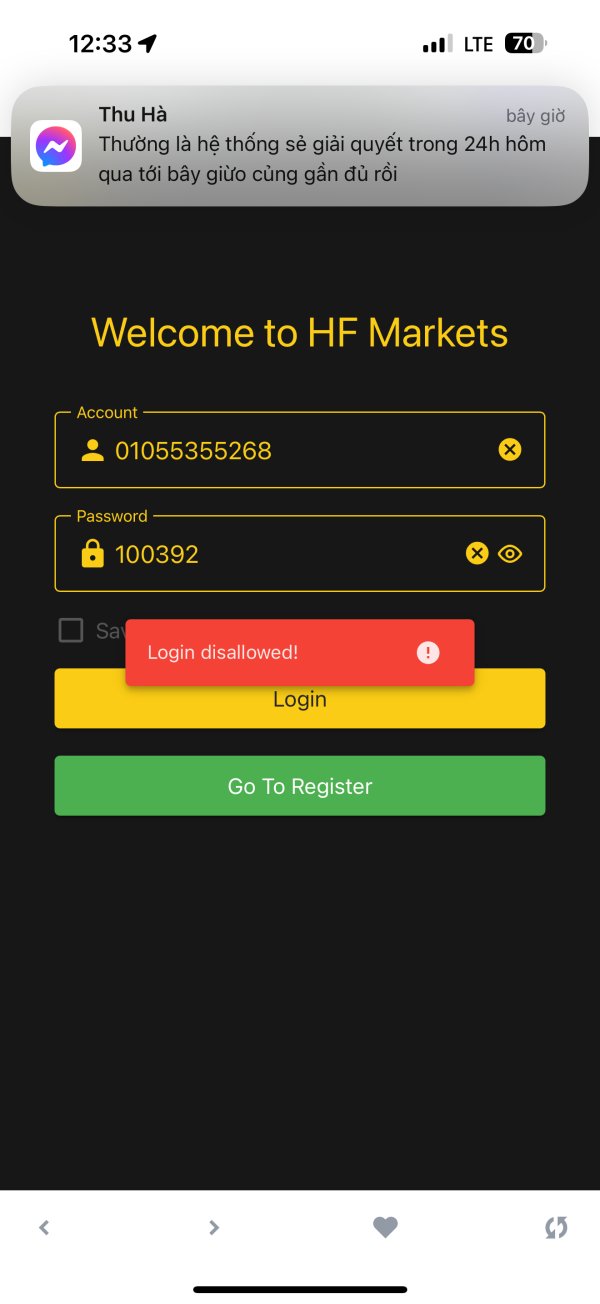

The platform's technological infrastructure represents one of its strongest competitive advantages. It offers traders access to both MetaTrader 4 and MetaTrader 5 platforms alongside the proprietary HFM mobile application. This multi-platform approach ensures compatibility with various trading preferences and technical requirements. The MT4/MT5 integration provides access to comprehensive charting packages, technical analysis tools, and automated trading capabilities through Expert Advisors (EAs).

With nearly 1,000 CFD instruments available across ten asset categories, HF Markets delivers exceptional market diversity that enables portfolio diversification strategies. The extensive instrument selection spans traditional forex pairs, commodity futures, individual equity CFDs, bond instruments, and cryptocurrency products. This breadth of available markets positions the platform competitively against specialized brokers who may offer deeper functionality in specific asset classes but lack comprehensive cross-market exposure.

User feedback consistently highlights satisfaction with platform stability and tool availability. However, some traders express desire for enhanced research and analysis resources. The absence of detailed educational materials and market research offerings in available documentation suggests potential gaps in trader development support. Advanced traders appreciate the EA support and signal service integration, which facilitates automated trading strategies and social trading opportunities.

Customer Service and Support Analysis (6/10)

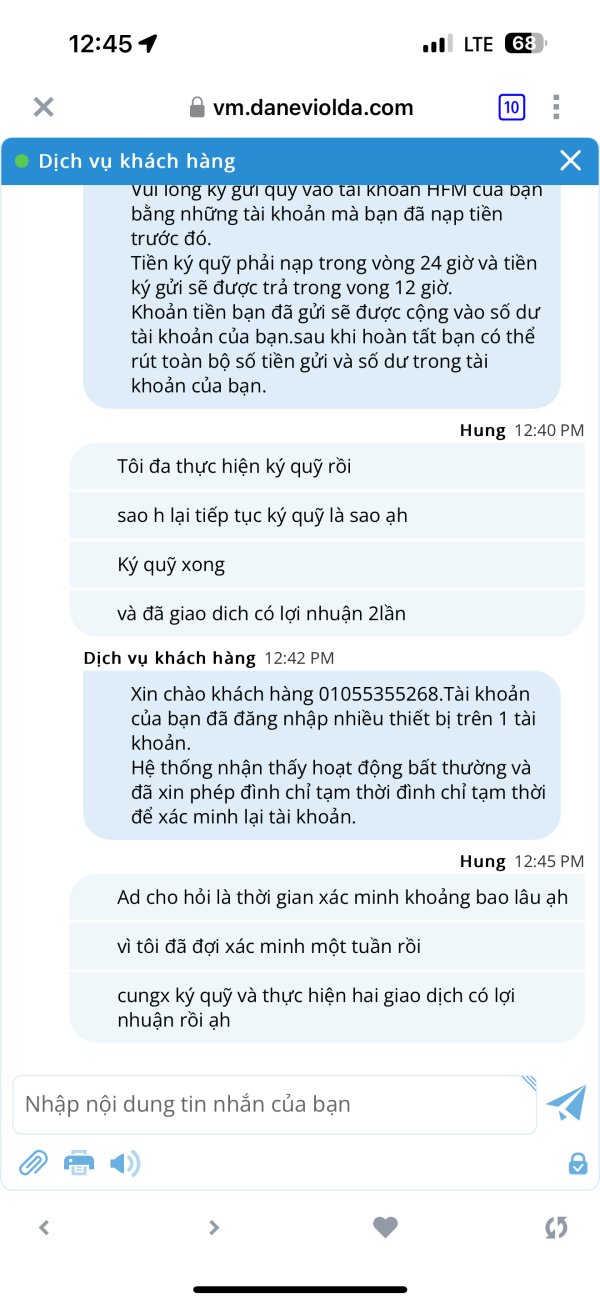

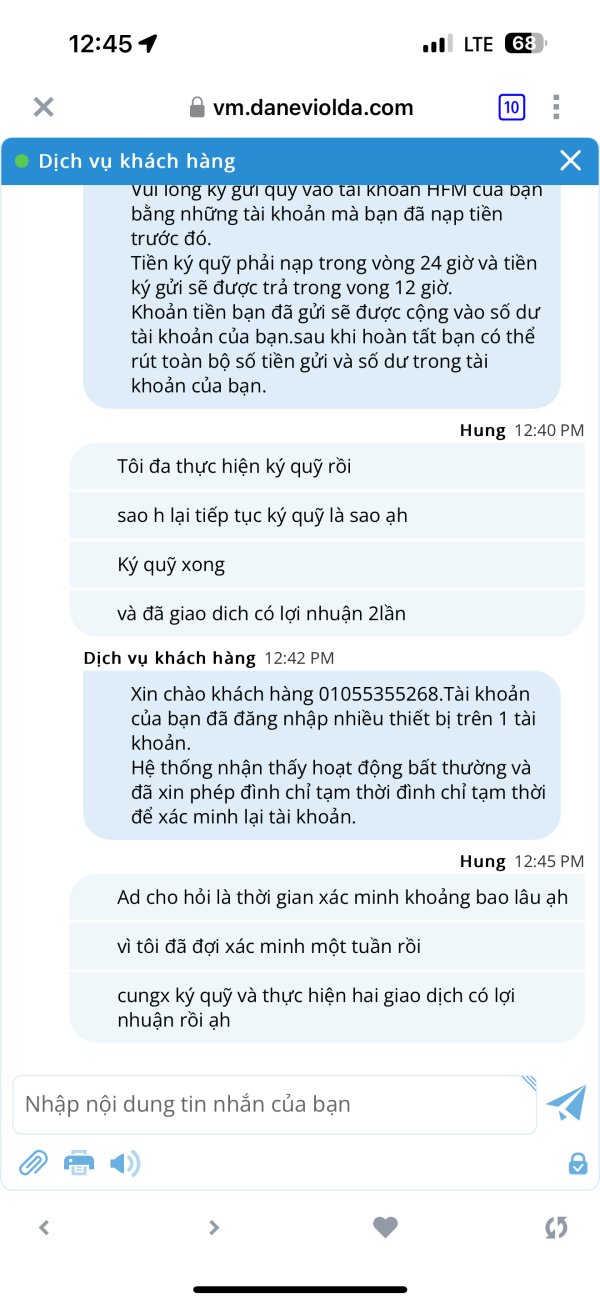

Customer service performance represents an area requiring improvement based on user feedback patterns. The broker provides multiple communication channels including telephone support, email correspondence, and live chat functionality. This ensures various contact options for client assistance. However, user reports consistently indicate longer-than-expected response times, particularly during high-volume trading periods when immediate support becomes crucial for position management.

Service quality assessments from trader feedback suggest inconsistent support experiences. Some users report knowledgeable and helpful assistance while others describe inadequate problem resolution. The variability in service quality indicates potential training or staffing issues that impact overall client satisfaction. Response time concerns are particularly problematic for active traders who require rapid assistance during volatile market conditions.

Multiple user reviews specifically mention frustration with email response delays. These sometimes extend beyond 24 hours for non-urgent inquiries. While live chat availability provides more immediate contact options, users report occasional technical difficulties accessing this service during peak hours. The absence of detailed information regarding supported languages and service hours in available documentation further complicates support accessibility for international clients.

Trading Experience Analysis (7/10)

Platform stability receives generally positive feedback from users. Most traders report consistent access and reliable order execution during standard market conditions. The MT4 and MT5 integration provides familiar trading environments for experienced users while offering comprehensive functionality for technical analysis and position management. Order execution quality appears satisfactory for most trading styles. However, some users report occasional slippage during high-volatility periods.

The moderate spread environment positions HF Markets competitively within industry standards. However, specific spread comparisons across different account types and market conditions require direct verification. Users appreciate the ECN execution model, which theoretically provides more transparent pricing by connecting trades directly to liquidity providers rather than broker dealing desk intervention.

Mobile trading through the HFM application receives mixed reviews. Users appreciate the convenience of smartphone access while noting occasional functionality limitations compared to desktop platforms. The app's performance appears adequate for basic trading operations and account monitoring. However, advanced charting and analysis capabilities remain better suited to desktop environments.

Market volatility handling shows room for improvement. Some traders report increased slippage and execution delays during major economic announcements or market stress periods. This hf markets review indicates that while normal market conditions provide satisfactory trading experiences, extreme market movements may challenge the platform's execution quality.

Trust and Security Analysis (7/10)

Regulatory compliance across multiple jurisdictions provides substantial credibility to HF Markets' operations. The broker maintains authorizations from CySEC in Cyprus, FCA in the United Kingdom, and DFSA in Dubai. This ensures adherence to strict financial services regulations across these key markets. This multi-jurisdictional approach demonstrates commitment to regulatory compliance and provides clients with various levels of investor protection depending on their account entity.

Client fund segregation represents a crucial security measure. Customer deposits are held separately from operational company funds according to regulatory requirements. The involvement of Deloitte as the auditing firm adds credibility to financial oversight and transparency. This segregation structure theoretically protects client funds in the unlikely event of broker financial difficulties. However, specific insurance coverage details require direct verification.

The broker's receipt of over 60 industry awards suggests recognition within the financial services community. However, the specific awarding organizations and criteria were not detailed in available sources. Industry recognition can indicate peer acknowledgment of service quality and operational standards, contributing to overall trustworthiness assessments.

Company transparency appears adequate based on available regulatory filings and public information. However, some users express desire for more detailed fee disclosures and operational information. The absence of significant negative regulatory actions in available sources suggests consistent compliance with applicable financial regulations across operating jurisdictions.

User Experience Analysis (5/10)

Overall user satisfaction scores of 3/5 stars indicate significant room for improvement in client experience delivery. This moderate rating reflects mixed feedback across various platform aspects. Particular concerns about customer service responsiveness and fee transparency overshadow positive feedback about instrument diversity and platform stability.

Interface design receives generally positive comments from users familiar with MetaTrader platforms. The MT4/MT5 integration provides familiar navigation and functionality. New traders may face learning curves associated with these professional-grade platforms. However, comprehensive tutorials and documentation are typically available through MetaTrader resources.

Registration and verification processes were not detailed in available sources. This prevents assessment of onboarding efficiency and user-friendliness. Similarly, specific information about deposit and withdrawal experiences requires direct user verification, as available documentation does not provide comprehensive details about fund transfer procedures and timeframes.

Common user complaints center on customer service response times and commission transparency issues. Many traders express frustration about difficulty obtaining clear fee schedules and trading cost breakdowns. This particularly affects active trading strategies where costs significantly impact profitability. These transparency concerns contribute to the moderate user satisfaction ratings and suggest areas for operational improvement.

The platform appears well-suited for experienced traders familiar with high-leverage trading and professional trading platforms. However, newcomers may benefit from additional educational resources and clearer fee structures. User demographic analysis suggests optimal fit for traders seeking diverse instrument access and high leverage options rather than those prioritizing customer service excellence or fee transparency.

Conclusion

This hf markets review reveals a broker offering substantial instrument diversity and competitive leverage options while facing challenges in customer service delivery and fee transparency. HF Markets positions itself effectively for experienced traders seeking access to nearly 1,000 CFD instruments across multiple asset classes. The 1:2000 maximum leverage appeals to sophisticated trading strategies requiring significant market exposure amplification.

The platform's regulatory compliance across multiple jurisdictions provides adequate security frameworks. The zero minimum deposit requirement ensures accessibility for traders with limited initial capital. However, the moderate 3/5 user satisfaction rating indicates significant improvement opportunities, particularly in customer service responsiveness and cost structure transparency.

HF Markets appears most suitable for experienced traders comfortable with high-leverage environments and familiar with professional trading platforms like MT4/MT5. The extensive instrument selection makes it attractive for portfolio diversification strategies. The ECN execution model theoretically provides competitive pricing. However, traders prioritizing exceptional customer service or complete fee transparency may find better alternatives in the competitive forex broker landscape.