Varna Trade 2025 Review: Everything You Need to Know

Executive Summary

This Varna Trade review shows concerning findings about this CFD trading platform. Multiple sources have flagged it as a potential scam. The company started in 2011 but got new registration papers in October 2023, which raises questions about its history and reliability. Varna Trade works without proper rules from government agencies. This creates big red flags for people who want to trade.

The broker offers CFD trading services across many types of investments. These include forex, stocks, indices, commodities, energy, and precious metals through their ST5 trading software platform. Key features include access to multiple asset classes and the ST5 trading platform. However, these benefits get overshadowed by the lack of regulatory protection and transparency.

The platform has received mostly negative feedback from users. Traders report poor customer service, unclear account conditions, and questionable business practices. Our analysis shows that Varna Trade targets traders who want diversified asset exposure. The high-risk nature of dealing with an unregulated company makes it wrong for most retail investors who want safety and regulatory protection.

Important Disclaimers

Regional Variations: Varna Trade operates without regulatory authorization in any jurisdiction. This means users across all regions face potential legal risks and lack consumer protection typically provided by regulated financial authorities. Traders should know that the absence of regulatory oversight means no compensation schemes or dispute resolution mechanisms are available.

Review Methodology: This evaluation uses publicly available information, user feedback, and industry reports. Our assessment has not included direct testing of the platform's services. We strongly advise potential users to conduct their own research before engaging with this broker.

Rating Framework

Broker Overview

Varna Trade presents itself as a CFD trading platform that was originally established in 2011. Recent records show a re-registration date of October 17, 2023. This difference in registration dates raises questions about the company's operational continuity and transparency.

The broker operates as an online trading platform focusing only on Contract for Difference products. This allows traders to guess on price movements without owning the actual assets. The company's business model centers around providing access to leveraged trading across multiple asset classes through their own ST5 trading software.

The lack of detailed information about the company's ownership structure, physical headquarters, or executive team creates big transparency concerns. The platform markets itself to retail traders seeking exposure to global financial markets. The absence of regulatory oversight means clients operate without the standard protections typically associated with legitimate brokerage services.

The broker's recent re-registration in 2023, despite claiming a 2011 establishment date, suggests potential operational disruptions or restructuring. This Varna Trade review finds that while the platform offers access to diverse trading instruments, the fundamental lack of regulatory compliance and transparency makes it a high-risk proposition for serious traders.

Regulatory Status: Varna Trade operates without authorization from any recognized financial regulatory authority. This unregulated status means clients have no access to investor protection schemes, dispute resolution services, or compensation funds typically available through licensed brokers.

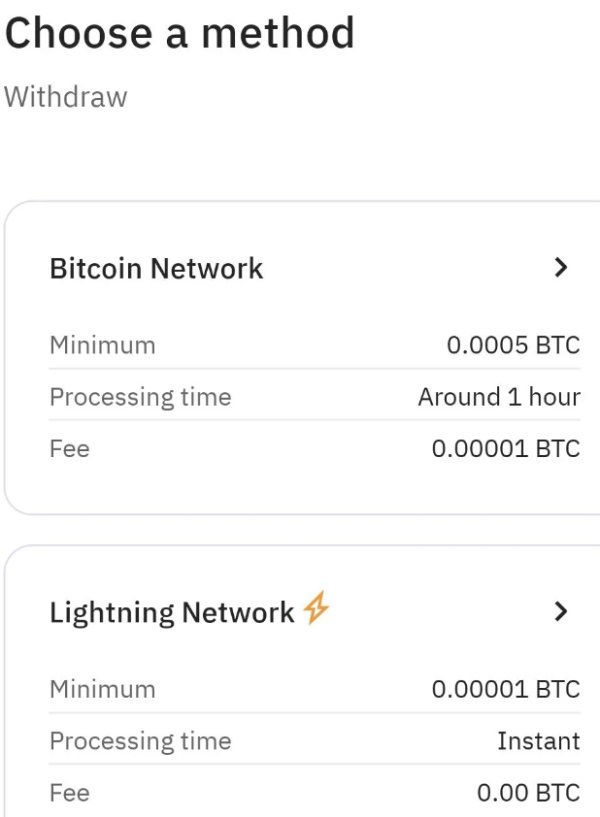

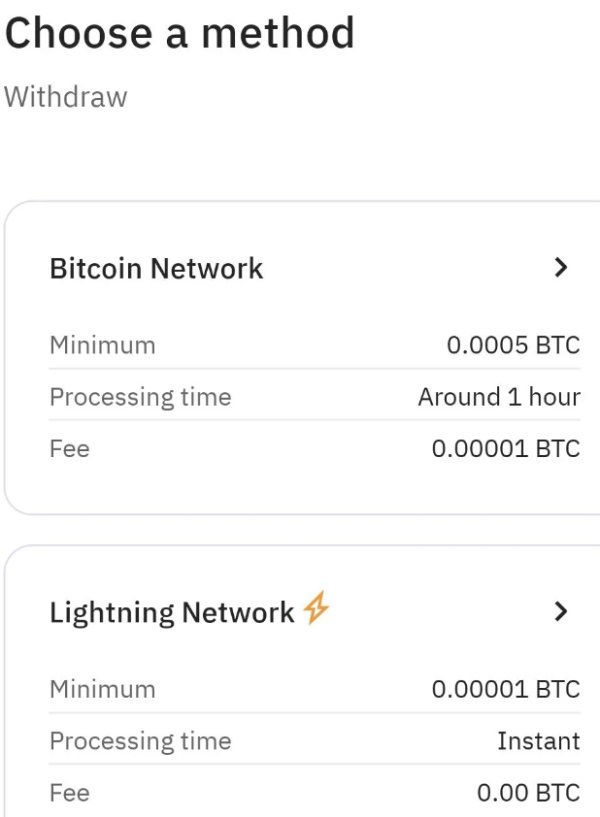

The absence of regulatory oversight represents a significant risk factor for potential users. Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available documentation. This lack of transparency regarding funding mechanisms is concerning and typical of platforms that may have operational limitations.

Minimum Deposit Requirements: The minimum deposit requirement has not been disclosed in available materials. This represents poor transparency standards compared to legitimate regulated brokers who clearly communicate their account funding requirements. Bonuses and Promotions: No information regarding bonus structures or promotional offerings has been identified in available sources.

While this may indicate the absence of potentially misleading marketing practices, it also suggests limited competitive offerings. Tradeable Assets: The platform provides access to CFDs across six major asset categories: foreign exchange pairs, individual stocks, market indices, various commodities, energy products, and precious metals. This diversification offers theoretical opportunities for portfolio diversification, though the unregulated nature of the platform undermines these potential benefits.

Cost Structure: Critical pricing information including spreads, commission rates, overnight financing charges, and other trading costs remains undisclosed in available documentation. This lack of cost transparency makes it impossible for traders to accurately assess the true expense of trading with this platform. Leverage Ratios: Specific leverage ratios offered by the platform have not been detailed in available information.

This represents another significant transparency gap that legitimate brokers typically address clearly. Trading Platform: The broker uses ST5 trading software for order execution and market access. However, detailed information about platform features, reliability metrics, or technical capabilities remains limited.

Geographic Restrictions: Specific information about regional trading restrictions or prohibited jurisdictions has not been detailed in available sources. Customer Support Languages: The range of languages supported by customer service representatives has not been specified in available documentation. This Varna Trade review finds that the lack of detailed operational information across multiple critical areas represents a significant red flag for potential users.

Account Conditions Analysis

The account conditions offered by Varna Trade remain largely hidden from view. Critical information about account types, features, and requirements is not readily available through standard disclosure channels. This lack of transparency stands in stark contrast to regulated brokers who typically provide comprehensive account specifications to help traders make informed decisions.

The absence of clear information about different account tiers makes it impossible for potential clients to understand what services they would receive at different funding levels. Account opening procedures have not been detailed in available documentation. This raises questions about the verification processes, documentation requirements, and timeline for account activation.

Legitimate brokers typically provide clear guidance on these procedures to ensure compliance with anti-money laundering regulations and customer identification requirements. The lack of such information suggests either poor operational standards or potential regulatory compliance issues. No information has been identified regarding specialized account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions.

The platform also lacks professional accounts for qualified investors or managed account services. This limitation may restrict the platform's appeal to diverse trading communities with specific religious or professional requirements. User feedback consistently highlights confusion regarding account terms and conditions.

Many traders report unclear communication about account limitations, trading restrictions, and service levels. The absence of transparent account documentation contributes to user frustration and suggests poor operational standards compared to established industry practices. This Varna Trade review finds that the lack of clear account condition information represents a significant barrier to informed decision-making for potential clients.

Varna Trade's trading infrastructure centers around their ST5 trading software. Detailed information about this platform's capabilities, features, and reliability remains limited in available documentation. The absence of a demo account option represents a significant limitation.

Most legitimate brokers provide risk-free testing environments to help traders evaluate platform functionality and develop trading strategies without financial exposure. Research and analytical resources appear to be minimal or non-existent based on available information. Professional traders typically require access to market analysis, economic calendars, technical indicators, and research reports to make informed trading decisions.

The apparent absence of these tools suggests that Varna Trade may not cater to serious traders who depend on comprehensive market intelligence for their trading activities. Educational resources, which are considered essential for retail trader development, do not appear to be offered by the platform. Legitimate brokers typically provide webinars, tutorials, trading guides, and educational articles to help clients improve their trading skills and market understanding.

The lack of educational support indicates that the platform may not prioritize long-term client success and development. Automated trading support and algorithmic trading capabilities have not been detailed in available documentation. Modern traders increasingly rely on automated strategies and expert advisors to optimize their trading performance.

The absence of such features may limit the platform's appeal to technologically sophisticated users. User feedback regarding trading tools has been predominantly negative. Traders express dissatisfaction with the limited functionality and poor technical support.

Industry experts have similarly criticized the platform's tool offerings. They note that the lack of comprehensive trading resources undermines the overall trading experience and professional utility of the platform.

Customer Service Analysis

Customer service quality represents a critical weakness for Varna Trade. Multiple user reports indicate poor responsiveness and inadequate support quality. Available information does not specify the customer service channels offered, such as phone support, live chat, email assistance, or help desk systems.

This makes it difficult for potential clients to understand how they would receive assistance when needed. Response times appear to be problematic based on user feedback. Traders report extended delays in receiving responses to inquiries and support requests.

Professional trading environments require prompt customer support to address urgent issues, technical problems, and account-related concerns. The apparent delays in customer service responsiveness suggest operational limitations that could impact trading activities. Service quality assessments from users consistently indicate dissatisfaction with the level of support provided.

Common complaints include unhelpful responses, lack of technical expertise among support staff, and difficulty resolving account or trading issues. These service quality problems suggest inadequate training or staffing within the customer support department. Multi-language support capabilities have not been detailed in available documentation.

This may limit the platform's accessibility to international traders who require assistance in their native languages. Professional brokers typically offer support in multiple languages to serve diverse client bases effectively. Customer service hours and availability schedules have not been specified.

This makes it unclear when traders can expect to receive assistance. Given the global nature of financial markets, 24/5 support during market hours is typically expected from professional trading platforms. User testimonials consistently express frustration with customer service experiences.

Many traders advise others to avoid the platform based on poor support interactions. The absence of positive customer service feedback represents a significant red flag for potential users who value reliable customer support.

Trading Experience Analysis

The overall trading experience with Varna Trade appears to be significantly compromised by various operational and technical limitations. Platform stability issues have been reported by users, with complaints about system downtime, connectivity problems, and technical glitches that can disrupt trading activities. These stability concerns are particularly problematic in fast-moving markets where reliable platform performance is essential for effective trade execution.

Order execution quality data has not been provided in available documentation. This makes it impossible to assess critical performance metrics such as execution speed, slippage rates, or fill quality. Professional traders require transparent execution statistics to evaluate whether a broker can meet their performance requirements.

The absence of such data represents a significant transparency gap. Platform functionality appears to be limited based on user feedback. Traders report that the ST5 software lacks advanced features commonly available on professional trading platforms.

Modern traders typically expect sophisticated charting tools, technical analysis capabilities, risk management features, and customizable interfaces that may not be adequately provided. Mobile trading experience information has not been detailed in available sources. This is concerning given the increasing importance of mobile trading capabilities for active traders who need to monitor and manage positions while away from their primary trading stations.

Trading environment quality, including factors such as liquidity provision, spread stability, and market depth, remains unclear due to the lack of detailed operational disclosure. Professional trading requires transparent information about market conditions and execution parameters that appears to be unavailable. User feedback regarding the overall trading experience is predominantly negative.

Traders express frustration about platform limitations, poor execution quality, and technical problems. This Varna Trade review finds that the combination of technical issues and operational limitations creates a suboptimal trading environment for serious market participants.

Trust and Safety Analysis

Trust and safety represent the most significant concerns with Varna Trade. The main issues stem from its unregulated status and classification as a potential scam by multiple industry sources. The absence of regulatory authorization from any recognized financial authority means that clients operate without fundamental protections typically associated with legitimate brokerage services.

These protections include deposit insurance, segregated client funds, and regulatory oversight of business practices. Fund safety measures have not been detailed in available documentation. This raises serious questions about how client deposits are handled, whether funds are segregated from company operating capital, and what protections exist against potential misuse of client money.

Regulated brokers are typically required to maintain client funds in segregated accounts with tier-one banks, but no such arrangements have been disclosed by Varna Trade. Company transparency is severely lacking. Limited information is available about ownership structure, management team, corporate governance, or operational procedures.

This opacity makes it impossible for potential clients to assess the credibility and stability of the organization they would be entrusting with their trading capital. Industry reputation is predominantly negative. Varna Trade has been flagged as a potential scam by multiple industry watchdog organizations and review platforms.

This classification reflects serious concerns about the platform's legitimacy and operational integrity that potential users should carefully consider. Regulatory verification efforts have failed to identify any legitimate licensing or authorization from recognized financial authorities. The absence of regulatory compliance means that standard industry protections, dispute resolution mechanisms, and oversight procedures are not available to clients.

Third-party evaluations consistently rate Varna Trade unfavorably. Industry experts and review platforms warn potential users about the risks associated with engaging with this unregulated entity. User trust feedback is overwhelmingly negative, with many traders expressing concerns about fund safety and platform legitimacy.

User Experience Analysis

Overall user satisfaction with Varna Trade is notably poor. The majority of available feedback expresses negative experiences and recommends that other traders avoid the platform. The consistent pattern of dissatisfaction across multiple user touchpoints suggests systemic problems with the platform's service delivery and operational standards.

Interface design and usability appear to be problematic based on user reports. Traders comment that the platform interface is not intuitive or user-friendly. Modern trading platforms are expected to provide clean, efficient interfaces that facilitate rapid decision-making and order execution.

Varna Trade appears to fall short of these expectations. Registration and verification processes have not been detailed in available documentation. This makes it unclear what procedures potential clients would need to complete to begin trading.

The lack of transparent onboarding information suggests poor operational communication standards that may create confusion for new users. Funding operation experiences have not been well-documented in available sources. The general pattern of negative user feedback suggests that deposit and withdrawal processes may be problematic.

Efficient and transparent funding operations are essential for professional trading, and any limitations in this area would significantly impact user experience. Common user complaints center around poor customer service, platform technical issues, lack of transparency, and concerns about fund safety. The consistency of these complaints across multiple review sources suggests that these are systemic rather than isolated issues.

User demographic analysis suggests that while the platform may theoretically appeal to traders seeking access to diverse asset classes, the high-risk nature of dealing with an unregulated entity makes it unsuitable for most retail investors who prioritize safety and regulatory protection. The negative feedback pattern indicates that even traders willing to accept higher risks have found the platform's service levels inadequate. Improvement recommendations based on user feedback would include obtaining proper regulatory licensing, improving customer service quality, enhancing platform stability, and providing greater transparency about operational procedures and fund safety measures.

Conclusion

This comprehensive Varna Trade review reveals a trading platform that presents significant risks and limitations that outweigh any potential benefits. The broker's unregulated status, classification as a potential scam, and consistently negative user feedback create a risk profile that is unsuitable for most retail traders. While the platform offers theoretical access to diverse asset classes through CFD trading, the fundamental lack of regulatory protection and operational transparency makes it an inappropriate choice for traders who prioritize safety and professional service standards.

The platform may superficially appeal to traders seeking access to multiple asset categories, but we strongly recommend against engaging with Varna Trade due to the substantial risks involved. The combination of no regulatory oversight, poor customer service, technical limitations, and negative industry reputation creates an environment where traders face significant potential for financial loss beyond normal market risks. Key advantages are limited to asset diversity, while the disadvantages include lack of regulatory protection, poor customer support, technical issues, and serious transparency concerns.

For traders seeking legitimate CFD trading opportunities, numerous regulated alternatives offer superior protection, service quality, and operational transparency.