GTI Markets 2025 Review: Everything You Need to Know

Executive Summary

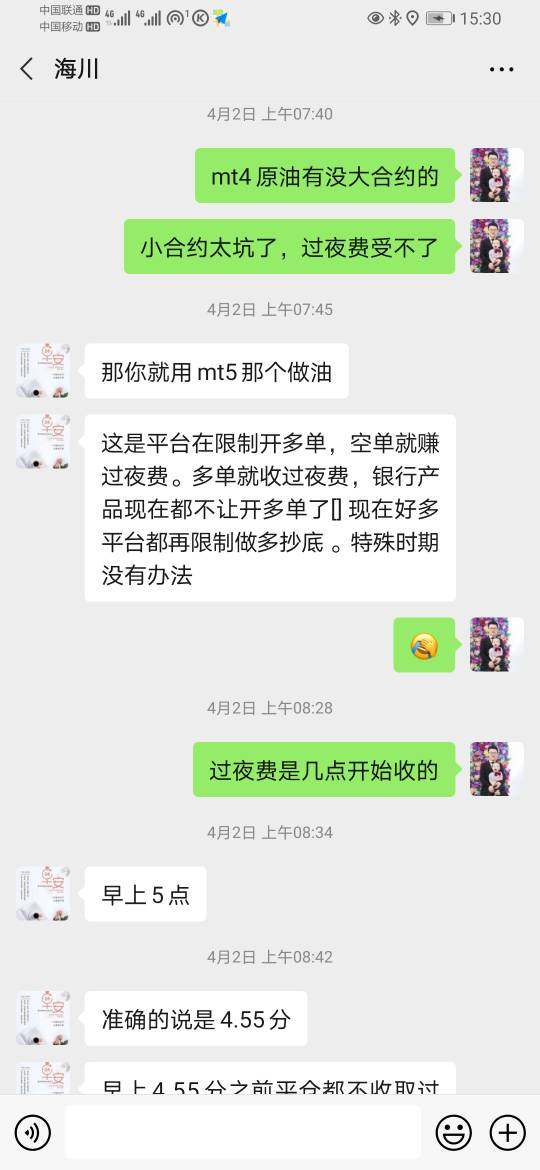

This comprehensive gti markets review reveals significant concerns about GTI Markets as a forex broker. Based on available information from regulatory databases and user feedback platforms, GTI Markets has been identified as a suspected clone or fraudulent brokerage operation that targets unsuspecting traders. While the platform claims to offer various trading instruments across multiple financial markets, the overwhelming evidence suggests traders should exercise extreme caution when considering this broker.

The broker appears to target forex traders with promises of diverse trading tools and market access. However, regulatory warnings and predominantly negative user reviews paint a concerning picture of this operation that cannot be ignored. According to WikiFX and other industry monitoring platforms, GTI Markets lacks proper regulatory oversight and has been flagged as potentially fraudulent by multiple watchdog organizations.

Given the serious regulatory concerns and negative user feedback, this review strongly advises traders to avoid GTI Markets entirely. The lack of legitimate regulatory authorization, combined with warning flags from industry watchdogs, makes this broker unsuitable for any trader seeking a safe and reliable trading environment where their funds are protected.

Important Notice

This evaluation is based on publicly available information from regulatory databases, industry monitoring platforms, and user feedback sources. Traders should note that regulatory landscapes can vary significantly across different jurisdictions, and what may be considered illegal in one region might have different implications elsewhere depending on local laws and enforcement mechanisms.

The assessment presented in this gti markets review draws from available data at the time of writing, including reports from WikiFX, WikiBit, and other industry monitoring services. However, the regulatory status and operational legitimacy of GTI Markets remain highly questionable across all reviewed jurisdictions without exception. Potential users should conduct their own due diligence and consult with financial advisors before making any trading decisions that could put their capital at risk.

Broker Rating Framework

Broker Overview

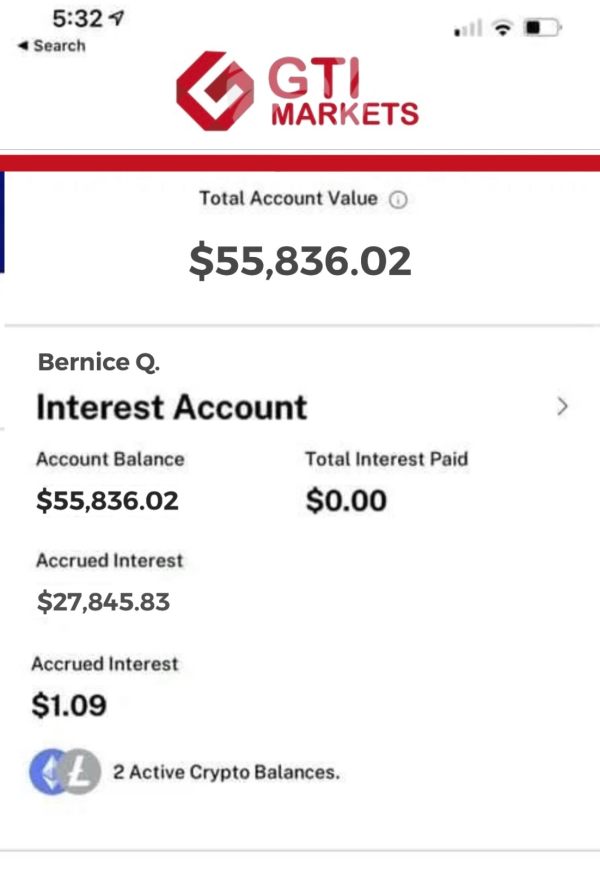

GTI Markets presents itself as a forex and CFD broker offering various trading instruments to retail traders worldwide. However, the company's background and establishment details remain largely unclear in available documentation, which raises immediate red flags about transparency. The broker claims to provide access to multiple financial markets, but serious questions arise regarding its legitimacy and operational authorization from recognized regulatory bodies.

According to industry monitoring services, GTI Markets appears to be operating without proper regulatory oversight from any major financial authority. The lack of transparent company information, including verified establishment dates, registered office locations, and legitimate licensing details, raises immediate red flags for potential traders who value security and regulatory protection. This absence of basic corporate transparency is particularly concerning in an industry where regulatory compliance is paramount for trader protection.

The broker's business model appears to focus on attracting forex traders through claims of diverse trading opportunities and competitive conditions. However, the suspected clone nature of this operation suggests that any trading activity may be conducted outside legitimate regulatory frameworks that protect traders. This gti markets review emphasizes that the fundamental lack of regulatory authorization makes any engagement with this broker extremely risky for traders seeking legitimate market access and fund protection.

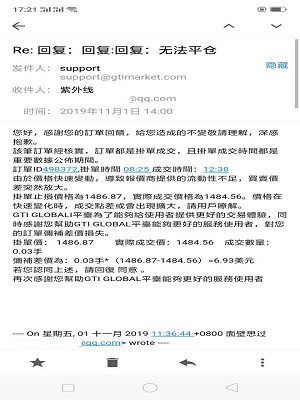

Regulatory Status: Available information indicates that GTI Markets lacks proper regulatory authorization from recognized financial authorities worldwide. Industry monitoring platforms have flagged this broker as potentially fraudulent or operating as a clone of legitimate entities, which represents the most serious type of warning in the forex industry.

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available sources from the broker itself. This lack of transparency regarding financial transactions is another concerning aspect of the broker's operations that legitimate brokers would typically address clearly.

Minimum Deposit Requirements: The exact minimum deposit amounts are not specified in available documentation from GTI Markets. This represents another gap in essential trader information that professional brokers typically provide upfront to help traders make informed decisions.

Promotions and Bonuses: No specific information about promotional offerings or bonus structures is available in the reviewed sources. This suggests limited or non-existent marketing incentives, though this may actually be preferable given the regulatory concerns surrounding the broker.

Available Assets: According to available information, GTI Markets claims to offer various trading instruments including forex pairs and CFDs across different market categories. However, the legitimacy of these trading offerings remains questionable given the regulatory concerns and lack of proper authorization from financial authorities.

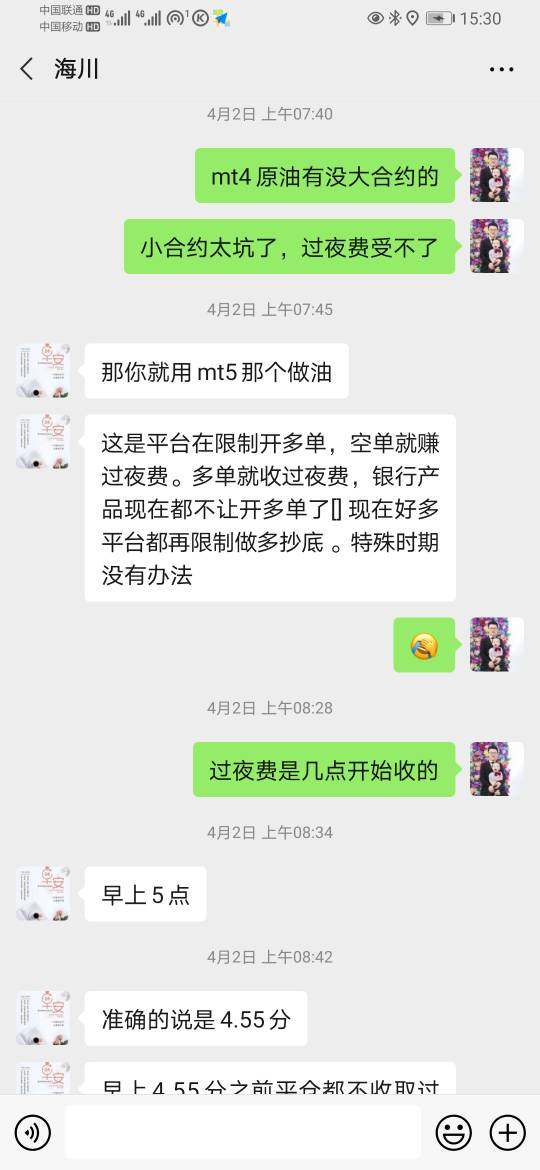

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in the reviewed sources from GTI Markets. This lack of transparency regarding pricing makes it impossible for traders to assess the true cost of trading with this broker or compare it to legitimate alternatives.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation from the broker. This represents another significant information gap for potential traders who need to understand risk parameters before making trading decisions.

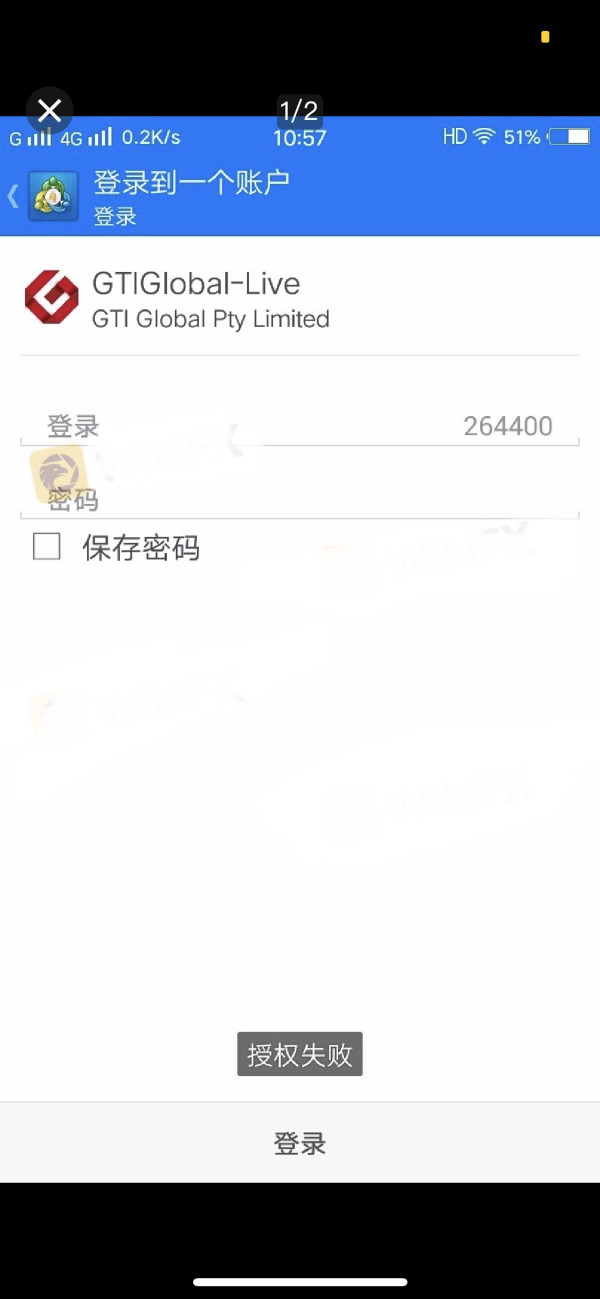

Platform Options: The trading platforms offered by GTI Markets are not specifically detailed in available sources. The broker appears to claim standard trading platform access, but the actual functionality and reliability remain unverified by independent sources.

Geographic Restrictions: Information about geographic limitations or restricted jurisdictions is not specified in available documentation. Legitimate brokers typically provide clear information about where they can and cannot accept clients based on regulatory requirements.

Customer Support Languages: Available sources do not detail the languages supported by customer service teams at GTI Markets. This gti markets review highlights the concerning lack of detailed operational information, which is typically readily available from legitimate, regulated brokers who prioritize transparency.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by GTI Markets remain largely unclear due to insufficient publicly available information from the broker. Legitimate brokers typically provide detailed information about their account types, minimum deposit requirements, and account features that help traders make informed decisions. However, GTI Markets fails to meet these basic transparency standards that are expected in the modern forex industry.

The absence of clear account type descriptions raises immediate concerns about the broker's operational legitimacy and commitment to transparency. Professional traders require detailed information about account specifications, including minimum balance requirements, account currencies, and special features such as Islamic accounts for Muslim traders who need Sharia-compliant trading conditions. The lack of this fundamental information suggests either poor business practices or deliberate obfuscation of important details that traders need.

Furthermore, the account opening process and verification requirements are not clearly outlined in available sources from GTI Markets. Regulated brokers must comply with Know Your Customer and Anti-Money Laundering requirements, which typically involve detailed documentation and verification procedures that protect both the broker and the trader. The absence of clear information about these processes raises additional questions about GTI Markets' regulatory compliance and operational legitimacy.

The overall lack of transparency regarding account conditions, combined with regulatory warnings from industry watchdogs, makes it impossible to recommend GTI Markets for any type of trading account. This gti markets review emphasizes that the fundamental absence of clear account information represents a significant red flag for potential traders who value transparency and regulatory protection.

While GTI Markets claims to offer various trading tools and instruments to its clients, the quality and legitimacy of these resources remain questionable based on available evidence. The broker appears to provide access to multiple market categories, including forex and CFDs, but the actual functionality and reliability of these tools are disputed by user feedback and industry monitoring services. The lack of detailed information about research and analysis resources is particularly concerning for traders who rely on fundamental and technical analysis to make informed trading decisions.

Legitimate brokers typically provide comprehensive market research, economic calendars, and analytical tools to support trader decision-making processes. The absence of clear information about these resources suggests limited support for informed trading decisions, which puts traders at a significant disadvantage. Educational resources, which are crucial for trader development and success, are not adequately described in available sources from GTI Markets or independent reviews.

Professional brokers typically offer extensive educational materials, webinars, and training programs to help traders improve their skills and understanding of the markets. The lack of clear educational offerings represents a significant disadvantage for traders seeking to develop their expertise and improve their trading performance. Automated trading support and compatibility with popular trading systems like Expert Advisors are not clearly detailed in available information from the broker.

This represents another gap in the technological infrastructure that modern traders expect from their brokers in today's competitive environment.

Customer Service and Support Analysis (Score: 2/10)

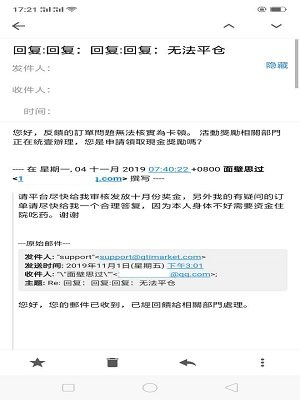

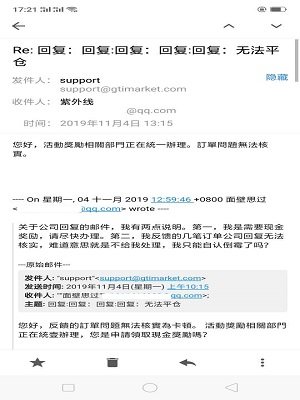

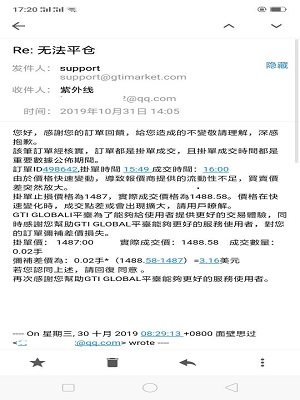

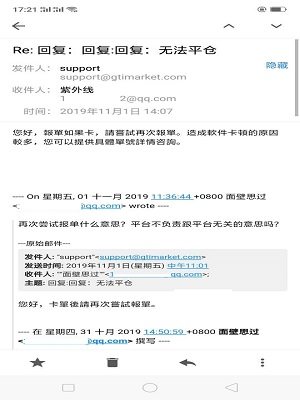

Customer service quality is a critical factor in broker evaluation, and GTI Markets appears to fall short in this area based on available feedback from users. The specific customer support channels, availability hours, and response times are not clearly detailed in reviewed sources, which itself represents a significant concern for traders who may need assistance. Professional brokers typically offer multiple communication channels including live chat, email support, and telephone assistance with clearly stated availability hours and expected response times.

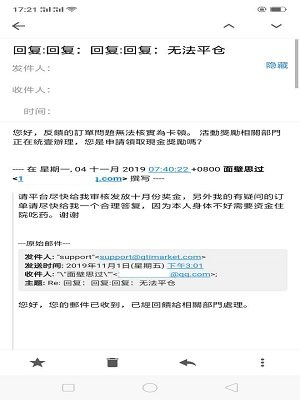

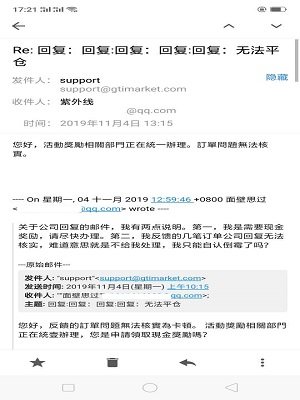

The lack of transparent information about customer support accessibility raises questions about the broker's commitment to client service and satisfaction. Response times and service quality metrics are not available in the reviewed sources, making it impossible to assess the efficiency of customer support operations at GTI Markets. User feedback suggests negative experiences with customer service, though specific details about support interactions are not extensively documented in available sources from independent reviewers.

Multilingual support capabilities are not clearly outlined by GTI Markets, which could present significant barriers for international traders. Professional brokers typically provide support in multiple languages to serve their global client base effectively and ensure clear communication. The absence of clear multilingual support information suggests potential communication barriers that could complicate problem resolution.

This lack of comprehensive customer service information, combined with negative user feedback, contributes to the overall poor rating in this category.

Trading Experience Analysis (Score: 2/10)

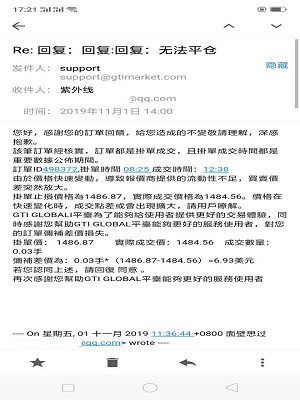

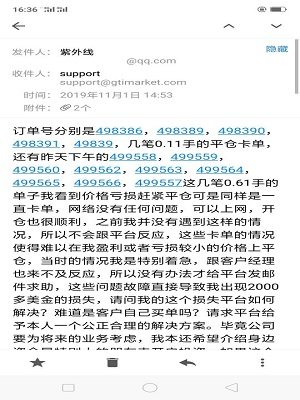

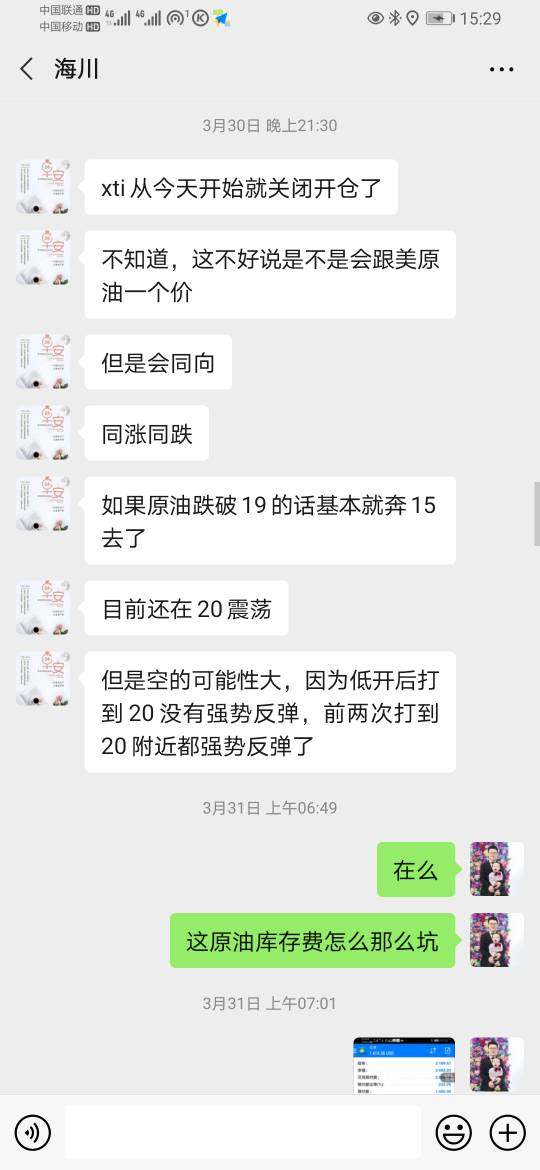

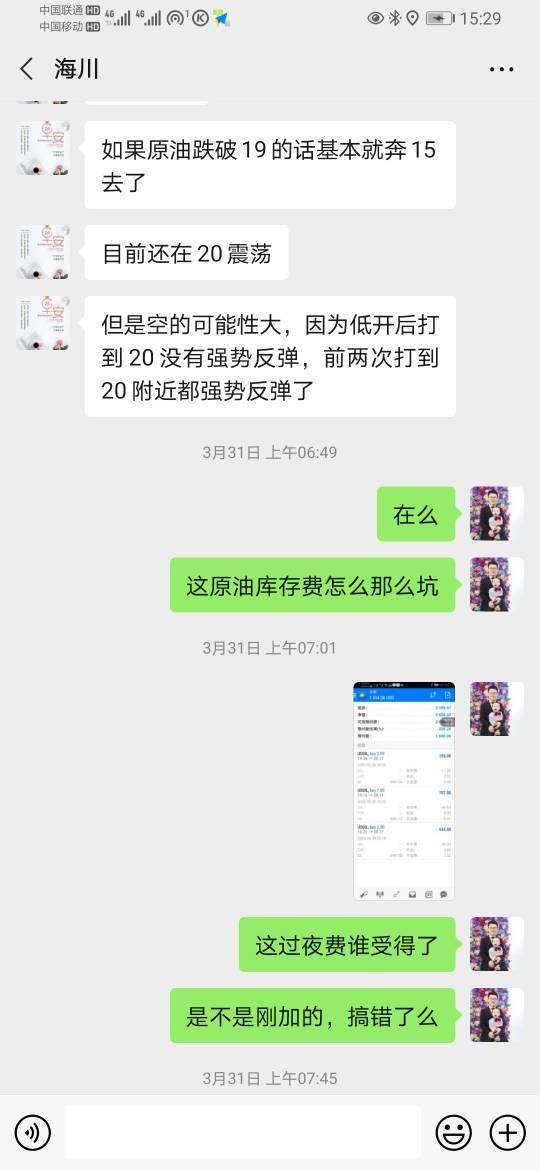

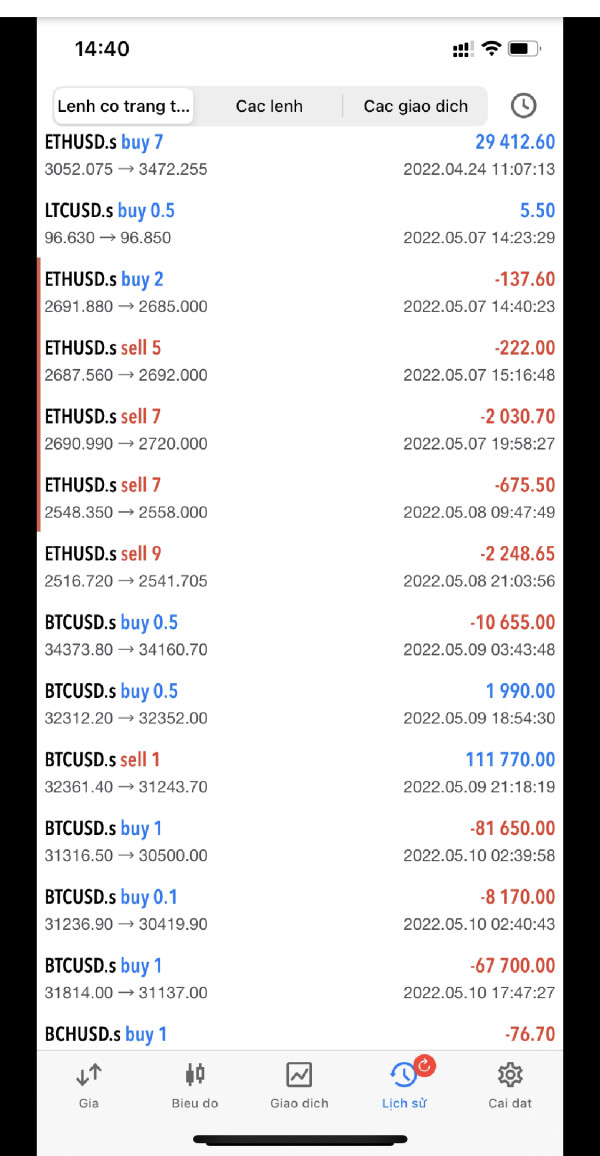

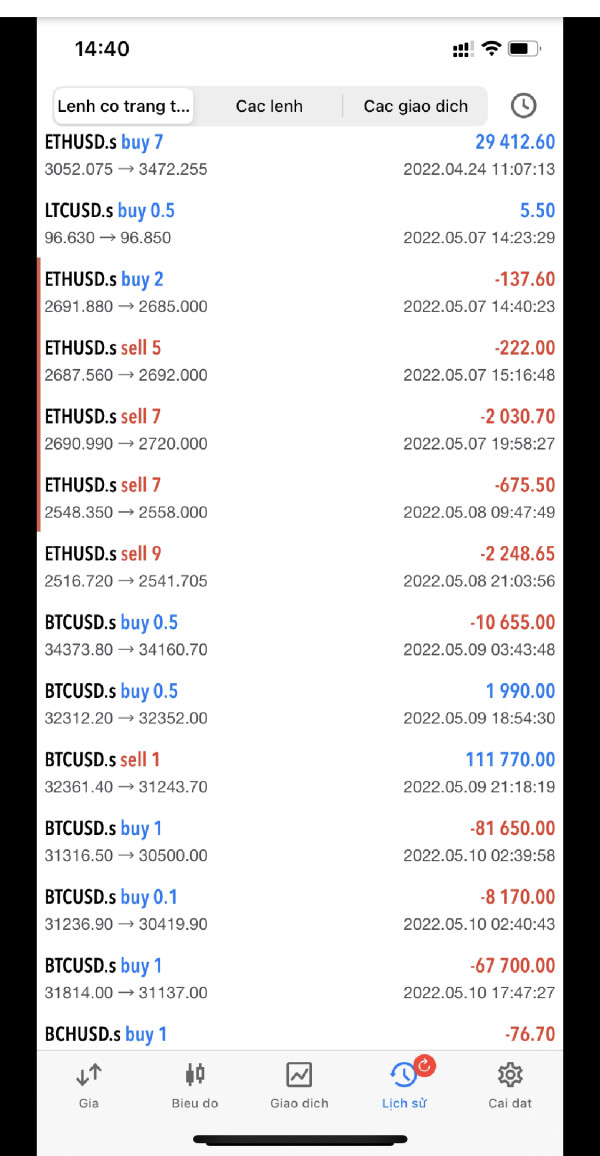

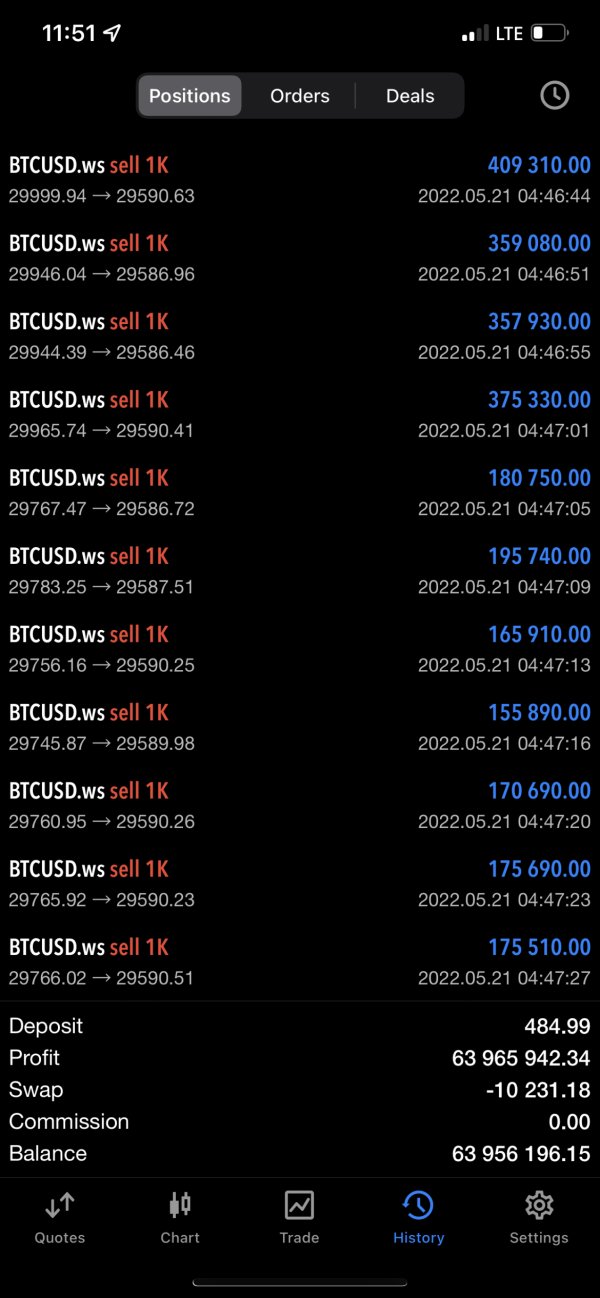

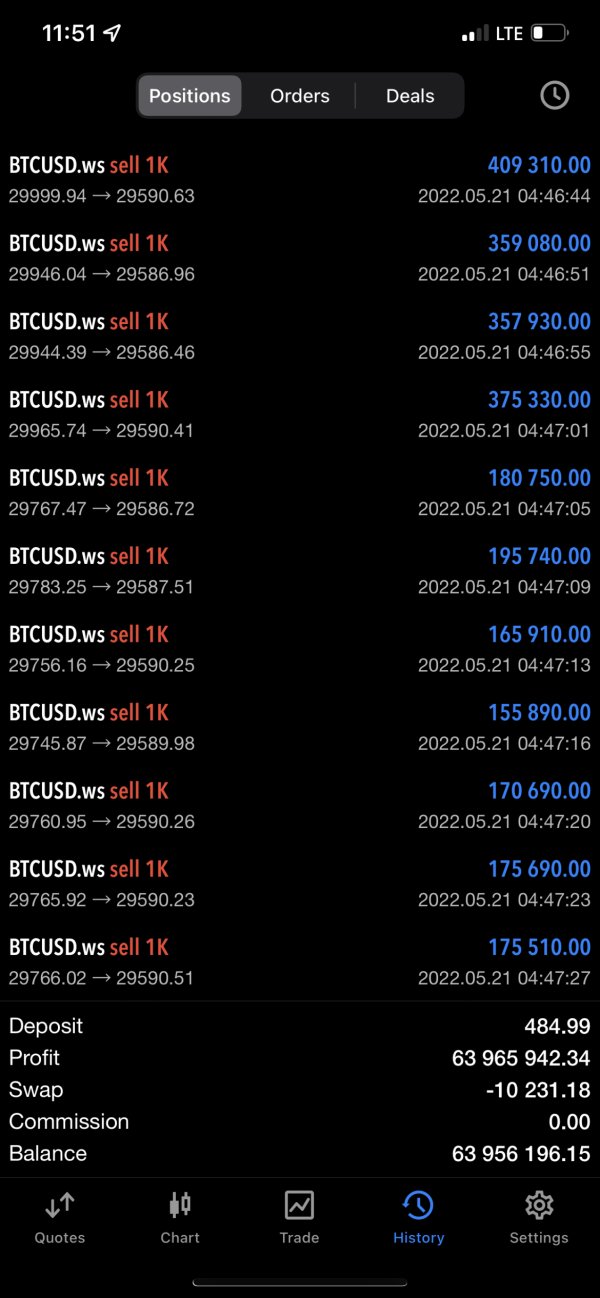

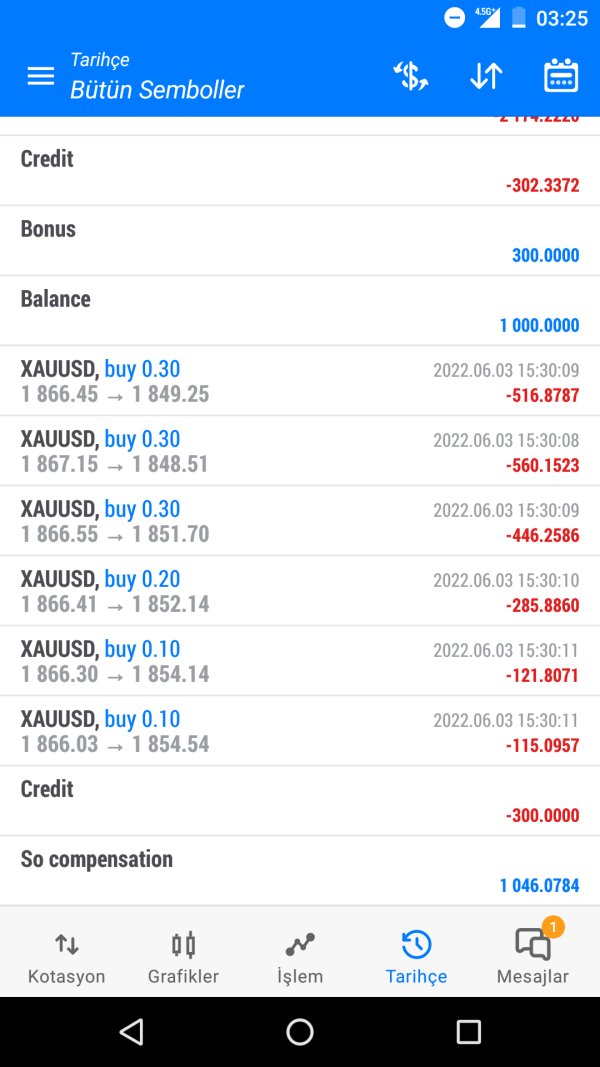

The trading experience offered by GTI Markets appears to be problematic based on available user feedback and industry assessments. Platform stability and execution speed are fundamental requirements for effective trading, and negative user experiences suggest significant deficiencies in these critical areas that can impact trading profitability. Order execution quality is a critical factor in trading success, and user feedback indicates concerns about slippage and requote issues that can significantly impact trader performance.

These problems can significantly impact trading profitability and represent serious operational deficiencies that legitimate brokers work to minimize through proper infrastructure investment. Platform functionality and feature completeness are not adequately detailed in available sources from GTI Markets or independent reviews. Modern traders require sophisticated trading platforms with advanced charting tools, technical indicators, and order management capabilities that facilitate effective trading strategies.

The lack of clear information about platform features suggests potential limitations in trading infrastructure offered by GTI Markets. Mobile trading experience is increasingly important for modern traders who need flexibility and mobility in their trading activities. However, specific information about mobile platform capabilities is not detailed in available sources from the broker or independent assessments.

The overall trading environment, including spread stability and market access, appears to be problematic based on user feedback and industry warnings. This gti markets review emphasizes that negative trading experiences represent a fundamental failure to meet trader expectations and industry standards for professional forex trading.

Trust and Security Analysis (Score: 1/10)

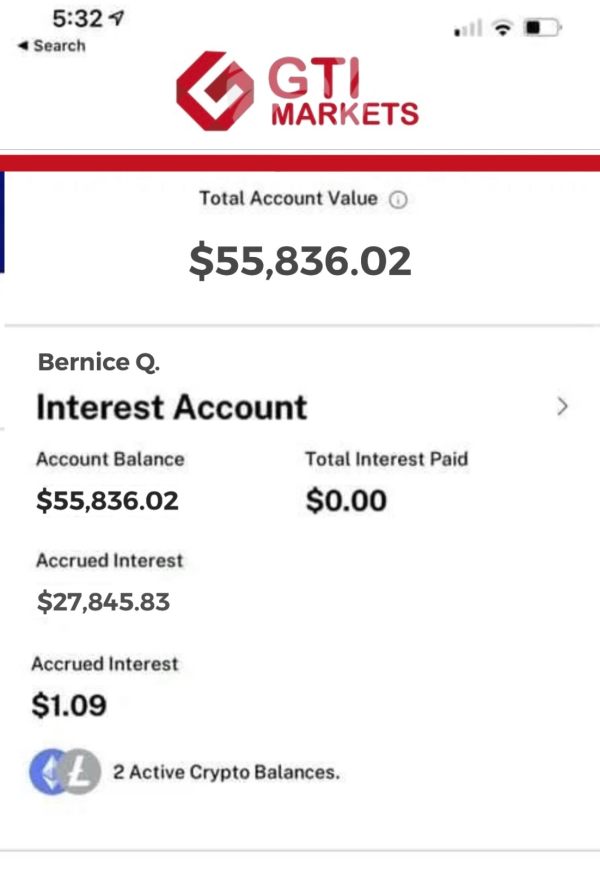

Trust and security represent the most critical concerns regarding GTI Markets and its operations. Industry monitoring platforms, including WikiFX and WikiBit, have identified GTI Markets as a suspected clone or fraudulent broker operation that poses significant risks to traders. This represents the most serious type of warning in the forex industry and should be considered a complete disqualification for any legitimate trading activity by responsible traders.

The lack of proper regulatory authorization from recognized financial authorities is a fundamental security concern that cannot be overlooked. Legitimate brokers operate under strict regulatory oversight that provides client protection, segregated fund management, and dispute resolution mechanisms that protect traders from fraud and operational failures. The absence of such oversight leaves traders completely vulnerable to potential fraud or operational failures without recourse or protection.

Fund security measures, which are typically detailed by legitimate brokers, are not clearly outlined in available sources from GTI Markets. Professional brokers implement client fund segregation, deposit insurance, and other protective measures that are essential for trader security and peace of mind. The absence of clear information about these protections represents a significant risk factor that responsible traders should not ignore.

Company transparency is severely lacking, with basic corporate information not readily available or verifiable through independent sources.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with GTI Markets appears to be extremely poor based on available feedback sources and industry assessments. The predominant recommendation from industry monitors and user feedback is to avoid this broker entirely, which represents the strongest possible negative assessment in the forex industry. Interface design and platform usability information is not adequately detailed in available sources, though user feedback suggests negative experiences with the overall trading environment and platform functionality.

Modern traders expect intuitive, well-designed platforms that facilitate efficient trading operations and enhance their trading experience. Registration and verification processes are not clearly outlined by GTI Markets, which creates uncertainty about account opening procedures for potential clients. Legitimate brokers provide clear, step-by-step guidance for account registration while maintaining compliance with regulatory requirements that protect both parties.

Funding operations experience is not specifically detailed in available sources, though the overall negative user feedback suggests potential problems with deposit and withdrawal processes. Efficient, transparent funding operations are essential for positive user experiences and trader satisfaction with their chosen broker. Common user complaints center around the broker's legitimacy and reliability, with widespread recommendations to avoid the platform entirely from industry experts.

This level of negative feedback is extremely concerning and represents a clear consensus among industry observers and users who have experience with GTI Markets.

Conclusion

This comprehensive gti markets review reveals significant and concerning issues that make GTI Markets unsuitable for any type of trading activity by responsible traders. The broker has been identified by industry monitoring platforms as a suspected clone or fraudulent operation, which represents the most serious type of warning in the forex industry and should not be taken lightly. The complete lack of proper regulatory oversight, combined with widespread negative user feedback and industry warnings, creates an unacceptable risk environment for traders who value their capital and security.

No trader, regardless of experience level or risk tolerance, should consider using GTI Markets for any trading activities given the serious concerns raised. The primary disadvantages include suspected fraudulent operations, lack of regulatory authorization, negative user experiences, and absence of basic transparency in operations that legitimate brokers provide as standard practice. There are no identifiable advantages that could possibly outweigh these fundamental security and legitimacy concerns that put trader funds and personal information at risk.

Traders seeking reliable forex and CFD trading should focus exclusively on properly regulated, well-established brokers with positive track records and transparent operations.