NESSfx 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive nessfx review evaluates a medium-risk CFD broker operating under the regulatory oversight of the Cyprus Securities and Exchange Commission. Based on available user feedback and official information, NESSfx receives a moderate rating of 6 out of 10, reflecting mixed user experiences and average service quality. The broker operates as a subsidiary of FxNet Limited, headquartered in Limassol, Cyprus. It offers trading opportunities across multiple asset classes including forex, commodities, indices, stocks, bonds, and cryptocurrencies.

NESSfx distinguishes itself by providing access to the popular MetaTrader 4 platform alongside web and mobile trading solutions. The broker's multi-asset approach makes it particularly suitable for intermediate-level traders who prefer portfolio diversification across different financial instruments. However, user feedback indicates concerns regarding customer service quality. Potential clients should carefully consider this before opening accounts.

Important Notice

Users in different regions may encounter varying regulatory policies and trading conditions when dealing with NESSfx. The broker's services and terms may differ based on local jurisdiction requirements and compliance standards. This review is compiled based on comprehensive analysis of user feedback and official information available from multiple sources. Prospective traders should verify current terms and conditions directly with the broker, as regulatory requirements and service offerings may change over time.

Rating Framework

Broker Overview

NESSfx operates as the trading brand of FxNet Limited, a financial services company established and headquartered in Limassol, Cyprus. According to TradingBrokers reports, the company positions itself as a CFD broker specializing in multi-asset trading solutions. While specific establishment dates are not detailed in available materials, the broker has maintained its presence in the competitive online trading market through its comprehensive asset offerings and platform accessibility.

The company's business model centers on providing Contract for Difference trading services across major financial markets. NESSfx enables clients to access forex currency pairs, commodities, equity indices, individual stocks, government bonds, and cryptocurrency markets through a single trading platform. This diversified approach appeals to traders seeking exposure to multiple asset classes without requiring separate accounts with different brokers.

NESSfx delivers its trading services primarily through the MetaTrader 4 platform, complemented by proprietary web-based and mobile trading applications. The broker operates under the regulatory supervision of the Cyprus Securities and Exchange Commission, providing a European Union regulatory framework for client protection. Available materials indicate that the company offers trading access across forex, commodities, indices, stocks, bonds, and cryptocurrencies. However, specific details regarding trading conditions and account features require direct verification with the broker.

Regulatory Jurisdiction: NESSfx operates under the oversight of the Cyprus Securities and Exchange Commission, providing EU-standard regulatory protection for client funds and trading activities. This regulatory framework offers certain safeguards including segregated client accounts and compensation scheme participation.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in current materials. This requires direct inquiry with the broker for accurate payment method listings.

Minimum Deposit Requirements: Current materials do not specify minimum deposit amounts for different account types. Direct contact with NESSfx is necessary for precise funding requirements.

Bonus and Promotional Offers: Available information does not include details about current bonus structures or promotional campaigns offered by the broker.

Tradeable Assets: NESSfx provides access to multiple asset categories including foreign exchange currency pairs, commodity CFDs, stock indices, individual equity shares, government bonds, and cryptocurrency instruments. This offers traders diversified market exposure opportunities.

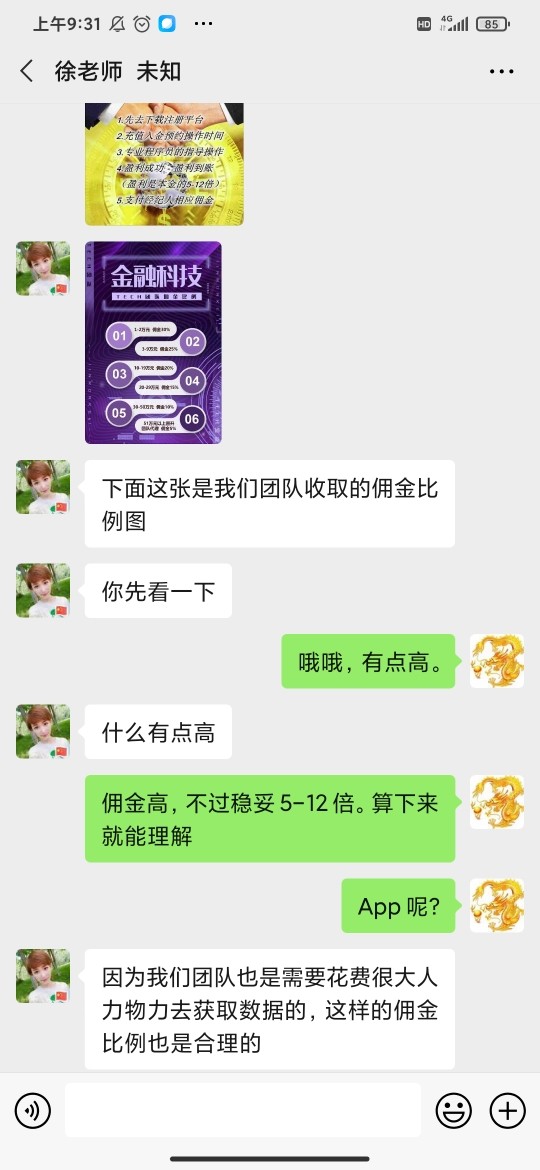

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not detailed in available materials. User feedback suggests some dissatisfaction with overall service quality that may extend to pricing competitiveness.

Leverage Ratios: Current materials do not specify maximum leverage ratios available for different asset classes or account types.

Platform Options: The broker primarily offers MetaTrader 4 as its main trading platform. It is supplemented by web-based and mobile trading applications for enhanced accessibility.

Geographic Restrictions: Specific information about regional limitations or restricted jurisdictions is not provided in current materials.

Customer Support Languages: Available materials do not specify the range of languages supported by the customer service team.

This nessfx review highlights the need for prospective clients to conduct direct inquiries regarding specific terms and conditions not detailed in publicly available information.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

NESSfx's account conditions receive an average rating based on limited available information and mixed user feedback. Current materials do not provide comprehensive details about different account types, their specific features, or tiered service levels that might be available to traders with varying experience levels and capital requirements. The absence of clearly published account specifications makes it difficult for potential clients to assess whether the broker's offerings align with their trading needs and financial capacity.

Minimum deposit requirements are not specified in available materials. This creates uncertainty for traders planning their initial investment amounts. The account opening process and required documentation procedures are similarly not detailed, though user feedback suggests some dissatisfaction with overall service delivery that may extend to the onboarding experience. Without specific information about special account features such as Islamic accounts for Muslim traders or professional account classifications, it becomes challenging to evaluate the broker's accommodation of diverse client requirements.

According to available user feedback, some customers express dissatisfaction with the company's service quality. This may reflect on account management and ongoing client relationship aspects. The lack of transparency regarding account conditions and the presence of negative user experiences contribute to the moderate rating in this category. This nessfx review recommends that prospective clients request detailed account information directly from the broker before making commitment decisions.

NESSfx demonstrates strength in its tools and resources offering, earning a good rating primarily due to its multi-asset trading capabilities and platform accessibility. The broker provides access to diverse trading instruments including forex currencies, commodities, stock indices, individual shares, bonds, and cryptocurrencies. This enables traders to build diversified portfolios across different market sectors. This comprehensive asset selection represents a significant advantage for traders seeking exposure to multiple financial markets through a single broker relationship.

The availability of MetaTrader 4 as the primary trading platform adds considerable value to the broker's tool offerings. MT4 is widely recognized as an industry-standard platform, providing advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and comprehensive order management features. The platform's popularity among traders worldwide ensures familiarity and ease of use for most clients transitioning to NESSfx services.

Web-based and mobile trading platforms complement the MT4 offering, providing traders with flexible access options across different devices and operating systems. However, current materials do not detail specific research resources, market analysis tools, educational content, or additional trading utilities that might enhance the overall trading experience. The absence of information about proprietary research, economic calendars, or educational programs limits the assessment of the broker's comprehensive support ecosystem for trader development and market awareness.

Customer Service and Support Analysis (5/10)

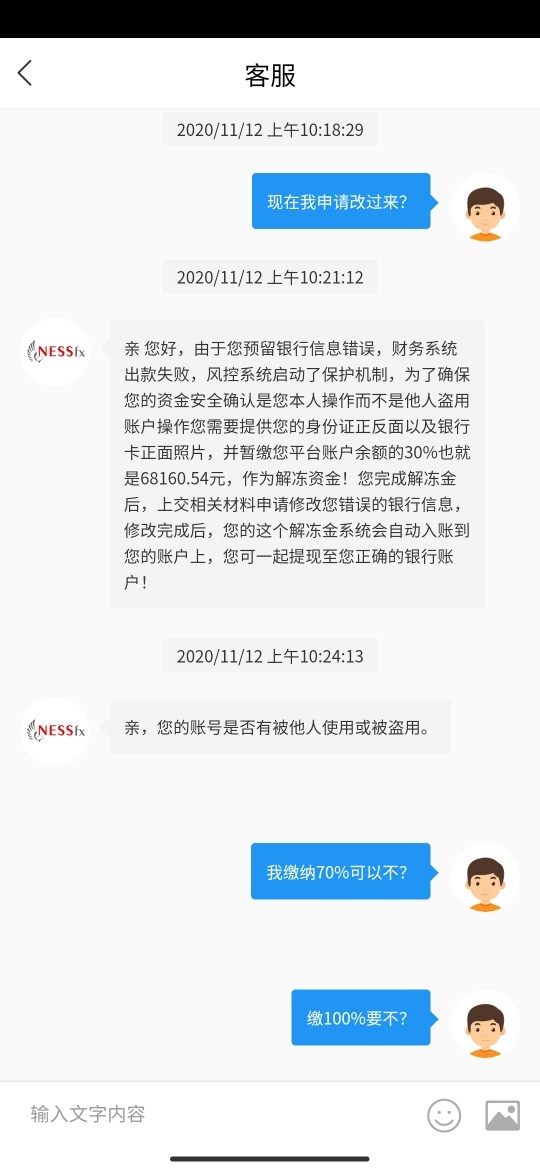

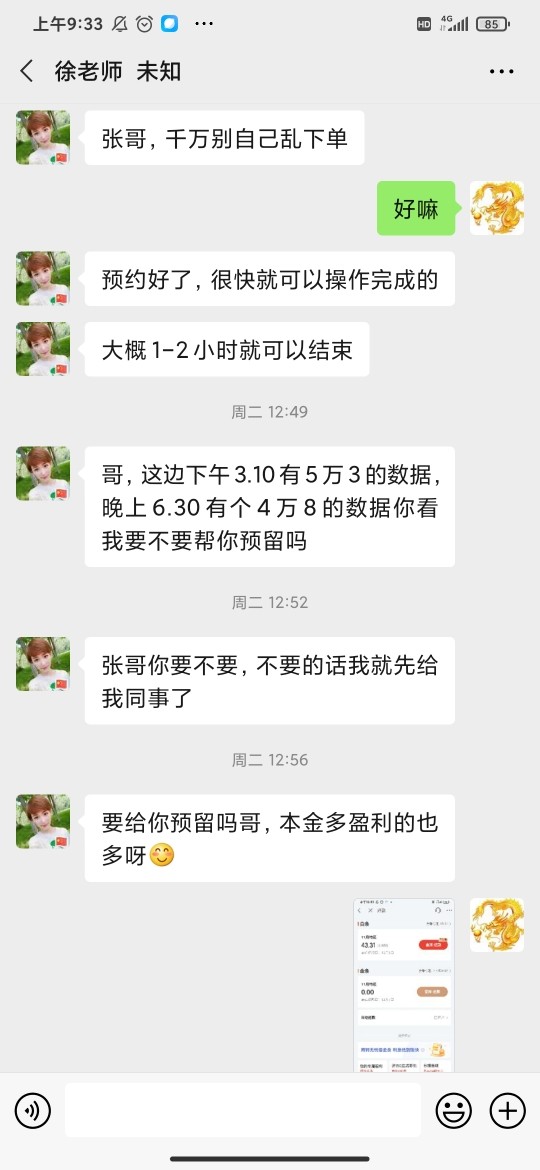

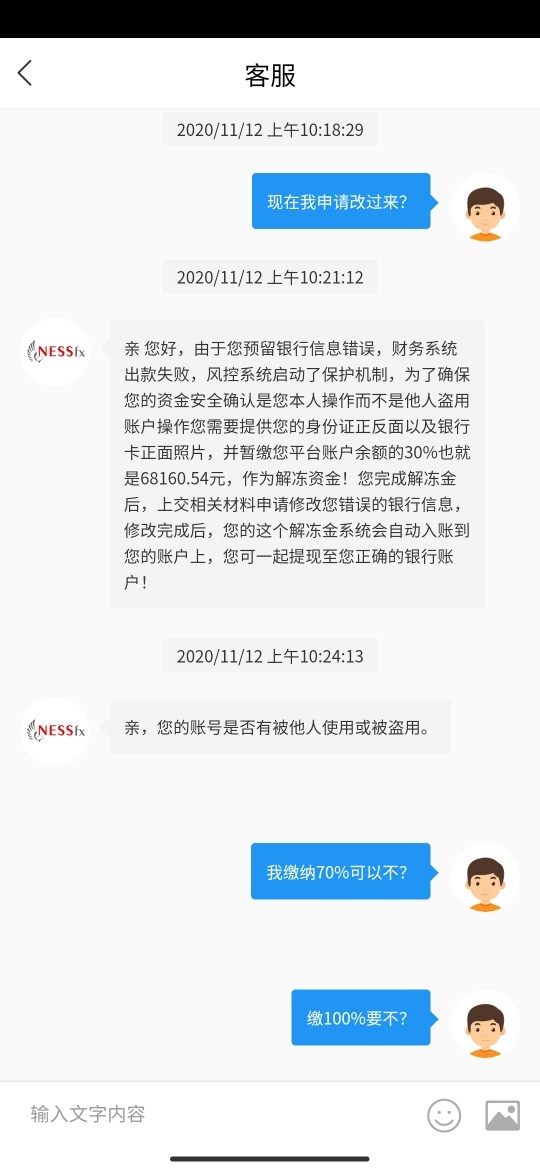

Customer service represents a concerning area for NESSfx, receiving an average rating based on negative user feedback regarding service quality. Available user reviews indicate dissatisfaction with the company's customer support performance. However, specific details about response times, communication channels, or resolution effectiveness are not provided in current materials. This lack of positive customer service feedback raises questions about the broker's commitment to client satisfaction and problem resolution.

The absence of detailed information about available customer support channels, operating hours, and multilingual support capabilities further complicates the assessment of service quality. Modern traders expect multiple communication options including live chat, telephone support, email assistance, and potentially social media responsiveness. Current materials do not specify which channels NESSfx maintains or their availability schedules.

Without information about customer service team training, escalation procedures, or service level commitments, it becomes difficult to evaluate whether the broker maintains professional support standards expected in the competitive online trading industry. The negative user feedback combined with limited transparency about support infrastructure suggests that customer service may be an area requiring improvement. Prospective clients should consider testing the broker's responsiveness during the account opening process to gauge service quality expectations.

Trading Experience Analysis (6/10)

The trading experience with NESSfx receives a fair rating based on platform availability and asset diversity. Limited user feedback prevents comprehensive evaluation of execution quality and overall trading conditions. The provision of MetaTrader 4 as the primary trading platform offers traders access to a robust, feature-rich environment with advanced charting, technical analysis capabilities, and automated trading support through Expert Advisors.

Platform stability and execution speed information is not available in current materials. This makes it difficult to assess whether NESSfx maintains the technical infrastructure necessary for reliable order processing during various market conditions. Slippage rates, requote frequency, and order fill quality data are similarly absent, preventing evaluation of execution performance that significantly impacts trading profitability.

The availability of web and mobile trading platforms suggests recognition of modern traders' needs for flexible access across different devices and locations. However, without specific user feedback about mobile platform functionality, synchronization capabilities, or feature completeness compared to the desktop MT4 platform, it's challenging to assess the quality of cross-platform trading experience.

Spread competitiveness, liquidity provision, and overall trading environment quality information is not detailed in available materials. This nessfx review notes that the lack of specific trading condition data and limited user experience feedback contribute to the moderate rating. Potential clients should request detailed trading specifications and consider demo account testing before committing capital.

Trust and Security Analysis (6/10)

NESSfx's trust and security profile receives a fair rating, primarily anchored by its regulatory status under the Cyprus Securities and Exchange Commission but limited by lack of transparency in other security measures. CySEC regulation provides a European Union regulatory framework that includes requirements for client fund segregation, capital adequacy, and participation in investor compensation schemes. This offers basic protection standards for trader funds.

However, current materials do not provide details about additional security measures such as negative balance protection, advanced encryption protocols, or comprehensive fund safety procedures beyond basic regulatory requirements. The absence of information about financial reporting, company transparency, or management team credentials limits the ability to assess the broker's overall corporate governance and operational transparency.

Industry recognition through awards, certifications, or third-party endorsements is not mentioned in available materials. This suggests limited external validation of the broker's service quality or security standards. User feedback indicates some dissatisfaction with service quality, which may reflect broader concerns about the company's operational standards and client relationship management.

Without detailed information about the broker's financial stability, insurance coverage beyond regulatory minimums, or track record of handling client concerns, the trust assessment remains moderate. The regulatory foundation provides basic security assurance. However, the lack of additional transparency and mixed user feedback prevent a higher confidence rating.

User Experience Analysis (5/10)

User experience with NESSfx receives an average rating based on a combination of platform accessibility and concerning user feedback patterns. The overall user satisfaction score of 6 out of 10 mentioned in available materials suggests mixed experiences among the broker's client base. Some users find value in the service while others express dissatisfaction with various aspects of their trading relationship.

Interface design and platform usability information is not specifically detailed in current materials. The provision of MetaTrader 4 suggests access to a familiar, industry-standard interface that most traders can navigate effectively. The availability of web and mobile platforms indicates recognition of modern trading preferences. However, without specific user feedback about interface quality or navigation efficiency, comprehensive user experience assessment remains limited.

Account registration and verification processes are not detailed in available materials. This makes it difficult to evaluate the onboarding experience that significantly influences first impressions and initial user satisfaction. Fund management experiences, including deposit and withdrawal processes, are similarly not described, preventing assessment of operational convenience that affects ongoing user relationships.

The presence of negative user feedback regarding service quality suggests that some clients experience frustration with aspects of their NESSfx relationship. Specific pain points are not detailed in available materials. This mixed feedback pattern contributes to the moderate user experience rating and suggests that prospective clients should carefully evaluate their specific needs against the broker's offerings before making commitments.

Conclusion

This comprehensive nessfx review reveals a medium-risk CFD broker offering diversified trading opportunities under CySEC regulatory supervision. NESSfx demonstrates strengths in asset variety and platform accessibility through MetaTrader 4. This makes it potentially suitable for intermediate traders seeking multi-asset exposure across forex, commodities, indices, stocks, bonds, and cryptocurrencies.

However, the broker faces challenges in customer service quality and transparency, with user feedback indicating dissatisfaction with service standards and limited publicly available information about specific trading conditions. The moderate overall rating of 6 out of 10 reflects these mixed characteristics. It shows adequate regulatory protection and trading tools balanced against service quality concerns and transparency limitations.

NESSfx appears most appropriate for intermediate-level traders who prioritize asset diversity and platform familiarity over premium customer service or comprehensive educational resources. Prospective clients should conduct thorough due diligence, request detailed terms and conditions, and consider demo account testing before committing capital. This ensures alignment with their trading requirements and service expectations.