EPFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive epfx review looks at a new ECN forex broker that started in 2022. EPFX calls itself a multi-asset trading platform that offers high leverage up to 1:500 and competitive spreads starting from 0 pips across more than 300 trading instruments. The broker works through EPFX PTY LTD, which has its main office in South Africa, and says it is registered in both Australia and South Africa, though we cannot find clear details about regulation.

EPFX mainly wants to attract active traders who seek different trading opportunities across forex, metals, commodities, stocks, and indices. The platform uses MetaTrader 5 as its main trading interface, giving traders advanced charting tools and automated trading capabilities. Based on user feedback on Trustpilot, where the broker has a 3.8-star rating from 57 reviews, customers really like the fast withdrawal processing times.

However, this epfx review shows major transparency concerns, especially about regulatory oversight and account structure details. While the broker offers attractive trading conditions including micro lot trading and substantial leverage, the lack of clear regulatory information and limited disclosure about fees and account requirements may worry careful investors.

Important Notice

Regional Entity Differences: EPFX claims registration in Australia and South Africa through EPFX PTY LTD, but specific regulatory authority oversight details are not clearly disclosed in available materials. Traders should exercise due diligence when evaluating the broker's regulatory status and consider the implications for fund protection and dispute resolution.

Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and the broker's official communications. Given the limited operational history since 2022, long-term performance data remains unavailable.

Rating Framework

Broker Overview

EPFX started in the competitive forex market in 2022 as an ECN broker offering CFD trading services across multiple asset classes. The company operates under EPFX PTY LTD, with its headquarters located in South Africa, positioning itself to serve global clients seeking diversified financial market access. As a relatively new entrant, EPFX has focused on attracting active traders through competitive leverage offerings and comprehensive instrument selection.

The broker's business model centers on providing direct market access through its ECN infrastructure. This allows traders to benefit from institutional-level pricing and execution speeds. EPFX targets traders who prioritize market volatility opportunities across various asset classes, from traditional forex pairs to emerging market instruments.

The company's rapid market entry strategy emphasizes technological capability and competitive trading conditions over extensive regulatory credentials. EPFX operates primarily through the MetaTrader 5 platform, offering traders access to advanced technical analysis tools, automated trading systems, and comprehensive market data feeds. The broker's asset portfolio encompasses over 300 trading instruments, including major and minor currency pairs, precious metals, energy commodities, global stock indices, and individual equity CFDs.

This epfx review notes that while regulatory authority information remains unclear, the broker maintains operational transparency through its platform offerings and customer communication channels.

Regulatory Jurisdictions: EPFX claims registration in Australia and South Africa under EPFX PTY LTD. However, specific regulatory authority oversight details are not prominently disclosed in available documentation.

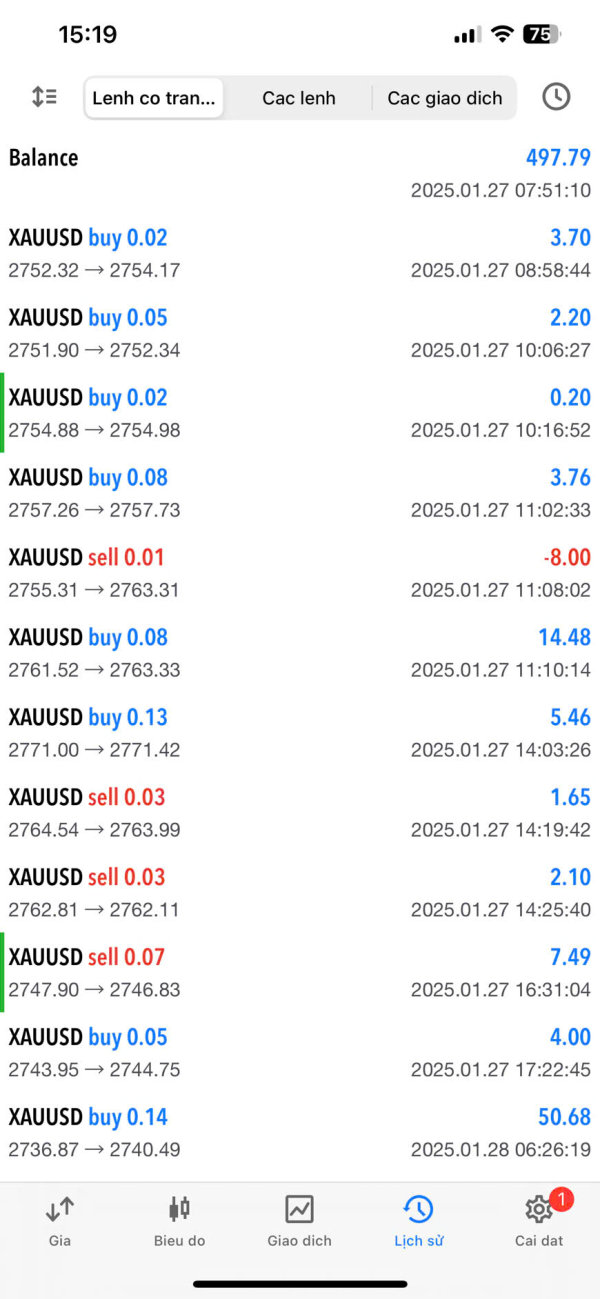

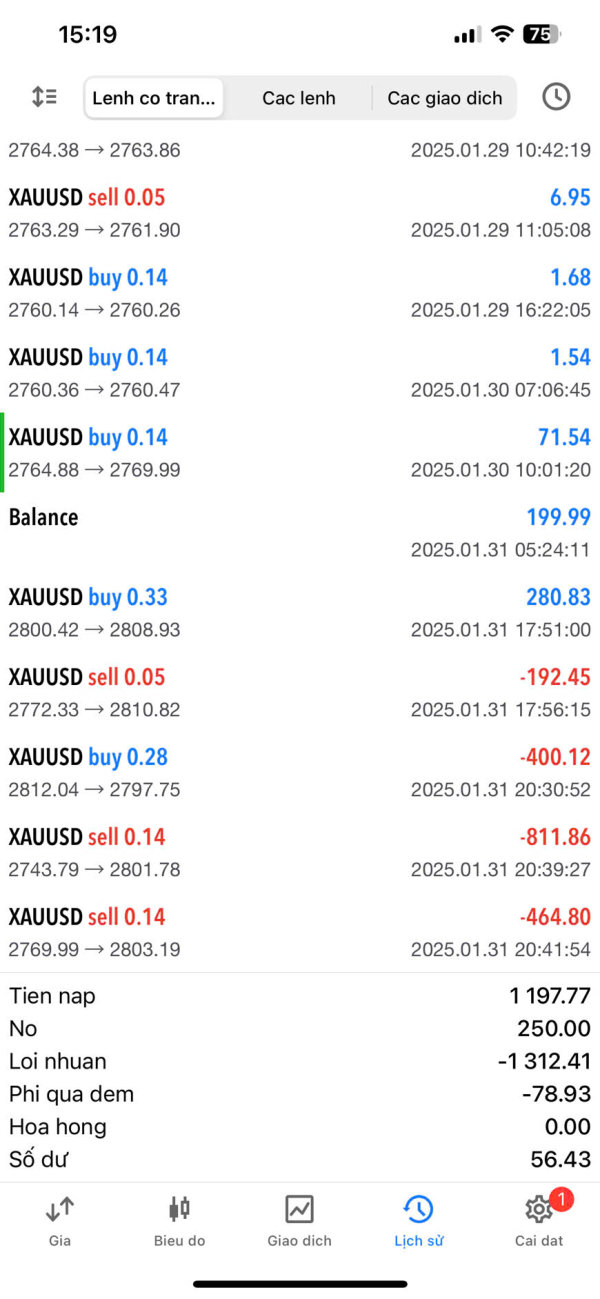

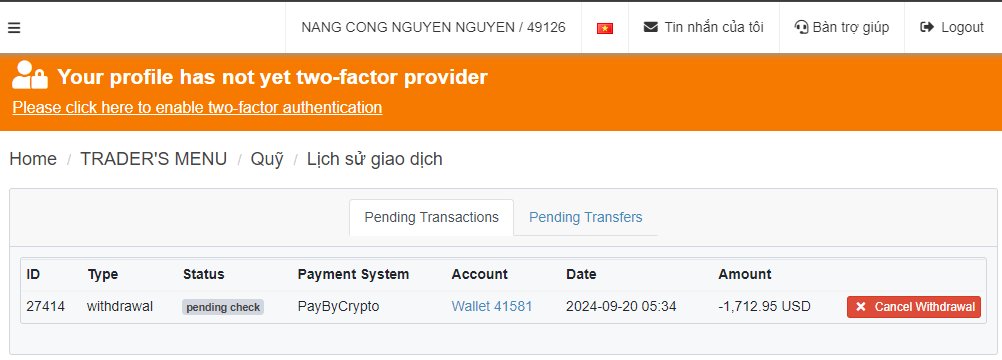

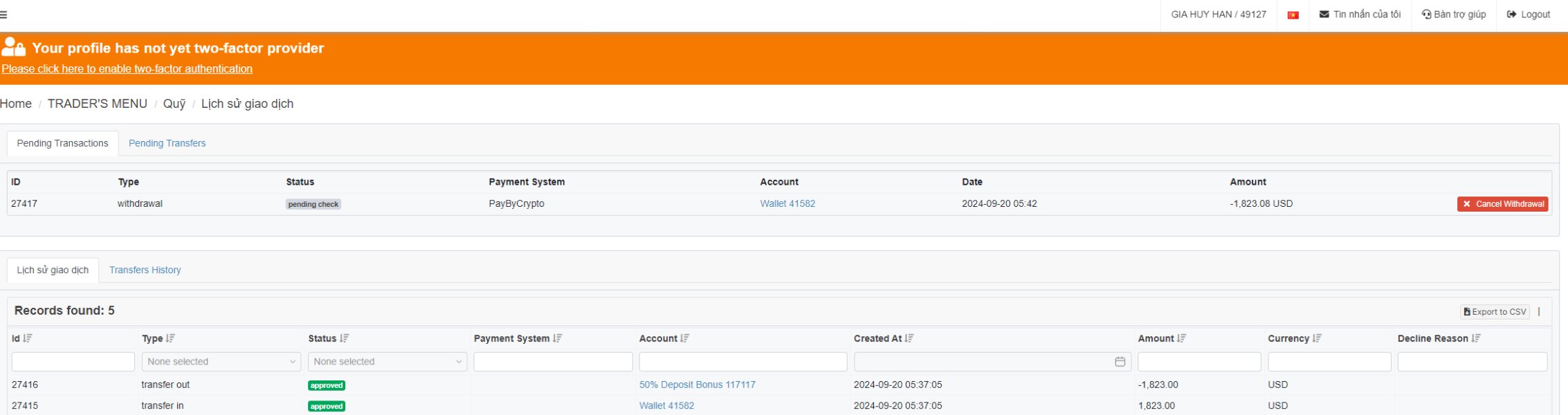

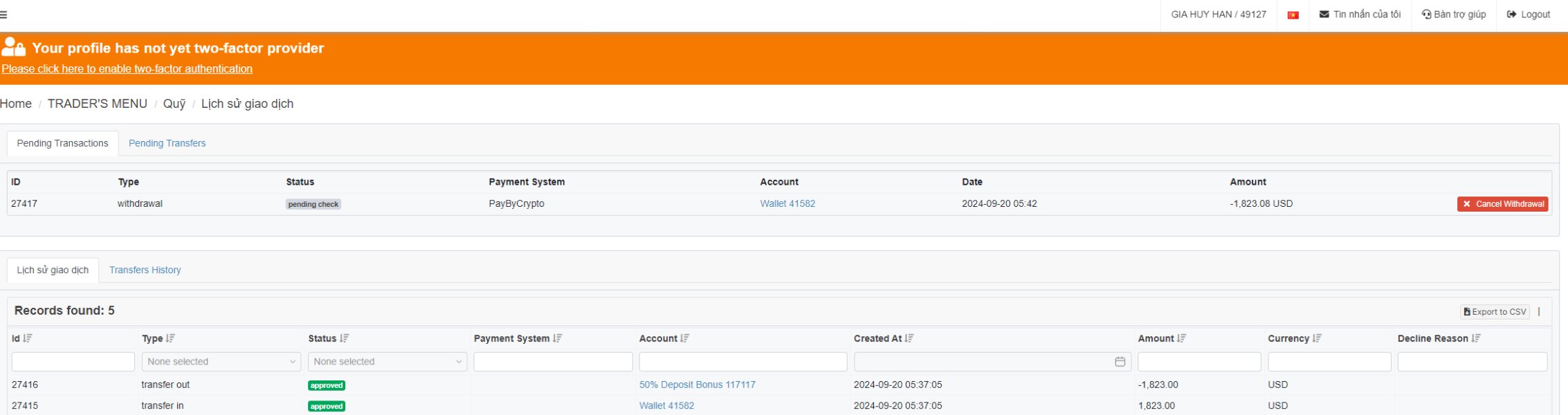

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available materials. User feedback indicates satisfactory withdrawal processing speeds.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in publicly available information. This potentially indicates flexible entry requirements or lack of transparency.

Bonus and Promotional Offers: Current promotional offerings, welcome bonuses, or loyalty programs are not detailed in available materials from this epfx review research.

Tradable Assets: The broker offers comprehensive market access including forex currency pairs, precious metals (gold, silver), energy commodities (oil, gas), major global stock indices, and individual stock CFDs across multiple markets.

Cost Structure: Spreads are advertised starting from 0 pips on major currency pairs. However, specific commission rates, overnight financing costs, and additional fees are not clearly detailed in available documentation.

Leverage Ratios: Maximum leverage of 1:500 is available to eligible traders. Micro lot trading capabilities support flexible position sizing strategies.

Platform Options: MetaTrader 5 serves as the primary trading platform. It provides advanced charting tools, technical indicators, automated trading capabilities, and mobile accessibility.

Geographic Restrictions: Specific country restrictions or regulatory limitations are not clearly outlined in available materials.

Customer Support Languages: Supported languages for customer service are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

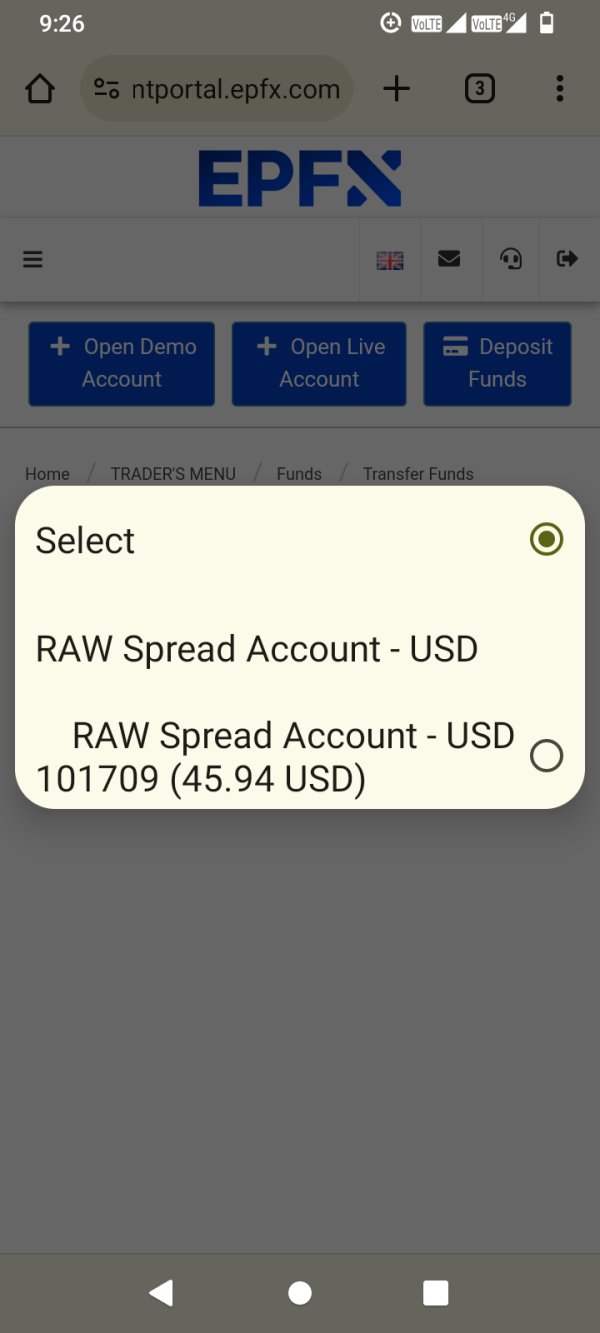

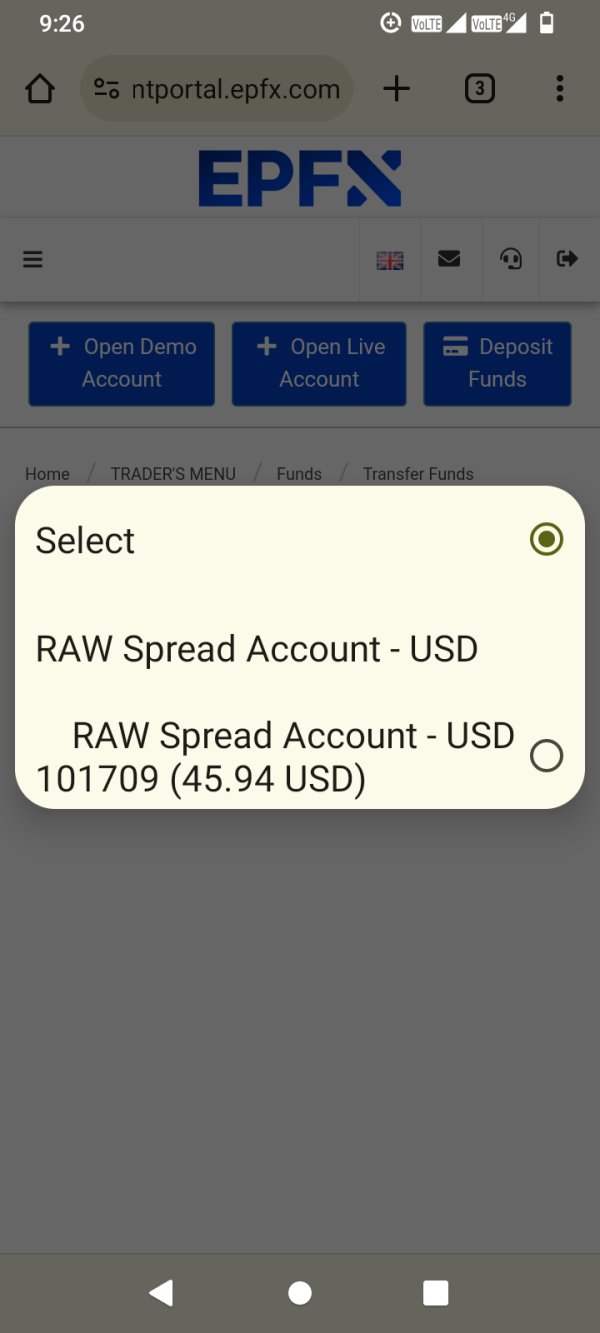

EPFX's account structure presents mixed transparency levels that impact trader decision-making. While the broker offers micro lot trading capabilities and high leverage ratios up to 1:500, specific details about account types, minimum deposit requirements, and fee structures remain unclear in publicly available materials. This epfx review finds that the lack of detailed account information may deter traders who prioritize comprehensive cost analysis before committing funds.

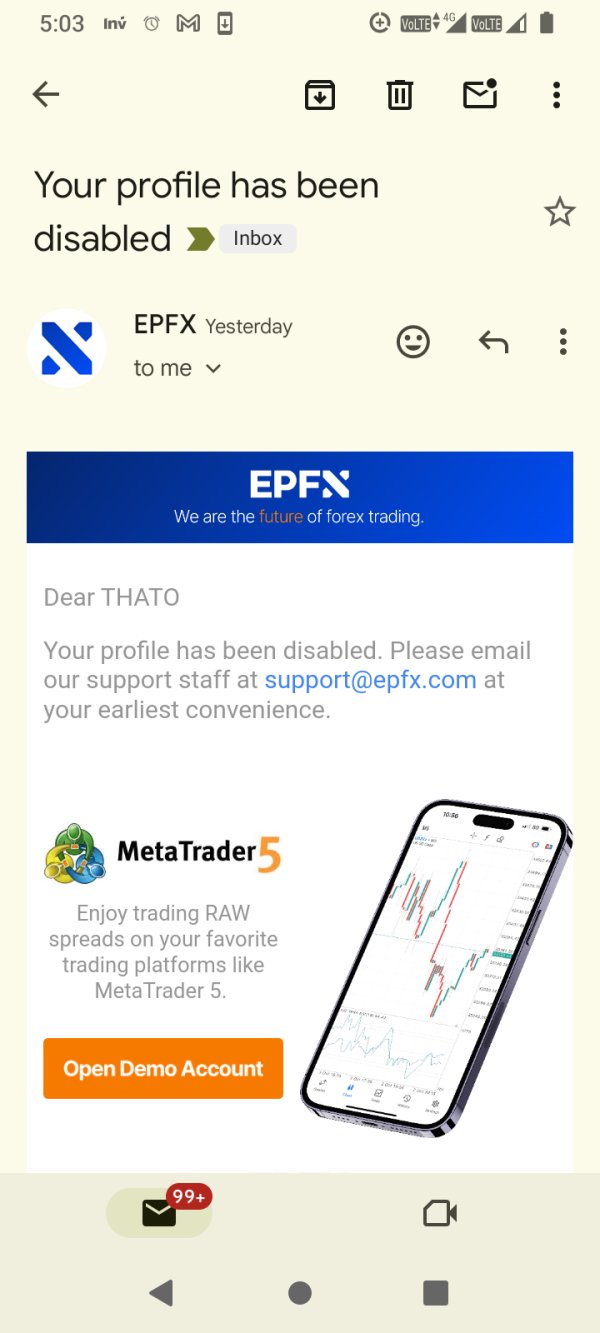

The absence of clearly defined account tiers or VIP programs suggests either a simplified account structure or insufficient marketing transparency. User feedback from Trustpilot indicates positive experiences with withdrawal processing, suggesting functional account management systems despite limited public documentation. However, without clear information about account opening procedures, verification requirements, or special account features like Islamic accounts, potential clients face uncertainty when evaluating suitability.

The broker's competitive leverage offering of 1:500 and micro lot capabilities indicate accommodation for both small and large traders. However, the lack of detailed margin requirements and risk management tools raises questions about comprehensive account protection measures. According to available information, EPFX appears to focus more on trading execution than account service transparency.

EPFX demonstrates strong performance in trading instrument diversity. The broker offers over 300 tradable assets across multiple market categories. The broker provides comprehensive access to forex currency pairs, including major, minor, and exotic pairs, alongside precious metals trading in gold and silver.

Commodity traders can access energy markets including crude oil and natural gas. Equity enthusiasts benefit from global stock index CFDs and individual stock trading opportunities. The MetaTrader 5 platform serves as the primary trading interface, providing traders with institutional-grade tools including advanced charting capabilities, technical indicators, automated trading systems, and real-time market data feeds.

The platform's mobile compatibility ensures traders can manage positions and monitor markets across devices. This supports both desktop and mobile trading strategies. However, this analysis reveals limited information about additional research resources, market analysis tools, or educational materials that many brokers provide to support trader development.

The absence of detailed information about economic calendars, daily market commentary, or trading signals suggests either minimal research support or inadequate marketing of available resources. Despite these limitations, the core trading tool offering remains comprehensive and suitable for active traders across multiple markets.

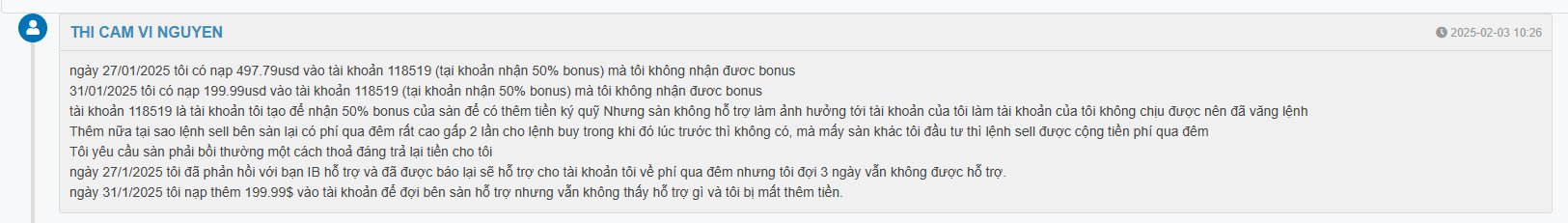

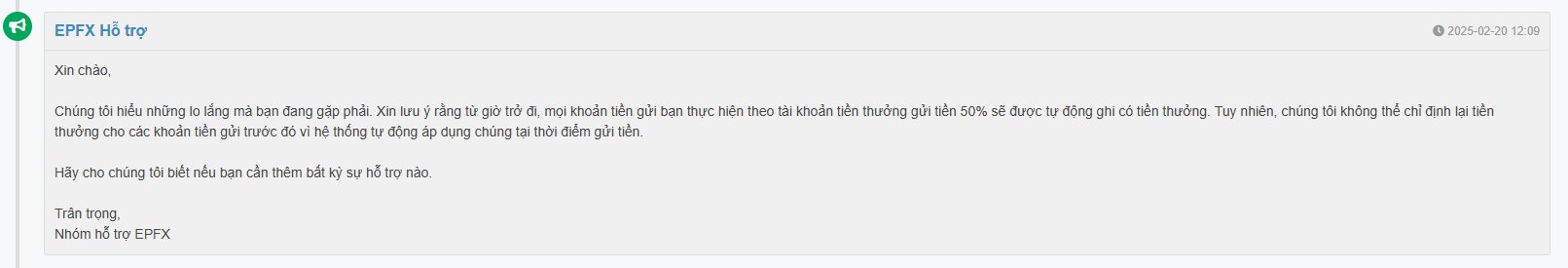

Customer Service and Support Analysis (Score: 7/10)

Customer service evaluation for EPFX relies primarily on user feedback rather than detailed service specifications. Comprehensive support channel information is not readily available. Trustpilot reviews highlight positive experiences with withdrawal processing speeds, indicating efficient back-office operations and responsive financial transaction handling.

Users specifically mention "fast withdrawals" as a notable positive aspect of their experience with the broker. The lack of detailed information about customer support channels, operating hours, or multilingual capabilities presents challenges for potential clients seeking comprehensive service assurance. Without clear documentation of live chat availability, phone support options, or email response timeframes, traders cannot fully assess support accessibility before account opening.

However, the absence of significant negative feedback regarding customer service issues in available user reviews suggests adequate support quality for existing clients. The broker's Trustpilot rating of 3.8 out of 5 indicates moderate satisfaction levels, though the limited review volume of 57 responses provides a relatively small sample size for comprehensive service quality assessment. Improvement opportunities exist in service transparency and communication channel documentation.

Trading Experience Analysis (Score: 8/10)

The trading experience evaluation for EPFX centers on MetaTrader 5 platform performance and execution quality based on available user feedback. The platform choice provides traders with industry-standard functionality including advanced charting tools, technical analysis capabilities, automated trading support through Expert Advisors, and comprehensive order management systems. User reviews do not indicate significant negative feedback regarding platform stability or execution quality.

EPFX's ECN business model suggests institutional-level execution speeds and pricing transparency. However, specific performance metrics such as average execution times or slippage statistics are not publicly available. The advertised spreads starting from 0 pips on major currency pairs indicate competitive pricing structures, while the 1:500 leverage capability provides substantial trading flexibility for qualified accounts.

The absence of reported execution problems or platform downtime issues in available user feedback suggests reliable trading infrastructure. However, without detailed information about order types, pending order capabilities, or advanced trading features, comprehensive platform assessment remains limited. This epfx review notes that the MetaTrader 5 platform generally provides robust trading functionality, and the lack of negative user feedback supports positive trading experience expectations.

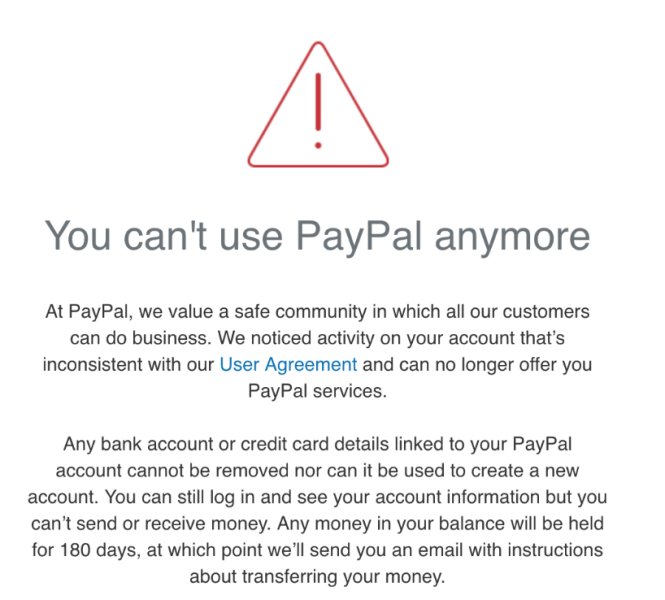

Trust and Regulation Analysis (Score: 5/10)

Trust assessment for EPFX reveals significant concerns regarding regulatory transparency and oversight clarity. While the broker claims registration in Australia and South Africa under EPFX PTY LTD, specific regulatory authority oversight details are not clearly disclosed in available materials. This lack of regulatory transparency represents a substantial trust factor concern for traders prioritizing fund security and regulatory protection.

The absence of clear regulatory license numbers, supervisory authority details, or fund protection scheme information limits trader ability to verify legitimate regulatory oversight. Without specific mention of regulatory bodies such as ASIC (Australia) or FSCA (South Africa), clients cannot independently verify regulatory compliance or understand available recourse mechanisms in case of disputes.

EPFX's relatively recent market entry in 2022 means limited operational history for assessing long-term reliability and regulatory compliance. The Trustpilot rating of 3.8 out of 5 suggests moderate user trust levels, though the limited review volume and absence of regulatory verification create uncertainty about overall trustworthiness. Traders prioritizing regulatory security may find the current transparency level insufficient for confidence-building.

User Experience Analysis (Score: 7/10)

Overall user experience assessment for EPFX relies on available feedback from 57 Trustpilot reviews. This results in a 3.8-star rating that indicates moderate satisfaction levels among existing clients. Positive feedback consistently highlights fast withdrawal processing as a notable strength, suggesting efficient account management and financial transaction handling that contributes to positive user experiences.

The broker's interface design and account management functionality details are not extensively documented in available materials. This limits comprehensive user experience evaluation. However, the MetaTrader 5 platform provides familiar functionality for experienced traders, while the absence of significant negative feedback regarding platform usability suggests adequate user interface design and navigation.

User demographic analysis indicates EPFX attracts active traders seeking high leverage opportunities and diversified asset access. However, the limited regulatory transparency may concern conservative investors. The moderate Trustpilot rating suggests mixed experiences, with positive operational aspects balanced by potential concerns about transparency and communication.

Improvement opportunities exist in account information clarity, regulatory communication, and comprehensive service documentation to enhance overall user confidence and satisfaction.

Conclusion

This comprehensive epfx review reveals a broker with strong trading capabilities but notable transparency limitations. EPFX offers competitive trading conditions including high leverage up to 1:500, diverse asset selection exceeding 300 instruments, and efficient withdrawal processing that users appreciate. The MetaTrader 5 platform provides robust trading functionality suitable for active traders across multiple markets.

However, significant concerns exist regarding regulatory transparency and account information disclosure. The broker's suitability primarily extends to experienced traders comfortable with moderate regulatory uncertainty who prioritize trading conditions over comprehensive oversight protection. Conservative investors or those requiring detailed regulatory assurance may find EPFX's current transparency level insufficient for their risk tolerance.

The main advantages include competitive leverage, diverse trading instruments, and efficient operational processing. Key disadvantages encompass unclear regulatory oversight and limited account structure transparency. Potential clients should carefully evaluate these factors against their individual trading priorities and risk management requirements.