goldfx 2025 Review: Everything You Need to Know

Abstract

GoldFX has become a broker known for its wide range of offerings. However, it is widely seen as a high-risk offshore company that operates without proper oversight. In this goldfx review, the broker's main problems include no regulation from top authorities and many user complaints about slow withdrawal processing. Despite these serious issues, GoldFX offers over 2,500 tradable instruments and provides competitive spreads as low as 1 pip, which appeals to traders who want diverse assets. The platform mainly serves experienced traders who care more about accessing many markets than having regulatory safety. Various independent sources like FXLeaders and The Forex Review have pointed out these features, showing a broker that does well in variety but struggles with trust and service problems. Overall, while GoldFX provides an impressive set of trading tools, its operational risks require extra caution for anyone using the platform.

Important Notice

GoldFX operates without backing from top regulatory bodies. This means that differences in rules and oversight can create big risks for users. This assessment uses data from independent reviews including FXLeaders and The Forex Review, among others. As an offshore broker, GoldFX exposes clients to risks that don't exist with brokers regulated by Tier-1 authorities. Also, differences in how things work in different regions and the lack of clear policies make the trading environment more complicated. Potential users should think about these limits and check their risk tolerance before using the broker. The evaluation here relies on multiple independent sources and reflects the most current information available.

Rating Framework

Broker Overview

GoldFX is a relatively unknown player in the forex industry with its headquarters in Cambodia. As an offshore broker, the company mainly serves online forex traders by providing a wide trading environment. The exact founding year is not shared in the available information, but GoldFX's business model focuses on offering many financial instruments along with educational support for traders. The broker stands out with a strong selection of traditional and modern assets, trying to serve diverse clients who value a wide product range. Despite these offerings, some operational details stay unclear, which leads to a view of high risk among industry watchers.

For trading execution, GoldFX uses the MetaTrader 5 platform, a respected application widely used in the industry. This goldfx review also notes that the broker supports many asset classes including forex pairs, stocks, indices, and commodities. The use of MT5 ensures that traders can access advanced charting tools and technical analysis features. However, the platform's overall potential is somewhat hurt by the lack of regulatory oversight from top authorities. This mix of a complete product suite and major regulatory problems makes GoldFX a broker that may suit experienced traders who are less worried about risk and want variety over total security. Sources like Forex Academy and Planet of Reviews stress that while the toolset is impressive, the operational risks tied to the broker should not be ignored.

Regulatory Region :

GoldFX is classified as an offshore broker and is not regulated by any major financial authorities. This lack of top oversight marks GoldFX as a high-risk option, especially for traders worried about fund safety. According to industry sources, the absence of strict regulatory controls is a major factor in the overall caution advised with this broker.

Deposit and Withdrawal Methods :

Information about GoldFX's deposit and withdrawal methods is not detailed in the available resources. While users have reported delays in processing withdrawals, specific payment options and processing times remain unclear in the current summary.

Minimum Deposit Requirements :

Specific details on the minimum deposit required to open an account with GoldFX are not shared in the information provided. This missing information adds to the overall lack of clarity in account conditions.

Bonus and Promotions :

The available data does not provide clarity on any bonus programs or promotional offers by GoldFX. Potential traders should contact the broker directly for more details, as such incentives are not clearly highlighted.

Tradable Assets :

GoldFX offers a wide range of tradable assets, featuring over 2,500 instruments. These include forex pairs, stocks, indices, and commodities, giving traders many options to diversify their portfolios. This broad selection is one of the broker's most appealing features, as noted in various goldfx review discussions.

Cost Structure :

The cost structure at GoldFX is only partly transparent, with competitive spreads reported at as low as 1 pip. However, complete details about commissions and other fees are not provided. This leaves some parts of the cost model unclear, requiring potential traders to be careful. Although the spread competitiveness is a strong selling point, the lack of complete fee disclosure means users might face unexpected costs in practice.

Leverage Ratio :

Information about the maximum leverage available on GoldFX is not provided in the current summary. This absence further adds to the lack of clarity in the broker's account conditions, especially for traders who focus on leverage specifications.

Platform Options :

GoldFX mainly uses the MetaTrader 5 platform, offering access to advanced trading tools and technical analysis utilities. This focus on a well-regarded platform is noted as a positive aspect of the broker's offering, confirming its ability to support various trading strategies.

Regional Restrictions :

No specific information is available about regional restrictions imposed by GoldFX. This lack of detail means potential clients should ask directly about any territorial limits that might affect their ability to trade.

Customer Service Languages :

The summary does not specify the languages supported by GoldFX's customer service. As with other areas, potential users might need to contact the broker to confirm language availability.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

The account conditions offered by GoldFX present major concerns based on the available data. The broker does not provide detailed information about commissions, minimum deposit requirements, or leverage options. This lack of clarity makes it hard for potential clients to form an informed opinion about the financial commitment and ongoing costs tied to trading through GoldFX. The absence of these critical details not only hurts transparency but also raises doubts about the broker's commitment to best industry practices. In various independent reports and user feedback, traders have been unable to verify the credibility of the account types available. As a result, this lack of clarity has led to a low score of 3/10 in our evaluation. In this goldfx review, the limited disclosure in account conditions clearly hurts user confidence, putting GoldFX at a disadvantage compared to more transparent brokers.

GoldFX excels when it comes to the variety of trading tools and resources available. The broker offers over 2,500 tradable instruments covering many asset classes including forex pairs, stocks, indices, and commodities. This wide selection allows traders to diversify their portfolios and explore multiple markets, which is a big advantage for experienced traders looking for strong trading options. Despite the impressive range, specifics around extra research tools, educational content, and automated trading support are not thoroughly detailed in the provided information. Still, the complete market offering and the use of the MT5 platform help position GoldFX well in this aspect. The rich array of tools is well-received by users, even though some additional features could enhance the overall trading experience. This strong focus on asset variety and resource availability justifies the score of 8/10 assigned for tools and resources.

2.6.3 Customer Service and Support Analysis

Customer service is a critical area where GoldFX appears to fall short. Reviews and ratings from platforms like Trustpilot consistently point to delays in withdrawal processing, which severely hurt client satisfaction. Users have reported that the support team is often unresponsive, particularly when addressing issues related to funds and transaction confirmations. The limited information on multilingual support and clear communication channels further makes these challenges worse. Although details about specific contact methods or hours of operation are scarce in the available information, the recurring theme in user feedback indicates that response times and issue resolution are problematic. Such shortcomings in customer service contribute to the overall low score of 4/10 in this category. This analysis shows the need for improved client support and operational efficiency to build trust and reliability for current and potential users.

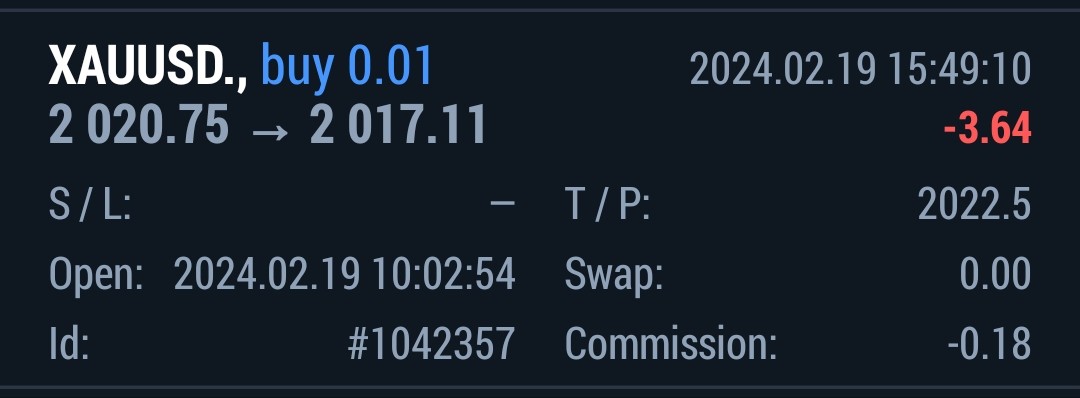

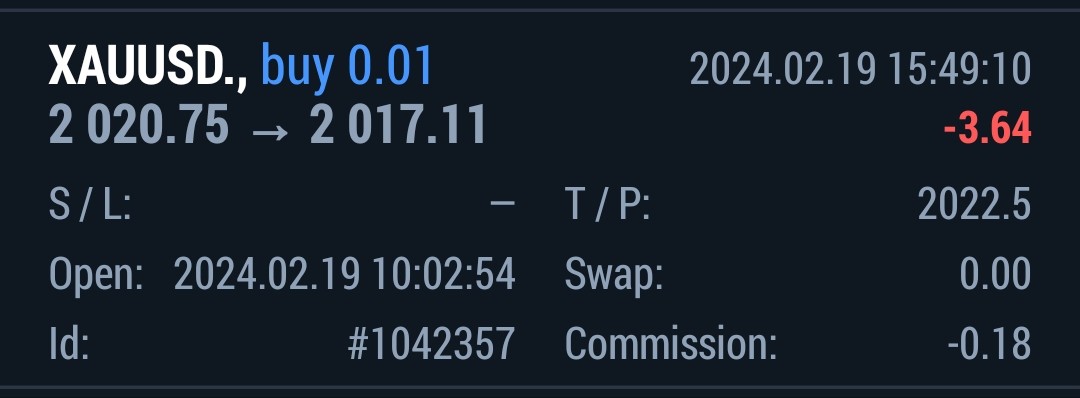

2.6.4 Trading Experience Analysis

The trading experience on GoldFX is characterized by the use of the MetaTrader 5 platform, which is widely known for its reliability and advanced functionality. Many traders appreciate the platform's strong charting tools, technical indicators, and overall execution quality. However, while the platform itself is a strong suit, several critical execution details such as potential issues with slippage and re-quotes have not been fully disclosed in the available reports. In trading conditions where even minor differences in execution can affect profitability, this lack of detail is noteworthy. Feedback from users suggests that while the overall environment is stable—with competitive spreads of 1 pip enhancing the trading value—the missing detailed information about order execution remains an area of concern. This goldfx review highlights a balanced view where the platform's strengths in offering modern tools are offset by incomplete transparency on execution specifics, leading to a trading experience score of 6/10.

2.6.5 Trustworthiness Analysis

Trust remains a major challenge for GoldFX given the absence of regulation from top financial oversight bodies. The broker operates as a high-risk offshore entity, exposing users to additional uncertainties and potential safety issues regarding their funds. Investor confidence is further hurt by reports of delayed withdrawal processes and lack of clear fund protection measures. Despite a wide range of tradable instruments, the inherent absence of strong regulatory supervision requires caution. Reviews from independent sources and user reports reflect severe concerns about the reliability and integrity of the broker. With no verifiable guarantees for fund security and transparency, the trustworthiness of GoldFX is significantly compromised. These factors collectively justify the very low trust score of 2/10.

2.6.6 User Experience Analysis

The overall user experience with GoldFX is mixed, largely due to internal inconsistencies in service quality and operational transparency. Many users have reported difficulties with the registration process and account verification steps, though specific details are not widely documented. The interface design and usability of the MT5 platform generally receive positive remarks; however, persistent issues—most notably in withdrawal processing—hurt the overall trading experience. User testimonials indicate that the delay in accessing funds has been a primary source of frustration. While some traders appreciate the broad selection of trading instruments, the inconvenience caused by slower customer support and unclear operational procedures takes away significantly from the overall satisfaction. There is a considerable gap between the potential of the platform and the realities of user experience, ultimately resulting in a moderate rating score of 5/10. This assessment shows the need for GoldFX to focus on improvements in operational efficiency and client communications to truly meet user expectations.

Conclusion

In summary, while GoldFX provides a vast array of trading instruments with competitive conditions, major shortcomings in regulatory oversight and customer support create substantial risks. This review highlights that advanced traders seeking diversity may find the platform's asset variety appealing, yet the lack of transparency and frequent withdrawal delays suggest that the broker is not suited for all investors. The key strengths lie in the wide toolset and the reliable MT5 platform, but these are balanced by crucial issues such as unregulated operations and poor customer service. As such, cautious, experienced traders who can navigate higher risk levels may consider GoldFX, while others might be better off exploring more regulated alternatives.