Globex360 2025 Review: Everything You Need to Know

Executive Summary

Globex360 is a South African-regulated forex broker. The company has been operating since 2017 and provides trading services under the oversight of the Financial Sector Conduct Authority. This globex360 review reveals that the broker offers competitive trading conditions with a minimum deposit requirement of just $20 and leverage up to 1:500. These features make it accessible to both new and experienced traders.

The broker operates primarily through the MetaTrader 4 platform. It offers access to multiple asset classes including forex, commodities, stocks, and indices. According to reports from 55brokers, Globex360 has received a user rating of 80 points. This rating indicates generally positive user satisfaction. The broker's low entry barrier and high leverage options position it as an attractive choice for traders seeking cost-effective trading solutions.

Globex360's regulatory status under the South African FSCA provides a foundation of legitimacy and security for its operations. The broker's focus on providing flexible trading conditions and diverse financial products has helped establish its presence in the competitive forex market since its inception in 2017.

Important Notice

Globex360 operates primarily in South Africa under FSCA regulation. Users should be aware that regulatory requirements may vary across different jurisdictions. Traders from other regions should verify the applicable regulations in their respective countries before opening an account.

This review is based on comprehensive analysis of user feedback and publicly available information from various sources. The evaluation aims to provide an objective assessment of Globex360's services, features, and overall performance in the forex trading market.

Rating Framework

Broker Overview

Company Background and Establishment

Globex360 was established in 2017 as an online forex and CFD broker headquartered in South Africa. The company has positioned itself as a provider of flexible trading conditions and diverse financial products. It focuses on serving clients across different experience levels. Since its inception, Globex360 has worked to build its reputation in the competitive online trading market by offering accessible entry points and competitive trading terms.

The broker operates under a business model that emphasizes accessibility and flexibility. It pays particular attention to accommodating traders who may be new to the forex market. According to traders.mba, Globex360 has established itself as a comprehensive broker offering various trading opportunities across multiple asset classes.

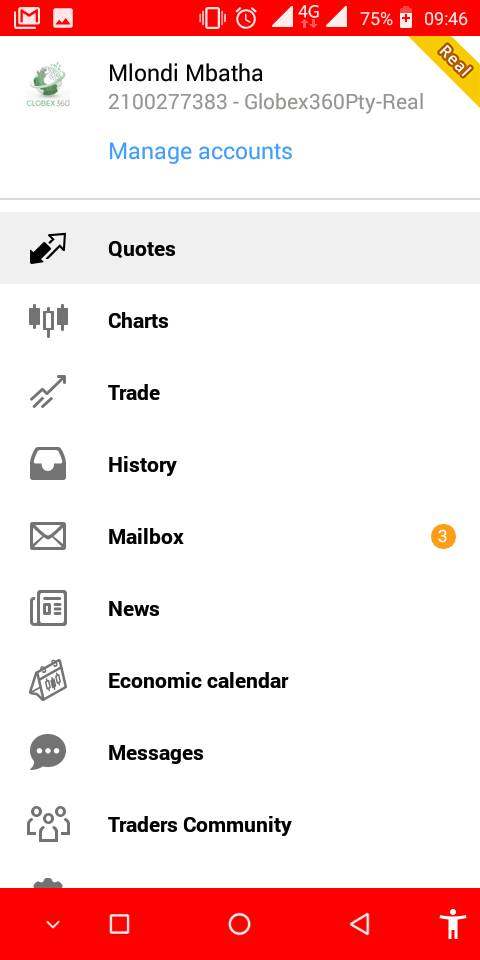

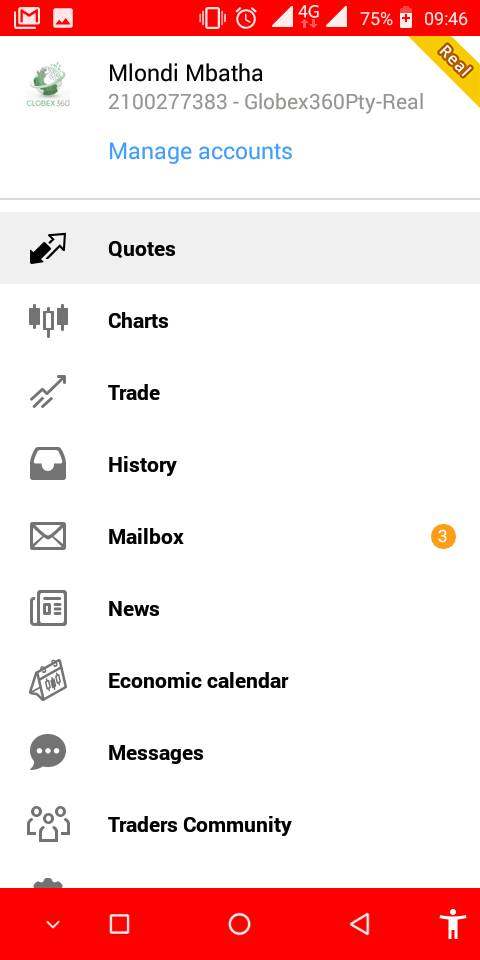

Trading Platform and Asset Coverage

Globex360 utilizes the widely popular MetaTrader 4 platform. This platform is renowned among traders for its robust functionality and user-friendly interface. The platform provides access to advanced charting tools, technical indicators, and automated trading capabilities that cater to both manual and algorithmic trading strategies.

The broker offers trading opportunities across multiple asset classes. These include foreign exchange pairs, commodities, individual stocks, and market indices. This diversified asset coverage allows traders to build varied portfolios and take advantage of different market opportunities. The company operates under the regulatory oversight of the South African Financial Sector Conduct Authority, which provides a framework of compliance and operational standards.

Regulatory Jurisdiction: Globex360 operates under the regulation of the South African Financial Sector Conduct Authority. This ensures compliance with local financial services regulations and provides a legal framework for its operations.

Minimum Deposit Requirements: The broker maintains an accessible entry point with a minimum deposit requirement of $20. This makes it particularly attractive for new traders or those looking to start with smaller capital amounts.

Leverage Ratios: Globex360 offers maximum leverage of up to 1:500. This provides traders with significant leverage opportunities for position sizing, though traders should be aware of the associated risks with high leverage trading.

Tradeable Assets: The broker provides access to multiple asset categories. These include forex currency pairs, commodities such as precious metals and energy products, individual company stocks, and major market indices. This offers comprehensive market exposure.

Trading Platform: The primary trading platform is MetaTrader 4. This provides users with professional-grade trading tools, advanced charting capabilities, and technical analysis indicators essential for effective trading decisions.

Cost Structure: Specific information regarding spreads and commission structures was not detailed in available sources. Prospective users are advised to inquire directly with the broker for comprehensive pricing information.

Deposit and Withdrawal Methods: Detailed information about specific deposit and withdrawal methods was not mentioned in the available source materials. This requires direct consultation with the broker for payment processing details.

Promotional Offers: Information regarding bonus programs or promotional activities was not specified in the source materials. Interested traders should contact the broker directly for current promotional offerings.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Globex360 demonstrates strong performance in account conditions. This is primarily due to its accessible minimum deposit requirement of $20 and competitive leverage offerings. This low entry threshold makes the broker particularly attractive to newcomers to forex trading who may not have substantial initial capital. The broker's account structure appears designed to accommodate traders across different experience levels and capital ranges.

The high leverage ratio of up to 1:500 provides experienced traders with significant position-sizing flexibility. However, this also requires careful risk management. According to the 55brokers evaluation, Globex360 received an 80-point user rating. This suggests general satisfaction with account terms and conditions. The combination of low minimum deposits and high leverage creates an appealing proposition for traders seeking flexible trading conditions.

However, specific details about different account types, Islamic account options, or premium account features were not detailed in available sources. The account opening process and verification requirements also lack specific documentation in the reviewed materials. This globex360 review indicates that while the basic account conditions are competitive, more detailed information about account varieties and special features would enhance the overall offering.

The broker's tool and resource offering centers around the MetaTrader 4 platform. This platform is widely recognized as an industry-standard trading platform. MT4 provides users with comprehensive charting capabilities, technical analysis tools, and support for automated trading through Expert Advisors. The platform's reliability and extensive feature set contribute positively to the overall trading experience.

Globex360 supports trading across multiple asset classes including forex, commodities, stocks, and indices. This provides traders with diversified investment opportunities. This variety allows for portfolio diversification and the ability to capitalize on different market conditions across various financial instruments.

However, the available source materials do not provide specific details about additional research resources, market analysis tools, or educational materials that the broker may offer. The absence of information about proprietary analysis tools, daily market reports, or educational resources represents a gap in the available information. While MT4 provides excellent basic functionality, the lack of detail about supplementary tools and resources prevents a higher rating in this category.

Customer Service and Support Analysis (6/10)

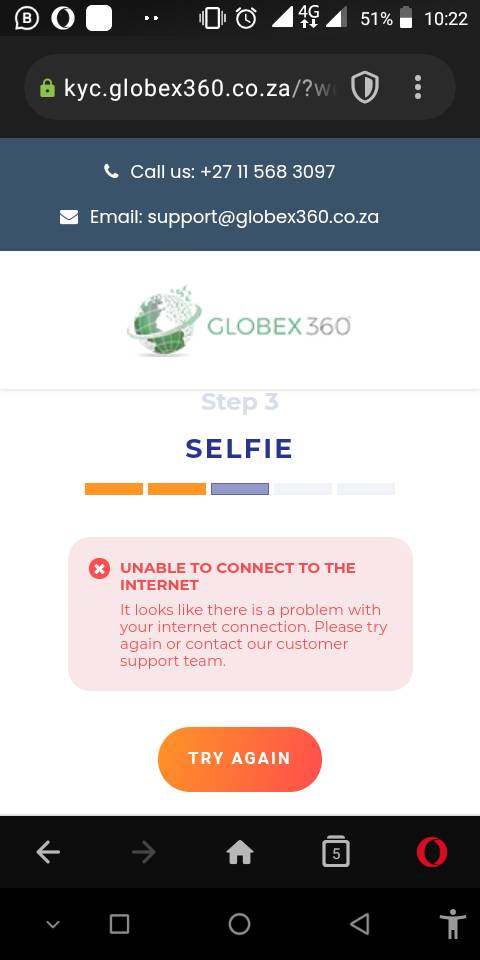

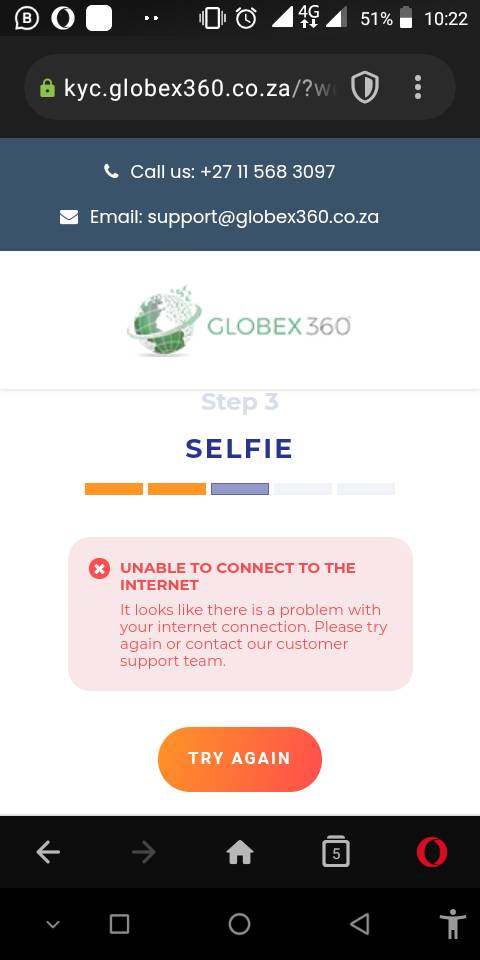

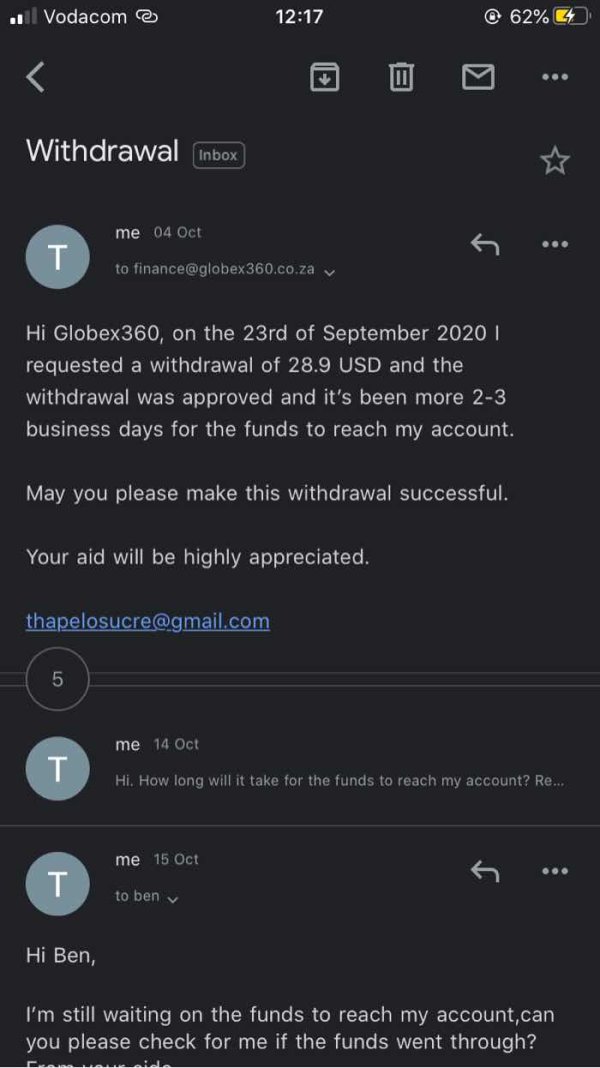

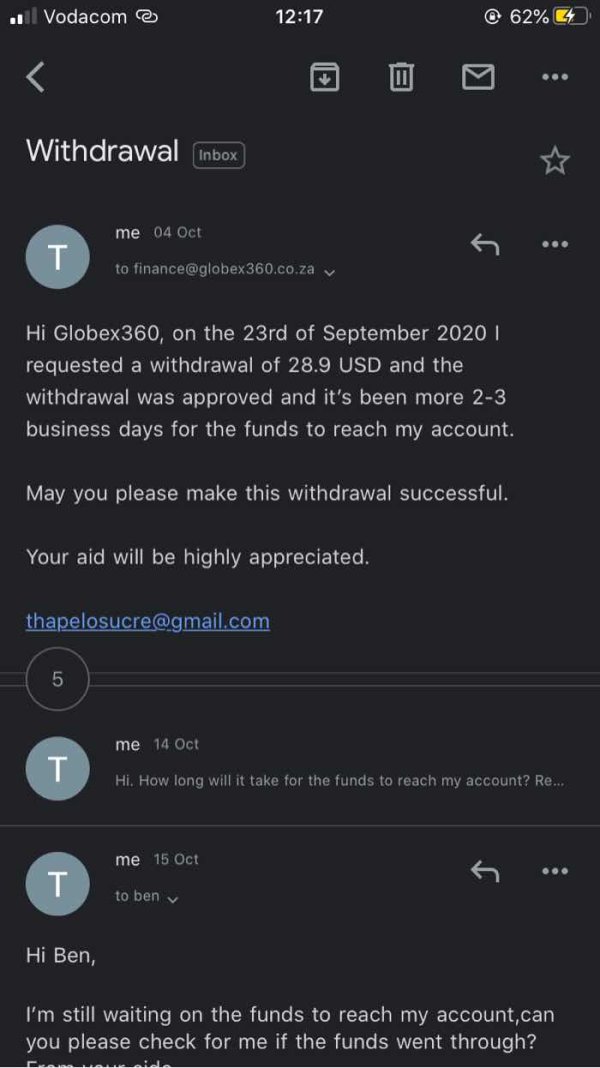

Customer service evaluation for Globex360 presents some limitations. This is due to insufficient detailed information in available sources. While customer review pages exist, specific ratings for customer service quality, response times, and service effectiveness were not detailed in the reviewed materials.

The availability of customer support channels was not specified in the source materials. This includes phone, email, live chat options, and their respective operating hours. Multilingual support capabilities and the geographical coverage of customer service operations also lack specific documentation. This is particularly relevant given the broker's South African base and potential international client base.

Response time metrics, problem resolution effectiveness, and user satisfaction with customer service interactions were not quantified in the available information. The absence of specific customer service performance data and user testimonials about support quality necessitates a conservative rating. Prospective clients would benefit from direct inquiry about customer service capabilities and availability before committing to the platform.

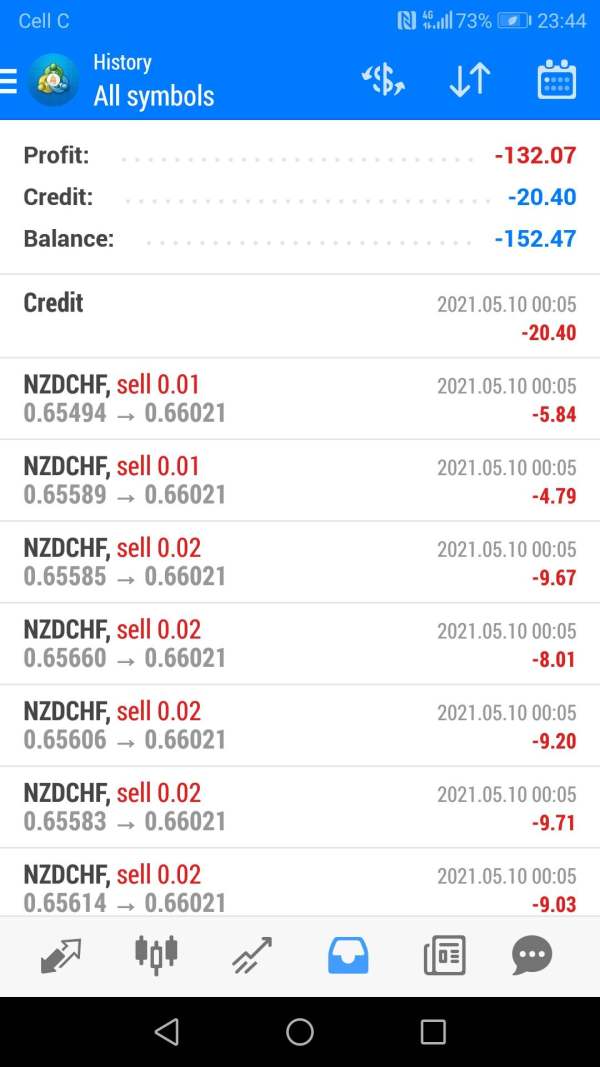

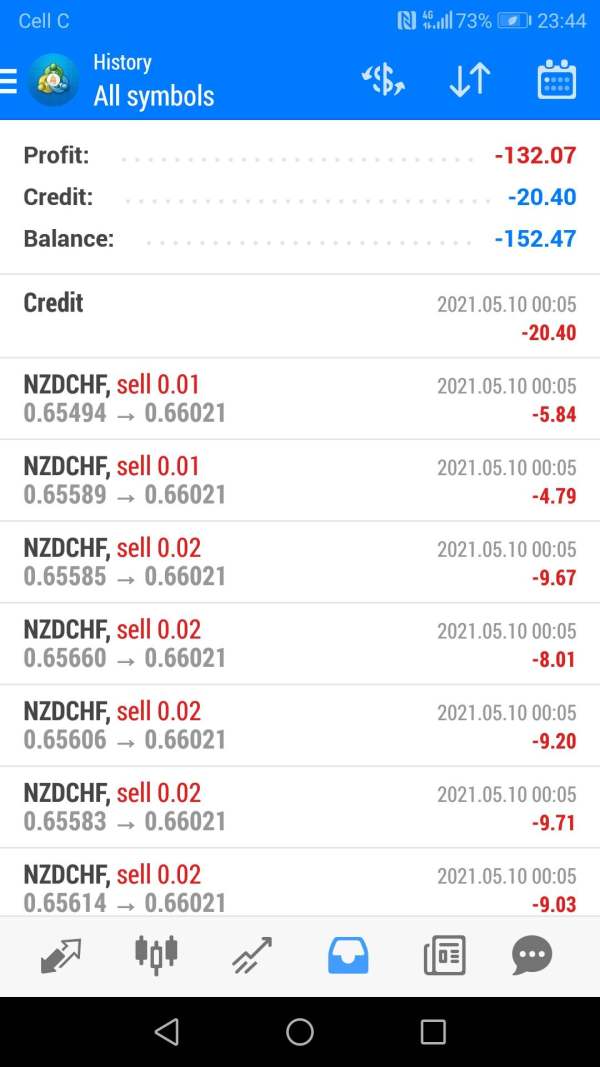

Trading Experience Analysis (7/10)

The trading experience with Globex360 is primarily built around the MetaTrader 4 platform. This platform generally receives positive feedback from the trading community for its stability and comprehensive functionality. MT4's proven track record and extensive feature set contribute to a solid foundation for trading activities.

However, specific performance metrics were not detailed in the available source materials. These include execution speed, slippage rates, and requote frequency. These technical performance indicators are crucial for assessing the quality of trade execution and overall trading experience. The absence of concrete data about server uptime, connection stability, and order processing times limits the ability to provide a comprehensive evaluation.

Mobile trading capabilities and the quality of the mobile application experience were also not specifically addressed in the reviewed materials. Given the importance of mobile trading in today's market, this represents a significant information gap. User feedback about the overall trading environment, including spread competitiveness and liquidity provision, was not extensively documented in the available sources. This globex360 review suggests that while the MT4 foundation is solid, more specific performance data would strengthen the evaluation.

Trustworthiness Analysis (7/10)

Globex360's trustworthiness is anchored by its regulation under the South African Financial Sector Conduct Authority. This provides a legitimate regulatory framework for its operations. This regulatory oversight ensures compliance with established financial services standards and provides some level of protection for client interests.

The broker's transparency has been mentioned in reviews. However, specific details about transparency measures, fund segregation policies, and client money protection schemes were not elaborated in the available sources. The company's operational history since 2017 provides some track record. However, detailed information about any regulatory actions, company performance history, or industry recognition was not available.

Third-party evaluation from 55brokers showing an 80-point user rating suggests generally positive user perception. However, more detailed breakdown of trust-related factors would strengthen this assessment. Information about insurance coverage, fund segregation practices, and dispute resolution mechanisms was not specified in the reviewed materials. The absence of detailed information about negative incidents, regulatory issues, or company financial stability represents a limitation in the trust evaluation.

User Experience Analysis (6/10)

User experience evaluation shows an 80-point rating from 55brokers. This indicates above-average user satisfaction with the platform. This rating suggests that users generally find the service acceptable. However, the specific factors contributing to this score were not detailed in available sources.

The MetaTrader 4 platform interface is generally well-regarded for its user-friendly design and intuitive navigation. This contributes positively to the overall user experience. The platform's familiarity among traders also reduces the learning curve for new users transitioning to Globex360.

However, specific feedback about the account opening process, verification procedures, and onboarding experience was not detailed in the source materials. Information about deposit and withdrawal convenience, processing times, and user satisfaction with fund operations was also not available. Common user complaints, areas for improvement, and specific positive feedback themes were not extensively documented. This limits the depth of user experience analysis. The broker's suitability for both novice and experienced traders is noted. However, specific user testimonials and detailed satisfaction metrics would enhance this evaluation.

Conclusion

This comprehensive globex360 review reveals a regulated forex broker that offers competitive basic trading conditions. It is particularly appealing to traders seeking low-cost entry into the forex market. The combination of a $20 minimum deposit, 1:500 leverage, and FSCA regulation creates a foundation for accessible trading opportunities.

Globex360 appears most suitable for new traders looking for an affordable entry point and experienced traders who value high leverage options and the reliability of the MT4 platform. The broker's regulatory status and competitive account conditions make it a viable option for traders prioritizing cost-effectiveness and regulatory compliance.

Key advantages include the low minimum deposit requirement, high leverage availability, and established regulatory oversight. However, notable limitations involve the lack of detailed information about customer service quality, specific trading costs, and comprehensive tool offerings. Prospective users should conduct direct inquiries to address these information gaps before making trading decisions.