Baosheng 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Baosheng presents a multifaceted investment horizon, appealing primarily to retail investors keen on diversifying their portfolios with a focus on long-term growth potential. The broker offers a broad range of investment opportunities including access to various markets, particularly in technology and emerging industries. However, alongside its potential for high returns, Baosheng is marred by scrutiny over its regulatory compliance and user safety. This duality cultivates a critical trade-off for investors, as they weigh ambitious prospects against the backdrop of significant risks tied to the broker's operation, especially regarding fee structures and withdrawal practices.

Investors should align themselves with Baosheng if they possess relevant trading experience, particularly in volatile markets, and are comfortable navigating the nuanced environment characterized by potential fees and less transparency. Contrarily, risk-averse individuals and those new to trading are likely to find Baosheng's complexities and mixed regulatory standing daunting.

⚠️ Important Risk Advisory & Verification Steps

Risk Advisory:

Investing with Baosheng could lead to notable losses due to regulatory uncertainties, withdrawal fees, and potential untrustworthiness associated with user complaints.

Potential Harms:

- Users may face high withdrawal fees, resulting in diminished returns (**$30** fee reported).

- Mixed reviews on regulatory compliance leading to concerns over fund safety.

- Reports of possibly illegitimate services or scams connected to the broker.

How to Self-Verify:

- Visit regulatory websites (e.g., NFA's BASIC database).

- Enter Baoshengs name or URL in the search tool to find registration information.

- Check user reviews on financial forums or dedicated scrutiny sites like WOT (Web of Trust).

- Document any complaints or warnings related to the broker for comprehensive insight.

- Consider engaging with current users to gauge their experiences, particularly on withdrawal processes.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 1985, Baosheng, officially known as Baosheng Science and Technology Innovation Co., Ltd., has carved a niche in the industrial sector by producing and selling specialized cable products in China. With headquarters in Yangzhou, the company taps into diverse markets, including electrical equipment and telecommunications. The broker's positioning in this sector allows it to cater to investors interested in growth opportunities, particularly in technology and emerging markets. However, as the trading landscape evolves, Baosheng's mixed regulatory reputation challenges its credibility and deter potential clients.

Core Business Overview

Baosheng offers a broad spectrum of financial products, focusing primarily on futures and options trading, with various asset classes including stocks and commodities. Its platforms provide access to both domestic and international markets, positioning it as a versatile broker for retail investors. However, it claims to operate under several regulatory bodies, a point of contention that calls for careful user scrutiny towards compliance and safety.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Regulatory Information Conflicts

The ambiguity surrounding Baosheng's regulatory framework raises significant red flags. Users have reported discrepancies in regulatory affiliation between different platforms and reviews, leading to mistrust. Some sources suggest that the broker may not maintain robust oversight, exposing investors to potential risks.

User Self-Verification Guide

- Visit the National Futures Association's BASIC page.

- Input the broker's name “Baosheng” or its website.

- Review the broker's registration status.

- Search for news or updates regarding regulatory actions or complaints.

- Consult customer testimonials from credible forums or review websites for firsthand experiences.

“I couldn‘t withdraw my funds without incurring huge fees. It made me question the broker’s legitimacy.” - Anonymous user feedback.

Industry Reputation and Summary

Despite Baoshengs established presence in the market, user feedback reflects a sample of both satisfied customers and those wary of the broker's trustworthiness. Consequently, potential investors should take proactive measures to self-verify the broker's operational legitimacy and regulatory adherence.

Trading Costs Analysis

Advantages in Commissions

Baosheng positions itself competitively with low commission structures that attract traders looking for cost-effective options. By leveraging this pricing strategy, the broker aims to increase user engagement and retention among experienced investors familiar with fluctuating market dynamics.

Traps of Non-Trading Fees

While Baosheng's commissions may be appealing, the broker carries a burden of non-trading fees, particularly high withdrawal fees that can significantly impact overall profitability. Reports indicate users faced withdrawal charges of up to **$30**, which is a deterrent for ongoing investment activity.

Cost Structure Summary

Ultimately, the cost structure offers pros for regular traders but poses substantial challenges for casual investors or those who prioritize fund accessibility. As such, investors must balance potential savings from low commissions against the hidden costs that could erode their returns.

Platform Diversity

Baosheng provides multiple trading platforms, such as MetaTrader 5 and NinjaTrader, catering to a wide range of user preferences. Each platform features customizable tools tailored for both novice and seasoned traders, enabling diverse trading strategies across different asset classes.

Quality of Tools and Resources

The broker excels in offering a host of sophisticated trading tools and educational resources, empowering users with the knowledge needed to navigate complex market landscapes. Yet, some features may not align seamlessly with the needs of beginner traders, reducing their user experience.

Platform Experience Summary

User feedback reveals a mixture of satisfaction and challenges associated with the broker's platforms. Some users have emphasized the difficulty in navigating specific features, thereby highlighting the need for improved beginner accessibility.

“The platform has great tools, but it's overwhelming for someone new to trading.” - User review excerpt.

User Experience Analysis

User Interface Feedback

Baosheng's user interface receives mixed reviews, with seasoned traders often praising its depth and usability. However, new users frequently express frustration over complex navigation and unclear instructions, which may lead to a less than satisfactory trading experience.

Community Dynamics

Active participation from Baoshengs trading community showcases experienced traders exchanging strategies, fostering a culture of learning amongst peers. Nonetheless, the variance in user experience suggests that improved onboarding for newcomers is necessary to elevate overall satisfaction.

Customer Support Analysis

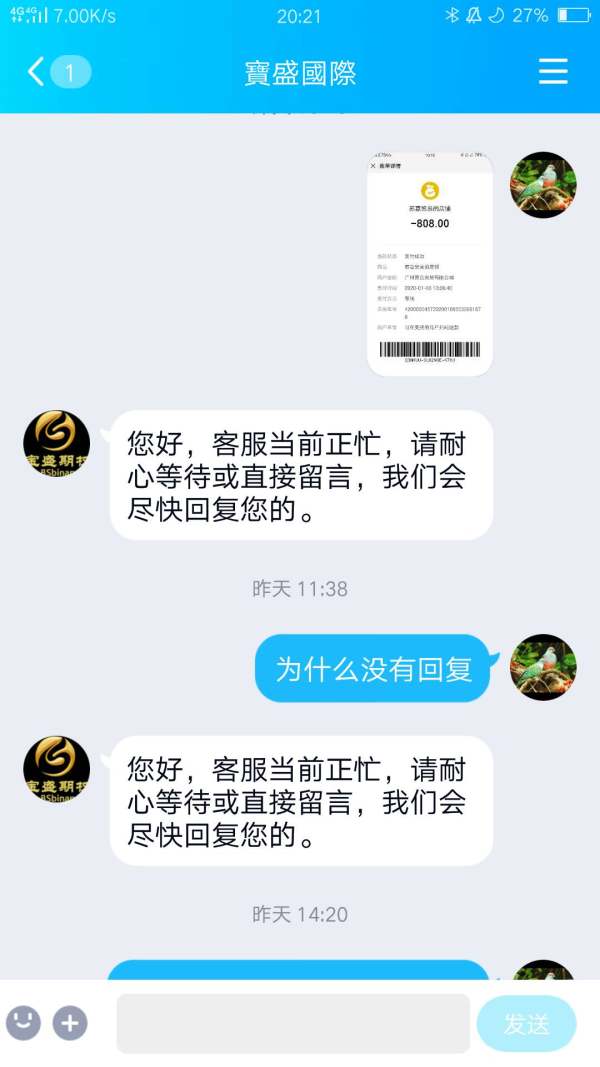

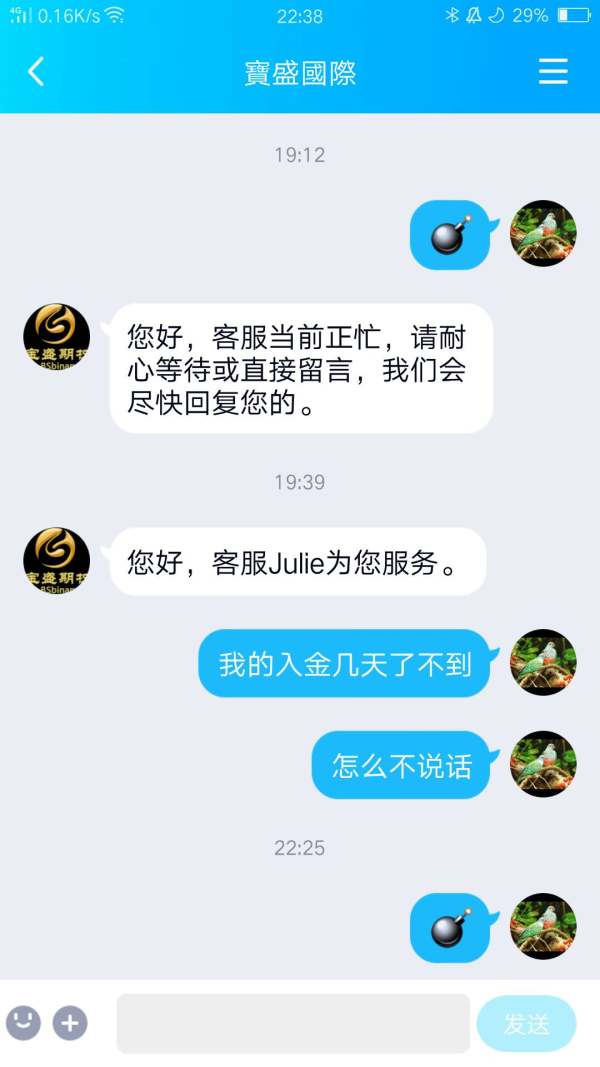

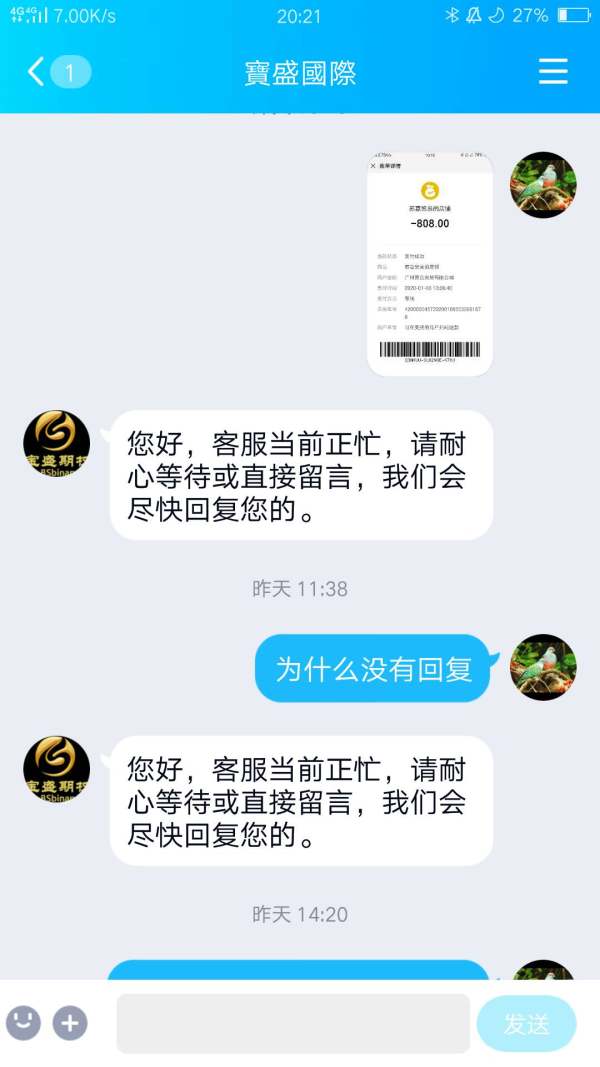

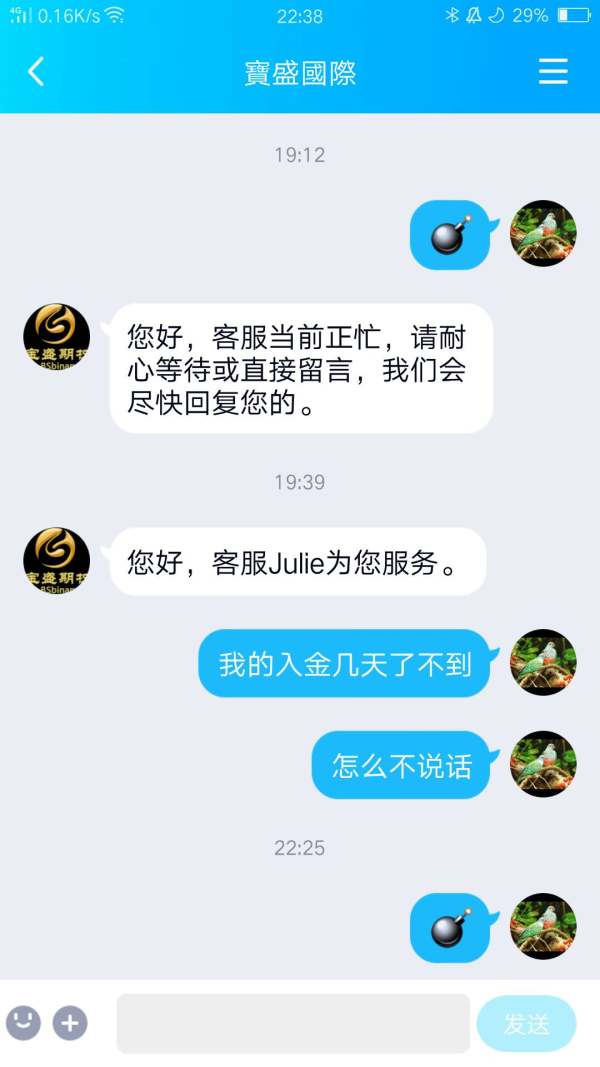

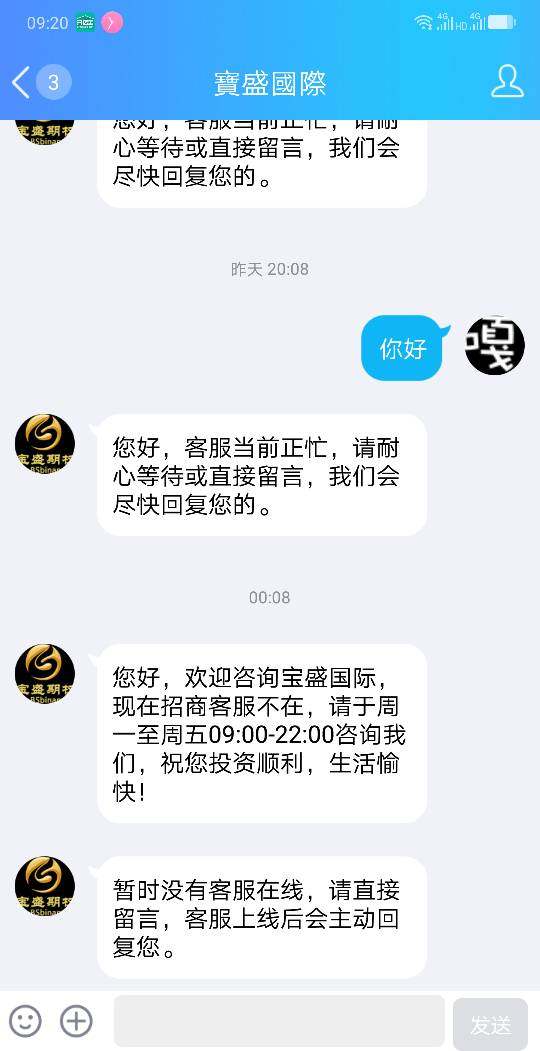

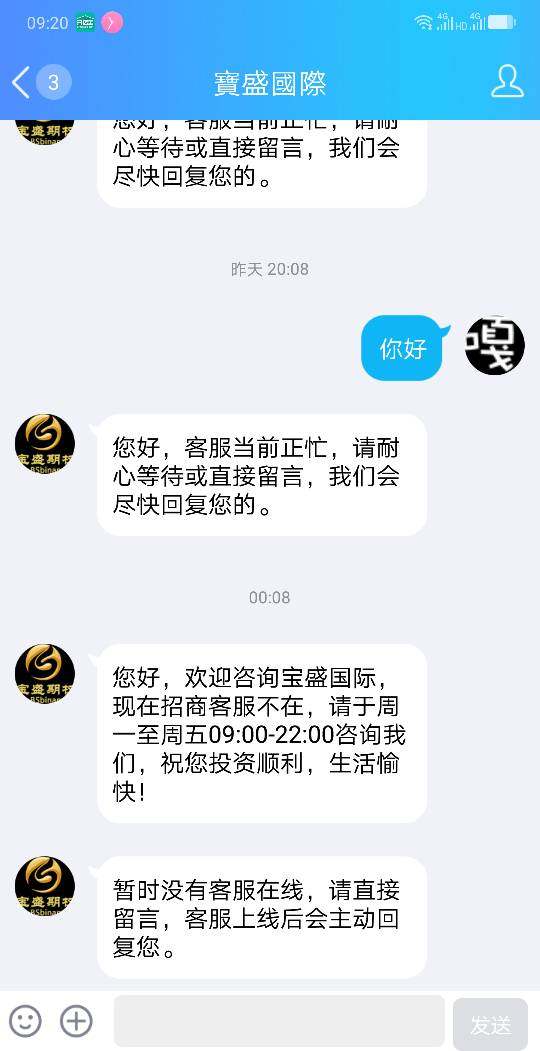

Response Times

Customer support at Baosheng operates through email and live chat, which users have cited as inconsistent. Several reports mention frustrating delays in response times, which could hinder the resolution of user concerns, impacting overall trust in the broker.

User Testimonials

While some users have outlined positive interactions with customer service, the clarity and responsiveness are markedly variable across experiences. Addressing these inconsistencies could significantly improve user perceptions of the broker's reliability.

“The customer service team is helpful when they respond. But waiting can be a hassle.” - Anonymously sourced feedback.

Account Conditions Analysis

Account Fundamentals

Baosheng's account conditions impose relatively high minimum deposits and unclear terms surrounding fees, potentially dissuading new investors. The lack of transparency regarding operational fees raises concerns about long-term engagement for users seeking a trustworthy environment.

Regulatory Concerns

Given recent financial scandals associated with similar brokers, Baoshengs account conditions invite scrutiny. Ensuring comprehensive clarity on fees and withdrawal processes is essential in building investor confidence, especially amid an already skeptical user base.

Conclusion

Baosheng serves as an intriguing option for investors with a penchant for risk and a desire for diverse investment opportunities. However, the underlying risks associated with regulatory compliance and operational transparency warrant a cautious approach. Investors should weigh Baoshengs potential against its pitfalls, applying thorough due diligence to navigate its complex trading landscape successfully. As the market evolves, staying informed and proactive remains key to making profitable investments with Baosheng while safeguarding capital against possible risks.