Giraffe Markets 2025 Review: Everything You Need to Know

Giraffe Markets has emerged as a new player in the forex and CFD trading landscape, offering a variety of trading instruments and leveraging the popular MetaTrader 5 platform. However, the reviews surrounding this broker present a mixed bag of user experiences and expert opinions, with some praising its features while others raise significant concerns about its legitimacy and regulatory status.

Note: It's important to highlight that Giraffe Markets operates under different entities across various regions, which could impact the user experience and regulatory compliance. This review aims to provide a balanced overview based on the latest available information.

Ratings Overview

We assess brokers based on user feedback, expert analysis, and factual data from multiple sources.

Broker Overview

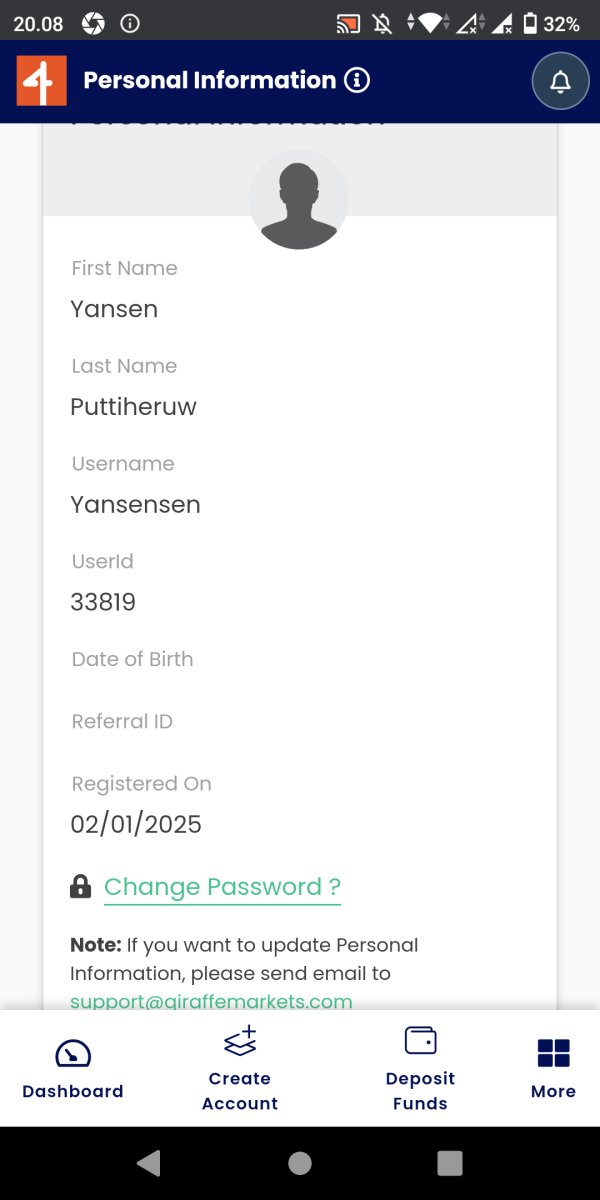

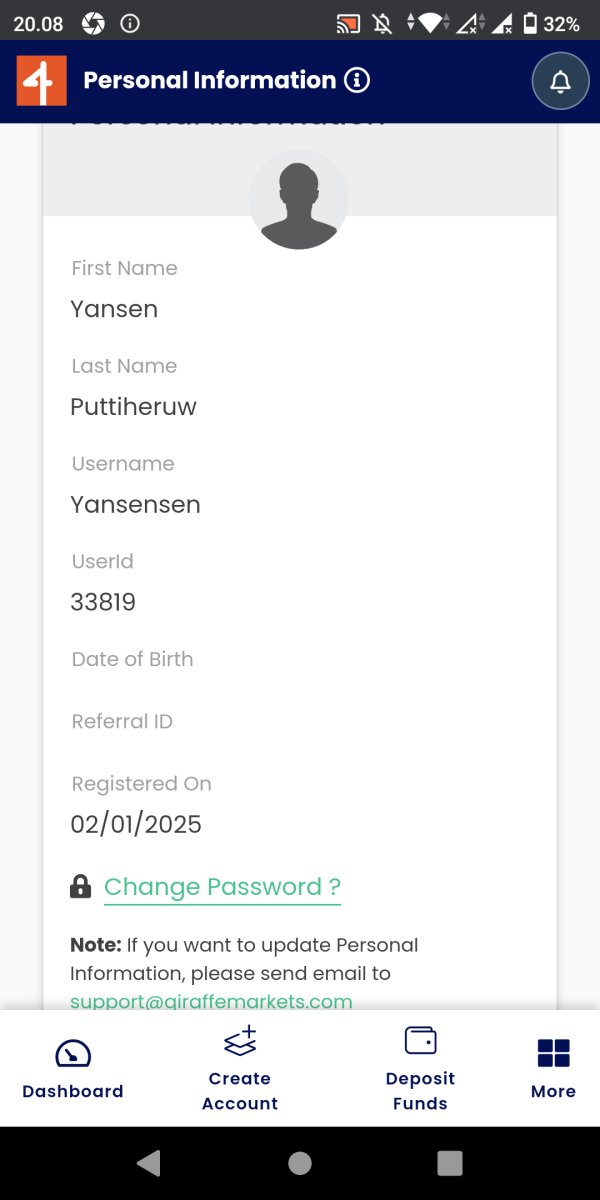

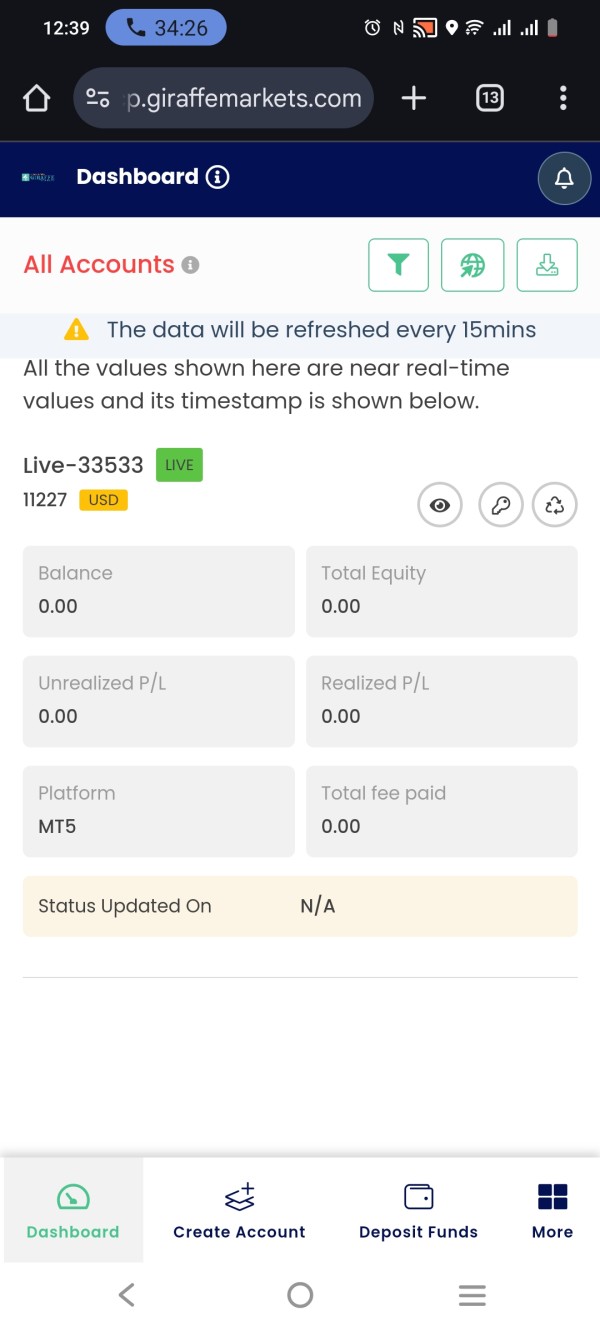

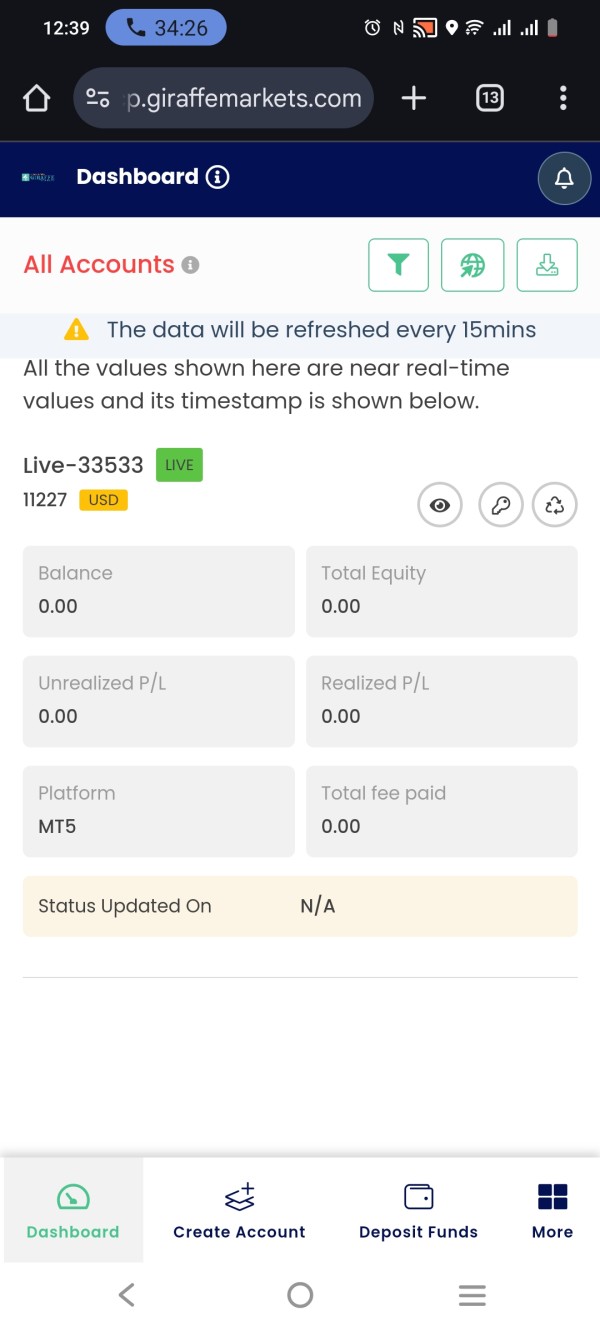

Founded in 2023, Giraffe Markets is an offshore broker registered in Saint Lucia and regulated by the Financial Services Regulatory Authority (FSRA) of Saint Lucia. The broker primarily offers trading through the MetaTrader 5 (MT5) platform, which is well-regarded for its advanced trading features. Giraffe Markets provides access to a wide range of asset classes, including over 40 forex pairs, various commodities, indices, and cryptocurrencies.

- Regulated Regions: Giraffe Markets operates under the FSRA of Saint Lucia, which is considered a low-tier regulator, raising concerns about investor protection.

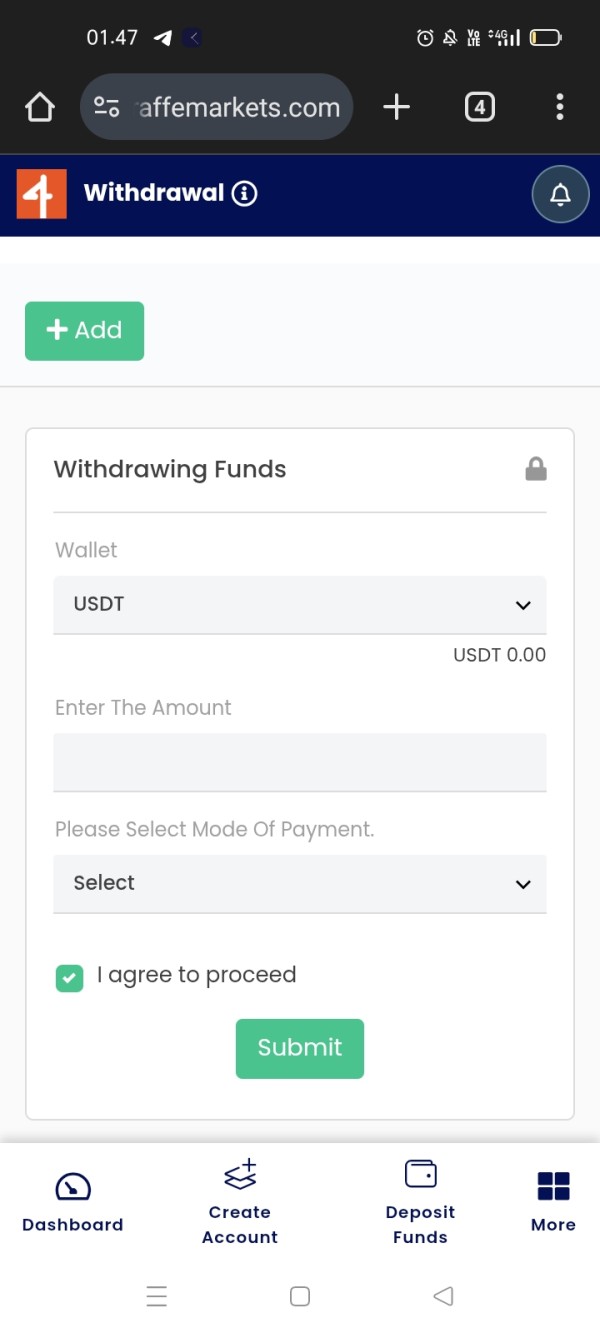

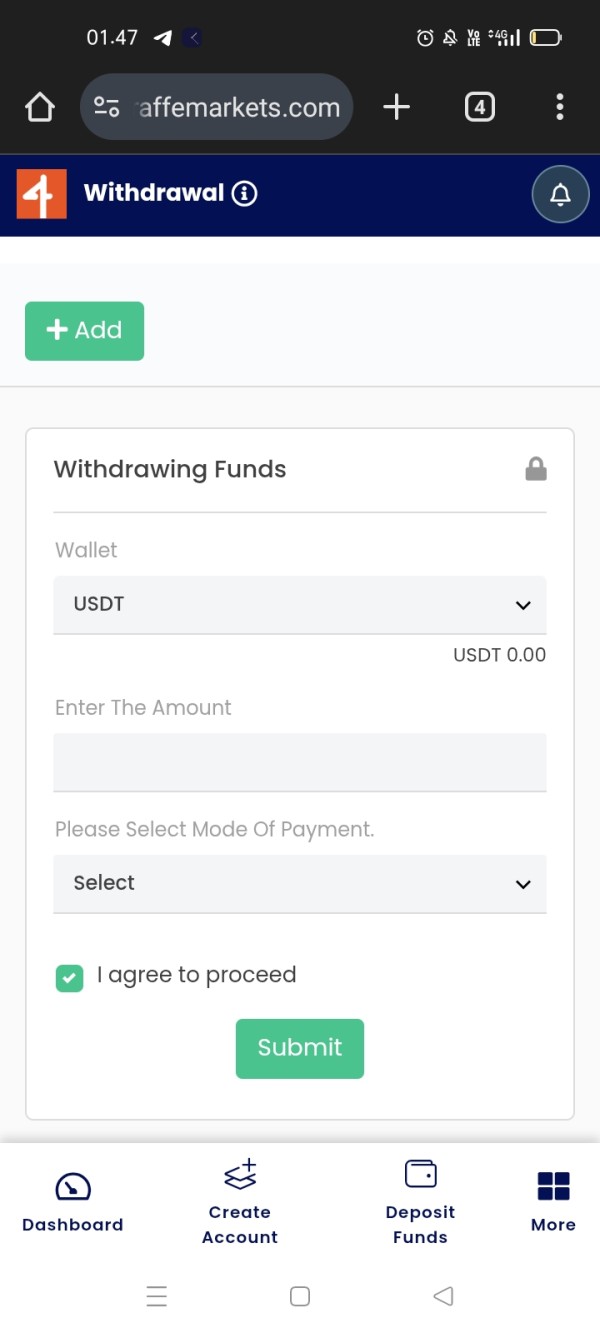

- Deposit/Withdrawal Methods: The broker accepts deposits and withdrawals via bank wire, credit card, and cryptocurrencies such as Tether (USDT).

- Minimum Deposit: The minimum deposit required to open a live account is $100.

- Bonuses/Promotions: Giraffe Markets offers promotional bonuses, including a $50 welcome bonus for new traders.

- Asset Classes: Traders can access forex, commodities, indices, stocks, and cryptocurrencies.

- Costs: The broker claims to offer spreads starting from 0.0 pips, though this may vary based on the account type. Commission structures are reportedly competitive, with some accounts being commission-free.

- Leverage: Giraffe Markets offers leverage of up to 1:500, which can be attractive for traders looking to maximize their positions.

- Trading Platforms: The primary platform is MetaTrader 5, available on desktop, mobile, and web.

- Restricted Regions: Giraffe Markets does not serve clients from certain countries, including the USA, Canada, and others.

- Customer Service Languages: The broker provides customer support in multiple languages, available 24/7.

Ratings Revisited

Detailed Breakdown

-

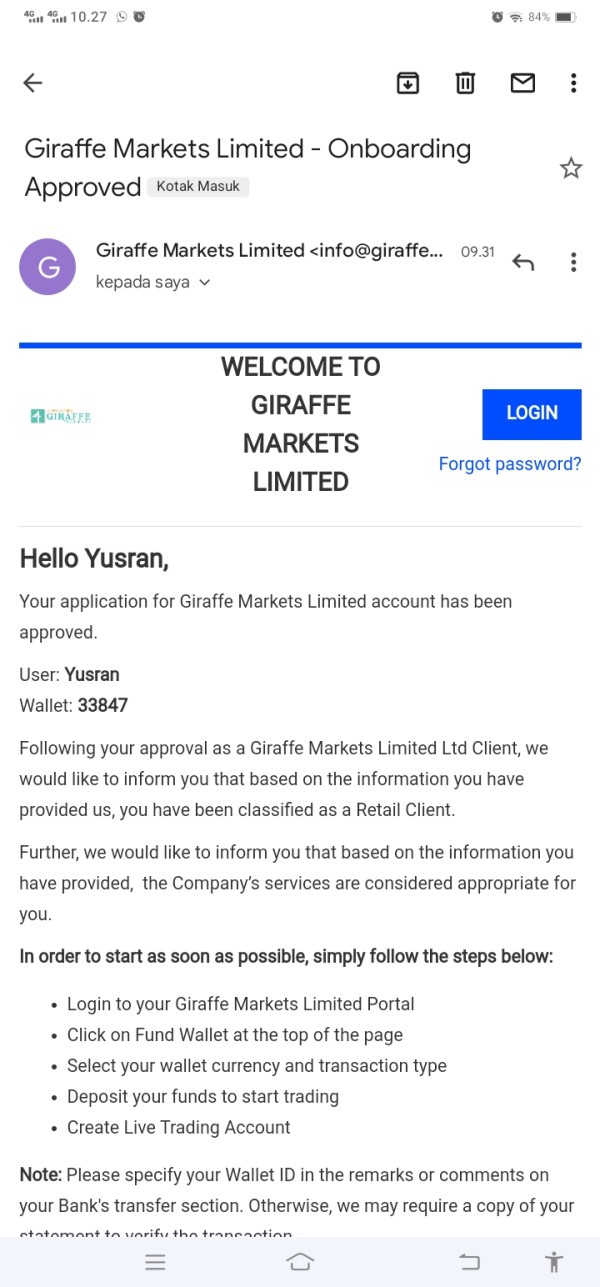

Account Conditions: Giraffe Markets offers a relatively low minimum deposit of $100, making it accessible for new traders. However, the lack of robust regulatory oversight raises red flags regarding the safety of client funds. According to Forex Fun, the broker is considered a "pseudo-broker" with questionable practices.

Tools and Resources: The availability of the MT5 platform is a significant advantage, as it provides advanced charting tools, automated trading options, and a user-friendly interface. Users have noted that the platform supports various trading strategies, enhancing the overall trading experience.

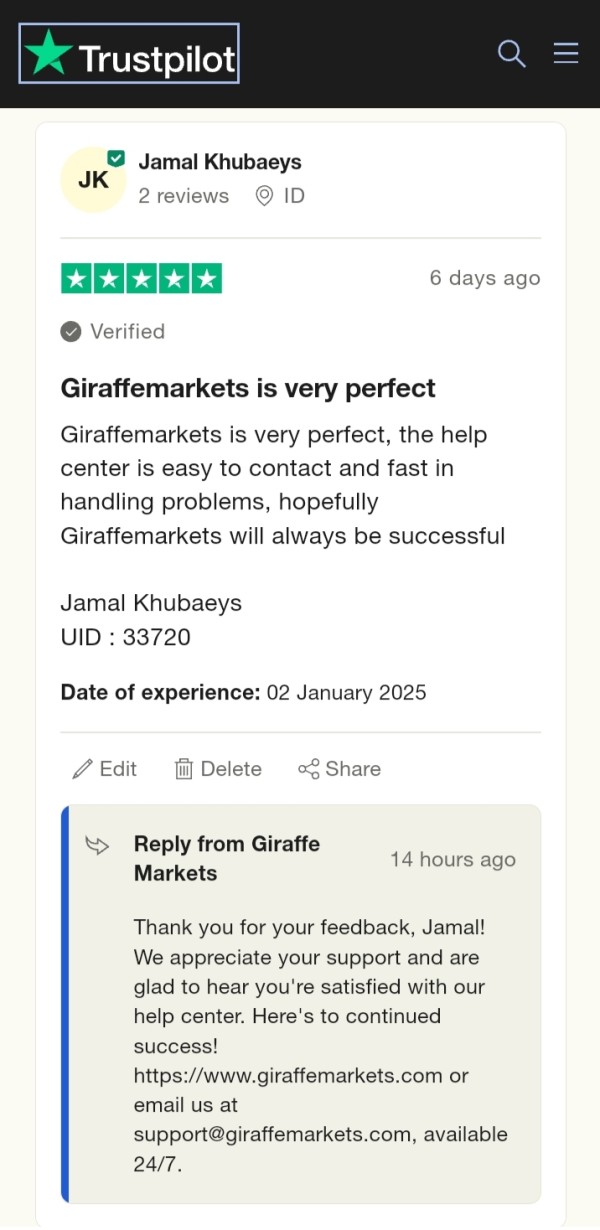

Customer Service and Support: Feedback on customer service has been mixed, with some users praising the responsiveness, while others reported difficulties in withdrawing funds. A user review on WikiBit highlighted fast withdrawals and good service, but this contrasts with reports of withdrawal issues from other sources.

Trading Setup (Experience): The trading experience is generally positive, with reports of fast order execution. However, some users have faced challenges when trying to withdraw their profits, which significantly impacts their overall satisfaction.

Trustworthiness: Giraffe Markets is regulated by the FSRA of Saint Lucia, which is considered a low-tier regulator. This lack of stringent oversight raises concerns about the broker's reliability and the safety of client funds. Multiple reviews indicate potential scams and fraudulent practices associated with the broker.

User Experience: While some users report a satisfactory trading experience, numerous complaints about withdrawal issues and the broker's legitimacy overshadow these positives. The overall sentiment appears to lean towards caution when dealing with Giraffe Markets.

In summary, while Giraffe Markets offers several appealing features, including a low minimum deposit and a robust trading platform, the concerns surrounding its regulatory status and user experiences highlight the need for potential traders to proceed with caution. Always conduct thorough research before engaging with any broker, especially those operating under offshore regulations.