gic trade 2025 Review: Everything You Need to Know

1. Abstract

GIC Trade is a new forex broker run by Global Investa Capital Pte., which started in 2023. The company's regulatory details are not clear, so it faces challenges in building trust with traders. However, GIC Trade does offer some good features, like no overnight fees and low spreads, which makes it attractive for traders who want to save money on costs. This gic trade review gives you an overview of what the broker offers right now, showing both the good parts and the things to worry about.

The broker doesn't have detailed regulatory information, which might make potential users careful about choosing them. GIC Trade focuses on providing services in forex, commodities, and cryptocurrencies. The company has a short history and uses a new business approach, which suggests it could do well but needs to improve in being more open and giving better service details. This review uses only the data we could find, and readers should think about their local laws before using this broker.

2. Notice

You should know that GIC Trade's regulatory status is not clearly explained. This uncertainty might affect how trustworthy it seems in different countries. Potential users must remember that legal requirements vary, and there are risk factors that come with brokers who don't have clear oversight.

This review was made using data and information we could find through public sources. Some parts of how the broker works—like specific platform technologies, how you deposit and withdraw money, and what clients say—might not be fully covered here. Readers should see this review as an analysis based on information we could access, and you should do more research on your own before making any investment choices.

3. Rating Framework

4. Broker Overview

GIC Trade started in 2023 and is run by Global Investa Capital Pte. As a new company in the competitive forex broker market, it positions itself as a fresh choice for traders interested in forex, commodities, and cryptocurrencies. Even though the company has a modern approach, the broker's lack of clear regulatory information is a big problem.

New traders should know that not having detailed regulatory credentials could affect how reliable the broker is and its reputation in the market. Still, the promise of no overnight fees and low spreads offers an attractive deal to traders who care about costs. This gic trade review shows that while early-stage innovation is good, the lack of complete information about how they operate and manage risks could worry careful investors.

The broker's business model focuses on giving access to major asset classes without charging clients extra costs like overnight fees. Though the specific details about trading platforms are not shared, users can still benefit from the main offering across forex, commodities, and cryptocurrencies. The company seems to focus on keeping costs low rather than being completely transparent about their services.

Without more data on platform technology, risk management tools, and other important details like minimum deposit requirements or available leverage, potential customers should be extra careful. This gic trade review points out that while not having operational details might make users less confident, the broker's new features may still help a specific group of people looking for particular trading benefits.

Regulatory Region:

The specific regulatory authorities for GIC Trade have not been mentioned, according to available information. The broker's regulatory framework stays uncertain, and the details are not provided in the data we have.

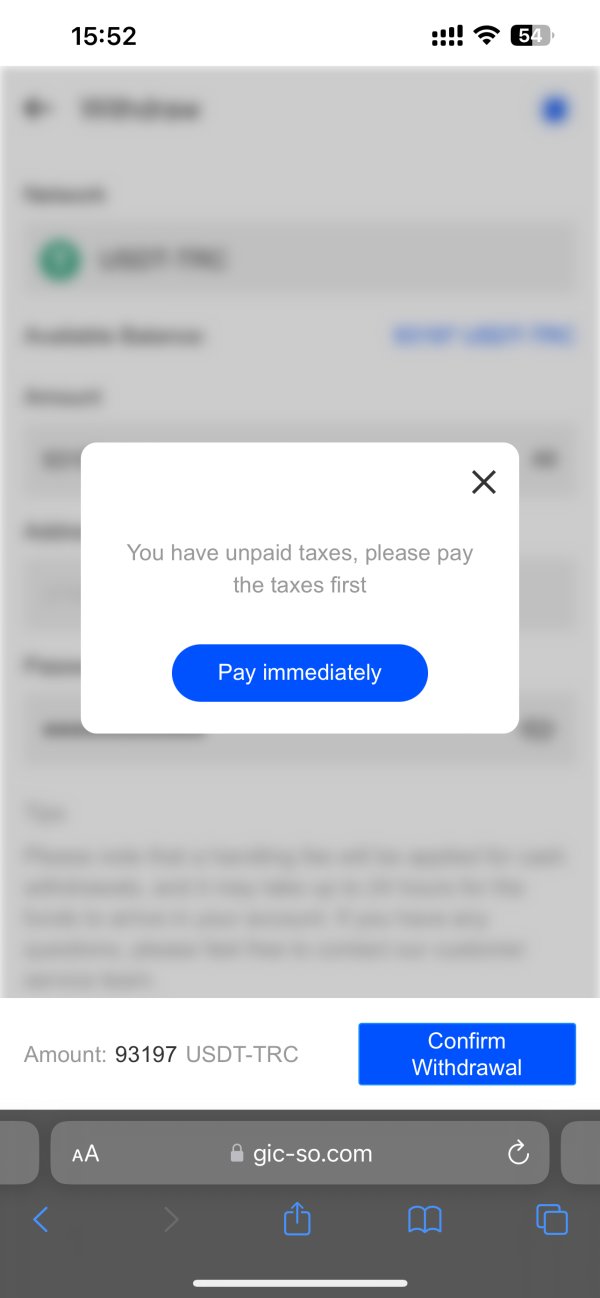

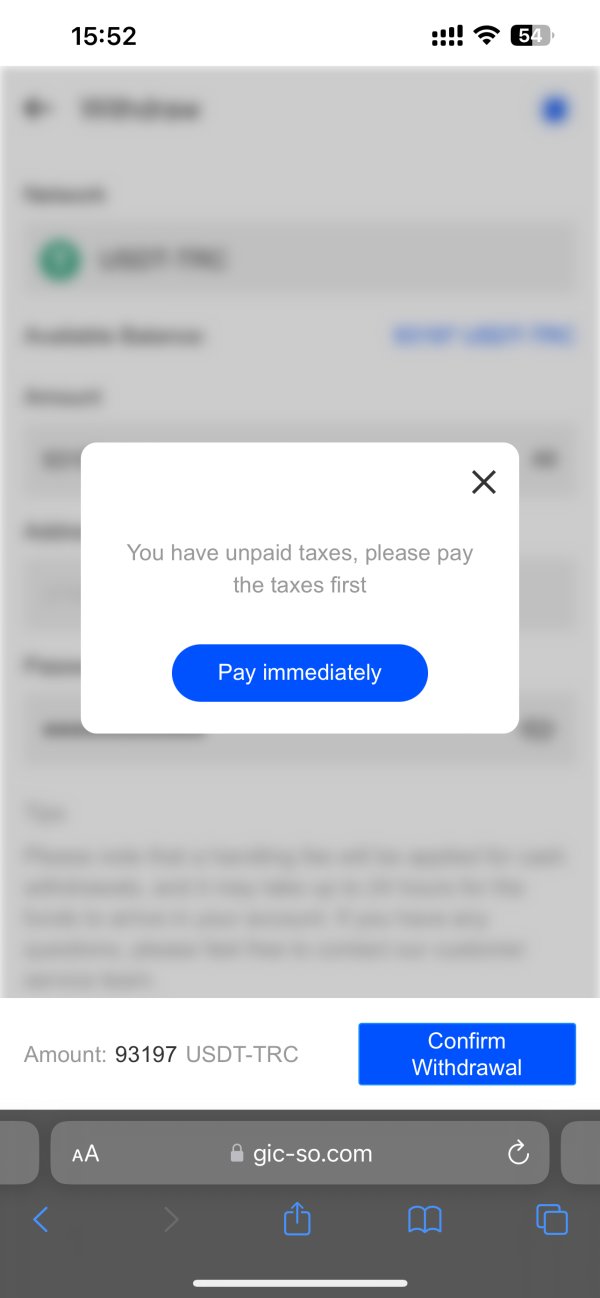

Deposit and Withdrawal Methods:

Detailed deposit and withdrawal options have not been shared. The information stays unspecified in the current summary.

Minimum Deposit Requirement:

The minimum deposit requirement is not mentioned in any of the sources we found. This leaves potential clients without clear instructions on how much money they need to start.

Bonus and Promotion Details:

No details about bonus programs or promotional offers are provided. No additional promotional strategies are outlined in the data we could access.

Tradable Assets:

GIC Trade gives access to trading in forex, commodities, and cryptocurrencies. This lets traders diversify their portfolios, though the range of specific instruments within each asset class is not clearly defined.

Cost Structure:

The broker's cost structure includes the notable benefit of no overnight fees, which could reduce holding costs for traders. Also, the spreads offered are considered competitive when compared to some industry averages. However, specific commission rates and related charge details have not been revealed, leaving a gap in a complete cost analysis.

Leverage Ratio:

There is no mention of leverage information or acceptable leverage limits in the summary. This makes it difficult to evaluate risk exposure.

Platform Options:

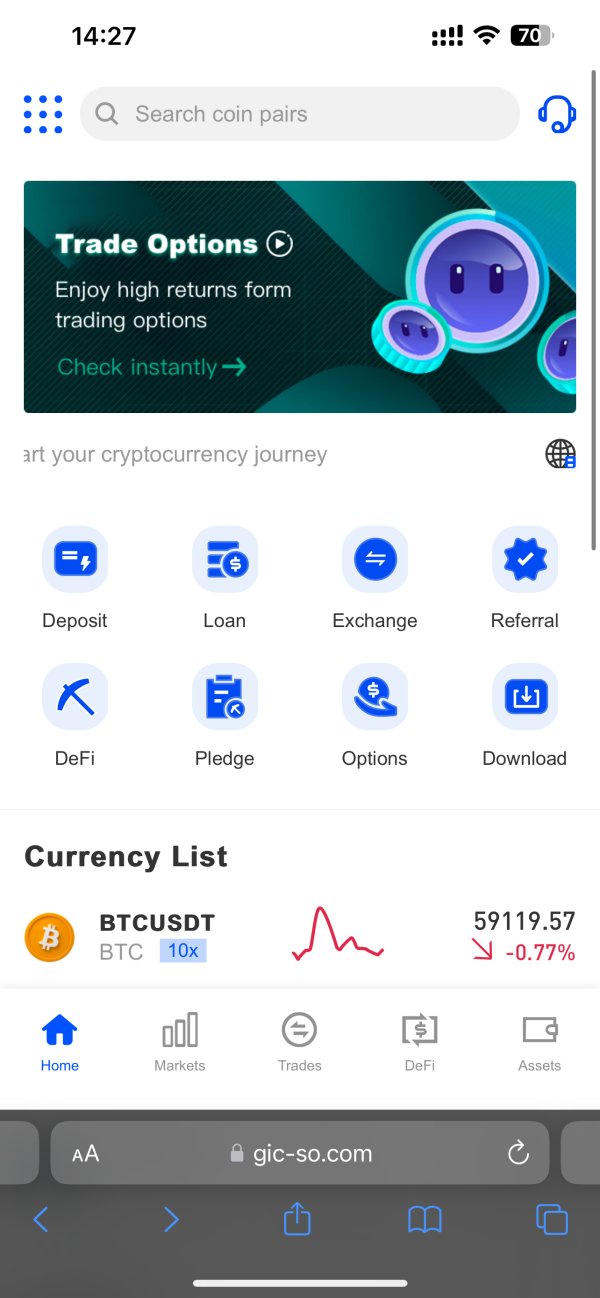

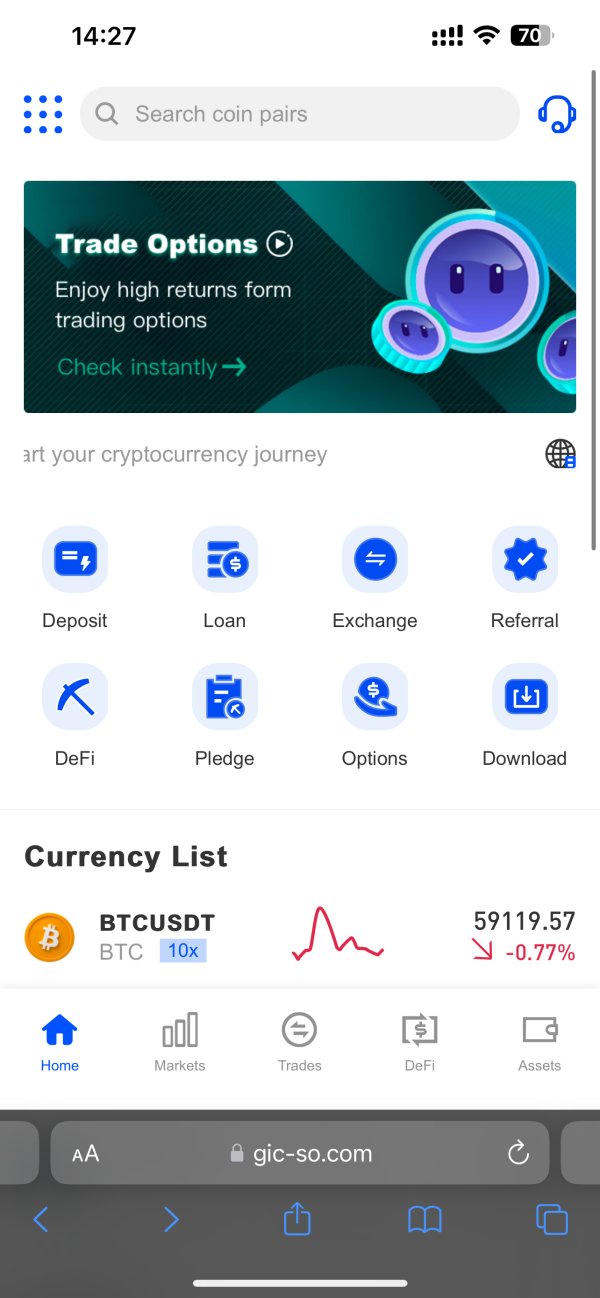

The actual trading platform used by GIC Trade remain unspecified. Without clear details on available software or web-based trading interfaces, users cannot assess platform functionality or user interface quality.

Regional Restrictions:

Information about any geographical or regulatory restrictions that may apply to GIC Trade users is not provided. Thus, potential regional limitations remain unclear.

Customer Service Languages:

No specific information on customer service language options has been supplied. This leaves it uncertain whether support is offered in multiple languages or only in a single language.

This gic trade review shows that while basic trading assets and a competitive cost structure are promoted, many operational details remain unclear. Such gaps in information—ranging from regulatory credentials to detailed service offerings—require careful consideration before engaging with the broker.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

The information available for GIC Trade does not include specific details about account types, commission structures, minimum deposit requirements, or available leverage ratios. The broker's account conditions remain largely unclear, making it difficult for potential clients to figure out whether the flexibility and features of the accounts match their trading needs. The lack of information about account opening procedures, such as verification processes or specialized accounts , further reduces confidence.

This limited disclosure results in a conservative rating of 4 out of 10. According to the summarized data, there are no verifiable user evaluations or direct comparisons with other brokers about account conditions, further complicating the assessment. Overall, the absence of complete details about trading accounts forces prospective traders to approach GIC Trade with caution.

GIC Trade claims to offer trading in multiple asset classes, including forex, commodities, and cryptocurrencies. However, detailed information about the range and quality of trading tools is missing. There is no mention of advanced charting software, automated trading capabilities, or integration with third-party research tools.

The lack of educational materials, market analysis resources, or live news feeds leaves traders without the strong support typically expected from established brokers. Moreover, the specifics of the trading platforms and any mobile application interfaces have not been outlined, creating uncertainty about the overall trading experience. With these limitations, the broker's offering in terms of tools and resources gets a rating of 5 out of 10.

This gic trade review reflects that while the multi-asset approach is good, the lack of transparency around the platforms and research tools is a notable shortfall that potential users should consider.

6.3 Customer Service and Support Analysis

Customer support is a vital part of any trading platform. Unfortunately, the current information shows that specific details about customer service channels, response times, and the quality of support remain undisclosed. There is no record of available multi-lingual support or extended hours of operation, which are important factors for traders in different time zones.

Also, no user feedback or testimonials about the responsiveness and professionalism of GIC Trade's support team have been documented. The absence of any detailed disclosure about the support infrastructure makes it challenging to accurately gauge the overall efficiency or reliability of the service. Consequently, GIC Trade scores a modest 3 out of 10 in customer service and support.

This rating is based on the noticeable lack of clarity in service quality, as reported by multiple sources noting that specific details are simply not available in the current reviews and public data.

6.4 Trading Experience Analysis

The trading experience on GIC Trade is marked by at least two promising features: no overnight fees and competitive spread offerings. These features can be attractive for active traders or those who hold positions over longer periods. However, the overall trading environment remains partially undefined due to insufficient information on platform performance, order execution speed, and platform stability.

There is no detailed insight into whether the trading platform supports advanced order types, integrated risk management features, or mobile trading capabilities. These unanswered questions are critical given that trading experience heavily depends on the technological infrastructure and user interface. With these considerations in mind, the platform receives a rating of 5 out of 10 in terms of trading experience.

As noted in this gic trade review, while cost advantages are clear, the failure to provide complete details on trading technology prevents a higher evaluation.

6.5 Trustworthiness Analysis

Trust is extremely important in financial trading. For GIC Trade, the key area of concern is its unclear regulatory status. The absence of clearly identified regulatory bodies, licensing information, and transparent disclosures on fund safety measures significantly undermines confidence.

Without established oversight or clear documentation on industry compliance, users must be especially cautious, particularly in environments where financial regulations are strict. Moreover, there are no third-party audits, user testimonials, or industry reputation scores to serve as reassurance. These factors have resulted in a low trustworthiness rating of 2 out of 10.

Different reports indicate that the regulatory gap and the broker's brief operational history are critical risks that potential investors need to keep in perspective when making their decisions.

6.6 User Experience Analysis

User experience generally includes ease of registration, how intuitive the platform interface is, and the smoothness of fund management procedures. Unfortunately, the information provided does not elaborate on these core aspects. There is no data on user satisfaction rates, interface design reviews, or feedback about the registration process and subsequent account management experiences.

Without direct user feedback, documented case studies, or expert assessments, assessing the practical usability of the platform remains a challenge. Consequently, GIC Trade scores only 3 out of 10 in the user experience category. It is clear from available data that while some cost-saving features are beneficial, the lack of transparent user experience information limits traders' ability to make an informed decision.

This gic trade review highlights the necessity for the broker to enhance its operational transparency to foster greater user confidence.

7. Conclusion

In summary, GIC Trade represents a new entry into the forex brokerage arena. Distinguished features such as no overnight fees and competitive spreads drive its initial appeal. However, the significant gaps in regulatory transparency and a lack of detailed operational disclosures cast considerable doubt over its trustworthiness and overall user experience.

This gic trade review advises that while the broker may suit traders who prioritize minimal overnight costs and lower spread expenses, caution is warranted for those looking for robust, transparent, and well-documented trading environments. Prospective users should conduct further due diligence before engaging with GIC Trade.