Regarding the legitimacy of INTL forex brokers, it provides CIRO and WikiBit, (also has a graphic survey regarding security).

Is INTL safe?

Business

License

Is INTL markets regulated?

The regulatory license is the strongest proof.

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

INTL FCStone Financial (Canada) Inc.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.intlfcstone.com/Expiration Time:

--Address of Licensed Institution:

20 Adelaide Street East Suite 1001 Toronto ON M5C 2T6Phone Number of Licensed Institution:

647-475-0452Licensed Institution Certified Documents:

Is INTL A Scam?

Introduction

INTL, established in 2018, is a foreign exchange broker based in the United Kingdom. It aims to cater to traders with a wide array of services, including forex trading and investment options. However, the growing number of brokers in the market makes it essential for traders to exercise caution and thoroughly evaluate the credibility of their chosen platforms. With the prevalence of scams and unreliable brokers, assessing a broker's legitimacy is crucial to safeguarding investments. This article employs a comprehensive approach, incorporating regulatory reviews, company background investigations, trading conditions analysis, customer experiences, and risk assessments to determine if INTL is indeed safe or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is fundamental to its legitimacy. INTL claims to be regulated by notable authorities such as the Financial Conduct Authority (FCA) in the UK. Regulatory oversight ensures that brokers adhere to specific standards, providing a safety net for traders. Below is a summary of INTLs regulatory information:

| Regulator | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FCA | [Not Provided] | United Kingdom | Verified |

| IIROC | 114247 | Canada | Verified |

The importance of regulation cannot be overstated. It signifies that a broker is subjected to regular audits and must comply with stringent financial standards. However, INTL's low score of 1.50 on WikiFX raises concerns about its operational integrity. While it has not faced major regulatory sanctions, the fact that it has been flagged for multiple exposures indicates that potential investors should tread carefully.

Company Background Investigation

INTL's company history reveals a relatively short existence since its inception in 2018. The company operates under the umbrella of various financial institutions and claims to have a presence primarily in Brazil and the UK. However, the lack of extensive historical data raises questions about its stability and reliability.

The management team‘s background is also a critical factor in assessing INTL’s credibility. A review of available information suggests that the team comprises professionals from diverse financial backgrounds, yet the specific qualifications and experiences of these individuals remain largely undisclosed. Transparency is vital in fostering trust; thus, the companys limited information on its management team could be a red flag for potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by INTL is crucial for evaluating whether it is safe or a scam. The broker's fee structure appears competitive at first glance, but scrutiny reveals some concerning elements. Below is a comparison of INTL's core trading costs against industry averages:

| Fee Type | INTL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | [Not Provided] | 1.0 - 2.0 pips |

| Commission Model | [Not Provided] | Varies |

| Overnight Interest Range | [Not Provided] | 0.5% - 2.0% |

While the spread and commission structure are vital for traders, the absence of specific figures raises eyebrows. Additionally, any unusual or hidden fees could be detrimental to traders' profitability. The lack of clarity in these areas may suggest a lack of transparency, which is often a hallmark of less reputable brokers.

Client Fund Security

The safety of client funds is a paramount concern for any trading platform. INTL claims to implement various security measures, including segregated accounts for client funds, which is a standard practice among reputable brokers. This ensures that client funds are kept separate from the companys operational funds, providing an additional layer of safety.

However, the absence of clear information regarding investor protection policies and negative balance protection raises concerns. While there have been no significant historical issues reported regarding fund security at INTL, the lack of transparency in this area could pose risks for potential investors.

Customer Experience and Complaints

Customer feedback is often a reliable indicator of a broker's reliability. A review of user experiences with INTL reveals a mixed bag of opinions. While some clients report satisfactory trading experiences, others have voiced concerns regarding withdrawal issues and slow customer service responses. Below is a summary of the primary complaints received:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delays | Medium | Addressed but slow |

One notable case involved a client unable to withdraw funds due to website issues, which highlights the potential operational risks associated with INTL. While the company has addressed complaints, the frequency and nature of these issues may indicate underlying problems.

Platform and Trade Execution

The performance and reliability of a broker's trading platform are critical factors for traders. INTL's platform has been described as user-friendly, yet there are concerns regarding execution quality and slippage. Reports of rejected orders and poor execution during high volatility periods have surfaced, raising questions about the platform's reliability.

A thorough evaluation of INTL's execution metrics is necessary to determine if it is safe for traders. If a broker frequently experiences slippage or rejects orders, it can significantly impact a trader's profitability and overall experience.

Risk Assessment

Using INTL poses various risks that potential investors should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Low score on regulatory platforms |

| Fund Security | Medium | Lack of transparency in fund protection |

| Customer Service | High | Reports of slow response and complaint handling |

To mitigate these risks, potential investors should conduct thorough due diligence, ensure they understand the fee structure, and monitor their accounts closely.

Conclusion and Recommendations

In conclusion, while INTL presents itself as a legitimate forex broker, several factors warrant caution. The low regulatory score, mixed customer feedback, and lack of transparency in trading conditions raise red flags. Although there are no direct indications of fraud, the potential risks associated with this broker suggest that traders should approach with caution.

For those considering trading with INTL, it may be prudent to explore alternative options that offer greater transparency, better regulatory oversight, and a proven track record of customer satisfaction. Reputable alternatives include brokers that have consistently received high marks for their regulatory compliance and customer service.

In summary, while INTL may not be outright a scam, the potential risks and concerns highlighted in this analysis suggest that traders should exercise caution and consider their options carefully before proceeding.

Is INTL a scam, or is it legit?

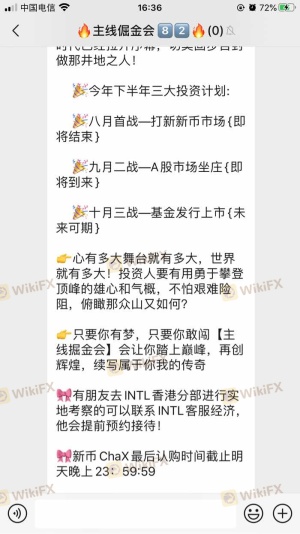

The latest exposure and evaluation content of INTL brokers.

INTL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INTL latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.