gcfx 2025 Review: Everything You Need to Know

Summary: The overall evaluation of gcfx reveals significant concerns regarding its legitimacy and user experiences, with many sources labeling it as a potential scam. Key findings highlight issues with withdrawal difficulties and a lack of regulatory oversight, raising red flags for potential investors.

Note: It's important to recognize that different entities may operate under similar names across various regions, which can complicate assessments of legitimacy. This review aims to provide a fair and accurate overview based on available information.

Rating Overview

We rate brokers based on user feedback, expert opinions, and factual data.

Broker Overview

Founded in 2022, gcfx operates under the website gcfx.world, claiming to provide access to a variety of financial markets. It offers trading through popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), focusing on a wide range of assets including forex, commodities, and cryptocurrencies. However, gcfx lacks a valid regulatory license, which poses significant risks for potential investors.

Detailed Overview

Regulated Geographic Areas:

gcfx claims to be regulated by the Labuan Financial Services Authority (LFSA) in Malaysia, but multiple sources have flagged this as a suspicious clone operation, indicating that the regulatory status is questionable at best.

Deposit/Withdrawal Currencies/Cryptocurrencies:

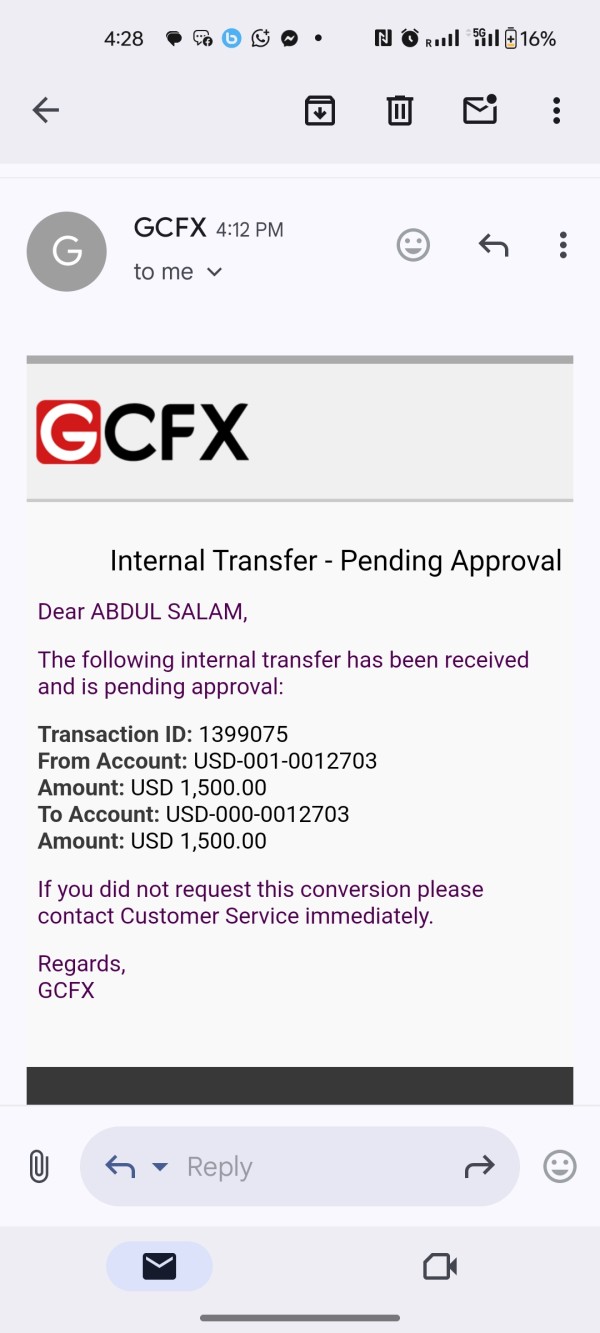

The platform supports deposits and withdrawals via traditional methods like bank transfers and credit cards, but specific currencies are not clearly mentioned. There are also indications that withdrawal processes can be cumbersome, with reports of users facing significant challenges in retrieving their funds.

Minimum Deposit:

The minimum deposit requirement is stated to be around $100, which is relatively standard in the industry. However, given the overall concerns regarding gcfx, this amount may not be worth the risk.

Bonuses/Promotions:

Information about bonuses or promotional offers is sparse. Many reviews suggest that aggressive marketing tactics may be utilized to lure in new clients, promising unrealistic returns.

Tradeable Asset Classes:

gcfx offers a variety of asset classes, including major and exotic currency pairs, commodities, indices, and cryptocurrencies. However, the quality and execution of trades have been reported as inconsistent, which can lead to a frustrating trading experience.

Costs (Spreads, Fees, Commissions):

While gcfx advertises tight spreads starting from 0.0 pips, user experiences suggest that these claims are often unmet, with actual spreads being much wider. Additionally, hidden fees may apply during withdrawal processes, further complicating the cost structure.

Leverage:

The broker offers leverage that varies by asset class, typically up to 1:500. While high leverage can amplify profits, it also significantly increases risk, particularly for inexperienced traders.

Allowed Trading Platforms:

gcfx primarily offers trading through MT4 and MT5 platforms, which are popular among traders for their advanced features. However, the platform's reliability has been questioned, with reports of glitches and slow execution times.

Restricted Regions:

There are reports indicating that gcfx does not accept clients from several major jurisdictions, including the United States and Canada, further raising concerns about its operational legitimacy.

Available Customer Service Languages:

Customer support is reportedly limited, primarily available in English, with little to no options for live chat or phone support. This has led to frustrations among users seeking assistance.

Detailed Breakdown

-

Account Conditions (Rating: 3/10):

The account conditions at gcfx are less than favorable, with a minimum deposit requirement that is standard but accompanied by a lack of transparency regarding fees and withdrawal processes. Users have reported significant difficulties in accessing their funds, which is a major concern.

Tools and Resources (Rating: 4/10):

While gcfx claims to offer a range of trading tools and educational resources, the actual availability and quality of these tools are inconsistent. Many users have noted that the promised features are often not delivered, leading to dissatisfaction.

Customer Service and Support (Rating: 2/10):

Customer service appears to be a significant weak point for gcfx. Users have reported slow response times and unhelpful support, which can be detrimental for traders needing immediate assistance.

Trading Setup (Experience) (Rating: 3/10):

The trading experience on gcfx is marred by reports of platform glitches and inconsistent execution speeds. Users have expressed frustration over these technical issues, which detract from the overall trading experience.

Trustworthiness (Rating: 1/10):

The trustworthiness of gcfx is highly questionable, with multiple sources labeling it as a potential scam. The lack of a valid regulatory license and numerous user complaints regarding withdrawal issues further exacerbate these concerns.

User Experience (Rating: 2/10):

Overall user experience with gcfx has been predominantly negative, with many users reporting that they felt misled by the broker's marketing tactics. The combination of poor customer support and technical issues has led to a lack of confidence in the platform.

In conclusion, gcfx review highlights significant risks associated with trading on this platform. Potential investors are strongly advised to conduct thorough research and consider alternative brokers with better regulatory oversight and user feedback.