GalaxyTrade 2025 Review: Everything You Need to Know

Executive Summary

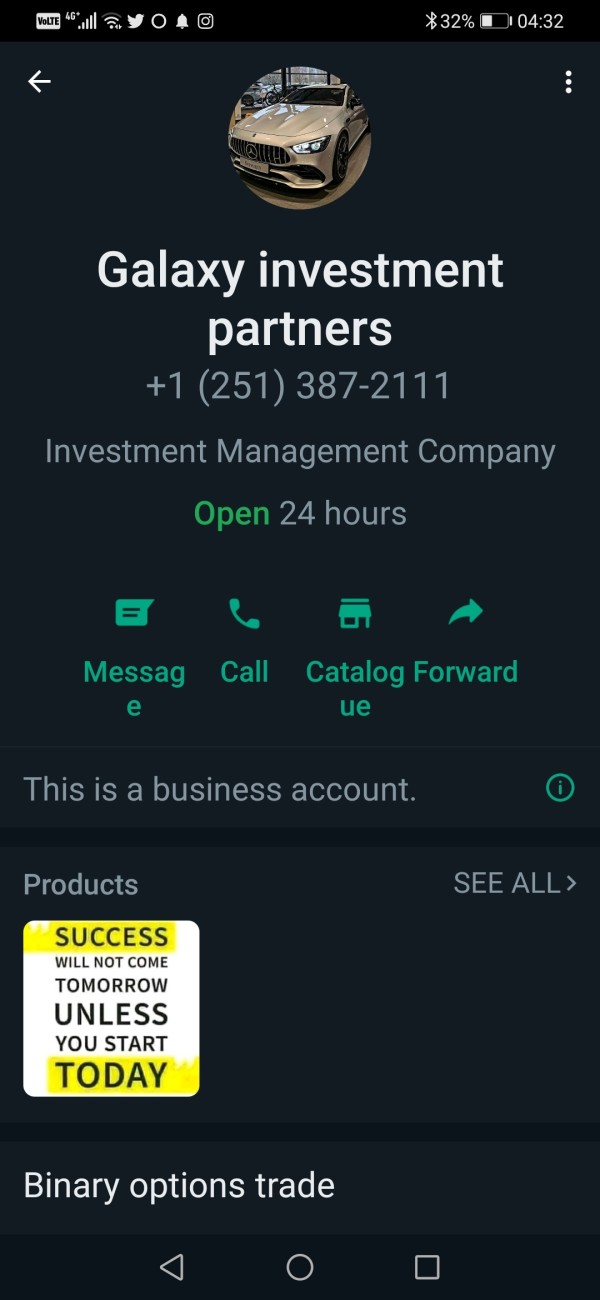

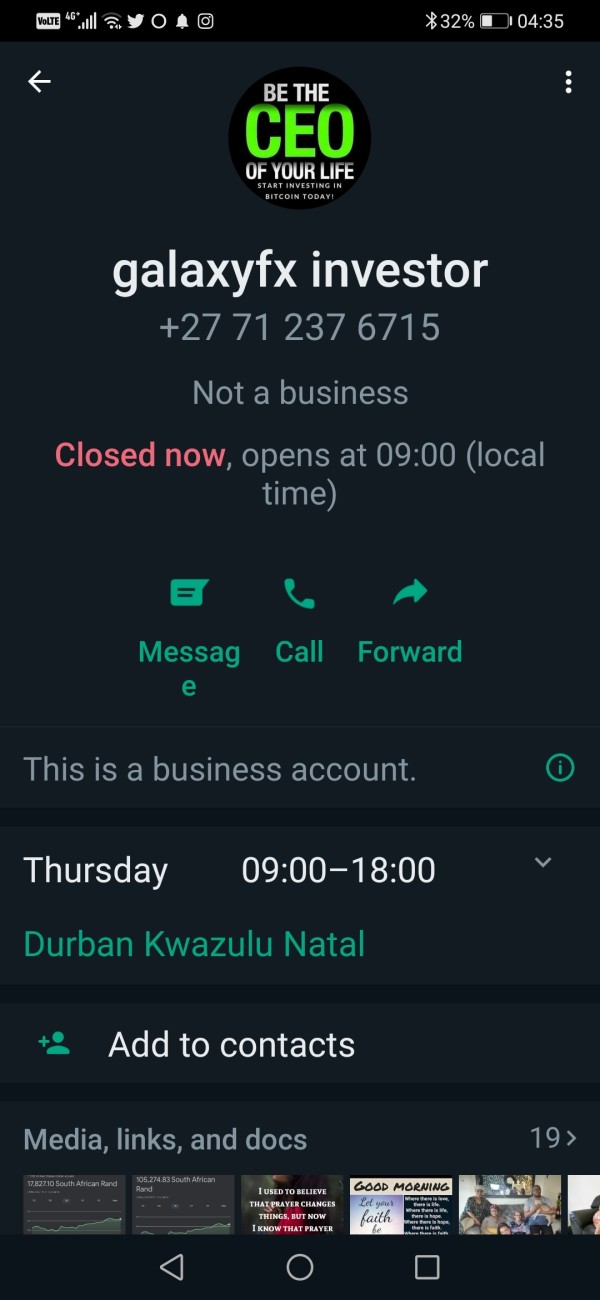

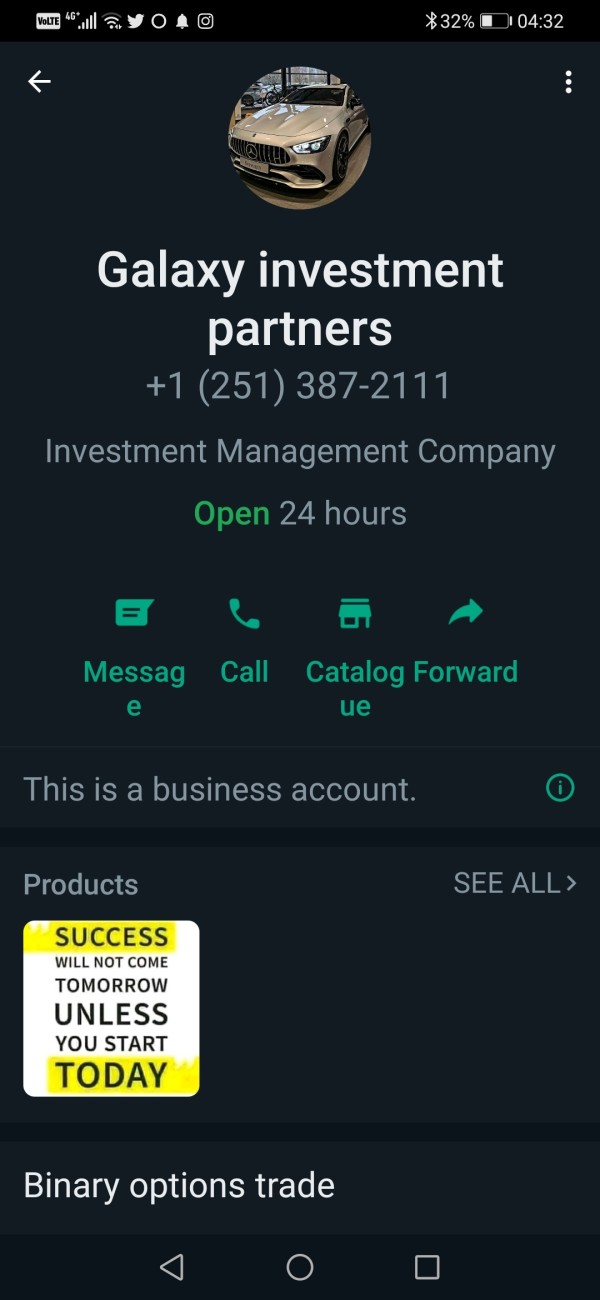

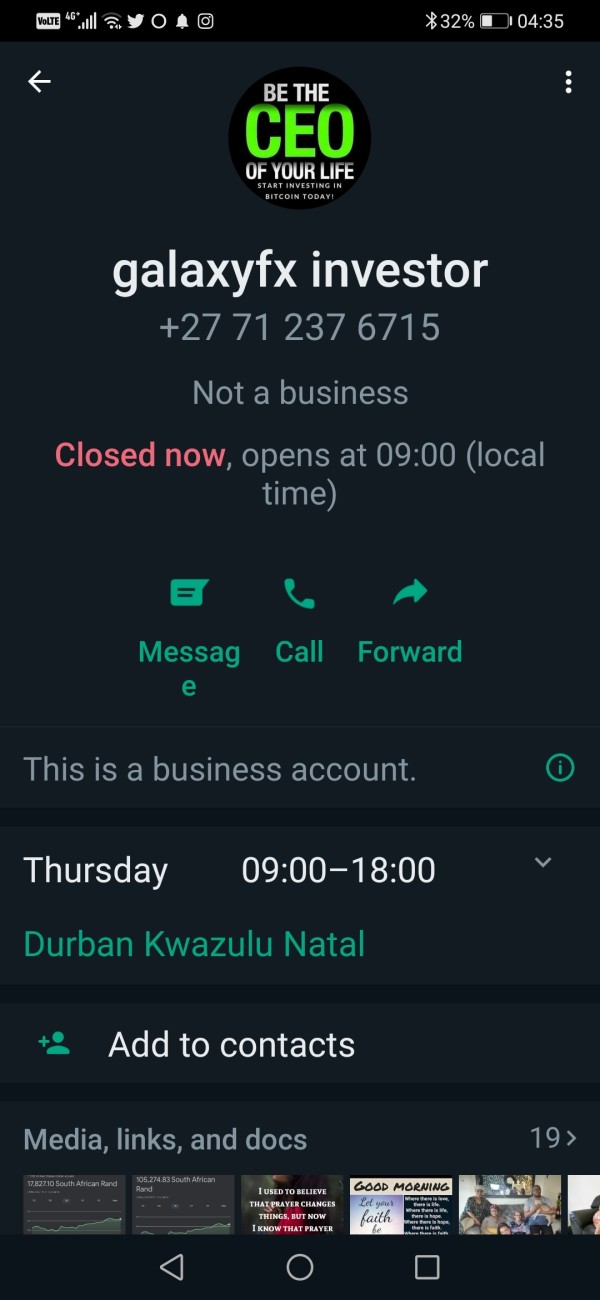

GalaxyTrade is an unregulated forex broker that offers over 350 trading instruments and an easy-to-use trading platform. Investors should be careful because the broker lacks regulation and transparency. This galaxytrade review shows that the broker operates under Plethora Group Ltd, which is registered in the Commonwealth of Dominica without oversight from major regulatory authorities.

The platform requires a minimum deposit of $250 and provides many trading tools for forex and CFDs. These features make GalaxyTrade attractive to beginners who want to start trading with low capital requirements. However, the lack of regulatory protection and limited transparency about operations create major concerns for potential traders.

GalaxyTrade uses a web-based trading platform designed to be user-friendly. The broker has a Trustpilot rating of 6.2 based on limited reviews, plus an average-to-good trust score on Scamadviser. These ratings suggest mixed user experiences and show why traders need to research carefully before using this platform.

Important Disclaimer

GalaxyTrade's regulatory status changes across different countries, and investors must understand the legal protections available in their specific regions. The broker's registration in the Commonwealth of Dominica means it lacks supervision from major regulatory bodies such as the FCA, ASIC, or CySEC. This situation could leave traders without standard investor protection schemes.

This review uses publicly available information and user feedback, which may change over time. Potential traders should check current terms, conditions, and regulatory status directly with the broker before making investment decisions. Information may become outdated between publication and reading.

Rating Framework

Broker Overview

GalaxyTrade operates as a forex and CFD broker under Plethora Group Ltd management, with registration in the Commonwealth of Dominica. The company's establishment date is not specified in available documents, though it positions itself as a platform for traders seeking easy entry into financial markets. The broker's business model focuses on providing forex trading services alongside CFD offerings across multiple asset classes.

The company centers its operations around web-based trading solutions. This galaxytrade review finds that while the broker emphasizes simplicity and user access, the lack of detailed company background information raises questions about operational transparency. GalaxyTrade's choice to register in Dominica, a place known for less strict financial regulations, matches its unregulated status but may worry traders who want regulatory oversight.

GalaxyTrade uses a simple web-based trading platform designed for ease of use, especially targeting new traders. The broker's asset portfolio includes forex pairs and CFDs, with claims of offering over 350 trading instruments across various market categories. However, the absence of major regulatory authority oversight means that standard investor protections typically associated with regulated brokers are not guaranteed for GalaxyTrade clients.

Regulatory Status: GalaxyTrade operates without regulation from major financial authorities, with registration limited to the Commonwealth of Dominica. This unregulated status means traders lack access to compensation schemes and dispute resolution mechanisms typically provided by established regulatory bodies.

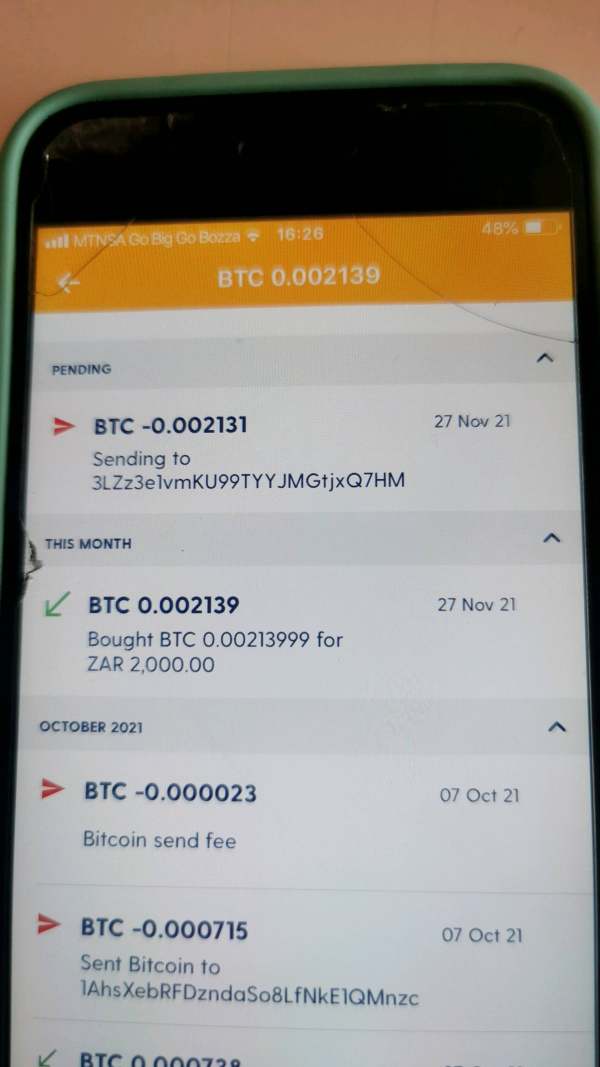

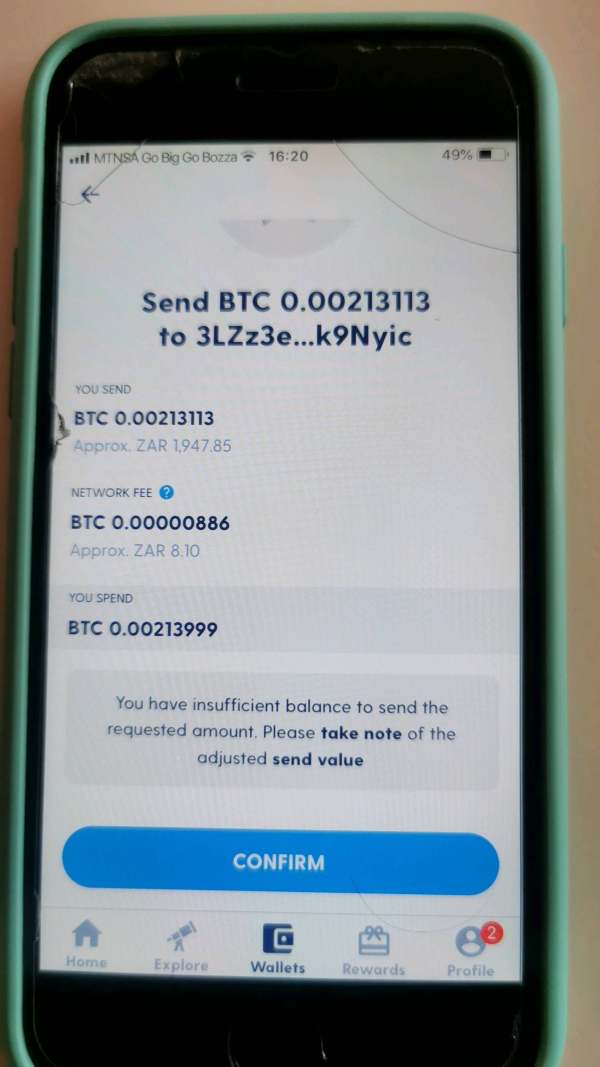

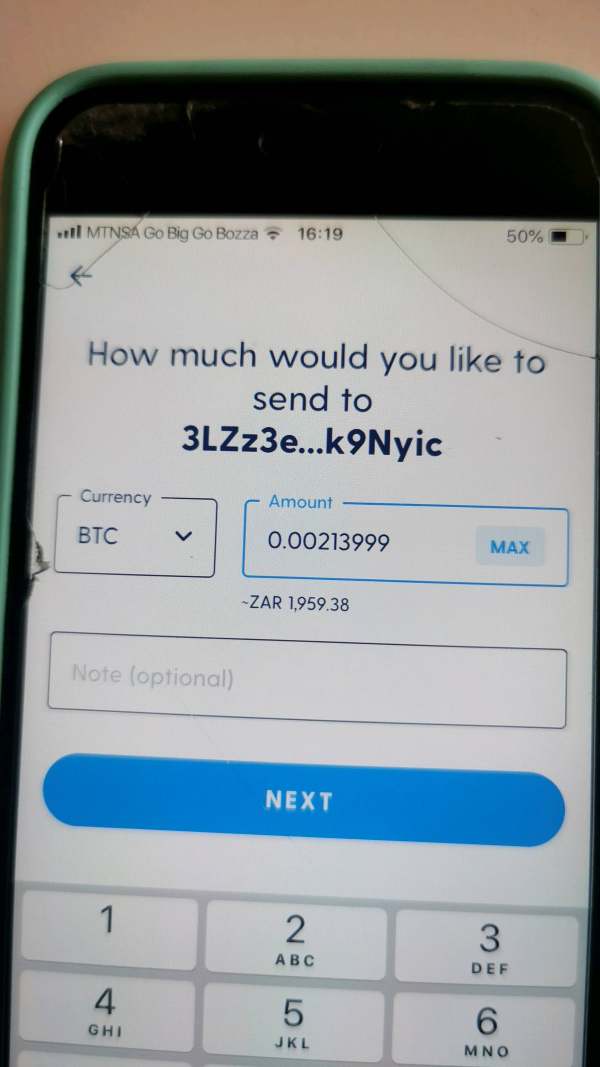

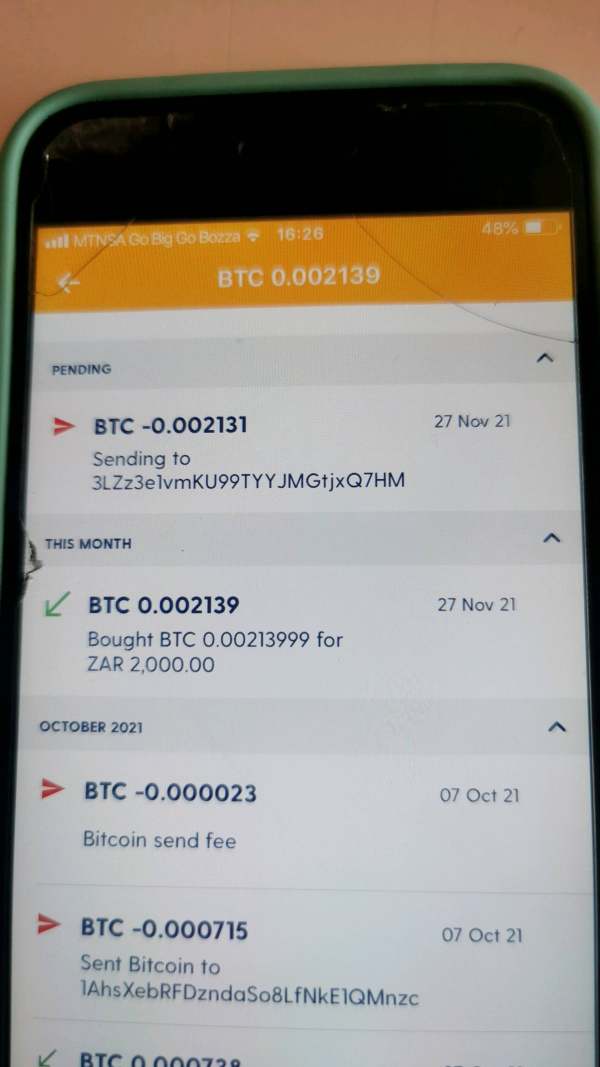

Deposit and Withdrawal Methods: Specific information about available payment methods for deposits and withdrawals is not detailed in available sources. Traders need to contact the broker directly for current options.

Minimum Deposit Requirements: The platform requires a minimum deposit of $250. This amount makes it accessible for beginning traders with limited initial capital.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not specified in available documentation. This suggests either absence of such programs or limited marketing transparency.

Tradeable Assets: GalaxyTrade provides access to over 350 trading instruments, including forex currency pairs and CFDs across various asset classes. Specific asset categories and availability details require further clarification.

Cost Structure: Detailed information about spreads, commissions, and other trading costs remains unspecified in available sources. This galaxytrade review notes that the absence of transparent pricing information may complicate trading cost assessments for potential clients.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in accessible documentation. Traders need to contact the broker directly for current leverage offerings.

Platform Options: The broker uses a web-based trading platform with reported rich functionality. Specific features, technical capabilities, and mobile accessibility details are not comprehensively documented.

Geographic Restrictions: Information about countries or regions where GalaxyTrade services are restricted or unavailable is not specified in current documentation.

Customer Service Languages: Available languages for customer support services are not detailed in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

GalaxyTrade's account structure information remains limited in available documentation. This creates challenges for comprehensive evaluation. The $250 minimum deposit requirement positions the broker competitively for entry-level traders, especially when compared to regulated brokers that often require higher initial investments. However, the absence of detailed account type specifications, including differences between potential standard, premium, or professional account categories, limits traders' ability to assess suitability for their specific needs.

The account opening process details are not outlined comprehensively in available sources. This raises questions about verification requirements, documentation needs, and approval timeframes. This galaxytrade review notes that the lack of information about special account features, such as Islamic accounts for Sharia-compliant trading or demo accounts for practice purposes, further complicates the evaluation process.

When compared to regulated competitors, GalaxyTrade's minimum deposit appears reasonable. However, the absence of transparent information about account benefits, trading conditions variations across account types, and potential upgrade pathways represents a significant limitation. The broker's unregulated status also means that standard account protections, including negative balance protection and segregated client funds, cannot be guaranteed without explicit confirmation from the platform.

GalaxyTrade's claim of offering over 350 trading instruments suggests a comprehensive asset selection. This potentially spans major and minor forex pairs, commodities, indices, and individual stock CFDs. This extensive instrument range could accommodate diverse trading strategies and portfolio diversification needs, particularly appealing to traders seeking exposure across multiple market sectors within a single platform.

However, the quality and depth of trading tools beyond basic instrument access remain unspecified in available documentation. Research and analysis resources, including market commentary, economic calendars, technical analysis tools, and fundamental analysis reports, are not detailed in accessible sources. The absence of information about educational resources, including webinars, tutorials, trading guides, and market insights, limits assessment of the broker's commitment to trader development.

Automated trading support capabilities, including Expert Advisor compatibility, copy trading features, or algorithmic trading infrastructure, are not specified in current documentation. While the web-based platform reportedly offers rich functionality, specific details about charting capabilities, technical indicators, order types, and risk management tools require direct verification with the broker for accurate assessment.

Customer Service and Support Analysis (Score: 4/10)

Customer service information for GalaxyTrade remains notably limited in available documentation. This presents significant concerns for potential traders who prioritize reliable support access. The absence of detailed customer service channel information, including availability of phone support, live chat functionality, email response systems, or social media support options, complicates assessment of the broker's commitment to client assistance.

Response time expectations, service quality standards, and support availability hours are not specified in accessible sources. The lack of information about multilingual support capabilities may particularly concern international traders seeking assistance in their native languages. Additionally, the absence of detailed problem resolution procedures and escalation protocols raises questions about the broker's ability to address complex client issues effectively.

Without specific user feedback about customer service experiences, support quality assessment relies primarily on general platform reviews. These show mixed results. The limited number of detailed customer service testimonials or case studies in available sources suggests either limited user engagement with support services or insufficient transparency in sharing client service experiences.

Trading Experience Analysis (Score: 6/10)

GalaxyTrade's web-based platform reportedly offers user-friendly design elements. This potentially benefits new traders seeking straightforward market access. However, specific information about platform stability, execution speeds, and technical performance metrics remains unspecified in available documentation. The absence of detailed platform feature descriptions, including advanced charting capabilities, technical analysis tools, and order management systems, limits comprehensive trading experience assessment.

Order execution quality information, including average execution speeds, slippage rates, and requote frequencies, is not detailed in accessible sources. This galaxytrade review notes that without transparent execution statistics, traders cannot adequately assess the platform's performance during various market conditions. This becomes especially important during high volatility periods when execution quality becomes crucial.

Mobile trading experience details, including dedicated mobile applications or mobile-optimized web platform functionality, are not outlined comprehensively. The trading environment's competitive aspects, such as spread competitiveness, liquidity provision, and market depth information, require direct verification with the broker for accurate assessment of overall trading conditions.

Trust and Security Analysis (Score: 3/10)

GalaxyTrade's unregulated status represents the most significant trust and security concern for potential traders. Operating without oversight from major regulatory authorities such as the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission means standard investor protection mechanisms are not guaranteed.

The broker's registration in the Commonwealth of Dominica, while legally compliant, does not provide the same level of regulatory oversight and client protection typically associated with major financial jurisdictions. Fund safety measures, including client fund segregation, deposit insurance, and negative balance protection, are not explicitly detailed in available documentation. These require direct confirmation from the broker.

According to available information, GalaxyTrade receives an average-to-good trust score on Scamadviser. However, this assessment may not reflect the comprehensive due diligence standards applied by major regulatory bodies. The absence of detailed information about the company's handling of negative events, regulatory inquiries, or client disputes further complicates trust assessment for potential traders prioritizing security and transparency.

User Experience Analysis (Score: 5/10)

GalaxyTrade's Trustpilot rating of 6.2 based on a limited number of reviews suggests moderate user satisfaction. However, the small sample size limits the reliability of this assessment. The user-friendly platform design reportedly caters to beginners, potentially providing an accessible introduction to forex and CFD trading for new market participants.

Registration and account verification process details are not outlined comprehensively in available sources. This makes it difficult to assess the efficiency and user-friendliness of onboarding procedures. Fund operation experiences, including deposit processing times, withdrawal procedures, and payment method reliability, require direct user feedback for accurate evaluation.

Common user complaints or praise themes are not extensively documented in accessible reviews. This limits insight into recurring user experience patterns. The broker's target demographic appears to focus on beginning traders seeking low-barrier market entry, though the absence of detailed user journey mapping and satisfaction metrics complicates comprehensive user experience assessment.

Conclusion

GalaxyTrade presents itself as an unregulated forex broker suitable for traders seeking to begin their trading journey with relatively low capital requirements. However, investors must remain vigilant about potential risks associated with its unregulated status. The platform's primary advantages include an extensive selection of over 350 trading instruments and a reportedly user-friendly web-based platform designed for accessibility.

Significant drawbacks include the absence of major regulatory oversight, limited transparency about operational details, and insufficient customer service information. Potential traders should carefully weigh these limitations against their individual risk tolerance and trading requirements before engaging with the platform.