Merj 2025 Review: Everything You Need to Know

Executive Summary

This Merj review gives you a complete analysis of what seems to be a financial services company with very little public information available. Merj operates under MERJ LIMITED, which is a UK-based company, but we don't know much about its forex trading services from current sources. The company has received a modest 3.2 out of 5 stars rating based on 4 employee reviews on AmbitionBox. This shows moderate workplace satisfaction but tells us little about client trading experiences.

The lack of clear regulatory information and detailed trading conditions creates big concerns for potential traders who want a reliable forex broker. The company appears to have some form of exchange token operations with a market cap of $18,901,856 as of December 2022. However, we don't understand how these cryptocurrency activities connect to traditional forex services. Traders thinking about Merj should be very careful because important information about spreads, leverage, trading platforms, and regulatory oversight is missing.

Important Notice

This review uses limited public information about Merj's operations. We don't know Merj's regulatory status in different countries from available sources. This may greatly impact trading decisions for users in various regions. Potential clients should check all regulatory credentials and trading conditions on their own before using any financial services provider. Our assessment uses public data, employee reviews, and available company information. However, detailed trading-specific information was not easy to find in current sources.

Rating Framework

Broker Overview

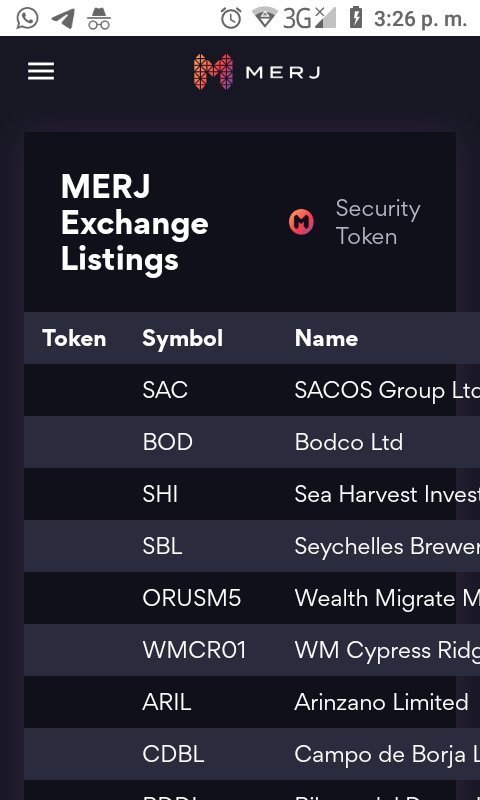

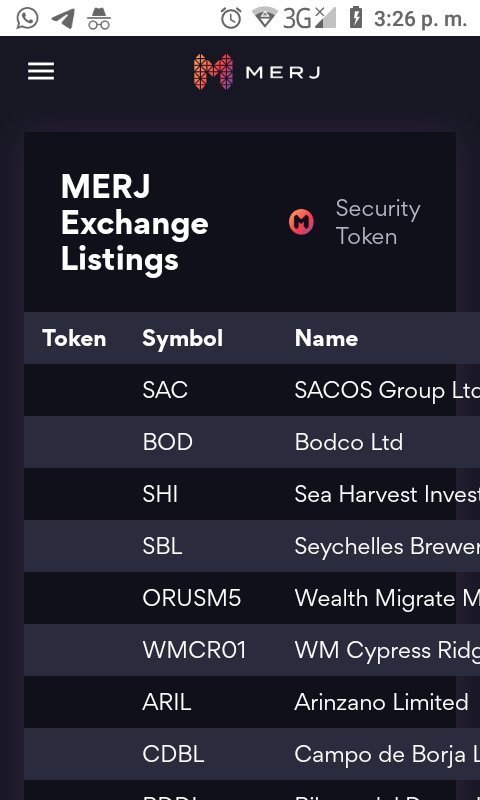

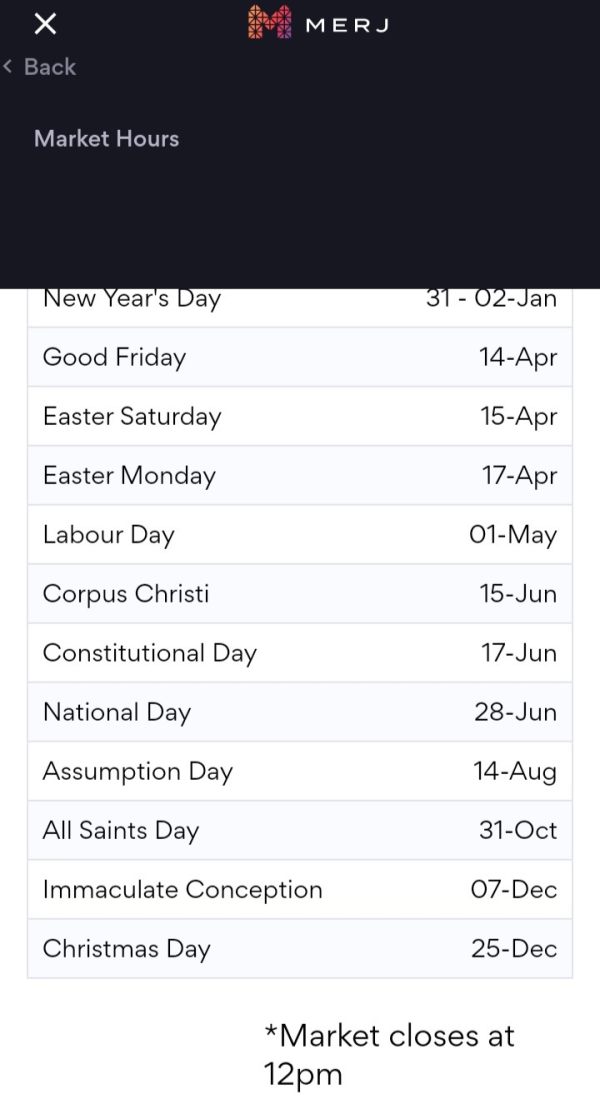

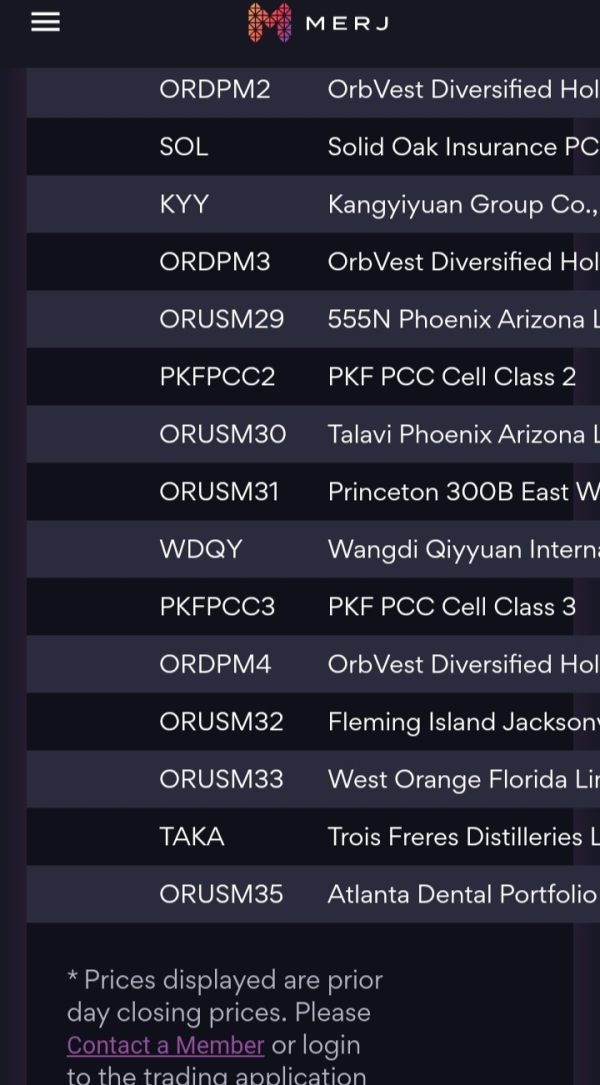

MERJ LIMITED operates from the United Kingdom. Available sources don't mention the specific founding date and detailed company history. The company appears to be involved in cryptocurrency markets through the MERJ Exchange Token. This token kept a price of $2.1 USD with a market cap of $18,901,856 as of its last trading date in December 2022. However, we don't understand how these digital asset operations connect to traditional forex brokerage services from current documentation.

Available sources don't clearly detail the company's business model and primary focus areas. This makes it hard to determine whether forex trading represents a core service or a secondary business line. The absence of clear information about trading platforms, supported currency pairs, and execution models suggests either limited forex operations or poor public disclosure of these services. This Merj review must therefore rely on general company information and limited performance indicators rather than detailed trading-specific data.

Regulatory Jurisdictions: Available sources don't mention specific regulatory oversight details. This represents a significant information gap for potential traders seeking regulated forex services.

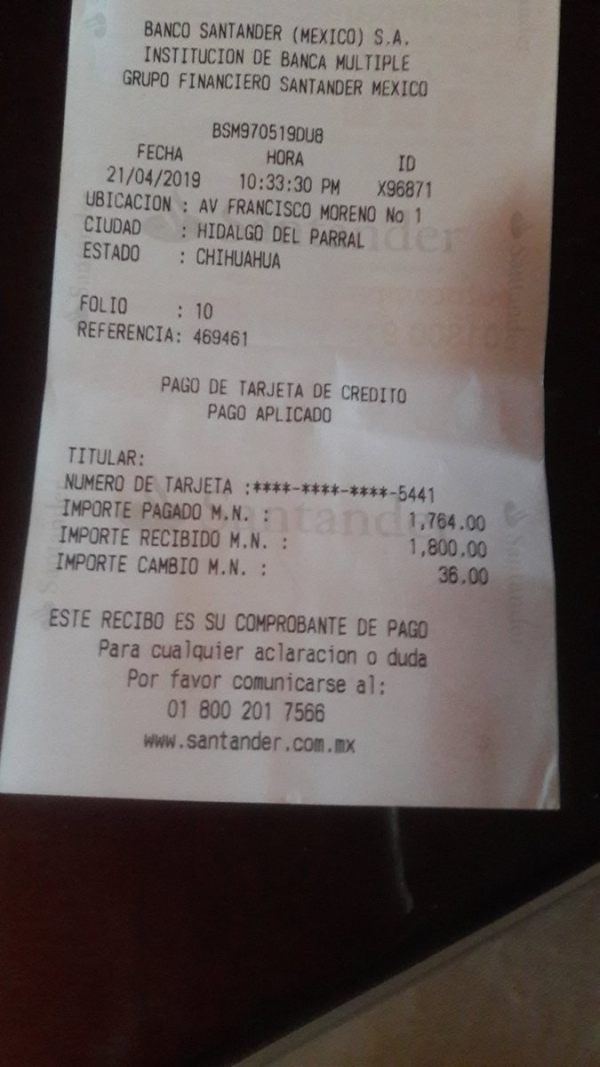

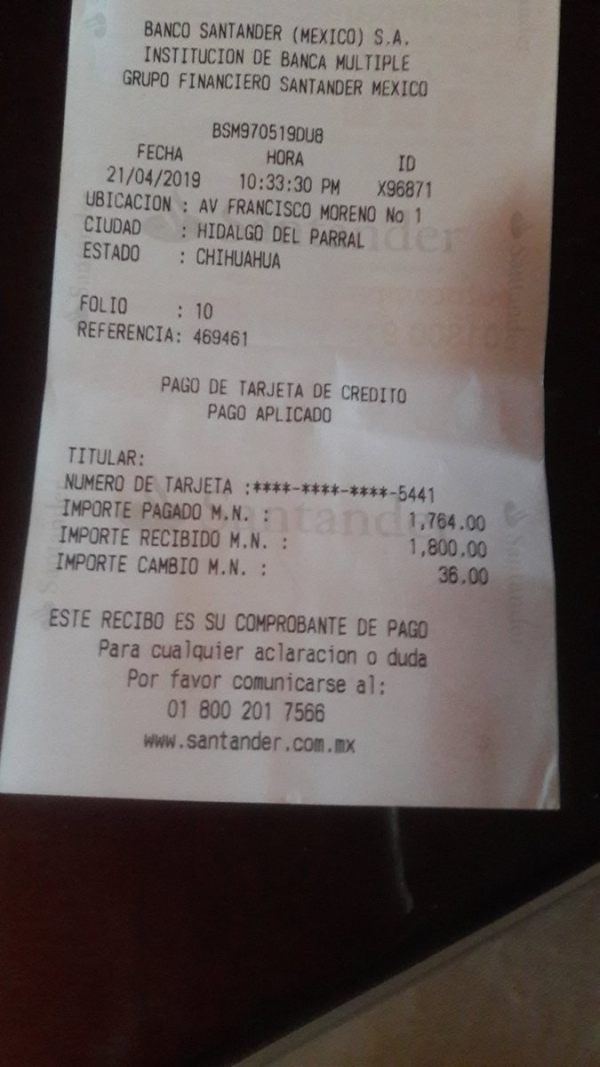

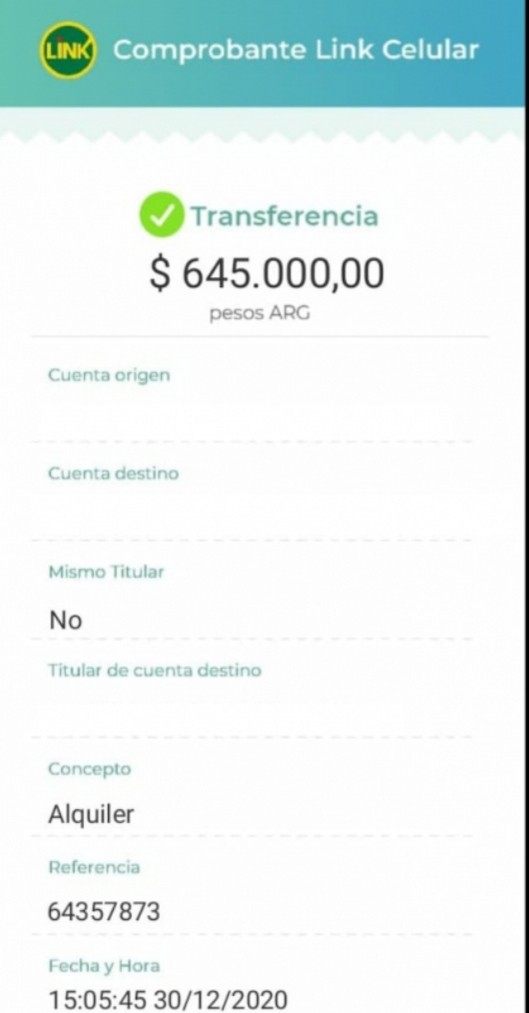

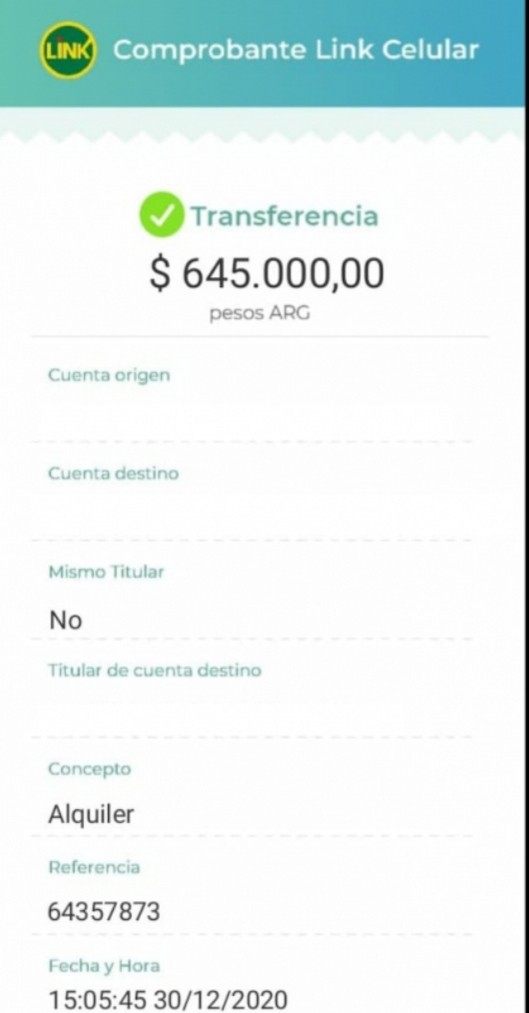

Deposit and Withdrawal Methods: Available sources don't specify supported payment methods, processing times, or fees for funding trading accounts.

Minimum Deposit Requirements: Current information sources don't detail specific minimum deposit amounts for different account types.

Bonuses and Promotions: Current sources don't provide information about welcome bonuses, trading incentives, or promotional offers.

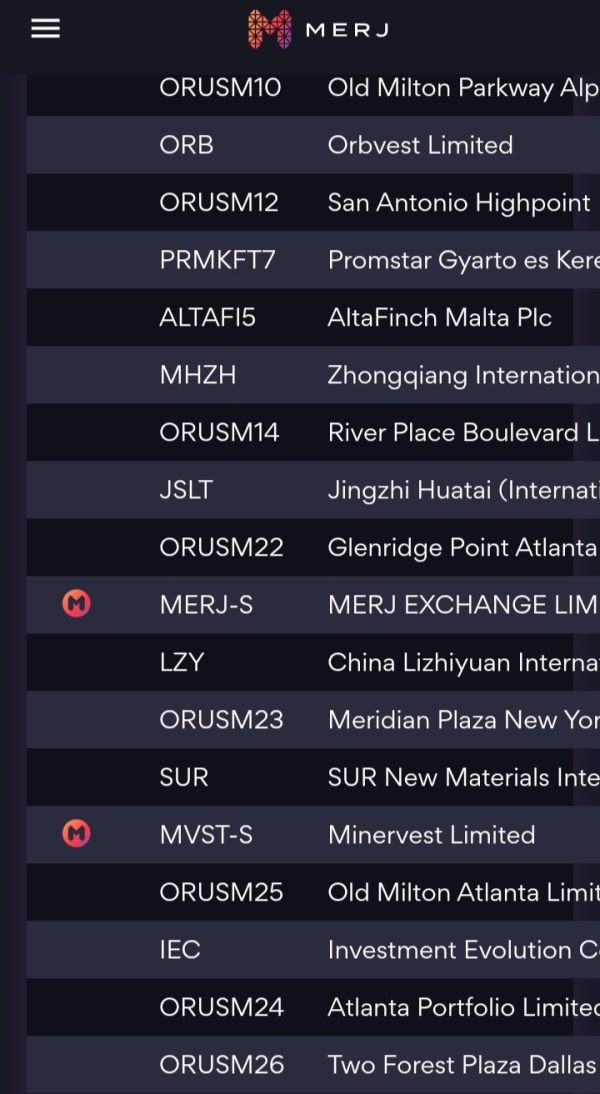

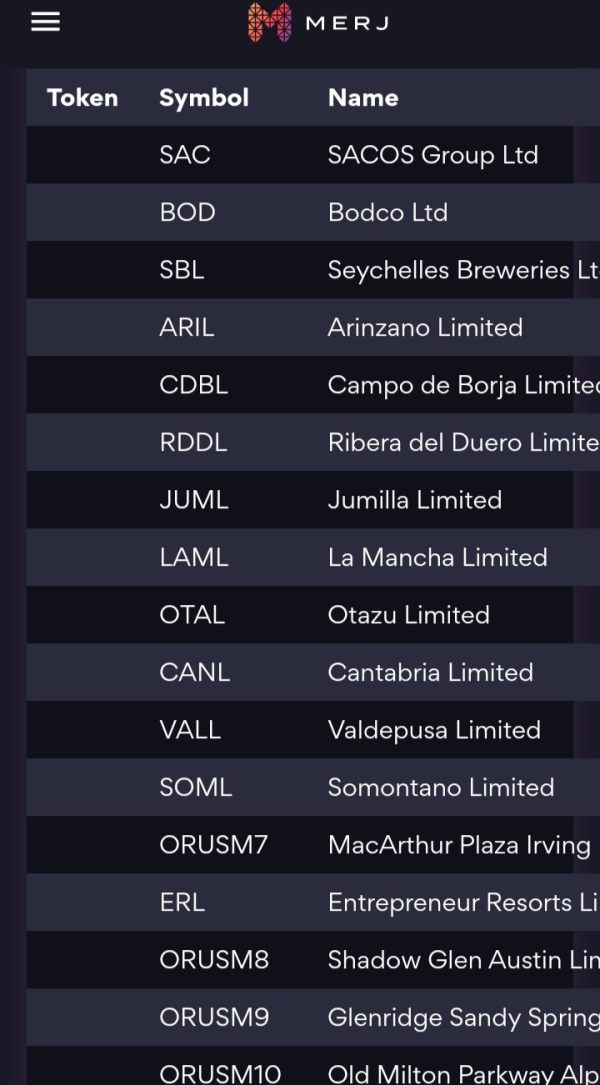

Tradeable Assets: The company has cryptocurrency token involvement, but available documentation doesn't list specific forex pairs, commodities, indices, or other trading instruments.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs are not specified in available sources. This makes cost comparison impossible.

Leverage Ratios: Current information sources don't mention maximum leverage offerings and margin requirements.

Platform Options: Available sources don't detail trading platform availability, whether MetaTrader, proprietary platforms, or web-based solutions.

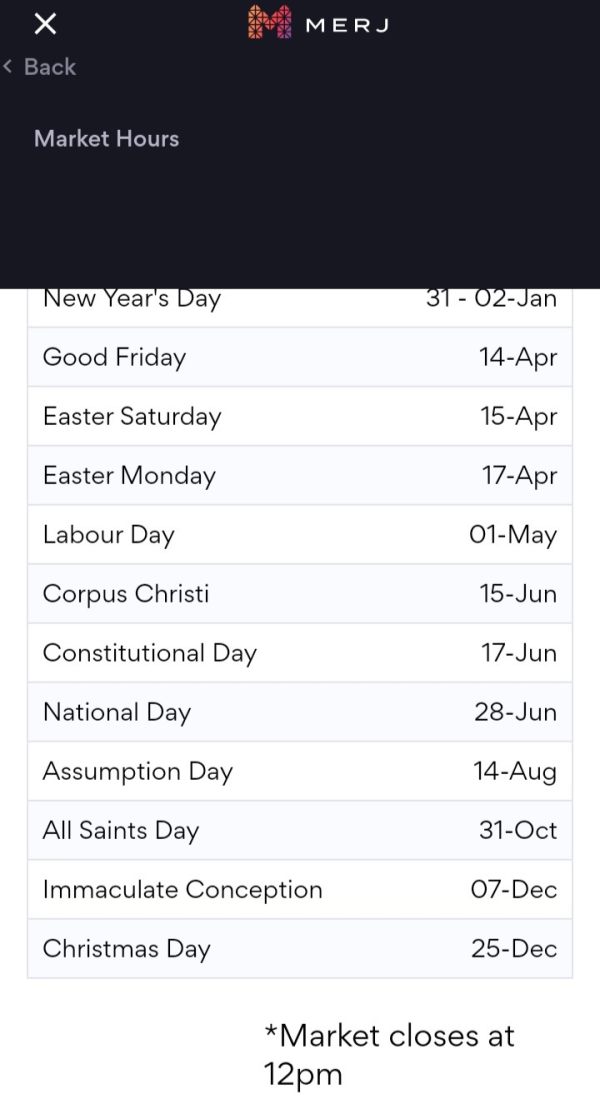

Geographic Restrictions: Current documentation doesn't address specific country limitations or service availability by region.

Customer Support Languages: Available sources don't specify supported languages for customer service.

This Merj review highlights significant information gaps that potential traders should consider when evaluating this service provider.

Detailed Rating Analysis

Account Conditions Analysis

The absence of specific account condition information in available sources presents a major concern for this Merj review. Traditional forex brokers typically offer multiple account types ranging from basic retail accounts to professional trading accounts with varying features, minimum deposits, and benefits. Current sources provide no details about account tiers, minimum funding requirements, or special account features that might be available.

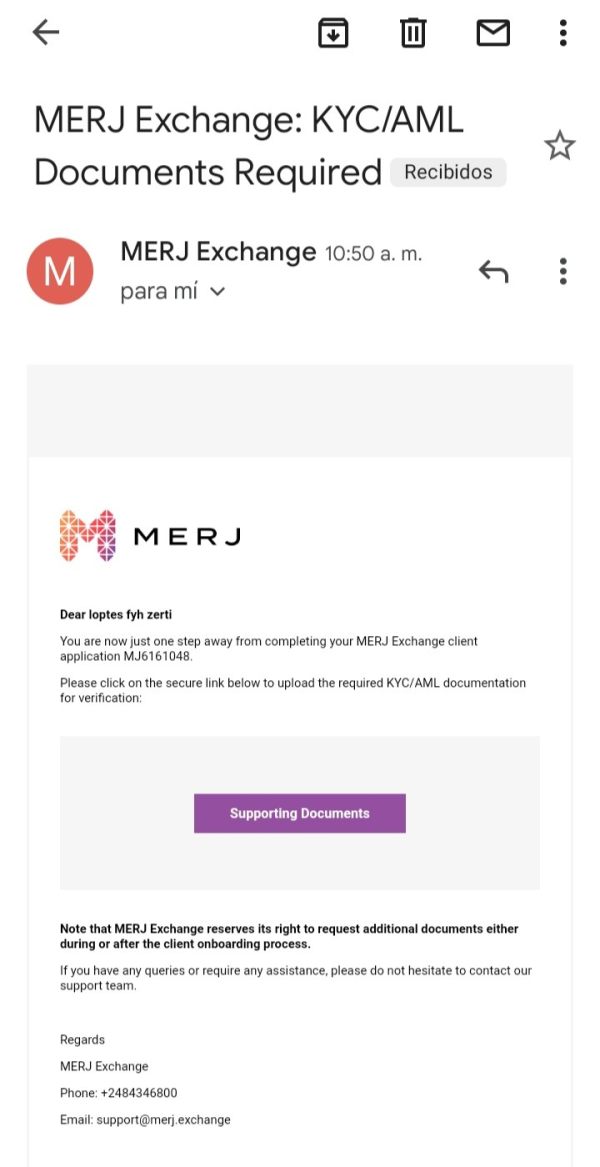

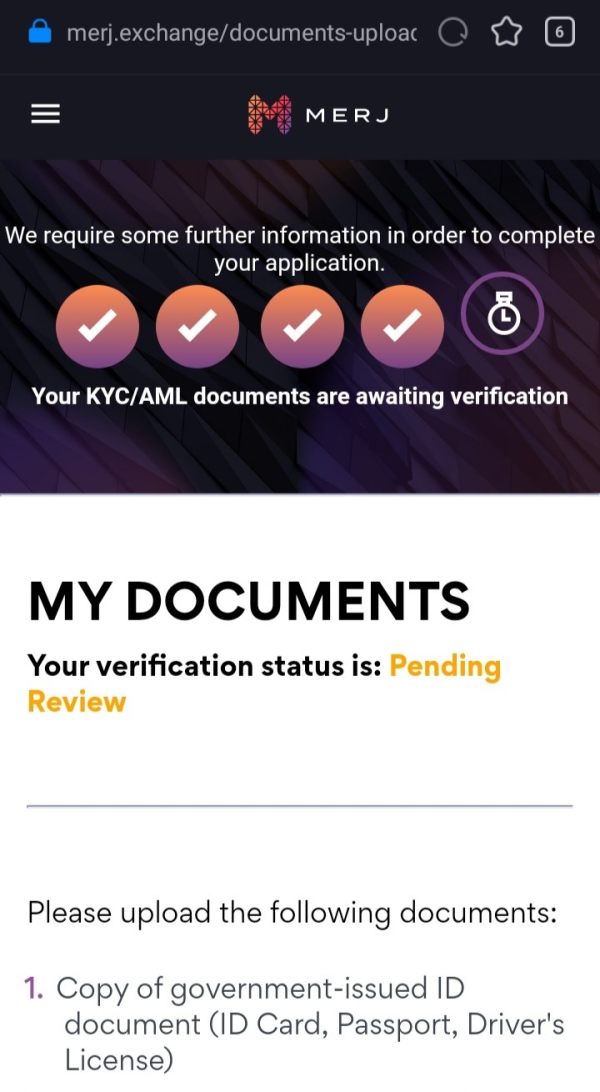

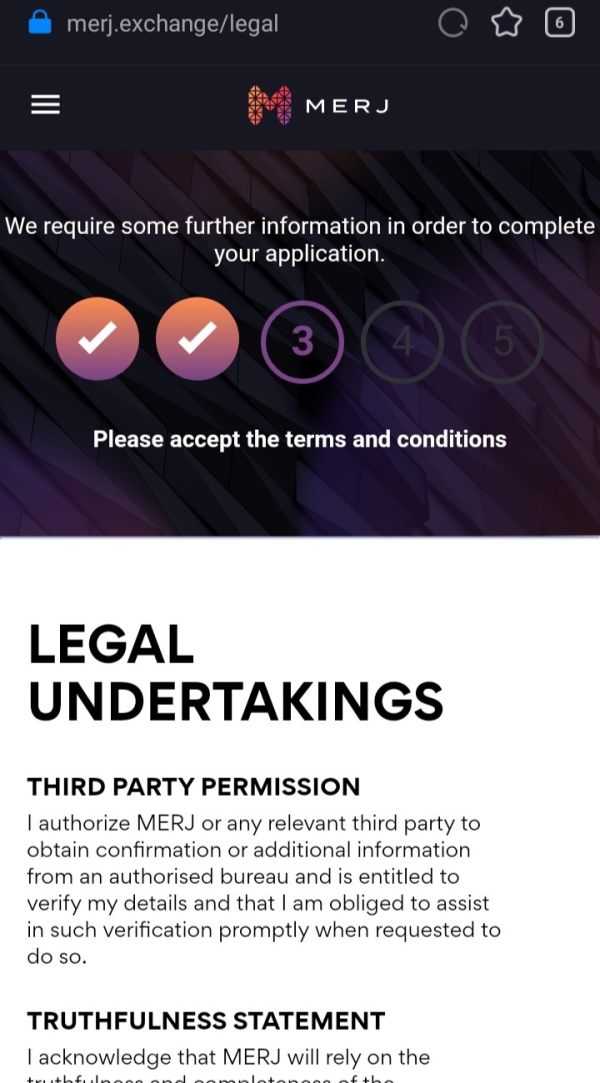

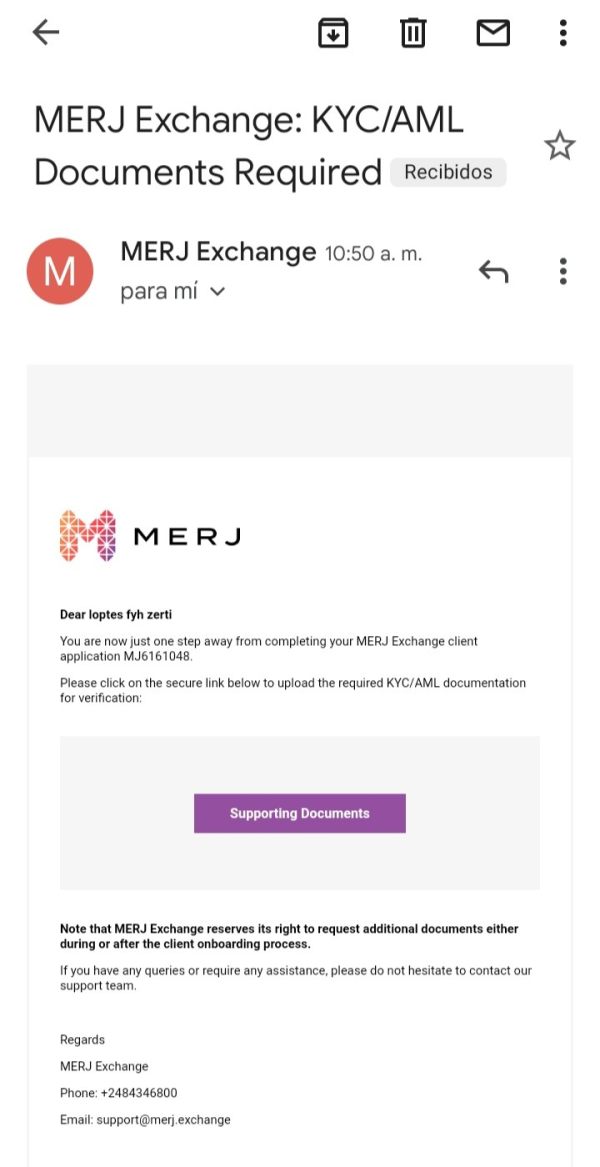

Potential traders cannot properly evaluate whether Merj's offerings align with their trading needs and religious requirements without information about Islamic accounts, demo account availability, or account upgrade pathways. The lack of transparency regarding account opening procedures, verification requirements, and approval timeframes further complicates the assessment process.

Most reputable forex brokers provide clear documentation about their account structures. This includes detailed comparisons of features, costs, and benefits across different account levels. The absence of such information raises questions about the comprehensiveness and professionalism of Merj's service offerings. Traders typically expect transparent disclosure of account conditions before committing funds to any brokerage relationship.

Available sources don't provide specific information about trading tools, analytical resources, or educational materials offered by Merj. Professional forex brokers typically provide comprehensive tool suites including technical analysis indicators, economic calendars, market news feeds, and educational resources to support trader development and decision-making processes.

The absence of information about research capabilities, market analysis provision, or third-party tool integration represents a significant gap in this evaluation. Modern forex trading requires access to sophisticated analytical tools, real-time market data, and comprehensive educational resources. This is particularly important for developing traders who need guidance and support.

Traders cannot assess whether Merj's platform meets contemporary trading requirements without details about automated trading support, expert advisor compatibility, or advanced order types. The lack of information about mobile trading capabilities, charting packages, or social trading features further limits the ability to evaluate the broker's technological offerings comprehensively.

Customer Service and Support Analysis

Customer service information is notably absent from available sources. This prevents a thorough assessment of support quality and availability. Professional forex brokers typically provide multiple contact channels including live chat, telephone support, email assistance, and comprehensive FAQ sections to address trader inquiries and technical issues.

The absence of information about support hours, response time commitments, or escalation procedures raises concerns about the level of customer care available to traders. Multi-language support capabilities are crucial for international forex brokers serving diverse client bases, but current sources don't mention these.

Potential clients cannot evaluate whether Merj provides adequate support infrastructure without details about account management services, technical support capabilities, or complaint resolution procedures. The lack of information about support team expertise, training programs, or service level agreements further complicates the assessment of customer service quality.

Trading Experience Analysis

Platform performance, execution quality, and overall trading environment details are not specified in available sources. This limits the ability to assess the practical trading experience offered by Merj. Professional forex execution requires stable platforms, fast order processing, minimal slippage, and reliable connectivity to provide traders with optimal market access.

The absence of information about platform uptime statistics, execution speed benchmarks, or slippage rates prevents evaluation of technical performance standards. Traders cannot determine whether the platform meets their operational requirements without details about order types, position sizing capabilities, or risk management tools.

Current sources don't address mobile trading capabilities, cross-platform synchronization, and offline functionality. Modern forex trading demands seamless access across multiple devices and operating systems. These features are essential for contemporary trading operations. This Merj review cannot adequately assess the trading experience without such fundamental information.

Trust Factor Analysis

The absence of specific regulatory information represents the most significant concern in this evaluation. Reputable forex brokers operate under strict regulatory oversight from recognized authorities such as the FCA, ASIC, CySEC, or other tier-one regulators. These authorities provide client protection through segregated funds, compensation schemes, and operational standards.

Traders cannot verify the safety measures protecting their funds or the legal framework governing their trading relationship without clear regulatory credentials. The lack of information about client fund segregation, insurance coverage, or dispute resolution mechanisms raises serious questions about financial security and regulatory compliance.

Available sources don't show company transparency regarding financial statements, audit reports, or regulatory filings. Professional forex brokers typically provide comprehensive disclosure about their regulatory status, operational licenses, and compliance procedures. This helps build client confidence and demonstrate regulatory adherence.

User Experience Analysis

Based on the limited 3.2 out of 5 star rating from 4 employee reviews on AmbitionBox, workplace satisfaction appears moderate. However, this provides minimal insight into client trading experiences. The small sample size of reviews limits the reliability of this assessment, and employee satisfaction does not necessarily correlate with client service quality.

Available sources don't detail interface design, platform usability, and account management processes. This prevents evaluation of the practical user experience. Current documentation doesn't describe registration procedures, verification workflows, and onboarding processes that significantly impact initial user impressions.

The absence of client testimonials, user feedback, or independent reviews makes it impossible to assess actual trading experiences or identify common user concerns. Potential traders cannot evaluate whether Merj's services align with their technical comfort levels and operational preferences without information about platform learning curves, feature accessibility, or user interface design principles.

Conclusion

This Merj review reveals significant information gaps that prevent a comprehensive evaluation of the broker's forex trading services. MERJ LIMITED appears to be a UK-based entity with some involvement in cryptocurrency markets, but the absence of crucial details about regulatory oversight, trading conditions, and customer support raises substantial concerns for potential forex traders.

The limited available information suggests that traders seeking transparent, well-regulated forex services should exercise considerable caution when considering Merj. The lack of regulatory clarity, undefined trading conditions, and absent customer service details make it difficult to recommend this broker for serious forex trading activities. Potential clients would benefit from seeking brokers with comprehensive regulatory disclosure, transparent trading conditions, and established track records in the forex industry.