FXM 2025 Review: Everything You Need to Know

Summary

FXM Traders is a UK-based forex broker that operates without regulatory oversight. This creates a controversial position in the trading community, but user evaluations suggest that FXM maintains a reputation as a trustworthy platform among its client base. The broker's primary offering is the FXM Trading Station. This proprietary platform is designed to facilitate technical analysis and strategy development for forex traders.

This fxm review reveals that the broker primarily targets intermediate-level traders who are comfortable operating in an unregulated trading environment. While the lack of regulatory supervision raises legitimate concerns about trader protection and fund security, FXM has managed to build a user base that appreciates its trading tools and platform functionality. The broker's focus on forex trading, combined with its specialized trading station, positions it as a niche player in the competitive online trading landscape.

However, potential clients should carefully consider the implications of trading with an unregulated broker. They must weigh the platform's features against the inherent risks associated with the absence of regulatory protection.

Important Notice

Regulatory Warning: FXM Traders operates as a UK-based broker but lacks authorization from major financial regulatory authorities including the Financial Conduct Authority or other recognized supervisory bodies. This absence of regulatory oversight means traders do not benefit from standard investor protection schemes, compensation funds, or regulatory dispute resolution mechanisms.

This review methodology incorporates comprehensive analysis of available user feedback, market positioning assessment, and platform functionality evaluation. Our assessment aims to provide a balanced perspective on FXM's offerings while highlighting both opportunities and risks associated with this unregulated broker.

Rating Framework

Broker Overview

FXM Traders emerged in the forex trading landscape in 2025 as part of the broader FXM Financial Group structure. The company established its operations base in the United Kingdom, positioning itself to serve the European and international forex trading markets. Despite its recent establishment, FXM has focused on developing a comprehensive trading ecosystem centered around forex market access and specialized trading tools.

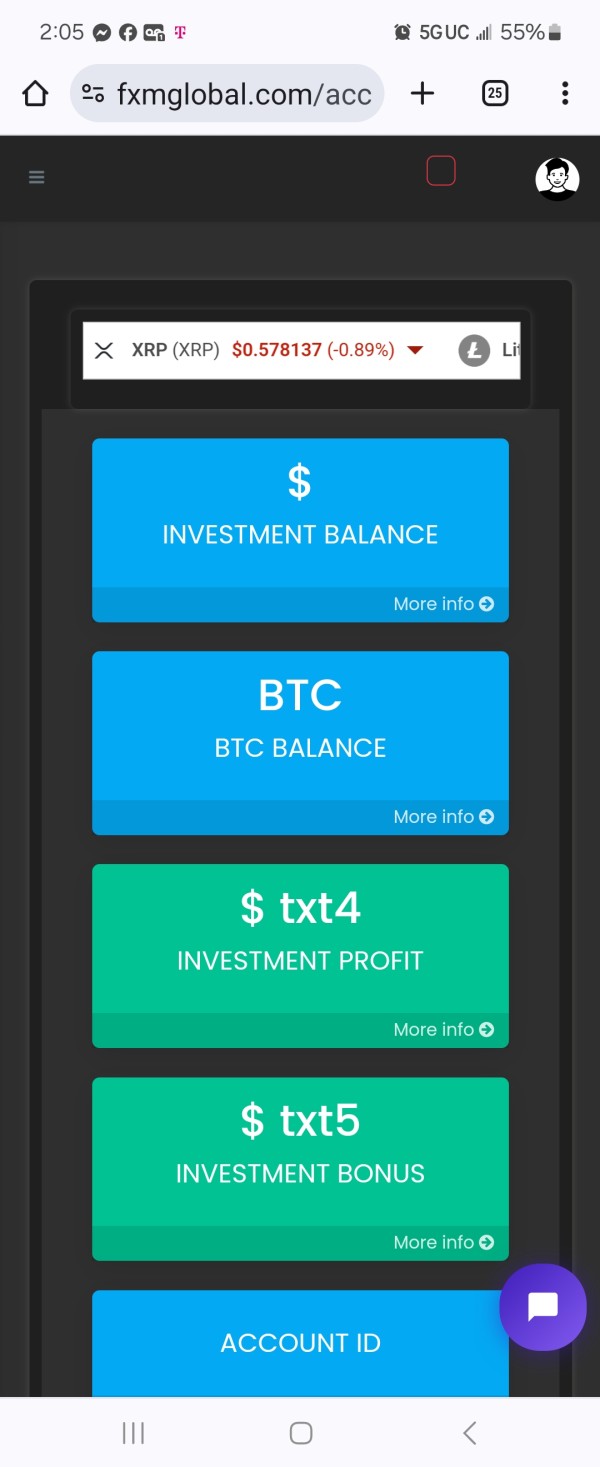

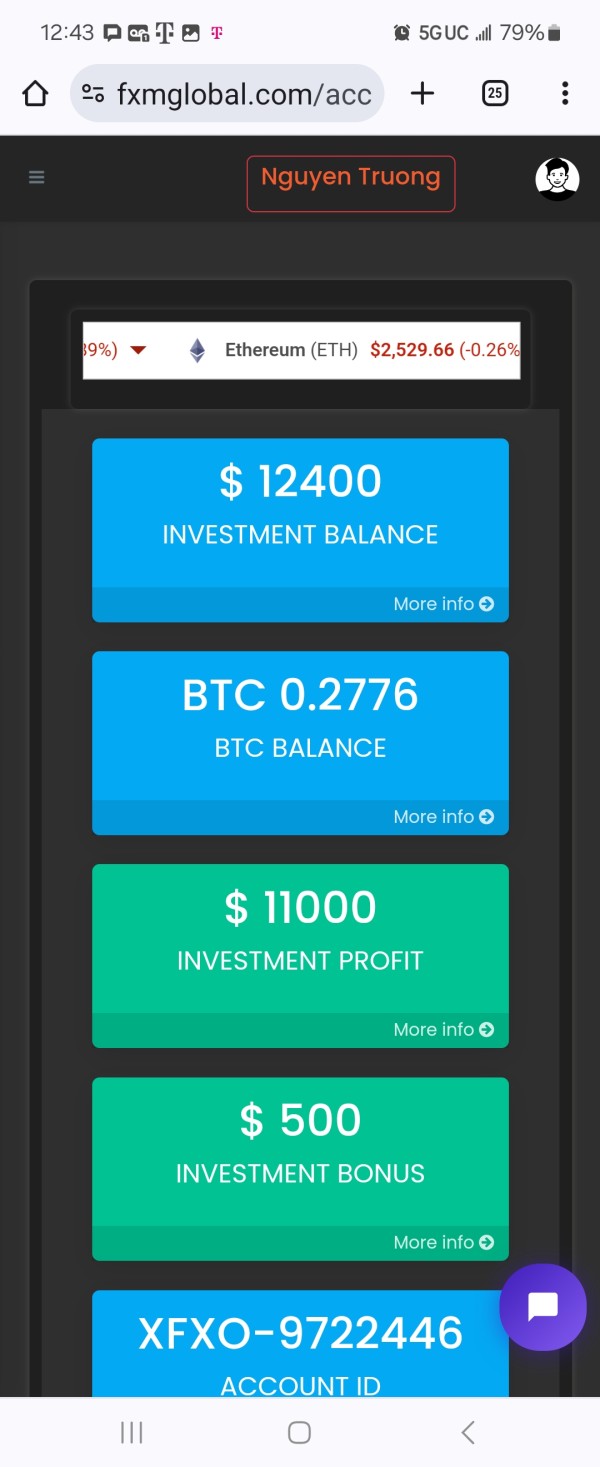

The broker's business model emphasizes direct market access for forex trading. It utilizes its proprietary technology infrastructure to deliver trading services, and FXM Traders operates primarily as a market maker, providing liquidity and pricing for major and minor currency pairs. This fxm review indicates that the company has invested significantly in developing its technological capabilities, particularly through the FXM Trading Station platform.

FXM Trading Station serves as the cornerstone of the broker's service offering. The platform provides traders with a comprehensive suite of technical analysis tools, charting capabilities, and strategy development features, and it supports various trading styles and approaches, from scalping to longer-term position trading. While the available information does not specify additional asset classes beyond forex, the broker's focus on currency trading appears to be its primary strength and market positioning strategy.

Regulatory Status: FXM Traders operates without specific regulatory authorization from major financial supervisory authorities. Located in the United Kingdom, the broker does not hold authorization or equivalent regulatory permissions from other jurisdictions.

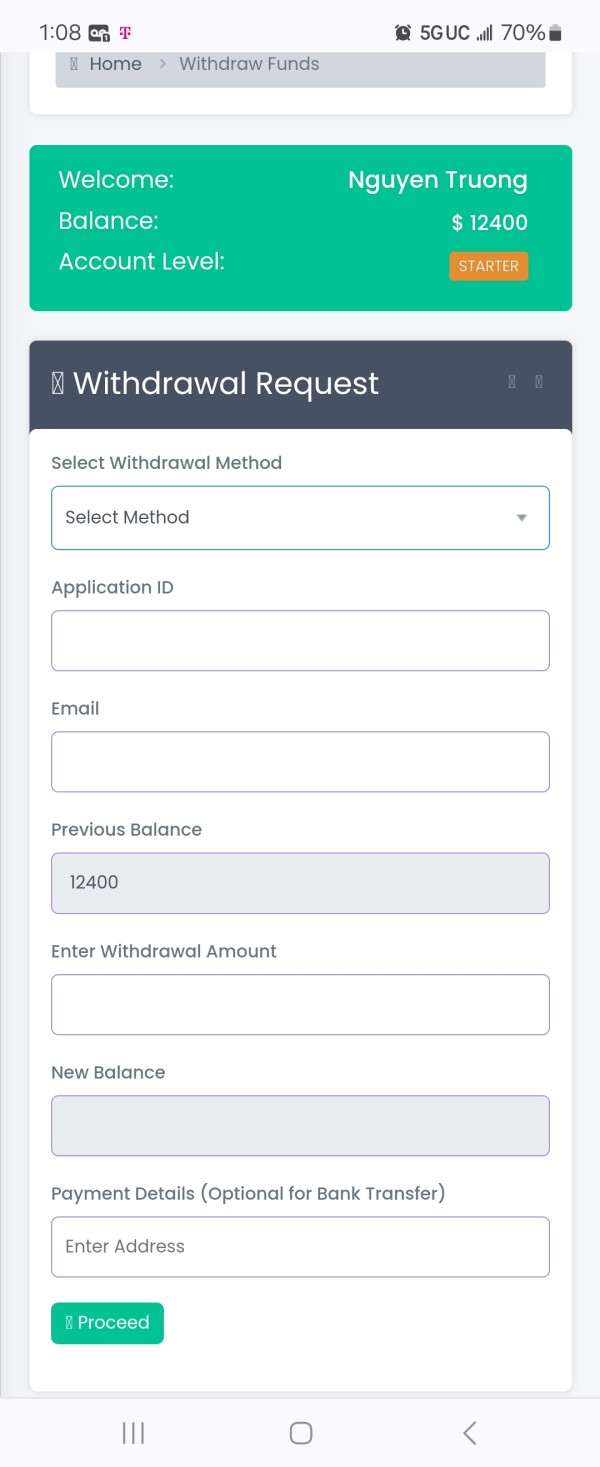

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available documentation. Prospective clients should contact the broker directly for comprehensive payment processing information.

Minimum Deposit Requirements: The exact minimum deposit threshold for account opening has not been specified in available broker information. This would require direct inquiry with FXM representatives.

Promotional Offerings: Current bonus structures, promotional campaigns, or incentive programs are not detailed in available broker documentation.

Tradeable Assets: The broker's primary focus centers on forex currency pairs. However, specific information regarding additional asset classes such as commodities, indices, or cryptocurrencies is not available in current documentation.

Cost Structure: This fxm review finds that detailed information regarding spreads, commissions, overnight financing charges, and other trading costs is not comprehensively available in public documentation.

Leverage Options: Specific leverage ratios and margin requirements have not been detailed in available broker information.

Platform Selection: FXM Trading Station represents the primary trading platform offering. Information regarding additional platform options or third-party software integration is not specified.

Geographic Restrictions: Specific regional limitations or restricted jurisdictions are not detailed in current available information.

Customer Support Languages: The range of supported languages for customer service communications has not been specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions evaluation for FXM Traders reveals significant information gaps that impact the overall assessment. Without detailed information regarding account types, minimum deposit requirements, or specific account features, potential traders face uncertainty when evaluating whether FXM meets their trading needs. The absence of clear account tier structures or specialized account options limits the broker's appeal to diverse trader segments.

Account opening procedures and verification requirements remain unspecified in available documentation. This creates additional uncertainty for prospective clients, and the lack of information regarding Islamic account availability, VIP account features, or other specialized account types suggests either limited product diversity or insufficient transparency in marketing communications.

This fxm review notes that successful forex brokers typically provide comprehensive account information to facilitate informed decision-making. FXM's limited disclosure in this area represents a significant weakness in their client acquisition and retention strategy. Without clear understanding of account conditions, traders cannot effectively compare FXM's offerings against industry competitors or assess value proposition relative to their trading requirements.

The absence of detailed account information also raises questions about the broker's commitment to transparency and client education. These are fundamental elements in building trust within the trading community.

FXM Trading Station demonstrates significant strength in providing comprehensive technical analysis capabilities and strategy development tools. The proprietary platform offers traders access to advanced charting functionality, multiple timeframe analysis, and customizable technical indicators essential for informed trading decisions. The platform's strategy development features enable traders to create, test, and implement automated trading approaches.

The technical analysis suite includes standard and advanced indicators, drawing tools, and pattern recognition capabilities that support both novice and experienced traders. The platform's architecture appears designed to handle complex analytical requirements while maintaining user-friendly navigation and functionality.

However, this evaluation is limited by the absence of information regarding additional research resources, market analysis publications, economic calendars, or educational content. Comprehensive broker offerings typically include fundamental analysis resources, market commentary, and educational materials that complement technical trading tools.

The lack of specified integration with third-party analysis platforms or external research providers may limit the platform's appeal to traders who rely on diverse information sources for trading decisions. Despite these limitations, the core trading tools and platform functionality represent a significant strength in FXM's service offering.

Customer Service and Support Analysis (Score: 5/10)

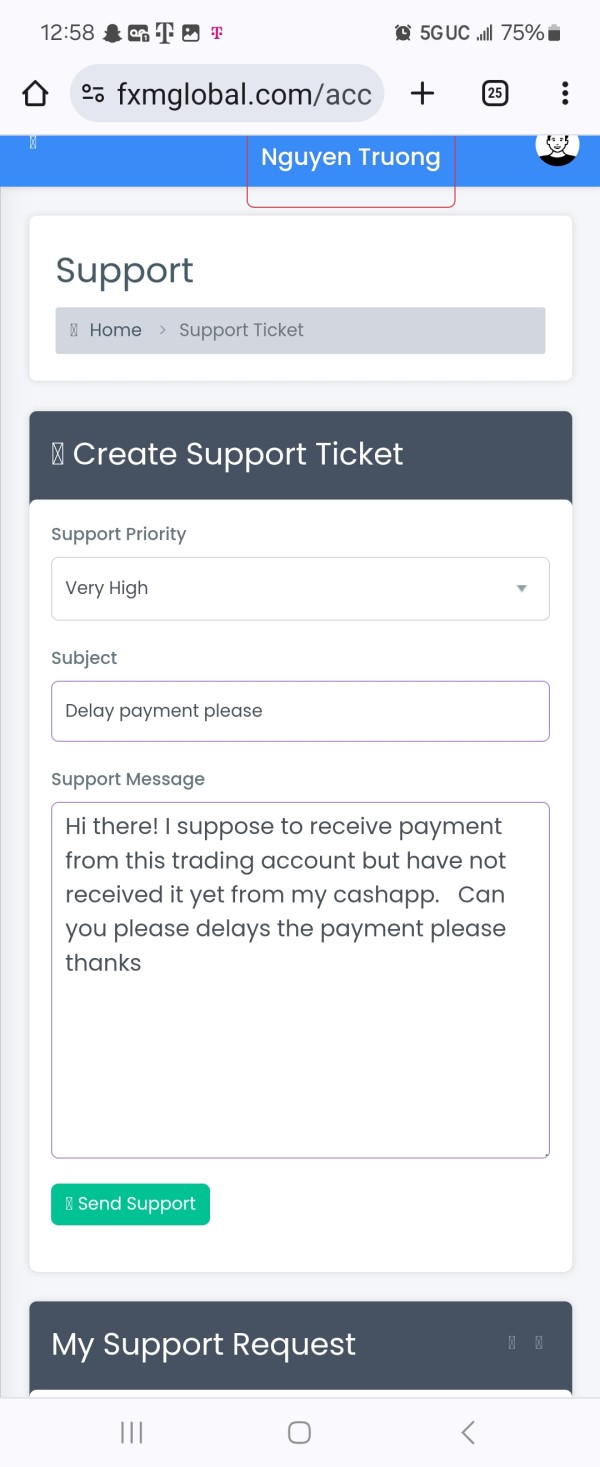

Customer service evaluation for FXM Traders is significantly hampered by the absence of detailed information regarding support channels, availability, and service quality standards. Without specific information about contact methods, response time commitments, or support staff expertise, this assessment relies on general industry standards and the limited available feedback.

The lack of specified customer service hours, multilingual support capabilities, or dedicated account management services suggests either limited service infrastructure or insufficient transparency in service marketing. Professional forex brokers typically provide multiple contact channels including phone, email, live chat, and sometimes social media support to accommodate diverse client preferences and urgency levels.

Response time commitments and service level agreements represent critical factors in trader satisfaction, particularly during volatile market conditions when rapid support access becomes essential. The absence of this information in available documentation creates uncertainty about FXM's commitment to client service excellence.

Without documented user feedback regarding service quality, problem resolution effectiveness, or staff expertise, this evaluation cannot provide definitive assessment of actual service performance. The neutral rating reflects the uncertainty created by limited available information rather than confirmed service deficiencies.

Trading Experience Analysis (Score: 6/10)

The trading experience evaluation focuses primarily on FXM Trading Station's functionality and performance capabilities. The platform's technical analysis tools and strategy development features suggest a comprehensive trading environment designed to support various trading approaches and experience levels. The proprietary platform architecture indicates investment in technology infrastructure to deliver reliable trading services.

Platform stability and execution speed represent critical factors in trading experience quality. However, specific performance metrics or independent testing results are not available in current documentation, and the absence of detailed information regarding order execution policies, slippage statistics, or latency measurements limits the ability to assess actual trading conditions comprehensively.

Mobile trading capabilities and cross-platform synchronization have become essential features for modern traders. Specific information regarding FXM's mobile offerings is not detailed in available documentation, and the lack of information regarding platform customization options, alert systems, or advanced order types may impact the platform's appeal to sophisticated traders.

User feedback regarding actual trading experience, platform reliability, and execution quality would provide valuable insight but is not sufficiently available in current documentation. The moderate rating reflects the platform's apparent technical capabilities balanced against the uncertainty created by limited performance data and user testimonials.

Trust and Security Analysis (Score: 3/10)

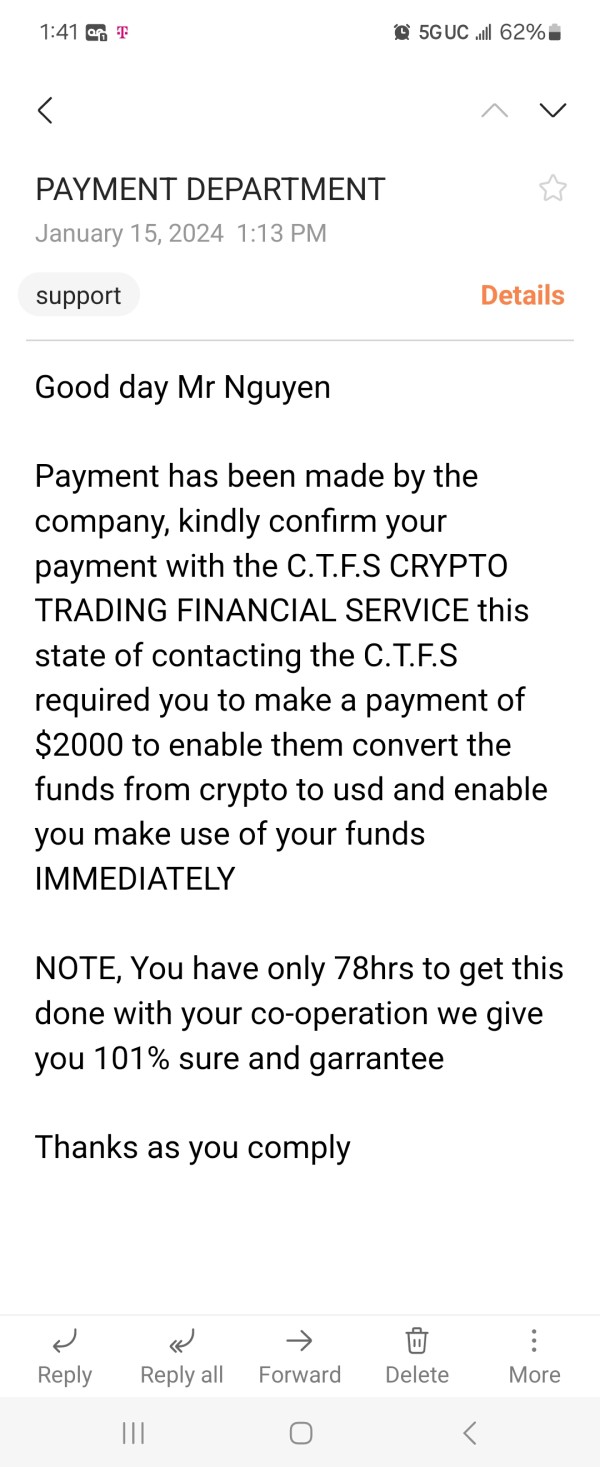

The trust and security evaluation reveals significant concerns primarily stemming from FXM's unregulated status. Operating without authorization from recognized financial regulatory authorities means traders lack standard investor protection mechanisms, compensation scheme coverage, and regulatory oversight of business practices. This regulatory gap represents the most significant risk factor in the FXM offering.

Fund security measures, segregated account policies, and client money protection protocols are not detailed in available documentation. This creates additional uncertainty about asset safety, and regulated brokers typically provide comprehensive information about client fund handling, segregation practices, and insurance coverage to demonstrate commitment to client protection.

The absence of regulatory supervision means FXM operates without mandatory compliance with capital adequacy requirements, business conduct standards, or dispute resolution mechanisms that characterize regulated broker operations. This creates inherent risks for traders regardless of the broker's actual business practices or intentions.

Company transparency regarding ownership structure, financial statements, or operational policies is limited in available documentation. Without regulatory reporting requirements or independent oversight, traders must rely entirely on the broker's voluntary disclosures and reputation within the trading community. The low rating reflects these fundamental structural concerns rather than specific evidence of misconduct or business failures.

User Experience Analysis (Score: 6/10)

User experience assessment indicates mixed feedback regarding FXM's service delivery and platform functionality. Available user evaluations suggest that some traders view FXM as a trustworthy platform despite the regulatory concerns, indicating positive experiences with actual service delivery. This suggests that the broker may be delivering satisfactory services to its existing client base.

The FXM Trading Station's technical capabilities appear to provide adequate functionality for traders seeking comprehensive analysis tools and strategy development features. However, the lack of detailed information regarding user interface design, navigation efficiency, and learning curve considerations limits the assessment of overall user experience quality.

Registration and account verification processes, fund deposit and withdrawal experiences, and ongoing account management procedures are not detailed in available documentation. These operational aspects significantly impact overall user satisfaction and retention rates among forex brokers.

The target user profile appears to focus on intermediate-level traders comfortable with unregulated trading environments. This suggests a specialized rather than mass-market approach, and this positioning may limit broader appeal but could provide focused service delivery for the intended audience. The moderate rating reflects the balance between apparent positive user feedback and the limitations created by regulatory concerns and information gaps.

Conclusion

FXM Traders presents a complex proposition in the forex trading landscape as a newly established broker offering specialized trading tools while operating without regulatory oversight. This fxm review reveals that despite user evaluations suggesting trustworthy service delivery, the fundamental absence of regulatory protection creates significant concerns for potential traders.

The broker's strength lies primarily in its FXM Trading Station platform. This platform offers comprehensive technical analysis capabilities and strategy development tools suitable for intermediate-level forex traders, but the lack of detailed information regarding account conditions, costs, and operational policies limits transparency and informed decision-making.

FXM appears most suitable for experienced traders who prioritize advanced trading tools over regulatory protection and are comfortable assuming the inherent risks of unregulated broker relationships. The primary advantages include specialized platform functionality and apparent user satisfaction. The main disadvantages center on regulatory absence and limited operational transparency.