Fox Markets 2025 Review: Everything You Need to Know

Summary

Fox Markets is an online forex broker registered in Saint Vincent and the Grenadines. It operates under Fox Markets Ltd. While the broker offers high leverage up to 1:400 and a diverse range of trading assets, significant concerns arise regarding its regulatory transparency and overall credibility. This fox markets review reveals a trading entity that provides access to over 40 currency pairs and CFDs across various asset classes including indices, commodities, precious metals, and cryptocurrencies through the MetaTrader 4 platform.

The broker targets traders seeking high leverage opportunities and diversified asset exposure. However, potential clients must carefully consider the regulatory implications of choosing a Saint Vincent and the Grenadines-based entity. User feedback presents a mixed picture. Some traders report platform stability while others raise concerns about withdrawal processes and customer service responsiveness. The lack of clear regulatory oversight from major financial authorities creates additional uncertainty for traders evaluating Fox Markets as their preferred broker.

Important Notice

Fox Markets operates as Fox Markets Ltd., registered in Saint Vincent and the Grenadines. This may not provide the same regulatory protections as brokers licensed by major financial authorities such as the FCA, ASIC, or CySEC. Regional differences in regulatory frameworks mean that trader protections and recourse mechanisms may vary significantly depending on jurisdiction.

This review is based on available information and user feedback at the time of writing. It may not encompass all aspects of the broker's operations. Trading conditions, policies, and regulatory status may change. Potential clients should verify current information directly with the broker before making investment decisions.

Rating Framework

Broker Overview

Fox Markets Ltd. operates as an online forex and CFD broker registered in Saint Vincent and the Grenadines. The exact establishment date remains unclear from available sources. The company positions itself as a provider of diverse trading opportunities across multiple asset classes, targeting both novice and experienced traders seeking access to international financial markets. According to Fundevity reports, skepticism surrounds the broker due to its offshore registration, which typically offers limited regulatory oversight compared to major financial jurisdictions.

The broker's business model centers on providing online trading services through established platforms. It primarily focuses on forex and CFD products. Fox Markets claims to serve a global clientele, though specific geographical restrictions and compliance measures remain unclear from available documentation. The company's operational transparency appears limited, with minimal public information about its management team, company history, or specific business practices.

Fox Markets offers trading through the MetaTrader 4 platform. It provides access to over 40 currency pairs and CFDs spanning indices, commodities, precious metals, and cryptocurrencies. The broker emphasizes high leverage offerings up to 1:400, appealing to traders seeking amplified market exposure. However, as noted in various fox markets review sources, the lack of clear regulatory information raises questions about the broker's compliance standards and trader protection mechanisms.

Regulatory Status: Fox Markets Ltd. is registered in Saint Vincent and the Grenadines. Specific regulatory license numbers and oversight authorities are not clearly disclosed in available materials. This offshore jurisdiction typically provides minimal regulatory oversight compared to major financial authorities.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in current sources. This requires direct verification with the broker.

Minimum Deposit Requirements: The minimum deposit amount for account opening is not specified in available documentation. This suggests potential clients need to contact Fox Markets directly for this information.

Bonus and Promotions: Current promotional offerings and bonus structures are not mentioned in available sources. This indicates either no active promotions or lack of transparency regarding incentive programs.

Tradable Assets: The broker provides access to over 40 currency pairs and CFDs across multiple asset classes. These include major and minor forex pairs, stock indices, commodities, precious metals, and cryptocurrency instruments.

Cost Structure: Specific details regarding spreads, commission structures, overnight fees, and other trading costs are not clearly outlined in available sources. The absence of transparent pricing information raises concerns about cost competitiveness and fee transparency.

Leverage Ratios: Fox Markets offers maximum leverage up to 1:400. This exceeds regulatory limits in many major jurisdictions and may indicate targeting of less regulated markets.

Platform Options: The broker primarily offers MetaTrader 4 platform. It provides standard charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

Geographic Restrictions: Specific countries or regions where Fox Markets services are restricted or unavailable are not detailed in current sources.

Customer Support Languages: Available customer service languages are not specified in accessible documentation. This requires direct inquiry for multilingual support capabilities.

This fox markets review reveals significant information gaps that potential traders should address through direct communication with the broker before account opening.

Account Conditions Analysis

Fox Markets offers three distinct account types. Specific details about each tier's features and requirements remain unclear from available sources. The lack of transparent information about account specifications, including minimum deposit requirements, spread differences, and exclusive features for each account level, creates uncertainty for potential clients evaluating their options.

The account opening process details are not thoroughly documented in accessible materials. This makes it difficult to assess the complexity and time requirements for new client onboarding. This information gap is particularly concerning for traders who value streamlined registration procedures and clear account setup expectations.

Regarding special account features such as Islamic accounts for Sharia-compliant trading, no specific information is available in current sources. The absence of details about swap-free options may limit the broker's appeal to Muslim traders seeking compliant trading solutions.

The broker's approach to account verification, documentation requirements, and identity confirmation procedures is not clearly outlined. This lack of transparency regarding compliance processes raises questions about the broker's adherence to international anti-money laundering standards and know-your-customer regulations.

Fox markets review sources indicate that while multiple account types exist, the differentiation between them and the specific benefits of higher-tier accounts remain unclear. This opacity in account structure makes it challenging for traders to make informed decisions about which account type best suits their trading needs and capital requirements.

Fox Markets provides the MetaTrader 4 platform as its primary trading interface. It offers standard charting capabilities, technical indicators, and automated trading support through Expert Advisors. The platform's stability and functionality generally receive positive feedback from users, though specific customization options and advanced features are not detailed in available sources.

The broker claims to offer advanced trading tools. However, specific details about proprietary indicators, market analysis features, or enhanced charting capabilities are not clearly documented. This lack of transparency about tool specifications makes it difficult to assess the platform's competitive advantages compared to other brokers offering similar services.

Research and analysis resources appear limited based on available information. There is no clear indication of daily market commentary, economic calendars, or fundamental analysis reports. The absence of comprehensive research support may disadvantage traders who rely on broker-provided market insights for their trading decisions.

Educational resources and training materials are not mentioned in accessible documentation. This suggests either minimal educational support or lack of transparency about available learning resources. This gap is particularly significant for novice traders who typically benefit from structured educational programs and trading guides.

Automated trading support through MetaTrader 4's Expert Advisors functionality is available. However, specific restrictions, performance monitoring, or broker-developed trading algorithms are not detailed. The lack of information about algorithmic trading support and copy trading features may limit appeal to traders seeking automated solutions.

Customer Service and Support Analysis

Customer service quality emerges as a significant concern in user feedback. Multiple reports indicate slow response times and inadequate problem resolution capabilities. According to available user reviews, traders have experienced difficulties obtaining timely assistance for account-related issues and technical problems.

The specific customer support channels available, including live chat, email support, phone assistance, and ticket systems, are not clearly documented in accessible sources. This lack of transparency about communication options makes it difficult for potential clients to understand how they can reach support when needed.

Response time expectations and service availability hours are not specified. This creates uncertainty about when traders can expect assistance. The absence of clear service level commitments raises concerns about support reliability during critical trading periods or urgent account issues.

Multilingual support capabilities are not detailed in available documentation. This potentially limits accessibility for non-English speaking traders. The lack of information about local language support may indicate limited international service capabilities.

User feedback suggests that problem resolution effectiveness varies significantly. Some traders report unsatisfactory outcomes when seeking assistance with withdrawal issues or account problems. These service quality concerns contribute to overall trust and reliability questions about the broker's operational standards.

Trading Experience Analysis

The MetaTrader 4 platform provides a familiar trading environment for most forex traders. It offers standard functionality including real-time pricing, order management, and technical analysis tools. User feedback generally indicates platform stability, though specific performance metrics such as execution speeds and server uptime are not documented in available sources.

Order execution quality data is not available in accessible materials. This makes it difficult to assess slippage rates, fill ratios, or execution speed performance during various market conditions. The absence of execution statistics raises questions about trading environment quality and price competitiveness.

Platform functionality appears comprehensive through MetaTrader 4's standard features. These include multiple order types, pending orders, and risk management tools. However, specific enhancements or customizations provided by Fox Markets are not detailed in current sources.

Mobile trading experience information is not available in accessible documentation. MetaTrader 4 typically offers mobile applications though. The lack of specific details about mobile platform features, synchronization capabilities, and mobile-specific tools creates uncertainty about trading flexibility.

The overall trading environment assessment is complicated by limited information about spreads, liquidity providers, and market depth. This fox markets review reveals that while the platform foundation appears solid through MetaTrader 4, specific trading conditions and competitive advantages remain unclear from available sources.

Trust and Reliability Analysis

The regulatory landscape surrounding Fox Markets presents significant concerns. The broker's registration in Saint Vincent and the Grenadines offers minimal oversight compared to major financial authorities. The absence of clear regulatory license numbers and compliance information raises questions about the broker's adherence to international financial standards.

Fund safety measures and client money protection protocols are not detailed in available sources. This creates uncertainty about segregated account practices, deposit insurance, or compensation schemes. This lack of transparency about client fund security represents a major trust concern for potential depositors.

Company transparency appears limited. There is minimal public information about management team, company ownership, financial statements, or operational history. The opacity surrounding corporate structure and leadership raises questions about accountability and business legitimacy.

Industry reputation suffers from user skepticism about the broker's legitimacy, as noted in multiple review sources. The combination of offshore registration and limited regulatory oversight contributes to credibility concerns among potential clients and industry observers.

Negative event handling capabilities are questionable based on user reports of withdrawal difficulties and unresolved customer service issues. The broker's response to client complaints and problem resolution effectiveness appears inadequate based on available feedback, further undermining trust and reliability perceptions.

User Experience Analysis

Overall user satisfaction appears mixed based on available feedback. Traders express varied experiences regarding platform functionality, customer service, and operational reliability. The lack of comprehensive user surveys or satisfaction metrics makes it difficult to assess general client contentment levels.

Interface design and usability rely primarily on MetaTrader 4's standard layout and functionality. Specific customizations or user experience enhancements provided by Fox Markets are not documented though. The platform's learning curve and accessibility for new traders remain unclear from available sources.

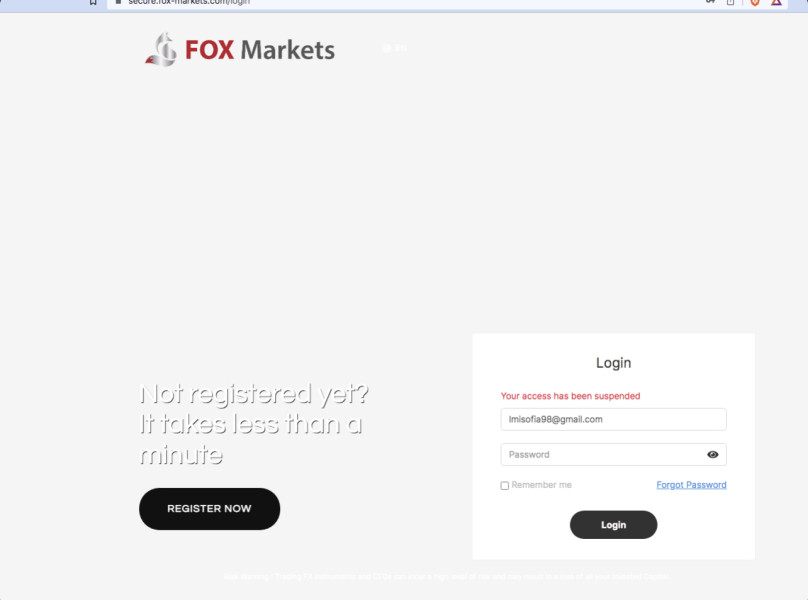

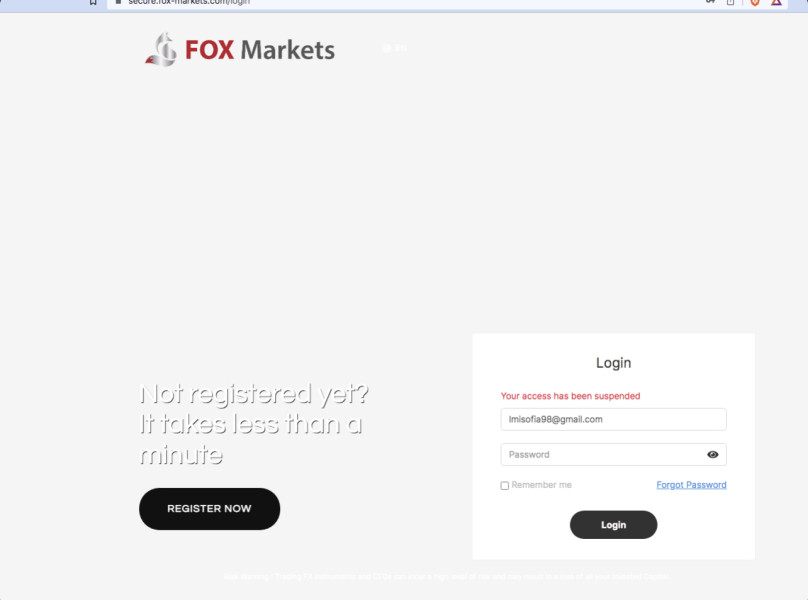

Registration and verification processes are not detailed in accessible materials. This makes it difficult to assess the complexity and time requirements for account setup. User feedback about onboarding experiences and documentation requirements is limited in available sources.

Fund operation experiences present particular concerns. User reports indicate withdrawal difficulties and processing delays. These operational issues significantly impact overall user satisfaction and raise questions about the broker's financial processing capabilities.

Common user complaints center around withdrawal problems and customer service responsiveness, according to available feedback. The frequency and severity of these issues suggest systematic operational challenges that affect the overall user experience and broker credibility.

Conclusion

Fox Markets presents a complex trading proposition that combines attractive features with significant concerns. While the broker offers high leverage up to 1:400 and access to diverse trading assets across multiple asset classes, the lack of clear regulatory oversight and transparency issues create substantial credibility challenges.

The broker may appeal to traders seeking high leverage opportunities and multi-asset exposure through the familiar MetaTrader 4 platform. However, the offshore registration in Saint Vincent and the Grenadines, combined with user reports of withdrawal difficulties and customer service issues, suggests that potential clients should exercise considerable caution.

The primary advantages include competitive leverage ratios and diverse asset access. Significant disadvantages encompass regulatory uncertainty, limited transparency, and operational reliability concerns. Traders considering Fox Markets should thoroughly evaluate these risk factors against their trading requirements and risk tolerance before proceeding with account opening.