FES 2025 Review: Everything You Need to Know

Executive Summary

This fes review gives you a complete analysis of FES as a trading platform based on available information and market research. FES shows itself as a broker that offers demo accounts and swap-free trading options with competitive spreads, though detailed regulatory information stays limited in publicly available sources. The platform seems to target traders who want to experience simulated trading environments and Islamic-compliant trading conditions.

Based on our evaluation, FES gets a neutral rating because of the lack of comprehensive regulatory disclosure and limited company background information in available materials. The broker's key features include demo account availability, swap-free options, and competitive pricing structures, making it potentially suitable for traders who prioritize these specific features. However, the absence of detailed regulatory credentials and company transparency may concern traders who prioritize regulatory oversight and corporate accountability.

The platform seems most appropriate for traders interested in testing trading strategies through demo accounts or those requiring swap-free trading conditions for religious or strategic reasons. However, potential users should conduct additional due diligence given the limited publicly available information regarding regulatory status and company background.

Important Notice

This review is based on available information from various sources and user feedback compiled through market research. Due to limited detailed information about FES's regulatory status and corporate structure in publicly accessible materials, this evaluation focuses on features and services that could be verified through available sources.

Traders should independently verify all regulatory credentials, terms of service, and company information before making any trading decisions. The evaluation methodology incorporates industry standards for broker assessment while acknowledging information limitations where they exist.

Rating Framework

Broker Overview

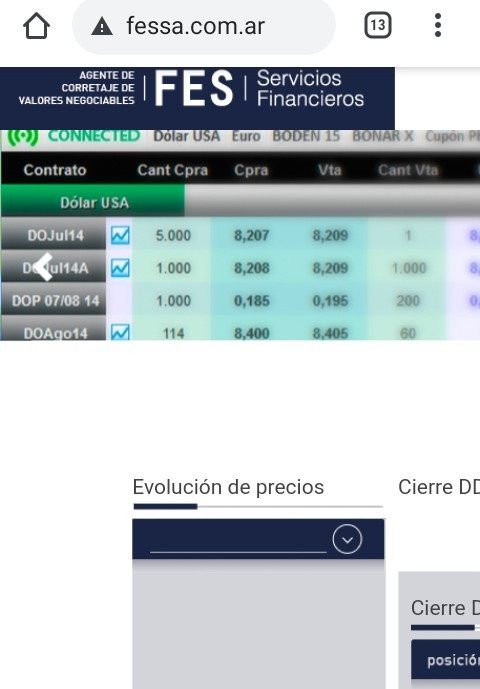

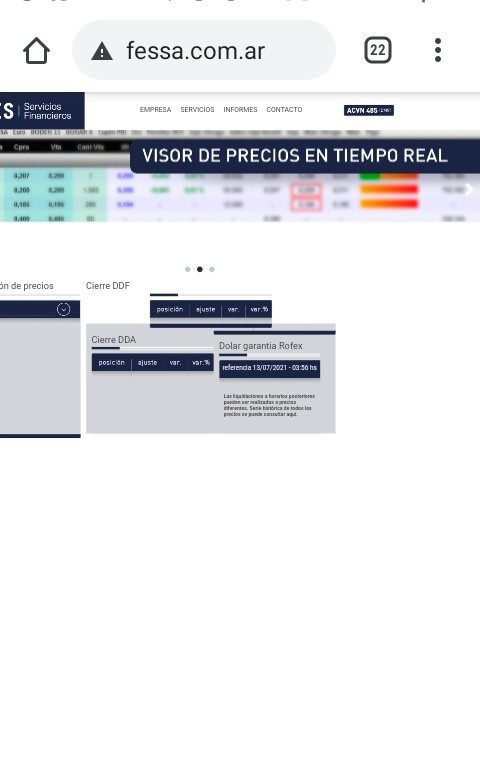

FES operates as a trading platform offering various account types including demo trading capabilities. While specific establishment dates and detailed company background information are not extensively documented in available public materials, the platform focuses on providing competitive trading conditions with particular emphasis on swap-free trading options.

The broker's business model seems to center around offering flexible trading environments suitable for different trader preferences, including those requiring Islamic-compliant trading conditions. The platform provides an account management portal system for client interface, though comprehensive details about the underlying technology infrastructure remain limited in publicly available sources.

According to available information, FES emphasizes competitive spread offerings and demo account accessibility. However, specific details regarding asset classes, primary regulatory jurisdictions, and comprehensive business model descriptions require further verification through direct contact with the broker. This fes review acknowledges these information gaps while focusing on verifiable features and services.

Regulatory Jurisdiction: Specific regulatory information not detailed in available materials, requiring direct verification with the broker.

Deposit and Withdrawal Methods: Comprehensive payment method information not specified in reviewed sources.

Minimum Deposit Requirements: Specific minimum deposit amounts not detailed in accessible documentation.

Bonus and Promotions: Current promotional offerings not extensively documented in available materials.

Tradeable Assets: Detailed asset class information requires verification through direct broker contact.

Cost Structure: Competitive spreads mentioned in available information, though comprehensive commission structures not detailed. The platform emphasizes competitive pricing as a key feature, though specific numerical spreads and fee schedules require direct verification.

Leverage Ratios: Specific leverage offerings not detailed in reviewed materials.

Platform Options: Account management portal system mentioned, though comprehensive platform details not extensively documented.

Geographic Restrictions: Specific regional limitations not detailed in available information.

Customer Service Languages: Language support options not specified in reviewed materials.

This fes review notes that many operational details require direct verification with the broker due to limited comprehensive information in publicly accessible sources.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

FES shows strength in account condition offerings through its provision of demo accounts and swap-free trading options. The availability of demo accounts provides valuable opportunities for traders to test strategies and familiarize themselves with the platform without financial risk. This feature particularly benefits new traders or those testing new trading approaches.

The swap-free account option addresses the needs of Islamic traders and those seeking to avoid overnight financing charges, representing an important accommodation for specific trader requirements. Competitive spreads mentioned in available materials suggest favorable pricing structures, though specific numerical values require direct verification.

However, this fes review notes that detailed information about account type varieties, specific minimum deposit requirements, and comprehensive account opening procedures are not extensively documented in available materials. The absence of detailed account tier structures and their respective benefits limits the completeness of account condition evaluation.

Account opening processes and verification requirements are not specifically detailed in reviewed sources, making it difficult to assess the user-friendliness of account establishment procedures. Special account features beyond swap-free options are not extensively documented, limiting the scope of account condition assessment.

FES provides an account management portal system for client interface, though comprehensive details about trading tools and analytical resources are not extensively documented in available materials. The account management system suggests basic infrastructure for client account oversight and transaction management.

Research and analytical resource availability requires verification through direct broker contact, as specific offerings are not detailed in publicly accessible information. Educational resource provision, including webinars, tutorials, or market analysis materials, is not extensively documented in reviewed sources.

Automated trading support capabilities, including Expert Advisor compatibility or algorithmic trading features, are not specifically detailed in available materials. The absence of comprehensive tool documentation limits the ability to fully assess the platform's analytical and trading support capabilities.

Third-party integration options and advanced charting capabilities require verification through direct platform evaluation, as these features are not extensively documented in publicly accessible information.

Customer Service and Support Analysis (6/10)

Available information indicates an 83% employee recommendation rate with a 4-point rating, suggesting adequate internal satisfaction levels that may translate to customer service quality. This employee satisfaction metric provides indirect indication of organizational culture and potential service delivery standards.

However, specific customer service channels, including phone, email, live chat availability, and operating hours are not detailed in reviewed materials. Response time commitments and service level agreements are not extensively documented in available sources.

Multilingual support capabilities and regional customer service availability require verification through direct contact with the broker. Problem resolution procedures and escalation processes are not specifically detailed in accessible documentation.

The absence of documented customer service testimonials or specific user feedback regarding support quality limits the comprehensive evaluation of customer service effectiveness. Service quality assessment relies primarily on indirect indicators rather than direct user experience documentation.

Trading Experience Analysis (5/10)

Platform stability and execution speed metrics are not extensively documented in available materials, limiting the assessment of technical trading experience quality. Order execution quality data, including slippage statistics and fill rates, requires verification through direct platform testing.

Platform functionality completeness, including advanced order types, one-click trading, and risk management tools, is not comprehensively detailed in reviewed sources. Mobile trading application availability and functionality require verification through direct platform evaluation.

Trading environment assessment, including market depth information, execution transparency, and trading condition consistency during different market conditions, is not extensively documented in available materials. User feedback regarding platform performance during high volatility periods is not readily available in reviewed sources.

This fes review notes that comprehensive trading experience evaluation requires direct platform testing and user feedback compilation, as specific performance metrics are not extensively documented in publicly accessible materials.

Trust and Regulation Analysis (4/10)

Regulatory credential information is not prominently featured in available documentation, representing a significant limitation for trust assessment. Specific regulatory body oversight, license numbers, and compliance frameworks require verification through direct broker inquiry.

Fund security measures, including segregated account provisions, insurance coverage, and client fund protection protocols, are not detailed in reviewed materials. Company transparency regarding ownership structure, financial statements, and operational oversight is not extensively documented in available sources.

Industry reputation assessment relies on limited available information, with comprehensive third-party evaluations not readily accessible. Negative event handling procedures and dispute resolution mechanisms are not specifically detailed in available documentation.

The absence of prominent regulatory disclosure and limited transparency information significantly impacts trust assessment, requiring potential users to conduct additional due diligence through direct verification processes.

User Experience Analysis (6/10)

Overall user satisfaction assessment relies on limited available feedback data, with comprehensive user review compilation not extensively documented in reviewed sources. Interface design and usability evaluation requires direct platform testing, as specific user experience metrics are not detailed in available materials.

Registration and verification process efficiency is not specifically documented, limiting assessment of onboarding experience quality. Fund operation experience, including deposit and withdrawal processing times and procedures, requires verification through direct user experience.

Common user complaint patterns and resolution effectiveness are not extensively documented in available sources. User demographic suitability assessment relies on limited available information regarding typical user profiles and satisfaction levels.

Improvement suggestion compilation from user feedback is not readily available, limiting the assessment of platform development responsiveness to user needs and preferences.

Conclusion

This fes review concludes with a neutral assessment of FES as a trading platform, primarily due to limited comprehensive information availability regarding regulatory status and detailed operational features. The broker shows positive aspects through demo account provision and swap-free trading options, appealing to specific trader segments requiring these features.

FES appears most suitable for traders seeking demo trading environments for strategy testing or those requiring Islamic-compliant trading conditions. The competitive spread offerings mentioned in available materials may attract cost-conscious traders, though specific pricing verification remains necessary.

The primary limitations center on limited regulatory transparency and comprehensive operational information availability. Potential users should prioritize direct verification of regulatory credentials, detailed terms of service, and comprehensive feature sets before making trading decisions. While the platform shows promise in specific areas, the information gaps require additional due diligence for complete evaluation.