Is Fenghe safe?

Pros

Cons

Is Fenghe Safe or Scam?

Introduction

Fenghe is a forex brokerage that has recently gained attention in the trading community, primarily due to its claims of offering a wide range of trading instruments including forex, cryptocurrencies, stocks, and commodities. As the forex market continues to attract more traders, the necessity for thorough evaluations of brokers like Fenghe becomes increasingly paramount. Traders must navigate through a myriad of options, and distinguishing between legitimate brokers and potential scams is crucial for safeguarding their investments. This article aims to provide an objective analysis of Fenghe, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. The evaluation is based on a comprehensive review of available resources, including user feedback, regulatory databases, and market analysis.

Regulation and Legitimacy

Understanding the regulatory environment is fundamental when assessing the safety of any brokerage. A well-regulated broker is typically subject to strict oversight, which can provide some assurance to traders regarding the safety of their funds and the legitimacy of the trading practices. Fenghe claims to hold a general registered NFA license; however, this status raises several concerns.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0555971 | USA | Suspicious Clone |

The National Futures Association (NFA) is a respected regulatory body in the United States, but Fenghes classification as a “suspicious clone” indicates that it may not be operating under the same stringent standards typically expected of NFA members. This lack of solid regulatory backing can lead to potential risks for traders, as it may imply a lack of accountability and oversight. Furthermore, the absence of additional regulatory licenses from reputable authorities such as the FCA or ASIC further complicates the broker's legitimacy. Overall, the regulatory environment surrounding Fenghe raises significant red flags, leading to the conclusion that Fenghe may not be a safe trading option.

Company Background Investigation

Fenghe Limited claims to be headquartered in Australia, but its operational history is relatively short, having been established within the last couple of years. The ownership structure and management team are critical components in evaluating a broker's credibility. However, detailed information about Fenghe's ownership and management is scarce, which raises concerns about transparency.

The management team‘s professional background is another area of concern. A strong management team with extensive experience in finance and trading can often indicate a higher likelihood of operational integrity. Unfortunately, Fenghe does not provide sufficient details about its management’s credentials, which leaves potential clients in the dark regarding the broker's leadership. Given the lack of transparency and the short history of the company, it is prudent for traders to approach Fenghe with caution, as the absence of a well-established background may suggest potential risks.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are vital. Fenghe presents itself as a commission-free broker, which can be appealing to many traders. However, the absence of clear information regarding spreads and fees raises concerns about hidden costs that could impact the overall trading experience.

| Fee Type | Fenghe | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 0.1 - 1.0 pips |

| Commission Model | No Commissions | Varies (0 - $10) |

| Overnight Interest Range | Not Specified | Varies (1 - 3%) |

The lack of specified spreads and overnight interest rates can indicate potential issues with transparency. Traders might find themselves facing unexpected costs that could significantly affect their profitability. Moreover, if a broker does not openly disclose its fee structure, it could signal a lack of integrity. Therefore, potential clients should carefully consider these factors before deciding to trade with Fenghe, as the trading conditions may not align with their expectations.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Fenghe claims to implement various measures to secure client investments, including fund segregation and risk management tools. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Fenghe does not provide detailed information regarding its policies for fund segregation or investor protection. In the event of financial difficulties, the absence of a robust investor protection scheme could leave clients vulnerable. Additionally, there have been concerns raised in user reviews regarding difficulties in withdrawing funds, which is a significant red flag. Historical issues with fund safety or disputes can be detrimental to a broker's reputation, and without a clear commitment to safeguarding client assets, Fenghe may not be a safe choice for traders.

Customer Experience and Complaints

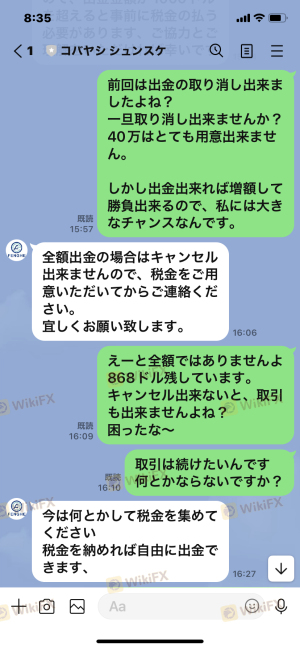

Analyzing customer feedback is essential for understanding the overall experience of trading with a broker. Fenghe has garnered a mix of reviews, with numerous clients reporting issues related to withdrawal processes and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Inconsistent |

| Transparency of Fees | Medium | Lacking |

Common complaints include difficulties in withdrawing funds and a lack of responsive customer support. Users have reported that their withdrawal requests remain "under review" for extended periods, leading to frustrations and suspicions of being scammed. The inconsistency in customer support responses further exacerbates these issues, as traders may find it challenging to resolve their concerns effectively. Case studies of individuals facing withdrawal challenges highlight the importance of thoroughly assessing a broker's reputation before committing funds.

Platform and Trade Execution

The performance of the trading platform is a critical factor in a trader's success. Fenghe offers the Sirix Station trading platform, which is designed to be user-friendly and efficient. However, the platform's performance, stability, and execution quality are vital to evaluate.

Users have noted varying experiences with order execution, including instances of slippage and occasional order rejections. Such issues can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. If a broker's platform exhibits signs of manipulation or fails to execute trades as intended, it could indicate deeper operational issues. Therefore, potential clients should carefully assess the platform's reliability and performance before engaging with Fenghe.

Risk Assessment

Using Fenghe involves certain risks that traders should be aware of. The combination of regulatory concerns, customer complaints, and platform execution issues suggests a higher-than-average risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of solid regulation raises concerns. |

| Fund Security | High | Unclear fund protection measures. |

| Customer Support | Medium | Complaints about responsiveness. |

| Trading Platform Reliability | Medium | Issues with execution and slippage. |

To mitigate these risks, traders should consider starting with a small investment and conducting thorough research before committing larger sums. Additionally, diversifying trading activities across multiple brokers can help reduce exposure to any one entity.

Conclusion and Recommendations

After a comprehensive review of Fenghe, it is evident that potential traders should exercise caution. The broker's lack of robust regulatory oversight, transparency issues, and negative customer feedback indicate that it may not be a safe trading option. While Fenghe does offer a variety of trading instruments and claims to provide a user-friendly platform, the associated risks and concerns cannot be overlooked.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by top-tier authorities such as the FCA or ASIC, which can provide a higher level of security and accountability. In conclusion, is Fenghe safe? The evidence suggests that traders should be wary and consider other options that offer greater transparency and regulatory assurance.

Is Fenghe a scam, or is it legit?

The latest exposure and evaluation content of Fenghe brokers.

Fenghe Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fenghe latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.