Excoin 2025 Review: Everything You Need to Know

Excoin has garnered a significant amount of attention in the online trading community, but the reviews paint a largely negative picture. Many users have reported issues related to withdrawals and transparency, while the lack of regulatory oversight raises serious concerns about the safety of funds. This review will delve into the key features, user experiences, and expert opinions surrounding Excoin to provide a comprehensive overview of what potential traders should consider.

Note: Its crucial to be aware of the various entities operating under the Excoin name, as the lack of clarity on regulatory status and corporate structure can significantly impact user experience and trustworthiness.

Ratings Overview

How We Rated the Broker: Ratings are based on a synthesis of user reviews, expert analysis, and factual data regarding Excoin's operations.

Broker Overview

Excoin, reportedly established in 2018, positions itself as an online trading platform providing access to various financial markets. The broker primarily offers trading through the MetaTrader 4 platform, which is a popular choice among traders for its robust features and user-friendly interface. However, Excoin's asset offerings are limited, with a focus on cryptocurrencies and CFDs rather than traditional forex pairs. Notably, Excoin does not appear to be regulated by any major financial authority, raising concerns about its legitimacy and the safety of client funds.

Detailed Breakdown

-

Regulatory Environment

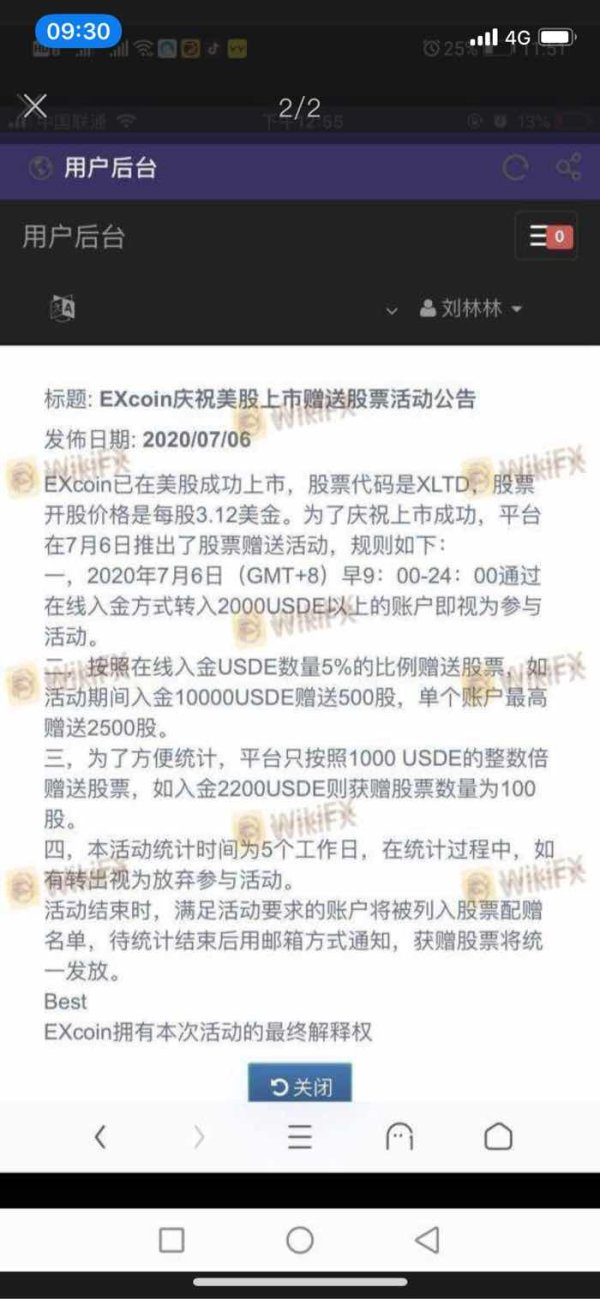

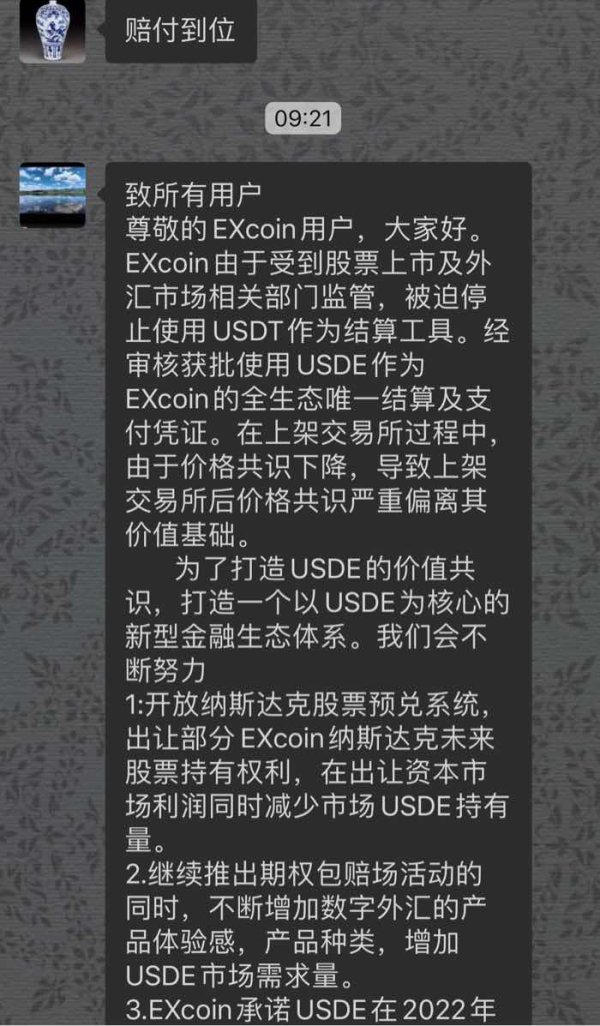

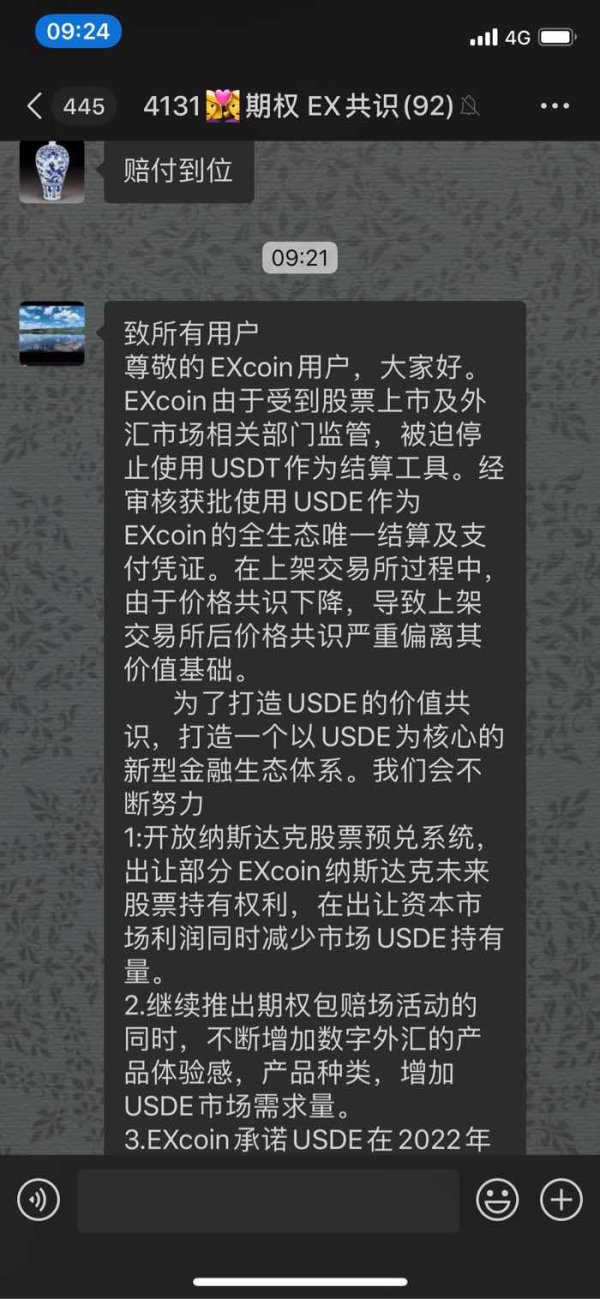

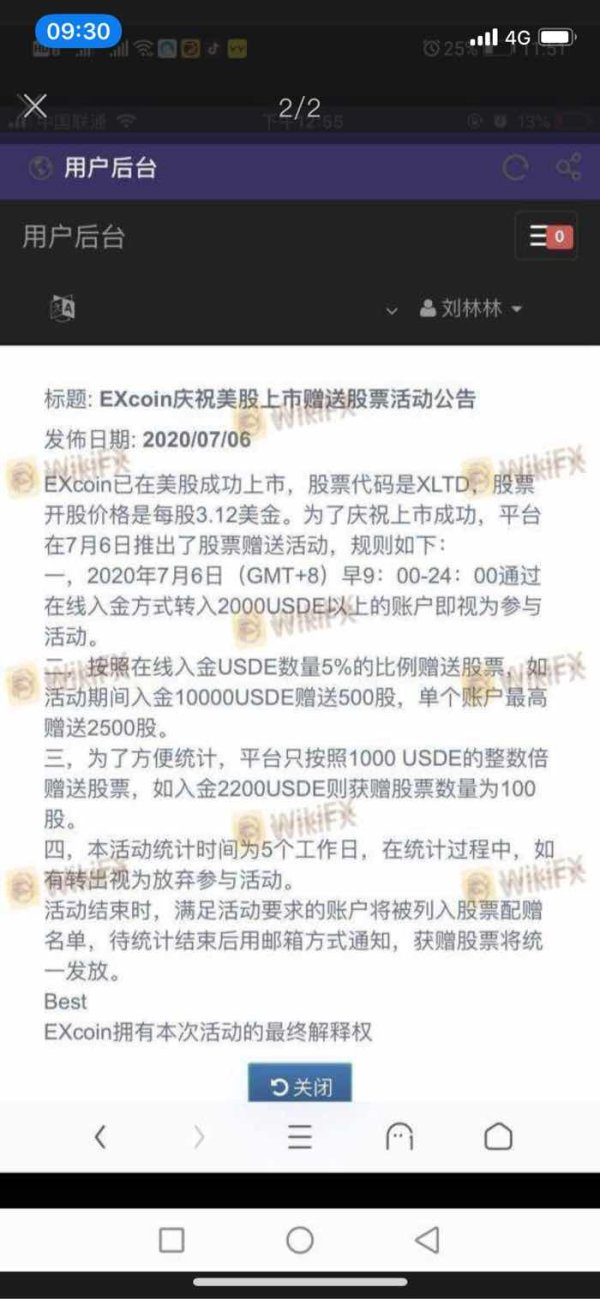

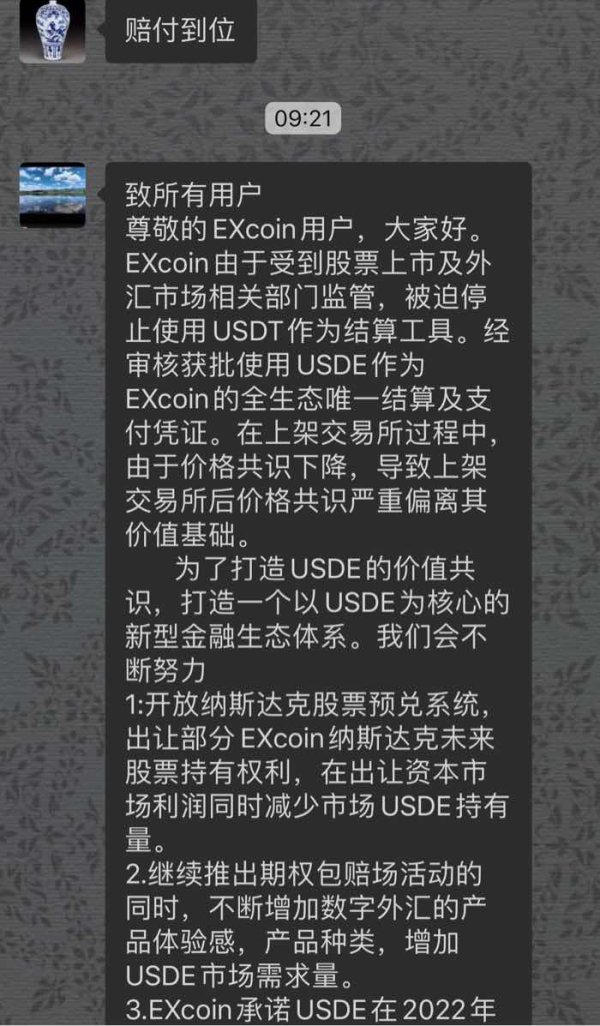

Excoin operates without any regulatory oversight, which is a significant red flag for potential investors. According to multiple sources, the broker is linked to various offshore entities, which may not adhere to the stringent regulations of more reputable jurisdictions. The absence of a regulatory framework means that traders have little recourse in the event of disputes or fund mismanagement.

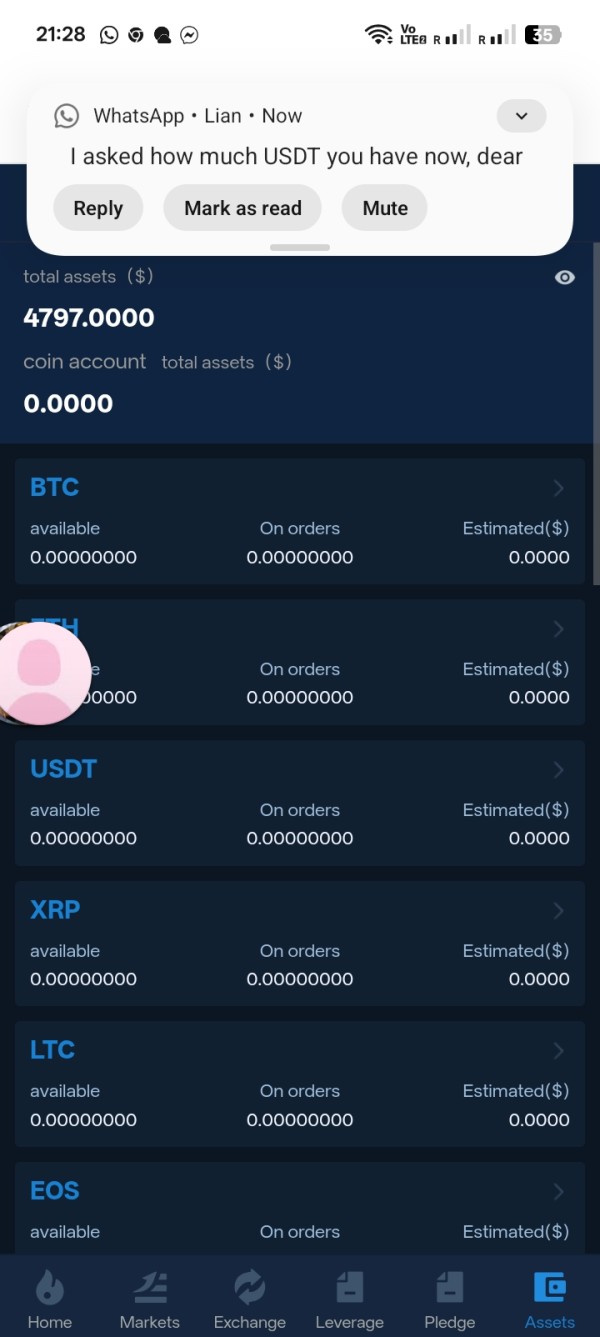

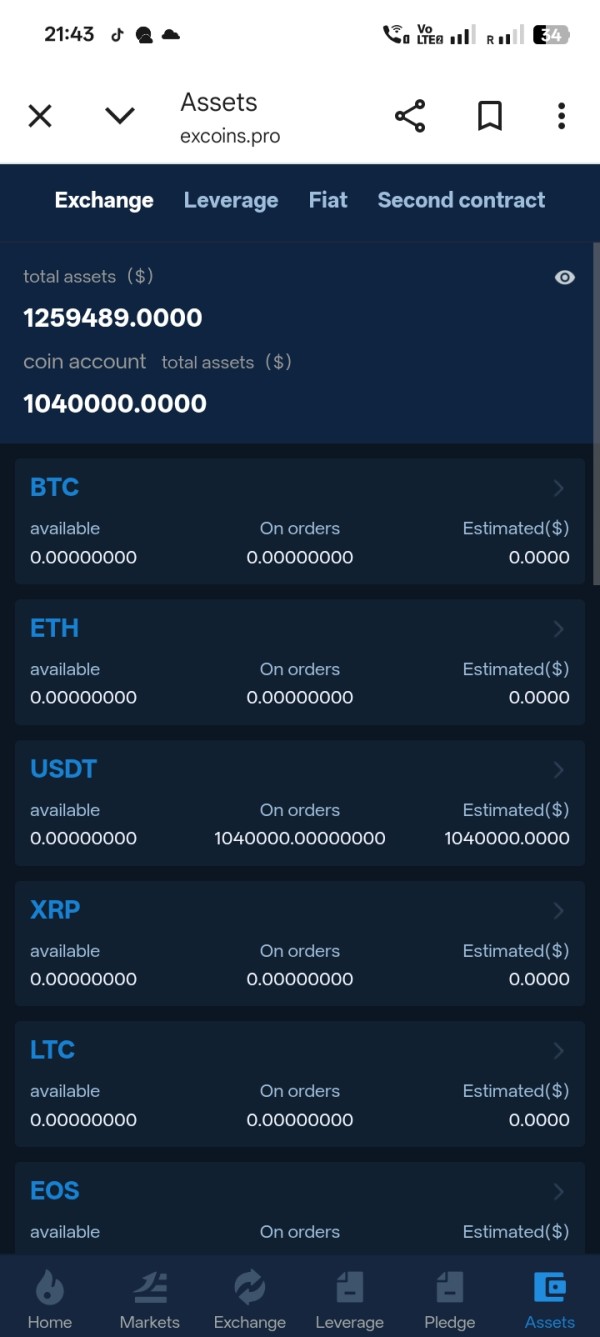

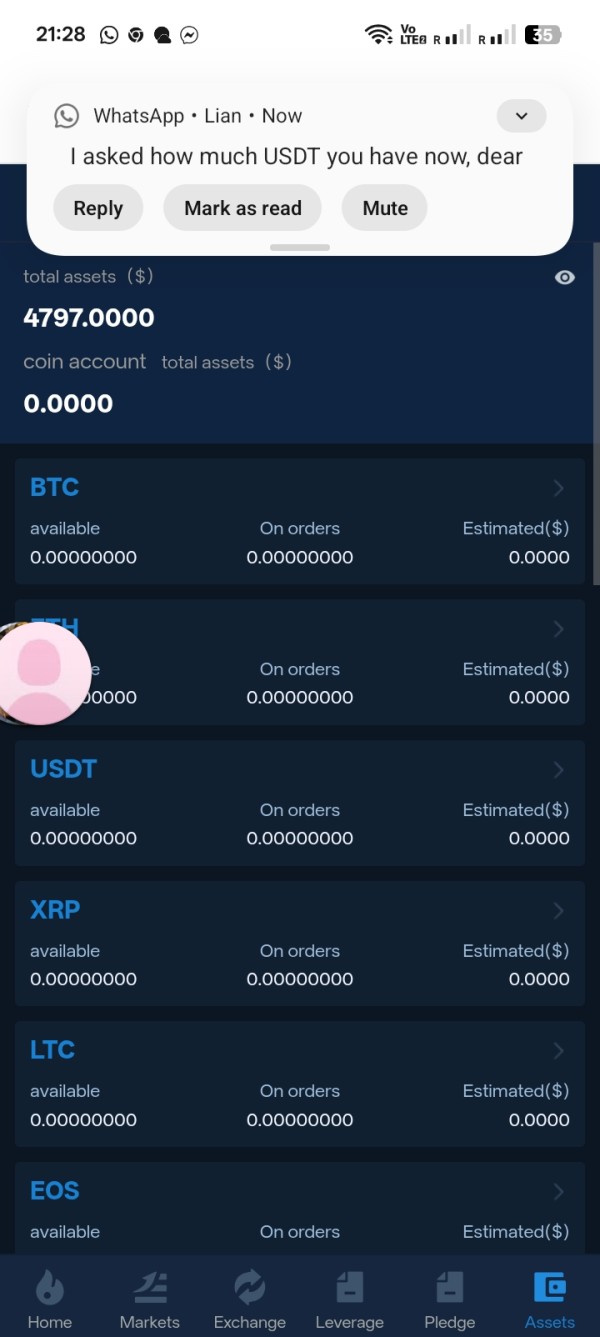

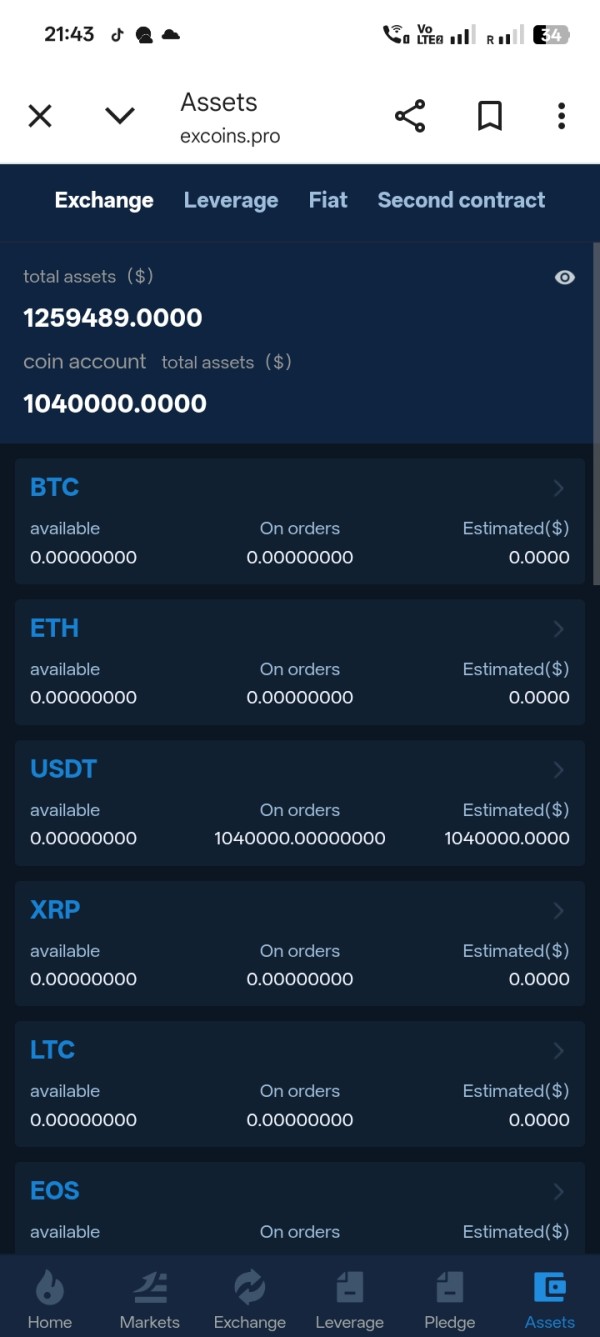

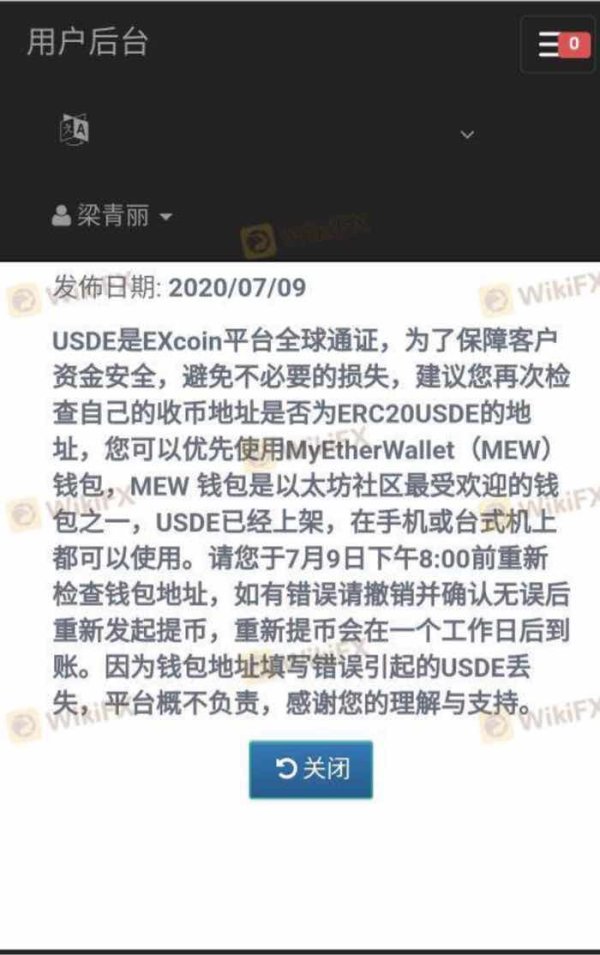

Deposit and Withdrawal Options

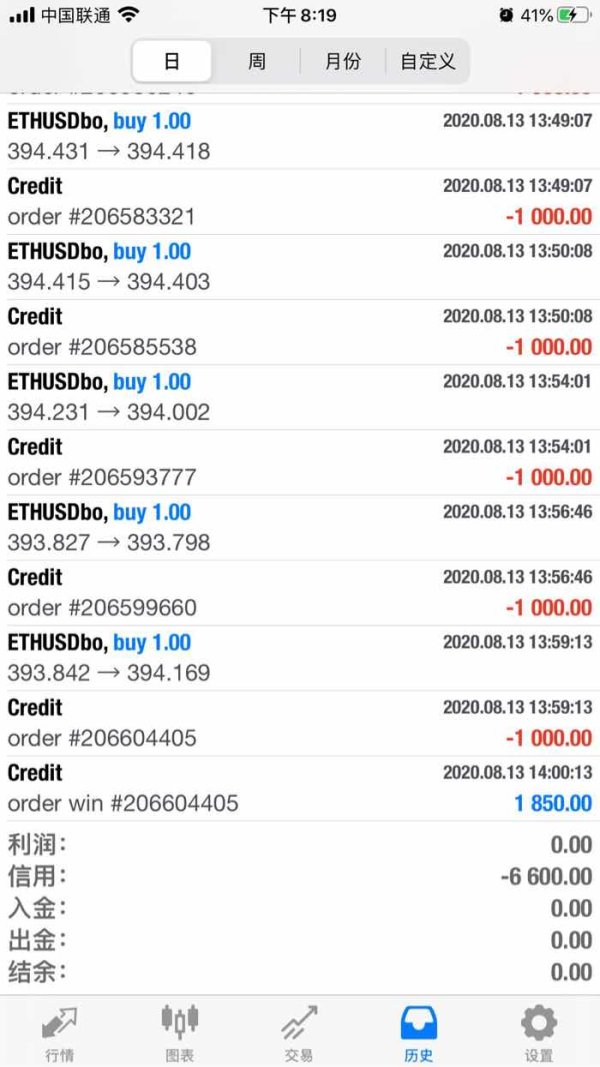

Excoin primarily accepts cryptocurrency deposits, particularly Bitcoin, which may limit accessibility for many users. The minimum deposit requirements are reported to be high, with some sources indicating a threshold of 0.5 BTC, which can exceed $3,000 USD at current market rates. Users have reported significant difficulties when attempting to withdraw funds, with many claiming their requests went unanswered or were outright denied, further straining the broker's credibility.

Asset Classes Available

While Excoin markets itself as a comprehensive trading platform, it primarily offers CFDs on cryptocurrencies, indices, and commodities. Traditional forex pairs are notably absent, which could be a drawback for traders looking for a more diverse trading portfolio. The platform includes popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, but the lack of conventional forex options may deter some traders.

Cost Structure

The cost of trading on Excoin appears to be high, with spreads reported as being on the upper end of the spectrum—around $50 for BTC/USDT trades. Additionally, there are concerns regarding hidden fees and unclear terms associated with trading costs, which can further complicate the trading experience.

Leverage and Trading Platforms

Excoin offers leverage levels ranging from 1:20 to 1:50, which may appeal to traders looking to maximize their positions. However, this also introduces greater risk, particularly in the highly volatile cryptocurrency market. The trading experience on Excoin is facilitated through the MetaTrader 4 platform, which is known for its advanced charting capabilities and trading tools, but many users have found the platform's interface to be lacking in sophistication compared to other brokers.

Customer Support and Languages

Users have expressed dissatisfaction with Excoin's customer service, citing long response times and inadequate support. The lack of clear communication and transparency has contributed to a negative user experience. The platform reportedly offers support in English, but users have noted that reaching customer service can be a frustrating ordeal.

Ratings Recap

Detailed Analysis of Ratings

- Account Conditions (2/10): The high minimum deposit requirement and lack of traditional forex options make it difficult for new traders to engage with the platform.

- Tools and Resources (3/10): While the MetaTrader 4 platform is a solid choice, the lack of educational resources and market analysis tools limits its appeal.

- Customer Service (2/10): User feedback indicates that customer support is lacking, with many reports of unresponsive service.

- Trading Experience (3/10): The trading interface is functional but lacks the advanced features found in more reputable brokers.

- Trustworthiness (1/10): The absence of regulatory oversight and numerous negative reviews significantly undermine trust in Excoin.

- User Experience (2/10): Overall user sentiment is negative, with many expressing dissatisfaction with their trading experiences and withdrawal issues.

In conclusion, while Excoin may present itself as an attractive option for cryptocurrency trading, the overwhelming consensus among users and experts is that the broker poses significant risks. The lack of regulation, high minimum deposit requirements, and poor customer service make it a questionable choice for both novice and experienced traders. As always, potential investors should conduct thorough research and consider safer, regulated alternatives before committing their funds.