Is EXcoin safe?

Pros

Cons

Is EXCoin Safe or Scam?

Introduction

EXCoin positions itself as a prominent player in the forex market, presenting itself as an online broker that offers access to various financial instruments, including forex, commodities, and cryptocurrencies. However, the rise of online trading has also led to an increase in fraudulent activities, prompting traders to exercise caution when selecting a broker. It is crucial for traders to thoroughly evaluate the legitimacy and reliability of any broker they consider. This article aims to investigate the safety and legitimacy of EXCoin by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and potential risks. The findings are based on a comprehensive review of multiple sources, including user feedback, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant factors in determining its credibility. Regulated brokers are subject to oversight by financial authorities, which helps ensure they adhere to industry standards and protect investors. In the case of EXCoin, it is important to note that the broker operates without a license from any reputable regulatory authority. This lack of regulation raises serious concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that EXCoin is not bound by any legal obligations to protect client funds or provide transparent information about its operations. Furthermore, warnings have been issued against EXCoin by various authorities, indicating that it may engage in practices that could be detrimental to traders. This lack of regulation is a significant red flag, suggesting that is EXCoin safe? is a question that requires serious consideration.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide insights into its reliability. EXCoin claims to have been established in 2018, but detailed information about its founders, management team, and operational history is scarce. The company's website lacks transparency regarding its ownership and management, which is often a hallmark of fraudulent brokers.

Many reports indicate that EXCoin may be operating under a suspicious clone license, which further complicates its legitimacy. The company's failure to disclose critical information about its management team and operational practices raises questions about its transparency and accountability. Given these factors, potential investors should approach EXCoin with extreme caution, as the lack of information may suggest that is EXCoin safe? is a question that remains unanswered.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. EXCoin's fee structure appears to be opaque, with little information available regarding spreads, commissions, and other costs. Such ambiguity is concerning, as it can lead to unexpected expenses that may erode trading profits.

| Fee Type | EXCoin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies by broker |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The lack of clarity regarding trading costs can be detrimental to traders, as it may indicate hidden fees or unfavorable trading conditions. Additionally, some reports suggest that EXCoin may impose unusual fees that could further disadvantage traders. Therefore, it is essential for potential users to consider whether is EXCoin safe? when evaluating its trading conditions.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. Reputable brokers implement stringent measures to protect client funds, such as segregating client accounts and providing investor protection schemes. However, the information available on EXCoin's website does not indicate any such measures in place.

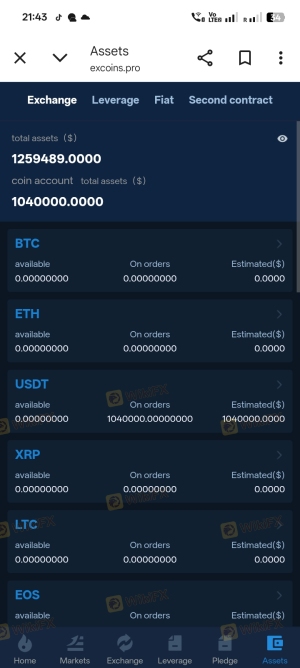

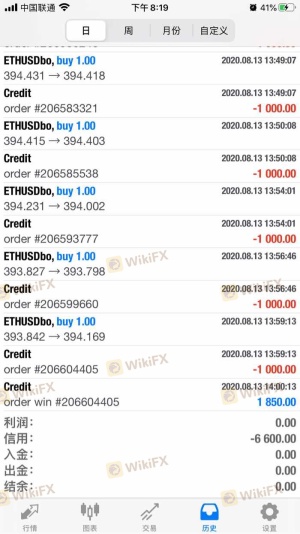

The absence of fund segregation and investor protection raises serious concerns about the safety of client deposits. Furthermore, historical complaints against EXCoin suggest that users have experienced issues with frozen accounts and difficulties withdrawing funds. These incidents highlight potential risks associated with trading through EXCoin, leading to a critical question: is EXCoin safe?

Customer Experience and Complaints

User feedback and complaints can provide valuable insights into a broker's operations and customer service quality. Reports from traders who have engaged with EXCoin reveal a concerning pattern of complaints, including frozen accounts, withdrawal issues, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Frozen Accounts | High | Poor |

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

Typical cases involve users reporting significant losses and being unable to access their funds. The lack of effective communication from EXCoin's support team exacerbates these issues, leading many to question the broker's reliability. Given the prevalence of complaints, it is reasonable to ask: is EXCoin safe?

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders. A stable platform with efficient trade execution can significantly enhance the trading experience. However, user reports indicate that EXCoin's platform may not meet these expectations. Concerns regarding order execution quality, slippage, and potential platform manipulation have been raised by users.

Traders have reported instances of orders being executed at unfavorable prices, which can lead to unexpected losses. Such issues may indicate that the platform is not functioning as intended, raising further concerns about its legitimacy. Thus, the question remains: is EXCoin safe?

Risk Assessment

Using an unregulated broker like EXCoin presents several risks that traders should be aware of. These risks include potential loss of funds, lack of recourse in the event of disputes, and exposure to fraudulent practices.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Issues with platform reliability |

To mitigate these risks, traders should consider using regulated brokers with a proven track record of reliability and customer protection. It is essential to conduct thorough research and due diligence before engaging with any broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that EXCoin raises significant red flags regarding its legitimacy and safety. The lack of regulatory oversight, transparency, and numerous complaints from users indicate that traders should approach this broker with caution.

For traders seeking reliable options, it is advisable to consider regulated brokers known for their transparency, customer service, and robust security measures. Some reputable alternatives include brokers regulated by the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

Ultimately, the question of is EXCoin safe? leans heavily towards a negative response, and potential investors should exercise extreme caution or seek alternatives that offer greater security and reliability in their trading endeavors.

Is EXcoin a scam, or is it legit?

The latest exposure and evaluation content of EXcoin brokers.

EXcoin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EXcoin latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.