etrans 2025 Review: Everything You Need to Know

Executive Summary

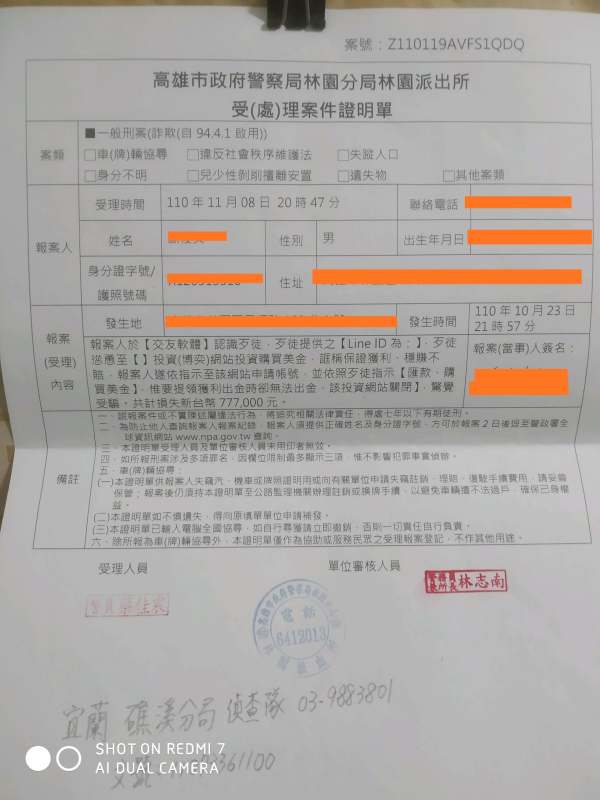

This etrans review shows troubling facts about eTrans Forex Broker's market performance. The main problems involve regulatory transparency and user trust issues that potential clients should know about.

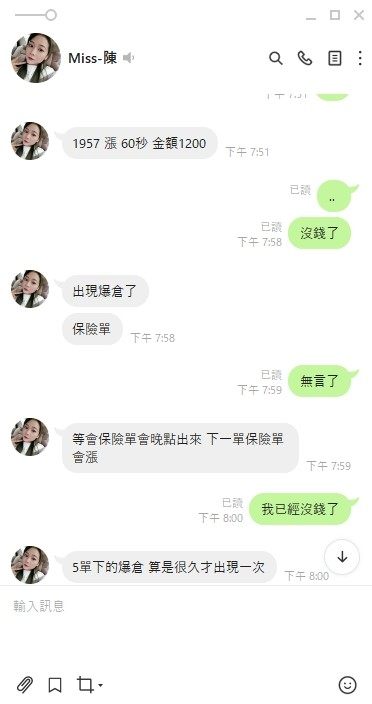

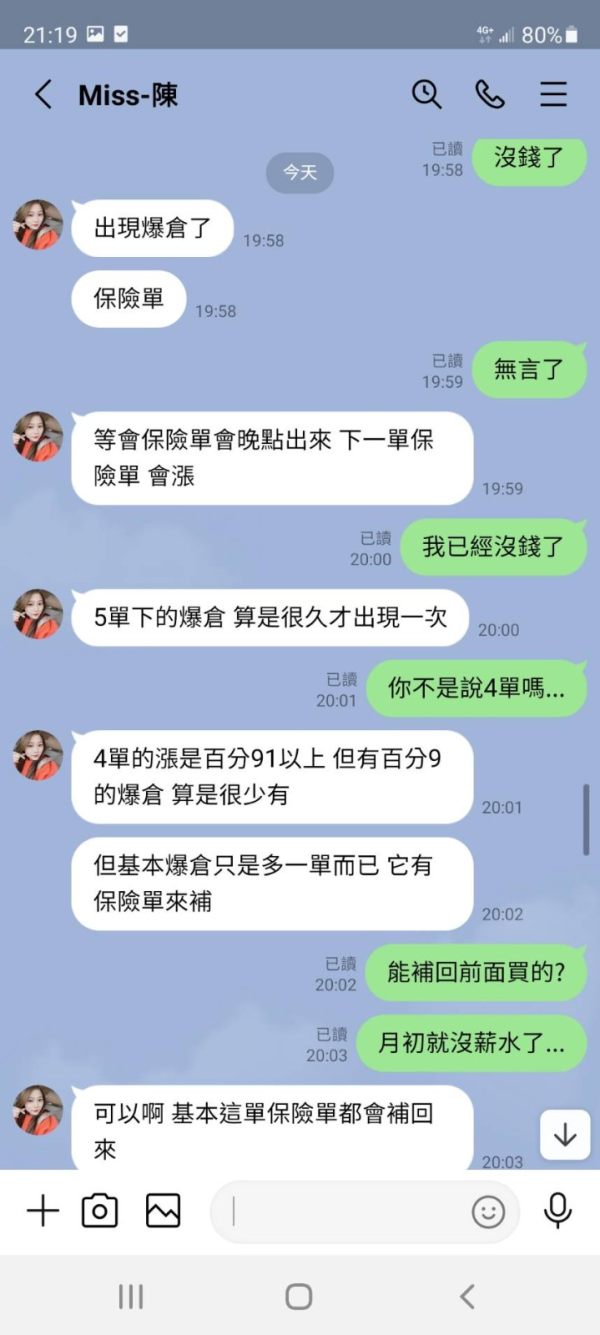

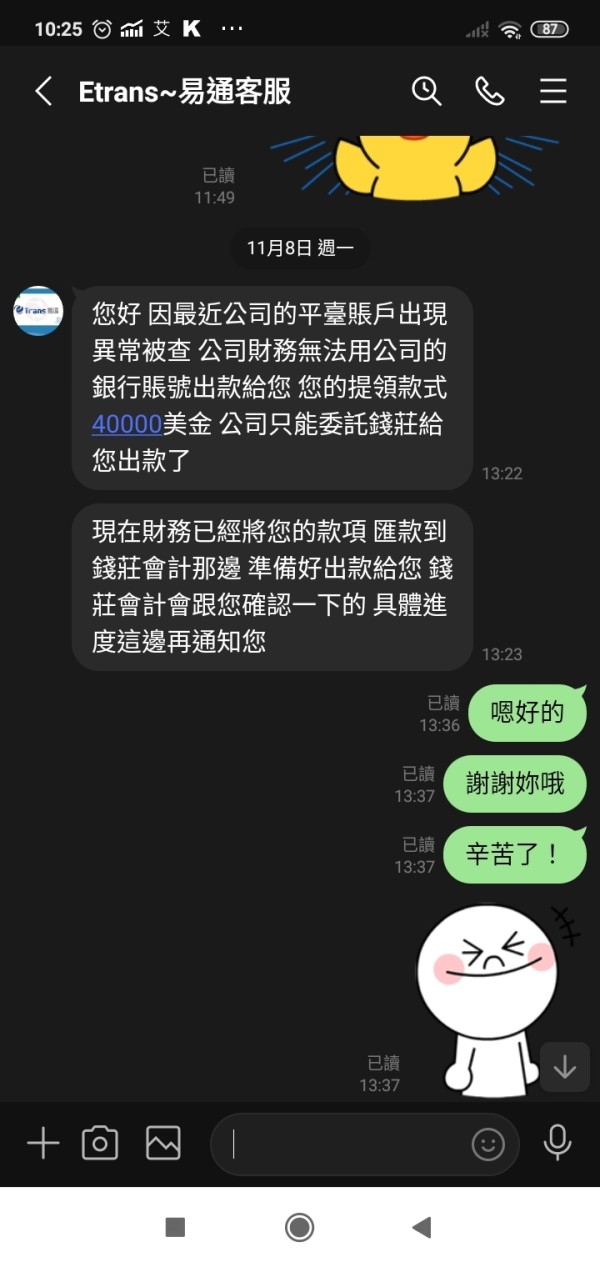

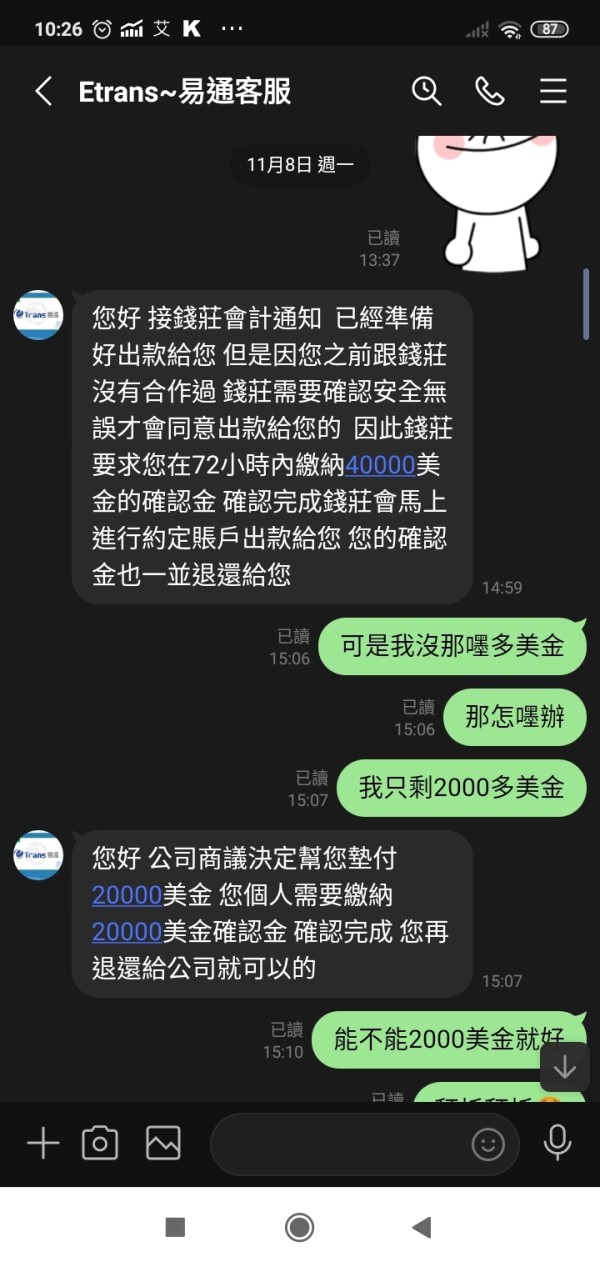

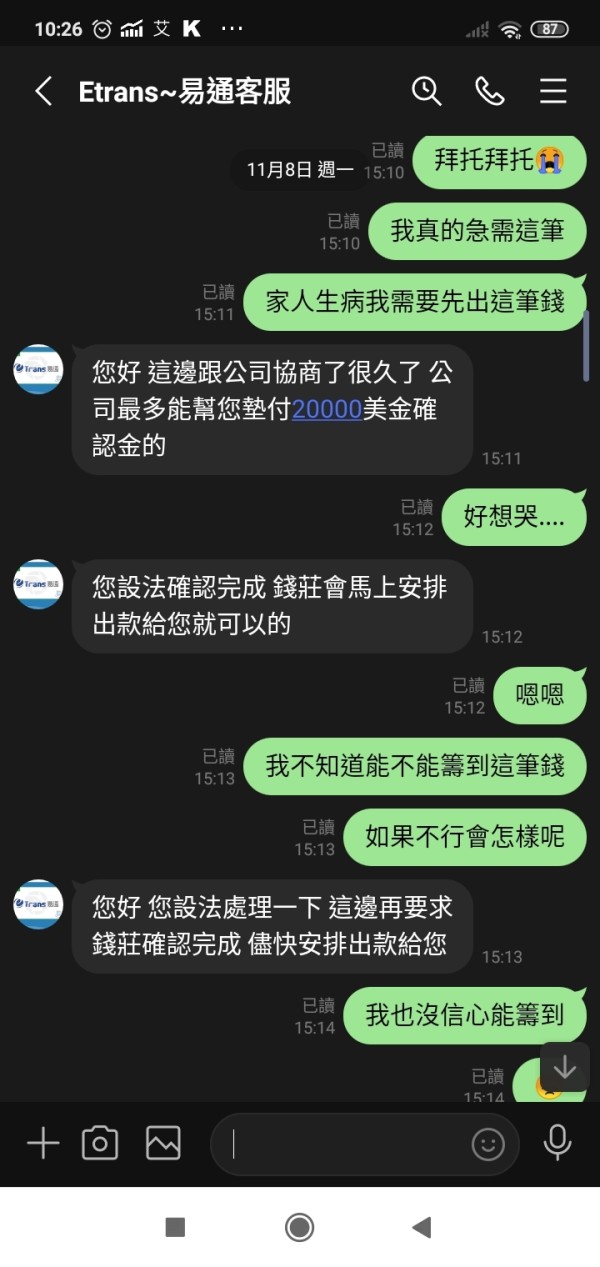

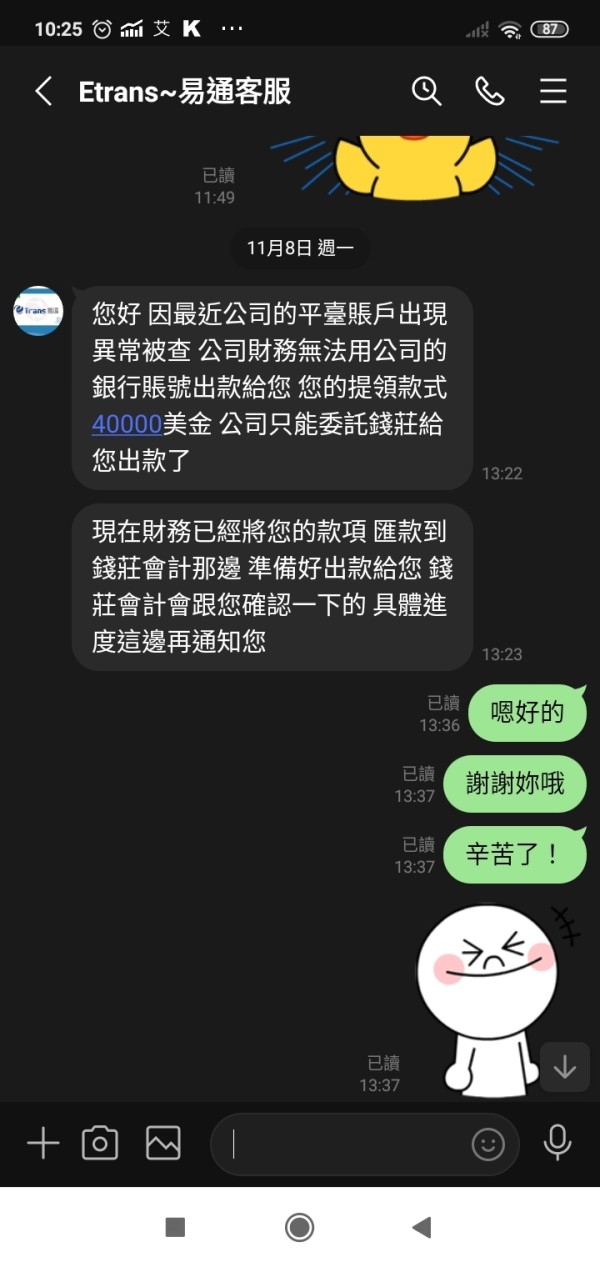

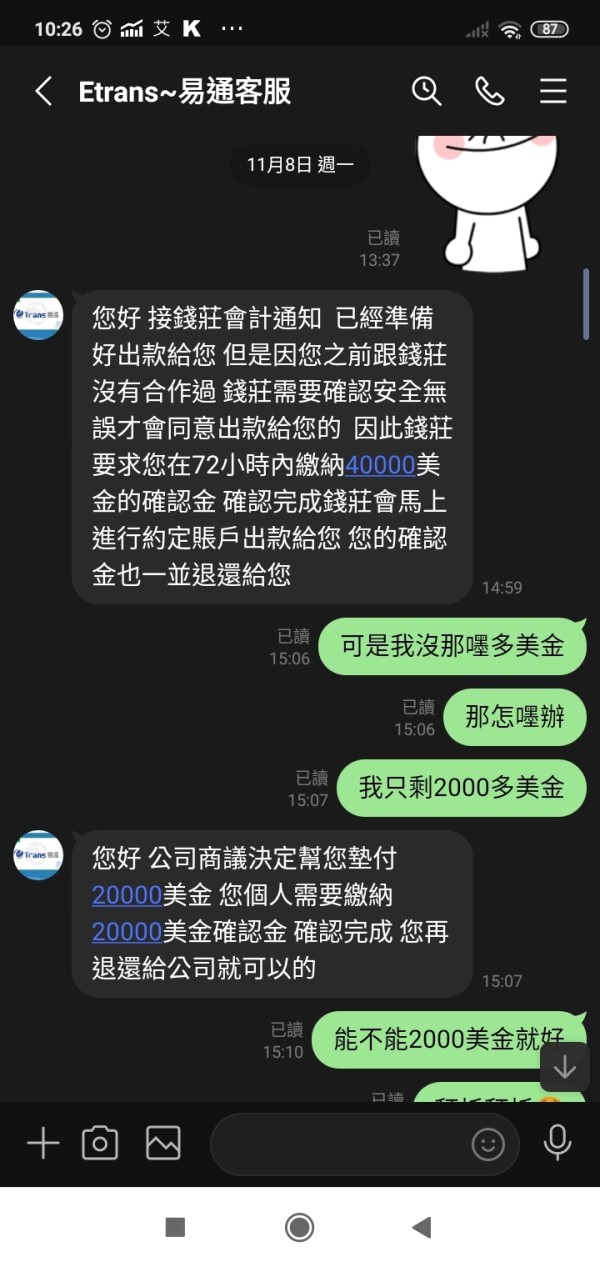

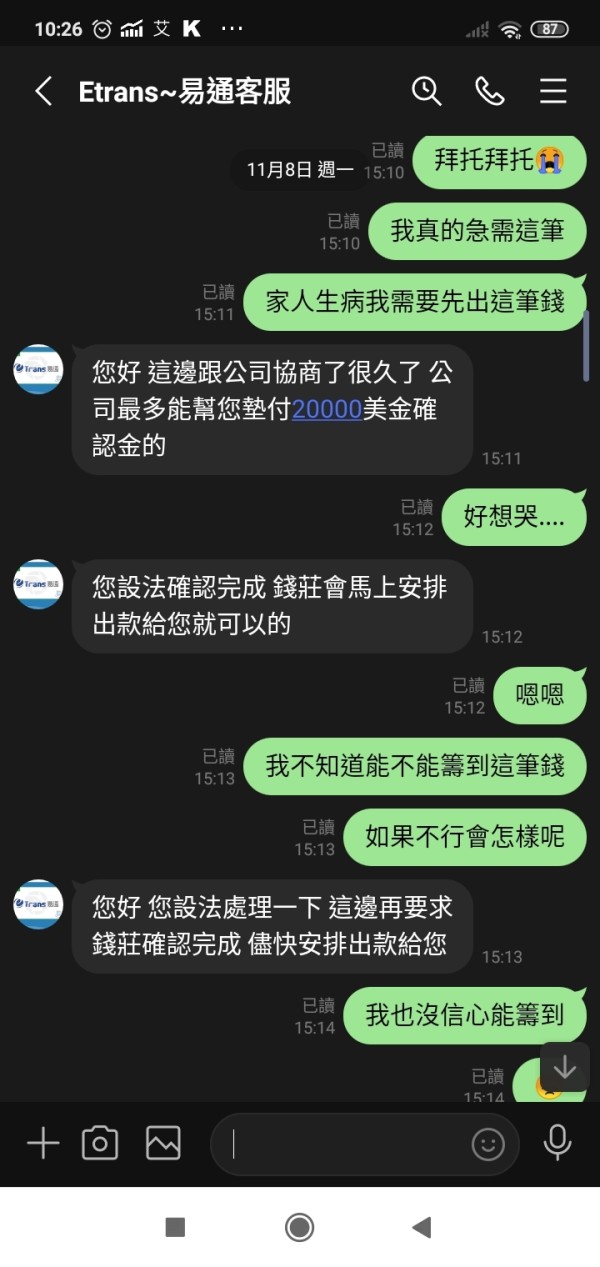

While the company keeps a decent internal culture based on what employees say, there are big gaps in how they operate transparently and satisfy clients. WikiBit reports tell us that eTrans Forex Broker has gotten many user complaints in the last three months.

This raises serious questions about their service quality and whether traders can rely on them. The broker mainly goes after retail and institutional investors who want forex trading chances across Australia, the United States, and Canada markets, but their track record shows problems.

eTrans Solutions employee reviews on Glassdoor show a salary and benefits rating of 3.7 out of 5. This suggests workers are somewhat happy inside the company, though this doesn't match what outside users experience.

The broker's overall market standing looks weak. There's very little public information about regulatory compliance, trading conditions, and how they operate day-to-day, which makes it hard for potential clients to trust them.

These transparency problems really hurt potential client confidence and market credibility.

Important Disclaimer

This evaluation covers eTrans entities that operate across multiple areas. They mainly serve Australian, US, and Canadian markets, but specific regulatory information stays unclear in available documents.

This lack of clarity is itself a big concern for potential clients who need to know these details. The assessment method combines user feedback analysis, company background research, and available market scoring data to give you a complete picture.

Readers should note that limited publicly accessible information about eTrans operations means you need to be very careful before making trading decisions. Cross-regional operational differences may exist, though specific details about differences between areas are not clearly documented in current available materials.

Overall Rating Framework

Broker Overview

eTrans Forex Broker started in 2018. The company positioned itself to serve forex trading markets across Australia, the United States, and Canada, but their operational transparency and regulatory clarity remain questionable.

Limited detailed information is available about its business structure and compliance frameworks. The broker claims to provide trading services to both retail and institutional clients, though specific details about account types, trading platforms, and service offerings are not clearly documented in publicly available materials.

This lack of transparency raises immediate concerns about operational legitimacy and client protection measures that every trader should consider. Available information suggests eTrans operates as a forex brokerage service provider, though the absence of clear regulatory documentation and platform specifications makes comprehensive evaluation challenging.

The company's market presence appears limited. There's minimal industry recognition or third-party verification of services, which is unusual for established brokers in today's market.

This etrans review finds that while the company maintains some operational presence, the lack of detailed public information about trading conditions, regulatory compliance, and service specifications significantly impacts its market credibility and potential client confidence.

Regulatory Status

Available materials do not provide specific information about regulatory oversight or compliance frameworks governing eTrans operations across its claimed service jurisdictions.

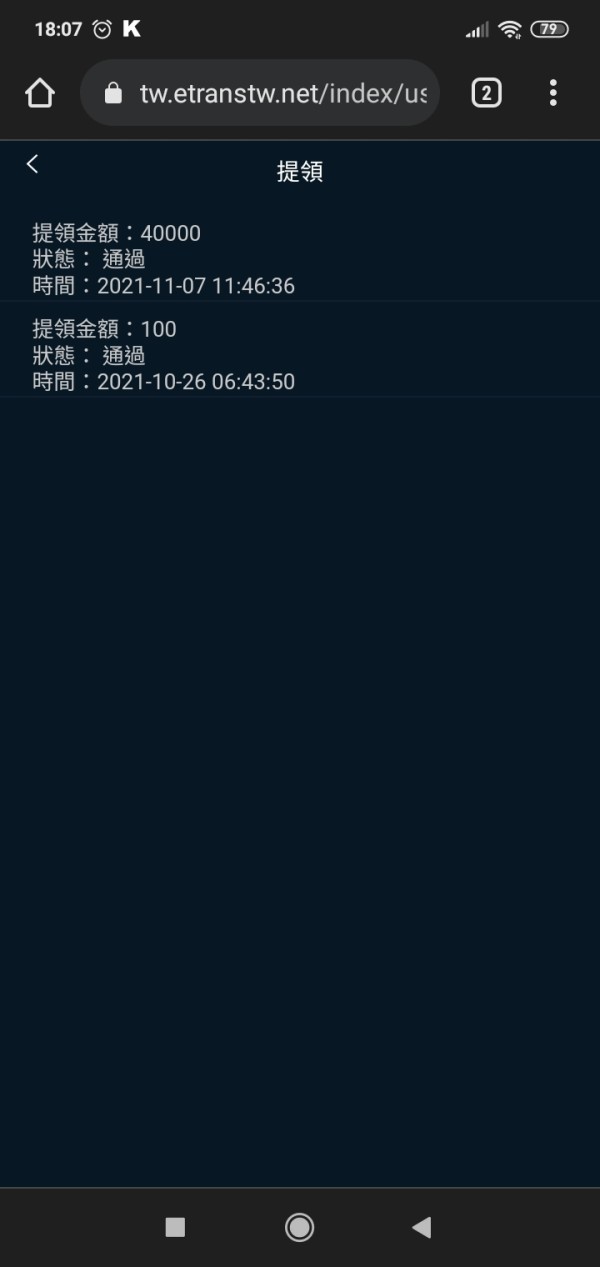

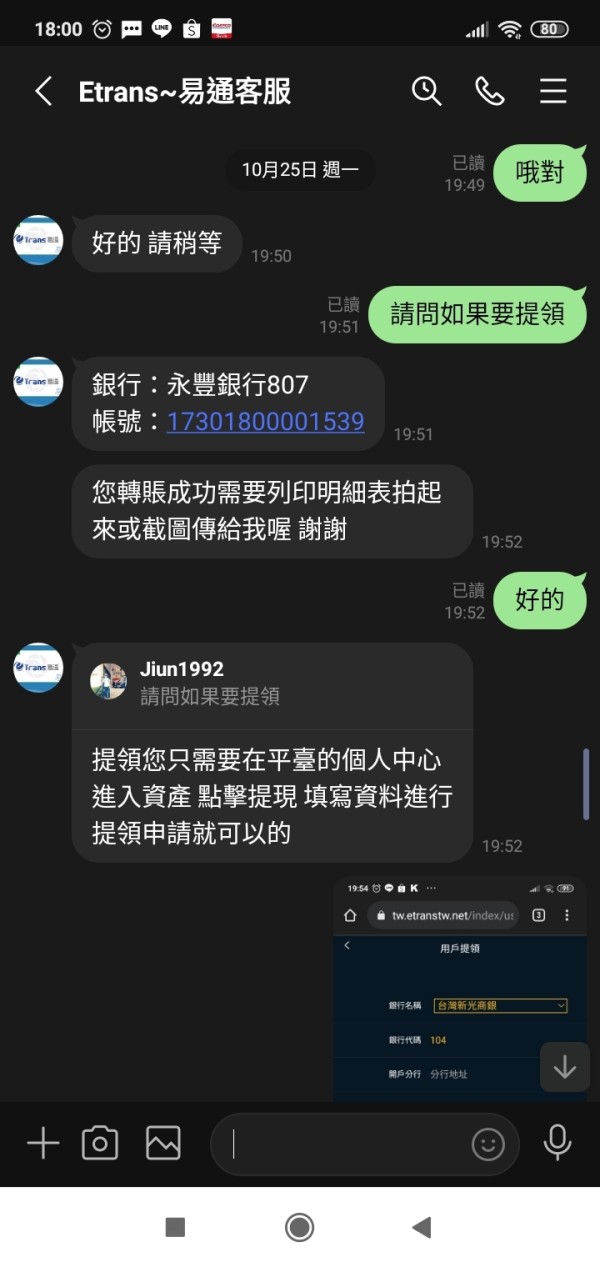

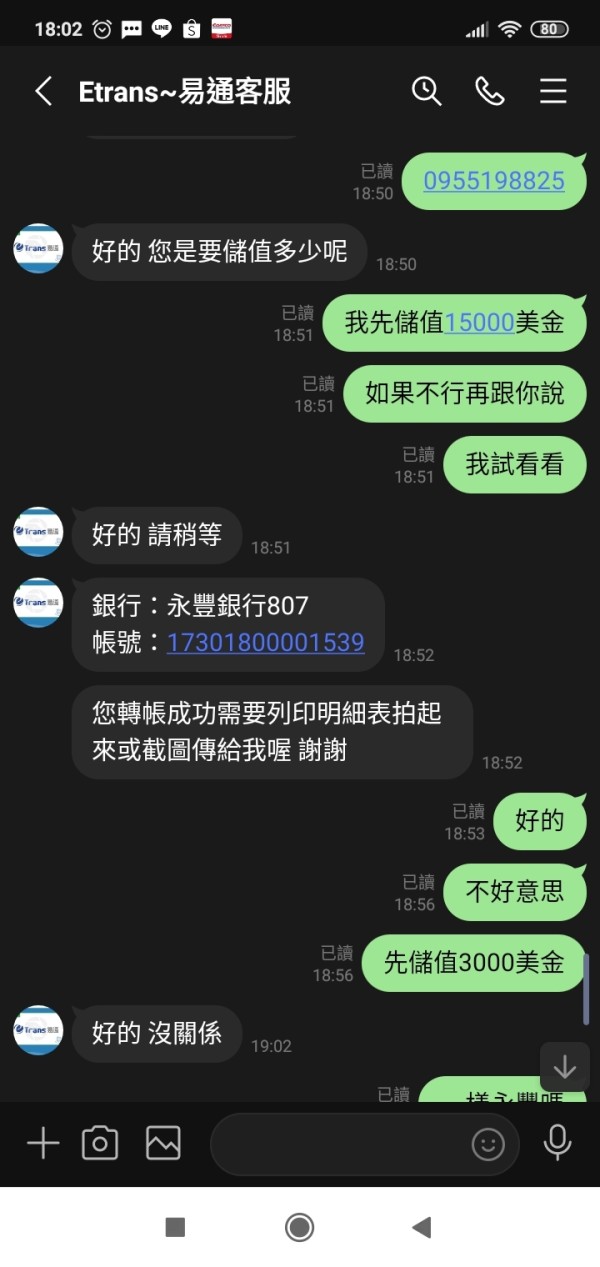

Deposit and Withdrawal Methods

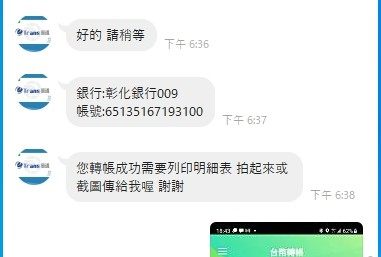

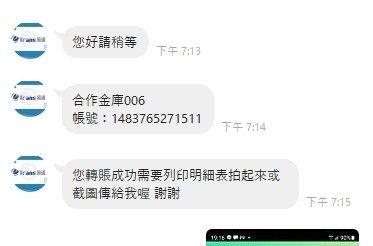

Specific information about available deposit and withdrawal methods is not detailed in current accessible documentation.

Minimum Deposit Requirements

Exact minimum deposit requirements are not specified in available broker information.

No information about bonus programs or promotional offerings is available in current documentation.

Tradeable Assets

Specific details about available trading instruments and asset classes are not clearly documented in accessible materials.

Cost Structure

Detailed information about spreads, commissions, and other trading costs is not available in current broker documentation. This represents a significant transparency concern that affects trader decision-making.

Leverage Ratios

Specific leverage offerings are not detailed in available materials.

Information about available trading platforms is not specified in current accessible documentation.

Geographic Restrictions

Specific geographic limitations are not clearly documented in available materials.

Customer Support Languages

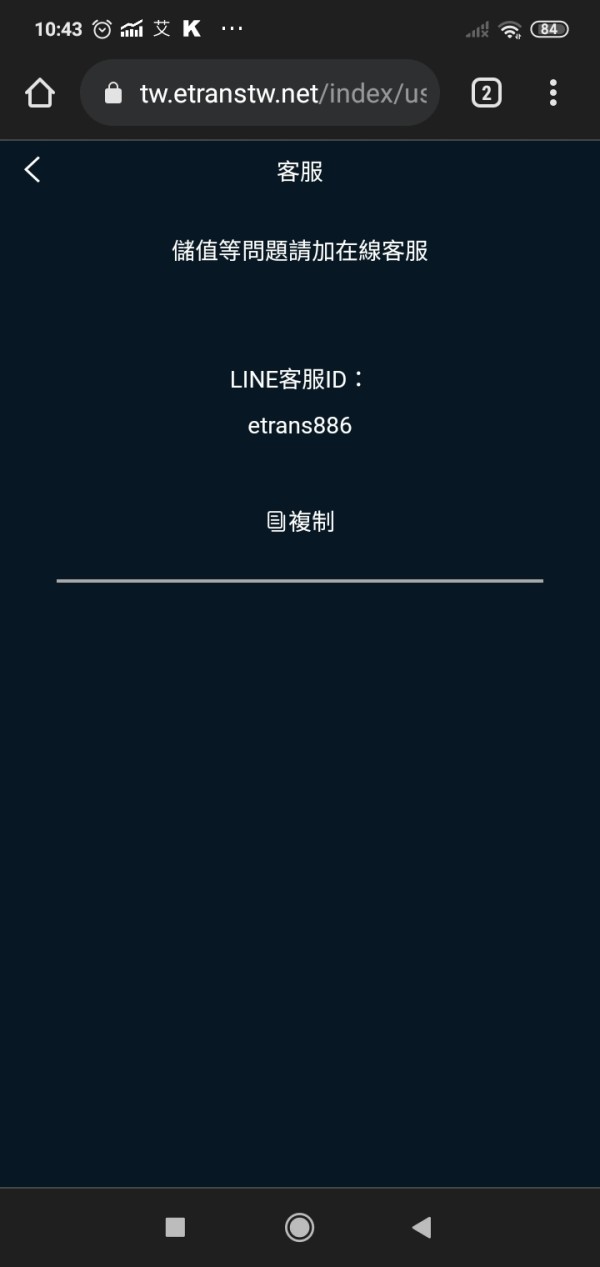

Available customer service language options are not specified in current documentation.

This etrans review notes that the absence of these fundamental details represents a significant concern for potential clients seeking comprehensive broker evaluation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

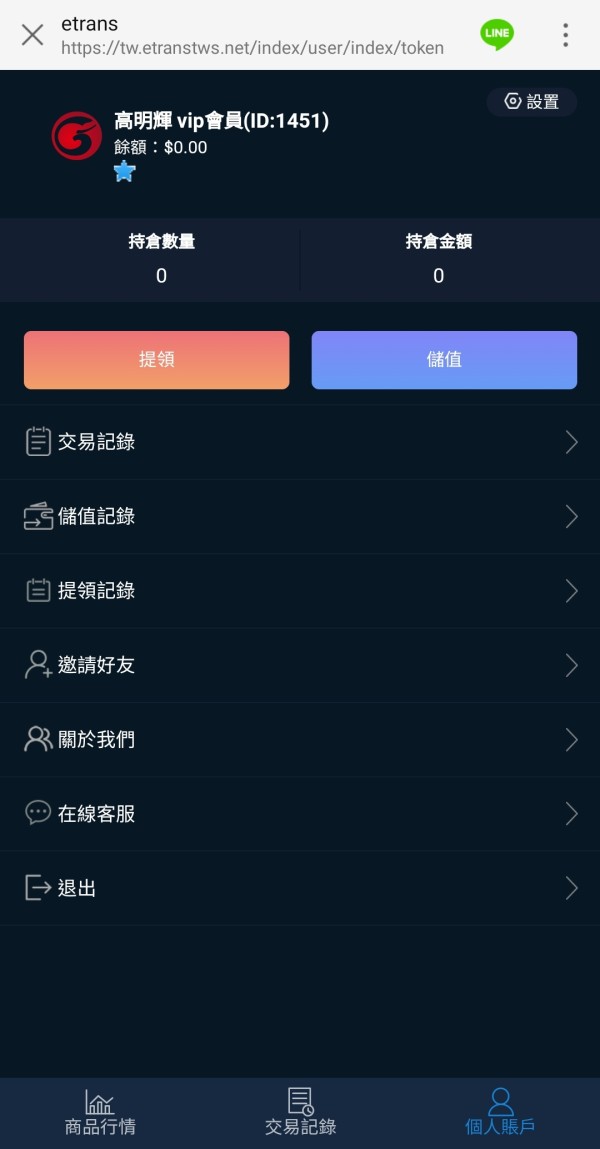

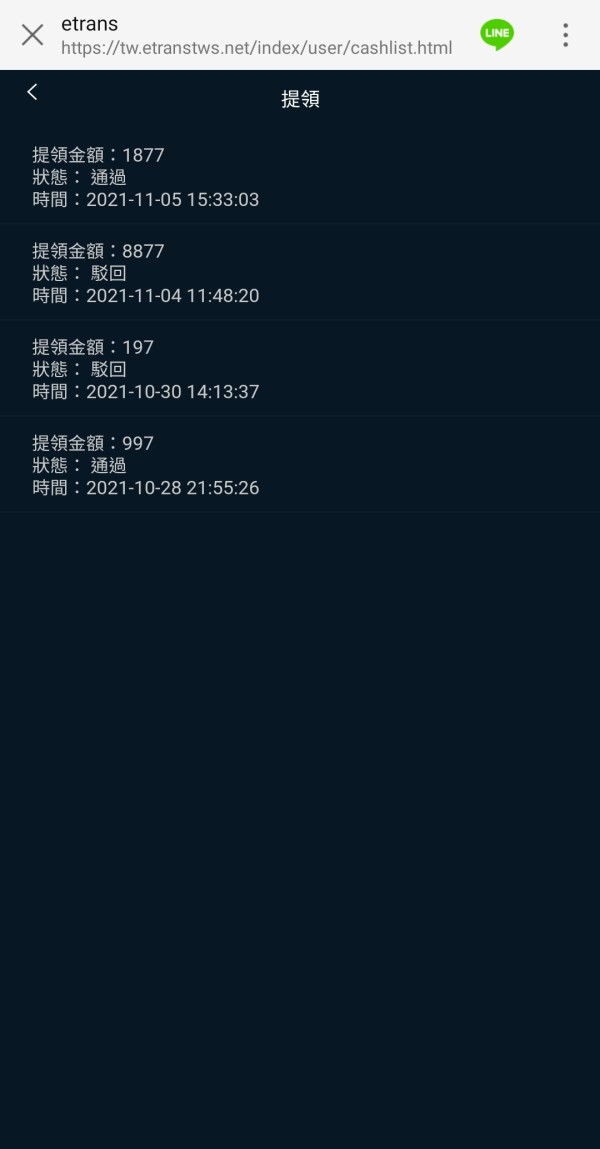

The account conditions evaluation for eTrans reveals significant information gaps that impact the overall assessment. Available documentation does not provide specific details about account types, minimum deposit requirements, or account opening procedures.

These are fundamental considerations for potential traders who need this information to make informed decisions. Without clear information about account tiers, trading conditions, or special features, prospective clients cannot make informed decisions about suitability for their trading needs.

The absence of transparent account condition documentation represents a major weakness in the broker's market presentation. Industry standard practice requires brokers to clearly outline account types, minimum deposits, and associated benefits or restrictions, but eTrans fails to meet this basic requirement.

eTrans's failure to provide this basic information publicly suggests either poor marketing transparency or potential operational limitations. This etrans review finds that the lack of detailed account condition information significantly hampers the broker's credibility.

It also makes it difficult for traders to assess whether the service meets their requirements.

The evaluation of trading tools and educational resources reveals substantial deficiencies in eTrans's service offerings. Available documentation does not specify what trading tools, analytical resources, or educational materials are provided to clients, which is a major red flag.

Modern forex brokers typically offer comprehensive trading platforms, market analysis tools, economic calendars, and educational resources to support client success. The absence of detailed information about these essential services raises questions about eTrans's commitment to client support and trading facilitation.

Research capabilities, automated trading support, and analytical tools are crucial components of competitive forex brokerage services. Without clear documentation of these offerings, potential clients cannot assess the broker's technological capabilities or educational support systems.

The lack of transparency regarding tools and resources significantly impacts the broker's competitive position. It also suggests limited investment in client-facing technology and support systems that modern traders expect.

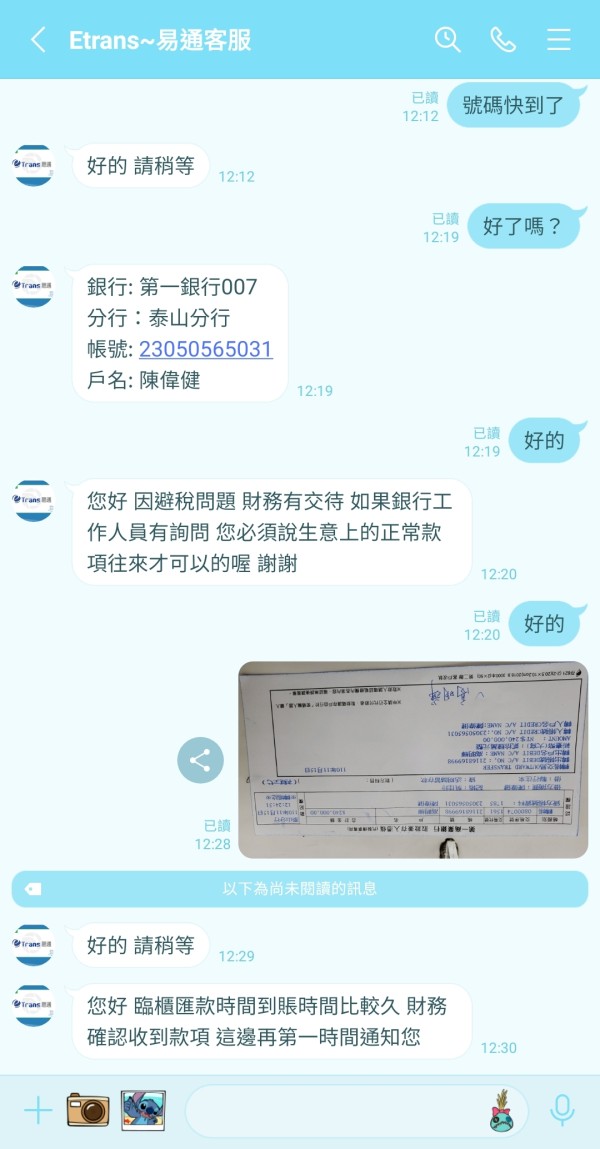

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation presents mixed findings based on available information. While employee satisfaction ratings suggest reasonable internal workplace conditions, external customer feedback indicates potential service quality concerns that clients should know about.

Available documentation does not specify customer service channels, response times, or support availability hours. These fundamental service parameters are essential for traders who require reliable assistance, particularly during volatile market conditions when quick support can make the difference between profit and loss.

The absence of clear information about multilingual support, technical assistance capabilities, or problem resolution procedures represents a significant service transparency gap. Professional forex brokers typically provide comprehensive customer support documentation and clear service level commitments to help clients understand what to expect.

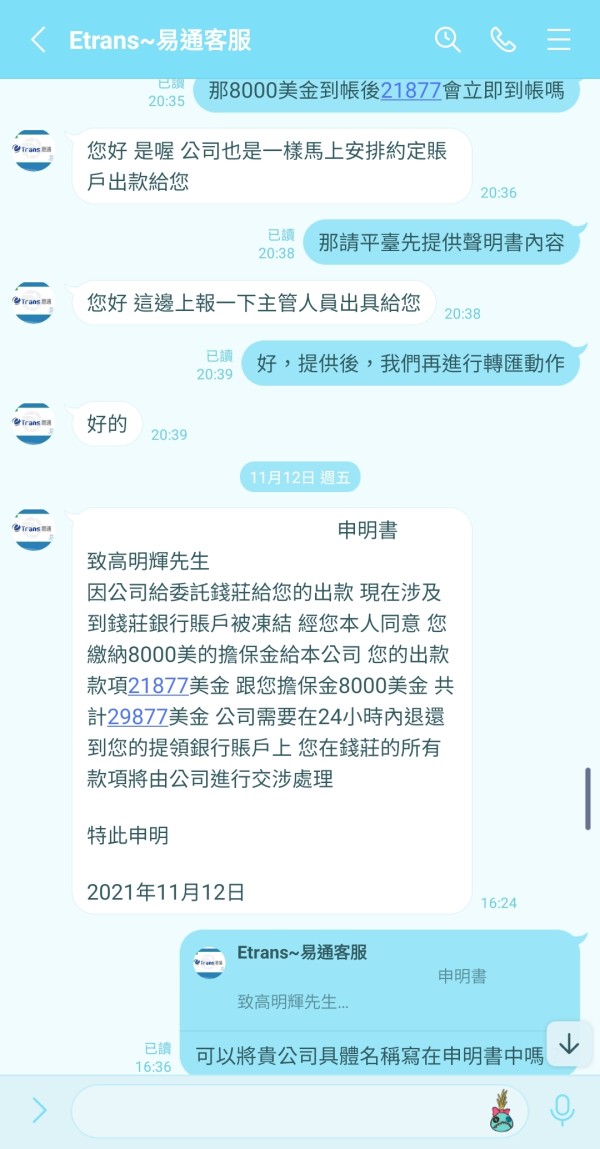

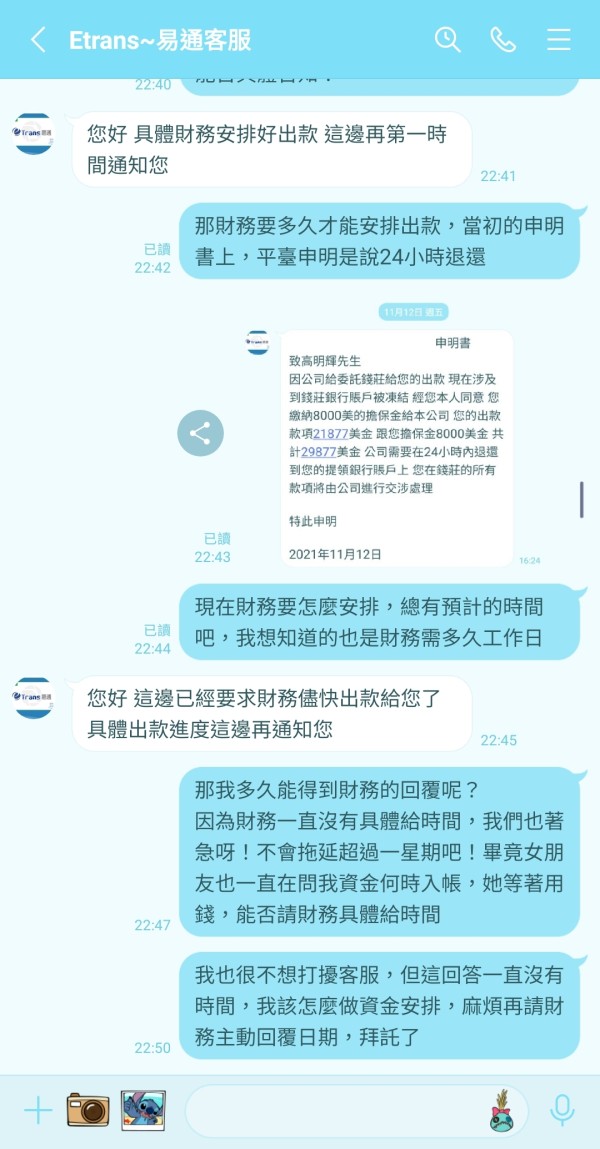

User complaints mentioned in available reports suggest potential service delivery issues. However, specific details about complaint resolution and service improvement measures are not documented in accessible materials, which makes it hard to judge if they're working to fix problems.

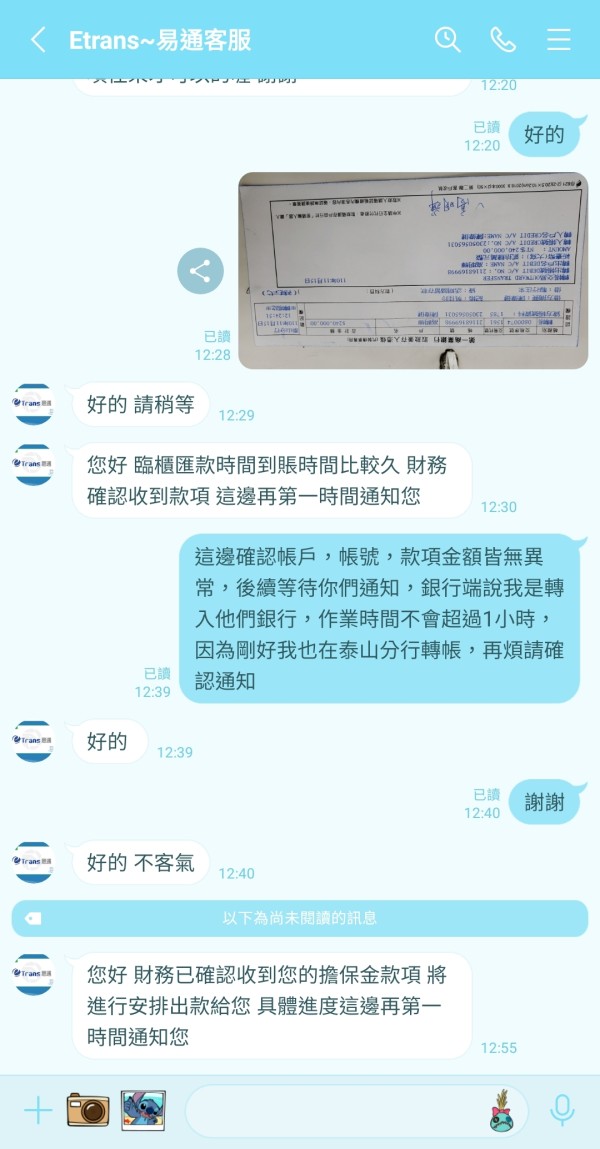

Trading Experience Analysis (Score: 4/10)

The trading experience assessment reveals concerning gaps in platform information and execution quality documentation. Available materials do not provide specific details about platform stability, order execution speeds, or trading environment characteristics that traders need to evaluate.

Professional forex trading requires reliable platform performance, fast execution speeds, and comprehensive trading functionality. The absence of detailed platform specifications and performance metrics makes it impossible to assess eTrans's trading infrastructure quality, which is a major problem for serious traders.

Mobile trading capabilities, platform features, and trading environment details are not specified in available documentation. These omissions represent significant concerns for traders seeking reliable and feature-rich trading platforms that can handle their trading strategies effectively.

Without clear information about trading conditions, platform capabilities, and execution quality, potential clients cannot adequately assess whether eTrans provides suitable trading infrastructure for their needs. This etrans review emphasizes that platform transparency and performance documentation are essential for credible forex brokerage operations.

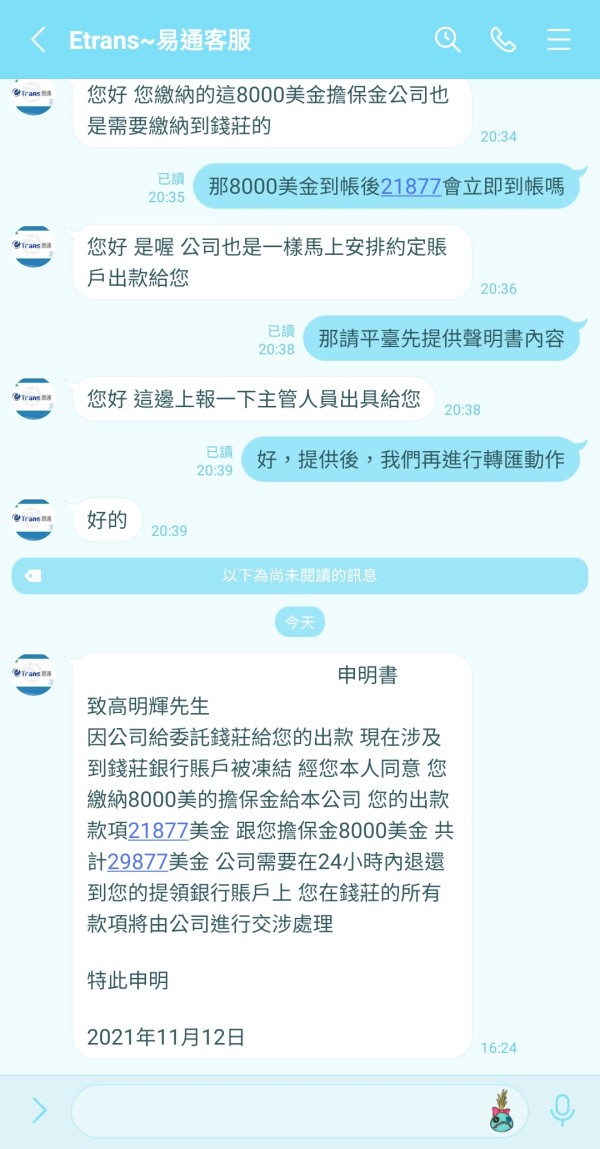

Trustworthiness Analysis (Score: 2/10)

The trustworthiness evaluation reveals significant concerns about eTrans's regulatory transparency and operational credibility. Available documentation does not provide clear information about regulatory oversight, licensing, or compliance frameworks that protect traders.

Regulatory compliance is fundamental for forex broker credibility and client protection. The absence of specific regulatory information raises serious questions about operational legitimacy and client fund security measures that every trader should consider before depositing money.

Industry best practices require brokers to clearly display regulatory licenses, compliance information, and client protection measures. eTrans's failure to provide this essential information represents a major trust deficit that should concern potential clients.

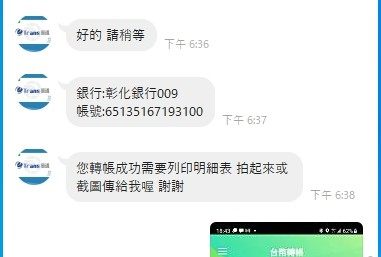

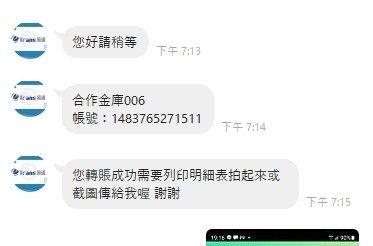

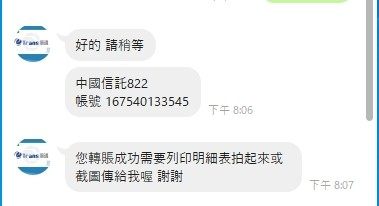

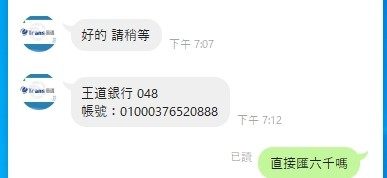

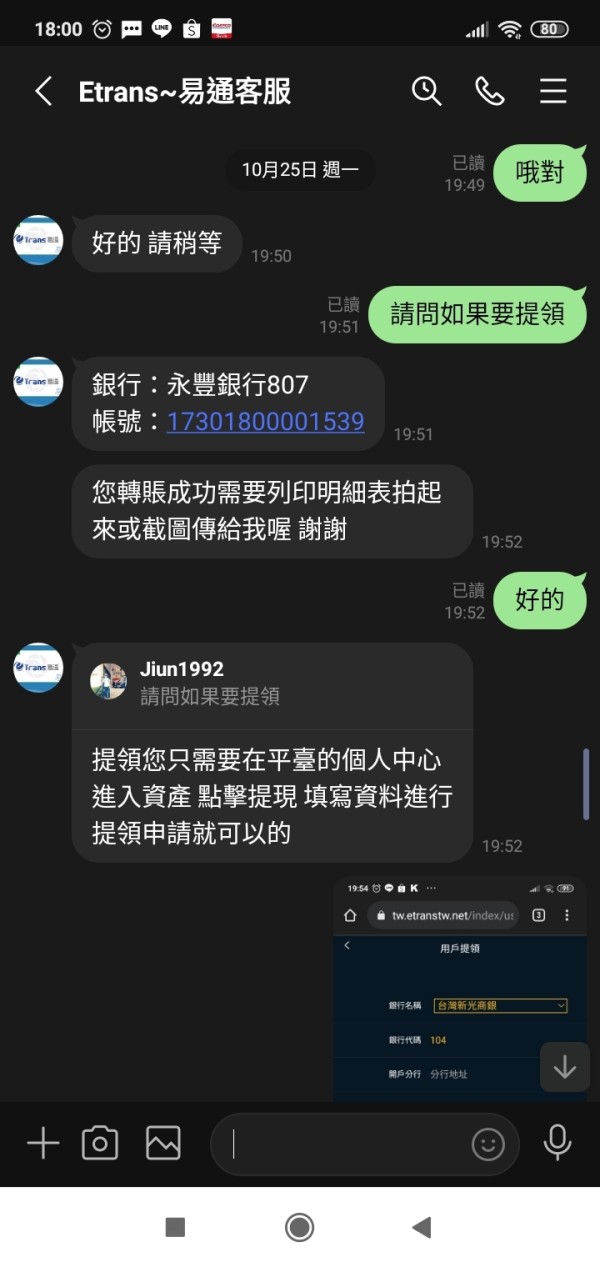

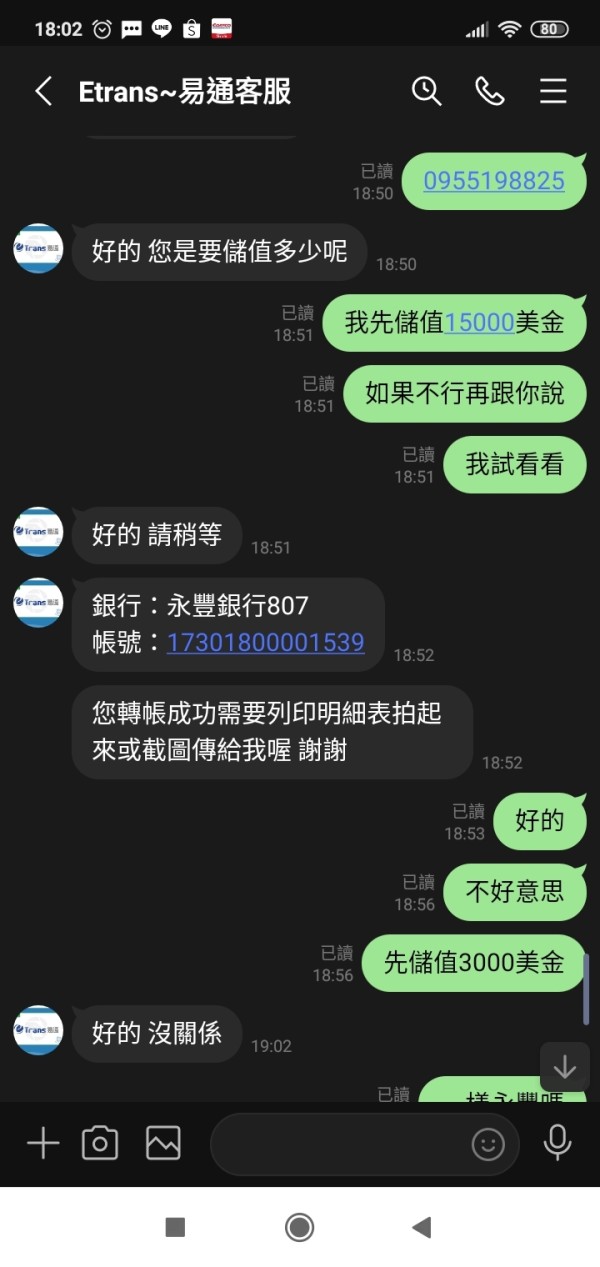

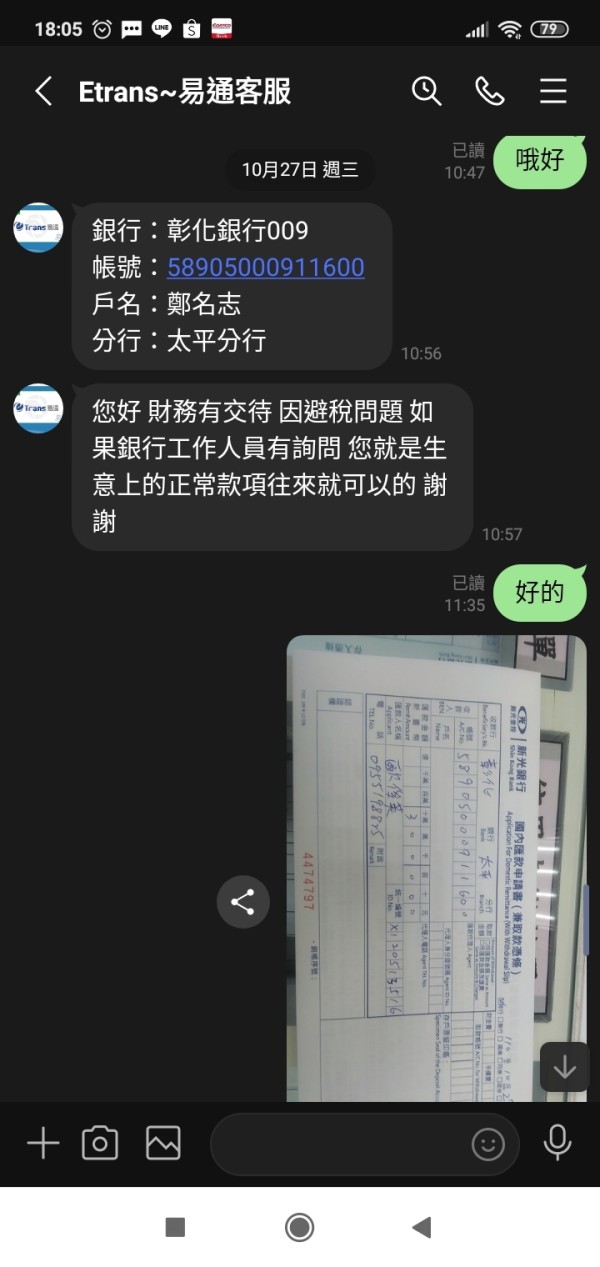

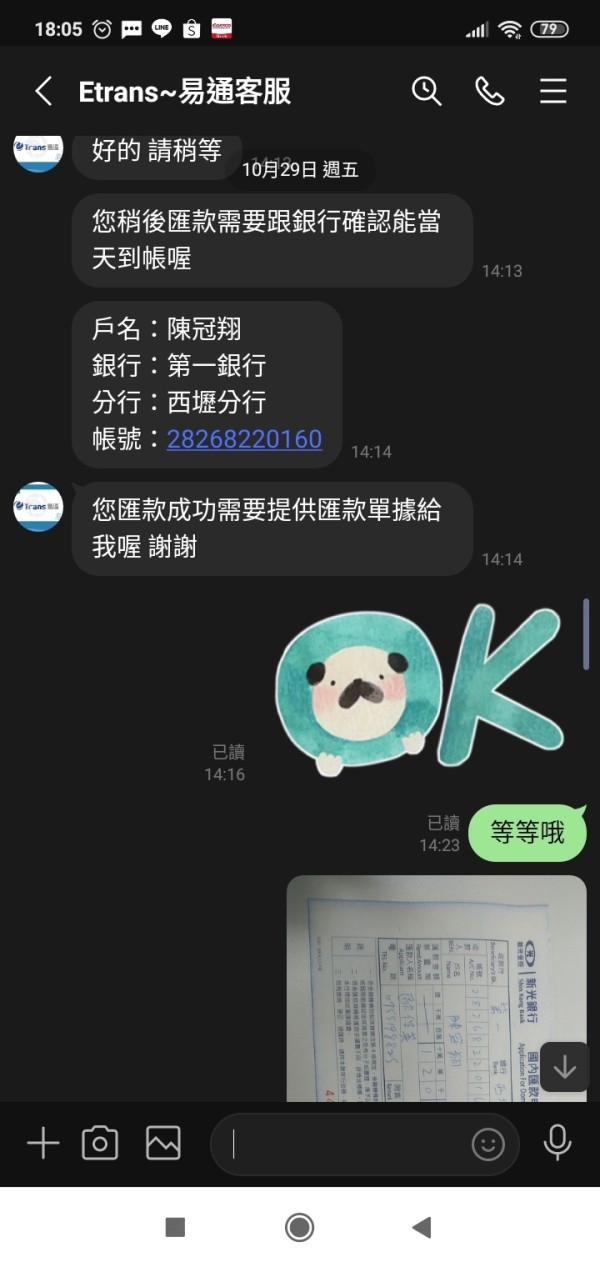

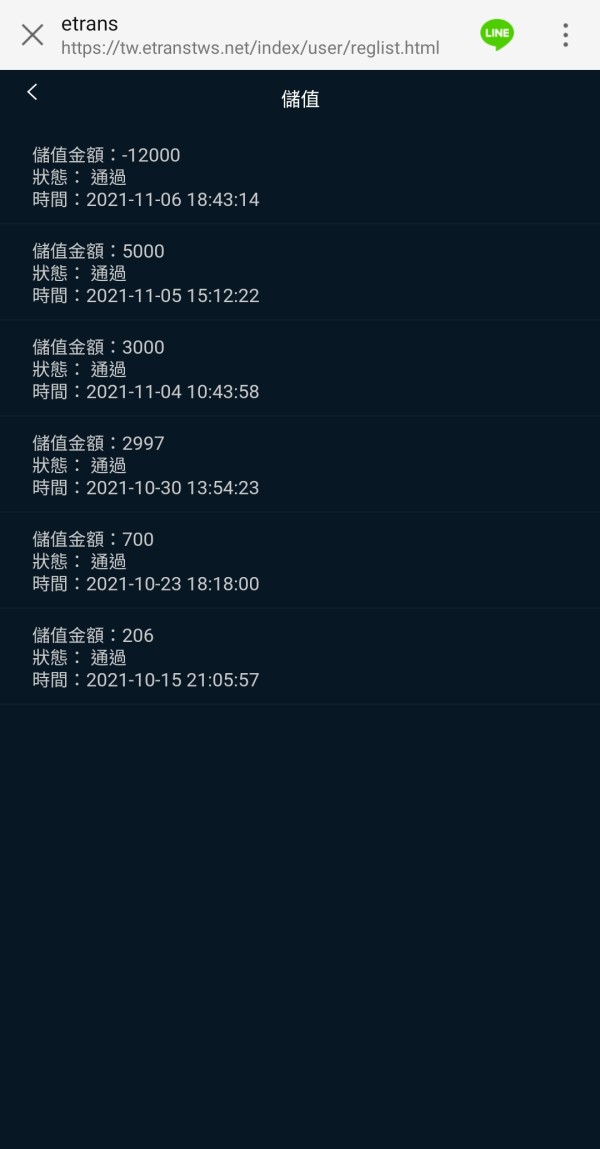

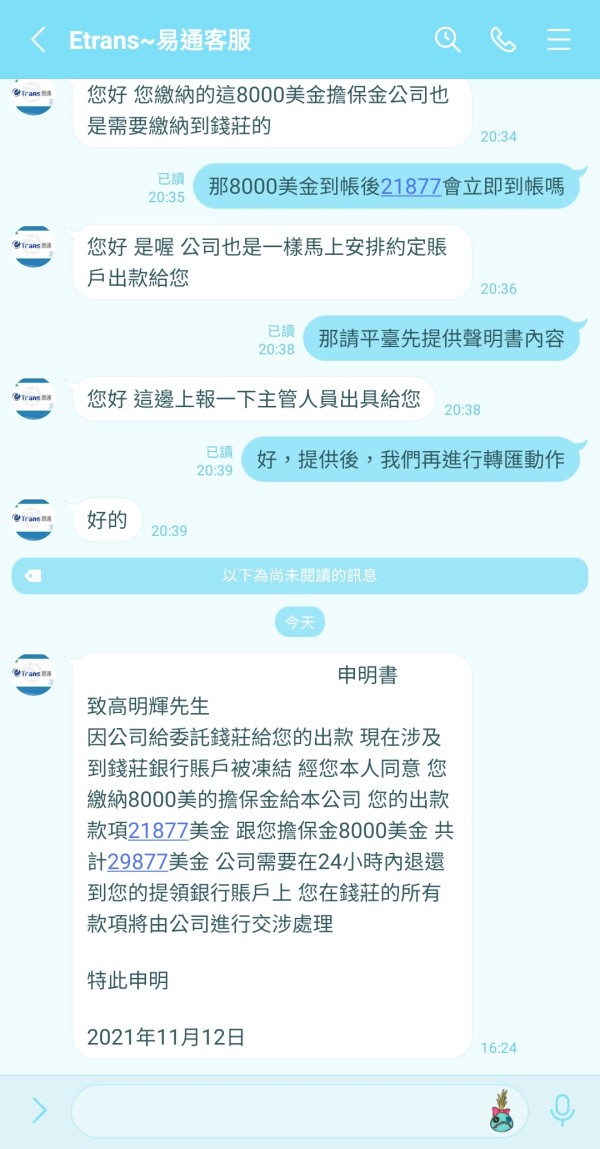

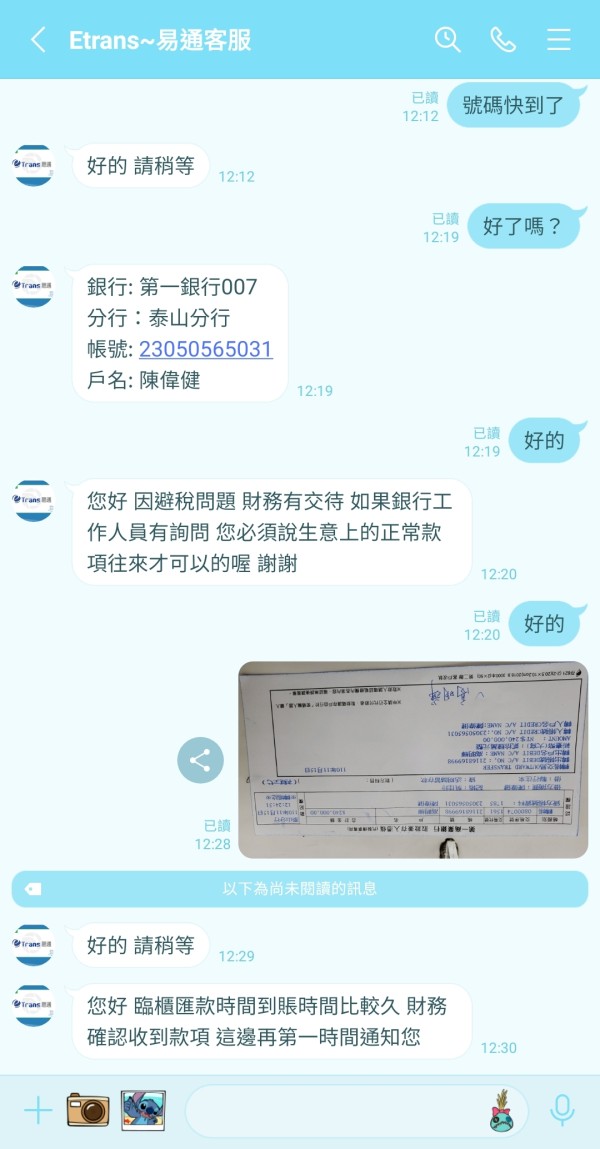

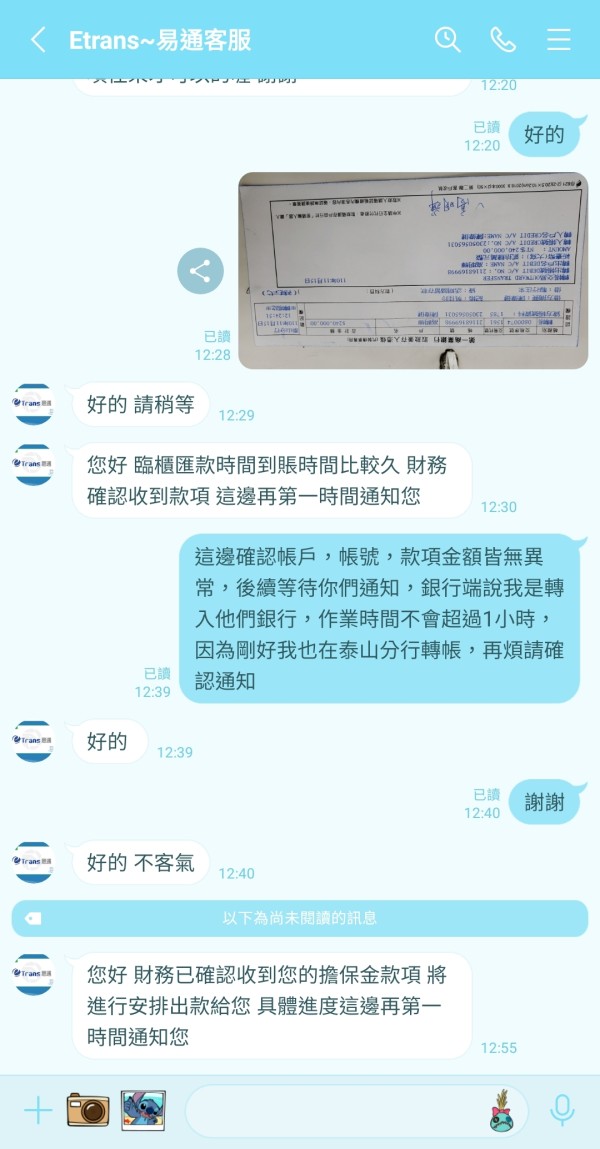

Third-party evaluations and user feedback suggest low confidence levels. There are complaints about transparency and operational clarity that compound the concerns about missing regulatory documentation and unclear operational procedures.

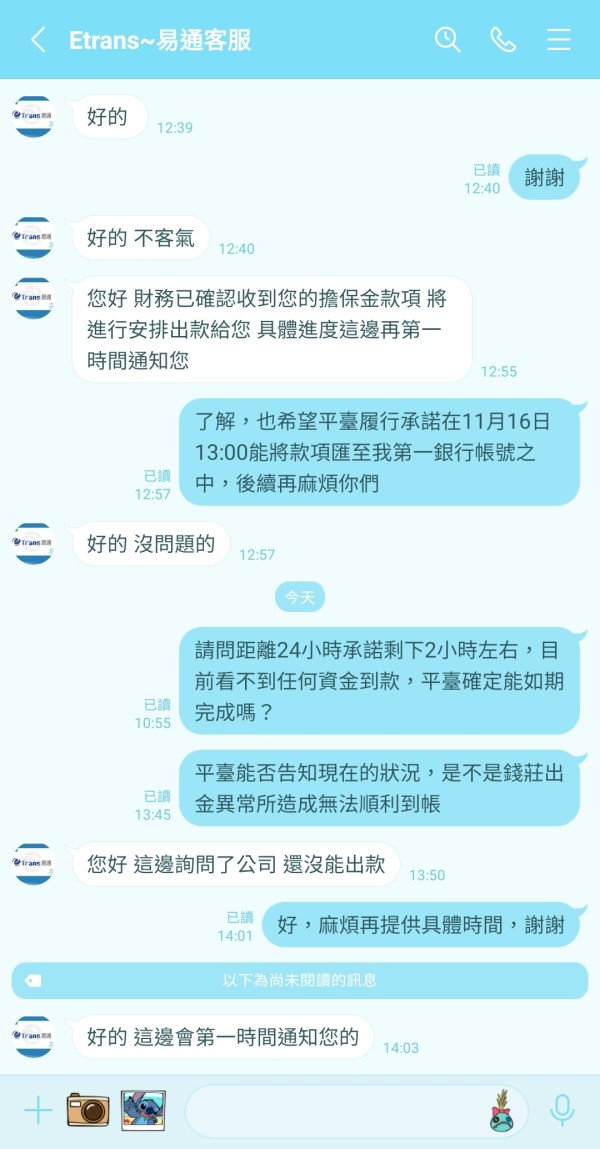

User Experience Analysis (Score: 5/10)

User experience evaluation presents mixed findings based on available feedback and operational transparency assessments. While internal employee satisfaction suggests reasonable workplace conditions, external user perspectives indicate potential experience quality concerns that affect real trading.

The registration process, platform usability, and overall service experience details are not clearly documented in available materials. These fundamental user journey elements are essential for assessing broker accessibility and client satisfaction potential, but eTrans doesn't provide this basic information.

Common user concerns appear to focus on transparency and operational clarity. However, specific feedback about interface design, ease of use, and service delivery is not detailed in accessible documentation, making it hard to judge the actual user experience.

The absence of comprehensive user experience documentation and limited positive user feedback suggests potential areas for improvement in service delivery and client communication.

Conclusion

This etrans review concludes that eTrans Forex Broker demonstrates significant weaknesses in regulatory transparency, operational documentation, and market credibility. The broker's overall performance is particularly concerning in trust and transparency dimensions that matter most to traders.

The service appears unsuitable for traders requiring high levels of regulatory compliance assurance and operational transparency. The absence of fundamental broker information represents a major barrier to confident trading decisions that could protect your investment.

While some internal operational aspects may function adequately, the lack of public transparency and regulatory clarity makes eTrans a high-risk choice for serious forex trading activities.