IronTrade 2025 Review: Everything You Need to Know

Summary

This irontrade review examines a broker that operates in a complex regulatory environment with mixed user feedback. IronTrade is an unregulated broker, which creates potential risks for traders, yet users on Trustpilot have given relatively positive reviews, especially highlighting easy withdrawals and good customer support. The platform offers its own web-based trading interface and supports multiple asset classes, including commodities, currencies, and stocks.

IronTrade is operated by Iron Trade and Investment Limited, headquartered in London, United Kingdom. The platform targets investors seeking to diversify their trading activities across various asset classes. While user reviews mention positive experiences with withdrawal processes and customer support quality, the lack of regulatory oversight raises significant concerns about trader protection and fund security.

The broker's main appeal lies in its multi-asset trading approach and user-friendly withdrawal processes. However, potential clients must carefully weigh these benefits against the substantial risks associated with trading through an unregulated entity.

Important Notice

Risk Warning: IronTrade operates as an unregulated broker, which may expose traders to significant legal and regulatory risks across different jurisdictions. Investors should exercise extreme caution when considering this platform. Unregulated brokers offer limited recourse in case of disputes or financial difficulties.

This review employs a comprehensive evaluation methodology, combining available user feedback, market information, and industry standards to provide an objective analysis. All information presented is based on publicly available sources and user testimonials. Readers should conduct their own due diligence before making any investment decisions.

Rating Framework

Broker Overview

IronTrade operates as an online trading platform managed by Iron Trade and Investment Limited. The company has its headquarters located at 91 Battersea Park Road, London, United Kingdom, SW8 4DU. The company positions itself as a multi-asset broker, offering traders access to various financial instruments and technical indicators designed to capture trading opportunities across different markets.

The broker's business model centers on providing traders with a web-based trading interface that supports multiple asset classes. IronTrade focuses on delivering trading tools and technical analysis capabilities to help traders identify and capitalize on market movements. The platform emphasizes accessibility and user-friendly features, particularly in terms of account management and withdrawal processes.

However, this irontrade review must highlight that the broker operates without regulatory oversight from major financial authorities. This unregulated status represents a significant concern for potential clients, as it means traders have limited protection and recourse options compared to regulated alternatives. The platform's target audience appears to be investors seeking diversified trading opportunities across commodities, currencies, and stocks.

Regulatory Status: IronTrade operates as an unregulated broker, which presents substantial risks for traders. The absence of regulatory oversight means clients lack standard protections typically provided by financial authorities.

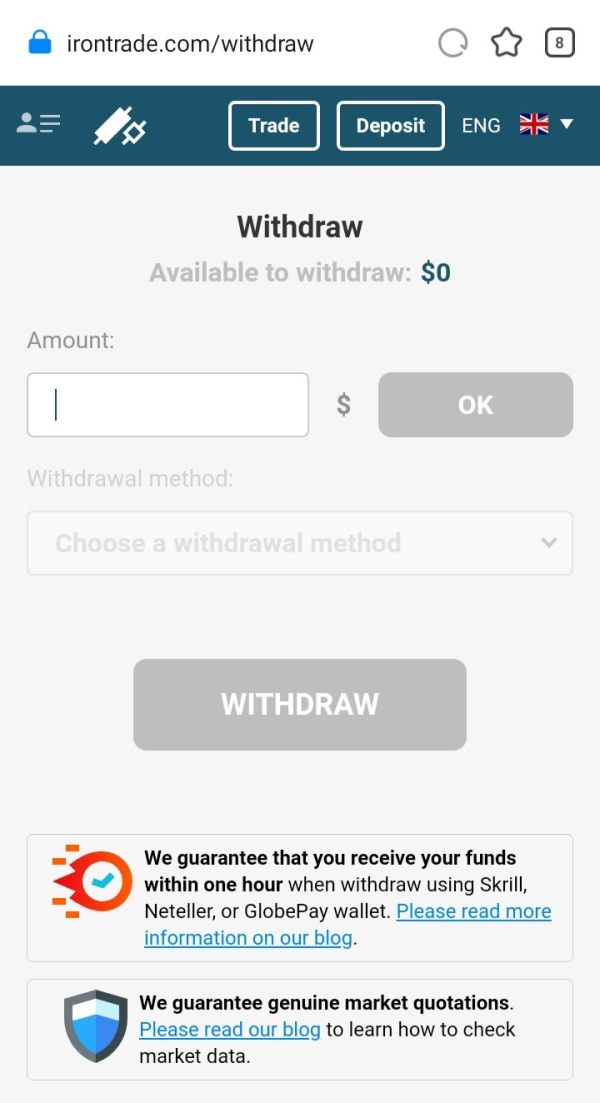

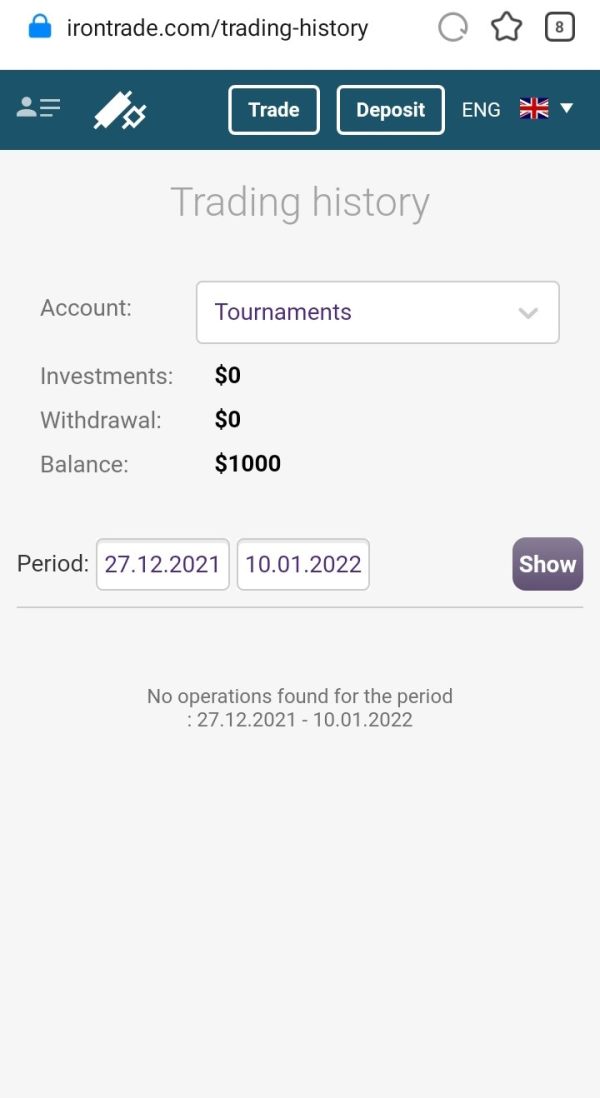

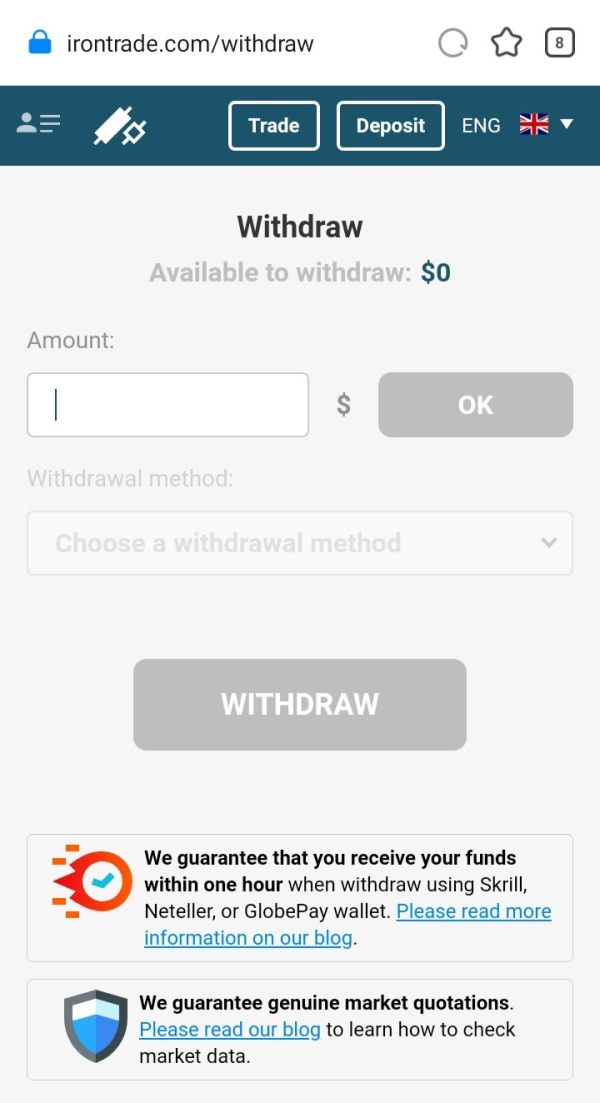

Deposit and Withdrawal Methods: Specific information regarding available payment methods is not detailed in available sources. User feedback suggests the withdrawal process is relatively straightforward.

Minimum Deposit Requirements: Detailed minimum deposit amounts are not specified in available documentation. Potential clients need to contact the broker directly for this information.

Bonuses and Promotions: Information about promotional offers or bonus programs is not available in current sources.

Tradeable Assets: The platform supports multiple asset classes including commodities, currencies, and stocks. This provides traders with diversification opportunities across different markets.

Cost Structure: Specific details regarding spreads, commissions, and other trading costs are not provided in available materials. This makes cost comparison difficult.

Leverage Options: Information about maximum leverage ratios and margin requirements is not detailed in accessible sources.

Platform Options: IronTrade offers a web-based trading interface but does not support popular platforms like MT4 and MT5. This may limit appeal for experienced traders.

Geographic Restrictions: Specific information about trading restrictions by region is not available in current documentation.

Customer Support Languages: Details about multilingual support options are not specified in available sources.

This irontrade review notes that the limited availability of detailed trading conditions information may indicate transparency issues. Potential clients should consider this when evaluating the platform.

Detailed Rating Analysis

Account Conditions Analysis

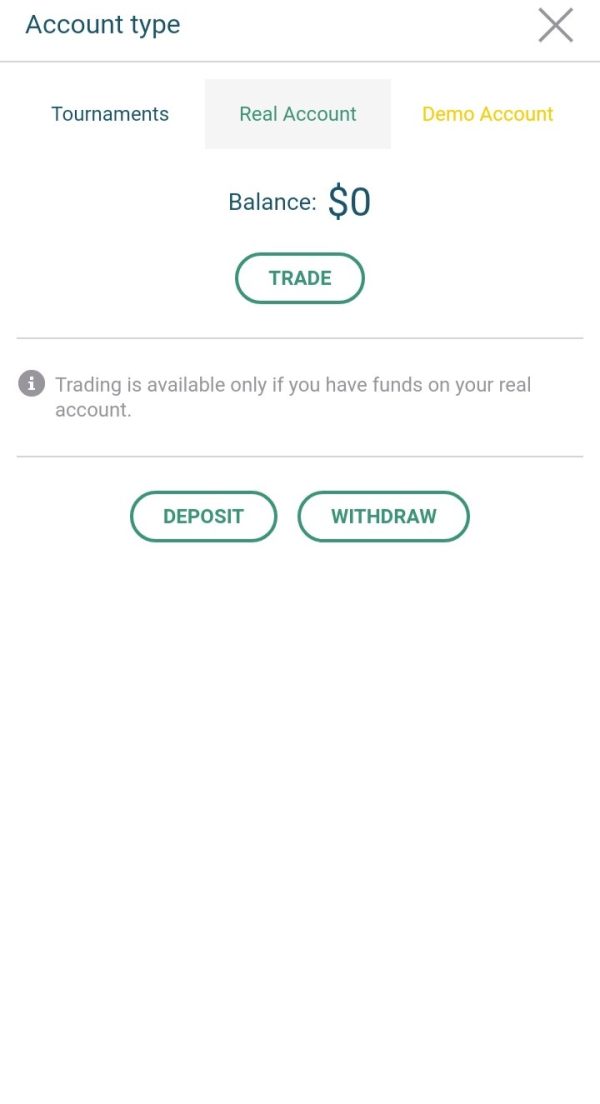

The account conditions evaluation for IronTrade receives a moderate score due to limited transparency regarding specific account features and requirements. Available sources do not provide comprehensive details about account types, minimum deposit requirements, or account opening procedures. This creates uncertainty for potential clients.

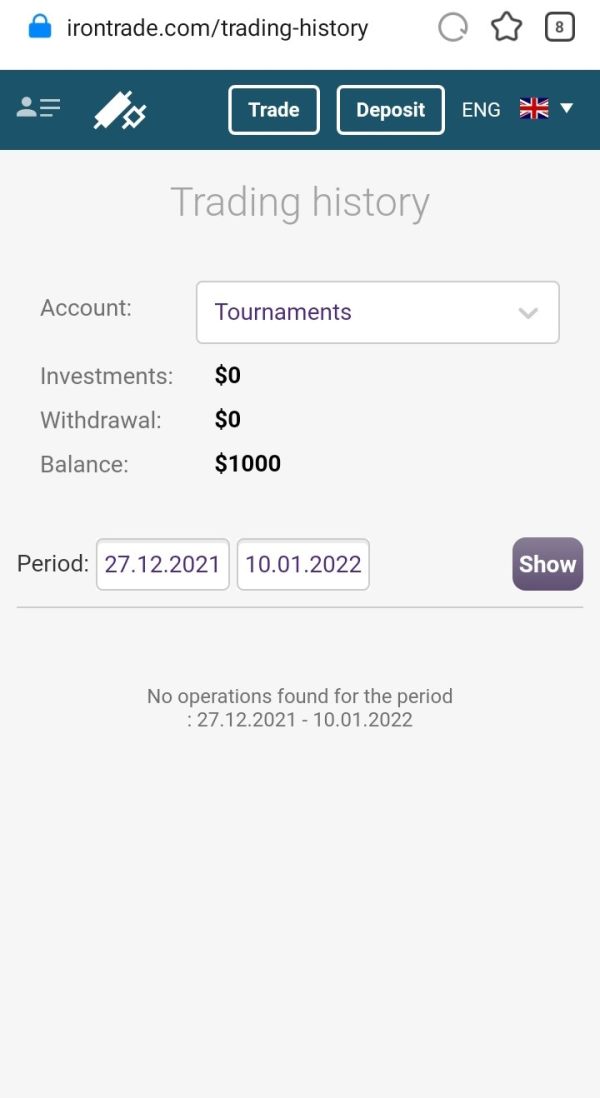

User feedback suggests that withdrawal processes are relatively straightforward, with several reviewers on Trustpilot mentioning "easy withdrawals" as a positive aspect of their experience. However, the absence of detailed information about account structures, fee schedules, and minimum balance requirements makes it difficult for traders to make informed decisions about account suitability. The lack of clearly defined account tiers or special features further complicates the evaluation process.

Most reputable brokers provide transparent information about different account types, associated benefits, and qualification criteria. IronTrade's limited disclosure in this area raises questions about operational transparency and may indicate a less professional approach to client onboarding.

This irontrade review emphasizes that potential clients should request detailed account condition information directly from the broker before committing to any trading activities. The current level of public disclosure is insufficient for informed decision-making.

IronTrade's tools and resources receive a moderate rating based on the platform's trading interface and multi-asset support capabilities. The broker provides various trading tools and technical indicators designed to help traders identify market opportunities. However, specific details about the range and sophistication of these tools are limited.

The platform supports multiple asset classes including commodities, currencies, and stocks, which provides traders with diversification opportunities. However, the absence of popular third-party platforms like MT4 and MT5 may disappoint experienced traders who prefer these industry-standard interfaces. Available information does not detail educational resources, research capabilities, or advanced analysis tools that many traders consider essential for successful trading.

The lack of comprehensive tool documentation makes it difficult to assess whether the platform meets the needs of different trader skill levels. User feedback regarding tool effectiveness is mixed, with some positive comments about the trading interface but limited specific feedback about tool quality or reliability. The platform approach may offer unique features, but without detailed specifications, traders cannot adequately evaluate functionality compared to industry standards.

Customer Service and Support Analysis

Customer service receives one of the higher ratings in this evaluation, primarily based on positive user feedback regarding support quality and responsiveness. Multiple Trustpilot reviews specifically mention "good support" and helpful customer service experiences. This suggests that IronTrade prioritizes client assistance.

The ease of withdrawal process, frequently mentioned in user reviews, indicates that the support team effectively handles account management requests. Users report that withdrawal requests are processed efficiently, which is often a critical indicator of customer service quality in the trading industry. However, specific information about support channels, availability hours, response times, and multilingual capabilities is not available in current sources.

The absence of detailed support infrastructure information makes it difficult to assess whether the positive user experiences represent consistent service quality or isolated incidents. While user feedback suggests satisfactory support experiences, the limited transparency about support procedures and capabilities prevents a higher rating. Potential clients should verify support channel availability and response time expectations before engaging with the platform.

Trading Experience Analysis

The trading experience evaluation reflects mixed user feedback and limited detailed performance information. Users provide moderate assessments of the platform's trading capabilities. However, specific performance metrics regarding execution speed, platform stability, and order quality are not available.

The web-based platform may offer unique features, but the absence of popular alternatives like MT4 and MT5 could limit trading flexibility for experienced users. This platform limitation may affect user experience, particularly for traders accustomed to advanced charting tools and automated trading capabilities. User reviews suggest acceptable trading conditions, though detailed feedback about spreads, slippage, or execution quality is limited.

The lack of comprehensive performance data makes it difficult to assess whether the platform meets professional trading standards. Mobile trading capabilities and platform accessibility across different devices are not detailed in available sources, which represents another gap in trading experience evaluation. This irontrade review notes that comprehensive trading experience assessment requires more detailed performance information than currently available.

Trust and Reliability Analysis

Trust and reliability receive the lowest rating due to significant concerns about regulatory status and associated risks. IronTrade operates as an unregulated broker, which fundamentally undermines trader protection and recourse options compared to regulated alternatives. Available information indicates potential associations with investment fraud concerns, including connections to substantial financial disputes.

These associations, combined with the unregulated status, create serious questions about operational integrity and client fund security. The absence of regulatory oversight means that standard investor protections, such as segregated client accounts, compensation schemes, and regulatory complaint procedures, are not available. This lack of protection represents a substantial risk for any trader considering the platform.

While some user reviews are positive, the fundamental regulatory and transparency issues cannot be overlooked. The limited public information about company operations, fund security measures, and dispute resolution procedures further compounds trust concerns.

User Experience Analysis

User experience receives a moderate rating based on balanced feedback from various sources, including relatively positive Trustpilot reviews. Users frequently mention easy withdrawal processes and satisfactory customer support. This suggests that basic platform functionality meets user expectations.

The overall user satisfaction appears mixed, with positive comments about accessibility and account management balanced against concerns about regulatory status and transparency. The user base seems to appreciate the multi-asset trading opportunities and straightforward account operations. However, specific feedback about interface design, navigation ease, and platform functionality is limited in available sources.

The absence of detailed user experience data makes it difficult to assess whether the platform meets modern usability standards. Common user concerns center around the unregulated status and potential risks, which affects overall satisfaction despite positive operational experiences. The broker appears suitable for users seeking diversified asset trading, though regulatory concerns remain a significant consideration for risk-conscious traders.

Conclusion

This irontrade review reveals a broker with mixed characteristics that potential clients must carefully evaluate. While user feedback indicates positive experiences with withdrawal processes and customer support, the fundamental issue of operating without regulatory oversight creates substantial risks that cannot be ignored.

IronTrade appears most suitable for traders seeking multi-asset trading opportunities who are willing to accept higher risks associated with unregulated brokers. The platform's strengths include user-friendly withdrawal processes and responsive customer support, based on available user testimonials.

However, the significant disadvantages include the unregulated status, limited transparency about trading conditions, and potential associations with fraud concerns. These factors substantially outweigh the positive aspects for risk-conscious traders who prioritize regulatory protection and operational transparency. Potential clients should exercise extreme caution and consider regulated alternatives that provide standard investor protections and regulatory oversight before engaging with this platform.