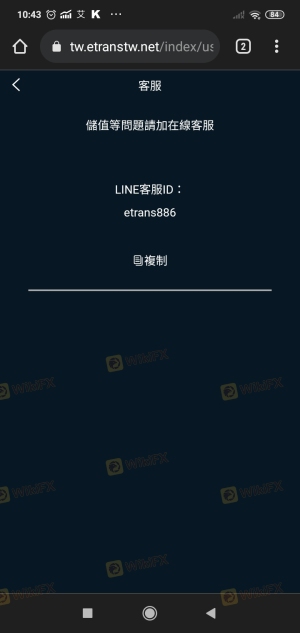

Regarding the legitimacy of Etrans forex brokers, it provides ASIC, FSPR and WikiBit, (also has a graphic survey regarding security).

Is Etrans safe?

Business

License

Is Etrans markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

E-TRANS GROUP PTY LTD

Effective Date:

2013-11-26Email Address of Licensed Institution:

alan.sun@etrans.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.etrans.com.auExpiration Time:

2024-06-12Address of Licensed Institution:

'2 Queen Street' Suite 801 Level 8, 2 Queen Street, MELBOURNE VIC 3000Phone Number of Licensed Institution:

0396021669Licensed Institution Certified Documents:

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

E-TRANS GROUP LIMITED

Effective Date:

2010-11-25Email Address of Licensed Institution:

george.wong@etrans.co.nzSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L1, 290 Queen St. Auckland Auckland Central 1010Phone Number of Licensed Institution:

099215566Licensed Institution Certified Documents:

Is Etrans Safe or a Scam?

Introduction

Etrans is a forex broker that has emerged in the trading landscape, claiming to offer various trading services to its clients. As the forex market continues to expand, it becomes increasingly important for traders to assess the legitimacy and reliability of brokers like Etrans. With the prevalence of scams in the financial sector, traders must exercise caution and conduct thorough evaluations before investing their hard-earned money. This article investigates whether Etrans is a safe trading option or if it raises red flags that potential investors should be aware of. Our assessment is based on a comprehensive review of various online sources, including user feedback, regulatory information, and company background.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its safety and reliability. Etrans claims to be regulated by several financial authorities, including the Australian Securities and Investments Commission (ASIC). However, the actual verification of this claim raises concerns. Below is a summary of the regulatory information available:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 439303 | Australia | Unverified |

| FSPR | 34363 | New Zealand | Unverified |

While Etrans asserts its regulatory compliance, numerous reports indicate a lack of transparency regarding its actual licensing and operational status. The absence of verifiable regulatory oversight places Etrans in a precarious position, making it difficult for potential investors to trust the integrity of the broker. Furthermore, the fact that it has received a low score on platforms like WikiFX (1.21 out of 10) indicates a concerning level of risk associated with trading through Etrans. This lack of credible regulation and oversight is a significant factor in evaluating whether Etrans is safe for traders.

Company Background Investigation

Etrans's history and ownership structure are crucial in understanding its reliability. Established in Australia, the broker has claimed to operate since 2013. However, the details surrounding its foundation, ownership, and management team are vague and often inconsistent across various platforms. Many reviews highlight that Etrans lacks transparency in its operations, which raises questions about its legitimacy.

The management team, which is often a critical factor in the success and ethical standing of a broker, is not well-documented for Etrans. This lack of information about the key players behind the broker further complicates the assessment of its reliability. Transparency in business operations is essential for building trust, and Etrans seems to fall short in this area. Without a clear understanding of the company's leadership and their professional backgrounds, it becomes increasingly challenging to ascertain whether Etrans is safe for potential investors.

Trading Conditions Analysis

The trading conditions offered by Etrans are another vital aspect of evaluating its safety. A thorough analysis reveals a somewhat opaque fee structure that may not be in line with industry standards. Traders must be cautious of any hidden fees or unusual policies that could affect their trading experience. Below is a comparison of Etrans's trading costs with the industry average:

| Fee Type | Etrans | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | 0.5-1.5% |

The lack of transparency regarding spreads, commissions, and overnight interest rates is alarming. Potential investors should be wary of brokers that do not clearly outline their fee structures, as this can often lead to unexpected costs and diminished profitability. Given these concerns, it is reasonable to question whether Etrans is safe for traders looking for a reliable and cost-effective trading environment.

Client Funds Security

The safety of client funds is paramount when assessing a broker's reliability. Etrans claims to implement various security measures, yet the specifics of these measures are not well-documented. Key aspects to consider include fund segregation, investor protection, and negative balance protection policies. Unfortunately, there is little information available about Etrans's approach to these critical safety measures.

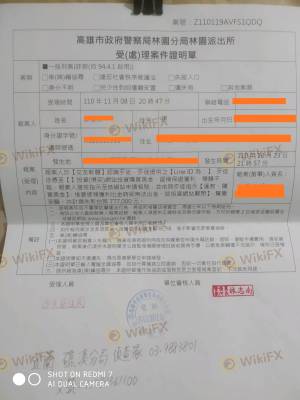

In the past, there have been complaints regarding difficulties in withdrawing funds, which raises significant concerns about the security of client investments. The lack of a robust framework to ensure the safety of client funds can be a major red flag for potential investors. Traders should always prioritize brokers that clearly outline their security protocols. The uncertainty surrounding Etrans's client fund security further complicates the question of whether Etrans is safe for trading.

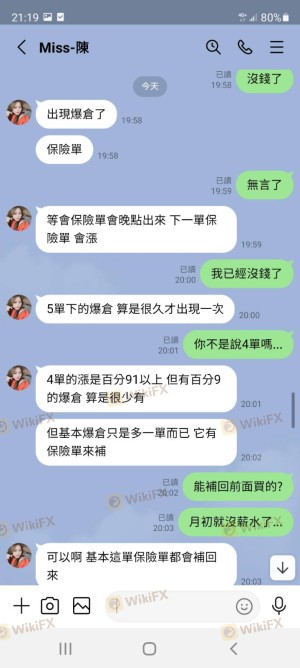

Customer Experience and Complaints

Analyzing customer feedback is essential in gauging a broker's reliability. Etrans has garnered a mix of reviews, with many users expressing dissatisfaction regarding their experiences. Common complaints include difficulties in withdrawing funds, poor customer service, and a lack of transparency in operations. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Transparency Concerns | High | Poor |

One notable case involved a trader who reported being unable to withdraw funds after several attempts, leading to frustration and financial losses. This experience highlights the significant risks associated with trading through Etrans and raises further doubts about whether Etrans is safe for potential investors.

Platform and Execution

The performance of a trading platform is crucial for a positive trading experience. Etrans claims to offer a reliable trading platform; however, user experiences suggest inconsistencies in execution quality, including slippage and order rejections. Traders have reported instances where their orders were not executed as expected, leading to potential financial losses.

The absence of a well-established trading platform may also indicate a lack of professionalism and reliability. A broker's ability to provide a stable and efficient trading environment is essential for building trust among its clients. Given the mixed reviews on execution quality, it is essential for traders to consider whether Etrans is safe for their trading needs.

Risk Assessment

When evaluating the overall risk of trading with Etrans, several key areas of concern arise. The lack of credible regulation, transparency issues, and negative customer experiences contribute to a higher risk profile for this broker. The following risk assessment summarizes the critical risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified regulatory claims |

| Financial Security Risk | High | Complaints regarding fund withdrawals |

| Execution Risk | Medium | Issues with order execution |

To mitigate these risks, potential investors should conduct thorough research, seek out credible alternatives, and consider using a demo account to test the broker's services before committing real funds.

Conclusion and Recommendations

In conclusion, the investigation into Etrans raises several red flags that suggest it may not be a safe trading option. The lack of verifiable regulation, transparency issues, and negative customer feedback all contribute to a concerning risk profile. While some traders may still choose to engage with Etrans, it is crucial to approach this broker with caution.

For traders seeking safer alternatives, consider established brokers with solid regulatory oversight, transparent fee structures, and positive customer experiences. Some reputable options include brokers regulated by ASIC or FCA, which have demonstrated a commitment to client safety and satisfaction. Ultimately, it is essential for traders to prioritize their security and conduct thorough evaluations before investing, especially when considering whether Etrans is safe for trading.

Is Etrans a scam, or is it legit?

The latest exposure and evaluation content of Etrans brokers.

Etrans Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Etrans latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.