Etor Review 1

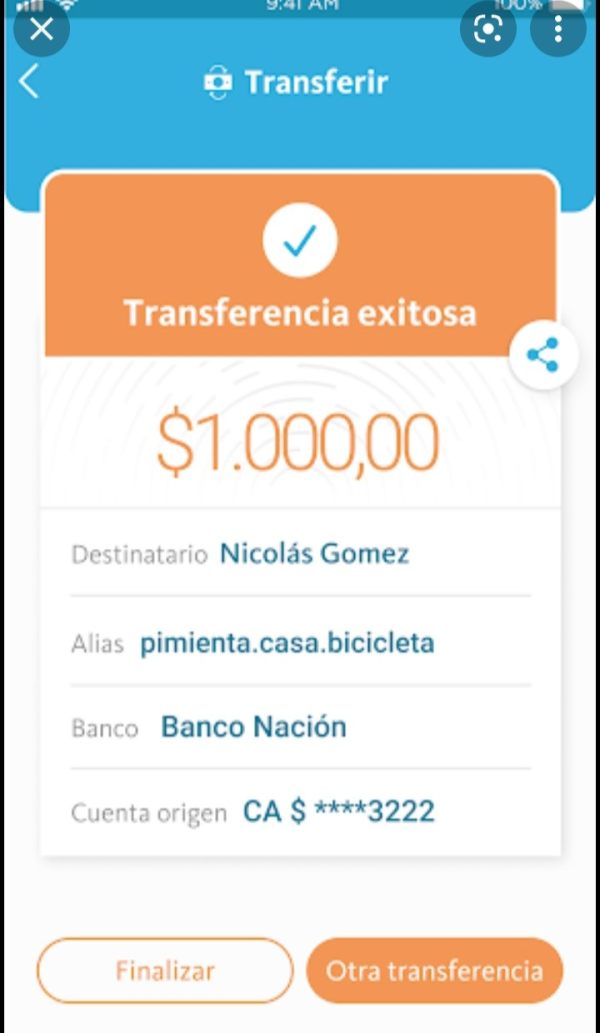

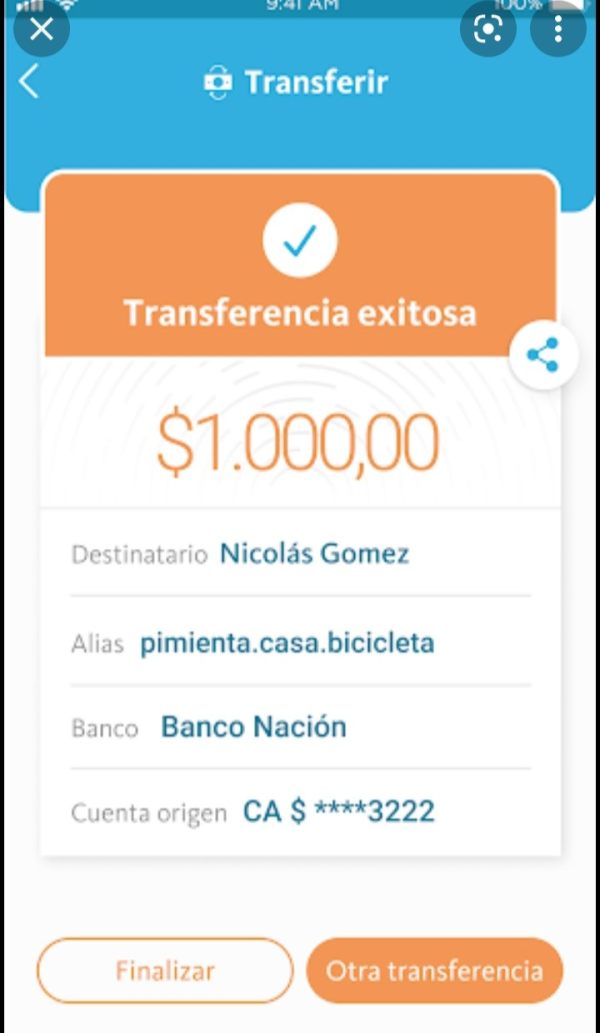

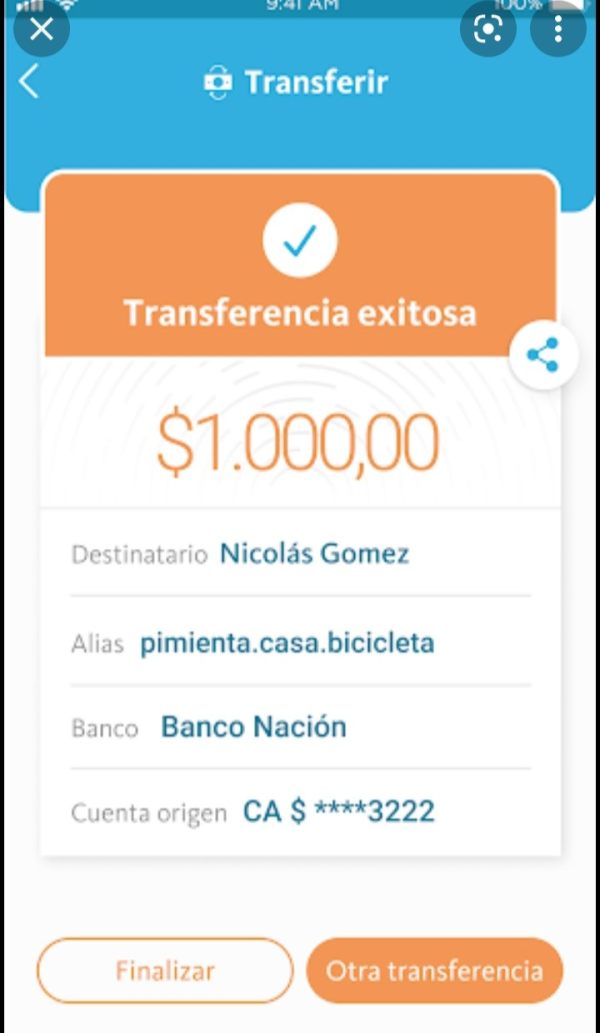

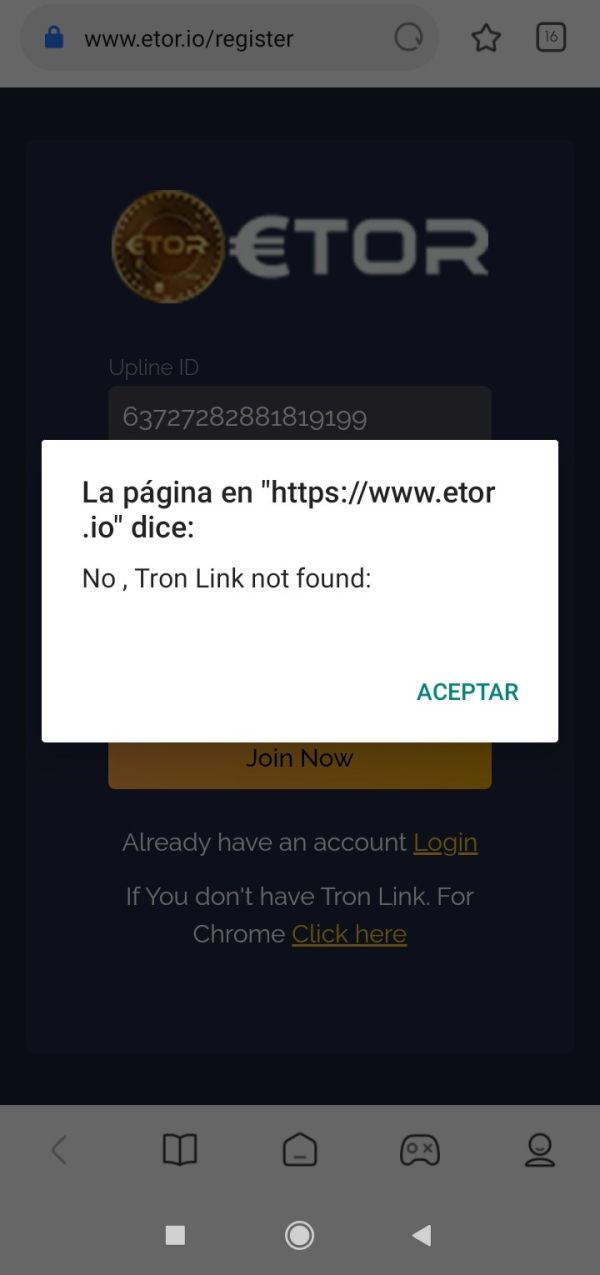

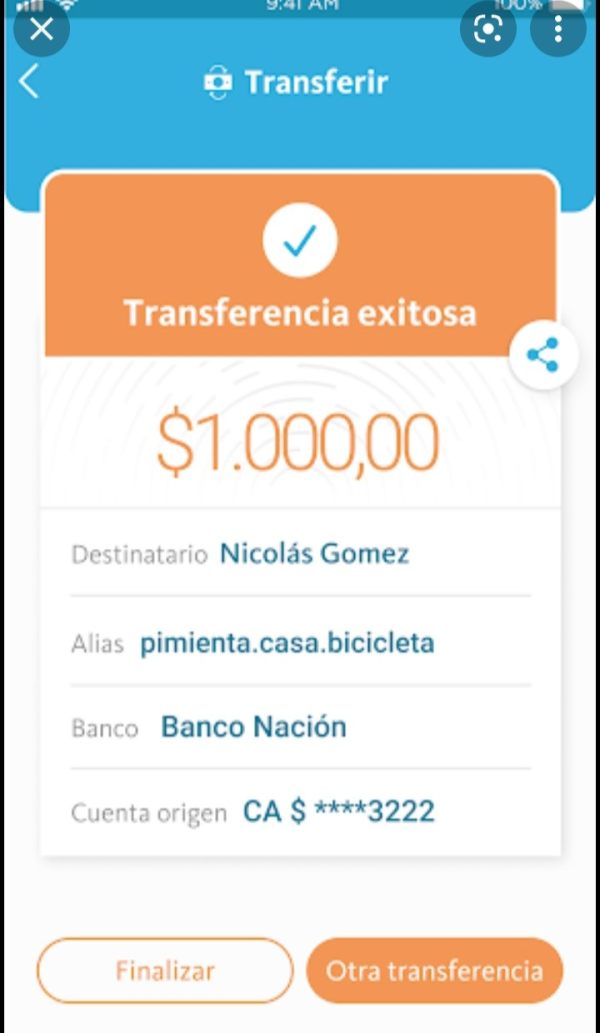

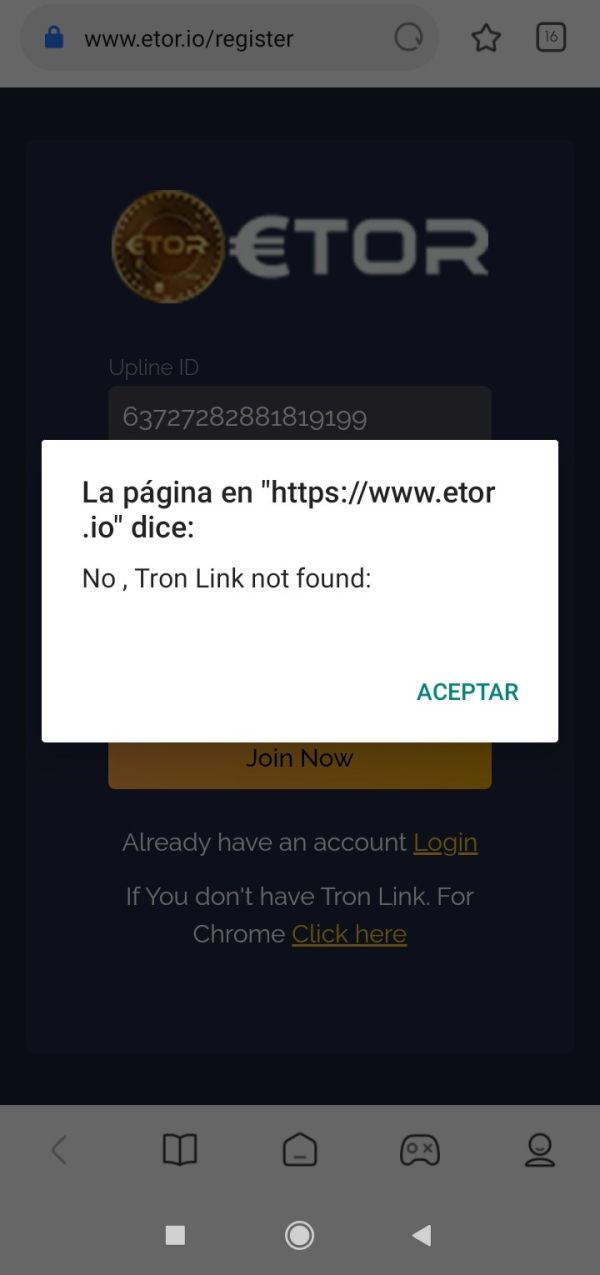

Please help me to get back my $ 1000 that I invested there. They are not allowing me to access my account and the withdrawal

Etor Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Please help me to get back my $ 1000 that I invested there. They are not allowing me to access my account and the withdrawal

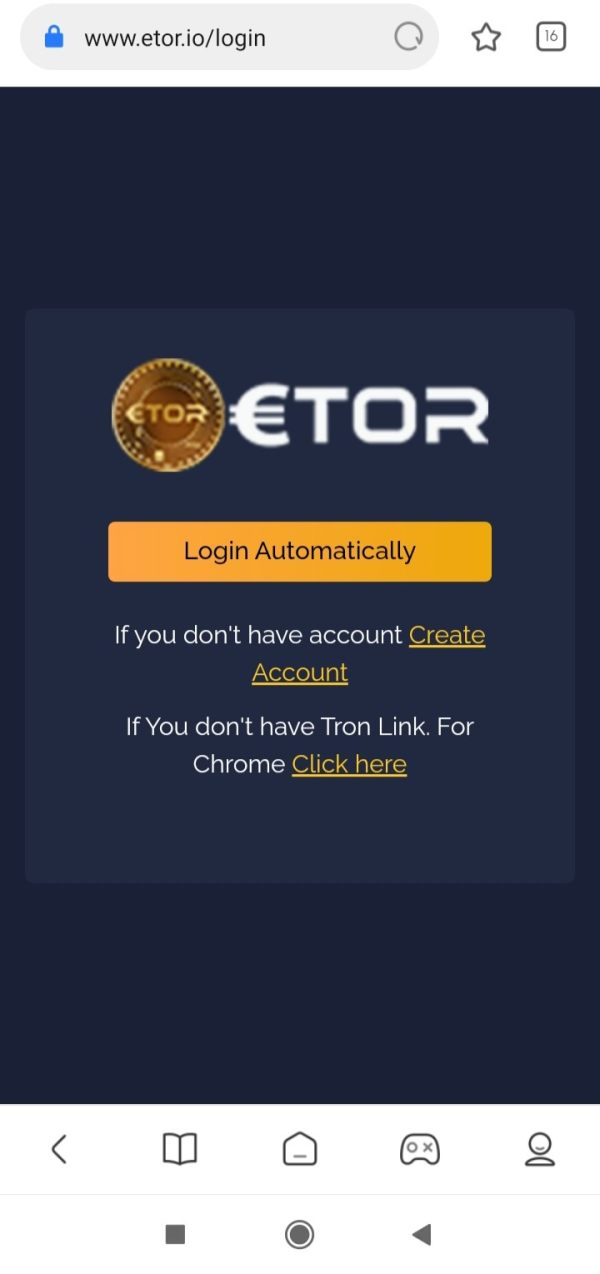

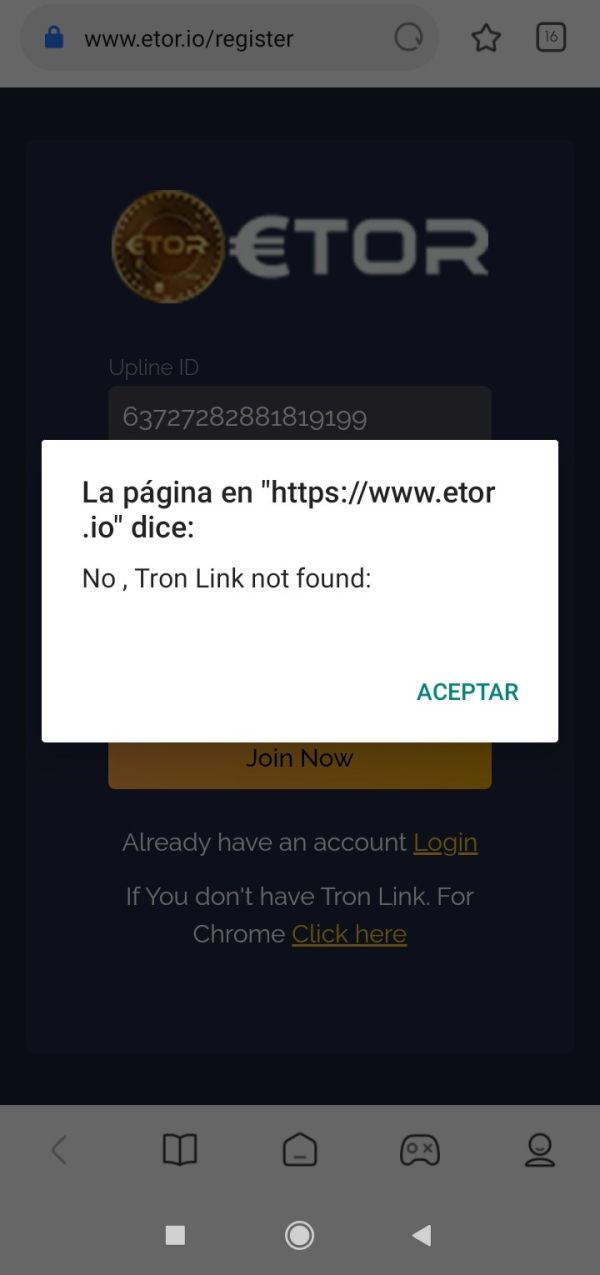

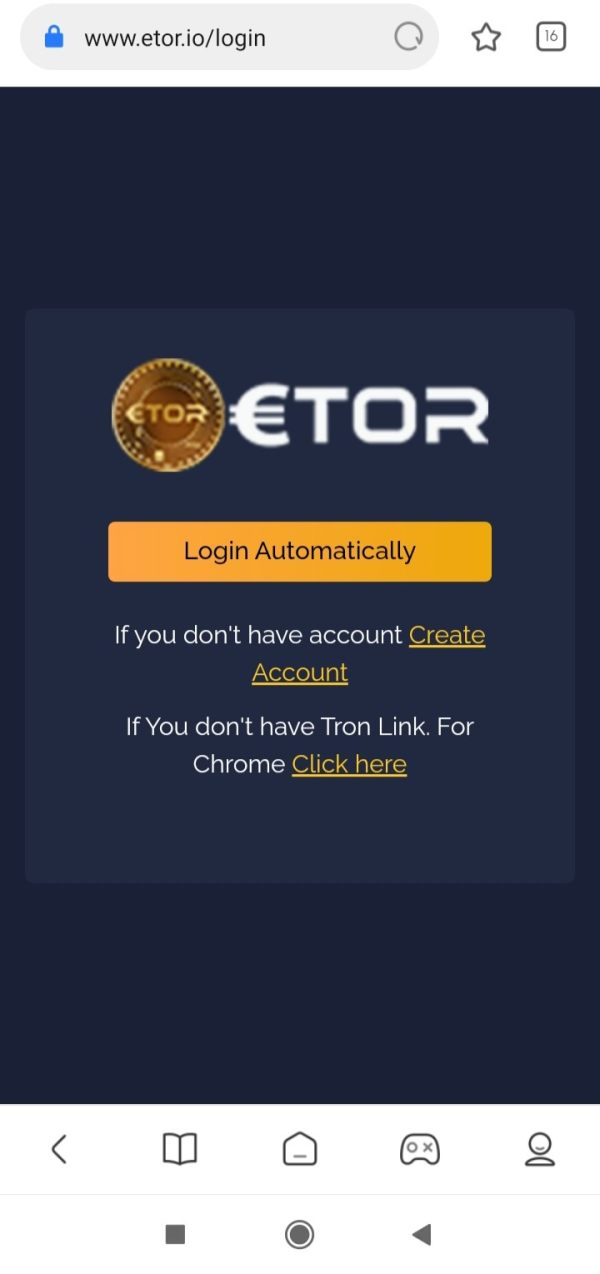

This comprehensive Etor review examines one of the most popular online forex brokers that has gained significant traction in the trading community. Etor stands out as a multi-asset online brokerage and social trading network. The platform enables users to seamlessly buy and sell leading cryptocurrencies while copying the trades of experienced traders on the platform. The broker's innovative social trading functionality allows users to replicate successful trading strategies. This makes it particularly attractive for those seeking to learn from experienced market participants.

Key highlights of Etor include its relatively low minimum deposit requirement of $100, which comes with a $10 bonus for new users. The platform also provides a comprehensive multi-asset trading environment. According to available user feedback, the platform maintains a solid reputation with generally positive reviews. Users particularly praise its social trading features and user-friendly interface. The broker caters primarily to beginners and intermediate traders who are interested in leveraging social trading to enhance their market experience. These traders can potentially improve their trading outcomes through community-driven strategies.

Regional Entity Differences: Users should be aware that Etor's regulatory framework and trading conditions may vary significantly across different geographical regions. Specific regulatory information was not detailed in available sources. This means traders should verify their local regulatory status before opening accounts.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, company background information, trading conditions, and publicly available data. Our assessment focuses on factual information and user experiences rather than promotional claims. This approach ensures an objective perspective on the broker's services and capabilities.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | 7/10 | Based on $100 minimum deposit requirement and $5 flat withdrawal fee structure |

| Tools and Resources | 8/10 | Strong multi-asset offering and innovative social trading functionality |

| Customer Service | 6/10 | Limited detailed feedback available regarding service quality and response times |

| Trading Experience | 7/10 | Positive user feedback on platform stability and social trading features |

| Trust and Regulation | 5/10 | Regulatory information not comprehensively detailed in available sources |

| User Experience | 8/10 | Generally positive user feedback and intuitive platform design |

Company Background and Establishment

Etor has established itself as a market-leading multi-asset online brokerage that focuses heavily on social trading innovation. The company has built its reputation around enabling traders to not only execute their own trades but also learn from and copy the strategies of successful traders within the platform's community. This approach has positioned Etor as a pioneering force in democratizing trading knowledge. The platform makes market participation more accessible to retail investors.

The broker's business model centers on creating a social trading ecosystem where experienced traders can share their strategies. Newcomers can benefit from this collective wisdom. This community-driven approach has attracted a diverse user base ranging from complete beginners to seasoned traders looking to share their expertise or discover new trading strategies.

Platform and Asset Offerings

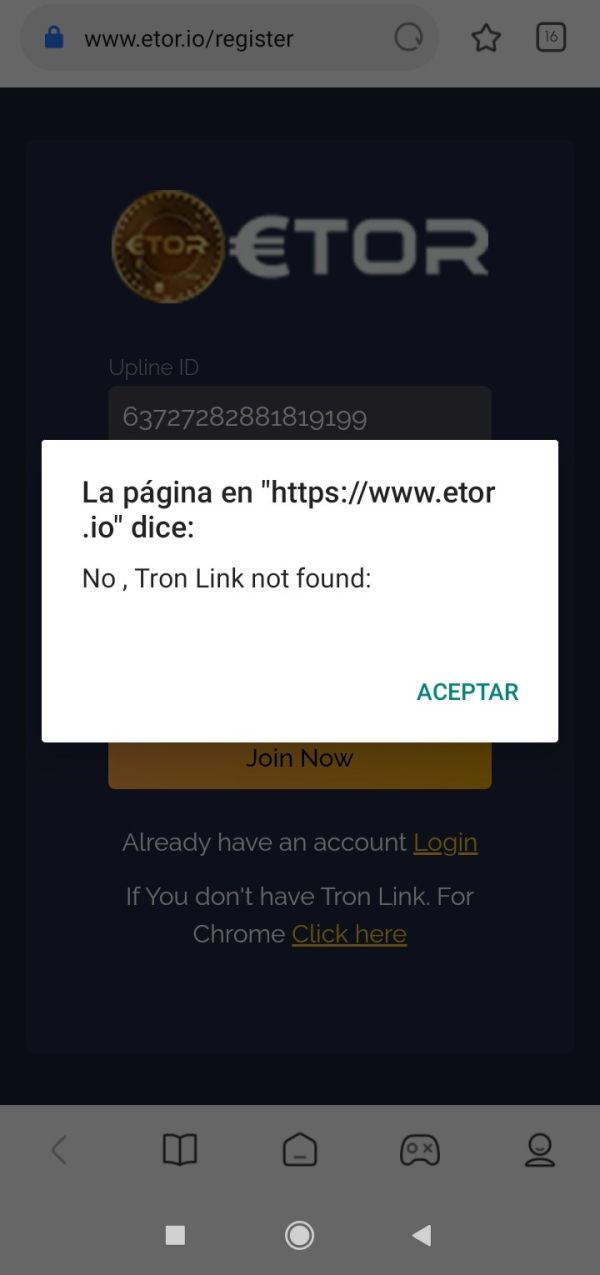

Etor operates through its proprietary trading platform that integrates social trading features with traditional brokerage services. The platform supports multiple asset classes, with particular strength in cryptocurrency trading alongside traditional financial instruments. Users can access leading cryptocurrencies and various other financial instruments through a unified interface that emphasizes both individual trading and social interaction. The platform's design focuses on making complex trading concepts accessible to users regardless of their experience level. It still provides the sophisticated tools that experienced traders require.

Regulatory Framework: Specific regulatory information was not comprehensively detailed in available sources. This represents a significant consideration for potential users who prioritize regulatory oversight in their broker selection process.

Deposit and Withdrawal Methods: While specific payment methods were not detailed in available sources, the broker maintains a clear fee structure for withdrawals with a flat $5 charge per transaction.

Minimum Deposit Requirements: Etor requires a minimum deposit of $100, positioning it as accessible to retail traders. New users can benefit from a $10 bonus when meeting this minimum deposit requirement.

Promotional Offerings: The platform offers a limited-time bonus of $10 for users who deposit at least $100. This provides additional value for new account holders.

Available Trading Assets: The broker provides access to multiple asset classes, with particular emphasis on cryptocurrency trading and other financial instruments. Specific asset counts were not detailed in available sources.

Cost Structure: Etor implements a straightforward fee structure with a flat $5 withdrawal fee regardless of the payment processor, withdrawal amount, or geographical location. This provides predictability for users planning their trading costs.

Leverage Options: Specific leverage information was not detailed in available sources. Users need to verify these details directly with the broker.

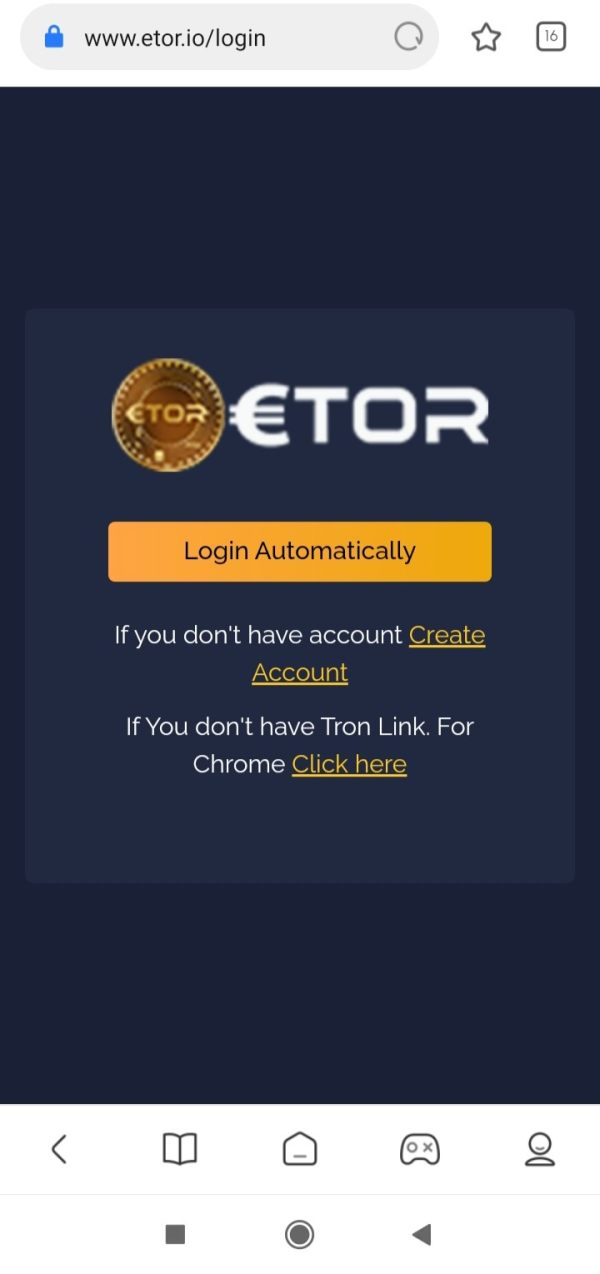

Platform Technology: The broker utilizes its proprietary platform technology that integrates social trading features with traditional trading functionality.

This Etor review highlights that while the broker offers innovative features, some technical specifications require direct verification with the company.

Etor's account conditions reflect a broker designed to accommodate retail traders with varying experience levels. The $100 minimum deposit requirement positions the platform as accessible to newcomers while still maintaining a threshold that indicates serious trading intent. This balance helps create a user base that is both diverse and committed to learning about trading.

The account opening process appears streamlined based on user feedback. Specific details about account types and their respective features were not comprehensively detailed in available sources. The platform's approach to account management seems to prioritize simplicity and accessibility, which aligns with its social trading focus where users benefit from community interaction rather than complex account tier structures.

The $10 bonus for new deposits provides additional value. Users should understand that such bonuses typically come with specific terms and conditions. The straightforward fee structure, particularly the flat $5 withdrawal fee, provides transparency that many traders appreciate when planning their trading costs. This Etor review notes that the account conditions generally favor retail traders seeking straightforward access to markets with social trading benefits.

The broker's tools and resources center around its innovative social trading platform. This represents a significant technological achievement in making trading knowledge more accessible. The social trading functionality allows users to observe, learn from, and copy the trades of successful traders, effectively democratizing access to trading expertise that was previously available only to institutional investors or wealthy individuals.

The multi-asset trading environment provides users with diverse investment opportunities. Specific details about research tools, market analysis resources, and educational materials were not comprehensively detailed in available sources. The platform's design appears to prioritize user interaction and community learning over traditional research tools, which represents a different approach from conventional brokers.

Users particularly appreciate the social trading features, which serve as both educational tools and potential profit-generation mechanisms. The platform's ability to seamlessly integrate social features with actual trading execution represents a technological sophistication that sets it apart from traditional brokers. However, traders seeking comprehensive fundamental analysis tools or advanced technical indicators may need to verify the availability of such resources directly with the broker.

Customer service information was not comprehensively detailed in available sources. This limits the ability to provide a thorough assessment of support quality and availability. This represents a significant gap in publicly available information about the broker's service capabilities.

The lack of detailed information about customer service channels, response times, and service quality suggests that potential users should directly verify these aspects before committing to the platform. Effective customer service is particularly important for social trading platforms where users may need assistance with both technical issues and understanding how to effectively utilize social trading features.

Multi-language support capabilities and service availability hours were not specified in available sources. This could be important considerations for international users. The absence of detailed customer service information in this Etor review reflects the need for users to conduct their own verification of support quality and availability before opening accounts.

User feedback suggests generally positive experiences with the platform's trading functionality. Users particularly praise the social trading features that distinguish Etor from traditional brokers. The platform appears to maintain good stability and provides users with intuitive access to both individual trading and social trading features.

The integration of social elements with trading execution appears seamless based on user reports. This allows traders to monitor and copy others' strategies without significant technical complications. This represents a sophisticated technological achievement that enhances the overall trading experience for users interested in community-driven trading approaches.

Platform speed and order execution quality were not specifically detailed in available sources. The generally positive user feedback suggests adequate performance in these areas. Mobile trading experience and advanced order types availability would require direct verification with the broker. This Etor review indicates that while the trading experience appears positive overall, users with specific technical requirements should verify platform capabilities directly.

The regulatory framework represents a significant area where detailed information was not comprehensively available in sources reviewed. This absence of clear regulatory information impacts the trust assessment, as regulatory oversight provides important protections for traders' funds and ensures adherence to industry standards.

Fund safety measures, segregation of client funds, and specific regulatory compliance details were not detailed in available sources. These represent crucial considerations for traders when selecting a broker, particularly given the importance of regulatory protection in the online trading industry.

The broker's market reputation appears generally positive based on user feedback. This suggests operational reliability even in the absence of detailed regulatory information. However, the lack of specific regulatory details means that users must conduct their own verification of the broker's regulatory status in their jurisdiction. Company transparency regarding regulatory compliance would strengthen the trust profile significantly.

Overall user satisfaction appears strong based on available feedback. Users show particular appreciation for the social trading functionality and platform accessibility. Users consistently highlight the innovative approach to making trading knowledge more accessible through community features.

The platform's interface design appears intuitive and user-friendly. It facilitates both newcomers and experienced traders in navigating the social trading environment. Registration and account verification processes seem streamlined, though specific details about these procedures were not comprehensively available.

Fund operation experiences, particularly regarding the $5 flat withdrawal fee, appear to meet user expectations for transparency and predictability. The user base appears well-suited to the platform's social trading focus, creating a community environment that enhances the overall experience. Users particularly value the ability to learn from successful traders while maintaining control over their own trading decisions.

Etor emerges as an innovative online brokerage that has successfully differentiated itself through its social trading platform and community-focused approach. The broker appears well-suited for beginners and intermediate traders who value learning from experienced market participants while maintaining accessible account conditions and straightforward fee structures.

The platform's strengths lie in its social trading innovation, reasonable minimum deposit requirements, and generally positive user experience. However, the absence of detailed regulatory information and comprehensive customer service details represents areas where potential users should conduct additional verification. Overall, Etor presents a compelling option for traders interested in community-driven trading approaches. Traditional traders seeking conventional research tools and detailed regulatory transparency may need to evaluate whether the platform meets their specific requirements.

FX Broker Capital Trading Markets Review