Easytrade 2025 Review: Everything You Need to Know

Executive Summary

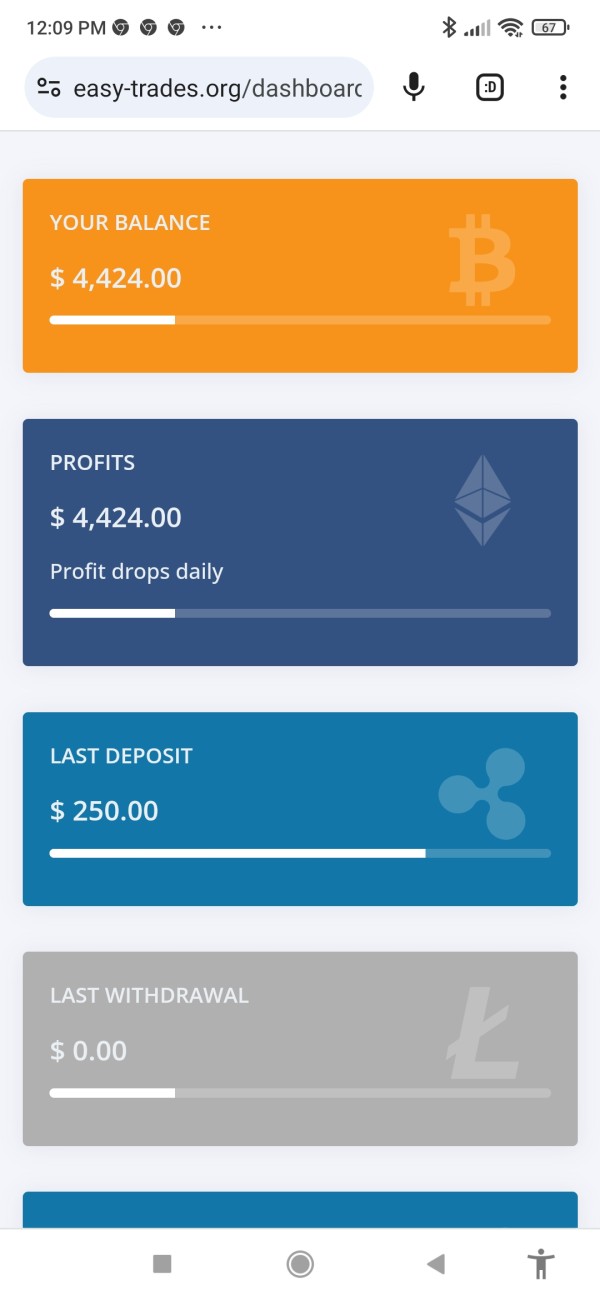

This Easytrade review reveals significant concerns about the platform's legitimacy and operational standards. Our comprehensive analysis of user feedback and available information shows major problems with this trading platform. Easytrade appears to be an unregulated trading platform that has attracted numerous negative reviews across multiple review platforms. The platform claims to offer trading in various asset classes including forex, stocks, cryptocurrencies, and commodities. However, the overwhelming user sentiment suggests serious issues with platform reliability and customer service.

The platform's lack of regulatory oversight is particularly concerning for potential traders seeking a secure trading environment. User reviews on Trustpilot and other platforms consistently highlight problems with platform stability, customer support responsiveness, and overall trading experience. Despite offering features like the TD Easy Trade app with 50 commission-free stock trades, the negative feedback significantly outweighs any potential benefits. The evidence suggests traders should look elsewhere for their trading needs.

Given the substantial red flags and negative user experiences, this review concludes with a strong recommendation for traders to exercise extreme caution and consider regulated alternatives for their trading activities.

Important Notice

This review is based on available user feedback and publicly accessible information about Easytrade. Due to the lack of specific regulatory information mentioned in available sources, user experiences may vary significantly across different regions. The platform's operational standards and service quality appear inconsistent based on user reports.

Our evaluation methodology incorporates user feedback from multiple review platforms, available platform information, and industry standard assessment criteria. We examine multiple sources to provide accurate information. Traders should conduct their own due diligence and consider regulatory status when selecting a trading platform.

Rating Framework

Broker Overview

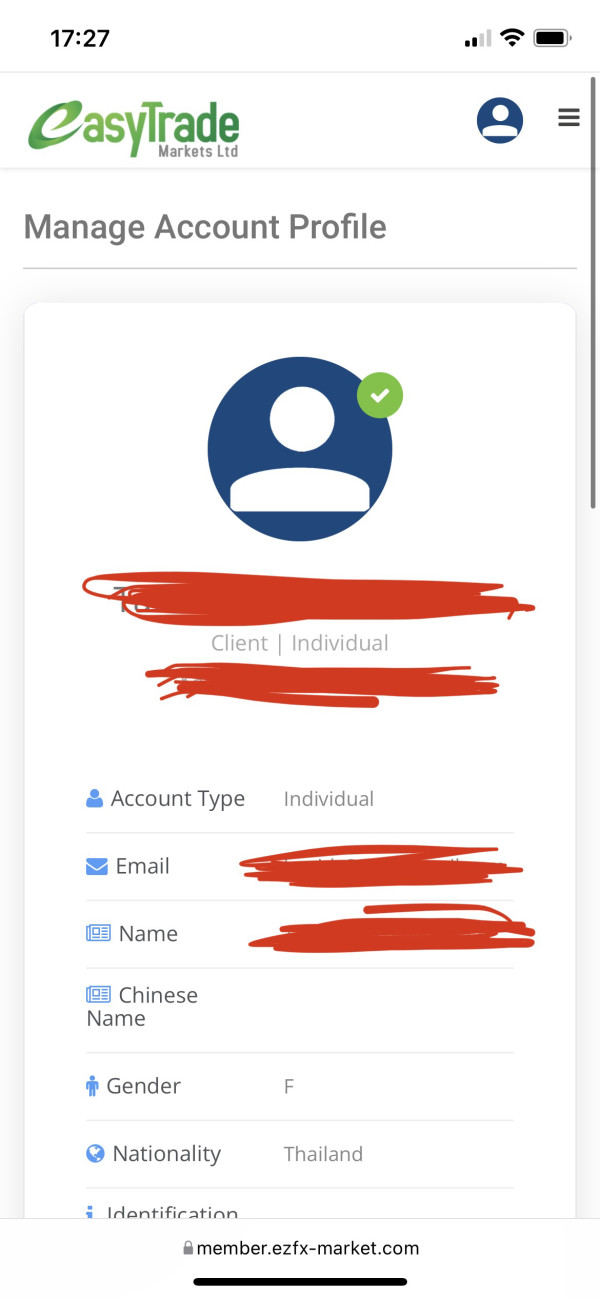

Easytrade.io presents itself as a multi-asset trading platform offering access to forex, company stocks, cryptocurrencies, and commodities. However, the platform's background information remains largely opaque, with limited transparency regarding its founding date, corporate structure, or operational history. The platform appears to target traders seeking diversified investment opportunities across multiple asset classes. Unfortunately, concerning user feedback suggests significant operational deficiencies that make this platform problematic for serious traders.

The platform's business model centers around providing multi-asset trading capabilities through its proprietary platform. However, the lack of clear regulatory oversight and numerous user complaints about platform reliability raise serious questions about the sustainability and legitimacy of this business approach. The platform's marketing emphasizes accessibility and variety in trading options. User experiences suggest a significant gap between promises and delivery that should concern potential customers.

According to available information, Easytrade operates through its web-based platform, offering trading in forex pairs, individual company stocks, various cryptocurrencies, and commodity markets. The platform lacks clear information about regulatory authorization, which is a critical concern for traders seeking secure and compliant trading environments. This Easytrade review emphasizes the importance of regulatory compliance in broker selection.

Regulatory Status: Available information does not specify any regulatory authorities overseeing Easytrade's operations, which represents a significant red flag for potential users seeking regulated trading environments.

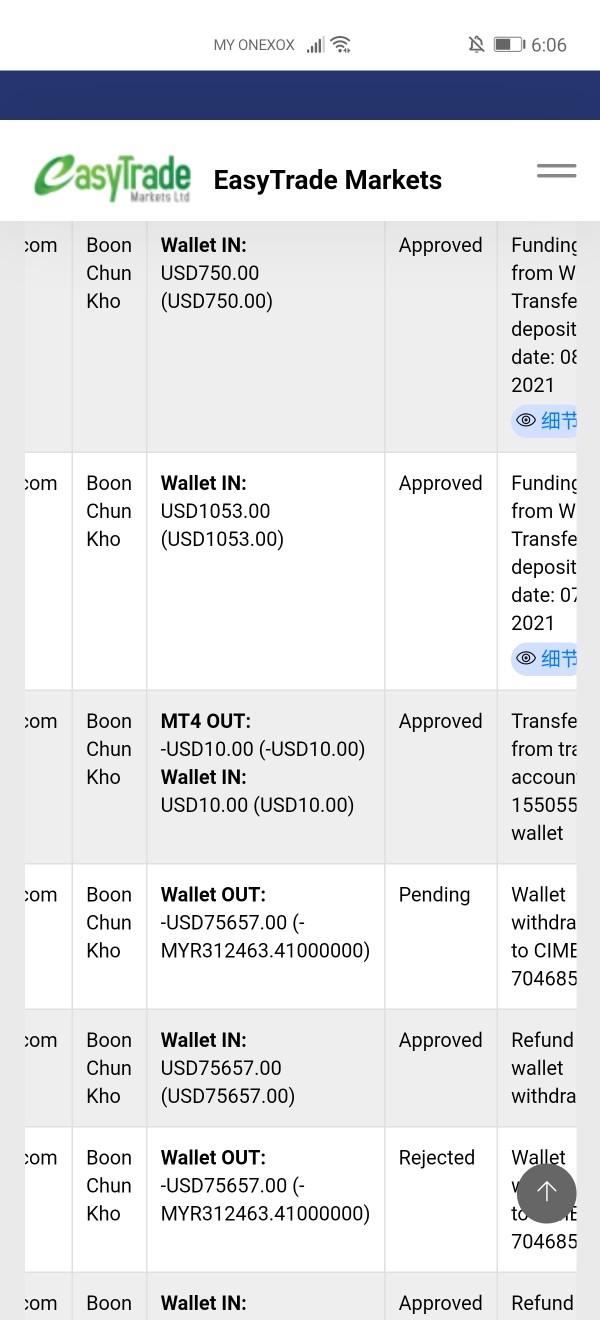

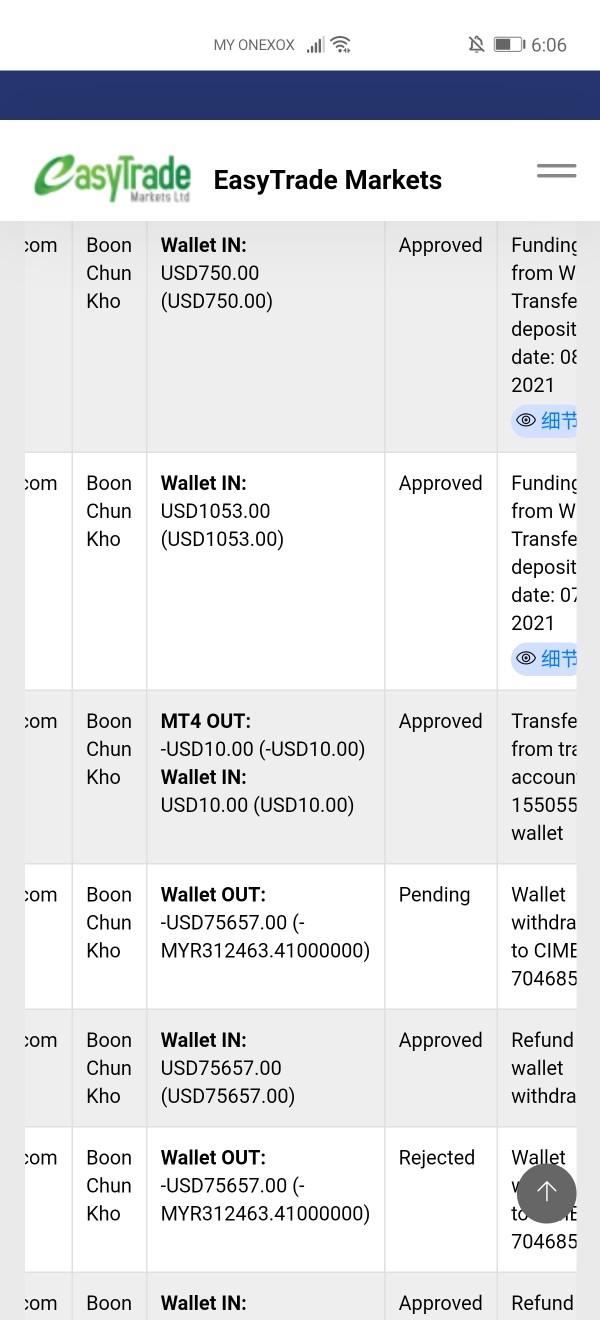

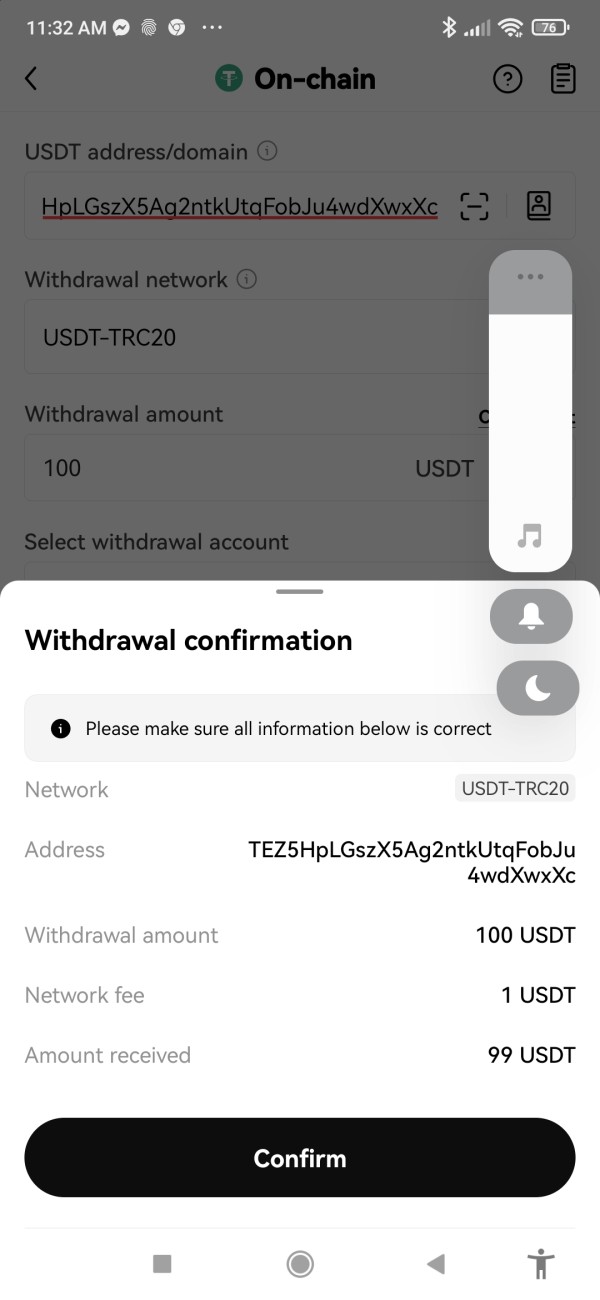

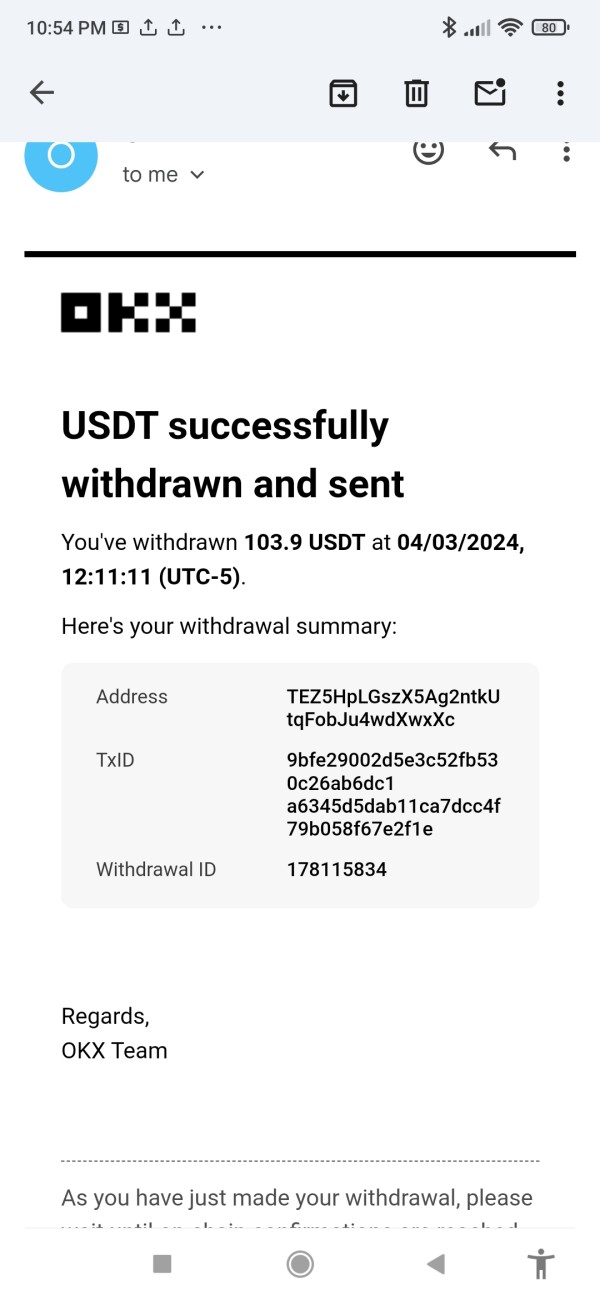

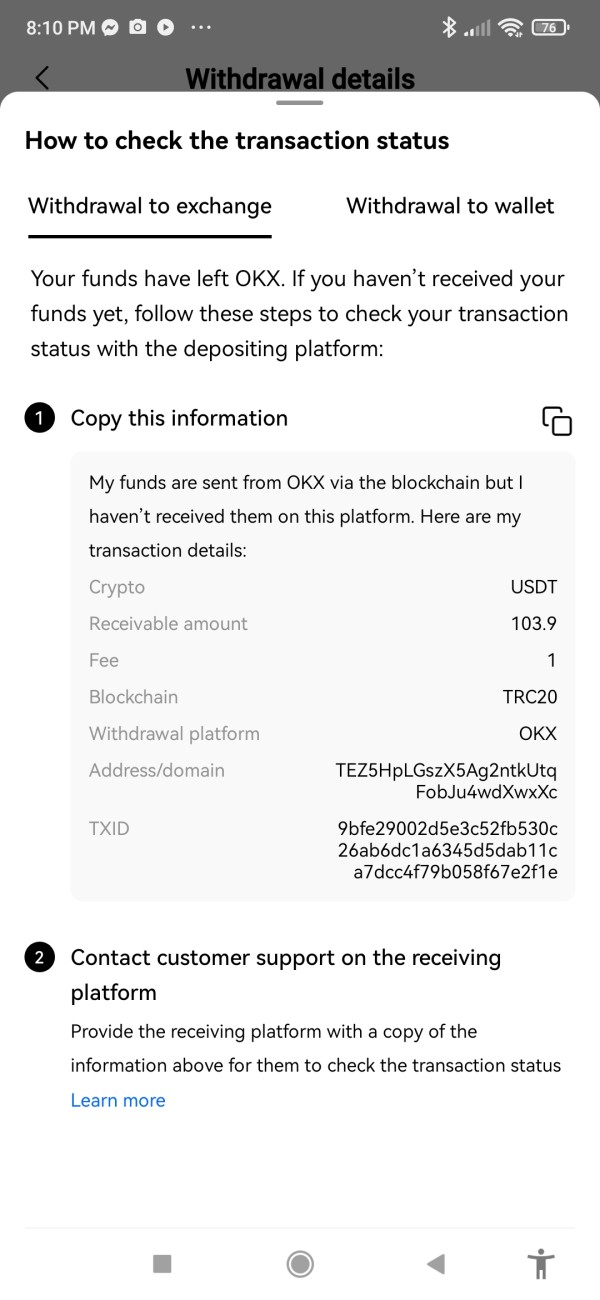

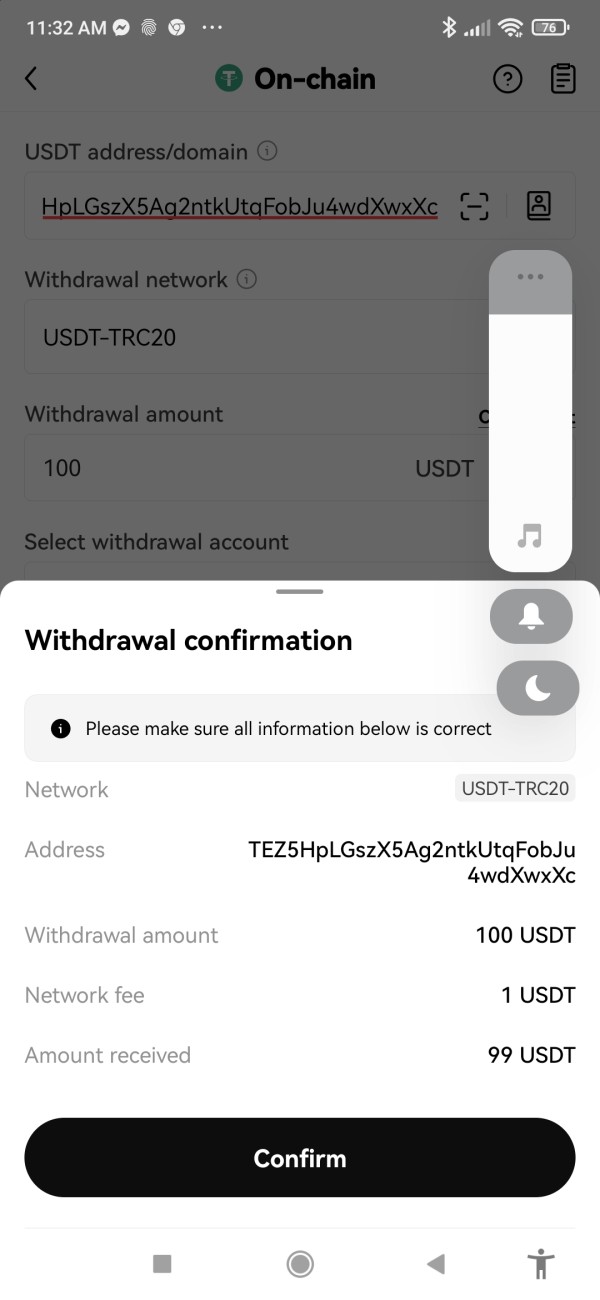

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources.

Minimum Deposit Requirements: The platform's minimum deposit requirements are not clearly specified in available documentation.

Bonuses and Promotions: Information about promotional offers, welcome bonuses, or ongoing incentives is not mentioned in available sources.

Tradeable Assets: The platform offers trading in forex currency pairs, company stocks, cryptocurrencies, and commodities, providing a diverse range of investment opportunities.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available sources, limiting transparency for potential users.

Leverage Options: Information about maximum leverage ratios and margin requirements is not specified in available documentation.

Platform Options: The platform appears to operate through proprietary web-based trading software, though specific technical details are not provided.

Geographic Restrictions: Information about regional limitations or restricted countries is not specified in available sources.

Customer Support Languages: Details about multilingual support options are not mentioned in available documentation.

This Easytrade review highlights the concerning lack of transparency in these fundamental areas, which are typically clearly disclosed by reputable brokers.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Easytrade lack the transparency and clarity expected from professional trading platforms. Available information does not specify different account types, their respective features, or the benefits associated with various account tiers. This opacity makes it difficult for potential traders to understand what they can expect from their trading relationship with the platform.

The absence of clear information about minimum deposit requirements, account maintenance fees, or special features like Islamic accounts suggests either poor communication practices or deliberately obscured terms. User feedback indicates dissatisfaction with account-related policies and procedures. However, specific details about account conditions are rarely mentioned in available reviews, which itself is concerning.

Compared to regulated brokers that typically offer detailed account specifications, fee schedules, and clear terms of service, Easytrade's lack of transparency in this area represents a significant deficiency. Professional traders typically expect comprehensive information about account types, funding requirements, and associated benefits before committing to a platform.

The platform's failure to provide clear account condition information in this Easytrade review analysis suggests either inadequate customer communication or intentional obfuscation of important terms and conditions.

While Easytrade claims to offer various trading tools and platform features, specific details about analytical resources, research capabilities, or educational materials are not well documented in available sources. The platform's tool offerings appear limited compared to industry standards. User feedback suggests inadequate analytical capabilities for serious trading activities, which limits the platform's usefulness for professional traders.

The absence of detailed information about charting tools, technical indicators, market analysis resources, or automated trading support indicates either limited platform capabilities or poor marketing communication. Professional traders typically require comprehensive analytical tools, real-time market data, and educational resources to make informed trading decisions.

User feedback suggests that the platform's tools and resources do not meet professional trading standards, with complaints about limited functionality and inadequate analytical capabilities. The lack of educational resources is particularly concerning for newer traders who require guidance and learning materials to develop their trading skills.

Educational content, market analysis, and research resources are standard offerings from reputable brokers, and their absence or inadequacy at Easytrade represents a significant limitation for traders seeking comprehensive trading support.

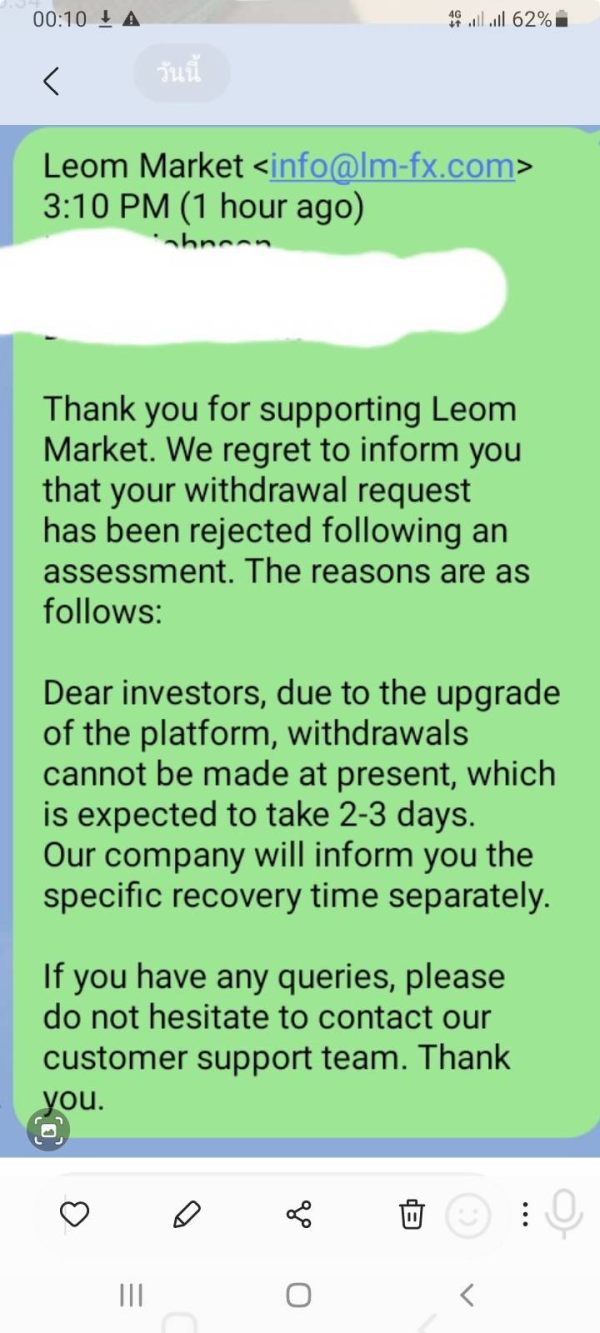

Customer Service and Support Analysis (4/10)

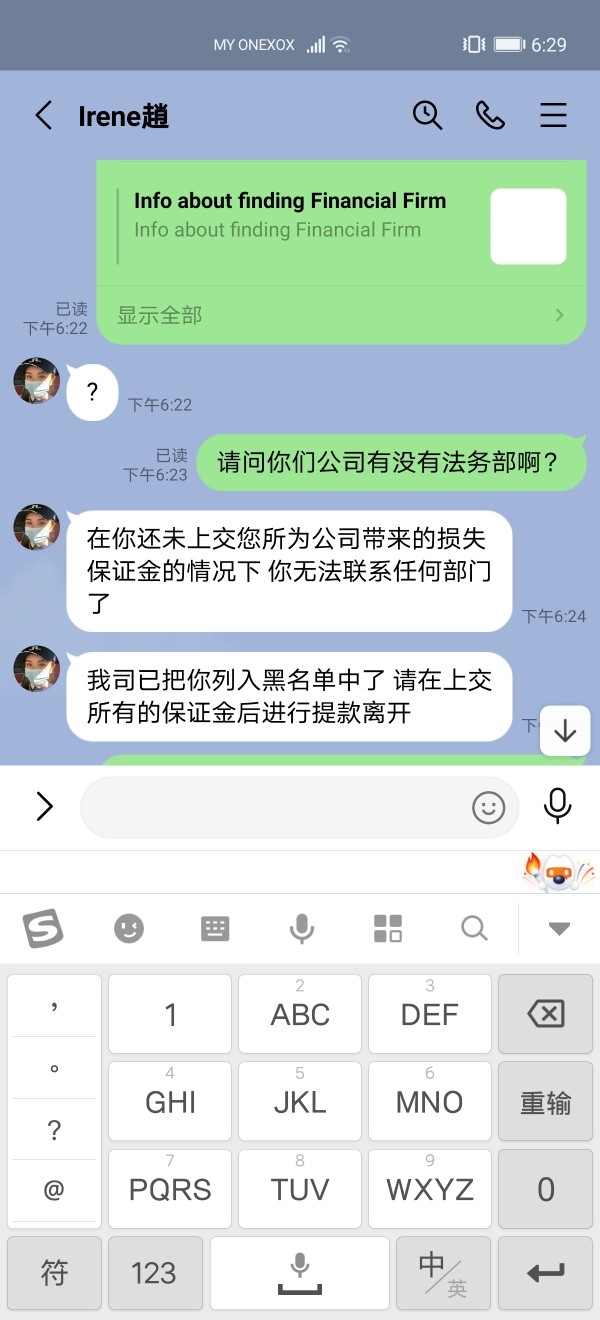

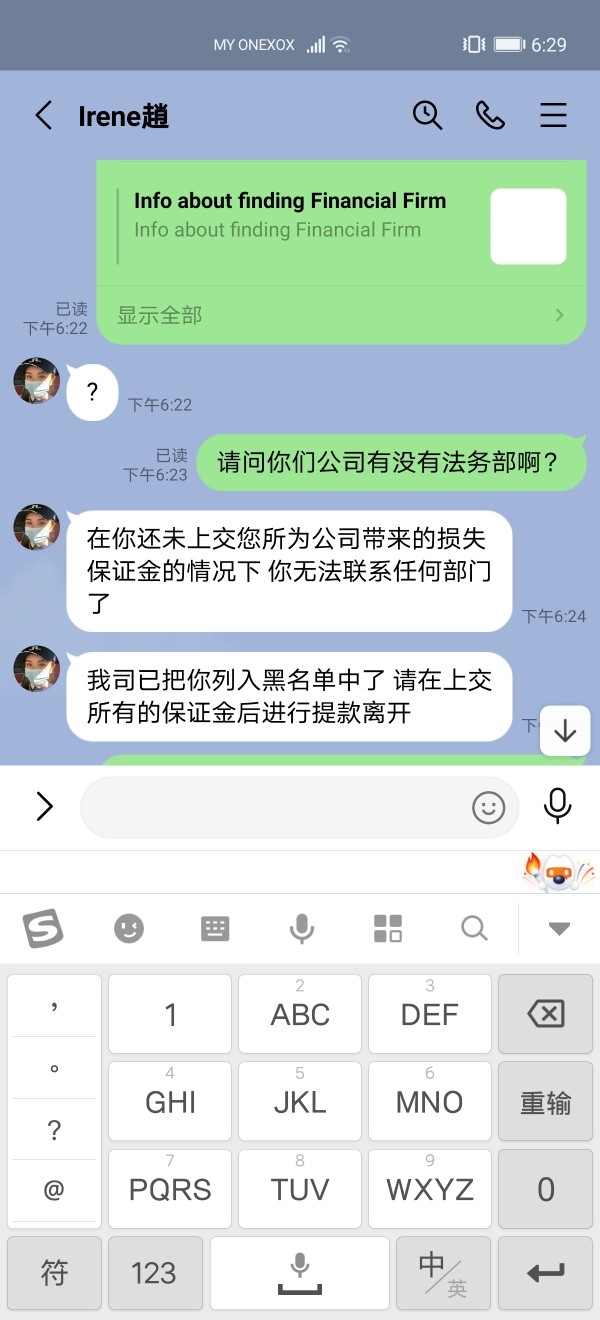

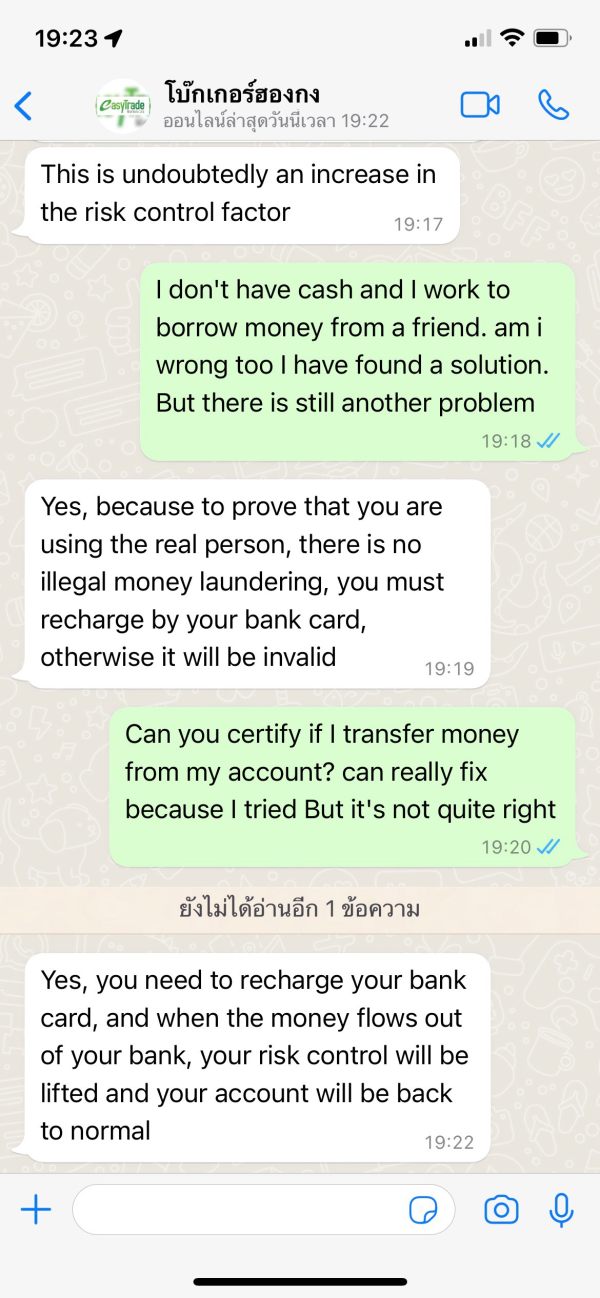

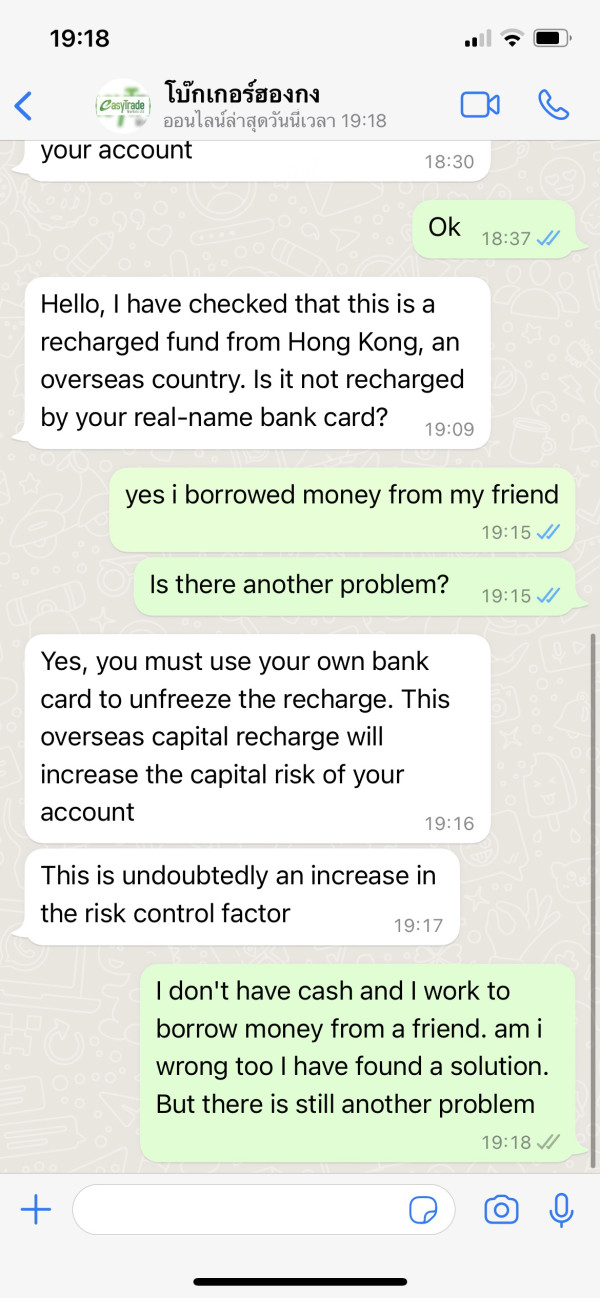

Customer service quality emerges as a significant concern in user feedback about Easytrade. Reviews on Trustpilot and other platforms consistently highlight problems with customer support responsiveness, professionalism, and problem-resolution capabilities. Users report difficulty reaching support representatives and inadequate responses to trading-related inquiries.

The platform's customer service channels, availability hours, and response time commitments are not clearly specified in available information. This lack of transparency about support services compounds user frustration when issues arise. Professional trading platforms typically provide multiple support channels, clearly defined response times, and comprehensive help resources.

User complaints frequently mention slow response times, unhelpful responses, and difficulty resolving account or trading issues. The absence of live chat, phone support details, or comprehensive FAQ sections suggests limited commitment to customer service excellence. These service deficiencies significantly impact the overall trading experience and user satisfaction.

Effective customer support is crucial for trading platforms, especially when users encounter technical issues, account problems, or need trading assistance. The consistently negative feedback about Easytrade's customer service represents a major operational weakness that affects user confidence and platform reliability.

Trading Experience Analysis (3/10)

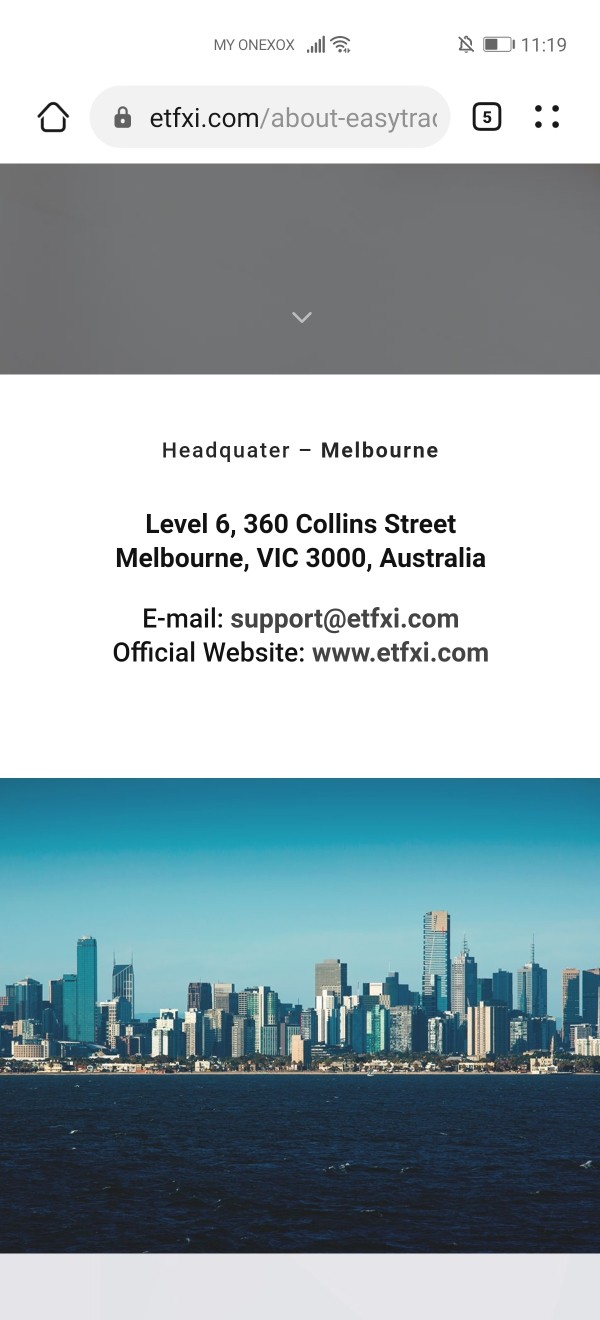

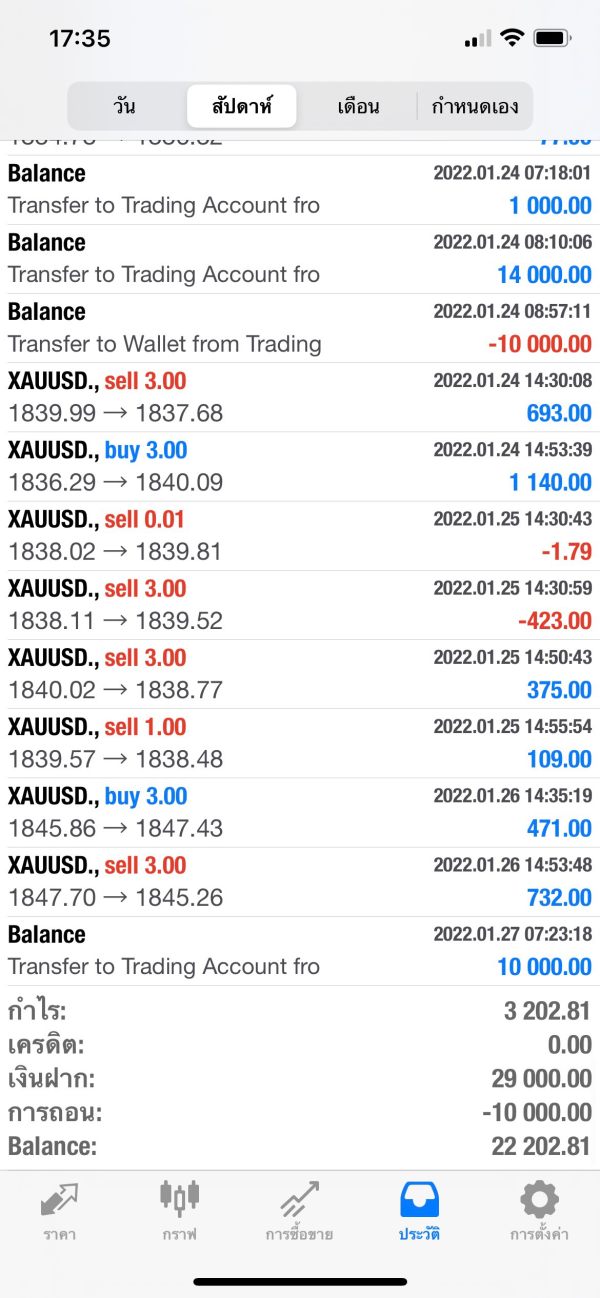

User feedback about the trading experience on Easytrade reveals significant concerns about platform stability, execution quality, and overall functionality. Reports suggest frequent technical issues, platform downtime, and problems with order execution that seriously impact trading effectiveness.

Traders have reported issues with slippage, requotes, and delayed order execution, which are critical problems that can significantly affect trading profitability. Platform stability issues, including connectivity problems and system crashes, create additional challenges for users attempting to execute time-sensitive trades.

The trading environment appears to suffer from inconsistent spreads and poor execution speeds, which are fundamental requirements for effective trading. Mobile trading experience, if available, does not appear to meet modern standards based on user feedback about platform limitations and technical problems.

Professional traders require reliable platform performance, fast execution speeds, and stable connectivity to implement their trading strategies effectively. The numerous reports of technical issues and poor execution quality in this Easytrade review suggest that the platform fails to meet these basic requirements for professional trading activities.

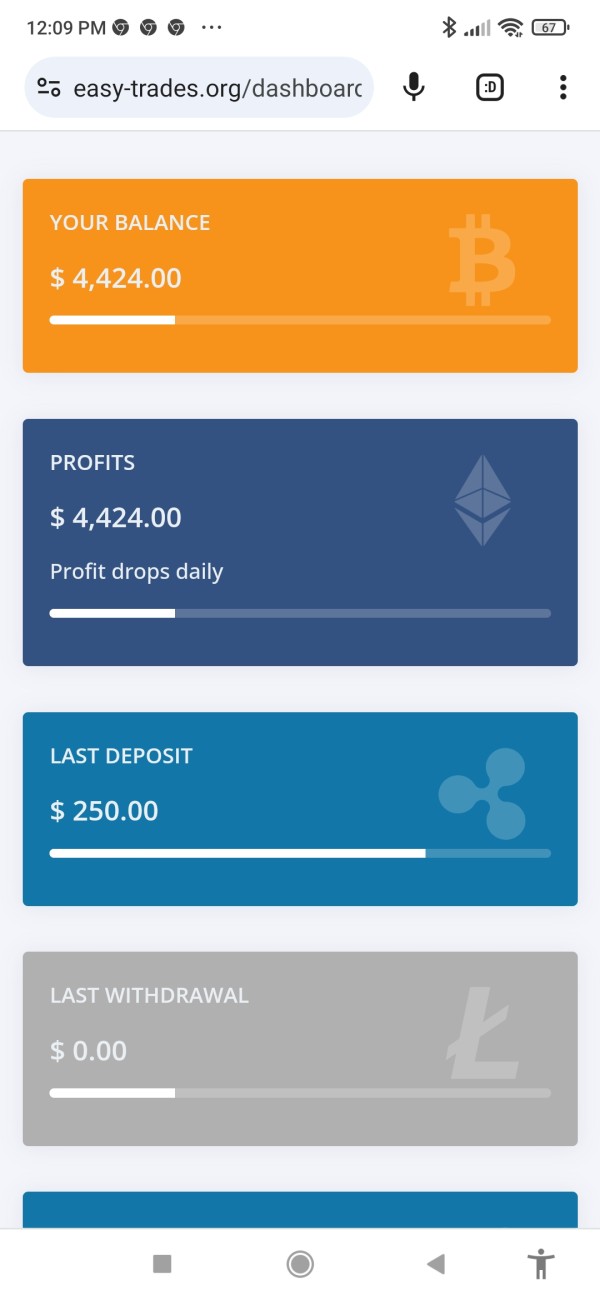

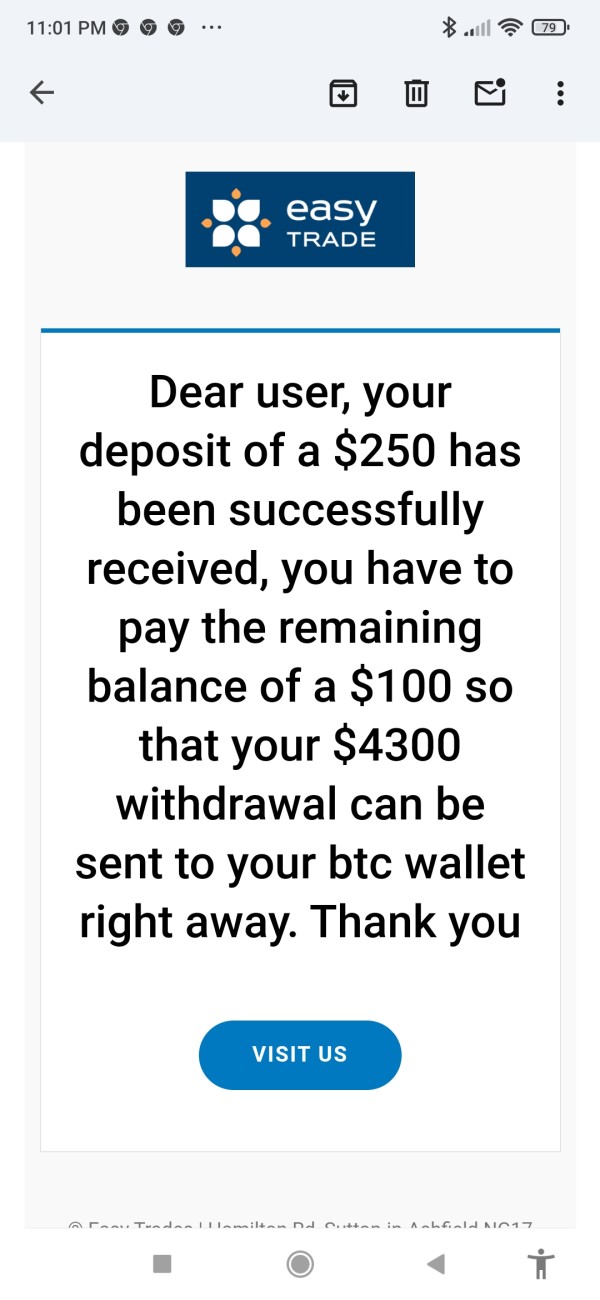

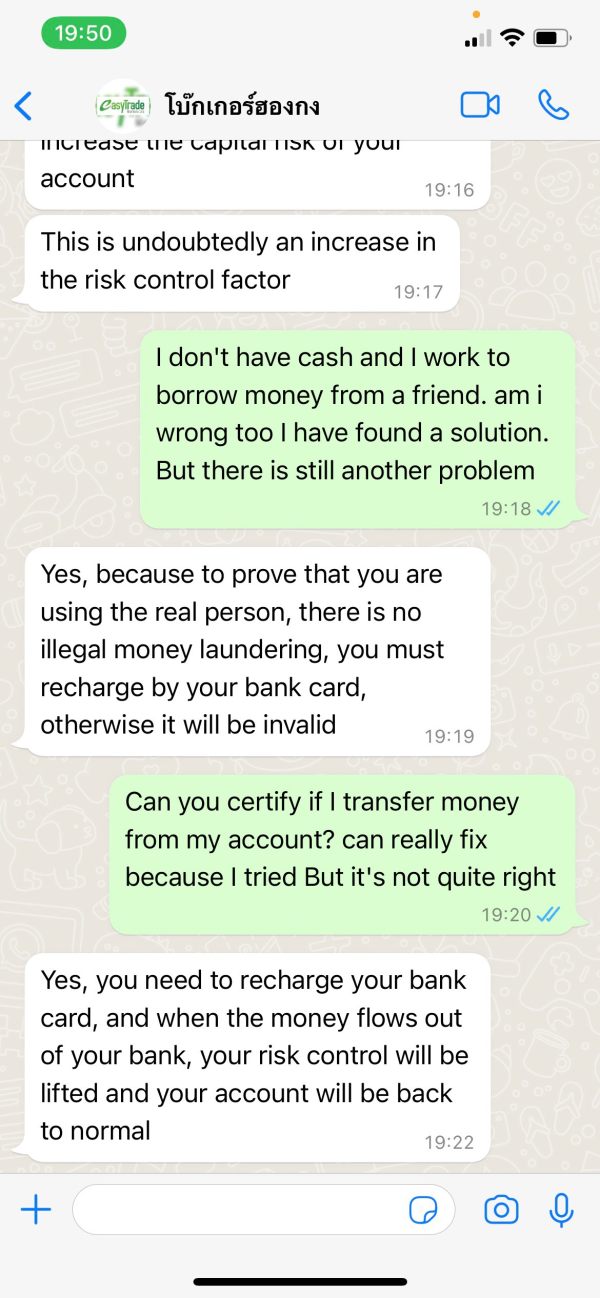

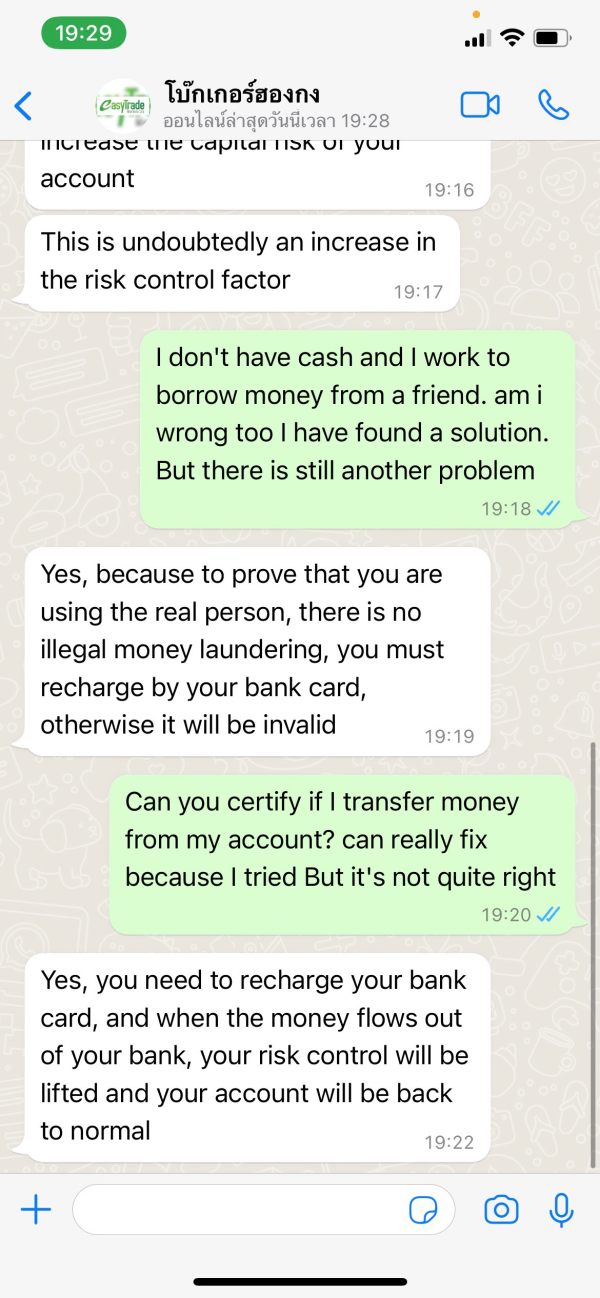

Trust and Reliability Analysis (2/10)

Trust and reliability represent the most concerning aspects of Easytrade's operations. The platform's lack of regulatory oversight creates fundamental questions about user fund safety, operational compliance, and legal protections for traders. Regulated brokers typically provide clear information about their licensing, regulatory compliance, and fund protection measures.

The absence of regulatory information, combined with widespread negative user feedback, suggests significant reliability concerns. Professional traders typically prioritize regulatory compliance and fund safety when selecting trading platforms. This makes the lack of oversight a critical deficiency that should concern any potential user.

User reviews across multiple platforms consistently express concerns about platform legitimacy and operational practices. The prevalence of negative feedback and warnings about potential scam activity seriously undermines user confidence and platform credibility.

Third-party review platforms show predominantly negative sentiment toward Easytrade, with users advising others to avoid the platform. This pattern of negative feedback from multiple sources indicates systemic issues with platform operations and user satisfaction that extend beyond isolated incidents.

User Experience Analysis (3/10)

Overall user satisfaction with Easytrade appears significantly below industry standards based on available feedback from multiple review platforms. Users consistently report frustration with platform functionality, customer service quality, and overall trading experience. These reports indicate systemic issues with user experience design and implementation that affect the platform's basic usability.

The platform's interface design and usability are not well documented, but user complaints suggest navigation difficulties and poor user interface design. Registration and account verification processes appear problematic based on user feedback about delays and complications in account setup procedures.

Common user complaints focus on platform instability, poor customer service, and difficulties with basic platform functions. These issues suggest fundamental problems with platform development and user experience optimization that affect day-to-day trading activities.

New traders and those with limited experience would likely find Easytrade particularly challenging given the reported technical issues and poor support quality. The combination of platform instability and inadequate customer support creates a hostile environment for learning and developing trading skills.

Conclusion

This comprehensive Easytrade review reveals significant concerns about the platform's legitimacy, operational standards, and user experience quality. The lack of regulatory oversight, combined with consistently negative user feedback across multiple review platforms, suggests that Easytrade does not meet the standards expected from professional trading platforms.

The platform is not recommended for any type of trader, particularly beginners who require stable platforms, reliable customer support, and educational resources to develop their trading skills. Experienced traders would likely find the platform's technical limitations and execution issues incompatible with serious trading activities.

While the platform claims to offer multi-asset trading opportunities, the significant drawbacks including lack of regulation, poor user experience, and reliability concerns far outweigh any potential benefits. Traders are strongly advised to consider regulated alternatives that provide transparent operations, reliable customer support, and comprehensive user protections.