VisionQuest 2025 Review: Everything You Need to Know

Executive Summary

This visionquest review gives you a complete look at VisionQuest's financial services in 2025. VisionQuest works as a financial planning and investment management firm that has been around for about 5 to 10 years. The company does great work in customer service and support, and clients are very happy with their personal financial planning services.

VisionQuest's main strengths are its custom approach to financial planning and investment management. The company uses experienced professionals who have the right licenses, including CA Brokers license and Series 65 license. The firm focuses on client-centered service and creates custom solutions instead of using the same approach for everyone. However, this review finds big gaps in transparency about specific trading conditions, regulatory details, and complete fee structures that potential clients should think about.

The main target audience for VisionQuest services includes people who want personal investment advice and complete financial planning services. Customer satisfaction ratings stay high based on available feedback, but the lack of detailed regulatory information and specific trading terms leads to an overall neutral assessment for this financial services provider.

Important Notice

This evaluation uses publicly available information and customer feedback from various sources. Readers should know that specific details about cross-regional entity differences were not clearly outlined in available materials. The assessment method used comprehensive analysis of company background information, client testimonials, and professional credentials verification.

Potential clients should conduct independent verification of regulatory status and specific service terms before working with VisionQuest services. This review reflects information available as of 2025 and may not capture recent developments or changes in service offerings.

Rating Framework

Broker Overview

VisionQuest Investments, LLC was started about 5 to 10 years ago. The company positions itself as a specialized financial planning and investment management firm. According to available information, the company's leadership holds important credentials including California Brokers license and Series 65 license, along with educational background from California Polytechnic State University-San Luis Obispo. The firm's founder maintains active membership in the Executive's Association of San Diego, where multiple board positions have been held over the years.

The company operates under a client-centered business model. It emphasizes personalized financial planning and investment management services tailored to individual client needs. VisionQuest Financial Planning LLC delivers services designed to accommodate client preferences and specific financial objectives. This approach makes the firm different from larger, more standardized financial service providers by focusing on customized solutions and direct client relationships.

However, this visionquest review notes that specific information about trading platform types, available asset classes, and primary regulatory oversight remains unclear in publicly available materials. The company appears to operate through multiple entities, including VisionQuest Wealth Management, LLC, which holds CRD number 135581 and SEC number 801-107528. This suggests proper regulatory registration for investment advisory services.

Regulatory Jurisdictions: Available information shows VisionQuest Wealth Management, LLC operates under SEC registration and holds CRD number 135581. However, specific regulatory jurisdiction details are not fully outlined in source materials.

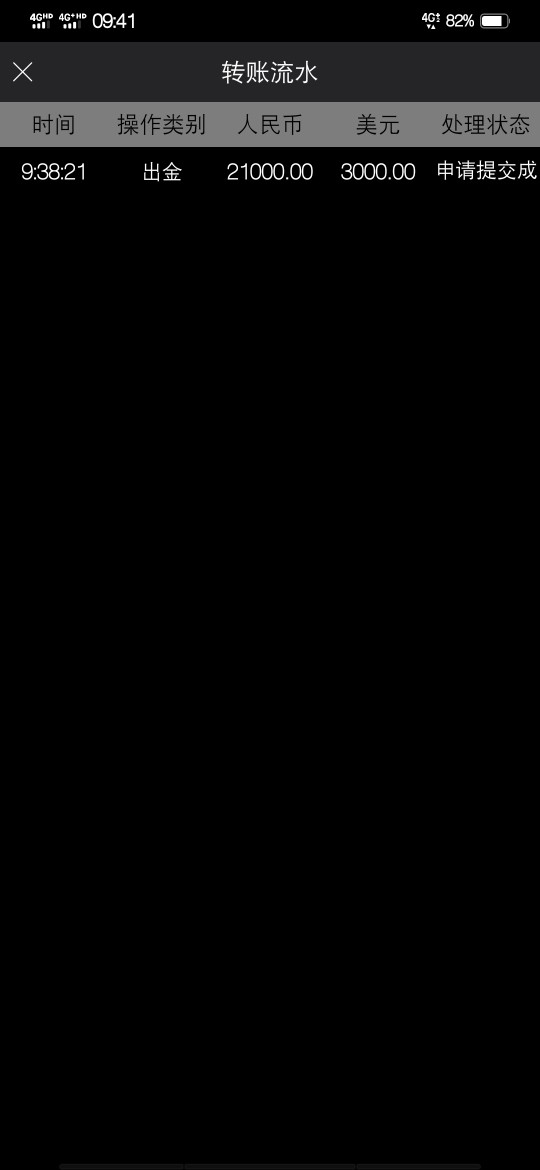

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation. This requires direct client inquiry for clarification.

Minimum Deposit Requirements: Minimum deposit amounts are not specified in publicly available information. This indicates potential customization based on individual client circumstances.

Bonuses and Promotions: No specific bonus or promotional information is mentioned in available sources. This suggests the firm focuses on service quality rather than promotional incentives.

Tradeable Assets: The range of tradeable assets and investment options is not specifically detailed in source materials. However, the firm's investment advisory registration suggests broad investment capabilities.

Cost Structure: Detailed fee structures, including management fees, advisory costs, and transaction expenses, are not clearly outlined in available public information. Prospective clients should request comprehensive fee disclosures directly from the firm.

Leverage Ratios: Specific leverage offerings are not mentioned in available documentation. This requires direct consultation for investment strategy discussions.

Platform Options: Trading platform specifications and technology infrastructure details are not provided in source materials. This represents a significant information gap for this visionquest review.

Regional Restrictions: Geographic service limitations are not clearly specified in available information.

Customer Service Languages: Supported languages for customer service are not detailed in source documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of VisionQuest's account conditions faces big limitations due to insufficient publicly available information. Standard account types, their specific features, and associated requirements are not clearly outlined in accessible documentation. This lack of transparency about account structures represents a notable concern for potential clients seeking to understand service options before engagement.

Minimum deposit requirements remain unspecified. This prevents accurate assessment of accessibility for different investor categories. The account opening process, including required documentation, verification procedures, and timeline expectations, is not detailed in available sources. Additionally, specialized account options such as retirement accounts, joint accounts, or accounts designed for specific investment strategies are not clearly described.

Without comprehensive account condition information, this visionquest review cannot provide definitive guidance on account suitability for different investor types. Prospective clients must engage directly with VisionQuest representatives to obtain essential account details. This may complicate initial decision-making processes.

Assessment of VisionQuest's trading tools and resources encounters substantial information gaps in available documentation. Specific trading platforms, analytical tools, and research resources offered to clients are not detailed in publicly accessible materials. This absence of information prevents comprehensive evaluation of the firm's technological capabilities and analytical support systems.

Educational resources, market research offerings, and client support materials are not specifically outlined in source documentation. The availability of automated trading systems, portfolio management tools, or advanced analytical features remains unclear based on available information. Professional investment advisory services are indicated through regulatory registrations, but specific tool implementations are not described.

Without detailed information about available tools and resources, potential clients cannot adequately assess whether VisionQuest's technological infrastructure meets their investment management needs. This represents a significant transparency gap that requires direct client inquiry for clarification.

Customer Service and Support Analysis

VisionQuest shows strong performance in customer service and support based on available client feedback. According to source materials, clients express high satisfaction levels with support services provided by Visionquest Solutions. This indicates effective customer relationship management. The company's emphasis on personalized service delivery appears to translate into positive client experiences and strong support relationships.

However, specific details about customer service channels, availability hours, and response time metrics are not provided in available documentation. Multi-language support capabilities and specialized support for different client segments are not clearly outlined. The firm's approach appears to prioritize direct relationship management and personalized attention over standardized support systems.

Client testimonials suggest that VisionQuest's team maintains accessibility for addressing questions and concerns. Customers note excellent support quality. This positive feedback supports the high rating assigned to customer service and support, though more detailed metrics would strengthen the assessment.

Trading Experience Analysis

Evaluation of VisionQuest's trading experience faces significant limitations due to insufficient information about platform stability, execution quality, and trading functionality. Specific trading platforms utilized by the firm are not identified in available sources. This prevents assessment of technological infrastructure and user interface quality.

Order execution speeds, platform reliability metrics, and trading environment characteristics are not detailed in accessible documentation. Mobile trading capabilities, advanced order types, and real-time market data access remain unspecified in source materials. The firm's focus on investment advisory services suggests emphasis on strategic investment management rather than active trading facilitation.

Without comprehensive trading experience information, this visionquest review cannot provide adequate guidance on platform suitability for different trading styles or frequency requirements. Potential clients requiring specific trading capabilities must engage directly with VisionQuest representatives for detailed platform discussions.

Trust and Reliability Analysis

VisionQuest's trust and reliability assessment reveals mixed indicators based on available information. The firm maintains proper regulatory registration through SEC filing and CRD number 135581. This indicates compliance with investment advisory regulations. Professional credentials held by leadership, including California Brokers license and Series 65 license, suggest appropriate qualifications for financial advisory services.

However, detailed information about fund security measures, client asset protection protocols, and transparency practices is not comprehensively outlined in available sources. The company's operational history of approximately 5 to 10 years provides some stability indication. However, longer-term track record data is not available for thorough reliability assessment.

Industry reputation metrics, third-party evaluations, and negative event handling procedures are not detailed in source materials. While regulatory compliance appears appropriate, the lack of comprehensive transparency information limits the ability to provide definitive trust and reliability ratings in this evaluation.

User Experience Analysis

User experience evaluation for VisionQuest encounters substantial information limitations regarding interface design, process efficiency, and overall client satisfaction metrics. Available feedback suggests positive client experiences with personalized service delivery. This indicates satisfaction with the firm's approach to client relationship management.

However, specific details about registration processes, account verification procedures, and ongoing user interface experiences are not provided in accessible documentation. The firm's emphasis on customized financial planning suggests focus on personal consultation rather than self-service digital experiences. However, specific implementation details remain unclear.

Overall user satisfaction appears positive based on available client feedback, particularly regarding support services and personalized attention. However, comprehensive user experience metrics, including process efficiency ratings and digital interface assessments, are not available for thorough evaluation in this visionquest review.

Conclusion

This comprehensive visionquest review reveals a financial services firm with strong customer service capabilities but significant transparency limitations regarding specific operational details. VisionQuest shows positive client satisfaction levels and maintains appropriate regulatory registrations for investment advisory services. This indicates legitimate business operations and professional service delivery.

The firm appears well-suited for clients seeking personalized financial planning and investment management services, particularly those who value direct relationship management over standardized digital platforms. However, the lack of detailed information about trading conditions, fee structures, and specific service terms represents a notable concern for potential clients requiring comprehensive service understanding before engagement.

VisionQuest's main strengths include experienced professional leadership, positive client feedback, and personalized service approaches. Primary weaknesses involve limited transparency about specific service terms and operational details that would facilitate informed client decision-making.