Is EasyTrade safe?

Business

License

Is Easytrade A Scam?

Introduction

Easytrade is an online forex and CFD broker that positions itself as a gateway for traders seeking access to various financial markets. With an array of trading instruments including currency pairs, commodities, and indices, Easytrade aims to attract both novice and experienced traders. However, the forex market is rife with potential pitfalls, and traders must exercise caution when selecting a broker. The importance of thorough due diligence cannot be overstated, as many brokers operate without proper oversight, leading to significant financial losses for unsuspecting clients. In this article, we will investigate the regulatory status, company background, trading conditions, customer experiences, and overall risk associated with Easytrade to determine whether it is a safe option for traders or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for assessing its legitimacy. Regulation serves as a safety net for traders, ensuring that brokers adhere to strict guidelines designed to protect client funds and promote fair trading practices. Unfortunately, Easytrade does not hold a license from any reputable financial authority, which raises serious concerns about its credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Easytrade operates without the scrutiny of a governing body, making it susceptible to fraudulent activities. This lack of oversight is compounded by reports from various financial watchdogs warning against Easytrade for operating illegally in multiple jurisdictions. The implications of being unregulated are significant; traders have no recourse if they encounter issues such as withdrawal problems or account manipulation. As such, it is imperative for traders to consider the regulatory landscape when evaluating if Easytrade is safe.

Company Background Investigation

Easytrade's history and ownership structure are shrouded in ambiguity. While it claims to be based in Estonia, there is little verifiable information regarding its corporate structure or management team. This lack of transparency is a red flag, as reputable brokers typically provide detailed information about their ownership and operational history.

The company's management team is largely unknown, which raises further concerns about its accountability and reliability. A transparent organization would typically disclose information about its executives and their professional backgrounds. However, Easytrade seems to lack this level of openness, making it difficult for potential clients to assess the broker's trustworthiness. The combination of an unclear ownership structure and minimal information disclosure leads to a conclusion that Easytrade may not be a reliable trading partner.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. Easytrade offers a range of trading instruments, but the specifics of its cost structure are concerning. Reports indicate that the broker may impose unusual fees, which could significantly impact traders' profitability.

| Fee Type | Easytrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unknown | 1.0 - 2.0 pips |

| Commission Structure | Unknown | Varies widely |

| Overnight Interest Range | Unknown | 0.5% - 1.5% |

The lack of clarity regarding spreads and commissions is troubling. Traders expect transparent pricing, and any ambiguity can lead to misunderstandings and unexpected costs. Additionally, the absence of a demo account limits traders' ability to familiarize themselves with the platform and its trading conditions before committing real funds. Overall, the trading conditions at Easytrade do not inspire confidence, raising questions about whether it is safe to trade with this broker.

Client Fund Security

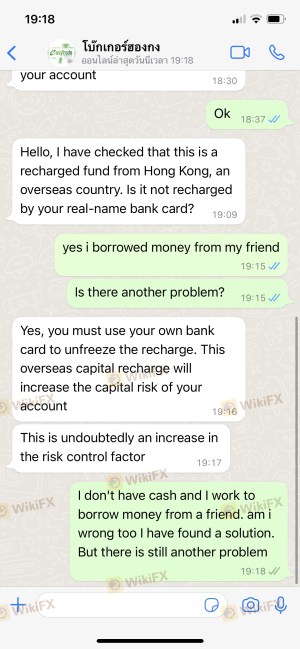

The safety of client funds is a paramount concern for any trader. Easytrade's policies regarding fund security are not well-documented, which raises alarms. The absence of information about fund segregation, investor protection schemes, and negative balance protection leaves traders vulnerable.

Many reputable brokers implement robust security measures to protect client funds, including segregated accounts and insurance against losses. However, Easytrade's lack of transparency in these areas suggests that it may not prioritize client security. Past incidents involving unregulated brokers indicate that traders often face significant difficulties in retrieving their funds, especially in cases where the broker has ceased operations or has been flagged for fraudulent activities. Therefore, the question remains: Is Easytrade safe for your hard-earned money?

Customer Experience and Complaints

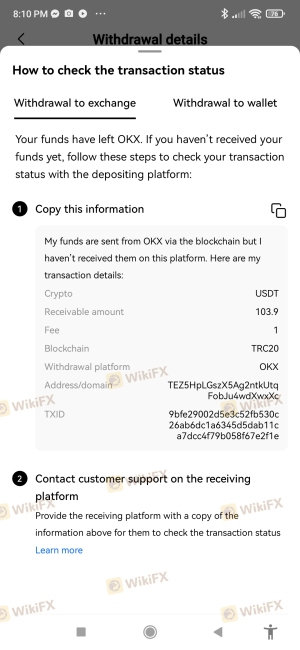

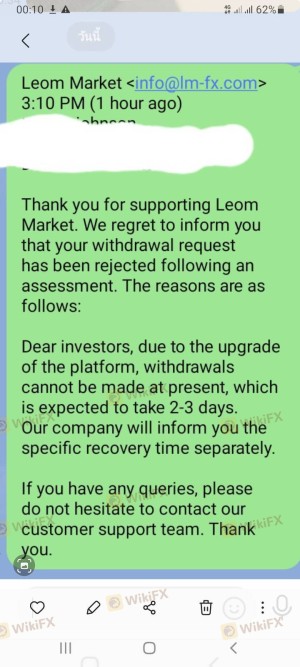

Analyzing customer feedback is crucial for understanding a broker's reputation. Reviews and testimonials about Easytrade are predominantly negative, with many users reporting issues related to withdrawals, account access, and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Access Problems | High | Poor |

| Customer Support Delays | Medium | Average |

Many traders have reported being unable to withdraw their funds after submitting requests, a common tactic employed by scam brokers to withhold client money. Additionally, complaints about poor customer service indicate that Easytrade may not be responsive to client concerns, further eroding trust. These patterns suggest that Easytrade is not a broker that prioritizes customer satisfaction or transparency, which is vital for a safe trading environment.

Platform and Trade Execution

The trading platform is another critical aspect of assessing a broker's reliability. Easytrade claims to offer a user-friendly platform, but reviews indicate that its performance and stability may not meet industry standards.

Many users have reported issues with order execution, including delays and slippage, which can significantly impact trading outcomes. Furthermore, the absence of a demo account limits traders' ability to test the platform before risking real capital. Concerns about potential manipulation also arise, as traders have reported experiencing unusual price movements that could indicate a lack of integrity in trade execution.

Risk Assessment

Engaging with Easytrade carries inherent risks, primarily due to its unregulated status and negative customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for traders |

| Financial Risk | High | Potential loss of funds due to fraud |

| Operational Risk | Medium | Issues with platform stability and support |

To mitigate these risks, traders should consider using regulated brokers that offer comprehensive protections and transparent practices. It is essential to prioritize safety and security when selecting a trading partner.

Conclusion and Recommendations

After a thorough investigation into Easytrade's regulatory status, company background, trading conditions, client fund security, and customer experiences, it is evident that Easytrade raises several red flags. The lack of regulation, combined with negative feedback from users, suggests that it may not be a safe option for traders.

For those considering trading with Easytrade, it is advisable to exercise extreme caution. Instead, traders should opt for well-regulated brokers known for their reliability and transparency. Recommended alternatives include brokers regulated by reputable authorities such as the FCA or ASIC, which provide a safer trading environment and better customer support.

In summary, the question "Is Easytrade safe?" can be answered with a resounding no; potential traders should seek safer options to protect their investments and ensure a more secure trading experience.

Is EasyTrade a scam, or is it legit?

The latest exposure and evaluation content of EasyTrade brokers.

EasyTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EasyTrade latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.