Bexchange 2025 Review: Everything You Need to Know

Executive Summary

This bexchange review shows a troubling picture of a low-rated, unregulated forex broker. Bexchange has attracted significant attention for all the wrong reasons, despite being established in 2021 and registered in the United Kingdom. The company operates without proper oversight from the Financial Conduct Authority (FCA). This happens even though they claim UK registration.

The broker offers trading across multiple asset classes including forex, indices, commodities, and cryptocurrencies, with leverage reaching up to 1:500. However, the platform has generated numerous scam-related complaints and maintains only a moderate trust score among users. While Bexchange may appeal to traders seeking high leverage and diverse trading instruments, the lack of regulatory protection and mounting user complaints raise serious red flags.

The broker's target demographic appears to be high-risk tolerance investors. Even experienced traders should exercise extreme caution when considering this platform. Based on available public information and user feedback, Bexchange presents significant risks that outweigh its limited advantages.

This makes it unsuitable for most retail traders seeking a secure trading environment.

Important Notice

Regional Entity Differences: Bexchange claims registration in the United Kingdom but operates without FCA authorization or regulation. Traders should be aware that despite UK registration claims, the broker lacks the consumer protections typically associated with FCA-regulated entities.

Review Methodology: This evaluation is based on publicly available information, user feedback, and regulatory database searches. Given the limited transparency from Bexchange itself, some information gaps exist in areas such as specific trading platforms, fee structures, and operational procedures.

Rating Framework

Broker Overview

Bexchange entered the forex market in 2021 as a UK-registered trading platform. The company positions itself as a multi-asset broker serving international clients. The company operates from the United Kingdom but notably lacks authorization from the Financial Conduct Authority.

This creates an immediate regulatory gap that affects trader protection. Despite its relatively recent establishment, Bexchange has quickly gained attention in the trading community, though unfortunately much of this attention stems from negative user experiences and regulatory concerns. The broker's business model centers on providing access to multiple financial markets including foreign exchange, stock indices, commodities, and cryptocurrency trading.

According to available information, Bexchange offers leverage ratios up to 1:500. This significantly exceeds the 1:30 maximum leverage permitted by FCA regulations for retail clients. This discrepancy further highlights the broker's operation outside standard UK regulatory frameworks and suggests targeting of international markets where such leverage restrictions may not apply.

This bexchange review finds that while the company presents itself as a comprehensive trading solution, the lack of detailed information about its operational structure, ownership, and regulatory compliance creates substantial uncertainty for potential clients seeking transparent and secure trading conditions.

Regulatory Status: Bexchange operates under UK registration but critically lacks FCA authorization. This regulatory gap means traders do not benefit from Financial Services Compensation Scheme protection or FCA oversight mechanisms that typically safeguard retail investors.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options remains undisclosed in available materials. This creates uncertainty about funding convenience and processing times for potential clients.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds for different account types. This makes it difficult for traders to plan their initial investment requirements.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not detailed in publicly available information. This suggests either absence of such programs or limited marketing transparency.

Tradeable Assets: Bexchange provides access to four main asset categories: foreign exchange pairs, stock indices, commodities, and cryptocurrencies. The platform offers reasonable diversification opportunities for multi-market traders.

Cost Structure: Detailed information about spreads, commissions, and other trading costs remains unavailable in public resources. This prevents accurate cost comparison with regulated alternatives.

Leverage Ratios: The platform offers maximum leverage of 1:500. This is substantially higher than FCA-permitted levels of 1:30 for major currency pairs, indicating operation outside UK retail trading regulations.

Platform Options: Specific trading platform details are not comprehensively documented in available materials. This leaves questions about software quality and functionality unanswered.

This bexchange review highlights significant information gaps that prospective traders should consider carefully before engagement.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Bexchange's account conditions receive a below-average rating due to substantial transparency issues and limited publicly available information. The broker has not disclosed specific account types, tier structures, or minimum deposit requirements. This makes it impossible for potential clients to understand what trading conditions they might encounter.

This lack of transparency contrasts sharply with regulated brokers who typically provide comprehensive account specifications. User feedback indicates confusion about account opening procedures and requirements, with several complaints noting unexpected conditions or changes to account terms. The absence of clear account categorization also suggests limited customization for different trader experience levels or capital requirements.

Compared to established, regulated competitors, Bexchange's account conditions appear underdeveloped and poorly communicated. The moderate trust score of 60 points from user evaluations reflects these concerns, with many traders expressing uncertainty about their account status and available features.

This bexchange review finds that the broker's approach to account management lacks the professionalism and clarity expected in modern forex trading, contributing to overall user dissatisfaction and trust issues.

The tools and resources offered by Bexchange receive a mediocre rating. This is primarily due to limited information about specific trading tools and analytical capabilities. While the broker provides access to multiple asset classes including forex, indices, commodities, and cryptocurrencies, details about charting tools, technical indicators, and research resources remain largely undisclosed.

Available information suggests basic trading functionality without advanced features commonly found with established brokers. The absence of detailed platform specifications makes it difficult to assess whether Bexchange provides adequate tools for technical analysis, automated trading, or risk management. Educational resources appear minimal or non-existent based on available information, which is particularly concerning for a broker that may attract inexperienced traders with high leverage offerings.

The lack of market analysis, economic calendars, or trading guides suggests limited commitment to trader development and education. User feedback regarding tools and resources is sparse, but available comments suggest basic functionality that may satisfy simple trading needs while falling short of professional-grade requirements expected by serious traders.

Customer Service Analysis (Score: 4/10)

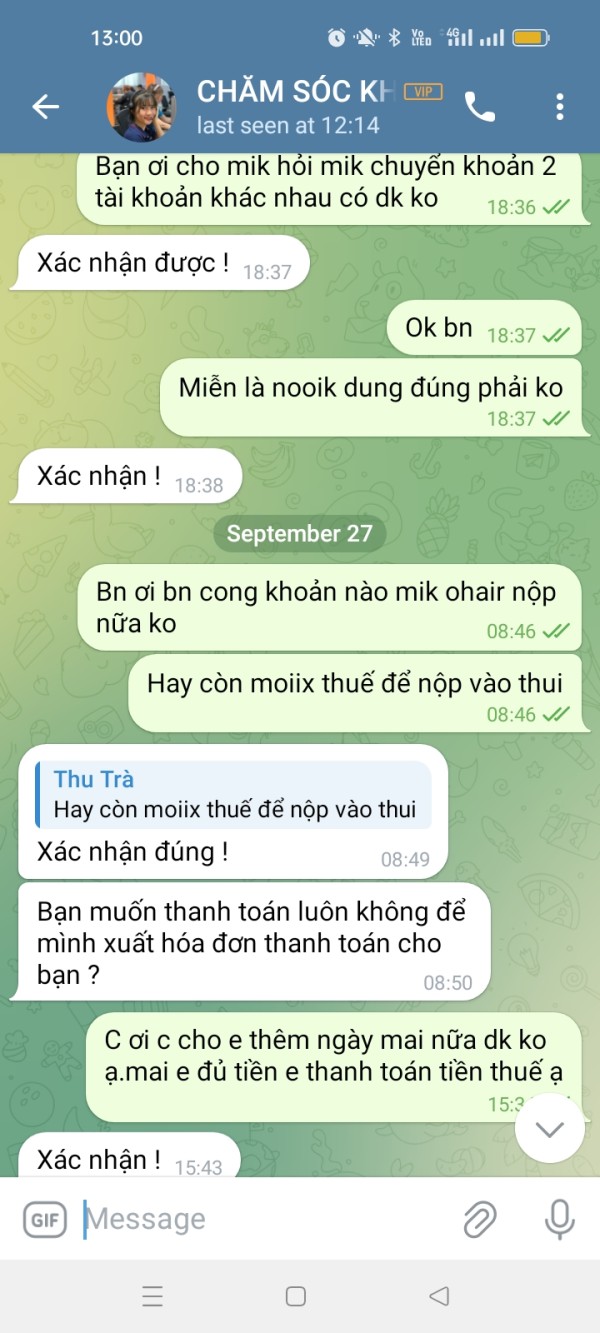

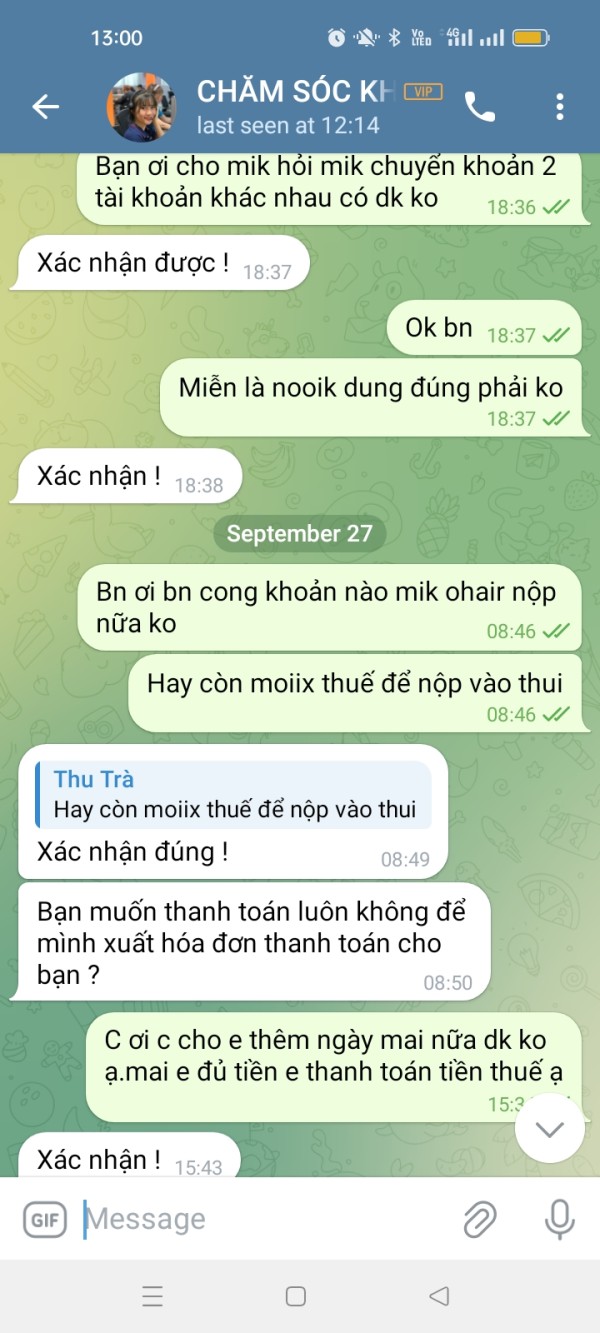

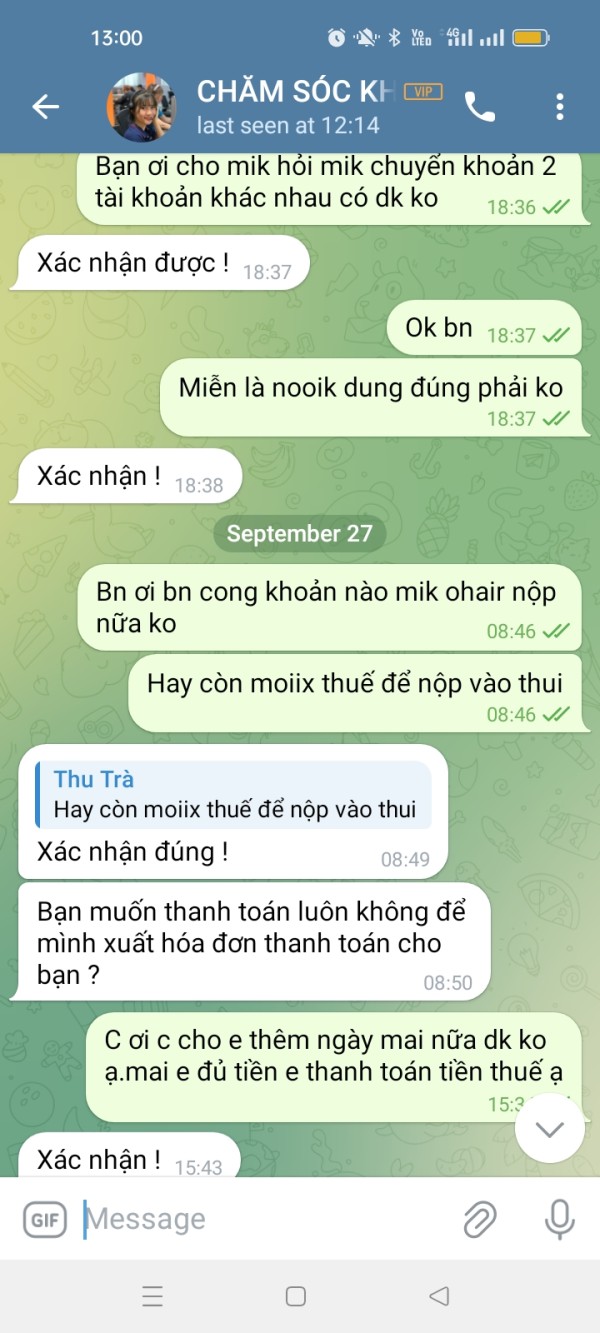

Customer service represents a significant weakness for Bexchange. Multiple user complaints highlight poor support quality and responsiveness issues. The broker's customer service receives a low rating due to documented problems with complaint resolution and communication effectiveness.

User feedback consistently mentions difficulties reaching customer support representatives and receiving timely responses to inquiries. Several complaints indicate that support requests regarding account issues, withdrawals, or technical problems often go unresolved for extended periods, creating frustration and trust issues among clients. The absence of detailed information about support channels, operating hours, or multilingual capabilities suggests limited infrastructure for customer assistance.

This is particularly problematic given the broker's international client base and the complexity issues that can arise in forex trading. Problem resolution appears inconsistent based on available user reports, with some clients reporting eventual resolution while others indicate complete lack of response to serious concerns. This inconsistency undermines confidence in the broker's commitment to client satisfaction and proper business practices.

Trading Experience Analysis (Score: 5/10)

Bexchange's trading experience receives a middle-ground rating. This balances high leverage availability against significant transparency concerns and user complaints. The platform offers leverage up to 1:500, which appeals to traders seeking amplified market exposure, though this level exceeds regulatory standards in many jurisdictions.

Platform stability and execution quality remain uncertain due to limited user feedback and absence of detailed performance metrics. Available user comments suggest mixed experiences, with some traders reporting acceptable execution while others note issues with order processing and platform responsiveness. The lack of specific information about spreads, commissions, and execution models makes it difficult to assess the true cost of trading with Bexchange.

This transparency gap prevents traders from making informed decisions about the platform's competitiveness compared to regulated alternatives. Mobile trading capabilities and platform features are not well-documented, suggesting either limited functionality or poor marketing communication. The absence of detailed platform specifications raises questions about the sophistication of trading tools and user interface quality.

This bexchange review finds that while basic trading functionality appears available, the overall trading experience lacks the transparency and reliability expected from professional forex brokers.

Trust and Safety Analysis (Score: 3/10)

Trust and safety represent Bexchange's most significant weaknesses. These areas earn the lowest rating among all evaluated criteria. The broker's unregulated status creates fundamental concerns about client fund protection and operational oversight that cannot be overlooked.

Operating without FCA authorization despite UK registration means Bexchange lacks the regulatory safeguards that protect retail traders. This includes segregated client funds, compensation schemes, and regular compliance audits. This regulatory gap exposes traders to risks that regulated alternatives actively mitigate.

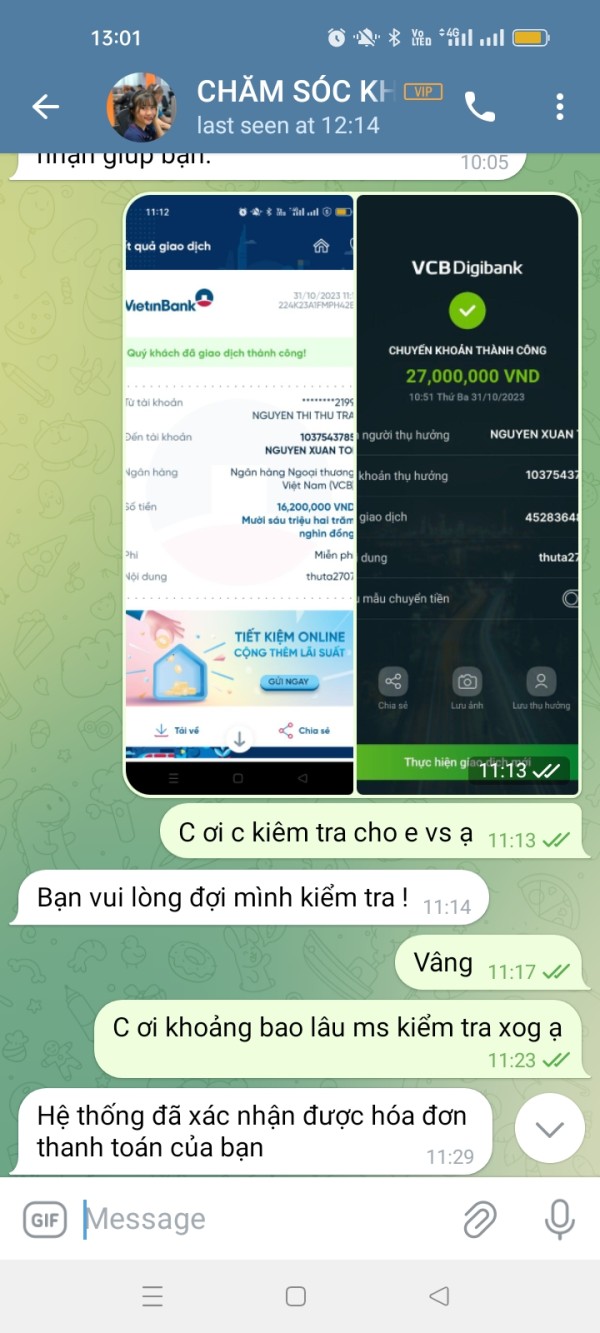

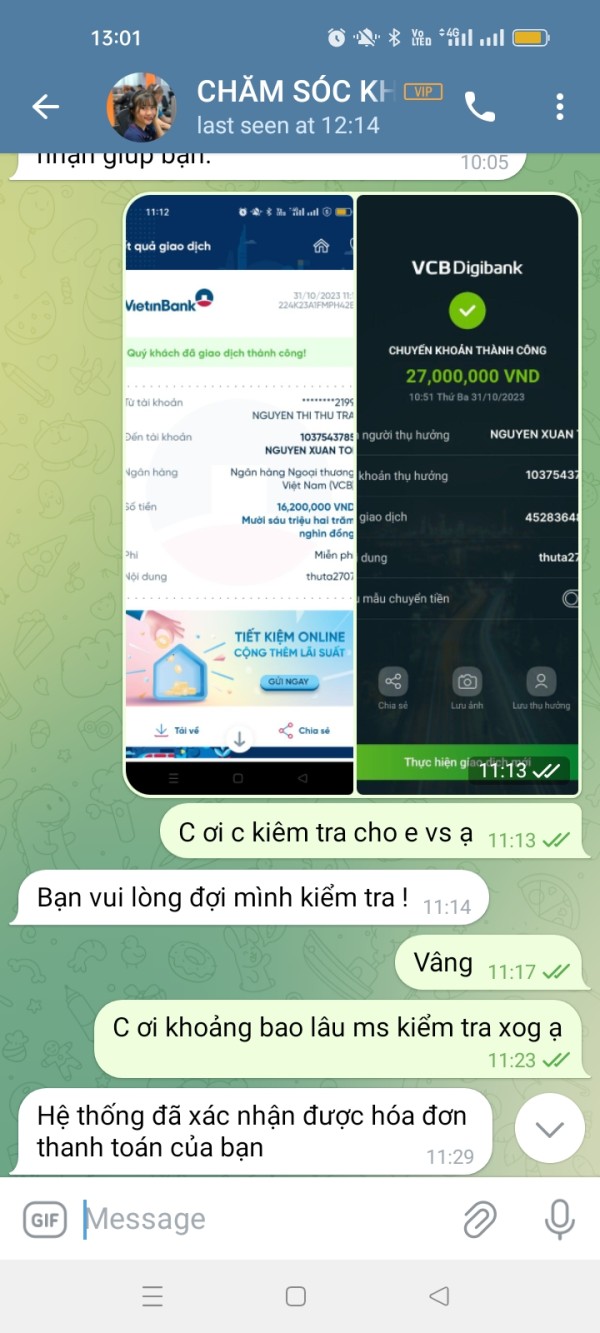

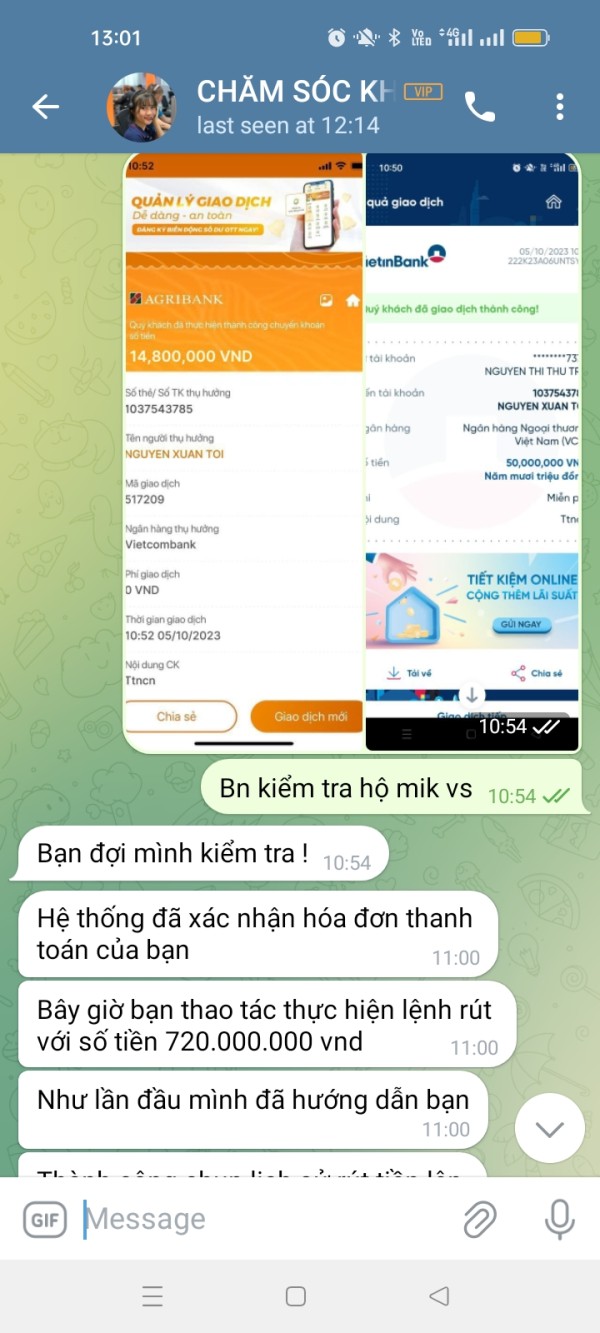

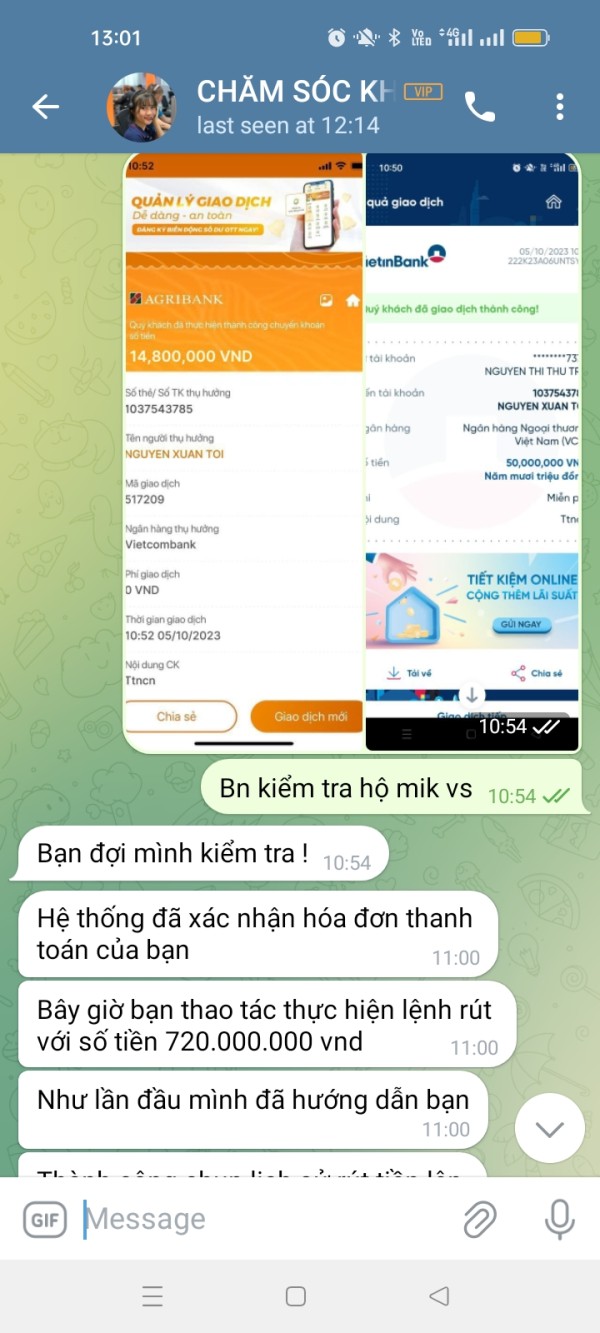

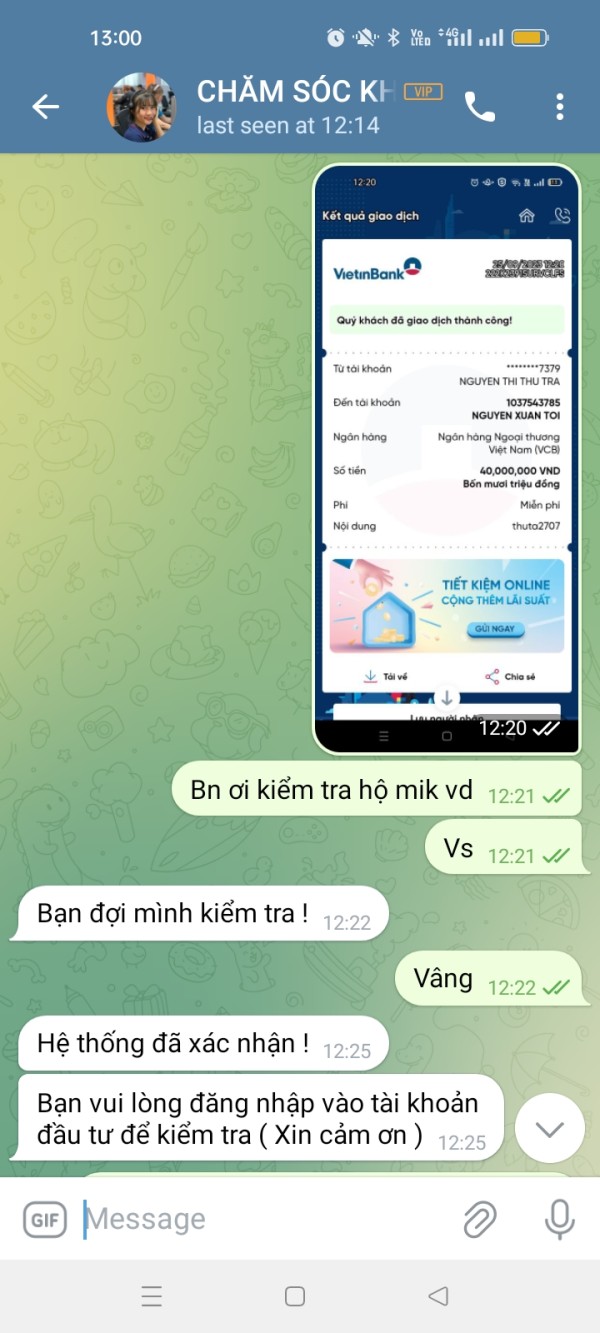

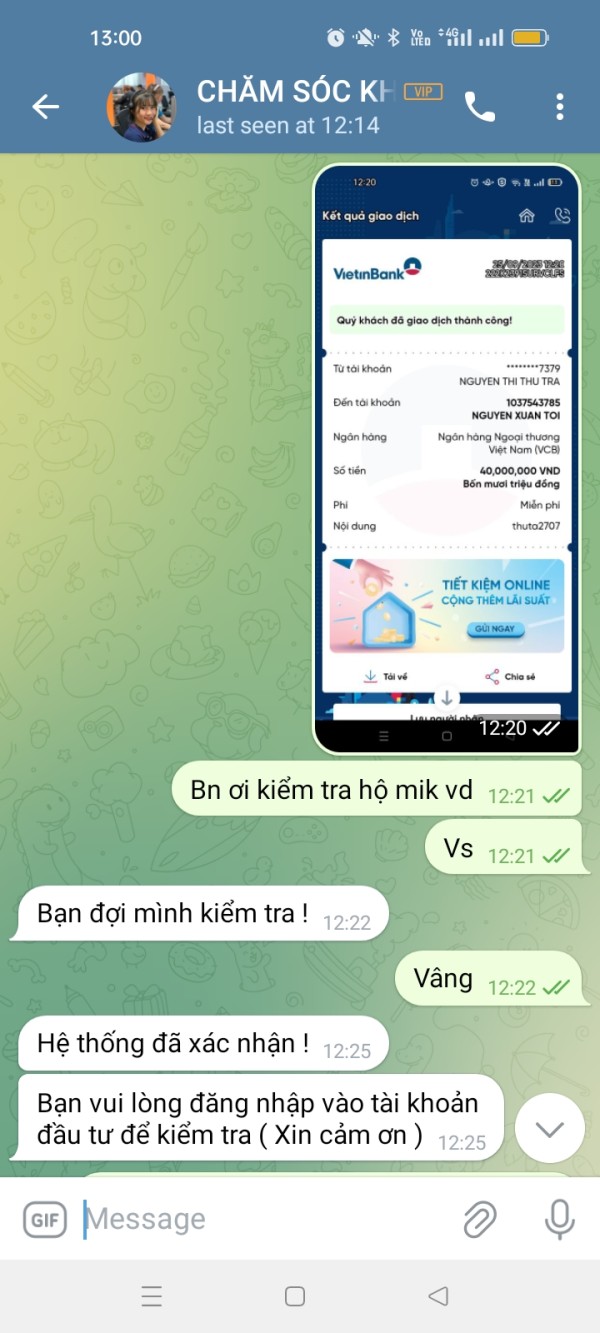

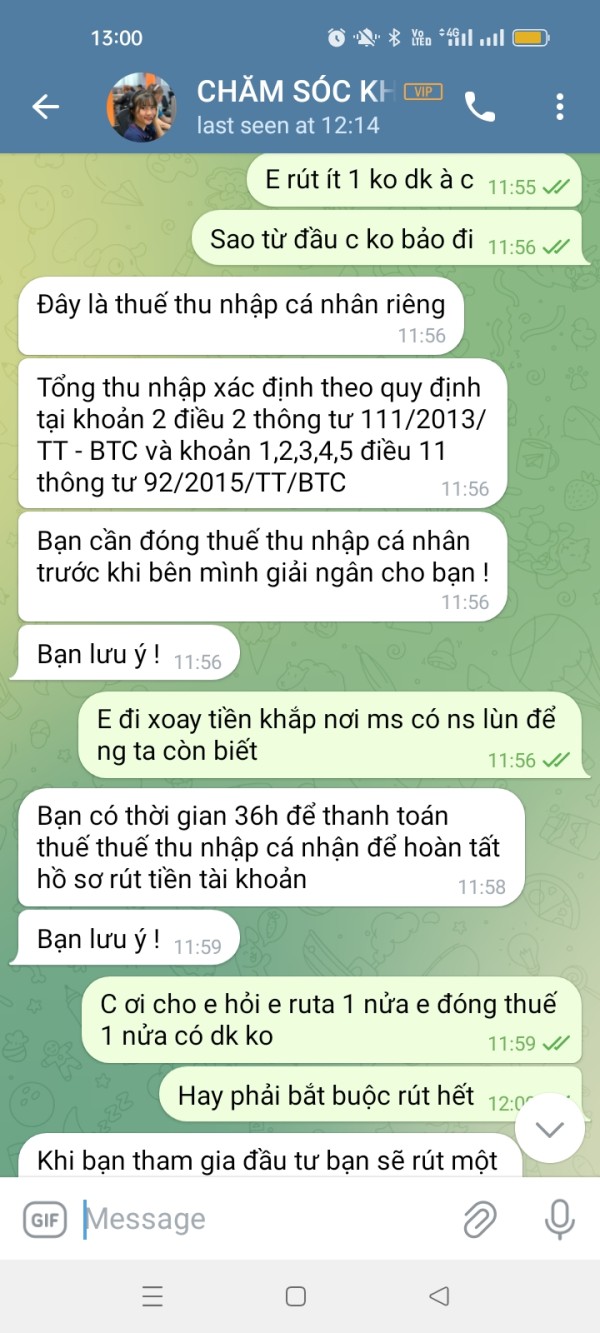

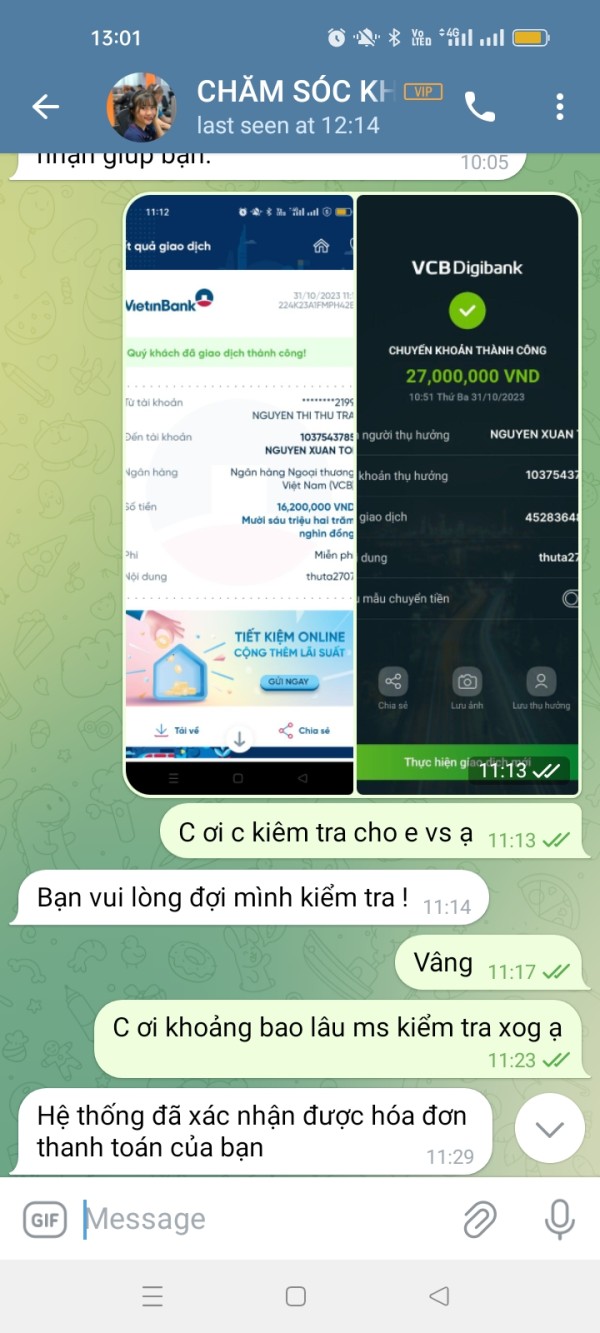

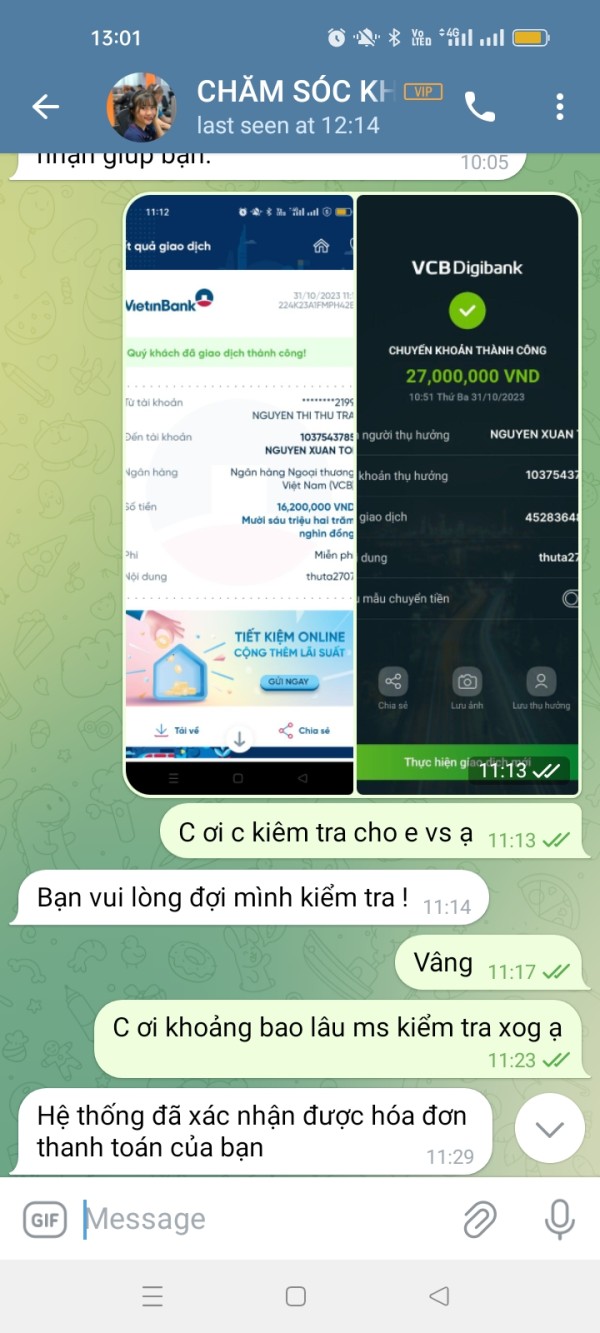

The broker has attracted numerous scam-related complaints and allegations, significantly undermining its reputation within the trading community. These complaints often involve withdrawal difficulties, unexpected account restrictions, and poor customer service responses to serious concerns. Third-party evaluations consistently rate Bexchange as a low-quality broker, with warning flags raised by multiple review platforms and regulatory watch services.

The absence of proper licensing and transparency creates an environment where trader protection is minimal. Company transparency remains poor, with limited information available about ownership structure, financial backing, or operational procedures. This opacity prevents traders from conducting proper due diligence and understanding the risks associated with fund deposits.

User Experience Analysis (Score: 4/10)

User experience with Bexchange reflects the broader concerns identified throughout this evaluation. The moderate satisfaction score of 60 points masks significant underlying issues. While some users report basic functionality, the overall experience is hampered by transparency problems and service quality concerns.

Interface design and platform usability information remains limited, preventing assessment of user-friendly features or navigation efficiency. The absence of detailed platform demonstrations or user guides suggests minimal attention to user experience optimization. Registration and verification processes are not well-documented, with user feedback indicating confusion about requirements and procedures.

Several complaints mention unexpected verification delays or requests for additional documentation without clear explanation. Common user complaints center on withdrawal difficulties, poor customer support responsiveness, and lack of transparency about trading conditions. These issues create frustration and uncertainty that significantly impact overall user satisfaction.

The broker appears suitable primarily for high-risk tolerance traders willing to accept significant uncertainty in exchange for high leverage access. However, even risk-tolerant users should carefully consider the substantial drawbacks identified in user feedback and regulatory analysis.

Conclusion

This comprehensive bexchange review reveals a broker with significant limitations and risks that outweigh its limited advantages. Bexchange operates as an unregulated entity despite UK registration claims. This creates fundamental trust and safety concerns that cannot be ignored.

The broker's lack of transparency regarding trading conditions, platform features, and operational procedures compounds these regulatory concerns. While Bexchange may appeal to high-risk tolerance traders seeking elevated leverage ratios and multi-asset trading access, the numerous red flags identified throughout this evaluation make it unsuitable for most retail traders. The combination of regulatory gaps, user complaints, and transparency issues creates an environment where trader protection is minimal.

The broker's main advantages include diverse asset class availability and high leverage options, but these benefits are overshadowed by substantial disadvantages. These include unregulated status, poor customer service, and documented user complaints about withdrawal difficulties and platform reliability. Traders seeking secure, transparent, and professionally managed trading environments should consider regulated alternatives that provide proper client protections and clear operational standards.