FOTM 2025 Review: Everything You Need to Know

Executive Summary

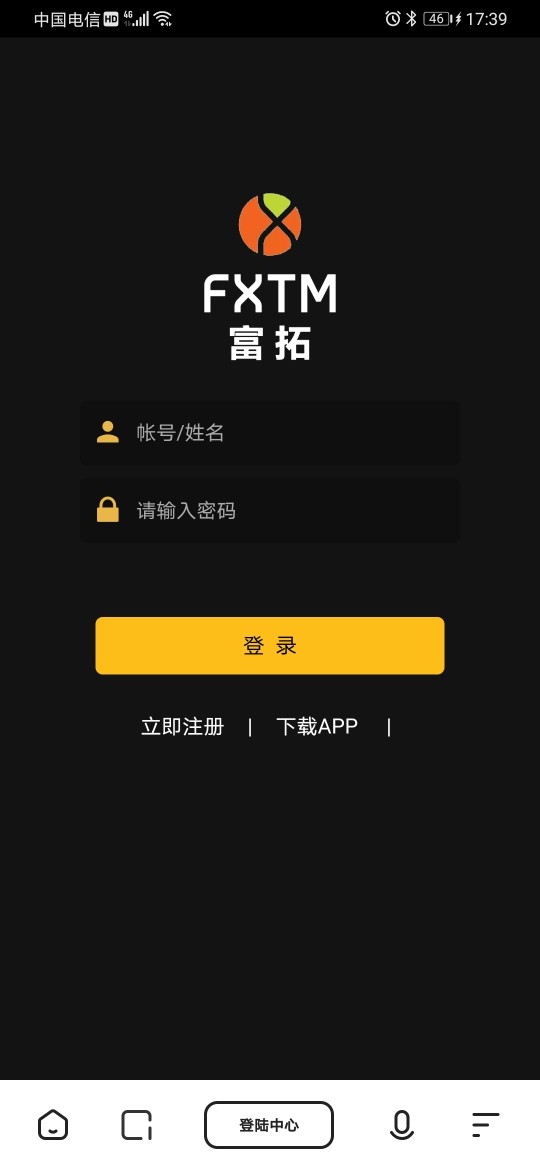

This fotm review examines a trading platform that presents mixed user feedback and unclear regulatory standing in the forex market. FOTM operates as an online forex broker. It claims registration in China, though specific regulatory information remains undisclosed in available documentation. The platform offers real-time account management capabilities and provides both demo account options and swap-free trading alternatives for users seeking diverse trading conditions.

User experiences with FOTM vary significantly. Some traders express satisfaction with certain aspects of the service while others report concerns about platform adequacy. The broker appears to target users interested in experiencing various trading conditions, though the lack of transparent regulatory oversight raises important considerations for potential clients. Based on available information, FOTM presents both opportunities and risks. These require careful evaluation by prospective traders.

Important Notice

This evaluation is based on publicly available information, user feedback, and market research. FOTM's regulatory status across different jurisdictions may vary. Potential users should verify current licensing information independently. The broker's operations in various regions may be subject to different oversight standards, and regulatory compliance may differ significantly between territories.

Our assessment methodology incorporates user testimonials, available platform documentation, and industry standard comparison metrics. However, due to limited transparency regarding specific regulatory credentials, traders should exercise additional due diligence before engaging with this broker's services.

Rating Framework

Broker Overview

FOTM operates as an online forex broker in the competitive financial services sector. Specific establishment details remain unclear in available documentation. The company claims registration in China and focuses primarily on providing forex trading services to international clients. The broker's business model centers around offering diverse trading conditions and account management solutions, though comprehensive background information about company history and founding principles is not readily available in public sources.

The platform emphasizes real-time account management capabilities. It provides access to both live and demo trading environments. FOTM's service portfolio includes swap-free account options, which particularly appeals to traders with specific religious or strategic requirements. However, the broker's market positioning and competitive advantages remain somewhat unclear due to limited public disclosure about company operations, management structure, and strategic direction in the forex industry.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing FOTM's operations. This represents a significant transparency concern for potential users.

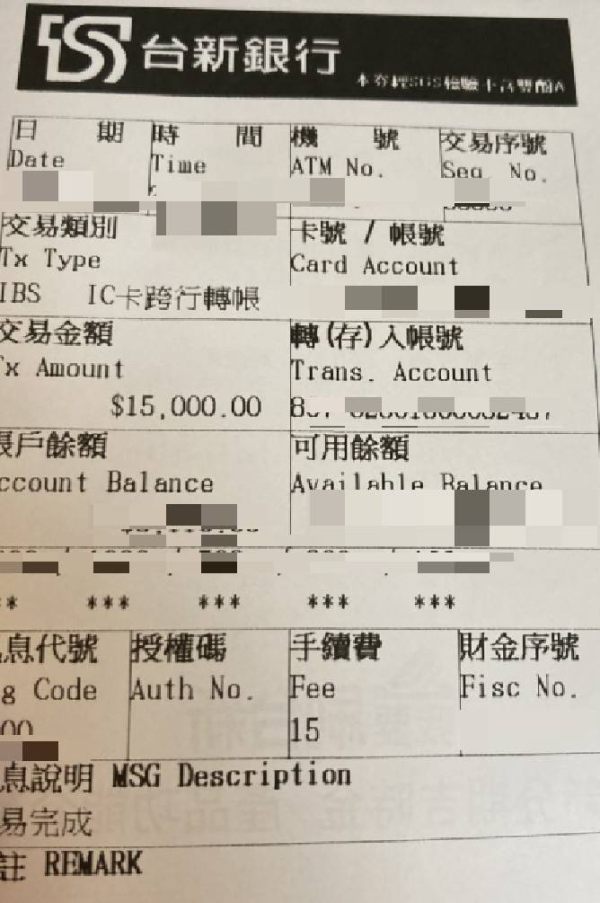

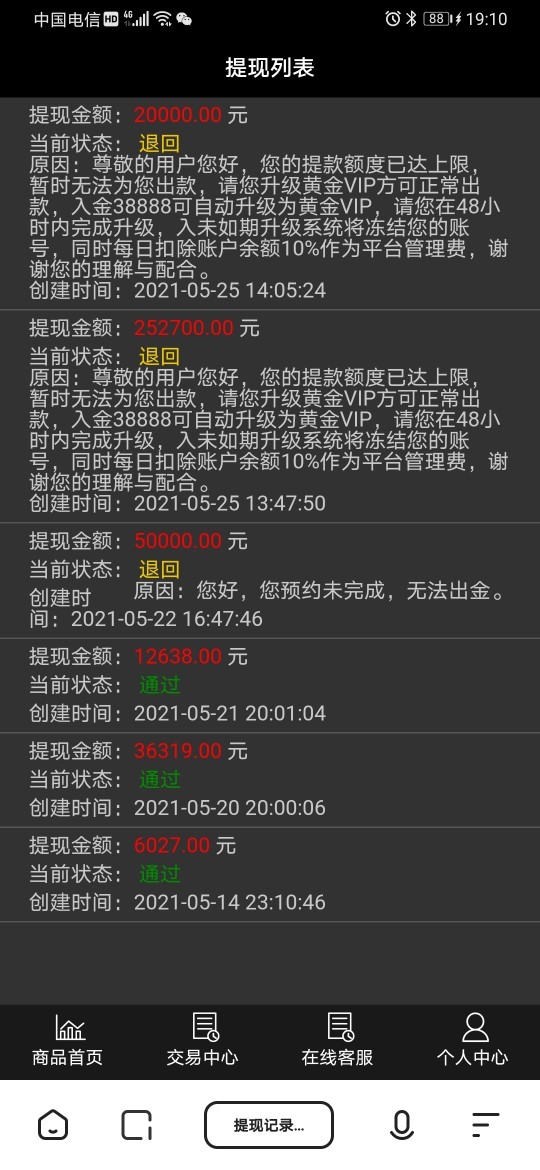

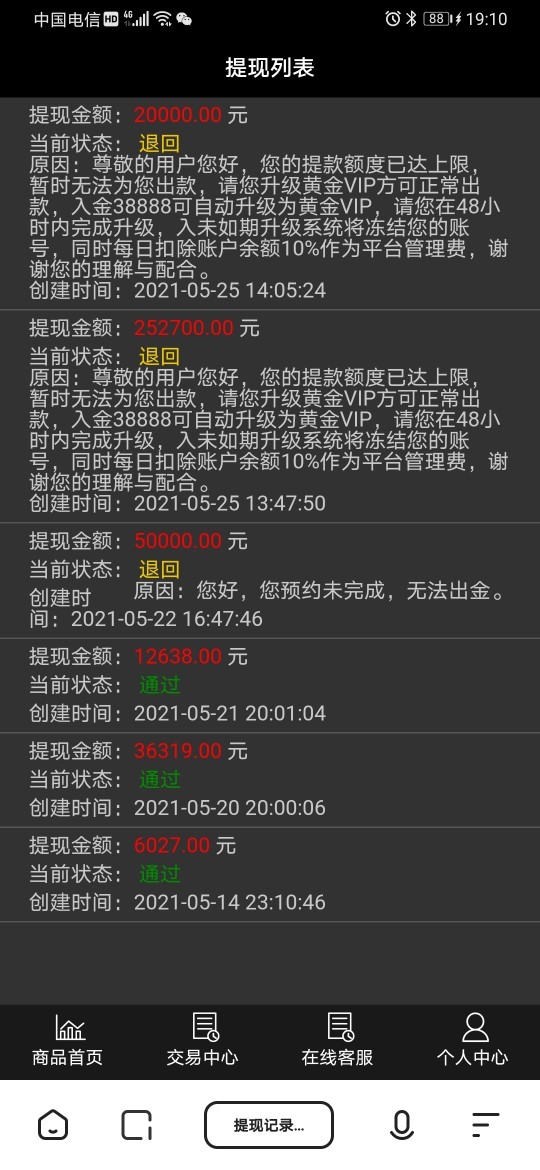

Deposit and Withdrawal Methods: Specific payment processing options and supported financial instruments are not detailed in accessible documentation.

Minimum Deposit Requirements: The platform has not disclosed specific minimum deposit amounts in available materials.

Promotional Offers: Information regarding bonus programs, promotional campaigns, or incentive structures is not mentioned in current documentation.

Tradeable Assets: FOTM primarily focuses on forex trading services. The complete range of available currency pairs and additional instruments requires further clarification.

Cost Structure: Detailed information about spreads, commission rates, and fee schedules is not comprehensively outlined in available sources. This makes cost comparison challenging.

Leverage Options: Specific leverage ratios and margin requirements are not clearly stated in accessible platform information.

Platform Technology: The broker provides real-time account management systems and demo account functionality. Technical specifications remain limited.

Geographic Restrictions: Specific regional limitations or service availability constraints are not detailed in current fotm review materials.

Customer Support Languages: Language support options for client services are not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

FOTM's account conditions present significant information gaps that impact user decision-making. The platform does not provide clear details about available account types. This makes it difficult for traders to understand which options best suit their needs. Without specific information about account tiers, features, or requirements, potential users cannot adequately assess whether the broker's offerings align with their trading objectives.

The absence of disclosed minimum deposit requirements creates uncertainty for new users planning their initial investment. Most reputable brokers clearly communicate these fundamental requirements. FOTM's lack of transparency in this area raises concerns about operational clarity. Additionally, the account opening process details are not comprehensively outlined, leaving users uncertain about verification procedures and timeline expectations.

User feedback suggests some dissatisfaction with account adequacy. Reports indicate that some traders find the platform's offerings insufficient for their needs. The lack of information about specialized account features, such as Islamic accounts or professional trader options, further limits the platform's appeal to diverse user segments. This fotm review finds that improved transparency in account conditions would significantly benefit potential users.

FOTM demonstrates stronger performance in providing trading tools and technological resources. The platform offers real-time account management capabilities, which represents a valuable feature for active traders who require immediate access to account information and position monitoring. This functionality enables users to maintain better control over their trading activities. It helps them respond quickly to market changes.

The availability of demo accounts provides an important resource for new traders to familiarize themselves with the platform without risking real capital. This feature demonstrates FOTM's recognition of user needs for practice environments and skill development opportunities. However, the platform's educational resources and research materials are not comprehensively detailed in available information.

While the basic trading infrastructure appears functional, the absence of detailed information about advanced trading tools, analytical resources, and automated trading support limits the platform's appeal to sophisticated traders. The platform would benefit from more comprehensive disclosure about available research resources, market analysis tools, and educational content. This would better serve user development needs.

Customer Service and Support Analysis (Score: 5/10)

Customer service quality at FOTM receives mixed feedback from users. This indicates inconsistent support experiences across the user base. The platform's customer service infrastructure details are not clearly outlined, making it difficult to assess available support channels, response time commitments, or service quality standards. This lack of transparency creates uncertainty for users who may require assistance with technical issues or account-related questions.

User experiences vary significantly. Some traders report satisfactory interactions while others express concerns about support adequacy. The absence of specific information about multilingual support capabilities may limit accessibility for international users who prefer assistance in their native languages. Additionally, customer service hours and availability schedules are not clearly communicated.

The platform would benefit from more transparent communication about support processes, escalation procedures, and service level commitments. Without clear information about professional training standards for support staff or specialized assistance for technical issues, users cannot adequately assess the reliability of customer service when needed.

Trading Experience Analysis (Score: 6/10)

The trading experience on FOTM presents a mixed picture based on available user feedback and platform capabilities. Some users report satisfactory experiences with the platform's trading environment. Others express concerns about various aspects of trade execution and platform functionality. The real-time account management feature contributes positively to the overall trading experience by providing immediate access to account information.

Platform stability and execution quality information is limited in available documentation. This makes it difficult to assess critical factors such as slippage rates, order execution speed, and system uptime reliability. These technical performance metrics are essential for traders who depend on consistent platform performance for their trading strategies.

The absence of detailed information about mobile trading capabilities limits understanding of the platform's accessibility across different devices and trading environments. Additionally, specific details about trading environment factors such as spreads, liquidity providers, and execution models are not comprehensively disclosed. This fotm review suggests that enhanced transparency about technical performance would improve user confidence in the platform.

Trust and Security Analysis (Score: 3/10)

FOTM's trust and security profile presents significant concerns due to unclear regulatory oversight and limited transparency about safety measures. The absence of specific regulatory authority information creates uncertainty about the level of oversight governing the broker's operations and client fund protection standards. This regulatory ambiguity represents a substantial risk factor for potential users.

Information about fund security measures, segregated account policies, and client protection protocols is not detailed in available documentation. Most reputable brokers clearly communicate their safety standards and regulatory compliance measures. FOTM's lack of transparency in this area raises important questions about operational security standards.

The platform's company transparency regarding financial reporting, management information, and operational details is limited. This further impacts user confidence. Without clear information about regulatory compliance, audit procedures, or industry certifications, users cannot adequately assess the security of their potential investments with this broker.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with FOTM varies considerably based on available feedback. This indicates inconsistent experiences across different user segments. Some traders report positive experiences with certain platform aspects, while others express dissatisfaction with various service elements. The platform appears to attract users interested in exploring different trading conditions, though overall satisfaction levels remain mixed.

Interface design and usability information is not comprehensively detailed in available sources. This makes it difficult to assess the platform's accessibility and user-friendliness. Registration and verification process details are similarly limited, creating uncertainty for new users about onboarding procedures and timeline expectations.

User feedback suggests that some traders find the platform's offerings inadequate for their needs. Reports indicate insufficient service levels in certain areas. The platform would benefit from addressing user concerns about service adequacy and improving transparency about platform capabilities. Better communication about features, processes, and support options would likely enhance overall user satisfaction.

Conclusion

This fotm review reveals a broker with mixed performance across key evaluation criteria. FOTM offers some valuable features, including real-time account management and demo account options. However, it faces significant challenges related to regulatory transparency and information disclosure. The platform appears most suitable for users interested in experimenting with different trading conditions, though potential clients should approach with caution given the unclear regulatory status.

The broker's main strengths lie in its technological infrastructure and account management capabilities. Primary weaknesses center on regulatory transparency and comprehensive service documentation. Users considering FOTM should carefully evaluate the risks associated with unclear regulatory oversight against the potential benefits of the platform's trading tools and account options.