Summary

This raymond james financial review looks at a financial services company with a long history in the investment industry. The company was founded in 1962 and became public in 1983. Raymond James Financial has its main office in St. Petersburg, Florida, and now has over 10,000 employees with about 8,700 financial advisors across the United States, Canada, and other countries.

The company handles client assets worth $1.92 billion as of 2024. It has won awards for helping communities and giving to charity. But our review shows mixed feedback from users, with some clients worried about service quality and how advisors act. The overall rating is neutral because there is not enough clear information about trading rules and oversight details.

Raymond James Financial mainly helps investors who want different types of financial services, including investment banking and wealth management. The company has been around for a long time and is well-known in the market, which are good things. However, potential clients should think carefully about the mixed user feedback and do their own research before using their services.

Important Notice

This raymond james financial review uses detailed analysis of user feedback, company information, and public data. Our review method uses many sources to give a fair look at the firm's services and how well it performs.

Since specific regulatory information and detailed trading conditions are not well documented in available materials, future clients should be extra careful and check all terms and conditions on their own before making investment decisions.

Rating Framework

Broker Overview

Raymond James Financial is a well-known company in the financial services sector with over sixty years in the market. Robert James founded the company in 1962. The firm has grown from its start into a complete financial services organization. When the company became public in 1983, it was an important step in its growth because it had to share more information through required financial reports.

The company's business focuses on investment banking and different financial services through its large network of financial advisors. About 8,700 financial advisors work throughout the United States, Canada, and international markets, so Raymond James Financial has a big presence in the wealth management sector. The firm's total client assets of $1.92 billion as of 2024 show its important market position and how much clients trust it.

However, specific details about trading platforms, types of investments, and regulatory oversight are not clear in available documents. This lack of clear information about main operations makes it hard for potential clients who want complete information about the firm's services. The missing detailed regulatory information especially raises questions about oversight and client protection that future investors usually expect from established financial services companies.

Regulatory Oversight: Available materials do not name specific regulatory bodies that watch over Raymond James Financial's operations, though as a public company since 1983, the firm operates under standard SEC requirements for publicly traded financial services companies.

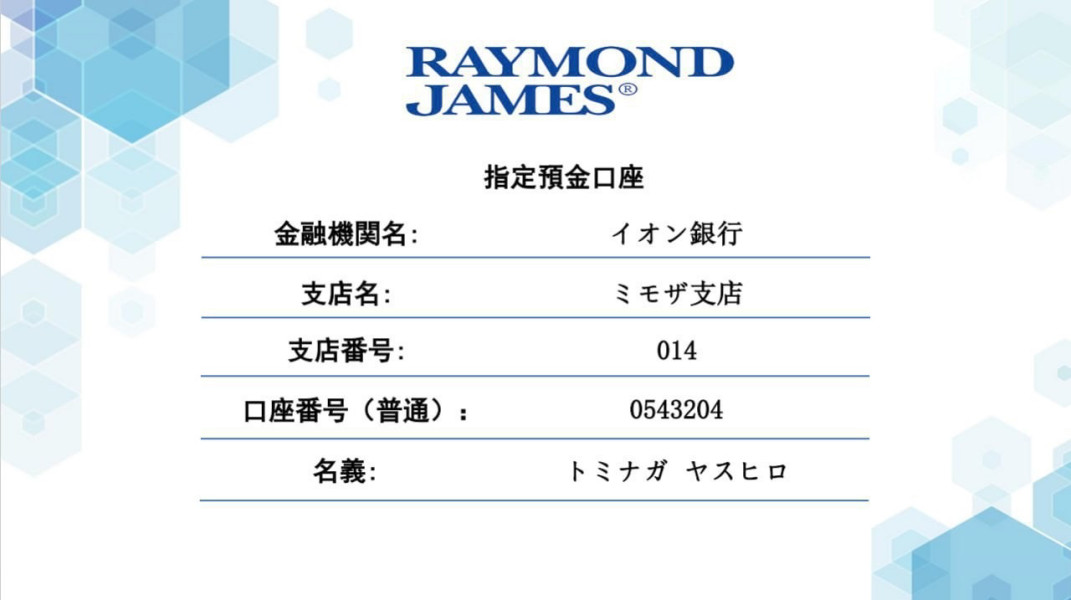

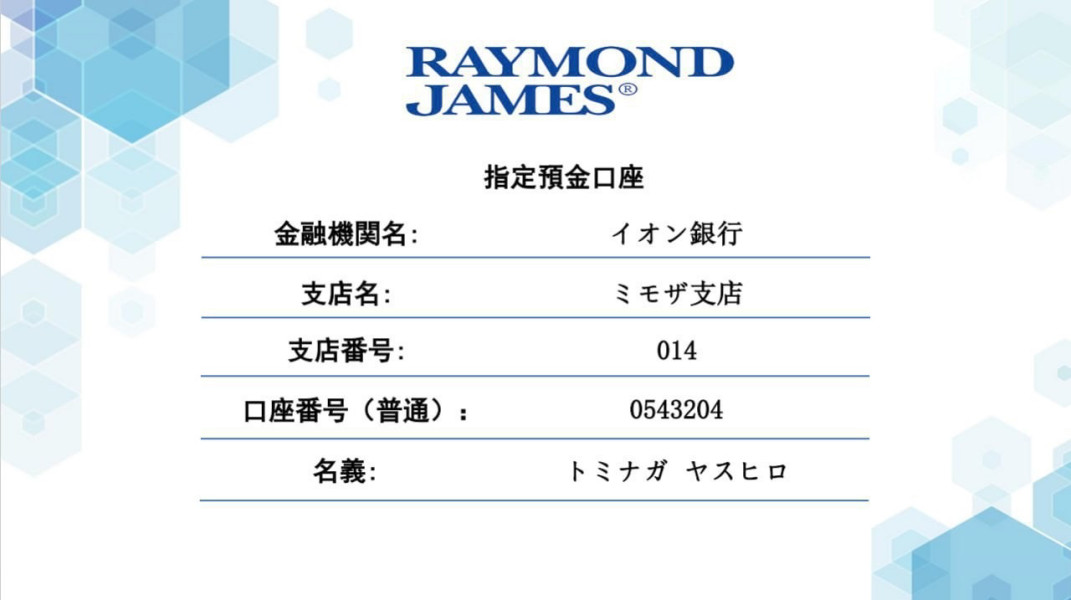

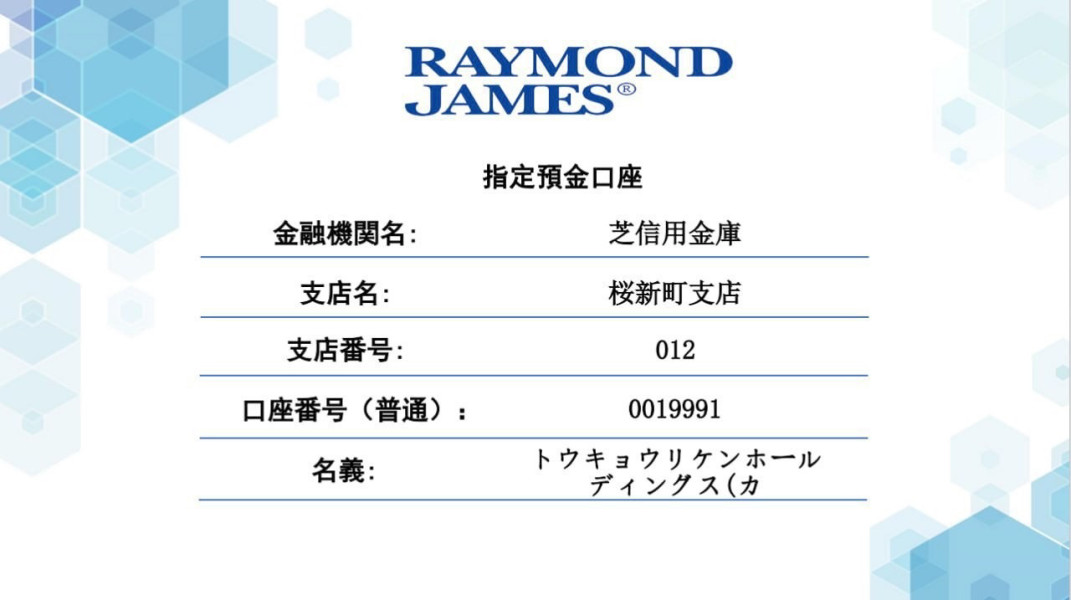

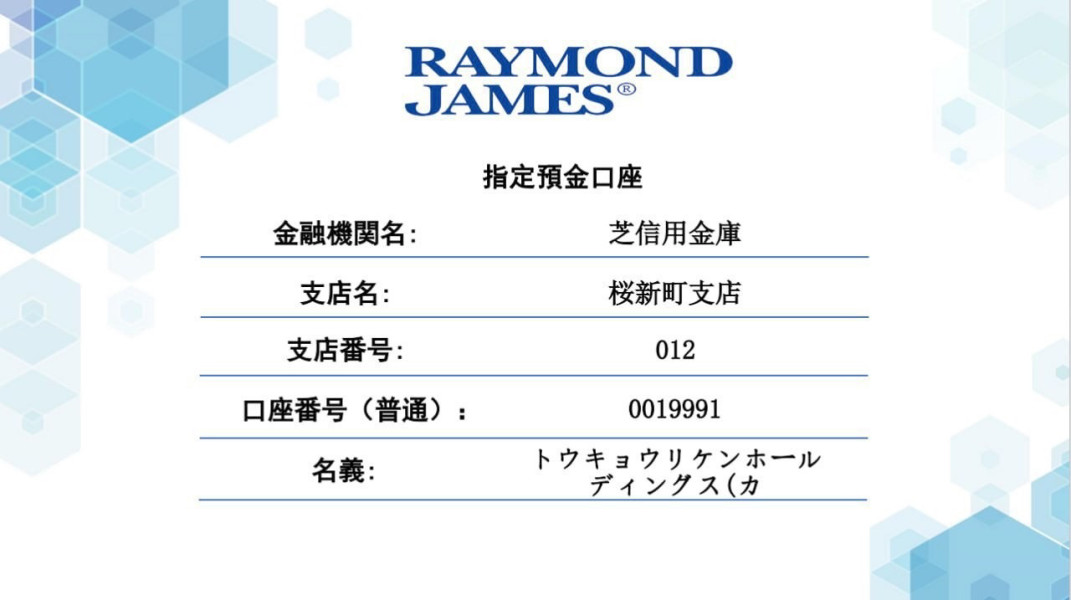

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal processes is not detailed in available documents, so clients need to talk directly with the firm for these operational details.

Minimum Deposit Requirements: Minimum investment amounts and account opening requirements are not listed in available materials, which means potential clients need direct communication with advisors to find out entry-level investment amounts.

Promotional Offers: Current bonus structures or promotional deals are not outlined in available sources, which means any special offers would need to be discussed directly with company representatives.

Tradeable Assets: While the company operates as a diversified financial services provider, specific asset classes and investment products available to clients are not fully detailed in public materials.

Cost Structure: Fee schedules, commission rates, and ongoing service charges are not clearly outlined in available documents, which is a big information gap for potential clients comparing costs.

Leverage Options: Leverage ratios and margin trading capabilities are not listed in available materials, which limits understanding of available trading options for qualified investors.

Platform Selection: Details about trading platforms, software options, and technology infrastructure are not provided in available sources, making it difficult to judge the firm's technological capabilities.

Geographic Restrictions: While the company operates in the United States, Canada, and overseas markets, specific regional limitations are not clearly defined in available documents.

Customer Service Languages: Multi-language support capabilities are not listed in available materials, though the firm's international presence suggests possible multilingual service availability.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Raymond James Financial's account conditions faces big limitations because there is not enough publicly available information about specific account types and their features. Available materials do not provide complete details about the variety of account options offered to different investor categories, making it challenging to judge the firm's competitiveness in this important area.

Minimum deposit requirements, which are a basic consideration for potential clients, are not listed in available documents. This lack of transparency about entry-level investment amounts creates uncertainty for future investors trying to determine their eligibility for various service levels. The missing clear minimum deposit information is different from industry standards where such details are usually prominently featured.

Account opening procedures and required documentation processes are similarly not documented in available sources. This information gap extends to specialized account types, such as retirement accounts, corporate accounts, or accounts designed for specific investor categories. The lack of detailed account condition information suggests potential clients would need to engage directly with company representatives to obtain basic account details.

Without access to complete account condition information, this raymond james financial review cannot provide a definitive assessment of this critical service component. Future clients should prioritize obtaining detailed account information during initial consultations to ensure the firm's offerings align with their specific investment needs and requirements.

Assessment of Raymond James Financial's trading tools and analytical resources encounters big limitations because there is not enough detailed information in available materials. The firm's technology infrastructure and analytical capabilities are important factors for modern investors, yet specific details about trading platforms and research tools are not fully documented in available sources.

Research and analysis resources, which form the backbone of informed investment decision-making, are not detailed in available documents. This information gap prevents evaluation of the firm's analytical capabilities, market research quality, and investment recommendation processes that clients typically expect from established financial services providers. Educational resources and investor training programs are similarly not documented in available materials.

Modern investors increasingly value complete educational support, making this information gap particularly significant for potential clients seeking to enhance their investment knowledge and skills through their chosen financial services provider. Automated trading support and algorithmic trading capabilities are not listed in available sources, limiting understanding of the firm's technological sophistication and ability to serve clients with advanced trading requirements. The missing detailed tool and resource information suggests potential clients would need direct consultation to assess the firm's technological capabilities and analytical support systems.

Customer Service and Support Analysis

Customer service evaluation reveals concerning patterns based on available user feedback, showing significant challenges in this critical service area. User reports suggest problematic experiences with certain financial advisors, with specific feedback mentioning manipulative and confusing practices that undermine client confidence and satisfaction. According to user testimonials, some clients have experienced situations where "Raymond James will never stand with the customers doesn't matter that the financial adviser is lying."

This feedback shows systemic issues with customer advocacy and support when conflicts arise between clients and advisors, suggesting inadequate internal oversight and client protection mechanisms. The missing detailed information about customer service channels, response times, and support availability further complicates assessment of the firm's customer service capabilities. Standard service metrics such as average response times, available communication channels, and service hour coverage are not listed in available documents.

Multi-language support capabilities and international customer service provisions are similarly not documented, despite the firm's international presence. This information gap particularly affects potential international clients seeking to understand available support options in their preferred languages and time zones. The combination of negative user feedback about advisor practices and limited transparency about service infrastructure raises significant concerns about the overall customer service experience potential clients might expect.

Trading Experience Analysis

Evaluation of the trading experience at Raymond James Financial faces big challenges because there is not enough information about platform performance, execution quality, and trading infrastructure. Available materials do not provide specific details about trading platform stability, execution speeds, or order processing capabilities that modern traders consider essential for effective market participation. Platform functionality and user interface design are not detailed in available sources, preventing assessment of the trading environment's usability and feature completeness.

This information gap extends to mobile trading capabilities, which have become increasingly important for active traders requiring market access across multiple devices and locations. Order execution quality metrics, including fill rates, slippage statistics, and execution speed benchmarks, are not provided in available documents. These technical performance indicators are important factors for traders evaluating potential trading partners, particularly for active trading strategies requiring reliable and efficient order processing.

Trading environment features such as advanced order types, risk management tools, and real-time market data access are similarly not documented in available materials. The missing complete trading experience information suggests potential clients would need extensive direct consultation to understand the firm's trading capabilities and technological infrastructure. This raymond james financial review cannot provide definitive assessment of trading experience quality without access to detailed platform specifications and performance metrics that would typically be available for complete evaluation.

Trust and Reliability Analysis

Trust and reliability assessment reveals mixed indicators that warrant careful consideration by potential clients. While Raymond James Financial's status as a public company since 1983 provides some level of transparency through required financial reporting, specific regulatory oversight details remain unclear in available documents. The company's long-standing market presence since 1962 and substantial client asset base of $1.92 billion suggest established operational stability and market credibility.

Additionally, national recognition for community support and corporate philanthropy indicates positive corporate citizenship and social responsibility commitment. However, concerning user feedback about advisor practices and customer support raises significant trust-related questions. Reports of manipulative practices and inadequate customer advocacy suggest potential systemic issues that could undermine client confidence and financial security.

The missing detailed information about client fund protection measures, regulatory compliance programs, and internal oversight mechanisms creates additional uncertainty about the firm's reliability safeguards. Standard industry protections such as account insurance coverage, segregated fund storage, and regulatory audit results are not clearly documented in available materials. Third-party ratings and independent industry evaluations are not fully available in available sources, limiting external validation of the firm's trustworthiness and operational reliability.

This information gap prevents comparison with industry standards and peer performance metrics.

User Experience Analysis

User experience evaluation reveals a complex picture with mixed feedback patterns that require careful interpretation. Available user ratings show a 4.1 out of 5 overall score, suggesting generally positive user satisfaction levels, though this must be balanced against specific negative feedback about advisor practices and customer support quality. Positive aspects of user experience appear to stem from the company's established market presence and complete service offerings that appeal to investors seeking diversified financial services.

The firm's recognition for corporate philanthropy and community support may contribute to positive brand perception among socially conscious investors. However, significant negative feedback about specific advisor practices creates concerning user experience patterns. Reports describing certain financial advisors as engaging in questionable practices and the company's alleged failure to support customers during disputes indicate serious user experience challenges that could affect client satisfaction and retention.

Interface design and platform usability information are not detailed in available sources, preventing assessment of the technological user experience components. This information gap extends to account management processes, document access systems, and online service capabilities that increasingly influence overall user satisfaction. The registration and verification process details are similarly not documented, though these initial user interactions significantly impact overall experience perceptions.

Without complete user experience metrics and detailed feedback analysis, potential clients should conduct thorough due diligence and consider direct consultations to assess compatibility with their service expectations.

Conclusion

This raymond james financial review presents a nuanced evaluation of a long-established financial services firm with both positive and concerning characteristics. While Raymond James Financial's six-decade market presence and substantial client asset base demonstrate operational stability, significant transparency limitations and mixed user feedback create important considerations for potential clients. The firm appears most suitable for investors seeking diversified financial services from an established provider with extensive advisor networks and complete service capabilities.

However, the lack of detailed information about trading conditions, regulatory oversight, and service specifications requires potential clients to conduct extensive direct consultation before making commitment decisions. Primary advantages include the company's established market presence since 1962, substantial client asset management capabilities, and national recognition for corporate social responsibility. Conversely, significant disadvantages include limited transparency about operational details, concerning user feedback about advisor practices, and insufficient publicly available information about customer protection measures and service conditions.