DUX HOLDING 2025 Review: Everything You Need to Know

Summary

DUX HOLDING presents a complex picture in the forex trading landscape. This dux holding review offers a balanced assessment that traders need to see. The company started in 2022 and operates from Hong Kong, offering trading services across multiple asset classes including foreign exchange, commodities, indices, and cryptocurrencies. The broker entered the market recently, and user feedback shows mixed results, so potential clients should think carefully before choosing this platform.

The broker's main appeal comes from its diverse trading options. Traders can access various financial instruments through one platform, which saves time and effort. But the short operational history and worrying user reports create big concerns for potential clients. Information from trust-radar.com and WikiBit shows that user experiences vary a lot, with some traders raising serious concerns about whether the platform is legitimate.

This detailed evaluation helps traders who want multi-asset trading opportunities. However, they must weigh these benefits against potential risks that could affect their investments. The mixed user feedback ranges from standard trading experiences to more serious problems, which means prospective clients should do extra research before using DUX HOLDING's services.

Important Notice

Regional Entity Differences: DUX HOLDING's regulatory status changes significantly across different areas. Specific regulatory information stays limited in available documents, which creates uncertainty for international traders. Traders in different regions may face varying levels of legal protection and regulatory oversight. The lack of clearly disclosed regulatory credentials in primary sources raises important questions for international clients.

Review Methodology: This assessment uses publicly available information, user feedback from multiple sources, and industry reports. The evaluation does not include direct testing of the platform or first-hand checking of all claims, which limits the scope of our findings. Readers should do independent research and consider talking with financial advisors before making trading decisions.

Rating Overview

Broker Overview

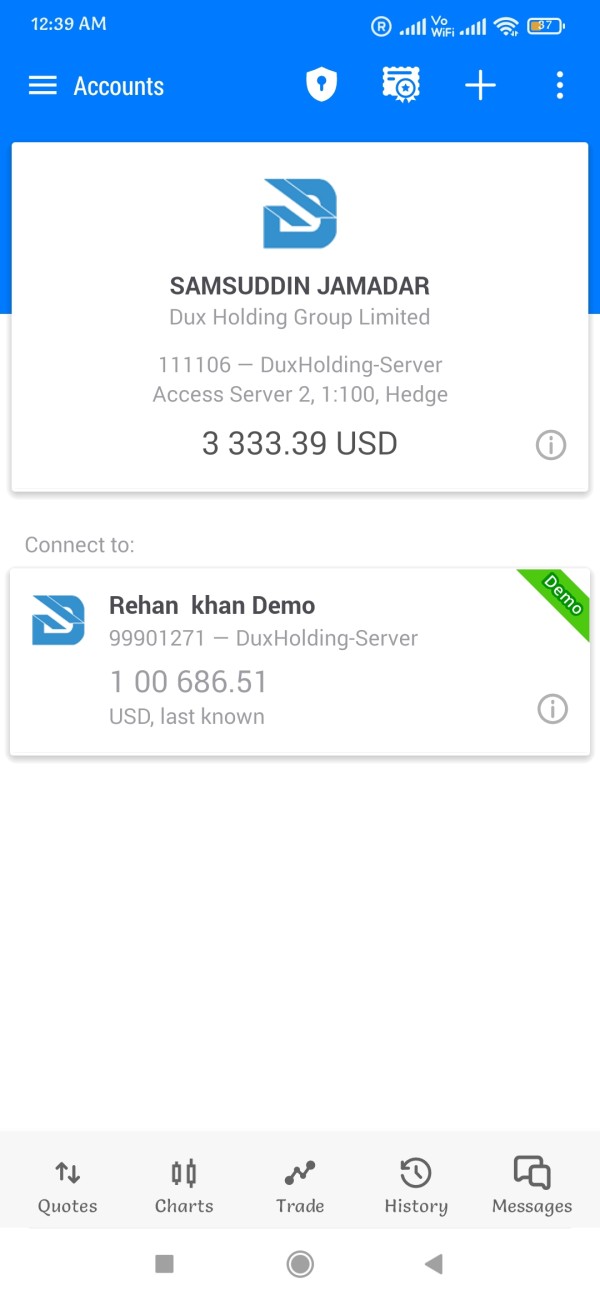

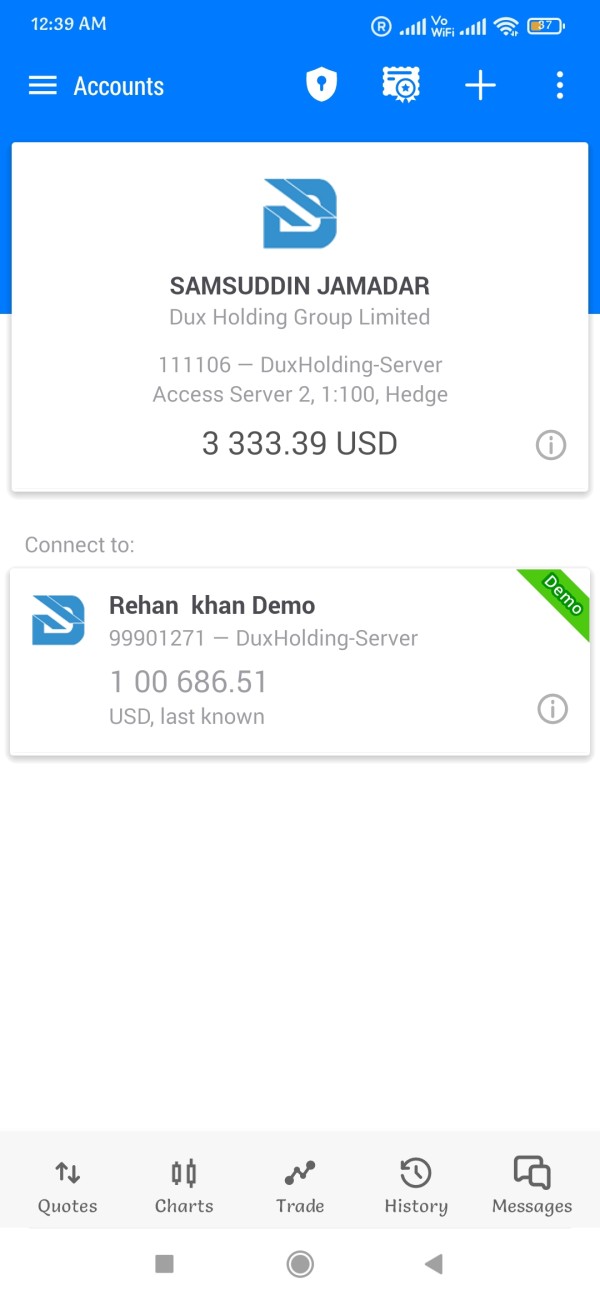

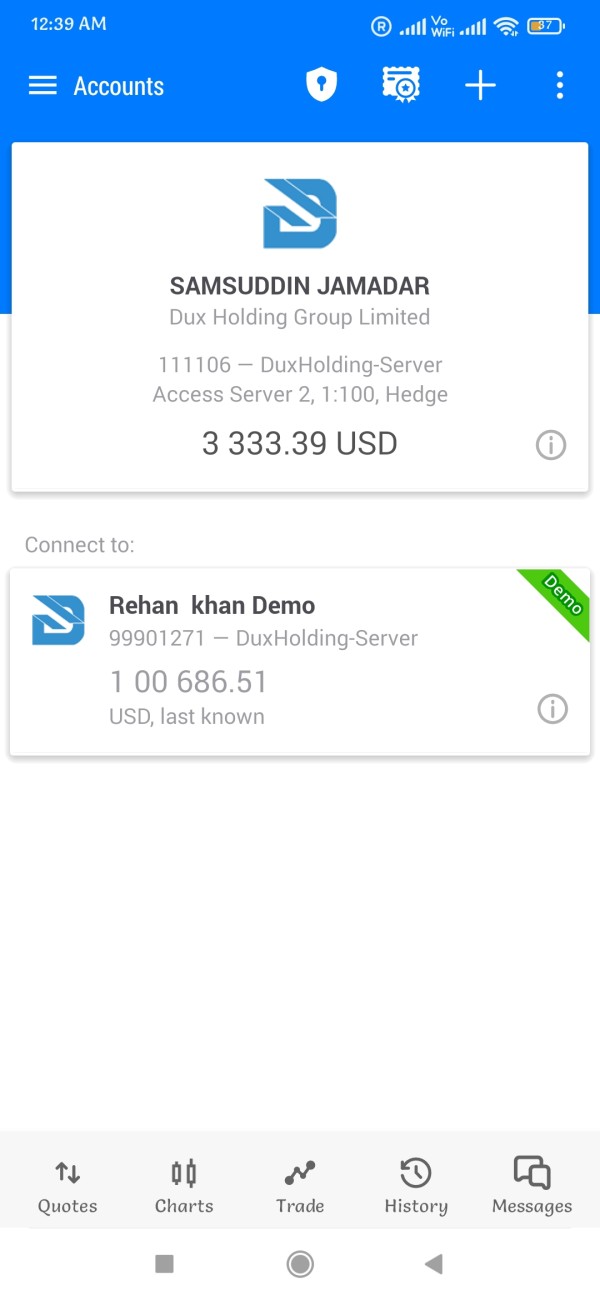

DUX HOLDING entered the competitive forex market in 2022. The company positions itself as a multi-asset trading provider based in Hong Kong, targeting traders who want comprehensive market access. The business model centers on providing access to diverse financial markets, including traditional forex pairs, commodity futures, major stock indices, and the growing cryptocurrency sector. WikiBit's company profile shows that DUX HOLDING aims to serve traders seeking broad market exposure through one unified trading environment.

The broker's recent establishment reflects how dynamic the modern forex industry has become. New companies frequently try to capture market share through innovative offerings or competitive positioning, but this creates challenges for evaluation. This dux holding review must acknowledge that the company's limited operational history provides fewer data points for comprehensive assessment compared to more established market participants.

DUX HOLDING's service portfolio includes foreign exchange trading across major, minor, and exotic currency pairs. The company also provides access to precious metals, energy commodities, and agricultural products, giving traders multiple options for portfolio diversification. The inclusion of cryptocurrency trading aligns with current market trends, though specific details about supported digital assets remain limited in available documentation. The multi-asset approach suggests the company targets traders who prefer consolidated account management rather than maintaining relationships with multiple specialized brokers.

Regulatory Status: Available documentation does not specify concrete regulatory oversight. This creates uncertainty about the broker's compliance framework and client protection measures, which are essential for trader safety.

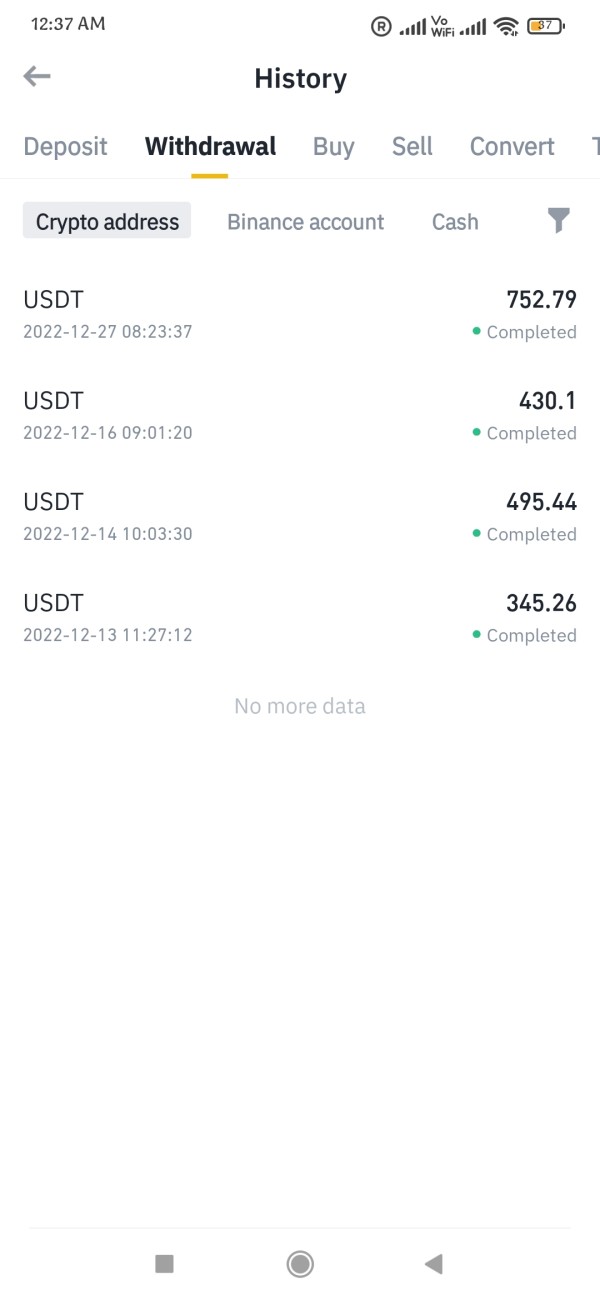

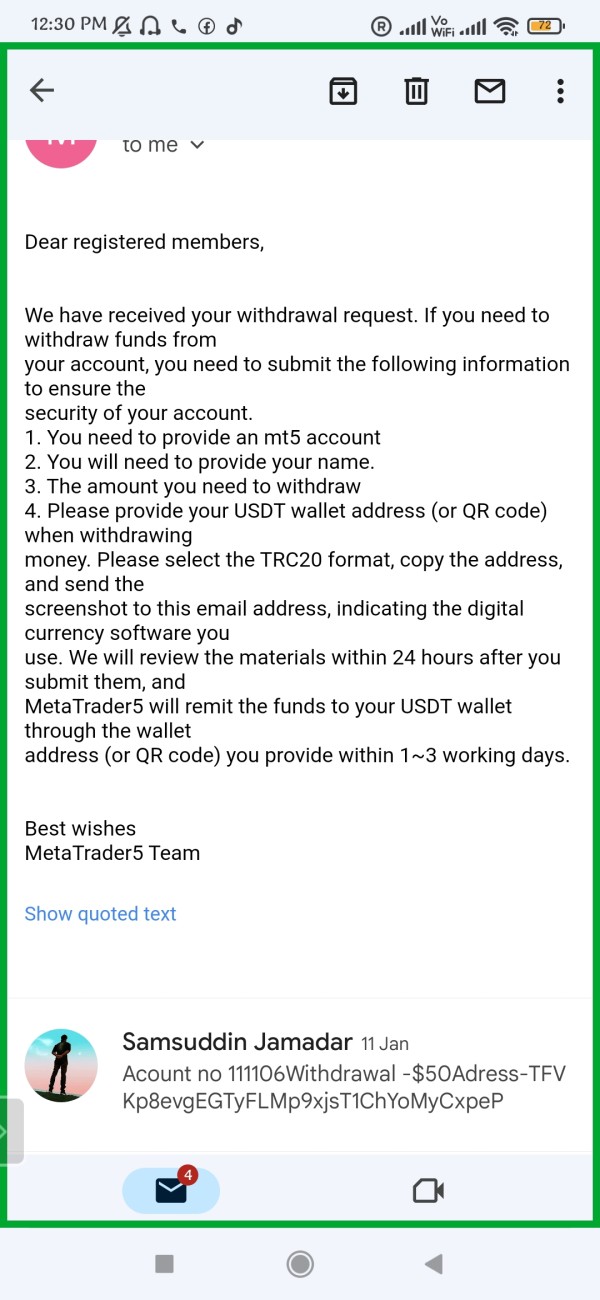

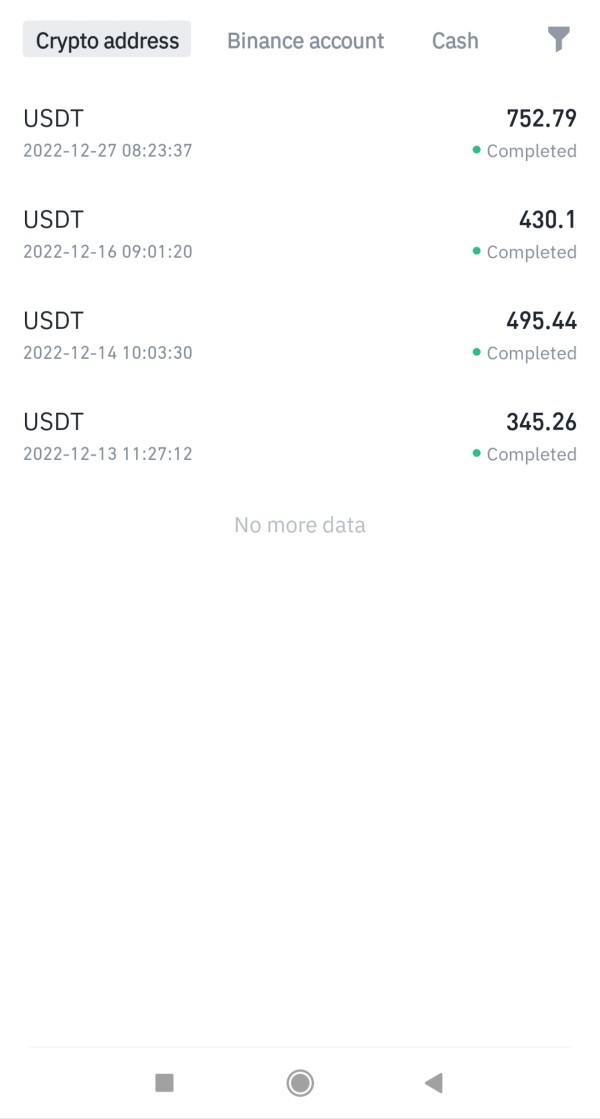

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in current available sources.

Minimum Deposit Requirements: The exact minimum deposit threshold has not been disclosed in accessible company materials or third-party reviews.

Promotional Offers: Current bonus structures, welcome promotions, or loyalty programs are not specified in available documentation.

Tradeable Assets: The platform provides access to forex currency pairs, commodities including precious metals and energy products, major stock indices, and cryptocurrency instruments. However, the complete asset list requires direct platform verification to confirm all available options.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not comprehensively available in current sources. Traders need to contact the broker directly to get this important pricing information.

Leverage Ratios: Specific leverage offerings across different asset classes and account types are not detailed in accessible documentation.

Platform Options: The trading platform technology and available software solutions are not specifically identified in current dux holding review materials.

Geographic Restrictions: Specific country limitations or regional service restrictions are not clearly outlined in available sources.

Customer Support Languages: The range of supported languages for customer service interactions is not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The assessment of DUX HOLDING's account conditions faces big limitations due to insufficient publicly available information. This dux holding review cannot identify distinct account tiers, their respective features, or the criteria for accessing different service levels, which makes evaluation difficult. The absence of clear minimum deposit information creates uncertainty for potential clients trying to understand entry requirements.

Account opening procedures and verification processes are not detailed in accessible sources. This makes it hard for prospective traders to understand what to expect during onboarding, which can lead to surprises or delays. The lack of information about specialized account types, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits how well we can evaluate whether the broker accommodates diverse client needs.

User feedback from various review platforms suggests mixed experiences with account setup and management. However, specific details remain limited, which makes it hard to identify patterns or common issues. The company's recent establishment means fewer long-term account holders can provide comprehensive feedback about account condition stability and how things have changed over time.

The scoring reflects the significant information gaps and the challenges these create for potential clients. Traders seeking to make informed decisions about account suitability and long-term trading relationship viability will find it difficult to get the information they need.

DUX HOLDING's tools and resources receive a moderate rating based on the multi-asset trading capability mentioned in available sources. The broker offers forex, commodities, indices, and cryptocurrency trading, which suggests some level of platform sophistication that could benefit traders. However, specific analytical tools and research resources are not detailed in current documentation, making it hard to assess the full value proposition.

The absence of information about charting capabilities, technical analysis tools, economic calendar integration, or market research provision limits comprehensive evaluation. Modern traders typically expect sophisticated charting packages, real-time market data, and comprehensive research materials to make informed trading decisions. The availability of these resources through DUX HOLDING remains unclear, which creates uncertainty about the platform's analytical support.

Educational resources have become increasingly important for broker differentiation and client development. These resources are not specifically mentioned in available materials, which suggests either limited educational support or insufficient documentation of existing resources. Traders who value learning opportunities may find this gap concerning, especially newer traders who rely on educational content to improve their skills.

Automated trading support, including expert advisor compatibility or algorithmic trading capabilities, is not addressed in current sources. This gap is significant given the growing importance of automated trading strategies in modern forex markets, where many successful traders rely on algorithmic approaches.

Customer Service and Support Analysis (Score: 4/10)

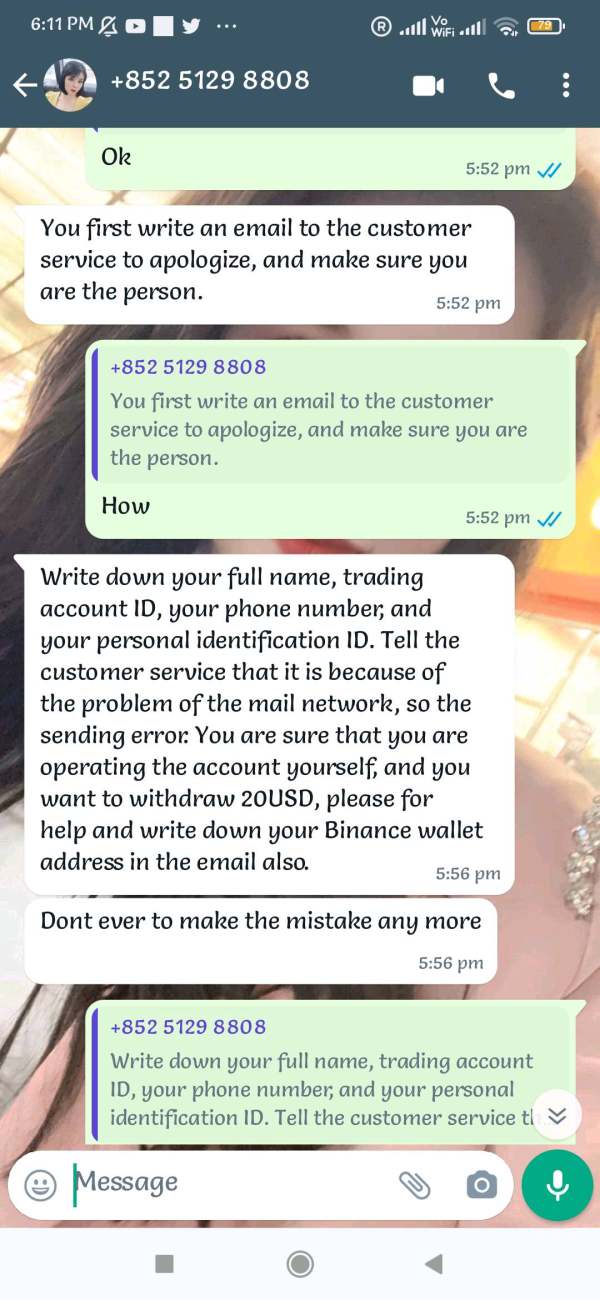

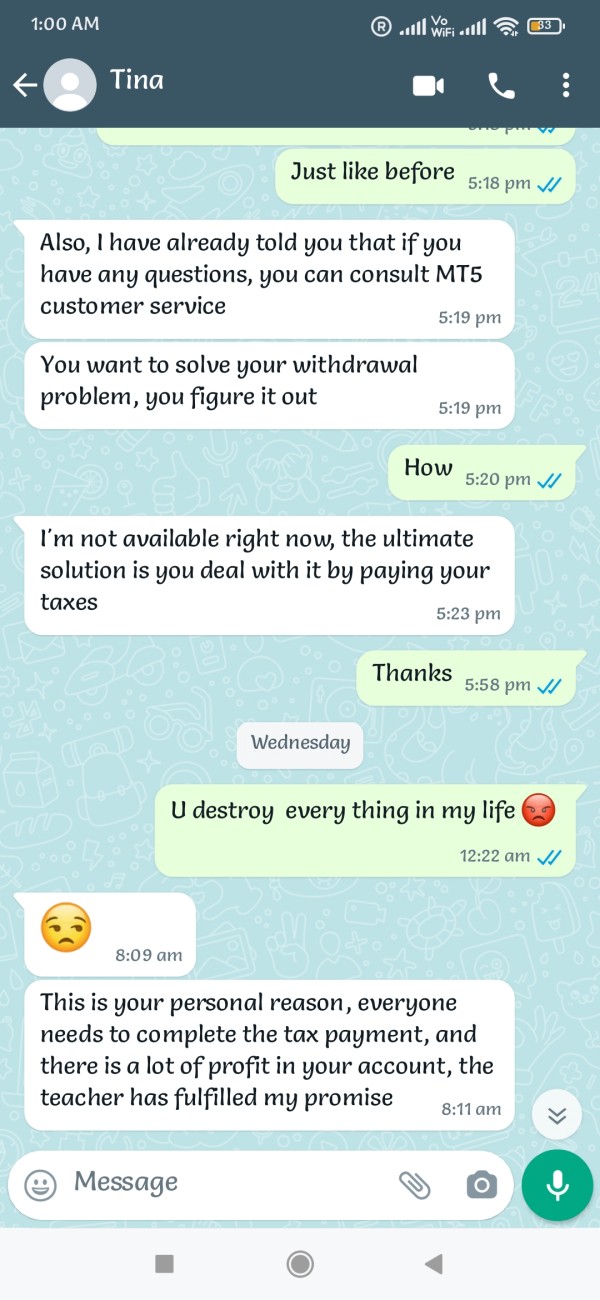

Customer service evaluation for DUX HOLDING reveals concerning limitations based on available user feedback and documented support channels. Available information shows that customer support primarily operates through email and telephone channels, but the quality and responsiveness of these services receive mixed reviews from users. This creates uncertainty about whether traders can get help when they need it most.

The absence of live chat support creates a significant disadvantage in today's forex industry. Live chat has become a standard expectation because traders often need immediate assistance during active trading sessions when markets move quickly. Without this option, traders may face delays in getting help during critical moments.

User feedback from various review platforms indicates inconsistent service quality throughout the organization. Some clients report satisfactory interactions while others express frustration with support responsiveness and problem resolution effectiveness, creating an unpredictable support experience. The limited operational history of the company may contribute to these inconsistent support experiences as procedures and staff expertise continue to develop.

Multilingual support capabilities are not clearly documented in available sources. This potentially limits accessibility for non-English speaking traders who need support in their native language. The lack of comprehensive support hour information also creates uncertainty about availability during different global trading sessions, which is important for international traders.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation for this dux holding review encounters significant challenges due to limited specific information about platform performance. Without clear identification of the trading platform technology or software provider, assessing stability, speed, and functionality becomes very difficult. This lack of transparency makes it hard for potential clients to understand what they can expect from the trading environment.

Order execution quality, including fill rates, slippage characteristics, and requote frequency, is not documented in available sources. These factors are crucial for trader satisfaction and profitability because they directly affect trading results and costs. Their absence in evaluation materials is particularly concerning for potential clients who need to understand execution quality before committing funds.

User feedback regarding trading experience appears mixed throughout various review platforms. Some reports raise concerns about platform reliability and execution practices, which could affect trader profitability and satisfaction. However, the limited volume of detailed user reviews makes comprehensive assessment challenging, and the company's recent establishment means fewer traders have extensive experience to share with potential clients.

Mobile trading capabilities are essential for modern forex trading but are not specifically addressed in current documentation. The absence of information about mobile app availability, functionality, or performance represents a significant gap in understanding the complete trading experience offering, especially for traders who need to manage positions while away from their computers.

Trustworthiness Analysis (Score: 3/10)

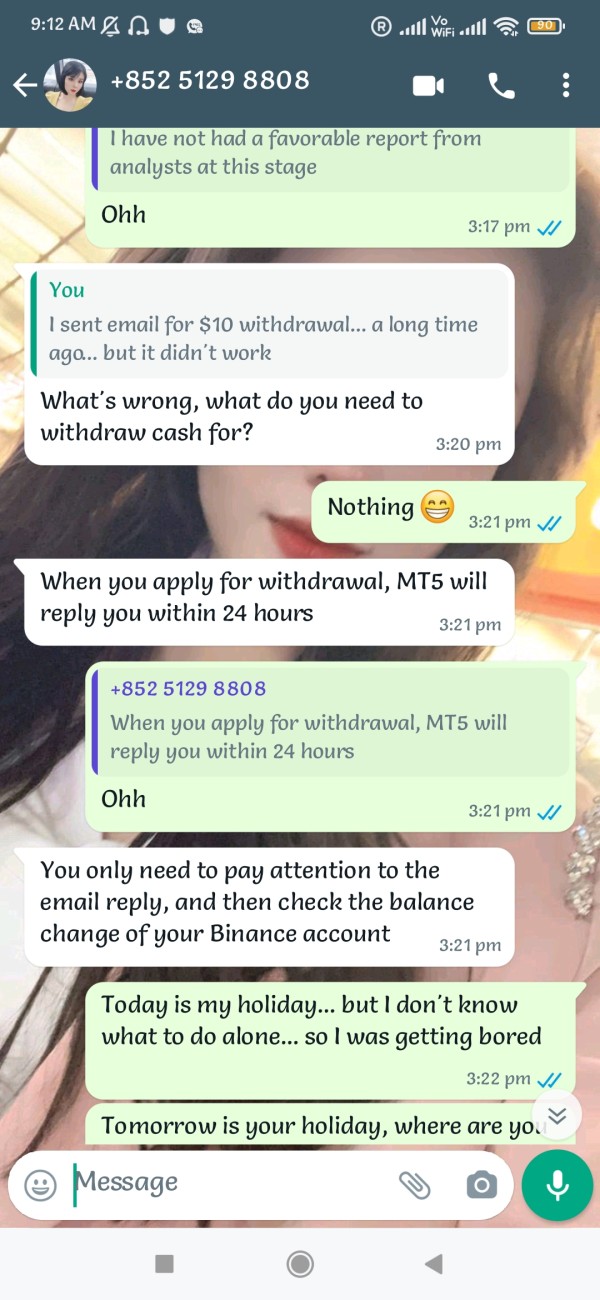

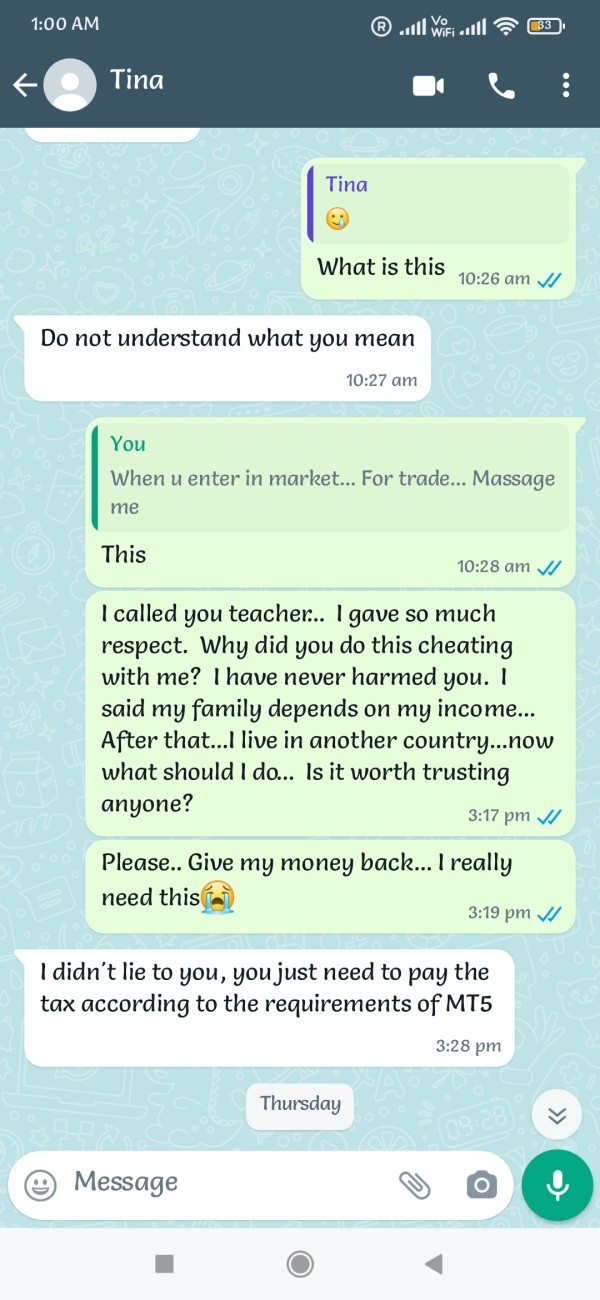

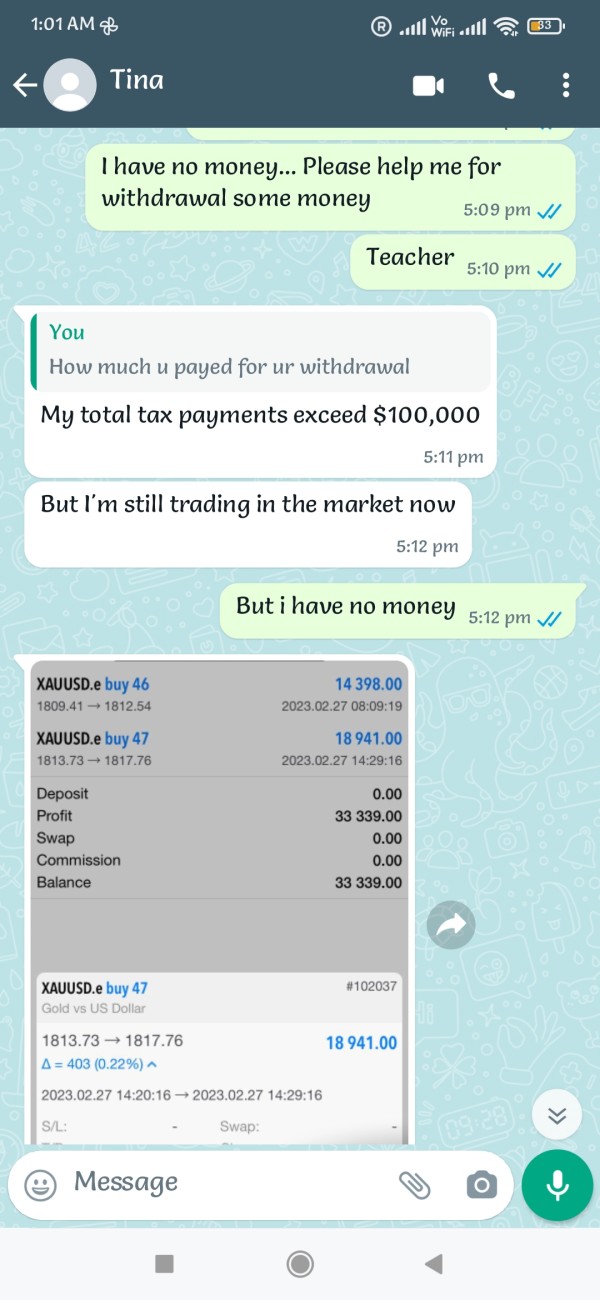

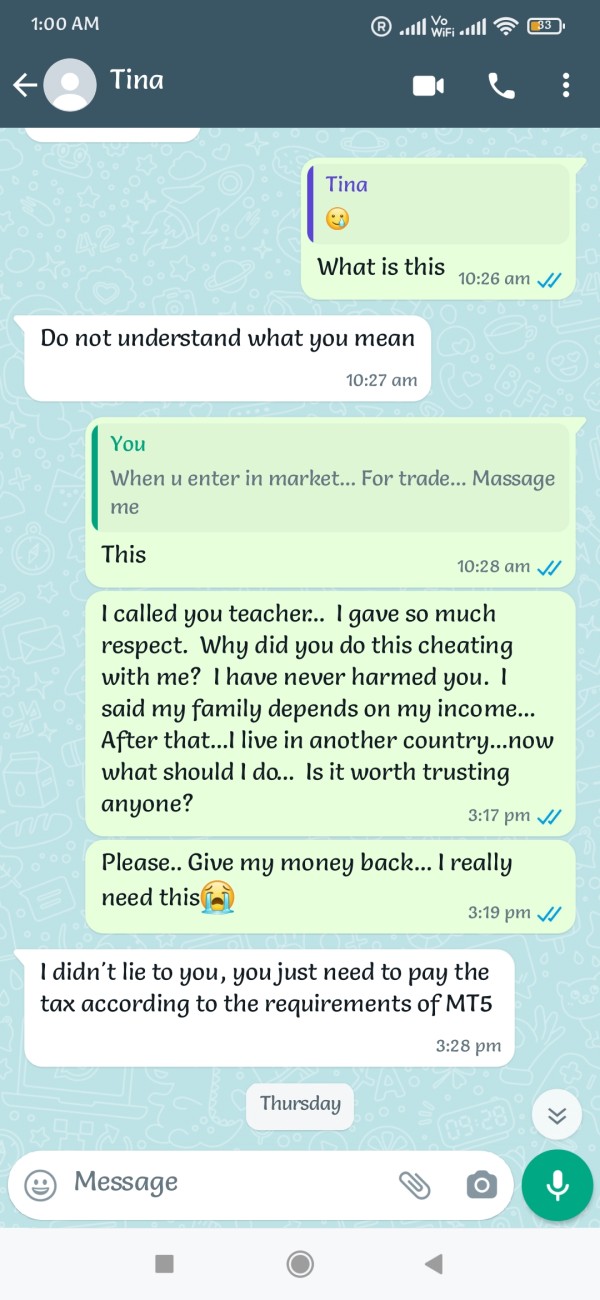

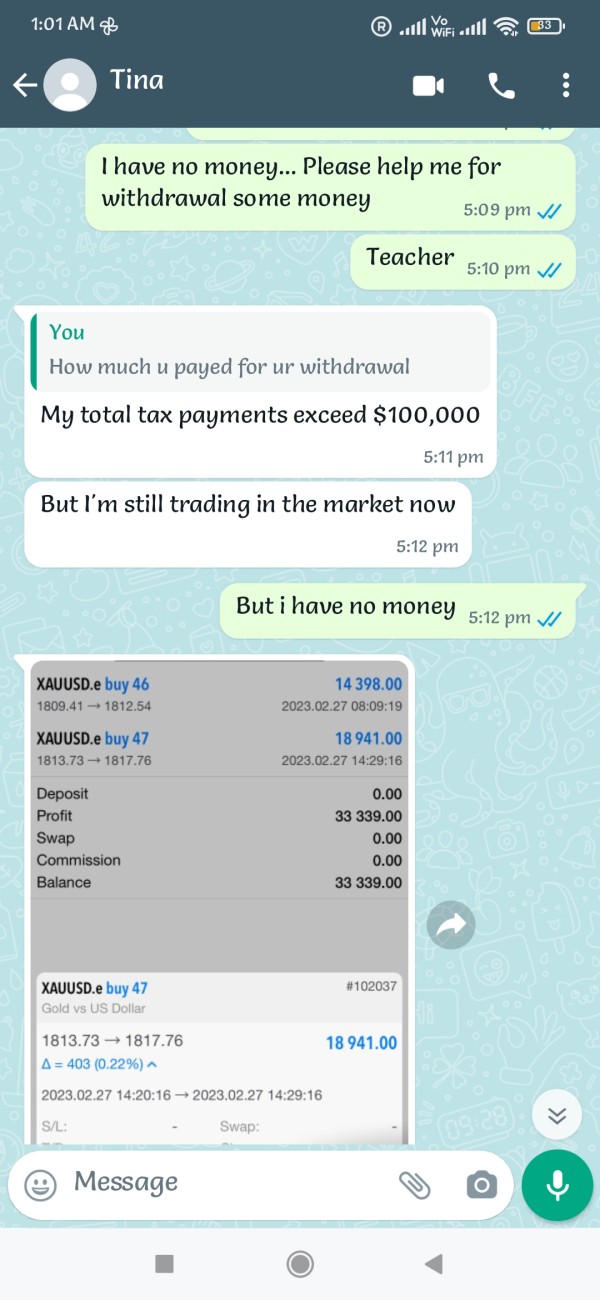

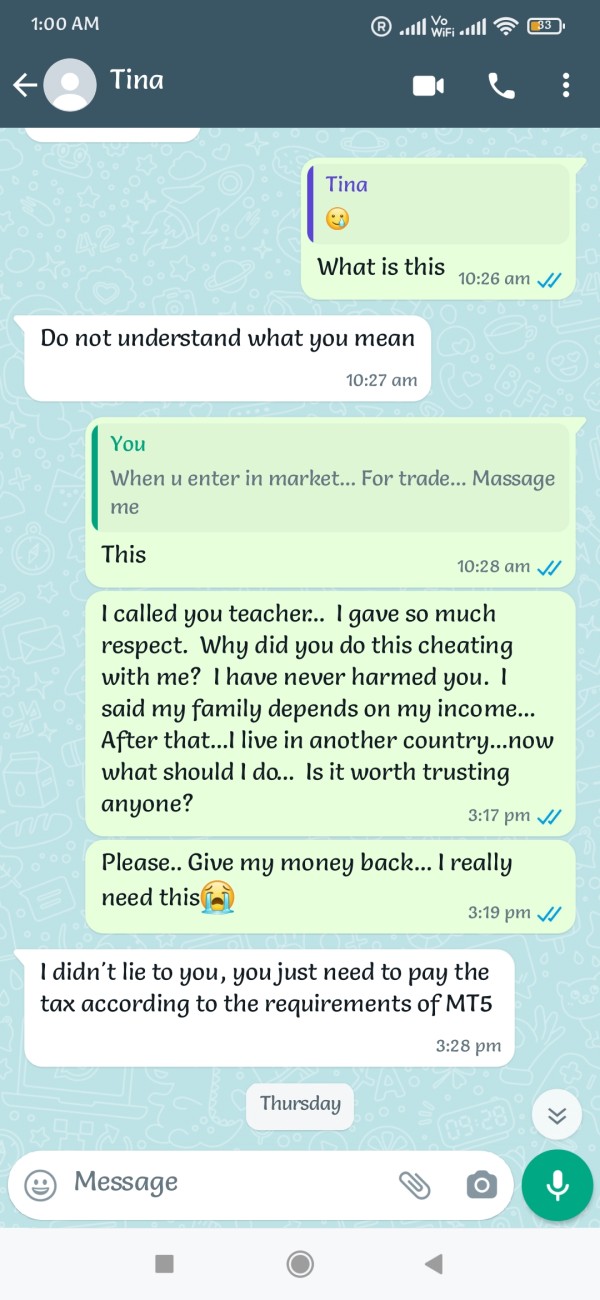

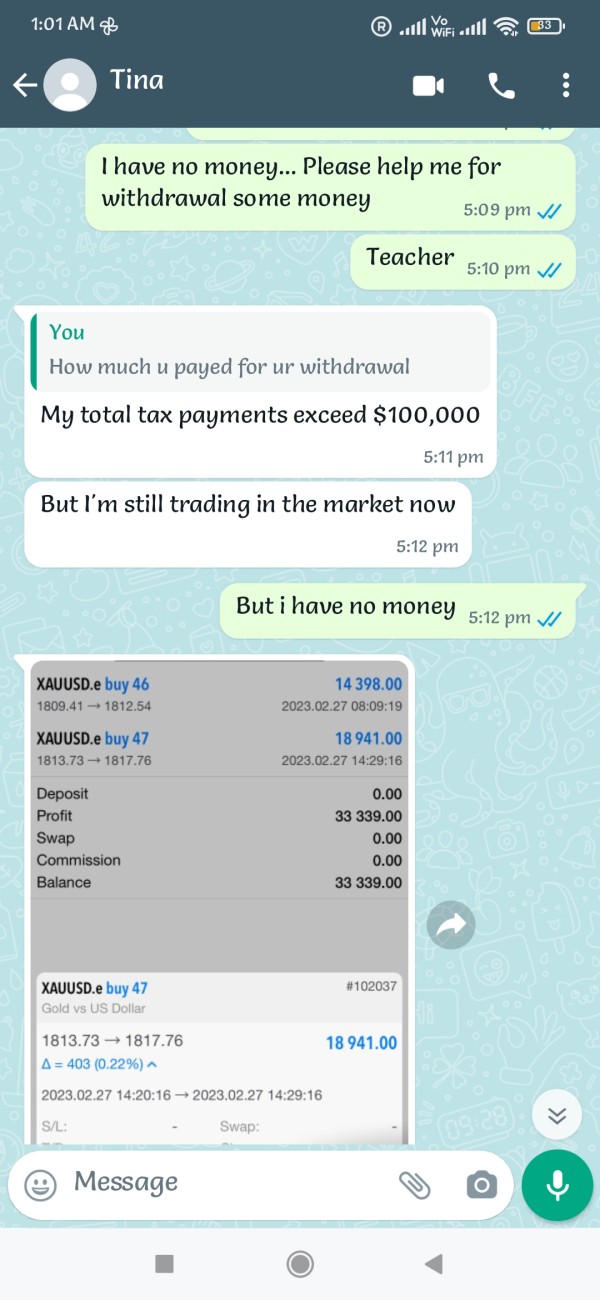

Trustworthiness represents the most concerning aspect of DUX HOLDING's evaluation. This dimension earns the lowest score in this comprehensive assessment due to several serious red flags that potential clients must consider. Reports from trust-radar.com show that some users have raised serious allegations about the platform's legitimacy, with warnings about potential fraudulent activities creating significant concerns for prospective clients.

The absence of clearly documented regulatory oversight makes trust concerns even worse. Regulatory supervision provides essential client protections and operational standards that help ensure fair treatment and proper business practices. Without transparent regulatory compliance information, traders cannot verify the broker's adherence to industry standards or access regulatory complaint mechanisms if problems arise.

Fund security measures, including client money segregation, deposit insurance, or compensation schemes, are not detailed in available documentation. These protections are fundamental for client confidence and represent industry best practices that legitimate brokers typically highlight prominently in their marketing materials. The lack of information about these safeguards raises questions about client fund protection.

The company's limited operational history, while not inherently negative, provides fewer reference points for assessing long-term reliability and stability. Combined with concerning user reports and regulatory uncertainty, this creates a challenging environment for building client trust and confidence in the platform's legitimacy.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with DUX HOLDING presents a complex picture based on available feedback from various review platforms. The mixed nature of user experiences ranges from standard trading interactions to serious concerns about platform legitimacy, which creates significant considerations for potential clients. This wide range of experiences makes it difficult to predict what new users might encounter.

Interface design and platform usability information is not comprehensively available in current sources. This makes it difficult to assess the user-friendliness of the trading environment, which is important for trader productivity and satisfaction. Modern traders expect intuitive interfaces, efficient navigation, and responsive design across devices, but the evaluation of these factors remains limited by information availability.

Registration and account verification experiences are not detailed in current sources for proper assessment. User feedback suggests varying experiences with onboarding processes, which can significantly impact initial impressions and long-term satisfaction. The efficiency and transparency of these procedures often determine whether new clients have a positive start with the platform.

Common user complaints, based on available review information, include concerns about customer service responsiveness and more serious allegations about platform reliability. The presence of fraud warnings from some users creates particular concern for the overall user experience assessment and affects whether this platform can be recommended to potential traders.

Conclusion

This comprehensive dux holding review reveals a broker requiring significant caution from potential clients. DUX HOLDING offers multi-asset trading capabilities across forex, commodities, indices, and cryptocurrencies, which could appeal to traders seeking diverse investment options. However, substantial concerns about trustworthiness and user experience create important considerations that prospective traders cannot ignore.

The broker may appeal to traders seeking diversified asset access through a single platform. This is particularly true for those interested in cryptocurrency trading alongside traditional forex instruments, as the combined offering could simplify portfolio management. However, the concerning user reports, limited regulatory transparency, and information gaps suggest that only highly experienced traders comfortable with elevated risk should consider this platform.

The primary advantages include multi-asset trading capabilities and relatively recent market entry with potentially innovative approaches. These features could benefit traders who value convenience and want exposure to multiple markets through one account. However, significant disadvantages include trust concerns, limited regulatory disclosure, mixed user feedback, and insufficient transparency about trading conditions and platform specifications that make informed decision-making difficult.