Is DUX HOLDING safe?

Business

License

Is Dux Holding Safe or Scam?

Introduction

Dux Holding is a relatively new player in the forex market, having been established in Hong Kong in 2022. The broker positions itself as a provider of diverse trading opportunities, including forex, commodities, and cryptocurrencies. However, the rapid growth of online trading has also led to an increase in fraudulent schemes, making it essential for traders to carefully evaluate the legitimacy and safety of their chosen brokers. In this article, we will investigate whether Dux Holding is a scam or if it can be considered a safe trading platform. Our analysis will be based on a thorough examination of the broker's regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any trading platform. A regulated broker is subject to oversight by financial authorities, which helps ensure transparency and protect investors. Dux Holding, however, operates without any valid regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Dux Holding does not adhere to the stringent standards set by recognized financial authorities. This lack of oversight leaves traders vulnerable to potential fraud, as unregulated brokers are not held accountable for their actions. Furthermore, the absence of a regulatory framework can lead to inadequate dispute resolution mechanisms, putting traders at risk if issues arise.

Company Background Investigation

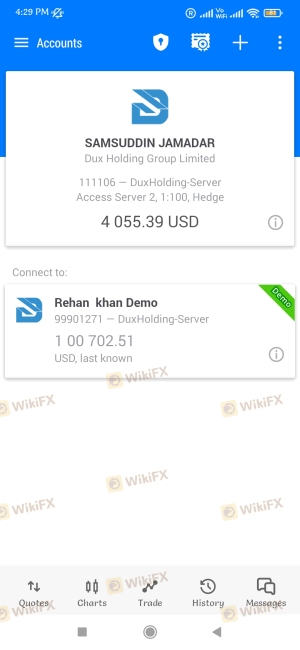

Dux Holding Group Limited claims to offer a broad range of trading services, but its background raises several red flags. Established in 2022, the company is relatively new and lacks a substantial track record. Its ownership structure is not transparent, and there is limited information available about its management team. This opacity is concerning, as reputable brokers typically disclose their leadership and operational details to instill confidence among prospective clients.

Moreover, the company's website is often reported as inaccessible, further complicating the ability to gather information about its operations and policies. This lack of transparency is a significant factor when assessing whether Dux Holding is a scam or a safe option for traders. Without clear information regarding its management and operational history, potential clients should approach this broker with caution.

Trading Conditions Analysis

The trading conditions offered by Dux Holding could be appealing at first glance, but a closer look reveals some concerning aspects. The broker offers various account types with different leverage ratios and spreads. However, the unregulated status of the broker raises concerns about the overall fairness of its trading conditions.

| Fee Type | Dux Holding | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0-1.5 pips |

| Commission Structure | Variable | Low to None |

| Overnight Interest Range | Unknown | 0.5%-1.5% |

While competitive spreads can be attractive, the absence of a clear commission structure and the potential for hidden fees can lead to unexpected costs for traders. Furthermore, unregulated brokers often employ questionable fee policies, which can lead to diminished profits or increased losses for traders. This raises the question: is Dux Holding safe for traders looking to maximize their returns?

Customer Funds Security

The safety of customer funds is paramount when evaluating any trading platform. Dux Holding's lack of regulation means that there are no mandatory investor protection measures in place. This is a significant concern, as traders' funds may not be safeguarded in the event of insolvency or fraudulent activities.

Dux Holding does not provide information regarding fund segregation or negative balance protection, both of which are essential for ensuring the safety of client funds. The absence of these measures indicates a higher risk for traders, as they may not have recourse to recover their investments if the broker engages in malpractices or faces financial difficulties.

Customer Experience and Complaints

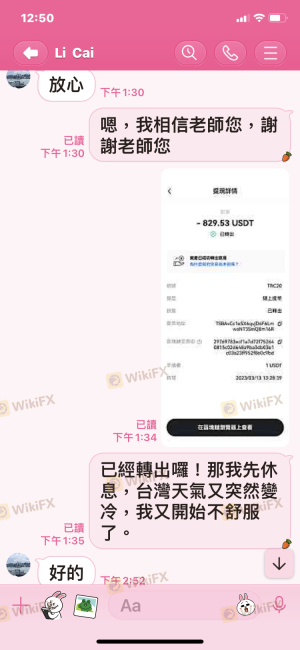

Customer feedback is a crucial indicator of a broker's reliability. Unfortunately, reviews of Dux Holding reveal a pattern of negative experiences among users. Many traders report difficulties in withdrawing their funds, with some claiming they were pressured to deposit additional amounts before being allowed to access their accounts.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| High Pressure Sales Tactics | Medium | Inadequate |

| Lack of Customer Support | High | Poor |

These complaints suggest that Dux Holding may engage in practices commonly associated with scam brokers, such as delaying withdrawals and employing aggressive sales tactics. The overall lack of responsiveness from the company further compounds these issues, leading to frustration among clients who seek assistance.

Platform and Trade Execution

When assessing whether Dux Holding is safe, it is vital to evaluate the performance of its trading platform. The broker claims to offer a user-friendly interface with various trading tools, but many users report issues with stability and execution quality. Instances of slippage and order rejections have been noted, raising concerns about the platform's reliability.

Moreover, the absence of a well-established trading infrastructure can lead to manipulation risks, where brokers may influence market prices to their advantage. This further emphasizes the importance of trading with a regulated broker, as regulatory oversight helps mitigate such risks.

Risk Assessment

Using Dux Holding comes with a range of risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of investor protection measures. |

| Withdrawal Risk | High | Reports of difficulty in accessing funds. |

Given these risks, it is crucial for traders to approach Dux Holding with caution. Seeking alternative, regulated brokers can provide a safer trading environment and better protections for their investments.

Conclusion and Recommendations

In conclusion, the investigation into Dux Holding raises significant concerns regarding its legitimacy and safety. The broker's unregulated status, lack of transparency, and negative customer feedback strongly suggest that it may not be a safe option for traders.

For those considering trading with Dux Holding, it is essential to weigh the risks carefully. We recommend exploring regulated alternatives that provide robust investor protection and transparent trading conditions. Brokers such as IG, OANDA, or Forex.com are known for their regulatory compliance and commitment to client safety, making them more suitable options for traders seeking a secure trading environment.

Ultimately, is Dux Holding safe? The evidence points to significant risks, and potential traders should proceed with extreme caution.

Is DUX HOLDING a scam, or is it legit?

The latest exposure and evaluation content of DUX HOLDING brokers.

DUX HOLDING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DUX HOLDING latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.