DSG 2025 Review: Everything You Need to Know

Summary

This comprehensive dsg review evaluates DSG Group's performance across multiple dimensions based on available user feedback and company information. DSG Group positions itself as an innovative car finance provider. The company commits to making automotive financing more accessible, efficient, and cost-effective for consumers. DSG emphasizes simplicity without compromising on options. They offer a wide range of financing solutions through their group of brands.

However, our analysis reveals mixed results in terms of overall performance. DSG Group demonstrates certain strengths in their business model and industry expertise, but there are notable concerns regarding transparency and regulatory clarity. The company's team consists of highly experienced motor sector professionals. This represents a positive aspect of their service delivery. Their integrated approach to car finance solutions suggests a comprehensive understanding of customer needs. This understanding applies specifically to the automotive financing space.

The evaluation indicates that DSG primarily targets consumers seeking automotive financing solutions. Their services are designed to create optimal outcomes through diverse financing options. Despite their stated commitment to cost-effectiveness and accessibility, the lack of detailed regulatory information and limited transparency in certain operational aspects raises questions. These questions concern their overall market positioning and trustworthiness in the current financial services landscape.

Important Notice

This dsg review is based on publicly available information and company materials. Due to the limited regulatory information available in our research, potential clients should exercise caution. They should conduct additional due diligence before engaging with DSG's services. Different regional entities may operate under varying regulatory frameworks. Services may differ significantly across jurisdictions.

The evaluation methodology employed in this review considers company background, stated business objectives, available user feedback, and industry positioning. However, readers should note that comprehensive regulatory verification and detailed operational analysis require additional investigation. This investigation goes beyond the scope of this assessment.

Rating Framework

Based on available information, DSG receives the following ratings across six key dimensions:

Broker Overview

DSG Group operates as a specialized financial services provider focused on automotive financing solutions. The company's mission centers on driving innovation in car finance. They have a stated commitment to making financing more accessible, efficient, and cost-effective for all customers. Their business model emphasizes creating comprehensive solutions that deliver the widest range of finance options. They maintain simplicity and cost-effectiveness throughout this process.

The organization has assembled a team of industry experts with extensive experience in the motor sector. They position themselves as "car finance, from the car people." This expertise-driven approach suggests a deep understanding of automotive industry dynamics and customer financing needs. DSG's group structure encompasses multiple brands designed to optimize customer outcomes. They achieve this through diversified service offerings.

However, specific details regarding the company's establishment date, regulatory status, and operational history remain unclear from available sources. The lack of transparent information about their regulatory oversight, licensing, and compliance framework presents challenges. These challenges affect potential clients seeking to verify the company's credentials and operational legitimacy in the financial services sector.

Regulatory Status: Specific information about DSG's regulatory oversight and licensing is not clearly detailed in available materials. This raises concerns about transparency and compliance verification.

Deposit and Withdrawal Methods: The company has not provided detailed information about available funding methods. Processing times and associated fees for client transactions are also unclear.

Minimum Deposit Requirements: Specific minimum deposit amounts and account opening requirements are not clearly specified. This information is missing from accessible company documentation.

Promotions and Bonuses: Current promotional offerings, incentive programs, or bonus structures are not detailed. Available company materials do not include this information.

Available Assets: While DSG focuses on car finance, the specific range of financial products and services available to clients requires further clarification. The company needs to provide more details about their offerings.

Cost Structure: Detailed information about fees, interest rates, processing charges, and other costs associated with DSG's services is not comprehensively available. Public materials lack this crucial information.

Leverage Options: Information regarding leverage ratios or financing terms is not specifically detailed. Available company resources do not include these specifications.

Platform Options: The technological platforms, digital tools, and service delivery methods employed by DSG are not thoroughly described. Accessible materials lack comprehensive platform information.

Regional Restrictions: Specific geographical limitations or service availability restrictions are not clearly outlined. Company documentation does not specify these important details.

Customer Support Languages: The range of languages supported by DSG's customer service team is not specified. Available information does not include language support details.

This dsg review highlights the need for greater transparency in operational details and service specifications.

Account Conditions Analysis

DSG's account conditions present several areas of concern due to limited transparency in their offering structure. The company has not provided comprehensive details about different account types, tier structures, or specific requirements for accessing their services. This lack of clarity makes it difficult for potential clients to understand what to expect. They cannot properly assess DSG's financing solutions without this information.

The absence of clearly stated minimum deposit requirements or account opening procedures raises questions about the company's operational transparency. Most reputable financial services providers offer detailed information about account conditions, fee structures, and client onboarding processes. DSG's limited disclosure in this area suggests either incomplete public communication or potentially less structured service offerings.

Furthermore, the company has not specified whether they offer specialized account types for different client segments. These segments might include individual consumers versus commercial clients. This lack of segmentation information makes it challenging to assess whether DSG's services are appropriately tailored to diverse customer needs. The automotive financing market requires different approaches for different client types.

The evaluation of account conditions is significantly hampered by the absence of user feedback specifically addressing account setup experiences. There is no information about ongoing account management or satisfaction with account-related services. This dsg review identifies the need for more comprehensive account information disclosure. Such disclosure would enable informed decision-making by potential clients.

The assessment of DSG's tools and resources reveals significant gaps in available information about their technological capabilities and client support systems. While the company positions itself as innovative in car finance, specific details about digital tools, online platforms, or mobile applications are not readily available. Their public materials lack this crucial information.

DSG has not provided comprehensive information about research resources, market analysis tools, or educational materials that might support client decision-making in automotive financing. This absence of detailed resource information contrasts with industry standards. Financial services providers typically highlight their technological capabilities and support tools.

The company's emphasis on having a team of experienced motor sector professionals suggests potential for valuable advisory resources and expertise-based support. However, without specific details about how this expertise is delivered to clients through structured tools or resources, it remains unclear. Customers cannot determine how they can access and benefit from this knowledge base.

Additionally, there is no clear information about automated systems, online calculators, comparison tools, or other digital resources that might enhance the customer experience. The lack of transparency regarding available tools and resources represents a significant limitation. This limitation affects the evaluation of DSG's service delivery capabilities and technological sophistication.

Customer Service and Support Analysis

DSG's customer service and support capabilities remain largely unclear due to limited available information about their service delivery structure. The company has not provided detailed information about customer support channels, availability hours, or response time commitments. These are typically standard disclosures for financial services providers.

The absence of specific information about customer service languages, support team expertise, or escalation procedures makes it difficult to assess the quality and accessibility of DSG's client support systems. While the company emphasizes having experienced motor sector professionals, it's unclear how this expertise translates into customer service excellence. The connection to specialized support capabilities is not established.

Furthermore, there is no available information about digital support options, such as live chat, online help centers, or self-service resources. Modern customers typically expect these features from financial services providers. The lack of transparency regarding customer service infrastructure raises questions about the company's commitment to client support and satisfaction.

Without access to customer testimonials, service quality metrics, or independent reviews of customer service experiences, this evaluation cannot provide a comprehensive assessment of DSG's support capabilities. The limited information available suggests potential areas for improvement. Customer service transparency and communication need enhancement.

Trading Experience Analysis

Evaluating DSG's trading experience presents unique challenges as the company primarily focuses on car finance rather than traditional trading services. However, the overall client experience in accessing and utilizing DSG's financing solutions remains an important consideration. Potential customers need to understand what they can expect from the service process.

The company has not provided detailed information about their service delivery platforms, digital interfaces, or user experience design. This lack of transparency makes it difficult to assess the efficiency and user-friendliness of their financing application and management processes.

Without specific information about processing times, approval procedures, or client interface quality, it's challenging to evaluate the overall experience customers can expect when engaging with DSG's services. The absence of user feedback or testimonials further complicates the assessment. Client satisfaction and service quality remain unverified.

The company's emphasis on simplicity and efficiency in their mission statement suggests an intention to provide smooth client experiences. However, without concrete details about implementation and execution, this remains an unverified claim. This dsg review identifies the need for more comprehensive information about the practical aspects of client engagement and service delivery. Such information is necessary to properly evaluate the trading or service experience.

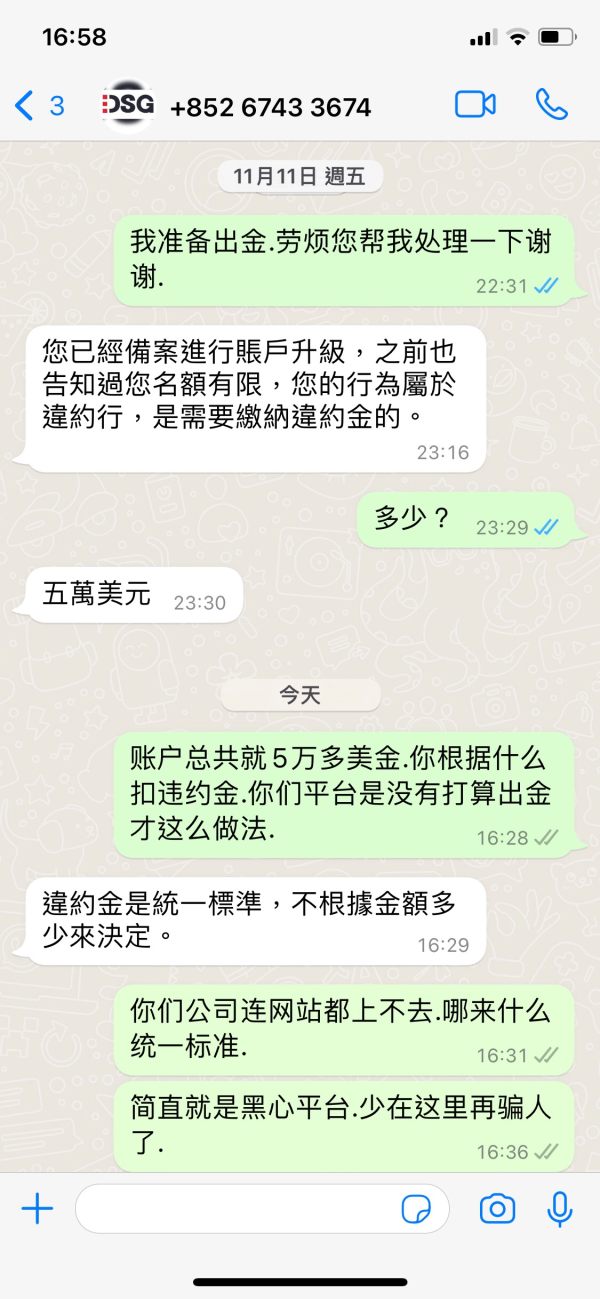

Trust Score Analysis

DSG's trust score reflects significant concerns about transparency and regulatory clarity. The most notable issue is the absence of clear regulatory information, including licensing details, oversight authorities, and compliance frameworks. This lack of regulatory transparency is particularly concerning for a financial services provider. Clients typically expect clear verification of regulatory status and consumer protections.

The company has not provided comprehensive information about security measures, fund protection protocols, or insurance coverage that might protect client interests. This absence of security-related disclosures raises questions about risk management and client asset protection capabilities.

Furthermore, there is limited information about the company's operational history, track record, or industry recognition that might support trust-building. The lack of third-party endorsements, industry awards, or independent verification of service quality contributes to concerns. These concerns relate to the company's market credibility and reliability.

Without access to independent reviews, regulatory filings, or industry reports that might validate DSG's claims and operational integrity, potential clients face significant challenges in assessing the trustworthiness of the organization. The limited transparency in multiple operational areas compounds these trust-related concerns.

User Experience Analysis

The evaluation of DSG's user experience is significantly limited by the absence of detailed information about client interfaces, service delivery processes, and customer satisfaction metrics. The company has not provided comprehensive details about their digital platforms, application processes, or ongoing client management systems.

While DSG emphasizes simplicity and efficiency in their service approach, there is insufficient information available to verify how these principles translate into actual user experiences. The lack of user testimonials, case studies, or satisfaction surveys makes it impossible to assess real-world client experiences. DSG's services remain largely unverified from a user perspective.

The company's stated commitment to creating optimal customer outcomes through diverse financing options suggests potential for positive user experiences. However, without concrete implementation details or user feedback, this remains speculative. The absence of information about user interface design, process efficiency, or customer journey optimization represents a significant gap. Available assessment materials lack this crucial information.

Additionally, there is no clear information about common user challenges, complaint resolution processes, or continuous improvement initiatives that might indicate DSG's commitment to enhancing user experiences over time. The limited transparency in user experience-related information makes it difficult for potential clients to set appropriate expectations. They cannot make informed decisions about engaging with DSG's services.

Conclusion

This comprehensive dsg review reveals a company with stated ambitions in automotive financing but significant transparency challenges that impact overall assessment. While DSG Group positions itself as an innovative car finance provider with experienced industry professionals, the lack of detailed operational information, regulatory clarity, and user feedback creates substantial concerns. These concerns are particularly relevant for potential clients.

DSG may be suitable for consumers specifically seeking automotive financing solutions and willing to conduct additional due diligence to verify service quality and regulatory compliance. However, the limited transparency in multiple operational areas suggests that more established and transparent alternatives might be preferable. Most clients would benefit from choosing providers with clearer operational disclosure.

The primary advantages include the company's stated focus on automotive financing expertise and commitment to accessible solutions. However, significant disadvantages include the lack of regulatory transparency, limited operational details, and absence of verifiable user feedback. Potential clients should exercise considerable caution and seek additional information before engaging with DSG's services.