UCS Review 1

A fraud victim report has been filed.

UCS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

A fraud victim report has been filed.

UCS (UCS Max) is a newly established forex broker operating without regulatory oversight, raising serious concerns regarding its legitimacy and the safety of client funds. For experienced traders, UCS presents an attractive, albeit risky, option for high-risk investments; however, it carries significant dangers that should not be overlooked. Novice traders or those prioritizing security and compliance would be wise to avoid UCS, given alarming reports of withdrawal issues and unresponsive customer support.

| Dimension | Rating | Justification |

|---|---|---|

| Trustworthiness | 1/5 | No regulation and numerous negative user reviews. |

| Trading Costs | 3/5 | Competitive commissions but hidden withdrawal fees. |

| Platforms & Tools | 2/5 | Limited quality tools and outdated platform design. |

| User Experience | 1/5 | Frequent complaints about poor customer support. |

| Customer Support | 1/5 | Unresponsive support and lack of reliable assistance. |

| Account Conditions | 2/5 | Unclear policies and potential for high-risk trading. |

UCS, founded in 2024, operates through its website, ucsmax.com, aimed at providing clients with access to global financial markets. The broker has positioned itself in a highly competitive field but notably lacks the regulatory framework typically seen in reliable trading platforms.

UCS primarily offers forex trading and CFDs (Contracts for Difference). The absence of regulatory oversight raises concerns for potential investors, suggesting that the platform is not compliant with best practices in client protection, which should be a priority for every trading operation.

| Detail | Information |

|---|---|

| Regulation | None |

| Minimum Deposit | $100 |

| Leverage | Up to 1:100 |

| Major Fees | Withdrawal fees may apply |

The lack of regulation from recognized authorities poses significant risks for investors. Without oversight, there are no safety mechanisms in place should anything go wrong. Reports have conveyed that UCS operates outside the law, heightening concerns regarding client safety and fund security.

To safeguard investments, potential clients are encouraged to:

Feedback on funds safety and overall client experiences paints a grim picture. Users have reported overwhelming negativity, warning against engaging with UCS, which is categorized as a platform without trust.

UCS claims to offer competitive commissions that may appeal to specific traders seeking lower costs.

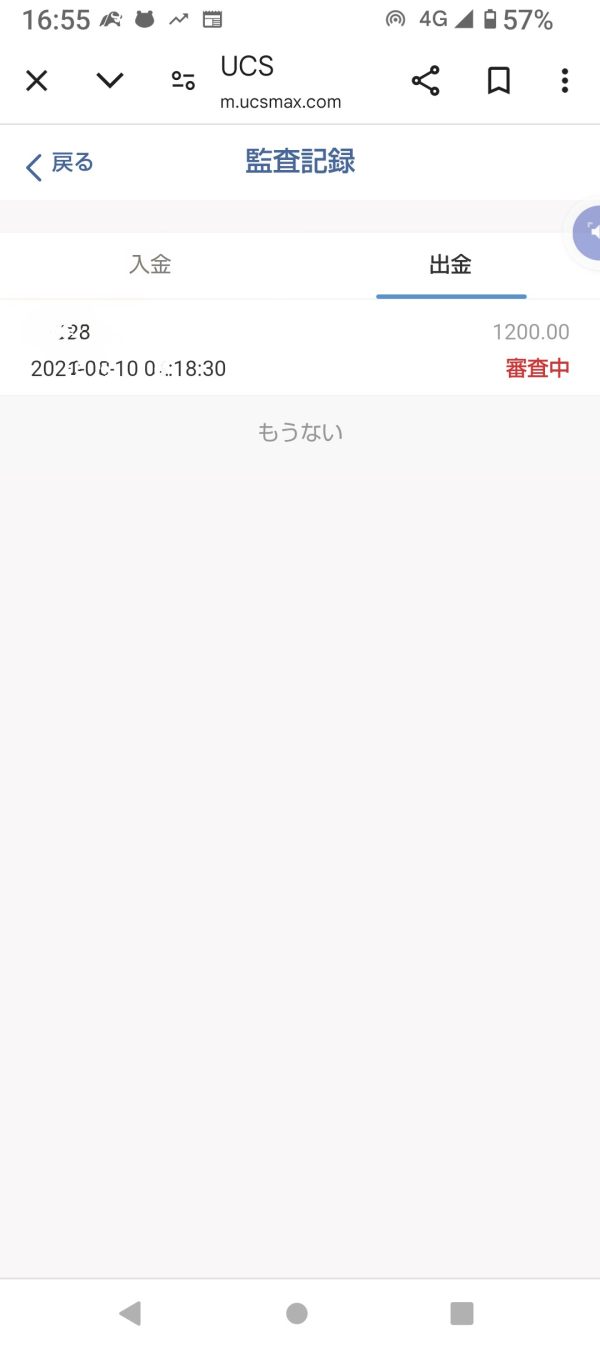

However, hidden fees often disrupt this appeal. Users have reported issues with withdrawal fees, indicating unexpected costs that can derail trading profits.

“I tried withdrawing my earnings and was hit with hefty fees I wasn't made aware of.”

For different trader types, particularly novices, the hidden costs can compound initial investments, leading to an unfavorable trading environment.

The trading platform provided by UCS suffers from delays and outdated design. The user interface fails to support efficient trading practices, as evidenced by user dissatisfaction.

Access to analytical tools is limited, suggesting a lack of investment in creating a competitive product capable of retaining users in this competitive landscape.

Complaints about user experience are frequent, indicating that investors may encounter significant hurdles while trying to navigate the platform.

“Interacting with customer support was frustrating! I often received no response at all, leaving me in the dark.”

The consistent theme of unresponsiveness detracts from the user experience, leading to widespread dissatisfaction with the service.

UCS reportedly suffers from unresponsive customer support and inadequate assistance, leading to unaddressed queries from clients.

Users frequently express frustration over contacting support, reporting experiences of being left without critical assistance when issues arise.

“Once I deposited funds, any attempts to communicate with support were met with silence.”

Policies regarding account conditions lack clarity, leaving potential traders unsure of what to expect or the inherent risks involved.

Such uncertainties can lead users to engage in high-risk trading without sufficient preparation, further increasing the potential for losses.

In conclusion, UCS appears to be a dubious choice for traders of any experience level, given its lack of regulation, negative user feedback, and fundamental issues with service delivery. The combination of possible substantial financial losses and absence of legal recourse underscores the risks of trading with an unregulated broker like UCS. Investors are urged to prioritize verified and regulated platforms when seeking trading opportunities to ensure the safety of their funds and the integrity of their trading experience.

FX Broker Capital Trading Markets Review